North America Electrophysiology Market

Market Size in USD Billion

CAGR :

%

USD

4.05 Billion

USD

7.41 Billion

2025

2033

USD

4.05 Billion

USD

7.41 Billion

2025

2033

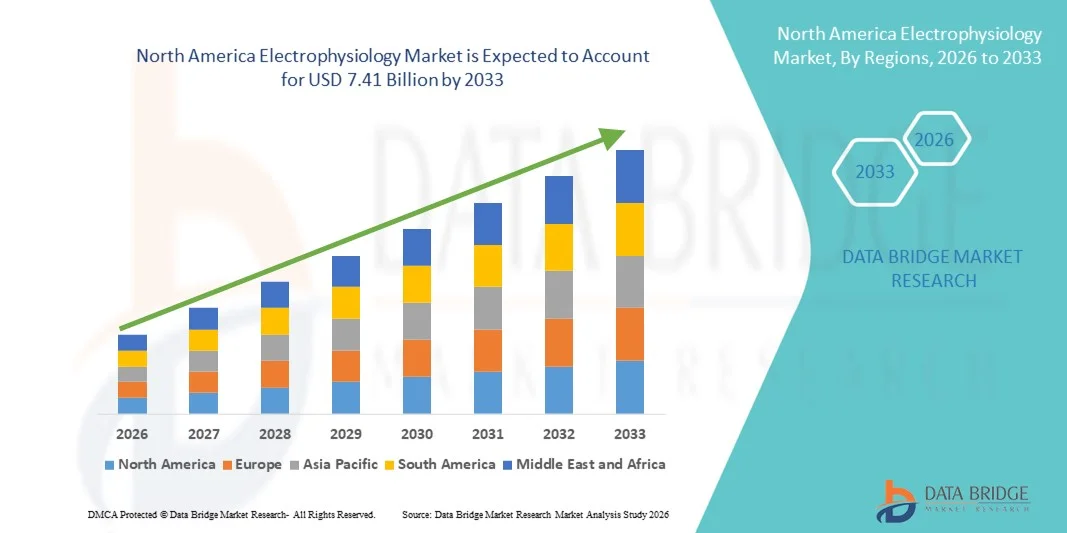

| 2026 –2033 | |

| USD 4.05 Billion | |

| USD 7.41 Billion | |

|

|

|

|

North America Electrophysiology Market Size

- The North America electrophysiology market size was valued at USD 4.05 billion in 2025 and is expected to reach USD 7.41 billion by 2033, at a CAGR of 7.85% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiac arrhythmias, particularly atrial fibrillation, along with the growing geriatric population and higher incidence of cardiovascular disorders across the region

- Furthermore, continuous technological advancements in mapping systems, catheter ablation technologies, and implantable cardiac devices, coupled with strong reimbursement frameworks and expanding adoption of minimally invasive procedures in hospitals and specialized cardiac centers, are positioning electrophysiology solutions as a cornerstone of modern cardiac care. These converging factors are accelerating procedural volumes and innovation, thereby significantly boosting the industry’s growth

North America Electrophysiology Market Analysis

- Electrophysiology systems, encompassing advanced cardiac mapping technologies, catheter ablation devices, and implantable rhythm management solutions, are increasingly vital components of modern cardiovascular care across hospitals and specialized cardiac centers due to their precision in diagnosing and treating complex arrhythmias through minimally invasive procedures

- The escalating demand for electrophysiology solutions is primarily fueled by the rising prevalence of atrial fibrillation and other cardiac arrhythmias, a growing geriatric population, increasing awareness of early diagnosis, and a strong shift toward minimally invasive, catheter-based treatment approaches

- The United States dominated the electrophysiology market with the largest revenue share of 88.6% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement frameworks, and a strong presence of leading medical device manufacturers, with the country experiencing substantial growth in ablation procedures and electrophysiology lab expansions driven by continuous technological innovations in 3D mapping and robotic-assisted navigation systems

- Canada is expected to witness steady growth during the forecast period due to expanding access to specialized cardiac centers, increasing healthcare investments, and a rising burden of cardiovascular diseases

- Ablation Catheters segment dominated the electrophysiology market with a market share of 54.3% in 2025, driven by its high clinical efficacy in treating atrial fibrillation and other supraventricular tachycardias, shorter recovery times compared to surgical alternatives, and growing physician preference for advanced radiofrequency and cryoablation technologies

Report Scope and North America Electrophysiology Market Segmentation

|

Attributes |

North America Electrophysiology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Electrophysiology Market Trends

Advancement of Pulsed Field Ablation and AI-Enabled Mapping Systems

- A significant and accelerating trend in the North America electrophysiology market is the rapid adoption of pulsed field ablation (PFA) technology and artificial intelligence (AI)-enabled 3D cardiac mapping systems. This integration of next-generation ablation energy sources with intelligent imaging platforms is significantly enhancing procedural precision, safety, and efficiency

- For instance, Boston Scientific’s FARAPULSE PFA System has gained strong traction across U.S. hospitals for atrial fibrillation treatment, while Abbott’s EnSite X EP System offers advanced mapping capabilities to support complex arrhythmia procedures

- AI integration in electrophysiology systems enables improved real-time signal interpretation, automated mapping adjustments, and optimized lesion placement guidance during catheter ablation procedures. For instance, certain advanced mapping platforms utilize machine learning algorithms to enhance anatomical accuracy and reduce fluoroscopy time, thereby improving overall procedural outcomes. Furthermore, next-generation ablation platforms offer enhanced safety profiles by selectively targeting myocardial tissue while minimizing damage to surrounding structures

- The seamless integration of electrophysiology systems with hospital imaging infrastructure and electronic health records facilitates coordinated patient management across cardiology departments. Through a unified procedural workflow, clinicians can manage diagnostics, mapping, ablation therapy, and post-procedural monitoring within an integrated cardiac care environment, creating a streamlined and data-driven treatment pathway

- This trend toward more precise, data-driven, and minimally invasive electrophysiology procedures is fundamentally reshaping clinical expectations for arrhythmia management. Consequently, companies such as Medtronic are developing advanced catheter technologies and mapping solutions with enhanced automation and compatibility with modern EP lab ecosystems

- The demand for advanced electrophysiology technologies that deliver higher efficacy, shorter procedure times, and improved patient safety is growing rapidly across hospitals and specialized cardiac centers, as healthcare providers increasingly prioritize innovation and long-term arrhythmia management outcomes

- In addition, the integration of remote monitoring systems and wearable cardiac devices with electrophysiology workflows is supporting comprehensive arrhythmia management, enabling earlier diagnosis and more personalized treatment strategies across North America

North America Electrophysiology Market Dynamics

Driver

Rising Prevalence of Cardiac Arrhythmias and Expanding Access to Minimally Invasive Care

- The increasing prevalence of atrial fibrillation and other complex cardiac arrhythmias, coupled with expanding access to minimally invasive catheter-based therapies, is a significant driver for the heightened demand for electrophysiology procedures in North America

- For instance, in recent years, Johnson & Johnson MedTech expanded its electrophysiology portfolio through advancements in catheter ablation technologies and mapping platforms, strengthening its presence in U.S. electrophysiology labs

- As cardiovascular disease burden continues to rise and the aging population expands, healthcare providers are increasingly adopting advanced electrophysiology systems to deliver effective rhythm management solutions with reduced hospital stays and faster patient recovery

- Furthermore, strong reimbursement frameworks and favorable clinical guidelines supporting catheter ablation as a first-line therapy for certain arrhythmias are encouraging higher procedural volumes and capital investments in EP laboratory infrastructure

- The preference for minimally invasive interventions, improved clinical success rates, and technological innovation in ablation energy sources are key factors propelling the adoption of electrophysiology systems across tertiary care hospitals and specialized cardiac centers. The ongoing expansion of electrophysiology training programs and investments in advanced cardiac facilities further contribute to market growth

- Increasing public awareness campaigns and routine cardiac screening initiatives are supporting early detection of arrhythmias, thereby expanding the eligible patient pool for electrophysiology interventions

- Continuous product approvals and regulatory clearances for innovative ablation and mapping systems are further stimulating competitive dynamics and accelerating technology adoption in the regional market

Restraint/Challenge

High Procedural Costs and Technology Adoption Barriers

- Concerns surrounding the high capital investment required for advanced electrophysiology systems, including mapping platforms and ablation technologies, pose a significant challenge to broader market expansion, particularly for smaller healthcare facilities

- For instance, the installation of a fully equipped electrophysiology laboratory with 3D mapping and robotic navigation systems requires substantial upfront investment, which may limit adoption in cost-sensitive institutions

- Addressing these cost-related concerns through value-based care models, long-term outcome data, and operational efficiency improvements is crucial for encouraging broader technology uptake. Companies such as Abbott and Boston Scientific emphasize clinical efficacy and workflow optimization benefits to justify capital expenditures. In addition, the complexity of electrophysiology procedures and the need for specialized physician training can act as barriers to rapid expansion, particularly in community hospitals

- While procedural volumes are increasing, variability in reimbursement rates and regulatory approval timelines for novel technologies can delay widespread commercialization and adoption of next-generation systems

- Overcoming these challenges through cost optimization strategies, expanded physician training initiatives, supportive reimbursement policies, and demonstration of long-term clinical and economic benefits will be vital for sustained market growth in the North America electrophysiology sector

- Limited availability of highly trained electrophysiologists in certain geographic areas can create capacity constraints and procedural backlogs, affecting timely patient access to advanced treatments

- In addition, potential concerns related to long-term safety data for newly introduced ablation technologies may result in cautious adoption patterns among conservative healthcare provider

North America Electrophysiology Market Scope

The market is segmented on the basis of product, target disease, and end user.

- By Product

On the basis of product, the North America electrophysiology market is segmented into ablation catheters, laboratory devices, diagnostic catheters, access devices, and other products. The ablation catheters segment dominated the market with the largest market revenue share of 54.3% in 2025, driven by the high procedural volume of catheter ablation for atrial fibrillation and other complex arrhythmias. Ablation catheters are central to electrophysiology procedures, as they directly deliver radiofrequency, cryoablation, or pulsed field energy to targeted cardiac tissue. The increasing preference for minimally invasive rhythm management therapies has significantly elevated demand for technologically advanced ablation systems. Continuous innovation in contact-force sensing, irrigated-tip designs, and pulsed field ablation technologies further strengthens this segment’s leadership. Moreover, strong clinical evidence supporting catheter ablation as a first-line therapy for certain arrhythmias contributes to sustained product demand across major hospitals and cardiac centers.

The laboratory devices segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing investments in advanced electrophysiology lab infrastructure across the United States and Canada. Laboratory devices, including 3D mapping systems, recording systems, and intracardiac imaging platforms, play a critical role in enhancing procedural accuracy and workflow efficiency. The growing adoption of AI-enabled mapping technologies and real-time imaging integration is accelerating upgrades of existing EP laboratories. Healthcare facilities are prioritizing modernization of cardiac care units to support rising arrhythmia case volumes. In addition, expansion of hybrid operating rooms and outpatient electrophysiology centers is driving new installations of advanced laboratory equipment.

- By Target Disease

On the basis of target disease, the market is segmented into atrial fibrillation, atrial flutter, Wolff-Parkinson-White syndrome, atrioventricular nodal reentry tachycardia, and others. The atrial fibrillation segment dominated the market with the largest revenue share in 2025, primarily due to its high prevalence across the aging North American population. Atrial fibrillation is one of the most commonly diagnosed cardiac arrhythmias and is strongly associated with increased stroke risk and heart failure. The rising clinical emphasis on early rhythm control strategies has significantly increased catheter ablation procedures for AF patients. Favorable reimbursement coverage and updated clinical guidelines recommending ablation as an effective treatment option further strengthen this segment. Continuous technological advancements in pulsed field ablation and cryoballoon systems are also supporting improved safety and efficacy outcomes in AF treatment.

The atrioventricular nodal reentry tachycardia segment is projected to witness the fastest growth rate from 2026 to 2033, driven by improved diagnostic capabilities and increasing awareness of supraventricular tachycardias. Enhanced access to specialized electrophysiology centers has enabled more accurate differentiation of arrhythmia subtypes. Minimally invasive catheter-based interventions for AVNRT demonstrate high success rates and low recurrence, encouraging broader procedural adoption. In addition, advancements in mapping precision and reduced fluoroscopy exposure are improving patient safety profiles. The growing trend toward same-day discharge procedures in select arrhythmia cases is also supporting procedural growth in this segment.

- By End User

On the basis of end user, the North America electrophysiology market is segmented into hospitals and ambulatory surgical centers (ASCs). The hospitals segment dominated the market with the largest revenue share in 2025, owing to the availability of advanced cardiac infrastructure and multidisciplinary cardiology teams. Complex electrophysiology procedures often require comprehensive perioperative support and intensive monitoring capabilities, which are more readily available in hospital settings. Large tertiary care hospitals also serve as referral centers for complicated arrhythmia cases, contributing to higher procedural volumes. Furthermore, hospitals are more likely to invest in advanced mapping systems, robotic navigation platforms, and hybrid EP labs. Strong reimbursement coverage for inpatient and outpatient hospital-based procedures further sustains segment dominance.

The ambulatory surgical centers (ASCs) segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing shift toward cost-effective and minimally invasive outpatient procedures. Advances in ablation technologies with improved safety profiles are enabling select electrophysiology interventions to be performed in outpatient settings. ASCs offer reduced procedural costs, shorter patient wait times, and streamlined workflows compared to traditional hospital environments. The growing emphasis on value-based care and healthcare cost optimization is encouraging providers to expand electrophysiology services into ambulatory settings. In addition, favorable regulatory updates supporting outpatient reimbursement for certain ablation procedures are accelerating the expansion of electrophysiology capabilities within ASCs across North America.

North America Electrophysiology Market Regional Analysis

- The United States dominated the electrophysiology market with the largest revenue share of 88.6% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement frameworks, and a strong presence of leading medical device manufacturers

- Healthcare providers in the country highly value the clinical precision, improved patient outcomes, and operational efficiency offered by advanced electrophysiology systems, including 3D mapping technologies and next-generation ablation platforms

- This widespread adoption is further supported by favorable reimbursement policies, advanced healthcare infrastructure, the presence of leading medical device manufacturers, and the growing preference for catheter-based rhythm management therapies, establishing electrophysiology systems as a critical component of modern cardiac care across hospitals and specialized centers

The U.S. Electrophysiology Market Insight

The U.S. electrophysiology market captured the largest revenue share within North America in 2025, fueled by the high prevalence of atrial fibrillation and the strong adoption of minimally invasive catheter ablation procedures. Healthcare providers are increasingly prioritizing advanced rhythm management solutions supported by sophisticated 3D mapping systems and next-generation ablation technologies. The growing preference for early rhythm control strategies, combined with favorable reimbursement frameworks and expanding electrophysiology lab infrastructure, further propels market growth. Moreover, continuous technological advancements, including pulsed field ablation and AI-enabled mapping platforms, are significantly contributing to the expansion of the electrophysiology industry across major cardiac centers.

Canada Electrophysiology Market Insight

The Canada electrophysiology market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing cardiovascular disease prevalence and the gradual expansion of specialized cardiac care facilities. Rising investments in healthcare infrastructure and modernization of hospital-based electrophysiology laboratories are fostering greater adoption of advanced mapping and ablation systems. Canadian healthcare providers are increasingly focused on improving patient outcomes through minimally invasive procedures with shorter recovery times. In addition, growing awareness regarding early arrhythmia diagnosis and supportive public healthcare coverage are expected to stimulate market growth across the country.

Mexico Electrophysiology Market Insight

The Mexico electrophysiology market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by improving access to advanced cardiac care and increasing healthcare investments. The rising burden of cardiovascular disorders and expanding private healthcare facilities are encouraging the adoption of catheter-based arrhythmia treatments. Greater availability of trained cardiologists and electrophysiologists is also supporting procedural growth. Furthermore, ongoing healthcare reforms and the gradual integration of advanced electrophysiology technologies into urban hospitals are expected to contribute to sustained market expansion.

North America Electrophysiology Market Share

The North America Electrophysiology industry is primarily led by well-established companies, including:

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- GE HealthCare (U.S.)

- Stereotaxis Inc. (U.S.)

- Biotronik SE & Co. KG (Germany)

- MicroPort Scientific Corporation (China)

- Siemens Healthineers AG (Germany)

- CardioFocus, Inc. (U.S.)

- AtriCure, Inc. (U.S.)

- Freudenberg Medical (Germany)

- Imricor Medical Systems (U.S.)

- Catheter Precision, Inc. (U.S.)

- Ablacon, Inc. (U.S.)

- Impulse Dynamics (U.S.)

- Teleflex Incorporated (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Hansen Medical (U.S.)

- CathRx (U.S.)

What are the Recent Developments in North America Electrophysiology Market?

- In September 2025, Kardium secured U.S. FDA premarket approval (PMA) for its Globe Pulsed Field Ablation system, allowing the Canadian company to enter the U.S. atrial fibrillation treatment market with an integrated PFA platform and mapping software, expanding competition in next-generation ablation technologies

- In July 2025, Boston Scientific received expanded FDA approval for its FARAPULSE Pulsed Field Ablation (PFA) System to include pulmonary vein and posterior wall ablation for treatment of persistent atrial fibrillation, broadening its clinical indication beyond paroxysmal AF and potentially increasing its use in complex arrhythmia cases

- In April 2025, Merit Medical Systems, Inc. commercially launched the Ventrax™ Delivery System in the U.S., a novel retrograde access tool designed to facilitate catheter access for ventricular tachycardia ablation, addressing a key clinical need in one of the fastest-growing segments of electrophysiology treatment

- In April 2025, Johnson & Johnson MedTech announced it would highlight 22 abstracts related to electrophysiology innovation at the Heart Rhythm Society 2025 Annual Meeting, including discussions on pulsed field ablation (PFA) and care strategies for atrial fibrillation, underscoring ongoing research activity and clinical interest in advanced EP therapies

- In October 2024, Medtronic received FDA approval for its Affera™ Mapping and Ablation System with the Sphere-9™ Catheter, an all-in-one high-density mapping and dual-energy (pulsed field and radiofrequency) ablation system approved for treating persistent atrial fibrillation and atrial flutter, providing electrophysiologists enhanced procedural flexibility and efficiency in complex arrhythmia cases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.