North America Collagen Supplements Market

Market Size in USD Million

CAGR :

%

USD

2,507,483.91 Million

USD

3,849,086.59 Million

2022

2030

USD

2,507,483.91 Million

USD

3,849,086.59 Million

2022

2030

| 2023 –2030 | |

| USD 2,507,483.91 Million | |

| USD 3,849,086.59 Million | |

|

|

|

North America Collagen Supplements Market Analysis and Insights

The increasing awareness about collagen supplements North America has enhanced the demand for the market. The cost-effectiveness benefit of collagen supplements also contributes to the market's growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increase in improved advancement of processes and techniques to process collagen and preparation of collagen supplements also contributes to the rising demand for collagen supplements.

The North America collagen supplements market is expected to grow in the forecast year due to the rise in market players and the availability of advanced services. Manufacturers are engaged in the developmental activity for launching novel collagen supplements and efficient collagen supplements in the market. The increasing development in the field of dietary supplements is further boosting market growth. However, difficulties such as the stringent regulations for the production and commercialization of collagen supplement products might hamper the growth of the North America collagen supplements market in the forecast period.

Increasing healthcare expenditure is expected to give opportunities to the market. However, the high cost of collagen supplements may challenge market growth.

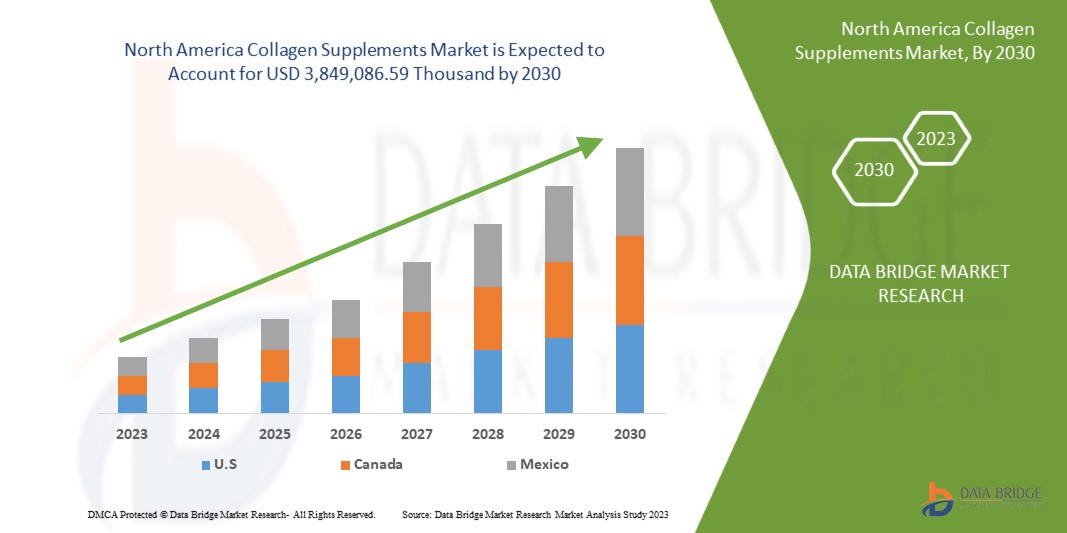

Data Bridge Market Research analyzes that the North America collagen supplements market is expected to reach USD 3,849,086.59 thousand by 2030 from USD 2,507,483.91 thousand in 2022, growing at a CAGR of 5.6% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customized to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, and Pricing in USD |

|

Segments Covered |

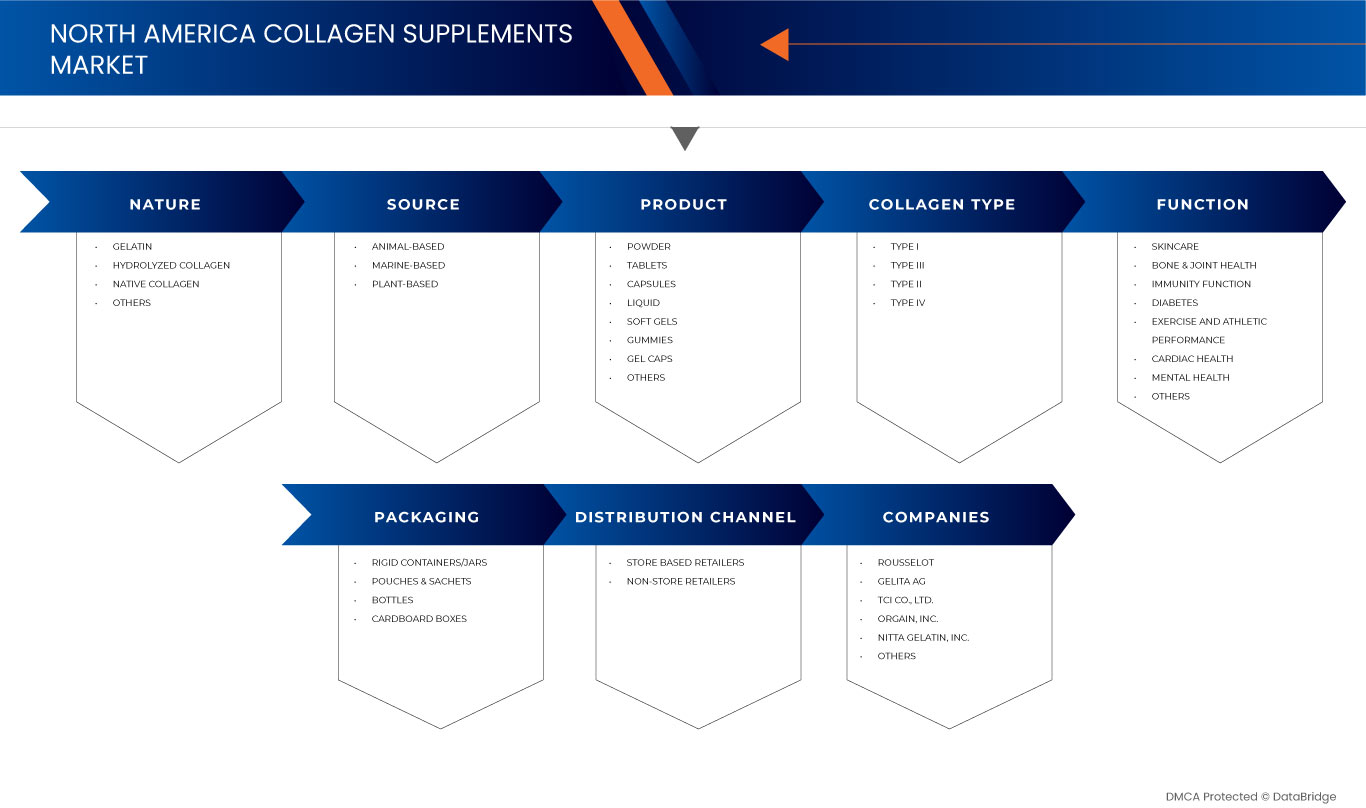

Nature (Gelatin, Hydrolyzed Collagen, Native Collagen, and Others), Source (Animal-Based, Plant-Based, and Marine-Based), Product (Powder, Tablets, Capsules, Liquid, Soft Gels, Gummies, Gel Caps, and Others), Collagen Type (Type I, Type II, Type III, and Type IV), Function (Skincare, Bone & Joint Health, Immunity Function, Diabetes, Exercise and Athletic Performance, Cardiac Health, Mental Health, and Others), Packaging (Rigid Containers/Jars, Pouches & Sachets, Bottles, and Cardboard Boxes), Distribution Channel (Store-Based Retailers and Non-Store Retailers) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

GELITA AG, TCI CO., LTD., Nordic Naturals, Nitta Gelatin Inc., Orgain Inc., Essential elements, HUM Nutrition Inc., ReFa USA, BUBS Naturals, Sports Research Corporation, Agent Nateur, SkinnyFit, LLC., Rousselot (A Subsidiary of Darling Ingredients), Vital Proteins LLC. (A subsidiary of Nestle Health Science), and Renew Life Formulas, LLC. (A subsidiary of The Clorox Company) |

North America Collagen Supplements Market Definition

Collagen supplements are dietary products that contain collagen, a protein that plays a crucial role in maintaining the health and structure of various tissues in the body, including the skin, bones, tendons, ligaments, and cartilage. Collagen is abundant in our bodies and helps to keep our skin firm, maintain joint flexibility, and support the overall integrity of connective tissues. Collagen supplements have gained popularity in recent years due to their potential benefits for skin, joint, and overall connective tissue health. These dietary products contain collagen, a crucial protein responsible for maintaining the structural integrity of various tissues in the body.

North America Collagen Supplements Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing Use of Collagen Supplements in Treatment Procedure of Bone Diseases

The North America collagen supplements market has experienced significant growth in recent years, driven by increasing health awareness and the rising demand for natural remedies to address various health concerns. One notable driver for this market's expansion is the growing use of collagen supplements as an essential component in the treatment procedures of bone diseases. Collagen, the primary structural protein in the body, plays a crucial role in bone health, and its supplementation has gained recognition as an effective approach to managing bone-related conditions.

Collagen is a key component of the extracellular matrix in bones, providing structural support and flexibility to the skeletal system. The body's natural collagen production declines with age, leading to a loss of bone density and increased susceptibility to bone diseases such as osteoporosis and osteoarthritis. In addition, factors, such as sedentary lifestyles, poor nutrition, and hormonal changes can further exacerbate bone health issues. The incidence of bone-related conditions rises as the aging population grows, leading to a higher demand for effective preventive and management strategies. Various studies show how collagen supplements help in bone disease treatment.

Opportunity

- Product Innovation and Launches

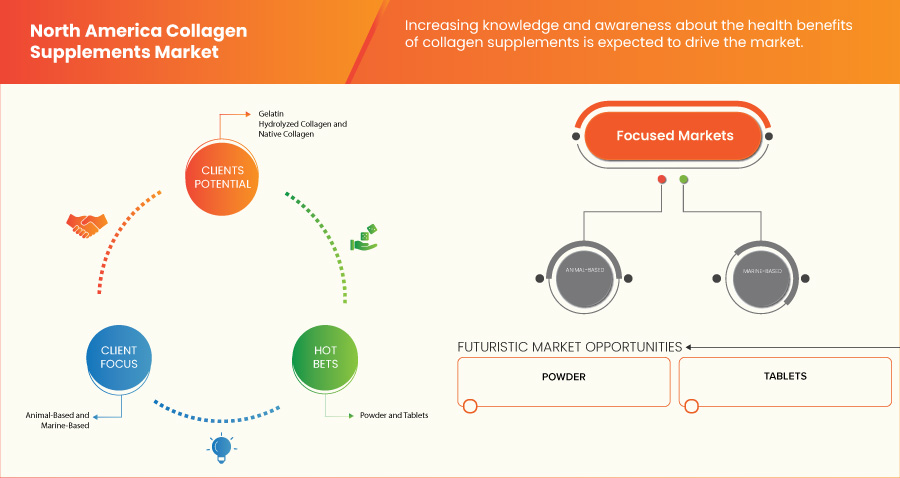

Product innovation and launches represent a promising opportunity for the growth of the North America collagen supplement market. Manufacturers are increasingly investing in research and development to create innovative collagen supplement formulations as consumer demand for natural and effective health and wellness products continues to rise. These innovations not only cater to existing consumer needs but also attract new consumer segments, propelling market expansion. Manufacturers can meet the evolving demands of health-conscious consumers worldwide with continuous advancements in research, formulation, and sustainability practices. Companies can attract new consumers and strengthen their market position by offering diverse and specialized collagen supplement options.

Challenges/ Restraints

- Regulations upon the Slaughtering of Farm and Poultry Animals

The slaughtering of animals has become an offensive act in various places because the extraction of a considerable amount of collagen leads to the killing of a variety of animals, which can even reach a point where some animals may extinct, which are already less in number. Before extraction, manufacturers have to notify an official government agency about all the establishments and get all of them registered.

In the case of collagen supplements, registration of all establishments is a legal requirement. Also, other than the agency, the local authority veterinary officer is advised and his permission is required for an on-farm poultry slaughterhouse based on the risk of assessment. Thus, all these procedures and regulations create challenges for the manufacturers to obtain collagen from animal sources is expected to restrain the market growth.

- Low Penetration of Collagen Supplements in Developing Regions

The low penetration of collagen supplements in developing regions poses a substantial challenge for the market growth. Despite the increasing popularity of collagen supplements in developed countries, their adoption in developing regions has been comparatively limited due to various factors.

One of the primary obstacles hindering the uptake of collagen supplements in developing regions is the lack of awareness and education about these products. Many consumers in these regions may not be familiar with collagen supplements or may not fully understand their potential health benefits. The absence of effective marketing and educational campaigns has contributed to this knowledge gap, resulting in lower consumer interest and demand.

Moreover, cultural and traditional practices play a significant role in shaping consumer preferences in developing regions. In some cultures, traditional healing practices and herbal remedies are deeply ingrained, and the concept of consuming collagen supplements may not align with these cultural beliefs. As a result, consumers may be hesitant to embrace collagen supplements, preferring traditional remedies they perceive as more effective and familiar.

Recent Development

- In May 2023, Sports Research Corporation, the leading family-owned and operated vitamin, supplement, and performance essentials-based company, officially entered an ongoing rebranding phase. This rebranding will help the company in its business expansion

- In January 2021, Rousselot announced that it has launched MSC-certified marine collagen peptides at Beauty & Skincare Formulation Conference 2021. The product has been launched by the name of Peptan Marine. This product launch helped the company in its product portfolio expansion

North America Collagen supplements Market Scope

The North America collagen supplements market is categorized into seven notable segments based on nature, source, product, collagen type, function, packaging, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Nature

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Others

On the basis of nature, the market is segmented into gelatin, hydrolyzed collagen, native collagen, and others.

Source

- Animal-Based

- Marine-Based

- Plant-Based

On the basis of source, the market is segmented into animal-based, plant-based, and marine-based.

Product

- Powder

- Tablets

- Capsules

- Liquid

- Soft Gels

- Gummies

- Gel Caps

- Others

On the basis of product, the market is segmented into powder, tablets, capsules, liquid, soft gels, gummies, gel caps, and others.

Collagen Type

- Type I

- Type III

- Type II

- Type IV

On the basis of collagen type, the market is segmented into type I, type II, type III, and type IV.

Function

- Skincare

- Bone & Joint Health

- Immunity Function

- Diabetes

- Exercise And Athletic Performance

- Cardiac Health

- Mental Health

- Others

On the basis of function, the market is segmented into skincare, bone & joint health, immunity function, diabetes, exercise and athletic performance, cardiac health, mental health, and others.

Packaging

- Rigid Containers/Jars

- Pouches & Sachets

- Bottles

- Cardboard Boxes

On the basis of packaging, the market is segmented into rigid containers/jars, pouches & sachets, bottles, and cardboard boxes, and others.

Distribution Channel

- Store Based Retailers

- Non-Store Retailers

On the basis of distribution channel, the market is segmented into store-based retailers and non-store retailers.

North America Collagen supplements Market Regional Analysis/Insights

The North America collagen supplements market is categorized into seven notable segments based on nature, source, product, collagen type, function, packaging, and distribution channel.

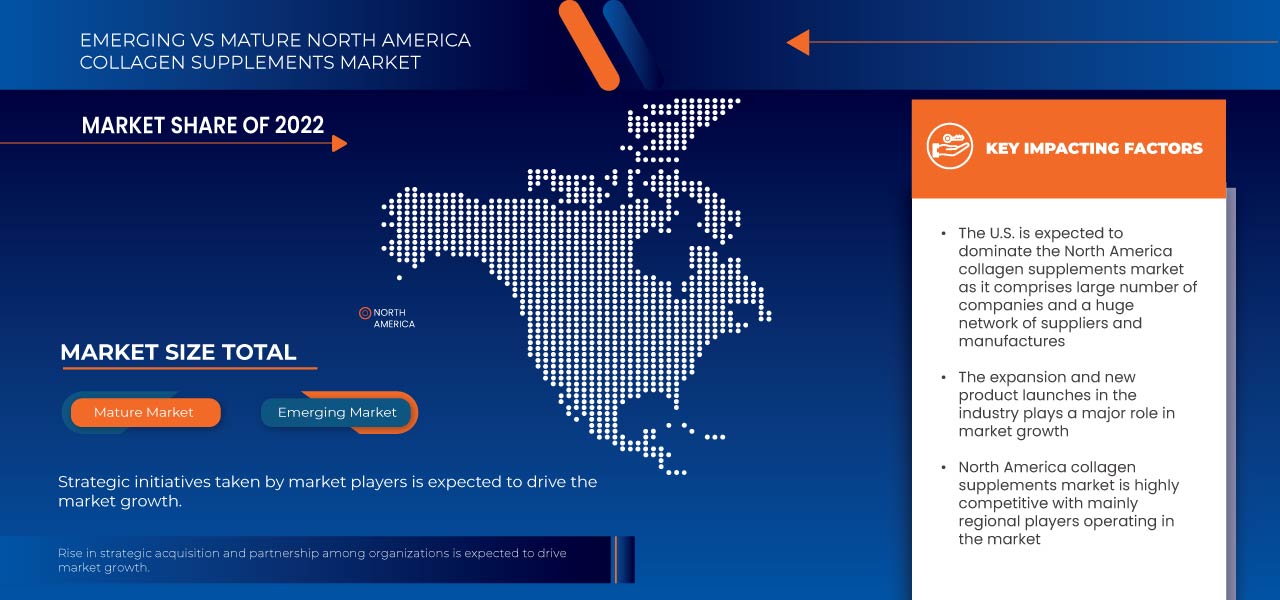

The countries covered in this market report are U.S., Canada, and Mexico.

U.S. is expected to dominate due to the presence of key market players in the largest consumer market with high GDP. U.S. is expected to grow due to rise in technological advancement for the production of collagen supplements.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Collagen supplements Market Share Analysis

North America collagen supplements market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breath, application dominance, product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major market players in the North America collagen supplements market are GELITA AG, TCI CO., LTD., Nordic Naturals, Nitta Gelatin Inc., Orgain Inc., Essential elements, HUM Nutrition Inc., ReFa USA, BUBS Naturals, Sports Research Corporation, Agent Nateur, SkinnyFit, LLC., Rousselot (A Subsidiary of Darling Ingredients), Vital Proteins LLC. (A subsidiary of Nestle Health Science), and Renew Life Formulas, LLC. (A subsidiary of The Clorox Company) among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 NATURE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.2 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 FACTORS INFLUENCING PURCHASING DECISION

4.5 SHOPPING BEHAVIOUR AND DYNAMICS

4.5.1 RECOMMENDATION FROM FAMILY AND FRIENDS -

4.5.2 RESEARCH

4.5.3 IMPULSIVE –

4.5.4 ADVERTISEMENTS –

4.6 NEW PRODUCT LAUNCH STRATEGY

4.7 CONSUMER DISPOSABLE INCOME DYNAMICS/ SPEND DYNAMICS

4.8 PRODUCTION AND CONSUMPTION PATTERN

4.9 IMPORT-EXPORT ANALYSIS

4.9.1 SPECIFICATIONS FOR MANUFACTURING AND DISTRIBUTING COLLAGEN SUPPLEMENTS AND POWDERS

4.9.2 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, REGULATIONS

4.1 PORTER'S FIVE FORCES MODEL

5 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, PRICING ANALYSIS

6 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, BRAND OUTLOOK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF COLLAGEN SUPPLEMENTS IN TREATMENT PROCEDURE OF BONE DISEASES

7.1.2 INCREASING KNOWLEDGE AND AWARENESS ABOUT THE HEALTH BENEFITS OF COLLAGEN SUPPLEMENTS

7.1.3 INCREASING USE OF COLLAGEN SUPPLEMENTS FOR COSMETIC PURPOSES

7.2 RESTRAINTS

7.2.1 REGULATIONS UPON THE SLAUGHTERING OF FARM AND POULTRY ANIMALS

7.2.2 POSSIBLE SIDE EFFECTS

7.3 OPPORTUNITIES

7.3.1 RISING USE OF COLLAGEN SUPPLEMENTS AMONG SPORTS ATHLETES

7.3.2 PRODUCT INNOVATION & LAUNCHES

7.4 CHALLENGES

7.4.1 LOW PENETRATION OF COLLAGEN SUPPLEMENTS IN DEVELOPING REGIONS POSES A SUBSTANTIAL CHALLENGE

7.4.2 ETHICAL AND SUSTAINABLE SOURCING CONCERNS

8 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY NATURE

8.1 OVERVIEW

8.2 GELATIN

8.3 HYDROLYZED COLLAGEN

8.4 NATIVE COLLAGEN

8.5 OTHERS

9 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, BY SOURCE

9.1 OVERVIEW

9.2 ANIMAL-BASED

9.2.1 BOVINE

9.2.1.1 CATTLES

9.2.1.2 BUFFALOES

9.2.1.3 OTHERS

9.2.2 POULTRY

9.2.2.1 CHICKEN

9.2.2.2 TURKEY

9.2.2.3 OTHERS

9.2.2.4 OTHERS

9.3 MARINE-BASED

9.3.1.1 FISHES

9.3.1.2 SEAWEEDS/ALGAES

9.3.1.3 OTHERS

9.4 PLANT-BASED

10 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY PRODUCT

10.1 OVERVIEW

2.1 POWDER

2.2 TABLETS

2.3 CAPSULES

2.4 LIQUID

2.5 SOFT GELS

2.6 GUMMIES

2.7 GEL CAPS

2.8 OTHERS

11 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY COLLAGEN TYPE

11.1 OVERVIEW

11.2 TYPE I

2.9 TYPE III

11.3 TYPE II

11.4 TYPE IV

12 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 SKINCARE

12.3 BONE & JOINT HEALTH

12.4 IMMUNITY FUNCTION

12.5 DIABETES

12.6 EXERCISE AND ATHLETIC PERFORMANCE

12.7 CARDIAC HEALTH

12.8 MENTAL HEALTH

12.9 OTHERS

13 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, BY PACKAGING

13.1 OVERVIEW

13.2 RIGID CONTAINERS/JARS

13.3 POUCHES & SACHETS

13.4 BOTTLES

13.5 CARDBOARD BOXES

14 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 STORE BASED RETAILERS

14.2.1 SUPERMARKETS/HYPERMARKETS

14.2.2 DRUG AND PHARMACY STORE

14.2.3 MULTI-BRAND STORES

14.2.4 MONO-BRAND STORES

14.2.5 OTHERS

14.3 NON-STORE BASED RETAILERS

14.3.1 E-COMMERCE PLATFORMS

14.3.2 COMPANY WEBSITES

15 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY REGION

15.1 OVERVIEW

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

16 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, COMPANY PROFILES

18.1 ROUSSELOT (A SUBSIDIARY OF DARLING INGREDIENTS)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 GELITA AG

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 TCI CO., LTD.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 ORGAIN INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 NITTA GELATIN INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 AGENT NATEUR

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BUBS NATURALS

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ESSENTIAL ELEMENTS

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 HUM NUTRITION INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 NORDIC NATURALS

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 REFA USA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 RENEW LIFE FORMULAS, LLC. (A SUBSIDIARY OF THE CLOROX COMPANY)

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 SKINNY FIT, LLC.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 SPORTS RESEARCH CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 VITAL PROTEINS LLC. (A SUBSIDIARY OF NESTLE HEALTH SCIENCE)

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 HERE ARE THE PRICES OF SOME COLLAGEN SUPPLEMENTS:

TABLE 2 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, BY SOURCE, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ANIMAL BASED IN COLLAGEN SUPPLEMENTS MARKET, BY SOURCE, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA BOVINE IN COLLAGEN SUPPLEMENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA POULTRY IN COLLAGEN SUPPLEMENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA MARINE BASED IN COLLAGEN SUPPLEMENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY COLLAGEN TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA STORE BASED RETAILERS IN COLLAGEN SUPPLEMENTS MARKET, BY SOURCE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA NON-STORE BASED RETAILERS IN COLLAGEN SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA ACUTE MYELOID LEUKEMIA DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: SEGMENTATION

FIGURE 10 INCREASING USE OF COLLAGEN SUPPLEMENTS IN TREATMENT PROCEDURE OF BONE DISEASE IS EXPECTED TO DRIVE THE NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET IN THE FORECAST PERIOD

FIGURE 11 GELATIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET

FIGURE 13 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY NATURE, 2022

FIGURE 14 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY NATURE, 2023-2030 (USD THOUSAND)

FIGURE 15 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY NATURE, CAGR (2023-2030)

FIGURE 16 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY NATURE, LIFELINE CURVE

FIGURE 17 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY SOURCE, 2022

FIGURE 18 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY SOURCE, 2023-2030 (USD THOUSAND)

FIGURE 19 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY SOURCE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY PRODUCT, 2022

FIGURE 22 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY PRODUCT, 2023-2030 (USD THOUSAND)

FIGURE 23 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 25 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY COLLAGEN TYPE, 2022

FIGURE 26 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY COLLAGEN TYPE, 2023-2030 (USD THOUSAND)

FIGURE 27 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY COLLAGEN TYPE, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY COLLAGEN TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY FUNCTION, 2022

FIGURE 30 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY FUNCTION, 2023-2030 (USD THOUSAND)

FIGURE 31 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY FUNCTION, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 33 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY PACKAGING, 2022

FIGURE 34 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY PACKAGING, 2023-2030 (USD THOUSAND)

FIGURE 35 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY PACKAGING, CAGR (2023-2030)

FIGURE 36 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 37 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 38 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 39 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 40 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: SNAPSHOT (2022)

FIGURE 42 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY REGION (2022)

FIGURE 43 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY REGION (2023 & 2030)

FIGURE 44 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY REGION (2022 & 2030)

FIGURE 45 NORTH AMERICA COLLAGEN SUPPLEMENT MARKET: BY NATURE (2023-2030)

FIGURE 46 NORTH AMERICA COLLAGEN SUPPLEMENTS MARKET: COMPANY SHARE 2022 (%)

North America Collagen Supplements Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Collagen Supplements Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Collagen Supplements Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.