North America Enteral Feeding Formula Market

Market Size in USD Billion

CAGR :

%

USD

1.75 Billion

USD

3.00 Billion

2024

2032

USD

1.75 Billion

USD

3.00 Billion

2024

2032

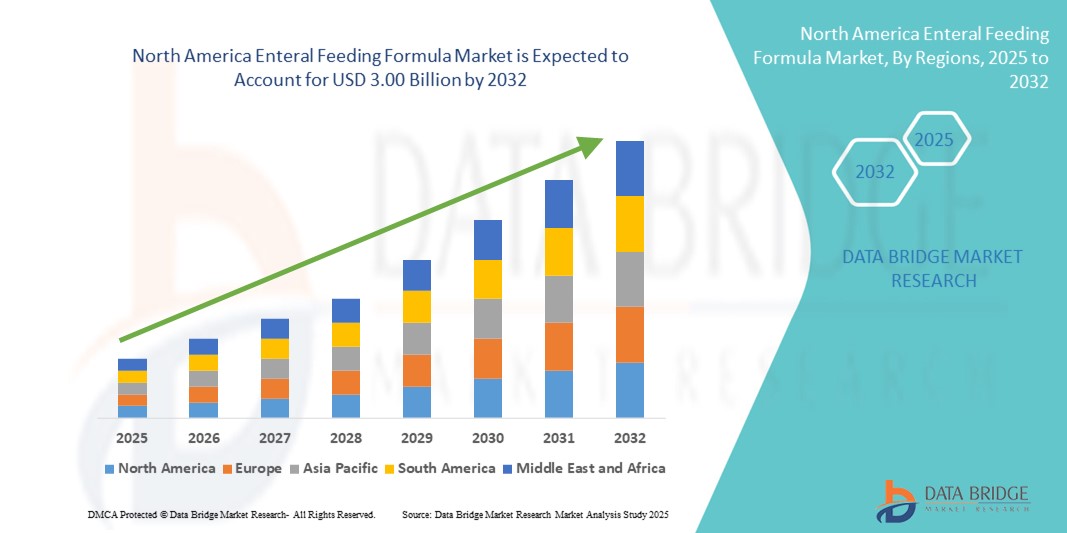

| 2025 –2032 | |

| USD 1.75 Billion | |

| USD 3.00 Billion | |

|

|

|

|

North America Enteral Feeding Formula Market Size

- The North America enteral feeding formula market size was valued at USD 1.75 billion in 2024 and is expected to reach USD 3.00 billion by 2032, at a CAGR of 6.90% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases such as cancer, gastrointestinal disorders, and neurological conditions, which demand long-term nutritional support

- In addition, rising geriatric population, growing awareness regarding clinical nutrition, and technological advancements in formula composition are promoting the adoption of enteral feeding formulas across hospitals, long-term care facilities, and home healthcare settings, thereby accelerating the market’s growth trajectory

North America Enteral Feeding Formula Market Analysis

- Enteral feeding formulas, designed for patients who cannot meet nutritional needs through oral intake, are becoming increasingly essential in clinical and home care settings across North America due to their targeted nutritional benefits and ease of administration

- The rising demand for enteral nutrition is primarily driven by the increasing incidence of chronic illnesses such as cancer, neurological disorders, and gastrointestinal diseases, coupled with growing awareness about the benefits of clinical nutrition in improving patient outcomes

- U.S. dominated the North America enteral feeding formula market with the largest revenue share of 79.9% in 2024, attributed to its advanced healthcare infrastructure, high healthcare spending, supportive reimbursement policies, and strong presence of leading clinical nutrition companies

- Canada is expected to be the fastest growing country in the North America enteral feeding formula market during the forecast period, driven by increasing healthcare awareness, rising prevalence of digestive and neurological disorders, and expanding home healthcare services

- The adult segment dominated the North America enteral feeding formula market with a market share of 63% in 2024, driven by a high burden of chronic diseases among adults and increasing adoption of long-term enteral nutrition support in post-acute care settings

Report Scope and North America Enteral Feeding Formula Market Segmentation

|

Attributes |

North America Enteral Feeding Formula Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Enteral Feeding Formula Market Trends

Rising Demand for Personalized and Disease-Specific Nutrition Solutions

- A major and accelerating trend in the North America enteral feeding formula market is the growing shift toward personalized and disease-specific nutritional formulas tailored to meet the unique metabolic and dietary needs of individual patients. This trend is enhancing clinical outcomes and improving patient compliance in long-term nutritional support

- For instance, Nestlé Health Science offers a range of specialized enteral nutrition products, such as Peptamen® for patients with gastrointestinal dysfunction and Impact® formulas designed to support immune function in critically ill patients. Similarly, Abbott’s Glucerna® series targets patients with diabetes by providing controlled carbohydrate formulations

- Advances in nutritional science and biotechnology are enabling manufacturers to develop formulas enriched with condition-specific nutrients such as omega-3 fatty acids, glutamine, and prebiotics to address complex conditions such as cancer, inflammatory bowel disease, and sarcopenia

- Moreover, the integration of digital health tools and AI-driven diagnostics in healthcare is supporting clinicians in selecting optimal formula types based on individual patient profiles, ensuring more effective and targeted therapy

- The demand for customized enteral feeding formulas is growing rapidly in hospitals, long-term care facilities, and home settings, as patients and caregivers increasingly value nutritional regimens that align closely with medical diagnoses and overall health goals

- This trend toward personalization and advanced formulation is reshaping industry standards and prompting leading companies such as Danone and Fresenius Kabi to expand their portfolios with innovative solutions tailored to specific clinical conditions

North America Enteral Feeding Formula Market Dynamics

Driver

Increasing Chronic Disease Burden and Aging Population

- The growing prevalence of chronic diseases, including cancer, stroke, neurological disorders, and gastrointestinal conditions, combined with the rapidly aging population, is a major driver of the rising demand for enteral feeding formulas across North America

- For instance, the U.S. Census Bureau projects that by 2034, older adults will outnumber children for the first time in U.S. history, indicating a rising need for long-term nutritional support due to age-associated illnesses

- Patients suffering from dysphagia or reduced mobility often require enteral nutrition to maintain energy levels and promote healing. Enteral formulas offer a reliable, non-invasive solution for such populations, leading to increased usage in hospitals and home healthcare

- Moreover, growing awareness among healthcare providers regarding the clinical benefits of early nutrition intervention, along with favorable reimbursement policies from Medicare and private insurers, is encouraging the integration of enteral feeding in patient care protocols

- The increasing availability of easy-to-administer and nutritionally complete formulas, including blenderized and elemental options, is also supporting the adoption of enteral nutrition across both acute and chronic care settings

Restraint/Challenge

Reimbursement Gaps and Risk of Complications

- One of the significant challenges hindering the broader adoption of enteral feeding formulas in North America is the complexity and variability in reimbursement policies, particularly for home-based enteral nutrition and certain specialized products

- For instance, while Medicare Part B provides limited coverage for enteral nutrition under strict criteria, many patients face out-of-pocket expenses for specific formulas or delivery supplies, which can deter long-term usage

- In addition, complications associated with enteral feeding, such as aspiration pneumonia, tube dislodgement, and gastrointestinal intolerance, raise clinical concerns and may lead to treatment discontinuation or hospitalization

- The need for proper caregiver training and monitoring, especially in home settings, adds another layer of complexity to enteral feeding administration

- While ongoing improvements in formula tolerability and delivery system design are addressing these issues, further efforts in policy standardization, healthcare provider education, and patient support are crucial to overcoming these barriers and ensuring sustained market growth

North America Enteral Feeding Formula Market Scope

The market is segmented on the basis of product, application, type of tube feeding, stage, and end user.

- By Product

On the basis of product, the North America enteral feeding formula market is segmented into standard formulas, diabetic formula, renal formula, hepatic formula, pulmonary formula, peptide-based formula, other disease-specific formulas, and disease-specific formulas. The standard formulas segment dominated the market with the largest market revenue share in 2024, driven by their broad applicability in various clinical conditions and widespread use in both hospital and home settings. These formulas provide balanced nutrition suitable for patients without specific dietary restrictions and are often the first choice for general nutritional support.

The diabetic formula segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing incidence of diabetes and the demand for formulas specifically designed to manage blood glucose levels. These formulas are gaining popularity among healthcare providers and caregivers for their effectiveness in managing nutrition in diabetic patients across diverse care environments.

- By Application

On the basis of application, the North America enteral feeding formula market is segmented into oncology, neurology, critical care, diabetes, gastroenterology, and others. The oncology segment dominated the market with the largest revenue share in 2024, driven by the high nutritional needs of cancer patients undergoing chemotherapy and radiation therapy. These patients often experience appetite loss or swallowing difficulties, making enteral formulas essential for maintaining strength and immune function.

The neurology segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing cases of stroke, ALS, and other neurological disorders requiring long-term nutritional support. Enteral feeding plays a crucial role in managing patients with dysphagia and neurological impairment, contributing to the segment's rapid growth.

- By Type of Tube Feeding

On the basis of type of tube feeding, the North America enteral feeding formula market is segmented into gastric tube feeding, nasogastric tube feeding, gastrostomy tube feeding, and duodenal or jejunal tube feeding. The gastric tube feeding segment held the largest market revenue share in 2024, driven by its common use in both acute and long-term care settings. Gastric feeding is often preferred when the digestive system is functional, and it supports efficient nutrient delivery with lower procedural complexity.

The duodenal or jejunal tube feeding segment is anticipated to witness the fastest growth rate from 2025 to 2032, due to its effectiveness in patients with high aspiration risk or compromised gastric function. This type is commonly used in critical care and surgical recovery, where direct small intestine delivery enhances absorption and minimizes complications.

- By Stage

On the basis of stage, the North America enteral feeding formula market is segmented into adult and pediatric. The adult segment dominated the market with the largest market revenue share of 63% in 2024, driven by the rising prevalence of chronic illnesses and the growing elderly population requiring long-term nutritional support. Adults represent the majority of enteral nutrition users, especially those with conditions such as cancer, stroke, and diabetes.

The pediatric segment is anticipated to witness steady growth during the forecast period, fueled by the increasing need for enteral nutrition in premature infants and children with congenital or developmental conditions. Pediatric-specific formulas and innovations in infant feeding are supporting this segment’s growth.

- By End User

On the basis of end user, the North America enteral feeding formula market is segmented into hospitals, nursing homes, assisted living facilities, home care agencies, and hospices and long-term care facilities. The hospitals segment held the largest market revenue share in 2024, driven by high usage of enteral nutrition in acute care settings, especially for patients in intensive care units and post-operative recovery. Hospitals rely on a wide range of enteral formulas to manage patient nutrition efficiently.

The home care agencies segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the shift toward home-based medical care and the increasing preference for patient-centered treatment models. Advancements in portable feeding systems and caregiver training are enabling patients to receive enteral nutrition safely in home environments.

North America Enteral Feeding Formula Market Regional Analysis

- The United States dominated the North America enteral feeding formula market with the largest revenue share of 79.9% in 2024, attributed to its advanced healthcare infrastructure, high healthcare spending, supportive reimbursement policies, and strong presence of leading clinical nutrition companies

- Healthcare providers and patients in the U.S. increasingly recognize the importance of enteral nutrition for recovery and disease management, especially in home healthcare settings where personalized and disease-specific formulas are gaining traction

- This widespread adoption is further supported by well-established healthcare infrastructure, favorable insurance coverage, and growing awareness of the benefits of early nutritional intervention, making enteral feeding formulas a vital component of nutritional therapy across both acute and long-term care environments

The U.S. Enteral Feeding Formula Market Insight

The U.S. enteral feeding formula market captured the largest revenue share of 79.4% in 2024 within North America, driven by a high prevalence of chronic diseases, a growing elderly population, and well-established healthcare infrastructure. The increased emphasis on home healthcare and patient-centric treatment has significantly contributed to the rise in demand for enteral nutrition solutions. Innovations in disease-specific formulas and personalized nutrition, along with strong reimbursement frameworks and rising awareness about clinical nutrition, continue to support market expansion across hospital, long-term care, and home settings.

Canada Enteral Feeding Formula Market Insight

The Canada enteral feeding formula market is projected to expand at a substantial CAGR throughout the forecast period, fueled by rising healthcare awareness, increased incidence of neurological and gastrointestinal disorders, and a growing focus on preventive health. The country’s aging population, coupled with government efforts to enhance long-term care services, is fostering greater adoption of enteral nutrition. Improvements in patient care strategies and the availability of advanced formula options are further driving growth in both institutional and home-based nutritional support applications.

Mexico Enteral Feeding Formula Market Insight

The Mexico enteral feeding formula market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing investment in healthcare infrastructure and expanding access to clinical nutrition. Rising rates of malnutrition, cancer, and chronic illnesses are prompting healthcare providers to incorporate enteral formulas into treatment protocols. Government-led healthcare initiatives and improving awareness about nutritional therapy are also expected to support market development, particularly in hospitals and long-term care facilities across urban centers.

North America Enteral Feeding Formula Market Share

The North America enteral feeding formula industry is primarily led by well-established companies, including:

- Nutricia (Netherlands)

- Hormel Foods Corporation (U.S.)

- Medline Industries, Inc. (U.S.)

- Mead Johnson & Company, LLC. (U.S.)

- Nestlé Health Science (Switzerland)

- Abbott (U.S.)

- Meiji Holdings Co., Ltd. (Japan)

- Fresenius Kabi AG (Germany)

- B. Braun SE (Germany)

- Trovita Health Science (U.S.)

- Victus Inc. (U.S.)

- Avanos Medical Inc. (U.S.)

- Cardinal Health (U.S.)

- Moog Inc (U.S.)

- Conmed Corporation (U.S.)

- Cook (India)

- Danone S.A. (France)

- Nestlé S.A. (Switzerland)

- Real Food Blends (U.S.)

- Smartfish AS (Norway)

What are the Recent Developments in North America Enteral Feeding Formula Market?

- In January 2025, Otsuka Pharmaceutical Factory, Inc. launched ENOSOLID Semi Solid for Enteral Use, a semi-solid nutrition formula tailored to provide essential nutrients, vitamins, and trace elements based on typical Japanese dietary intake. With L-carnitine and inulin, this 900 kcal option supports patients requiring lower maintenance energy and reduces reflux risk, complementing their earlier RACOL Semi-Solid product

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.