North America Biofortification Market

Market Size in USD Million

CAGR :

%

USD

28.70 Million

USD

54.31 Million

2024

2032

USD

28.70 Million

USD

54.31 Million

2024

2032

| 2025 –2032 | |

| USD 28.70 Million | |

| USD 54.31 Million | |

|

|

|

|

North America Biofortification Market Size

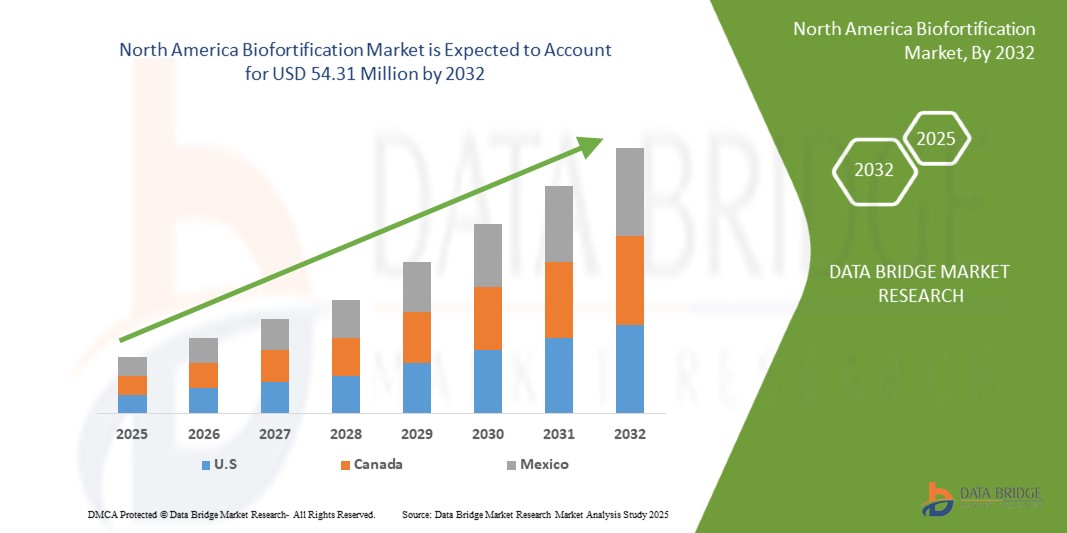

- The North America Biofortification Market size was valued at USD 28.7 million in 2024 and is expected to reach USD 54.31 million by 2032, at a CAGR of 8.3 % during the forecast period

- The market growth is largely fueled by the increasing demand for high-nutrition foods, rising consumer health consciousness due to health issues like nutritional deficiencies and malnutrition, and increased funding for agrigenomics and technological advancements in agricultural practices

- Furthermore, the growing emphasis on addressing specific health concerns through fortified products, particularly those targeting vitamins, minerals, and functional ingredients, is driving the popularity of biofortified crops in the region. These converging factors are accelerating the uptake of biofortification solutions, thereby significantly boosting the industry's growth across food processing and direct consumption

North America Biofortification Market Analysis

- Biofortification, an innovative strategy to enhance the nutritional quality of food crops through agricultural practices, conventional breeding, or genetic modification, is becoming an increasingly vital component of public health and food security initiatives in North America. It offers a sustainable and cost-effective approach to combat micronutrient deficiencies, often referred to as "hidden hunger," which affects significant portions of the population

- The escalating demand for biofortified crops in North America is primarily fueled by a growing consumer awareness of the importance of nutrient-rich foods, increasing concerns about malnutrition and diet-related health issues, and a rising preference for natural and sustainable food solutions over traditional fortification or supplements

- North America is expected to dominate the biofortification market with a significant market share, driven by a well-developed agricultural sector, substantial investments in R&D in agrigenomics, and a technologically advanced population that is increasingly adopting healthier dietary habits. The U.S., in particular, is experiencing substantial growth in the cultivation and consumption of biofortified crops, driven by innovations from both established agricultural companies and biotech startups focused on enhancing essential vitamins and minerals in staple foods

- The Vitamins segment is expected to be the fastest growing nutrient segment in the North America biofortification market during the forecast period due to the rising demand for functional and enhanced processed food products and efforts to combat widespread vitamin deficiencies

- The Fruits and Vegetables segment accounts for a significant share of the market, driven by ongoing efforts to increase the nutritional content of these widely consumed crops, especially in relation to carotenoids (precursors to Vitamin A) and other essential micronutrients

Report Scope and North America Biofortification Market Segmentation

|

Attributes |

North America Biofortification Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Biofortification Market Trends

“Advancements in Nutritional Enhancement and Sustainable Agriculture”

- A significant and accelerating trend in the North America biofortification market is the growing emphasis on developing climate-resilient, nutrient-rich crops through advanced breeding techniques and biotechnology. This approach aims to address micronutrient deficiencies and promote sustainable agricultural practices

- For instance, biofortified crops such as vitamin A-enriched sweet potatoes and iron-fortified beans are gaining traction among health-conscious consumers seeking natural and minimally processed food options. These crops are increasingly available in supermarkets, farmers' markets, and food assistance programs, expanding access to nutrient-rich foods across diverse socioeconomic groups

- The integration of biofortified crops into public health initiatives, including school feeding programs and maternal and child health interventions, underscores their role in improving dietary diversity and addressing malnutrition. Government agencies and non-profit organizations are actively promoting the consumption of biofortified foods to enhance public health outcomes

- Advancements in agricultural biotechnology and breeding techniques are driving innovation in the development of biofortified crop varieties with improved nutritional profiles and agronomic traits. Researchers and plant breeders employ methods such as conventional breeding, genetic engineering, and marker-assisted selection to tailor biofortified crops to specific dietary needs and environmental conditions

- The trend towards integrating biofortification with sustainable farming practices is gaining momentum. By enhancing the nutritional value of crops and reducing the need for chemical fertilizers, biofortification contributes to environmentally friendly agricultural systems. This holistic approach aligns with the growing consumer demand for sustainable and health-promoting food options

- The demand for biofortified crops in North America is expected to continue its upward trajectory, driven by increasing recognition of their potential to improve public health, enhance food security, and promote sustainable agriculture. Continued collaboration among researchers, policymakers, industry stakeholders, and civil society will be essential to scale up biofortification efforts and ensure equitable access to nutrient-rich foods for all segments of the population

North America Biofortification Market Dynamics

Driver

“Rising Health Consciousness and Government Support for Nutritional Security”

- The increasing prevalence of micronutrient deficiencies in North America, particularly among vulnerable populations such as children and the elderly, is driving the demand for biofortified crops as a sustainable solution to improve dietary quality and public health outcomes

- For instance, the U.S. Department of Agriculture (USDA) and other governmental bodies have supported research and policy initiatives aimed at integrating nutrient-enriched crops like iron-rich beans, zinc-fortified wheat, and vitamin A-enriched sweet potatoes into food and nutrition programs. These initiatives are expected to fuel biofortification market growth during the forecast period

- As consumers grow more health-conscious and increasingly seek out functional and nutritionally rich food options, biofortified crops provide a natural, non-GMO alternative that aligns with clean-label and whole-food trends

- Furthermore, biofortification supports sustainable agricultural practices by reducing the reliance on external nutrient supplementation and synthetic fortification, thus appealing to environmentally aware consumers and farmers alike

- The incorporation of biofortified ingredients into institutional meal programs, food aid, and commercial food products is expanding access across socioeconomic groups and driving mainstream adoption

- The combined effect of public-private partnerships, rising consumer demand for health-forward diets, and growing awareness of long-term nutritional security is expected to significantly drive the North American biofortification market over the coming years

Restraint/Challenge

“Limited Consumer Awareness and High Development Costs”

- One of the key challenges hindering the broader adoption of biofortified crops in the North America biofortification market is the limited awareness among consumers and stakeholders about the benefits and availability of biofortified food products. Many consumers remain unfamiliar with biofortification and may not distinguish it from conventional or genetically modified crops, leading to skepticism or indifference

- For instance, despite successful pilot programs involving iron-rich beans and zinc-fortified wheat, consumer uptake has been relatively slow due to insufficient promotion, lack of labeling standards, and minimal retail visibility

- Additionally, the high initial research and development (R&D) costs associated with breeding and testing nutrient-enriched crop varieties can deter investment, especially from smaller agricultural companies and research institutions. The biofortification process, whether through conventional breeding or agronomic methods, is time-consuming and capital-intensive, requiring significant regulatory approval and field validation

- These cost barriers are compounded by the limited commercial incentive for growers in the absence of strong consumer demand or price premiums for biofortified products. Farmers may also be reluctant to transition from traditional crops due to concerns about yield stability, market access, and the absence of dedicated supply chains

- While government and nonprofit support has helped mitigate some of these constraints, the success of the biofortification market in North America will depend on targeted consumer education campaigns, strategic public-private partnerships, and incentive programs that support both producers and distributors of biofortified foods

- Addressing these challenges is essential for scaling production, increasing adoption, and realizing the full public health potential of biofortification as a long-term nutritional strategy

North America Biofortification Market Scope

The market is segmented on the basis of crop type, nutrient, breeding technique, and application.

- By Crop Type

On the basis of crop type, the North America biofortification market is segmented into cereals, pulses and legumes, fruits and vegetables, and others. The cereals segment dominates the largest market revenue share of 48.5% in 2024, led by the extensive consumption of staple grains such as wheat, rice, and maize in the region. Biofortified cereal crops, particularly iron and zinc-enriched wheat and maize, are gaining popularity due to their role in addressing widespread micronutrient deficiencies without altering consumer eating habits

The fruits and vegetables segment are anticipated to witness the fastest growth rate of 20.8% from 2025 to 2032, driven by the rising consumer demand for naturally nutrient-rich produce. Biofortification efforts targeting crops like sweet potatoes (rich in vitamin A) and tomatoes (enhanced with antioxidants) are aligning with North America's clean-label and health-conscious consumer trends

- By Nutrient

On the basis of nutrient, the market is segmented into iron, zinc, vitamins (including A, B, and others), amino acids, and others. The iron segment held the largest market revenue share in 2024 due to the high prevalence of iron-deficiency anemia, especially among women and children. Iron-biofortified beans, rice, and wheat have seen strong backing from public health initiatives aiming to combat malnutrition.

The vitamin A segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by successful development of crops like orange-fleshed sweet potatoes and golden rice. These crops are especially appealing in preventive nutrition programs and are gradually being integrated into school meals and food aid strategies in the U.S. and Canada

- By Breeding Technique

On the basis of breeding technique, the biofortification market is segmented into conventional breeding, agronomic practices, and genetic modification. The conventional breeding segment accounted for the largest market revenue share in 2024 due to its greater regulatory acceptance and consumer preference for non-GMO products. Institutions such as HarvestPlus and USDA continue to emphasize traditional breeding methods to enhance nutrient density in widely consumed crops

The agronomic practices segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing use of micronutrient-enriched fertilizers and soil biofortification strategies. These methods are being promoted for their scalability and ability to complement existing agricultural systems without altering crop genetics

- By Application

On the basis of application, the market is segmented into food industry, healthcare & nutritional programs, agriculture, and others. The food industry segment held the largest market revenue share in 2024, supported by the growing incorporation of biofortified ingredients in packaged and functional foods. Leading food manufacturers are exploring the use of nutrient-dense grains and produce to meet consumer demand for health-enhancing products

The healthcare & nutritional programs segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by policy-level support for addressing hidden hunger through food-based solutions. Biofortified foods are being increasingly adopted by government-funded school meal initiatives, maternal health programs, and public nutrition campaigns, especially targeting at-risk demographics across North America

North America Biofortification Market Regional Analysis

- North America is a significant and growing market for biofortification, driven by increasing awareness of micronutrient deficiencies, a strong focus on health and wellness among consumers, and robust investments in agricultural research and development. The region's developed agricultural infrastructure and advanced biotechnological capabilities facilitate the research, development, and adoption of biofortified crops

- Consumers in North America increasingly seek out nutritious food options and are receptive to innovations that offer enhanced health benefits, making biofortified products an attractive choice. This adoption is further supported by high disposable incomes, a sophisticated food industry, and a general preference for natural and sustainable food solutions

U.S. Biofortification Market Insight

The U.S. biofortification market holds a substantial share within North America, propelled by extensive agricultural research, significant government and private funding for nutrition initiatives, and a consumer base that is increasingly health-conscious. The swift uptake of research into functional foods and ingredients, coupled with rising demand for nutrient-dense whole foods, fuels the biofortification industry. Continuous advancements in plant breeding and genetic technologies, alongside collaborative efforts between academia and industry, further accelerate the development and commercialization of biofortified crop varieties, especially those addressing widespread deficiencies like iron and zinc

Canada Biofortification Market Insight

The Canadian biofortification market is projected to expand at a noteworthy CAGR throughout the forecast period, driven by a growing emphasis on food security, public health initiatives aimed at reducing nutrient deficiencies, and a strong agricultural sector. Canadian consumers are increasingly interested in sustainable and healthy food production, which aligns well with the principles of biofortification. Government support for agricultural innovation and research into crop improvement further contributes to market growth, with a focus on developing resilient and nutritious staple crops for domestic consumption and export

Mexico Biofortification Market Insight

The Mexican biofortification market is expected to witness considerable growth, fueled by rising concerns about malnutrition, particularly among vulnerable populations, and government programs aimed at improving public health through improved nutrition. While functional foods are already integrated into the Mexican diet, there is a growing opportunity for naturally biofortified staple crops to address deficiencies cost-effectively. Increasing consumer disposable incomes and expanding R&D efforts by major food companies, combined with a widening availability of diverse and affordable nutritious foods, are expected to propel the adoption of biofortified solutions in the country

North America Biofortification Market Share

The North America Biofortification Market industry is primarily led by well-established companies, including:

- Syngenta Crop Protection AG (Switzerland)

- HarvestPlus (US)

- Precigen (US)

- Arcadia Biosciences (US)

- Bayer AG (Germany)

- Intertek Group plc (UK)

- Corteva (US)

Latest Developments in North America Biofortification Market

- In April 2023, HarvestPlus, a global leader in crop biofortification, announced a collaboration with Texas A&M AgriLife Research to expand the development and distribution of iron- and zinc-biofortified wheat varieties in the southern United States. This initiative aims to address micronutrient deficiencies among vulnerable populations while supporting sustainable agriculture practices. The partnership emphasizes the growing focus on leveraging public research institutions to drive regional biofortification programs

- In March 2023, Bayer Crop Science unveiled its next-generation biofortified maize hybrids enhanced with provitamin A for pilot deployment in the U.S. Midwest. These new hybrids are designed to improve eye health and immune function, particularly in populations at risk of vitamin A deficiency. Bayer’s innovation reflects the increasing role of private agri-tech firms in accelerating the commercialization of nutrient-enriched staple crops

- In March 2023, USDA National Institute of Food and Agriculture (NIFA) launched a $10 million grant program under its Agriculture and Food Research Initiative (AFRI) to support research on biofortification strategies. The program focuses on developing biofortified crops through both conventional and gene-editing techniques, highlighting the U.S. government’s commitment to combating hidden hunger through science-backed food solutions

- In February 2023, BioNutrients LLC, a biotech startup based in North Carolina, announced the successful field trials of its zinc-enhancing biofertilizer for soybeans. The product, aimed at increasing zinc uptake in crops through soil application, represents a major step toward scalable agronomic biofortification. BioNutrients plans to launch commercial distribution by late 2025, contributing to sustainable and nutrient-rich farming solutions

- In January 2023, Canada’s International Development Research Centre (IDRC) in collaboration with McGill University initiated a community-based pilot project in Manitoba focusing on vitamin A-biofortified sweet potatoes. The project aims to provide Indigenous communities with access to more nutritious food sources while preserving traditional farming practices. This grassroots-level initiative demonstrates the role of biofortification in promoting nutritional equity and food sovereignty within underserved North American populations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Biofortification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Biofortification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Biofortification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.