North America Consumer Electronics Packaging Market

Market Size in USD Billion

CAGR :

%

USD

9.20 Billion

USD

24.12 Billion

2024

2032

USD

9.20 Billion

USD

24.12 Billion

2024

2032

| 2025 –2032 | |

| USD 9.20 Billion | |

| USD 24.12 Billion | |

|

|

|

|

Consumer Electronics Packaging Market Size

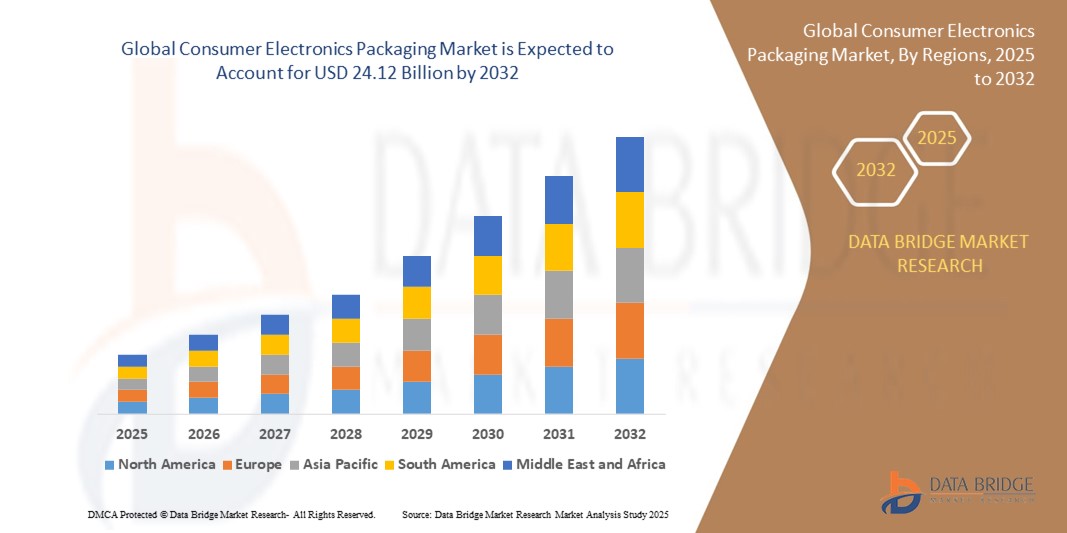

- The North America consumer electronics packaging market size was valued at USD 9.20 billion in 2024 and is expected to reach USD 24.12 billion by 2032, at a CAGR of 12.80% during the forecast period

- The market growth is primarily driven by the rising demand for consumer electronics, increasing adoption of sustainable packaging solutions, and advancements in packaging technologies tailored for e-commerce and retail distribution

- Growing consumer awareness of eco-friendly packaging materials, coupled with the booming e-commerce sector, is positioning consumer electronics packaging as a critical component of product safety and brand appeal, significantly boosting market expansion

Consumer Electronics Packaging Market Analysis

- Consumer electronics packaging, designed to protect and enhance the appeal of devices such as mobile phones, computers, and wearables, is a vital element of the supply chain, offering product protection, branding opportunities, and sustainability in both retail and e-commerce settings

- The surge in demand for consumer electronics packaging is fueled by the rapid growth of the consumer electronics industry, increasing focus on sustainable and recyclable materials, and the need for robust packaging solutions to support the e-commerce boom

- The U.S. dominated the North America consumer electronics packaging market with the largest revenue share of 38.9% in 2024, driven by high consumer electronics consumption, advanced packaging infrastructure, and the presence of major industry players

- Canada is expected to be the fastest-growing country in the North America consumer electronics packaging market during the forecast period, propelled by increasing urbanization, rising demand for consumer electronics, and growing adoption of eco-friendly packaging solutions

- The corrugated boxes segment held the largest market revenue share of 29.4% in 2024, driven by their versatility, cost-effectiveness, and superior protective qualities for safe transportation of electronics, particularly in e-commerce and retail sectors

Report Scope and Consumer Electronics Packaging Market Segmentation

|

Attributes |

Consumer Electronics Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Consumer Electronics Packaging Market Trends

“Increasing Adoption of Sustainable and Eco-Friendly Packaging Solutions”

- The North America consumer electronics packaging market is experiencing a significant trend toward the integration of sustainable and eco-friendly packaging materials

- Companies are increasingly utilizing biodegradable plastics, recycled paper, and paperboard to reduce environmental impact and align with consumer preferences for sustainability

- Advanced packaging designs, such as rightsizing and lightweighting, are being employed to minimize material usage while maintaining protection for electronic devices

- For instance, major players such as Mondi and DS Smith are developing innovative solutions, such as recyclable paper-based trays and eco-friendly corrugated boxes, to cater to the growing demand for sustainable packaging

- This trend enhances the appeal of packaging solutions for environmentally conscious consumers and helps companies comply with stringent environmental regulations in the U.S. and Canada

- Sustainable packaging also supports branding efforts, as companies leverage eco-friendly designs to differentiate their products in a competitive market

Consumer Electronics Packaging Market Dynamics

Driver

“Rising Demand for E-Commerce and Protective Packaging Solutions”

- The surge in e-commerce, particularly in the U.S. and Canada, is a major driver for the consumer electronics packaging market, fueled by the increasing popularity of online retail for electronics such as smartphones, laptops, and wearables

- Packaging solutions, such as corrugated boxes and foam inserts, are critical for ensuring product safety during shipping, protecting fragile devices from mechanical damage and environmental factors

- The U.S., as the dominating market, benefits from a robust e-commerce infrastructure and high consumer demand for electronics, driving the need for durable and visually appealing packaging

- Canada, the fastest-growing market, is seeing rapid e-commerce expansion, further increasing demand for protective packaging such as air bubble pouches and thermoformed trays

- The growth of 5G technology and IoT-enabled devices is also boosting the need for specialized packaging to support advanced electronics, enhancing unboxing experiences and brand value

Restraint/Challenge

“High Costs of Advanced Packaging Technologies and Regulatory Compliance”

- The high initial investment required for advanced packaging technologies, such as intelligent packaging and anti-microbial packaging, can be a significant barrier, particularly for smaller manufacturers in the North America market

- Integrating sustainable materials and technologies, such as active packaging or flexographic printing, into existing production lines is complex and costly

- Data security and environmental compliance concerns also pose challenges, as intelligent packaging systems may collect product or consumer data, raising privacy issues and requiring adherence to strict regulations in the U.S. and Canada

- The fragmented regulatory landscape across North America, particularly regarding recycling and single-use plastics, complicates operations for manufacturers and increases compliance costs

- These factors may deter adoption, especially in cost-sensitive segments, and limit market growth in regions with high regulatory scrutiny or economic constraints

Consumer Electronics Packaging market Scope

The market is segmented on the basis of type, packaging material, layer, technology, printing technology, distribution channel, and application.

- By Type

On the basis of type, the North America consumer electronics packaging market is segmented into corrugated boxes, paperboard boxes, thermoformed trays, blister packs and clamshell, protective packaging, bags, sacks, pouches, films, foam packaging, air bubble pouches, and others. The corrugated boxes segment held the largest market revenue share of 29.4% in 2024, driven by their versatility, cost-effectiveness, and superior protective qualities for safe transportation of electronics, particularly in e-commerce and retail sectors. Their eco-friendly nature, being recyclable and made from renewable materials, further boosts their adoption.

The paperboard boxes segment is expected to witness the fastest growth rate of 13.2% from 2025 to 2032, fueled by increasing demand for sustainable packaging solutions and their ability to offer high-quality printing for branding. The rise in e-commerce and consumer preference for visually appealing, eco-friendly packaging for products such as smartphones and wearables drives this growth.

- By Packaging Material

On the basis of packaging material, the North America consumer electronics packaging market is segmented into plastic, paper, aluminum foil, cellulose, and others. The plastic segment dominated with a 44.1% market revenue share in 2024, owing to its lightweight, durable, and versatile nature, which allows custom shapes to protect electronics from environmental factors such as moisture. Its widespread use in blister packs and clamshells supports its dominance.

The paper segment is anticipated to experience the fastest growth from 2025 to 2032, driven by increasing consumer and regulatory demand for sustainable, recyclable materials. The shift from plastic to paper-based packaging, particularly for corrugated and paperboard boxes, aligns with environmental concerns and eco-friendly trends in the electronics industry.

- By Layer

On the basis of layer, the North America consumer electronics packaging market is segmented into primary packaging, secondary packaging, and tertiary packaging. The primary packaging segment held the largest market revenue share of 63.7% in 2024, as it directly encases electronic products, providing essential protection against physical damage and environmental factors. Its role in enhancing product aesthetics and user experience further drives its dominance.

The secondary packaging segment is expected to witness robust growth from 2025 to 2032, driven by the rise in e-commerce, which requires additional protective layers for safe shipping and storage. Customizable secondary packaging also supports branding and improves unboxing experiences, contributing to its growth.

- By Technology

On the basis of technology, the North America consumer electronics packaging market is segmented into active packaging, intelligent packaging, modified atmospheric packaging, anti-microbial packaging, aseptic packaging, and others. The intelligent packaging segment held the largest market revenue share of 38.2% in 2024, driven by the integration of smart features such as QR codes, sensors, and NFC chips for product authentication, tracking, and enhanced consumer engagement.

The active packaging segment is anticipated to witness significant growth from 2025 to 2032, as it offers solutions to extend product shelf life and protect sensitive electronics from environmental factors such as humidity and temperature, particularly for high-value devices such as wearables and cameras.

- By Printing Technology

On the basis of printing technology, the North America consumer electronics packaging market is segmented into flexographic, gravure, and others. The flexographic printing segment dominated with a 60.8% market revenue share in 2024, due to its cost-effectiveness, fast-drying inks, and suitability for printing on porous surfaces such as corrugated boxes. Its widespread use in high-volume packaging for electronics supports its dominance.

The gravure printing segment is expected to witness the fastest growth from 2025 to 2032, driven by its ability to produce high-quality, detailed graphics for premium packaging, particularly for consumer electronics such as smartphones and televisions, where branding and aesthetics are critical.

- By Distribution Channel

On the basis of distribution channel, the North America consumer electronics packaging market is segmented into e-commerce, supermarkets/hypermarkets, specialty stores, and others. The e-commerce segment held the largest market revenue share of 52.3% in 2024, fueled by the rapid growth of online retail for consumer electronics, requiring durable and protective packaging for safe delivery. The U.S., with its robust e-commerce infrastructure, dominates this segment.

The specialty stores segment is anticipated to witness rapid growth of 14.5% from 2025 to 2032, driven by increasing demand for premium packaging that enhances in-store product presentation and aligns with consumer preferences for branded, high-quality unboxing experiences.

- By Application

On the basis of application, the North America consumer electronics packaging market is segmented into mobile phones, computers, televisions, DTH and set-top boxes, music systems, printers, scanners and photocopy machines, game consoles and toys, camcorders and cameras, electronic wearables, digital media adapters, and others. The mobile phones segment dominated with a 42.6% market revenue share in 2024, driven by the high volume of smartphone sales and the need for tailored, protective packaging with premium designs to enhance brand value and consumer experience.

The electronic wearables segment is expected to witness the fastest growth of 15.8% from 2025 to 2032, fueled by rising demand for smartwatches and fitness trackers, which require compact, protective, and visually appealing packaging to ensure product safety and market differentiation.

Consumer Electronics Packaging Market Regional Analysis

- The U.S. dominated the North America consumer electronics packaging market with the largest revenue share of 38.9% in 2024, driven by high consumer electronics consumption, advanced packaging infrastructure, and the presence of major industry players

- Consumers prioritize packaging that ensures product safety, enhances user experience, and aligns with environmental concerns, particularly in regions with high e-commerce penetration and diverse consumer preferences

- Growth is supported by advancements in packaging technologies, such as intelligent and active packaging, alongside rising adoption in both OEM and aftermarket segments

U.S. Consumer Electronics Packaging Market Insight

The U.S. dominates the North America consumer electronics packaging market with the highest revenue share in 2024, fueled by strong e-commerce demand and growing consumer awareness of sustainable packaging benefits. The trend towards premium product presentation and increasing regulations promoting eco-friendly materials further boost market expansion. The integration of advanced packaging solutions, such as blister packs and intelligent packaging, in consumer electronics such as mobile phones and computers complements both OEM and aftermarket sales, creating a dynamic market ecosystem.

Canada Consumer Electronics Packaging Market Insight

Canada is expected to witness the fastest growth rate in the North America consumer electronics packaging market, driven by rising demand for protective and aesthetically appealing packaging in urban and suburban settings. Increased interest in sustainable packaging solutions, such as recyclable corrugated boxes and paperboard, encourages adoption. Evolving regulations promoting environmentally friendly packaging materials and the growth of e-commerce further influence consumer choices, balancing functionality with compliance.

Consumer Electronics Packaging Market Share

The consumer electronics packaging industry is primarily led by well-established companies, including:

- JYX GmbH (China)

- DuPont (U.S.)

- AMETEK, Inc. (U.S.)

- JOHNSBYRNE (U.S.)

- Pregis LLC (U.S.)

- Universal Protective Packaging, Inc. (U.S.)

- Dordan Manufacturing Company (U.S.)

- UFP Technologies, Inc. (U.S.)

- Stora Enso (Finland)

- Smurfit Kappa (Ireland)

- Mondi (Austria)

- DS Smith (U.K.)

- Sealed Air (U.S.)

- Sonoco Products Company (U.S.)

- WestRock Company (U.S.)

- PAPIER METTLER KG (Germany)

- GY Packaging (China)

- New-Tech Packaging (U.S.)

- Maco PKG (U.S.)

What are the Recent Developments in North America Consumer Electronics Packaging Market?

- In February 2025, Siemens Digital Industries Software unveiled a certified automated workflow for TSMC’s Integrated Fan-Out (InFO) packaging technology, marking a significant advancement in semiconductor design and manufacturing. The workflow leverages Siemens’ Innovator3D IC, Xpedition Package Designer, HyperLynx DRC, and Calibre nmDRC software to support both InFO_oS and InFO_PoP variants. These tools enable high-density integration, precise design rule checking, and streamlined production, meeting the rising demand for compact, high-performance electronic devices across AI, HPC, and mobile applications

- In January 2024, INEOS Styrolution introduced Zylar® EX350, a new grade of methyl methacrylate butadiene styrene (MBS) material tailored for carrier tapes in electronic component packaging. Engineered for extrusion, Zylar EX350 offers a balanced combination of stiffness and toughness, enabling deeper and more rigid pocket designs compared to traditional GPPS/SBC blends. This enhances component stability, reduces mis-picks during assembly, and improves camera inspection transparency. The launch reflects growing demand for versatile, high-performance, and sustainable packaging materials in the electronics industry

- In December 2023, PwC US acquired nearly all assets of Surfaceink, a California-based product design and engineering firm renowned for its work in consumer electronics and Internet of Things (IoT) projects. This strategic move strengthens PwC’s ability to deliver end-to-end product development, combining Surfaceink’s expertise in hardware design, acoustics, and prototyping with PwC’s consulting and digital transformation services. The acquisition supports PwC’s broader goal of helping clients reinvent business models through human-led, tech-powered solutions, including packaging design, supply chain optimization, and connected product innovation

- In November 2023, the U.S. government introduced a strategic initiative under the CHIPS for America Program to strengthen the nation’s capabilities in advanced semiconductor packaging. The plan includes up to USD 1.6 billion in funding to support the development of a secure, resilient, and high-volume domestic packaging industry. This effort is part of the broader National Advanced Packaging Manufacturing Program (NAPMP), which aims to ensure that advanced-node chips manufactured in the U.S. are also packaged domestically, reducing reliance on overseas facilities and enhancing supply chain security

- In September 2023, Sandvik Coromant advanced its smart packaging capabilities by launching a new AI-driven tool aimed at improving packaging efficiency for industrial cutting tools. This innovation is part of Sandvik’s broader digital transformation strategy, which integrates AI and machine learning to streamline manufacturing workflows and reduce operational complexity. The tool supports automated decision-making, enhances tool selection accuracy, and simplifies data flow across production stages. By embedding intelligence into packaging processes, Sandvik is helping manufacturers reduce waste, boost productivity, and meet growing demands for sustainable and connected solutions in the North American market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Consumer Electronics Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Consumer Electronics Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Consumer Electronics Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.