North America Cell Based Assays Market

Market Size in USD Billion

CAGR :

%

USD

7.89 Billion

USD

17.77 Billion

2025

2033

USD

7.89 Billion

USD

17.77 Billion

2025

2033

| 2026 –2033 | |

| USD 7.89 Billion | |

| USD 17.77 Billion | |

|

|

|

|

North America Cell Based Assays Market Size

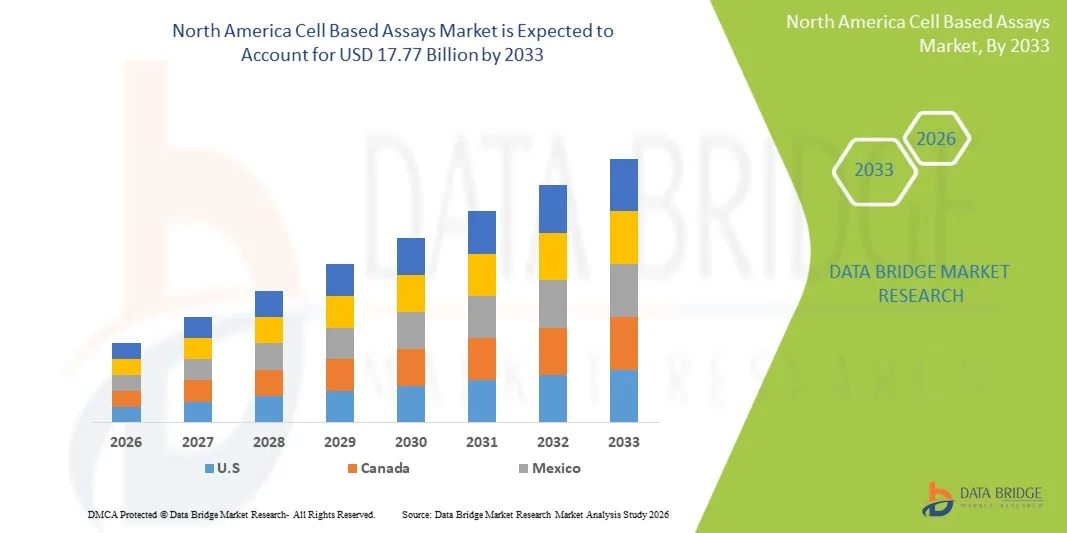

- The North America cell based assays market size was valued at USD 7.89 billion in 2025 and is expected to reach USD 17.77 billion by 2033, at a CAGR of 10.68% during the forecast period

- The market growth is largely fueled by the rising adoption of advanced cell-based analytical tools across drug discovery, toxicity studies, and high-throughput screening, driven by strong pharmaceutical and biotech R&D spending in the region

- Furthermore, increasing demand for accurate, user-friendly, and automation-compatible assay platforms is establishing cell-based assays as the preferred method for evaluating drug efficacy and safety. These converging factors are accelerating the integration of cell-based technologies in research workflows, thereby significantly boosting the market’s growth

North America Cell Based Assays Market Analysis

- Cell-based assays, enabling real-time measurement of cellular responses to drugs, toxins, and biological stimuli, are increasingly vital analytical tools within pharmaceutical, biotechnology, CRO, and academic research environments due to their higher physiological relevance, improved sensitivity, and compatibility with high-content and high-throughput screening systems

- The escalating demand for cell-based assays is primarily fueled by expanding drug discovery pipelines, rising emphasis on toxicity and safety assessment, and growing adoption of automation-integrated platforms that enhance assay precision, reproducibility, and efficiency across research workflows

- The United States dominated the North America cell-based assays market with the largest revenue share of 87.2% in 2025, supported by strong biomedical R&D investment, large pharmaceutical and biotech facilities, and the presence of major assay kit and reagent manufacturers

- Canada is expected to be the fastest-growing country in the North America cell-based assays market during the forecast period due to rising federal funding, growing biomanufacturing capabilities, and increasing adoption of advanced cell-based evaluation tools in academic and clinical labs

- The consumables segment dominated the North America cell-based assays market with an estimated market share of 40.9% in 2025, driven by recurring demand for assay kits, reagents, reporter gene constructs, and cell lines that are continually required across high-volume drug discovery and toxicity testing workflows

Report Scope and North America Cell Based Assays Market Segmentation

|

Attributes |

North America Cell Based Assays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Cell Based Assays Market Trends

“Rising Adoption of High-Throughput and AI-Enhanced Screening Technologies”

- A significant and accelerating trend in the North America cell-based assays market is the growing integration of high-throughput screening (HTS) systems with AI-based analytical platforms, enabling faster and more precise interpretation of cellular responses in drug discovery and toxicity evaluation across research environments

- For instance, advanced HTS platforms from companies such as Thermo Fisher Scientific and Molecular Devices now integrate automated imaging and AI-enhanced analytics, allowing researchers to process large volumes of cell-based data with greater speed, accuracy, and reproducibility

- AI-enabled solutions in cell-based assays support capabilities such as predictive toxicity modelling, improved image-based phenotypic screening, and deeper analysis of complex cell behaviours. For instance, AI-driven image analysis tools can refine single-cell resolution measurements and detect subtle phenotypic shifts that would otherwise be overlooked

- The seamless integration of these assay systems with automated liquid handlers, live-cell imagers, robotics, and cloud-enabled data platforms is enabling centralized control over entire screening workflows, supporting unified analysis and efficient multi-site data collaboration within research networks

- This trend toward more intelligent, automated, and interconnected assay platforms is fundamentally reshaping expectations for drug discovery productivity. Consequently, companies such as Danaher’s Molecular Devices and Sartorius are developing AI-supported systems designed to optimize assay performance and streamline high-content screening operations

- The demand for advanced, AI-supported, and high-throughput cell-based assay solutions is growing rapidly across pharmaceutical, biotechnology, and CRO sectors, as research organizations increasingly prioritize data accuracy, automation, and accelerated therapeutic development timelines

North America Cell Based Assays Market Dynamics

Driver

“Growing Need Due to Expanding Drug Discovery Programs and Safety Testing Requirements”

- The increasing emphasis on developing novel therapeutics, coupled with rising regulatory expectations for robust toxicity and safety assessment, is a significant driver for the heightened adoption of cell-based assays across North America’s pharmaceutical and biotechnology sectors

- For instance, in 2025, Thermo Fisher Scientific expanded access to its automated cell-based toxicity platforms to support accelerated drug development pipelines. Such advancements by key companies are expected to drive the cell-based assays industry growth during the forecast period

- As research organizations seek more predictive and physiologically relevant data, cell-based assays offer critical advantages, including real-time cellular monitoring, improved sensitivity, and reduced reliance on traditional animal-based testing approaches

- Furthermore, the growing popularity of high-content screening technologies and the rising number of biologics and small-molecule candidates are making cell-based assays an integral component of modern drug discovery workflows, offering seamless integration with imaging, automation, and data-analysis platforms

- The convenience of scalable high-throughput formats, remote data monitoring through cloud-enabled systems, and the ability to streamline entire screening pipelines are key factors propelling the adoption of cell-based assays in pharmaceutical, biotechnology, and CRO research facilities. The trend toward automation-supported laboratories and increasingly user-friendly assay platforms further contributes to market growth

Restraint/Challenge

“Assay Variability Issues and Regulatory Compliance Hurdles”

- Concerns surrounding assay variability, data reproducibility, and adherence to evolving regulatory standards pose a significant challenge to broader adoption of cell-based assays, particularly as research organizations depend on highly reliable and standardized results for drug evaluation

- For instance, high-profile reports highlighting inconsistencies in complex cell-based models have made some companies cautious about relying exclusively on these systems for safety testing, especially when reproducibility across laboratories is inconsistent

- Addressing these performance concerns through standardized protocols, improved assay validation methods, and robust quality-control practices is crucial for ensuring scientific reliability. Companies such as PerkinElmer and Sartorius emphasize assay robustness, validated workflows, and precision instrumentation to strengthen user confidence. In addition, the relatively high cost of advanced cell-based imaging and screening systems compared to basic biochemical assays can be a barrier for smaller laboratories with limited budgets

- While prices for consumables and automated systems are gradually declining, the perceived cost premium associated with high-content imaging, live-cell analysis platforms, and AI-enhanced tools can still hinder widespread adoption among budget-constrained academic and early-stage biotech research groups

- Overcoming these challenges through improved standardization, researcher training, and development of more cost-efficient assay solutions will be vital for sustained market growth, alongside broader regulatory clarity for advanced cell-based testing frameworks

North America Cell Based Assays Market Scope

The market is segmented on the basis of type, product & services, technology, application, end user, and distribution channel.

- By Type

On the basis of type, the North America cell-based assays market is segmented into cell viability assay, cytotoxicity assay, cell death assay, cell proliferation assay and others. The cell viability assay segment dominated the market with the largest market revenue share in 2025, driven by its central role in early-stage screening and routine viability checks across discovery and toxicology workflows. Laboratories favor viability assays for initial compound triage because they are broadly validated, compatible with standard plate readers, and easily automated for high-throughput formats. The widespread use of viability assays in oncology, infectious disease, and regenerative medicine research ensures steady recurring consumable demand. Their robustness and clear end-point metrics reduce assay development time, which is critical for high-volume pharmaceutical pipelines. Vendors supply pre-validated kits and controls that simplify regulatory documentation and cross-lab reproducibility. The prevalence of legacy workflows in major U.S. pharma hubs reinforces this segment’s dominant revenue contribution.

The cell proliferation assay segment is anticipated to witness the fastest growth over the forecast period, fueled by rising interest in immuno-oncology, stem cell research, and regenerative therapies that require dynamic cell behavior profiling. Proliferation assays provide insight on cell cycle effects and are integral to mechanism-of-action studies for novel biologics and cell therapies. Advances in label-free and real-time proliferation readouts increase adoption among translational and preclinical teams seeking kinetic data. The expansion of 3D culture systems and organoids, which demand sensitive proliferation metrics, further accelerates uptake. Growing funding for personalized medicine and CAR-T programs in the U.S. increases market pull for proliferation assays. Together, these factors position proliferation assays as the highest-growing type segment in North America.

- By Product & Services

On the basis of product & services, the market is segmented into consumables, services, instruments and software. The consumables segment dominated the market with the largest revenue share of 40.9% in 2025, driven by recurring purchases of assay kits, reagents, plates, and cell lines required for continuous R&D activity. Consumables are non-durable and consumed each experiment, creating predictable, high-frequency revenue streams for suppliers and strong switching costs for laboratories standardized on particular kits. Pre-validated consumable kits reduce assay setup time for pharma and CROs, supporting tight development timelines. The broad application scope—from screening to toxicity ensures cross-functional demand within large institutions. Moreover, supply agreements and bulk purchasing by pharmaceutical firms strengthen consumables’ market position. The inherent necessity of reagents for every assay cements consumables as the backbone of regional revenue.

The software & informatics segment is expected to register the fastest CAGR, as complex image and multi-omics outputs demand advanced data handling, LIMS integration, and AI-driven analytics. Cloud-based analysis platforms enable remote collaboration and standardized pipelines across multi-site trials and CRO partnerships. Machine learning tools for image segmentation and phenotypic profiling enhance signal extraction from high-content screens, increasing the value of software investments. Integration of assay metadata with ELN and regulatory documentation streamlines compliance workflows, attracting enterprise adoption. As instrument throughput and multiplexing rise, software becomes mission-critical for data interpretation, driving rapid growth in this segment.

- By Technology

On the basis of technology, the market is segmented into flow cytometry, high throughput screening, high content screening and label free detection. The high-throughput screening (HTS) segment dominated the market with the largest revenue share in 2025, thanks to its capacity to screen large compound libraries rapidly and cost-effectively for hit identification. HTS platforms are deeply entrenched in major pharma discovery operations and are supported by extensive automation, liquid handling, and integrated plate-reader ecosystems. Their scalability aligns with lead-generation strategies and allows CROs to offer competitive pricing for early-stage screening services. HTS workflows also integrate seamlessly with established cheminformatics pipelines, enabling rapid data triage. Ongoing investments in throughput optimization and reagent miniaturization preserve HTS’s central role in early discovery. The established vendor base and service networks across the U.S. reinforce HTS’s share dominance.

The high-content screening (HCS) segment is expected to grow the fastest, driven by demand for multiparametric phenotypic profiling and image-based insights that better predict in-vivo responses. HCS delivers single-cell resolution across morphology, organelle function, and signaling, making it invaluable for complex disease models and mechanism-of-action studies. Advances in automated microscopy, AI image analysis, and 3D imaging are expanding HCS applicability to organoids and co-culture systems. Pharmaceutical and biotech groups seeking deeper biological context are allocating more budget to HCS platforms despite higher upfront costs. Integration of HCS with downstream bioinformatics and target deconvolution further accelerates adoption, marking it as the fastest-growing technology segment.

- By Application

On the basis of application, the market is segmented into drug discovery, basic research and others. The drug discovery application dominated the market with the largest revenue share in 2025, reflecting North America’s concentration of biopharma R&D and prolific pipeline activity. Cell-based assays are indispensable across target validation, hit-to-lead optimization, and preclinical safety screening, making them central to early and mid-stage discovery budgets. Large pharma hubs—supported by venture-backed biotech clusters—sustain continuous assay demand across therapeutic areas, especially oncology and immunology. Robust partnerships between pharma and CROs further amplify drug discovery’s consumption of assays and services. The trend toward human-relevant in-vitro models heightens reliance on cell-based platforms for decision-making, consolidating drug discovery’s revenue leadership.

The predictive toxicology / safety screening application is anticipated to be the fastest-growing area, as regulatory pressure and ethical considerations drive reduction of animal testing and adoption of more predictive in-vitro alternatives. Investment in organ-on-chip, microphysiological systems, and integrated toxicity panels boosts demand for cell-based assays that can deliver human-relevant endpoint data early in development. Pharmaceutical companies prioritize early de-risking to avoid costly late-stage failures, shifting budgets toward predictive toxicology workflows. Regulatory acceptance of in-vitro methods and industry consortia promoting standardization further catalyze growth. As a result, safety testing workflows represent a high-growth application within the North America market.

- By End User

On the basis of end user, the market is segmented into pharmaceutical & biotechnology companies, contract research organizations, academic & research institutions, government organizations and others. The pharmaceutical & biotechnology companies segment dominated the market with the largest revenue share in 2025, driven by large R&D budgets, extensive in-house discovery programs, and steady pipeline activity requiring continuous assay deployment. These companies demand validated, scalable assays and premium instruments supported by service contracts and technical training, creating significant vendor lock-in. Their capacity to fund long-term platform adoption and integration with internal informatics makes them primary purchasers of both consumables and capital equipment. Concentration of major pharma and biotech players in North America ensures sustained high volume purchasing. Collaborative initiatives with academic centers and CROs further magnify their consumption footprint.

The contract research organizations (CROs) segment is expected to be the fastest-growing end-user group as drug developers increasingly outsource specialized assay workflows to accelerate timelines and manage costs. CROs expand service offerings in high-content, high-throughput, and GLP-compliant assay execution, attracting mid-sized biotechs and virtual pharma companies. Investment in automation, standardized SOPs, and scalable infrastructure enables CROs to handle diverse client needs, driving repeat business. The trend toward outsourcing non-core discovery activities, combined with CROs’ geographical reach, positions them for rapid market share gains. Their flexible, project-based model suits the evolving R&D landscape, accelerating segment growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and indirect. The direct sales channel dominated the market with the largest revenue share in 2025, as high-value instruments, customized workflows, and enterprise licensing agreements require direct manufacturer engagement for installation, validation, and support. Direct channels provide application training, on-site qualification, and service level agreements that large pharma and institutional buyers prioritize. Manufacturers also leverage direct relationships to co-develop assays and offer long-term consumable contracts. The complexity of integrating instruments with lab infrastructure favors direct procurement to ensure performance and regulatory compliance. This hands-on approach preserves margin and strengthens vendor–customer partnerships.

The indirect / e-commerce and distributor channel is expected to grow the fastest, driven by increasing digital procurement preferences among smaller labs, academic groups, and start-ups seeking convenient access to consumables and basic instruments. Online scientific marketplaces and distributor platforms streamline ordering, provide volume discounts, and offer faster replenishment cycles for routine reagents. Improved B2B logistics and catalog digitization reduce procurement friction and broaden supplier reach beyond major urban centers. Distributors bundling assay kits with technical support and training are expanding offerings to serve diverse end users. As purchasing teams embrace e-procurement, the indirect channel’s share is rising rapidly.

North America Cell Based Assays Market Regional Analysis

- The United States dominated the North America cell-based assays market with the largest revenue share of 87.2% in 2025, supported by strong biomedical R&D investment, large pharmaceutical and biotech facilities, and the presence of major assay kit and reagent manufacturers

- The country benefits from a highly developed research infrastructure, significant federal funding for biomedical innovation, and the presence of numerous leading assay kit manufacturers, CROs, and high-content screening technology providers

- U.S. researchers highly value the precision, scalability, and physiological relevance of cell-based assays, leading to strong integration across oncology, immunology, neuroscience, and personalized medicine programs

U.S. Cell Based Assays Market Insight

The U.S. cell-based assays market captured the largest revenue share of 87.2% in 2025 within North America, fueled by the country’s advanced pharmaceutical and biotechnology ecosystem and substantial investments in drug discovery and translational research. Researchers are increasingly prioritizing cell-based systems for high-throughput screening, mechanism-of-action studies, and immuno-oncology applications. The growing adoption of automated platforms, high-content imaging, and AI-driven data analysis further propels market expansion. Moreover, federal funding through NIH and other biomedical programs supports continuous innovation and widespread deployment of assay technologies. The presence of leading assay kit manufacturers, CROs, and instrument providers strengthens market infrastructure. Increasing demand for predictive, human-relevant in-vitro models and the push to reduce animal testing are also significantly contributing to growth.

Canada Cell-Based Assays Market Insight

The Canada cell-based assays market is projected to expand at a notable CAGR throughout the forecast period, driven by strong academic–industry collaborations, growing biotechnology investment, and increasing adoption of advanced assay technologies. Government initiatives supporting regenerative medicine, genomics, and translational research are fostering the use of cell-based assays in both academic institutions and biotech firms. Canadian researchers increasingly rely on high-throughput and high-content screening platforms to improve drug discovery efficiency. The country’s growing focus on predictive toxicology and in-vitro safety testing further strengthens adoption. In addition, automated workflows and AI-enabled data analysis tools are supporting broader market penetration. Canada’s regulatory alignment with U.S. standards also encourages cross-border collaborations and technology transfer.

Mexico Cell-Based Assays Market Insight

The Mexico cell-based assays market is witnessing steady growth, fueled by the country’s expanding pharmaceutical R&D sector and increasing adoption of cost-effective in-vitro testing solutions. CROs, academic laboratories, and biotech companies are investing in cell-based assays for preclinical screening, mechanistic studies, and safety testing workflows. Rising demand for affordable assay kits and instruments is enabling wider adoption among emerging biotech firms. Government initiatives promoting biomedical research infrastructure and local pharmaceutical development are supporting market expansion. The integration of automated platforms and standardized workflows is further accelerating assay uptake. Mexico’s growing presence in North America’s pharma and CRO network positions it as an emerging contributor to regional market growth.

North America Cell Based Assays Market Share

The North America Cell Based Assays industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Cytiva (U.S.)

- Danaher (U.S.)

- PerkinElmer (U.S.)

- Charles River Laboratories (U.S.)

- Promega Corporation (U.S.)

- Cell Signaling Technology, Inc. (U.S.)

- Corning Incorporated (U.S.)

- Cell Biolabs, Inc. (U.S.)

- Eurofins DiscoverX Corporation (U.S.)

- Agilent Technologies, Inc. (U.S.)

- BioVision, Inc. (U.S.)

- BioTek Instruments, Inc. (U.S.)

- Enzo Life Sciences, Inc. (U.S.)

- Abcam plc (U.K.)

- New England Biolabs, Inc. (U.S.)

- Lonza (U.S.)

- Sartorius AG (U.S.)

What are the Recent Developments in North America Cell Based Assays Market?

- In November 2025, the Muse Micro cell analyzer was awarded “Drug Discovery Solution of the Year” by the BioTech Breakthrough Awards, recognizing it as a breakthrough product in cell analysis and drug‑discovery workflows. The award highlights the instrument’s impact in making advanced flow cytometry more accessible, cost‑effective, and user‑friendly enabling academic labs, smaller biotech firms, and CROs to undertake complex cell‑based assays without heavy investment

- In May 2025, BD Biosciences announced the global commercial launch of the BD FACSDiscover A8 Cell Analyzer, described as the “world's first cell analyzer featuring breakthrough spectral and real-time cell imaging technologies.” This analyzer combines spectral flow cytometry (via BD SpectralFX™) with imaging (BD CellView™), enabling researchers to examine up to 50+ cell‑characteristics per cell and visualize spatial / morphological data in real time

- In March 2025, Cytek Biosciences announced the commercial launch of the Muse Micro cell analyzer a compact, easy‑to‑use flow cytometer designed to simplify and democratize cell analysis. The Muse Micro offers a “mix‑and‑read” workflow with pre‑optimized assay kits and up to five‑parameter analysis (scatter + three fluorescent channels), making routine assays such as viability, apoptosis, cell health, immune‑cell phenotyping and population analysis more efficient

- In August 2024, Newcells Biotech announced the launch of a new high‑content and high‑throughput imaging suite to support preclinical drug development programmes, including a new lung fibroblast-to-myofibroblast transition (FMT) assay. The suite combines advanced imaging systems (automated cell imaging, confocal and standard microscopy) with physiologically‑relevant in vitro models (iPSC- or primary‑cell based), enabling deeper insights into drug effects on human-such as tissues

- In May 2023, CellFE announced commercial availability of its Infinity Mtx platform, a microfluidic cell‑engineering system showcased at the ASGCT 2023 Annual Meeting. The platform uses rapid cell compression and re‑expansion to deliver payloads into cells efficiently offering high cell‑editing yields, reduced cell recovery times, and scalability for cell‑therapy manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.