North America Cbd Patch Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

6.24 Billion

2022

2030

USD

1.44 Billion

USD

6.24 Billion

2022

2030

| 2023 –2030 | |

| USD 1.44 Billion | |

| USD 6.24 Billion | |

|

|

|

North America Cannabidiol (CBD) Patch Market Analysis and Size

The growing popularity of CBD and its benefits among patients and healthcare professionals creates a significant demand for the products. Furthermore, increased emphasis on R&D activities and their subsequent results broaden the market's scope. These factors, taken together, compel regulatory authorities to develop a supportive regulatory structure to monitor, regulate, and support the region's emerging cannabidiol industry. The Farm Bill effectively established the cannabidiol industry in the United States, legalizing CBD formulations containing less than 0.3% THC in all 50 states. Furthermore, different policy structures are observed in individual states for different composition levels; the compound with less than 0.3% THC remains legal at the state level.

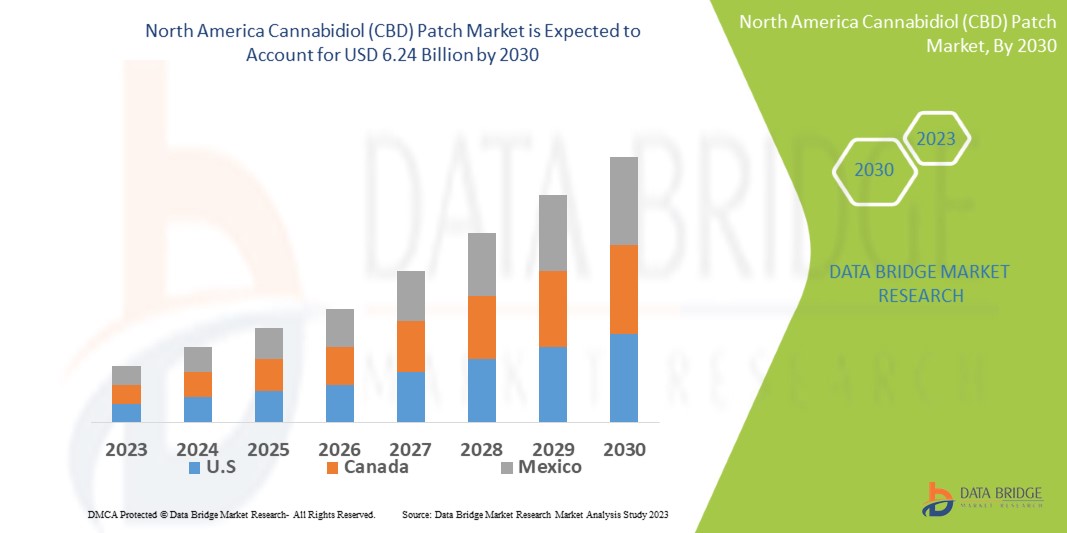

Data Bridge Market Research analyses that the cannabidiol (CBD) patch market which is USD 1.44 billion in 2022, is expected to reach USD 6.24 billion by 2030, at a CAGR of 20.1% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Cannabidiol (CBD) Patch Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Reservoir, Matrix and Layer Drug-In-Adhesive), Species (Cannabis Indica, Hybrid and Sativa), Packaging (Two to Five Patches, Single Patch and More Than Five Patch), Dosage (Below 30 mg, 30-40 mg, 40-50 mg and Above 50 mg), Derivatives (Cannabidiol (CBD), Tetrahydrocannabinol (THC) and Others), Application (Chronic Pain, Anxiety, Arthritis, Elevate Mood, Neurological Pain and Others), Source Type (Natural and Synthetic), End User (Homecare Setting, Research and Development Centers, Hospital, Clinics, Rehab Centers and Others), Distribution Channel (Dispensaries AND Pharmacies, Online and Conventional Stores) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Papa & Barkley (U.S.), Pure Ratios (U.S.), CHARLOTTE'S WEB (U.S.), Bioactive Solutions, Inc. (Australia), Envy LLC (U.S.), GoGreen Hemp (U.S.), Healist Naturals (U.K.), HempBombs, (U.S.) Isodiol International Inc (Canada), Manna Molecular Science, LLC. (U.S.), Mary’s Medicinals (U.S.), Nutrae LLC. (U.S.), PureKana LLC (U.S.), Social CBD (U.S.), Upstate Elevator (U.S.) |

|

Market Opportunities |

|

Market Definition

CBD patches are cannabidiol-containing transdermal patches (CBD). They gradually release CBD into the bloodstream via the skin. Some people may prefer this CBD delivery method over inhaling vaporised CBD or ingesting it orally through edibles or drinks. CBD patches may be a better option for certain applications, such as pain relief, but personal preference will play a role in determining the best way to take CBD. This transdermal method quickly delivers CBD to the area around the patch. It then makes its way into the bloodstream. CBD must first pass through the digestive system when taken orally, such as in the form of an oil or gummy.

North America Cannabidiol (CBD) Patch Market Dynamics

Drivers

- Mounting mental health issues and rising health-conscious population pool

The global population is facing an increase in the prevalence of various physical and mental disease conditions such as acute and chronic pain, anxiety, depression, osteoporosis, and among others. For instance, in the United Kingdom in 2020, approximately 28 million people will be affected by chronic pain (NHS), 6 million will suffer from anxiety, and more than 80% of adults will report a high level of stress. Numerous studies have demonstrated Cannabidiol's anti-inflammatory, anti-seizure, and pain-relieving properties. This has aided in the acceptance of CBD patches as a reliable solution in many countries.

Opportunities

- Environment-friendly hemp farming and emergence of CBD patches as natural alternative

As hemp contains more CBD, more hemp farming will support the production of CBD patches and promote market growth. Hemp farming is good for the environment because it reduces toxicity, eliminates radioactive chemicals, and helps restore damaged soil.

Furthermore, hemp farming contributes to environmental protection through bioremediation; it consumes four times as much CO2 as trees. As a result, increased hemp farming is directly proportional to increased CBD product manufacturing, which includes CBD patches.

Restraints/Challenges

- Rising sales of CBD patches

The rising sales and applications of CBD patches are the primary market drivers. The side effects of CBD and THC can be a challenge, but the expanding research scope for medical applications of CBD patches can be an opportunity. The restraining factors are the government and medical bodies' restrictions on the use of CBD for medical applications, as well as the challenges faced due to the impact of Covid-19 on the raw material supply chain.

This cannabidiol (CBD) patch market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the cannabidiol (CBD) patch market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2020, Papa & Barkley launched a new line of innovative rosin-infused skincare products. This cannabis and CBD skincare line is intended for patients suffering from irritated skin, sunburn, minor aches, scars, and redness, among other things. This will assist the company in expanding its portfolio in the cannabis and CBD wellness markets.

- In 2019, Pure Ratios announced its partnership with Caliva, a California-based producer and distributor of cannabis products. The collaboration has enabled the company to expand its customer base and penetrate deep into the California market.

- In 2021, Neno's Naturals CBD (also known as "Neno's CBD"), a vertically integrated cannabis company with excellent retail locations as well as a processing and manufacturing facility, announced the launch of its CBD product line, which includes CBD patches.

- In 2021, Always Pure Organics announced its business expansion by expanding its warehouse by 10,000 square feet.

North America Cannabidiol (CBD) Patch Market Scope

The cannabidiol (CBD) patch market is segmented on the basis of product, species, packaging, dosage, derivative, application, source type, end user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Reservoir

- Matrix and Layer Drug-In-Adhesive

Species

- Cannabis Indica

- Hybrid

- Sativa

Packaging

- Two to Five Patches

- Single Patch

- More Than Five Patch

Dosage

- Below 30 mg

- 30-40 mg

- 40-50 mg

- Above 50 mg

Derivatives

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

- Others

Application

- Chronic Pain

- Anxiety

- Arthritis

- Elevate Mood

- Neurological Pain

- Others

Source Type

- Natural

- Synthetic

End User

- Homecare Setting

- Research and Development Centers

- Hospital

- Clinics

- Rehab Centers

- Others

Distribution Channel

- Dispensaries

- Pharmacies

- Online

- Conventional Stores

Cannabidiol (CBD) Patch Market Regional Analysis/Insights

The cannabidiol (CBD) patch market is analyzed and market size insights and trends are provided by country, product, species, packaging, dosage, derivative, application, source type, end user and distribution channel as referenced above.

The countries covered in the cannabidiol (CBD) patch market report are U.S., Canada and Mexico in North America.

North America dominates the cannabidiol (CBD) patch market because of the presence of well-developed healthcare infrastructure and favourable reimbursement policies in the region.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 owing to the growing incidence of cancer such as bladder, esophagus, liver, pancreas, and others, high presence of major manufacturers across the U.S. Furthermore, technological advancements and rising foreign investment.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The cannabidiol (CBD) patch market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for cannabidiol (CBD) patch market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the cannabidiol (CBD) patch market. The data is available for historic period 2011-2021.

Competitive Landscape and Cannabidiol (CBD) Patch Market Share Analysis

The cannabidiol (CBD) patch market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to cannabidiol (CBD) patch market.

Some of the major players operating in the cannabidiol (CBD) patch market are:

- Papa & Barkley (U.S.)

- Pure Ratios (U.S.)

- CHARLOTTE'S WEB (U.S.)

- Bioactive Solutions, Inc. (Australia)

- Envy LLC (U.S.)

- GoGreen Hemp (U.S.)

- Healist Naturals (U.K.)

- HempBombs, (U.S.)

- Isodiol International Inc (Canada)

- Manna Molecular Science, LLC. (U.S.)

- Mary’s Medicinals (U.S.)

- Nutrae LLC. (U.S.)

- PureKana LLC (U.S.)

- Social CBD (U.S.)

- Upstate Elevator (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.