North America Enterprise Content Management Market

Market Size in USD Billion

CAGR :

%

USD

23.76 Billion

USD

71.62 Billion

2024

2032

USD

23.76 Billion

USD

71.62 Billion

2024

2032

| 2025 –2032 | |

| USD 23.76 Billion | |

| USD 71.62 Billion | |

|

|

|

|

Enterprise Content Management Market Size

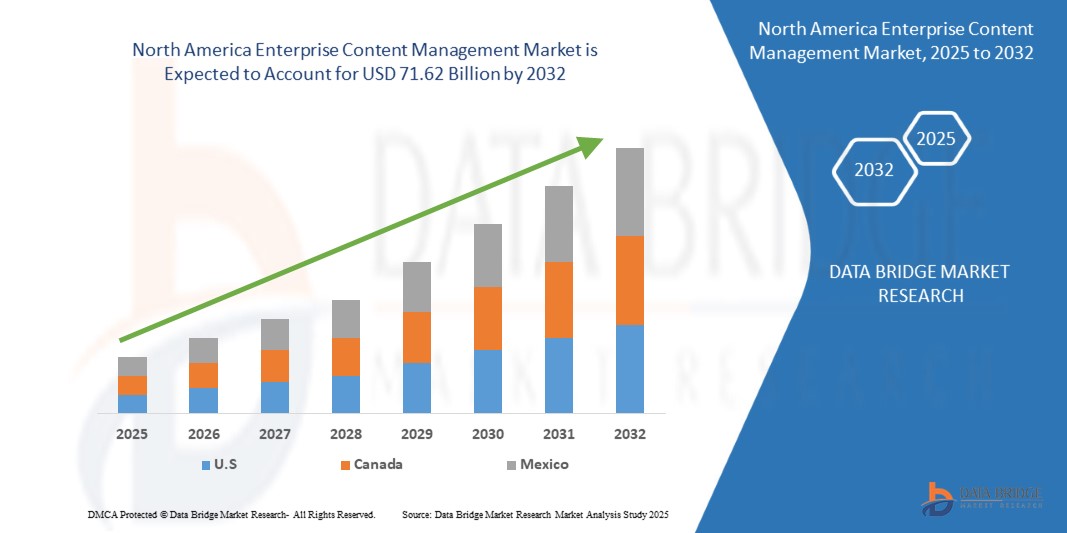

- The North America enterprise content management market size was valued at USD 23.76 billion in 2024 and is expected to reach USD 71.62 billion by 2032, at a CAGR of 14.9% during the forecast period

- The market growth is driven by factors such as increasing demand for cloud-based ECM solutions due to scalability and remote access capabilities

Enterprise Content Management Market Analysis

- The Enterprise Content Management (ECM) market encompasses a comprehensive suite of technologies, strategies, and tools used to capture, manage, store, preserve, and deliver content and documents related to organizational processes. ECM solutions streamline the handling of both structured and unstructured data, enabling enterprises to enhance information governance, regulatory compliance, collaboration, and workflow automation

- These systems play a pivotal role in digital transformation by supporting document digitization, secure access control, content lifecycle management, and integration with business applications. Widely adopted across industries such as BFSI, healthcare, government, manufacturing, and retail, ECM is critical for managing growing volumes of digital content. The market is being driven by the increasing need for remote accessibility, data privacy, cloud-based deployments, and AI-powered document processing, making ECM a cornerstone of modern enterprise information management strategies

- U.S. is expected to dominate the enterprise content management market due to the early adoption of advanced digital technologies, strong presence of leading ECM providers, and widespread implementation of cloud and AI-based solutions

- U.S. is expected to be the fastest growing region in the enterprise content management market during the forecast period due to rapid digital transformation across industries like BFSI, healthcare, and government, coupled with high enterprise IT spending, further strengthens North America's market leadership

- The content management segment is expected to dominate the enterprise content management market with the largest share of 29.39% in 2025, due to its foundational role in organizing, storing, and retrieving enterprise-wide information across diverse departments and industries. It enables seamless collaboration, real-time access, and centralized governance of digital content, which are essential for operational efficiency and compliance.

Report Scope and Enterprise Content Management Market Segmentation

|

Attributes |

Enterprise Content Management Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Enterprise Content Management Market Trends

“Integration of Intelligent Automation into ECM Systems”

- The North America enterprise content management market is undergoing a pivotal shift with the integration of Intelligent Automation technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP)

- These advancements are revolutionizing traditional content management practices by enabling automated document classification, intelligent metadata tagging, advanced search capabilities, and contextual content recommendations

- For instance, companies like OpenText and IBM are embedding AI-driven engines into ECM platforms to automate compliance checks, streamline data extraction from unstructured content, and enhance workflow efficiency across industries such as healthcare, finance, and legal services

- This trend reflects the growing need for real-time decision-making, scalability, and operational efficiency, positioning AI-powered ECM solutions as essential tools in enterprise digital transformation strategies

Enterprise Content Management Market Dynamics

Driver

Increasing Demand for Cloud-Based ECM Solutions Due to Scalability and Remote Access Capabilities

- Organizations are rapidly transitioning toward cloud-based ECM platforms because these solutions offer unparalleled scalability and flexibility. Cloud deployments allow businesses to expand or reduce their storage and processing capabilities without the need for costly infrastructure upgrades, making it easier to manage fluctuating workloads.

- Additionally, the cloud enables employees to securely access content anytime and from anywhere, supporting the needs of increasingly mobile and geographically dispersed workforces. This accessibility enhances collaboration and productivity while lowering the total cost of ownership compared to traditional on-premises systems.

- For instance, In April 2024, as per Paxton Media Ltd, Mattel partnered with Google Cloud to harness advanced analytics and AI capabilities, transforming how it leverages customer data. By synthesizing millions of consumer interactions in real time from social media to direct feedback Mattel gained actionable insights to fuel product innovation and hyper personalized engagement.

- This strategic move reflects the rising demand for cloud-based Enterprise Content Management (ECM) solutions, which offer the scalability and remote access required to manage and analyze large scale content efficiently. Through Google Cloud’s infrastructure, Mattel strengthened its ability to remotely access, process, and utilize data across teams, forging deeper connections with its regional audience and enhancing agility in decision-making

- This growing reliance is driving sustained market expansion, as cloud adoption becomes a core strategy for digital transformation initiatives.

Restraint/Challenge

High Upfront Investment and Ongoing Maintenance Costs Limit ECM Adoption among Small Businesses

- The substantial initial costs associated with purchasing, deploying, and customizing ECM software pose significant challenges, especially for Small and Medium-Sized Enterprises (SMEs)

- These expenses often include licensing fees, hardware procurement, system integration, and user training. Many smaller organizations lack the financial resources or technical expertise required to implement and sustain such complex systems, leading to slower adoption rates compared to larger enterprises

- For instance, in October 2023, the report by KrishaWeb explained how the total cost of Enterprise Content Management (ECM) systems went far beyond just license fees. It included implementation, hosting, training, integration, upgrades, and hidden costs like outdated architecture and in-house resource demands

- Many ECMs required high upfront investment and continuous maintenance, making them less feasible for small businesses. This complexity and cost acted as a major restraint, slowing ECM market growth. Gordon Flesch Company can help clients navigate these challenges with cost-effective, scalable ECM solutions that reduce total ownership costs

- Limited financial and technical resources lead many SMEs to postpone or avoid ECM implementation, restricting their ability to improve content management and operational efficiency. This financial hurdle significantly slows market growth by limiting ECM penetration in the small business segment

Enterprise Content Management Market Scope

The North America enterprise content management market is segmented into five notable segments based on the solution, deployment mode, enterprise size, service, and end-user.

- By Solution

On the basis of solution, the enterprise content management market is segmented into content management, record management, digital asset management, case management, e-discovery, workflow management, imaging and capturing, and others. The content management segment is expected to dominate the market with the largest market revenue share of 29.39% in 2025, due to its foundational role in organizing, storing, and retrieving enterprise-wide information across diverse departments and industries. It enables seamless collaboration, real-time access, and centralized governance of digital content, which are essential for operational efficiency and compliance.

The content management segment is anticipated to witness the fastest growth rate of 16.1% from 2025 to 2032, the rising adoption of remote work, hybrid IT environments, and demand for data mobility and disaster recovery capabilities further strengthen the cloud segment’s leadership in the market.

- By Deployment Mode

On the basis of deployment mode, the enterprise content management market is segmented into cloud and on-premise. The cloud segment is expected to dominate with the largest market revenue share of 76.63% in 2025, due to its scalability, cost efficiency, and ease of access across geographically dispersed teams. Cloud-based ECM solutions support real-time collaboration, faster deployment, and automatic updates, surpassing the limitations of on-premise systems in terms of infrastructure costs and maintenance.

The cloud segment is expected to witness the fastest CAGR of 15.0% from 2025 to 2032, due to demand for data mobility and disaster recovery capabilities further strengthen the cloud segment’s leadership in the market.

- By Enterprise Size

On the basis of enterprise size, the enterprise content management market is segmented into large enterprises and small & medium sized enterprises. The large enterprises segment is expected to dominate with the largest market revenue share of 79.92% in 2025, due to their higher volume of data, complex workflows, and strict regulatory compliance requirements.

The large enterprises segment is expected to witness the fastest CAGR of 15.0% from 2025 to 2032, spurred by investment heavily in advanced ECM solutions to manage diverse content types across multiple departments and global locations, surpassing the adoption levels of enterprises.

- By Service

On the basis of service, the enterprise content management market is segmented into professional services, managed services The professional services segment expected to dominate with the largest market revenue share of 61.77% in 2025, due to growing demand for consulting, integration, and implementation expertise across various industries.

The professional services segment is expected to witness the fastest CAGR of 15.1% from 2025 to 2032, due to enterprises customize ECM solutions to their specific operational and regulatory needs, surpassing the adoption of professional services.

- By End-User

On the basis of end-user, the enterprise content management market is segmented into Banking, Financial Services & Insurance (BFSI), IT & telecom, healthcare, government, retail & e-commerce, manufacturing, media and entertainment, education, and others. The Banking, Financial Services & Insurance (BFSI) segment is expected to dominate the market with the largest market revenue share of 23.42% in 2025, due to strong need for secure, compliant, and efficient data handling. The sector deals with large volumes of sensitive information requiring strict document control and regulatory compliance.

The Banking, Financial Services & Insurance (BFSI) segment is expected to witness the fastest CAGR of 16.9% from 2025 to 2032, driven by growing adoption of digital banking, fraud prevention, and workflow automation further boosts ECM demand, solidifying BFSI's market leadership.

Enterprise Content Management Market Regional Analysis

- U.S. is expected to dominate the North America enterprise content management market with the largest revenue share of 72.38% in 2025, due to early adoption of advanced digital technologies, strong presence of leading ECM providers, and widespread implementation of cloud and AI-based solutions

- The region benefits from stringent data compliance regulations such as HIPAA and GDPR (for North America operations), which drive demand for robust ECM systems. Additionally, the rapid digital transformation across industries like BFSI, healthcare, and government, coupled with high enterprise IT spending, further strengthens North America's market leadership

U.S. Enterprise Content Management Market Insight

The U.S. ECM market is expected to capture the largest revenue share of 72.38% within North America in 2025, supported by early adoption of digital content platforms and cloud-based document collaboration. Major organizations are investing in AI-driven ECM solutions to automate records management, reduce manual intervention, and ensure data privacy. The presence of key players such as IBM, OpenText, and Oracle, along with growing demand for remote access and workflow automation, significantly

Enterprise Content Management Market Share

The enterprise content management market is primarily led by well-established companies, including:

- IBM Corporation (US)

- Microsoft (US)

- Oracle (US)

- Adobe (US)

- Cisco Systems, Inc. (US)

- Ricoh (Japan)

- OpenText Corporation (Canada)

- SAP SE (Germany)

- KONICA MINOLTA, INC. (Japan)

- Xerox Corporation (US)

- Wipro (India)

- Epicor Software Corporation (US)

- Newgen Software Technologies Limited (India)

Latest Developments in North America Enterprise Content Management Market

- In January 2025, Cisco introduced Cisco AI Defense, an innovative solution designed to facilitate and secure AI transformation within enterprises. AI technology continues to advance, new safety concerns and security threats are emerging at an unprecedented pace, leaving existing security solutions inadequately prepared to address them. Cisco AI Defense is specifically engineered to enable enterprises to confidently develop, deploy, and secure AI applications

- In October 2024, Newgen Software partnered with Duck Creek Technologies to integrate NewgenONE OmniDocs with Duck Creek Policy, enhancing content access and management for insurers. This collaboration enables a 360-degree view of customer and policy data, streamlines workflows, accelerates development, and improves decision-making through secure archival, real-time collaboration, and intelligent content lifecycle management

- In April 2025, Atlassian introduced Rovo, an AI-driven platform designed to enhance team productivity by integrating with tools like Jira and Confluence. Rovo offers features such as intelligent search, AI assistants, and customizable agents to automate tasks and streamline workflows. It is now included in Jira and Confluence subscriptions, aiming to make AI capabilities more accessible to users

- In April 2025, Konica Minolta expanded its relationship with Square 9 Softworks into an exclusive partnership. This collaboration positions Konica Minolta as the sole regional distributor of Square 9’s AI-powered information management and workflow automation solutions, enhancing its ECM offerings

- In February 2025, Microsoft announced the deployment of SharePoint Premium to enhance content management across its global workforce. With over 300,000 users accessing Microsoft 365, the initiative focuses on improving content discoverability, security, and compliance. The goal is to simplify content management and foster a culture of efficient information handling within the organization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2.1 PENETRATION AND GROWTH PROSPECT MAPPING

4.2.2 NEW BUSINESS AND EMERGING BUSINESS REVENUE OPPORTUNITIES

4.2.3 REVENUE OPPORTUNITIES

4.2.4 CONSUMER BEHAVIOR

4.2.5 BUYING PATTERN

4.2.6 USES ANALYSIS

4.2.7 TECHNOLOGY ANALYSIS

4.2.7.1 KEY TECHNOLOGIES

4.2.7.2 COMPLEMENTARY TECHNOLOGIES

4.2.7.3 ADJACENT TECHNOLOGIES

4.3 CHALLENGES FOR NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET

4.3.1 CONTENT SILOS ACROSS DEPARTMENTS HINDER CENTRALIZED ECM IMPLEMENTATION

4.3.2 MIGRATING LEGACY DATA INVOLVES HIGH COST AND TECHNICAL RISK

4.3.3 USER ADOPTION RESISTANCE REDUCES ECM EFFECTIVENESS

4.3.4 INTEGRATION CHALLENGES WITH LEGACY SYSTEMS SLOW ECM DEPLOYMENT

4.3.5 DATA SECURITY AND COMPLIANCE CONCERNS COMPLICATE ECM STRATEGIES

4.4 INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.4.1 CUSTOMER BASE

4.4.2 SERVICE POSITIONING

4.4.3 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

4.4.4 APPLICATION REACH

4.4.5 SERVICE PLATFORM MATRIX

4.4.6 COMPANY COMPARATIVE ANALYSIS

4.4.7 COMPANY SERVICE PLATFORM MATRIX

4.5 COMPANY COMPETITIVE ANALYSIS

4.6 PRICING ANALYSIS BASED ON SALES, MARKETING & CUSTOMER SERVICE

4.6.1 OVERVIEW

4.6.2 HOW SALES STRATEGIES INFLUENCE PRICING PERCEPTION

4.6.3 MARKETING’S ROLE IN JUSTIFYING AND COMMUNICATING PRICING

4.6.4 THE IMPACT OF CUSTOMER SERVICE ON PRICING STRUCTURE

4.6.5 REGIONAL VARIATIONS IN ECM PRICING

4.7 FUNDING DETAILS—INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR

4.8 USE CASE AND ITS ANALYSIS

4.9 TARIFFS & IMPACT ON THE NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT SOFTWARE MARKET

4.9.1 OVERVIEW

4.9.2 TARIFF STRUCTURES

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CLOUD-BASED ECM SOLUTIONS DUE TO SCALABILITY AND REMOTE ACCESS CAPABILITIES

6.1.2 RAPID DIGITAL TRANSFORMATION ACROSS INDUSTRIES SUCH AS HEALTHCARE, EDUCATION, GOVERNMENT, BANKING ACCELERATES THE ADOPTION OF ENTERPRISE CONTENT MANAGEMENT PLATFORMS

6.1.3 SURGE IN REMOTE WORK MODELS FUELS THE NEED FOR SECURE AND CENTRALIZED CONTENT ACCESS

6.1.4 GROWING FOCUS ON IMPROVING CUSTOMER EXPERIENCE THROUGH FASTER INFORMATION ACCESS AND SHARING

6.2 RESTRAINTS

6.2.1 HIGH UPFRONT INVESTMENT AND ONGOING MAINTENANCE COSTS LIMIT ECM ADOPTION AMONG SMALL BUSINESSES

6.2.2 CONCERNS OVER DATA SECURITY AND PRIVACY SLOW DOWN ENTERPRISE CONTENT MANAGEMENT DEPLOYMENT

6.3 OPPORTUNITIES:

6.3.1 INCREASING FOCUS ON SUSTAINABILITY ENCOURAGES PAPERLESS OFFICE TRANSFORMATION THROUGH ECM

6.3.2 RISING DEMAND FOR MOBILE-FRIENDLY ECM SUPPORTS FLEXIBLE AND REMOTE WORK ENVIRONMENTS

6.3.3 ADVANCEMENTS IN AI AND MACHINE LEARNING OPEN NEW POSSIBILITIES FOR INTELLIGENT CONTENT AUTOMATION

6.4 CHALLENGES

6.4.1 CONTENT SILOS ACROSS DEPARTMENTS HINDER CENTRALIZED ECM IMPLEMENTATION

6.4.2 MIGRATING LEGACY DATA INVOLVES HIGH COST AND TECHNICAL RISK

7 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY SOLUTION

7.1 OVERVIEW

7.2 CONTENT MANAGEMENT

7.3 RECORD MANAGEMENT

7.4 DIGITAL ASSET MANAGEMENT

7.5 CASE MANAGEMENT

7.6 E-DISCOVERY

7.7 WORKFLOW MANAGEMENT

7.8 IMAGING AND CAPTURING

7.9 OTHERS

8 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISE

9 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL & MEDIUM SIZED ENTERPRISES

10 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY SERVICE

10.1 OVERVIEW

10.2 PROFESSIONAL SERVICES

10.3 MANAGED SERVICES

10.3.1 MANAGED SERVICES, BY TYPE

10.3.1.1 INTEGRATION & DEPLOYMENT

10.3.1.2 SUPPORT & MAINTENANCE

10.3.1.3 CONSULTING

10.3.1.4 TRAINING & EDUCATION

11 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES & INSURANCE (BFSI)

11.2.1 BANKING, FINANCIAL SERVICES & INSURANCE (BFSI), BY TYPE

11.2.1.1 RECORDS MANAGEMENT

11.2.1.2 DOCUMENT MANAGEMENT

11.2.1.3 IMAGING & CAPTURING

11.2.1.4 DIGITAL ASSET MANAGEMENT

11.2.1.5 WORKFLOW MANAGEMENT

11.2.1.6 CONTENT MANAGEMENT

11.2.1.7 EDISCOVERY

11.2.1.8 CASE MANAGEMENT

11.2.1.9 OTHERS

11.3 IT & TELECOM

11.3.1 IT & TELECOM, BY TYPE

11.3.1.1 RECORDS MANAGEMENT

11.3.1.2 CONTENT MANAGEMENT

11.3.1.3 CASE MANAGEMENT

11.3.1.4 DIGITAL ASSET MANAGEMENT

11.3.1.5 WORKFLOW MANAGEMENT

11.3.1.6 DOCUMENT MANAGEMENT

11.3.1.7 EDISCOVERY

11.3.1.8 IMAGING & CAPTURING

11.3.1.9 OTHERS

11.4 HEALTHCARE

11.4.1 NORTH AMERICA HEALTHCARE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE

11.4.1.1 RECORDS MANAGEMENT

11.4.1.2 DOCUMENT MANAGEMENT

11.4.1.3 IMAGING & CAPTURING

11.4.1.4 DIGITAL ASSET MANAGEMENT

11.4.1.5 WORKFLOW MANAGEMENT

11.4.1.6 CONTENT MANAGEMENT

11.4.1.7 CASE MANAGEMENT

11.4.1.8 EDISCOVERY

11.4.1.9 OTHERS

11.5 GOVERNMENT

11.5.1 NORTH AMERICA GOVERNMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE

11.5.1.1 RECORDS MANAGEMENT

11.5.1.2 CONTENT MANAGEMENT

11.5.1.3 CASE MANAGEMENT

11.5.1.4 DIGITAL ASSET MANAGEMENT

11.5.1.5 WORKFLOW MANAGEMENT

11.5.1.6 DOCUMENT MANAGEMENT

11.5.1.7 EDISCOVERY

11.5.1.8 IMAGING & CAPTURING

11.5.1.9 OTHERS

11.6 RETAIL & E-COMMERCE

11.6.1 NORTH AMERICA RETAIL & E-COMMERCE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE

11.6.1.1 RECORDS MANAGEMENT

11.6.1.2 CONTENT MANAGEMENT

11.6.1.3 CASE MANAGEMENT

11.6.1.4 DIGITAL ASSET MANAGEMENT

11.6.1.5 IMAGING & CAPTURING

11.6.1.6 EDISCOVERY

11.6.1.7 WORKFLOW MANAGEMENT

11.6.1.8 DOCUMENT MANAGEMENT

11.6.1.9 OTHERS

11.7 MANUFACTURING

11.7.1 NORTH AMERICA MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE

11.7.1.1 RECORDS MANAGEMENT

11.7.1.2 DIGITAL ASSET MANAGEMENT

11.7.1.3 CASE MANAGEMENT

11.7.1.4 CONTENT MANAGEMENT

11.7.1.5 WORKFLOW MANAGEMENT

11.7.1.6 DOCUMENT MANAGEMENT

11.7.1.7 IMAGING & CAPTURING

11.7.1.8 EDISCOVERY

11.7.1.9 OTHERS

11.8 MEDIA AND ENTERTAINMENT

11.8.1 NORTH AMERICA MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE

11.8.1.1 RECORDS MANAGEMENT

11.8.1.2 CONTENT MANAGEMENT

11.8.1.3 IMAGING & CAPTURING

11.8.1.4 DIGITAL ASSET MANAGEMENT

11.8.1.5 WORKFLOW MANAGEMENT

11.8.1.6 EDISCOVERY

11.8.1.7 CASE MANAGEMENT

11.8.1.8 DOCUMENT MANAGEMENT

11.8.1.9 OTHERS

11.9 EDUCATION

11.9.1 NORTH AMERICA MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE

11.9.1.1 RECORDS MANAGEMENT

11.9.1.2 DOCUMENT MANAGEMENT

11.9.1.3 IMAGING & CAPTURING

11.9.1.4 DIGITAL ASSET MANAGEMENT

11.9.1.5 WORKFLOW MANAGEMENT

11.9.1.6 CONTENT MANAGEMENT

11.9.1.7 CASE MANAGEMENT

11.9.1.8 EDISCOVERY

11.9.1.9 OTHERS

11.1 OTHERS

12 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 IBM CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT/NEWS

15.2 MICROSOFT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT/SERVICE PORTFOLIO

15.2.5 RECENT DEVELOPMENT/NEWS

15.3 ORACLE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT/SERVICE PORTFOLIO

15.3.5 RECENT DEVELOPMENT/NEWS

15.4 ADOBE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT/NEWS

15.5 CISCO SYSTEMS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SERVICE PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ATLASSIAN

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT/SERVICE PORTFOLIO

15.6.4 RECENT DEVELOPMENT/NEWS

15.7 CONTENTSTACK INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT/NEWS

15.8 DOCUWARE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT/NEWS

15.9 EPICOR SOFTWARE CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 SERVICE PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 FABASOFT

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT/SERVICE PORTFOLIO

15.10.4 RECENT DEVELOPMENT/NEWS

15.11 HYLAND SOFTWARE, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 INTELICS

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 KONICA MINOLTA, INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT/BRAND PORTFOLIO

15.13.4 RECENT DEVELOPMENT/NEWS

15.14 LASERFICHE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT/SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 NEWGEN SOFTWARE TECHNOLOGIES LIMITED.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 SERVICE PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 OPEN TEXT CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT/NEWS

15.17 RICOH

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 SERVICE PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SAP SE

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT/NEWS

15.19 SQUAREONE TECHNOLOGIES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT/SERVICE PORTFOLIO

15.19.3 RECENT DEVELOPMENT/NEWS

15.2 WIPRO

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 SERVICES PORTFOLIO

15.20.4 RECENT DEVELOPMENT/NEWS

15.21 XEROX CORPORATION

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 SOFTWARE PORTFOLIO

15.21.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 SERVICE PLATFORM MATRIX:

TABLE 2 TIERS OF CUSTOMER SUPPORT

TABLE 3 USED CASE ANALYSIS

TABLE 4 ECM ALTERNATIVES PRICING

TABLE 5 COST BREAKDOWN HIGHLIGHTS SAVINGS POTENTIAL OF PAPERLESS OFFICE TRANSITION

TABLE 6 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA CONTENT MANAGEMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA RECORD MANAGEMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA DIGITAL ASSET IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA CASE MANAGEMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA E-DISCOVERY IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA WORKFLOW MANAGEMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA IMAGING AND CAPTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA CLOUD IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA ON-PREMISE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA LARGE ENTERPRISES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA SMALL & MEDIUM-SIZED ENTERPRISES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY SERVICE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA PROFESSIONAL SERVICES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA MANAGED SERVICES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA MANAGED SERVICES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND), BY REGION, 2018-2032, (USD THOUSAND)

TABLE 25 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA IT & TELECOM IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA IT & TELECOM IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA HEALTHCARE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA HEALTHCARE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA GOVERNMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA GOVERNMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA RETAIL & E-COMMERCE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA RETAIL & E-COMMERCE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA MEDIA AND ENTERTAINMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA MEDIA AND ENTERTAINMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA EDUCATION IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA EDUCATION IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHERS IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY SERVICE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA MANAGED SERVICES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA IT & TELECOM IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA HEALTHCARE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA GOVERNMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA RETAIL & E-COMMERCE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA MEDIA AND ENTERTAINMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA EDUCATION IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. ENTERPRISE CONTENT MANAGEMENT MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. ENTERPRISE CONTENT MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. ENTERPRISE CONTENT MANAGEMENT MARKET, BY SERVICE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. MANAGED SERVICES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. ENTERPRISE CONTENT MANAGEMENT MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. IT & TELECOM IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. HEALTHCARE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. GOVERNMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. RETAIL & E-COMMERCE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. MEDIA AND ENTERTAINMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. EDUCATION IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA ENTERPRISE CONTENT MANAGEMENT MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 74 CANADA ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 75 CANADA ENTERPRISE CONTENT MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA ENTERPRISE CONTENT MANAGEMENT MARKET, BY SERVICE, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA MANAGED SERVICES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA ENTERPRISE CONTENT MANAGEMENT MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA IT & TELECOM IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA HEALTHCARE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA GOVERNMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA RETAIL & E-COMMERCE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA MEDIA AND ENTERTAINMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA EDUCATION IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO ENTERPRISE CONTENT MANAGEMENT MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 89 MEXICO ENTERPRISE CONTENT MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 90 MEXICO ENTERPRISE CONTENT MANAGEMENT MARKET, BY SERVICE, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO MANAGED SERVICES IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO ENTERPRISE CONTENT MANAGEMENT MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO IT & TELECOM IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO HEALTHCARE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO GOVERNMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO RETAIL & E-COMMERCE IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO MANUFACTURING IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO MEDIA AND ENTERTAINMENT IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO EDUCATION IN ENTERPRISE CONTENT MANAGEMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: SOLUTION TIMELINE CURVE

FIGURE 11 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: END USER COVERAGE GRID

FIGURE 12 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 EIGHT SEGMENTS COMPRISE THE NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET, BY SOLUTION (2024)

FIGURE 14 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 INCREASING DEMAND FOR CLOUD-BASED ECM SOLUTIONS DUE TO SCALABILITY AND REMOTE ACCESS CAPABILITIES IS EXPECTED TO DRIVE THE NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET IN 2025 & 2032

FIGURE 18 DROC ANALYSIS

FIGURE 19 PERCENT OF REMOTE WORKERS BY TOP 10 INDUSTRIES IN 2019, 2021, 2022

FIGURE 20 ANNUAL CO2 EMISSIONS FROM PAPER AND PULP MANUFACTURING (MILLION METRIC TONS)

FIGURE 21 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY SOLUTION, 2024

FIGURE 22 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 23 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY ENTERPRISE SIZE, 2024

FIGURE 24 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY SERVICE, 2024

FIGURE 25 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: BY END USER, 2024

FIGURE 26 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: SNAPSHOT (2024)

FIGURE 27 NORTH AMERICA ENTERPRISE CONTENT MANAGEMENT MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.