North America Dental Lab Market

Market Size in USD Billion

CAGR :

%

USD

3.97 Billion

USD

6.49 Billion

2023

2031

USD

3.97 Billion

USD

6.49 Billion

2023

2031

| 2024 –2031 | |

| USD 3.97 Billion | |

| USD 6.49 Billion | |

|

|

|

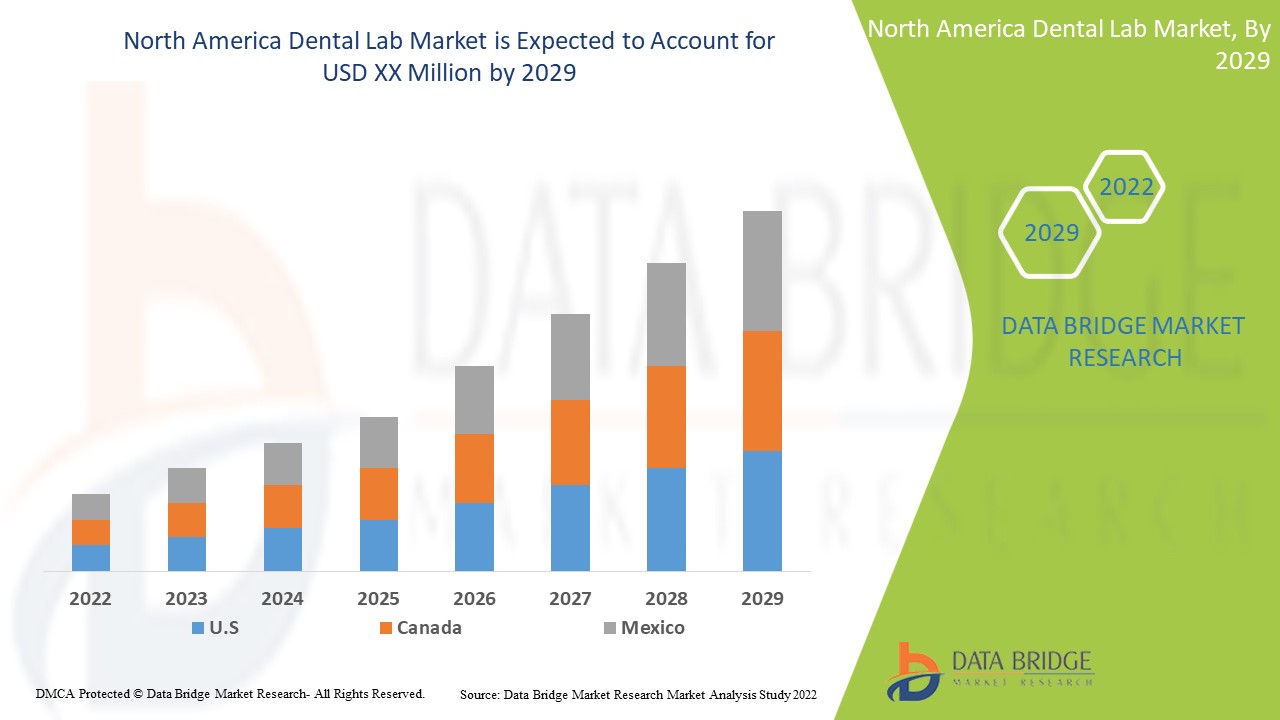

North America Dental Lab Market Analysis

The dental lab market is experiencing rapid growth driven by advancements in technology. With the latest methods such as CAD/CAM systems and 3D printing, labs are enhancing precision and efficiency in producing dental prosthetics. This technological leap not only improves product quality but also reduces production time and costs. Consequently, the market is witnessing an upsurge in demand for cutting-edge dental lab solutions.

North America Dental Lab Market Size

The North America dental lab market size was valued at USD 3.97 billion in 2023 and is projected to reach USD 6.49 billion by 2031, with a CAGR of 6.34% during the forecast period 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Equipment Type (Milling Equipment, Dental Scanner, 3D Printing System, CAD/CAM System, Casting Machines, Radiology Equipment, and Others), Product Type (Orthodontics, Endodontics, Restorative, Oral Care, Implants, and Prosthodontics) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Ultradent Products Inc. (U.S.), Young Innovations, Inc. (U.S.), Dentatus (Sweden), Carestream Dental LLC. (U.S.), Roland DGA Corporation (U.S.), 3Shape A/S (Denmark), Formlabs (U.S.), PLANMECA OY (Finland), Septodont (France), VOCO GmbH (Germany), 3M (U.S.), Henry Schein, Inc. (U.S.), GC Corporation (Japan), BIOLASE, Inc. (U.S.), Dentsply Sirona. (U.S.), BEGO GmbH & Co. KG (Germany), Bicon (U.S.), CAMLOG Biotechnologies GmbH (Switzerland), and Institut Straumann AG (Switzerland) |

|

Market Opportunities |

|

Dental Lab Market Definition

A dental lab is a specialized facility where dental prosthetics and appliances are crafted. These labs work closely with dentists to create custom-made items such as crowns, bridges, dentures, and orthodontic devices. Skilled technicians utilize advanced materials and techniques to ensure precise fit, functionality, and aesthetics, ultimately contributing to patients' oral health and well-being.

North America Dental Lab Market Dynamics

Drivers

- Shift towards Digital Dentistry

The dental industry is rapidly embracing digital dentistry, where practices utilize digital workflows for treatment planning and fabrication. This shift opens avenues for dental labs specializing in digital solutions. For instance, digital impressions are increasingly replacing traditional methods, with intraoral scanners such as iTero and TRIOS enabling precise 3D modeling of patients' teeth, streamlining the fabrication process for dental prosthetics and aligners.

- Rising Medical Tourism

The surge in medical tourism has notably boosted the demand for dental lab services, especially in countries renowned for their high-quality yet affordable dental care. Patients seek cost-effective solutions abroad for procedures such as dental implants or veneers. For instance, countries such as Thailand and Mexico have become popular destinations due to their skilled dental professionals and competitive prices, driving an influx of patients and subsequently increasing demand for dental lab services.

Opportunities

- Increasing Demand for Aesthetic Dentistry

The rising demand for aesthetic dental treatments such as veneers, crowns, and bridges is propelling the need for dental lab services. Patients increasingly seek these procedures for smile enhancement and restoration. For instance, the popularity of porcelain veneers among individuals aiming for a flawless smile has surged, driving dental labs to innovate in materials and techniques to meet this demand for aesthetically pleasing and durable global dental solutions.

- Advancements in Technology

Technological innovations such as CAD/CAM systems, 3D printing, and digital impression systems have revolutionized dental lab processes, enabling faster and more precise production of dental prosthetics. For instance, CAD/CAM technology enables digital design and milling of crowns and bridges, reducing production time and enhancing accuracy. Similarly, 3D printing facilitates the creation of intricate dental models and prostheses, streamlining the manufacturing process while ensuring high levels of detail and customization.

Restraints/Challenges

- Limited Skilled Labour

The dental lab industry grapples with severe labour shortages, with skilled technicians in high demand. This scarcity cripples scalability and efficiency. Challenges in training and retaining qualified staff severely constrain production capacity and compromise quality, undermining market growth and stability.

- High Cost of Equipment and Materials

The dental lab market struggles with the exorbitant expenses of procuring and maintaining cutting-edge equipment and top-tier materials. This financial burden disproportionately affects smaller labs, hindering their ability to compete effectively. The high costs create a significant barrier to entry and sustainability, impeding market growth and innovation in the dental industry. For instance, according to a 2019 Elsevier Inc. article, digital impressions with intraoral scanners cost USD 21.42 and USD 29.40 per arch and USD 37.66 and USD 102.10 per patient, respectively, significantly lower than conventional impressions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

North America Dental Lab Market Scope

The market is segmented on the basis of equipment type and product type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Equipment Type

- Milling Equipment

- Dental Scanner

- 3D Printing System

- CAD/CAM System

- Casting Machines

- Radiology Equipment

- Others

Product Type

- Orthodontics

- Endodontics

- Restorative

- Oral Care

- Implants

- Prosthodontics

North America Dental Lab Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, equipment type and product type as referenced above.

The countries covered in the market report are U.S., Canada and Mexico.

U.S. is expected to dominate the dental lab market, propelled by a surge in periodontal disorders and the region's status as a hub for dental treatment in North America. This dominance is fueled by a combination of factors, including advanced technology, skilled professionals, and a robust healthcare infrastructure.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Dental Lab Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- Ultradent Products Inc. (U.S.)

- Young Innovations, Inc. (U.S.)

- Dentatus (Sweden)

- Carestream Dental LLC. (U.S.)

- Roland DGA Corporation (U.S.)

- 3Shape A/S (Denmark)

- Formlabs (U.S.)

- PLANMECA OY (Finland)

- Septodont (France)

- VOCO GmbH (Germany)

- 3M (U.S.)

- Henry Schein, Inc. (U.S.)

- GC Corporation (Japan)

- BIOLASE, Inc. (U.S.)

- Dentsply Sirona. (U.S.)

- BEGO GmbH & Co. KG (Germany)

- Bicon (U.S.)

- CAMLOG Biotechnologies GmbH (Switzerland)

- Institut Straumann AG (Switzerland)

Latest Development in Dental Lab Market

- In March 2022, Ultradent Products launched a range of premium accessories designed for VALO Grand curing lights, introducing six new lenses. This expansion enables clinicians to enhance their use of VALO Grand lights, offering more versatility in patient care

- In January 2022, Formlabs, a leading 3D printing company, launched the Form 3+ and Form 3B+ printers, contributing to anticipated market growth in North America. These printers offer advanced capabilities, addressing diverse needs in various industries

- In February 2021, Dentsply Sirona released the CEREC SW 5.1.3 update, featuring validation of 17 new materials for the CEREC Primemill. Notably, this includes PMMA for surgical guides and bridge blocks for grinded processes, expanding the application range of the system

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.