North America Diagnostic Tests Market

Market Size in USD Million

CAGR :

%

USD

157,104.45 Million

USD

324,714.32 Million

2022

2030

USD

157,104.45 Million

USD

324,714.32 Million

2022

2030

| 2023 –2030 | |

| USD 157,104.45 Million | |

| USD 324,714.32 Million | |

|

|

|

|

North America Diagnostic Tests Market Analysis and Size

According to the World Health Organization (WHO), chronic diseases will account for approximately 41 million deaths per year by April 2021, accounting for 71% of all fatalities. As a result, diagnostic tests have proven useful in managing chronic illness conditions, as well as disease prevention, detection, and diagnosis. Clinical diagnostics enable early prevention and intervention by recognizing individual risk factors and early warning indicators. As a result, the overall market is expected to grow as the prevalence of chronic illnesses rises.

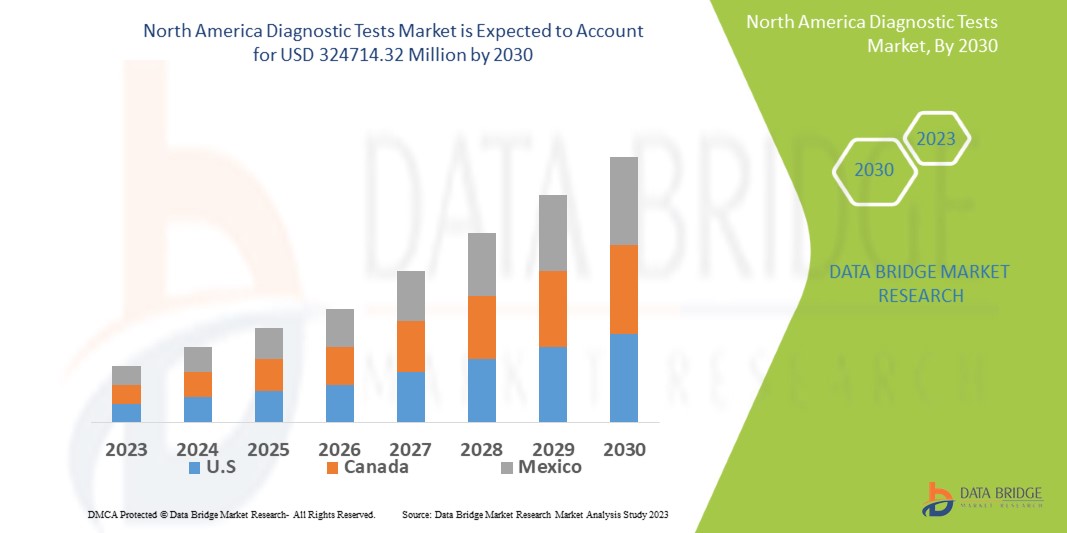

Data Bridge Market Research analyses that the diagnostic tests market, which was USD 157104.45 million in 2022, is expected to reach USD 324714.32 million by 2030, at a CAGR of 9.5% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Diagnostic Tests Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Glucose Test, Infectious Diseases Test, Cytology Test, CBC Test, Blood Culture Test, Syphilis Test, Urea Test, C-Reactive Protein Test, Antigen Test, HBA1C Test, Pregnancy Test, Lipid Profile Test, Electrolytes Test, Liver Function Test, Stool Helicobacter Pylori Test, Calcium Test, Crossmatch Test, Thyroid Function Test, Stool Microscopy Test, Urine Microscopy Test, Unit Packed RBCS Test, ESR Test and Others Test), Solutions (Services and Products), Technology (Immunoassay-Based, PCR-Based, Next Gene Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, Substrate Technology and Others), Mode of Testing (Prescription-Based Testing and OTC Testing), Approach (Molecular Diagnostic Instrument, In-Vitro Diagnostic Instrument and Point Of Care Testing Instrument), Sample Type (Urine, Saliva, Blood, Hair, Sweat and Others), Application (Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Odontology and Others), Testing Type (Biochemistry, Haematology, Microbiology, Histopathology and Others), Age (Pediatric, Adult and Geriatric), End User (Hospitals, Diagnostic Center, Research Labs and Institutes, Research Institute, Homecare, Blood Banks, Specialty Clinics, Ambulatory Surgical Centers and Others), Distribution Channel (Direct Tenders, Retail Sales and Online Sales) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

F-Hoffman La-Roche Ltd. (Switzerland), ABBOTT (U.S.), Danaher (U.S.), B.D. (U.S.), Thermo Fisher Scientific Inc. (U.S.), ACON Laboratories Inc. (U.S.), Hemosure, Inc. (U.S.), MicroGen Diagnostics (U.S.), QIAGEN (Germany), Grifols, S.A (Spain), BODITECH MED INC. (South Korea), Chembio Diagnostic Systems, Inc. (U.S.), Nanoentek (South Korea), DiaSorin S.p.A. (Italy), Bio-Rad Laboratories, Inc. (U.S.), BIOMEDOMICS INC (U.S.), EKF Diagnostics Holdings plc (U.K.), Siemens Healthcare GmbH (Germany), PerkinElmer Inc. (U.S.), BIOMÉRIEUX (France), ARKRAY USA, Inc. (U.S.), Biohit Oyj (Finland), Germaine Laboratories, Inc. (U.S.), Quidel Corporation (U.S.), Illumina, Inc. (U.S.), Lamdagen Corporation (U.S.), LifeSign LLC. (U.S.), Medixbiochemica (Finland), Nova Biomedical (U.S.), Ortho Clinical Diagnostics (U.S.), Sannuo Biosensing Co., Ltd. (U.S.), STRECK (U.S.), Sysmex Corporation (Japan), among others |

|

Market Opportunities |

|

Market Definition

Diagnostic tests are medical procedures used to aid in the detection or diagnosis of disease. These tests play an important role in disease control, surveillance, and prevention. These tests aid in the enhancement of patient care, consumer safety, and healthcare spending. A diagnostic test is one that is used to figure out what is causing a condition. A diagnostic test performed as part of a medical examination may be used to identify a disease or to determine the cause of symptoms. When used for other purposes, a diagnostic test can be used to identify specific strengths and weaknesses.

North America Diagnostic Tests Market Dynamics

Drivers

- Growing incidences of infectious and chronic diseases

Infectious diseases and chronic conditions are putting a strain on the global population. Infectious diseases like diphtheria, ebola, flu, hepatitis, HIV/AIDS, HPV, tuberculosis, and others are caused by microorganisms, and sudden outbreaks like dengue, Zika virus, COVID-19, and Swine flu drive international demand for clinical diagnostic tests. Furthermore, chronic diseases such as cancer, diabetes, cardiovascular disease, obesity, and others are driving up demand for clinical diagnostics.

- Rising clinical diagnostic tests

Clinical diagnostic tests are the most precise methods for identifying and characterising microorganisms. A practical test must be accurate, quick, and capable of determining the level of infection. Better testing determines the organism's strain and drug susceptibility more quickly, reducing the time it takes to find the right antibiotic. According to a World Health Organization (WHO) report, tuberculosis (TB) was one of the top ten causes of death. This is likely to be a significant market growth factor. The availability and accessibility to better diagnostic procedures are primarily responsible for the high incidence of cancer cases in living standards. Because clinical cancer diagnostics equipment is widely used in these procedures, demand for diagnostic tests rises during the forecast period.

Opportunities

- Growing demand for advanced diagnostic solutions

Clinical diagnostics are used to manage patients' health. It allows for the earlier detection of diseases and aids in the progression of illnesses. Furthermore, it may aid infected individuals in avoiding long-term consequences, raising public awareness of the significance of clinical diagnosis. Increased healthcare spending and health awareness encourage market growth. During the forecast period, demand for diagnostic kits is expected to rise as people become more concerned about the risk of disease transmission from infected patients. Diagnostic testing can be carried out using either services or tools and supplies. This feature will almost certainly improve patient convenience, benefiting the market.

Restraints/Challenges

- Affordability for diagnostics tests

Pricing pressures resulting from reimbursement cuts, budget constraints, and stringent regulatory policies are expected to stifle market growth. Furthermore, during the forecast period of 2023-2030, the diagnostic tests market is expected to be challenged by a lack of alignment with definitive central lab methods and insufficient adoption of POC devices in professional settings.

This diagnostic tests market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the diagnostic tests market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Diagnostic Tests Market

COVID-19 has negatively impacted the diagnostic test market because lab testing has increased, causing demand to rise even faster to keep up with suspected COVID-19 cases. According to the Atlantic Monthly Group, the number of COVID-19 tests worldwide increased dramatically from 760,441 in September 2020 to 964,792 in October 2020. As a result, the rising number of tests due to increased patient numbers and government funding is expected to drive demand for COVID-19 test kits and fuel the overall market's exponential growth.

Recent Developments

- In 2020, Siemens Healthcare GmbH officially announced the release of the RAPIDPoint 500e Blood Gas Analyzer, which broadened the company's product portfolio and is also used in COVID-19 efforts. This helps to increase revenue from the line.

- In 2020, Siemens Healthcare GmbH and the Marienhaus Hospital Group announced a ten-year collaboration. This collaboration will benefit the company in diagnostics in the long run. This agreement will also help the company's financial situation.

North America Diagnostic Tests Market Scope

The diagnostic tests market is segmented on the basis of type, solution, technology, mode of testing, approach, sample type, application, testing type, age, end user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Glucose Test

- Infectious Diseases Test

- Cytology Test

- CBC Test

- Blood Culture Test

- Syphilis Test

- Urea Test

- C-Reactive Protein Test

- Antigen Test

- HBA1C Test

- Pregnancy Test

- Lipid Profile Test

- Electrolytes Test

- Liver Function Test

- Stool Helicobacter Pylori Test

- Calcium Test, Crossmatch Test

- Thyroid Function Test

- Stool Microscopy Test

- Urine Microscopy Test

- Unit Packed Rbcs Test

- ESR Test and Others Test

Solutions

- Services

- Products

Technology

- Immunoassay-Based

- PCR-Based

- Next Gene Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Substrate Technology

- Others

Mode of Testing

- Prescription-Based Testing

- OTC Testing

Approach

- Molecular Diagnostic Instrument

- In-Vitro Diagnostic Instrument

- Point of Care Testing Instrument

Sample Type

- Urine

- Saliva

- Blood

- Hair

- Sweat

- Others

Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Odontology

- Others

Testing Type

- Biochemistry

- Hematology

- Microbiology

- Histopathology

- Others

Age

- Pediatric

- Adult

- Geriatric

End User

- Hospitals

- Diagnostic Center

- Research Labs and Institutes

- Research Institute

- Homecare

- Blood Banks

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

Distribution Channel

- Direct Tenders

- Retail Sales

- Online Sales

North America Diagnostic Tests Market Regional Analysis/Insights

The diagnostic tests market is analyzed and market size insights and trends are provided by country, type, solution, technology, mode of testing, approach, sample type, application, testing type, age, end user and distribution channel as referenced above.

The countries covered in the diagnostic tests market report are U.S., Canada and Mexico in North America.

In North America, the U.S. is dominating the market due to growing adoption of diagnostic tests for preclinical research of diagnostic tests in the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Diagnostic Tests Market Share Analysis

The diagnostic tests market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to diagnostic tests market.

Some of the major players operating in the diagnostic tests market are:

- F-Hoffman La-Roche Ltd. (Switzerland)

- ABBOTT (U.S.)

- Danaher (U.S.)

- B.D. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- ACON Laboratories Inc. (U.S.)

- Hemosure, Inc. (U.S.)

- MicroGen Diagnostics (U.S.)

- QIAGEN (Germany)

- Grifols, S.A (Spain)

- BODITECH MED INC. (South Korea)

- Chembio Diagnostic Systems, Inc. (U.S.)

- Nanoentek (South Korea)

- DiaSorin S.p.A. (Italy)

- Bio-Rad Laboratories, Inc. (U.S.)

- BIOMEDOMICS INC (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Siemens Healthcare GmbH (Germany)

- PerkinElmer Inc. (U.S.)

- BIOMÉRIEUX (France)

- ARKRAY USA, Inc. (U.S.)

- Biohit Oyj (Finland)

- Germaine Laboratories, Inc. (U.S.)

- Quidel Corporation (U.S.)

- Illumina, Inc. (U.S.)

- Lamdagen Corporation (U.S.)

- LifeSign LLC. (U.S.)

- Medixbiochemica (Finland)

- Nova Biomedical (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Sannuo Biosensing Co., Ltd. (U.S.)

- STRECK (U.S.)

- Sysmex Corporation (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.