North America Epilepsy Monitoring Devices Market

Market Size in USD Million

CAGR :

%

USD

470.56 Million

USD

738.76 Million

2024

2032

USD

470.56 Million

USD

738.76 Million

2024

2032

| 2025 –2032 | |

| USD 470.56 Million | |

| USD 738.76 Million | |

|

|

|

|

North America Epilepsy Monitoring Devices Market Size

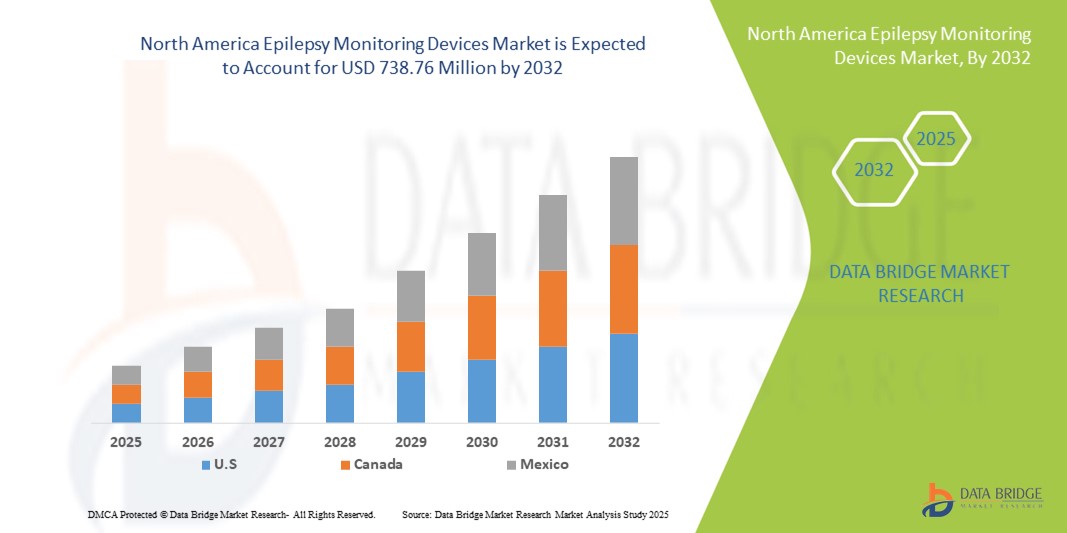

- The North America epilepsy monitoring devices market size was valued at USD 470.56 million in 2024 and is expected to reach USD 738.76 million by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by the increasing prevalence of epilepsy, rising awareness about neurological disorders, and advancements in diagnostic and monitoring technologies, which are enhancing patient management and care

- Furthermore, growing demand for accurate, real-time, and non-invasive monitoring solutions in both hospital and home care settings is positioning epilepsy monitoring devices as critical tools in neurological healthcare. These converging factors are accelerating the adoption of advanced monitoring systems, thereby significantly driving the market’s growth

North America Epilepsy Monitoring Devices Market Analysis

- Epilepsy monitoring devices, including wearable devices, smart devices, and conventional devices, are increasingly essential in both hospital and home care settings due to their ability to provide accurate, real-time neurological monitoring, support diagnosis, and improve patient management

- The escalating demand for epilepsy monitoring devices is primarily fueled by the rising prevalence of epilepsy, growing awareness of neurological disorders, and the need for continuous, non-invasive monitoring solutions that enhance patient safety and clinical outcomes

- U.S. dominated the North America epilepsy monitoring devices market with the largest revenue share of 73.3% in 2024, driven by advanced healthcare infrastructure, high adoption of digital health technologies, and a strong presence of key industry players, with significant growth in device adoption across hospitals, neurology centers, and homecare settings, supported by innovations in wireless, portable, and AI-enabled monitoring systems

- Canada is expected to be the fastest growing country in the epilepsy monitoring devices market during the forecast period due to increasing healthcare investments, rising awareness of neurological disorders, and growing demand for home-based monitoring solutions

- Smart devices segment dominated the North America epilepsy monitoring devices market with a market share of 48.8% in 2024, driven by their advanced features, remote monitoring capabilities, and integration with digital health platforms for real-time seizure tracking

Report Scope and North America Epilepsy Monitoring Devices Market Segmentation

|

Attributes |

North America Epilepsy Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Epilepsy Monitoring Devices Market Trends

Advancements in Smart and Wearable Monitoring Solutions

- A significant and accelerating trend in the North America epilepsy monitoring devices market is the growing adoption of smart and wearable devices that provide real-time seizure tracking and continuous EEG monitoring, enhancing patient care and clinical decision-making

- For instance, wearable seizure detection devices such as Embrace2 allow patients to track seizures and alert caregivers in real time, while smart EEG headsets enable remote monitoring in homecare and clinical settings

- AI integration in these devices enables features such as automated seizure detection, predictive analytics for seizure risk, and personalized monitoring recommendations, improving clinical outcomes and patient safety

- The seamless integration of epilepsy monitoring devices with digital health platforms and telemedicine solutions allows centralized monitoring and management, enabling neurologists to access patient data remotely and adjust treatment plans efficiently

- This trend toward intelligent, connected, and patient-centric monitoring systems is fundamentally transforming epilepsy management, with companies such as NeuroSigma developing AI-enabled devices that offer real-time alerts, predictive insights, and cloud connectivity

- The demand for smart, wearable, and connected epilepsy monitoring devices is growing rapidly across hospitals, neurology centers, and homecare settings as healthcare providers and patients increasingly prioritize accuracy, convenience, and continuous monitoring

North America Epilepsy Monitoring Devices Market Dynamics

Driver

Increasing Demand Due to Rising Epilepsy Prevalence and Digital Healthcare Adoption

- The rising prevalence of epilepsy, coupled with the growing adoption of digital health technologies, is a key driver for the heightened demand for advanced epilepsy monitoring devices

- For instance, in March 2024, Cadwell Laboratories launched a new wireless EEG system designed to enhance home-based monitoring and improve patient comfort while enabling remote neurologist access

- As healthcare providers aim to improve diagnostic accuracy and patient outcomes, epilepsy monitoring devices offer features such as continuous EEG tracking, real-time alerts, and cloud-based data sharing, representing a significant upgrade over conventional diagnostic methods

- Furthermore, the increasing implementation of telehealth services and remote patient monitoring programs is positioning these devices as essential tools in modern neurological care

- The convenience of wearable and smart devices that allow real-time tracking and remote data access for clinicians, combined with user-friendly interfaces, is propelling adoption across hospitals, neurology centers, and homecare settings

- The trend toward AI-assisted monitoring, predictive analytics, and seamless digital integration is further supporting the growth of epilepsy monitoring devices in North America

Restraint/Challenge

Data Security Concerns and High Device Costs

- Concerns regarding cybersecurity and data privacy in connected medical devices pose a significant challenge to the broader adoption of epilepsy monitoring solutions. Devices that transmit sensitive patient data over networks are susceptible to breaches, raising apprehensions among healthcare providers and patients

- For instance, reports of vulnerabilities in wireless EEG systems and wearable seizure trackers have made some institutions cautious about adopting cloud-connected monitoring solutions

- Addressing these challenges through robust encryption, secure authentication protocols, and compliance with HIPAA and FDA guidelines is essential for building trust among clinicians and patients

- In addition, the relatively high cost of advanced epilepsy monitoring devices compared to conventional systems can be a barrier to adoption, particularly for smaller clinics or budget-constrained homecare settings

- While basic devices have become more affordable, premium features such as AI-assisted seizure detection, wireless connectivity, and long-term continuous monitoring often come at a higher price point

- Overcoming these challenges through enhanced cybersecurity, regulatory compliance, and the development of cost-effective monitoring solutions will be vital for sustained market growth in North America

North America Epilepsy Monitoring Devices Market Scope

The market is segmented on the basis of product type, type of seizure, patient type, end user, and distribution channel.

- By Product Type

On the basis of product type, the epilepsy monitoring devices market is segmented into wearable devices, smart devices, and conventional devices. The smart devices segment dominated the market with the largest revenue share of 48.8% in 2024, driven by the rising adoption of AI-enabled seizure detection systems and remote monitoring capabilities. Smart devices allow real-time tracking of patient neurological activity, sending alerts to caregivers or clinicians during seizure events. Their integration with digital health platforms and telemedicine solutions enhances remote care management and supports early interventions. Hospitals and neurology centers increasingly prefer smart devices for continuous patient monitoring due to their accuracy, convenience, and compatibility with electronic medical records. Moreover, the growing consumer preference for connected healthcare solutions in homecare settings further reinforces the dominance of smart devices. The segment benefits from technological innovation, including cloud connectivity, predictive analytics, and mobile application support, enhancing its market appeal.

The wearable devices segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for portable and non-invasive monitoring solutions suitable for homecare and ambulatory patients. Wearable devices, such as wristbands or headbands, enable continuous seizure detection without limiting patient mobility. They are particularly appealing for pediatric and geriatric populations, allowing caregivers to monitor patients remotely in real-time. Technological advancements, such as AI-assisted detection and long battery life, are improving accuracy and convenience. The growing awareness of epilepsy and the need for proactive management is driving adoption in both clinical and homecare settings. In addition, partnerships between device manufacturers and digital health platforms are expanding the usability of wearable devices, further accelerating growth.

- By Type of Seizure

On the basis of seizure type, the epilepsy monitoring devices market is segmented into focal seizures and generalized seizures. The generalized seizures segment dominated the market with a revenue share of 54.1% in 2024, driven by the higher prevalence of generalized epilepsy and the demand for comprehensive monitoring solutions capable of capturing full-brain activity. Devices designed for generalized seizures offer advanced detection algorithms, allowing healthcare providers to assess seizure frequency, severity, and patterns more accurately. Hospitals and neurology centers prefer devices capable of monitoring generalized seizures for diagnostic accuracy and long-term management. The increasing use of AI and cloud-based monitoring platforms has enhanced device efficiency in capturing and analyzing generalized seizure events. Moreover, patient adherence to monitoring regimens is better supported through smart alert systems and mobile connectivity. The integration of generalized seizure monitoring devices with telehealth systems further consolidates their dominance in North America.

The focal seizures segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the rising awareness of localized seizure detection and personalized treatment approaches. Devices targeting focal seizures provide region-specific brain monitoring, enabling precise intervention and medication adjustments. Pediatric and adult patients increasingly benefit from devices that can differentiate seizure types, allowing for more accurate clinical assessments. Continuous innovation in AI-assisted algorithms and wearable detection tools enhances the adoption of focal seizure monitoring solutions. The shift toward home-based neurological care and remote patient monitoring is further driving growth in this segment. Clinicians are actively recommending focal seizure devices for patients requiring detailed, localized seizure tracking to improve treatment efficacy.

- By Patient Type

On the basis of patient type, the epilepsy monitoring devices market is segmented into pediatric, geriatric, and adult patients. The adult patient segment dominated the market with a 50.7% share in 2024, driven by the high prevalence of epilepsy among adults and the growing adoption of continuous monitoring devices in hospitals and homecare settings. Adults often require long-term monitoring for seizure management, which drives demand for both smart and wearable devices capable of real-time alerts. Hospitals and neurology centers prioritize adult-focused monitoring solutions for accurate diagnostics, seizure pattern analysis, and therapy management. Integration with telemedicine platforms supports remote monitoring, particularly for working adults requiring minimal lifestyle disruption. The presence of advanced device manufacturers and strong healthcare infrastructure in North America further reinforces dominance in the adult segment.

The pediatric patient segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing awareness of early epilepsy diagnosis and the rising prevalence of childhood epilepsy. Pediatric monitoring devices are designed to be non-invasive, comfortable, and suitable for continuous wear, encouraging compliance. Caregivers and hospitals are increasingly adopting wearable and smart devices that enable remote monitoring and immediate seizure alerts. Technological innovations, such as AI-driven seizure detection and integration with mobile apps, further support the rapid adoption in pediatric populations. The demand is particularly high in homecare settings, where parents seek reliable and continuous monitoring tools for children with epilepsy. Pediatric-focused devices also benefit from government initiatives and awareness campaigns promoting early detection and intervention.

- By End User

On the basis of end user, the epilepsy monitoring devices market is segmented into hospitals, homecare settings, neurology centers, diagnostic centers, ambulatory surgical centers & clinics, and others. The hospitals segment dominated the market with a 45.2% share in 2024, driven by the preference for advanced monitoring devices capable of continuous EEG recording, real-time seizure detection, and integration with hospital IT systems. Hospitals use these devices to enhance diagnostic accuracy, manage patient care efficiently, and reduce hospital stays. The adoption of smart and wearable devices in hospitals improves monitoring efficiency, reduces manual observation, and supports telemedicine applications. Neurologists and clinicians rely on these devices for comprehensive patient data collection, enabling better-informed treatment decisions. In addition, North American hospitals benefit from strong healthcare infrastructure, reimbursement policies, and technology adoption, reinforcing dominance.

The homecare settings segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by rising demand for patient-centric care, remote monitoring, and the adoption of wearable and smart devices. Homecare monitoring allows patients, particularly pediatric and geriatric populations, to maintain independence while ensuring real-time seizure detection. Integration with mobile applications, cloud platforms, and telehealth services enables caregivers and clinicians to track patient health remotely. The convenience, cost-effectiveness, and accessibility of home-based monitoring solutions are driving rapid adoption. Technological improvements, such as lightweight wearables and AI-assisted alerts, further enhance usability in homecare. The trend toward proactive epilepsy management and personalized care is creating significant opportunities in this segment.

- By Distribution Channel

On the basis of distribution channel, the epilepsy monitoring devices market is segmented into retail sales, online sales, direct tenders, and others. The direct tenders segment dominated the market with a 47.5% share in 2024, driven by bulk procurement by hospitals, neurology centers, and homecare service providers. Direct tenders facilitate streamlined purchasing, competitive pricing, and ensured authenticity of devices. Hospitals and diagnostic centers often prefer direct tender agreements to acquire advanced monitoring systems with service and maintenance contracts. Large-scale procurement through tenders allows healthcare institutions to equip multiple units efficiently while maintaining compliance with regulatory standards. The presence of major manufacturers and distributors in North America supports dominance in this channel.

The online sales segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing e-commerce adoption, growing awareness among patients and caregivers, and the convenience of home delivery for wearable and smart monitoring devices. Online platforms enable access to a wider range of products, comparison of features, and integration with telemedicine services. The trend of purchasing medical devices online is gaining traction, particularly for homecare and pediatric patients, where caregivers seek convenient access to advanced monitoring solutions. Manufacturers are also investing in direct-to-consumer online channels to enhance outreach and provide seamless support. Digital marketing, product demonstrations, and easy return policies further drive online sales growth.

North America Epilepsy Monitoring Devices Market Regional Analysis

- U.S. dominated the epilepsy monitoring devices market with the largest revenue share of 73.3% in 2024, driven by advanced healthcare infrastructure, high adoption of digital health technologies, and a strong presence of key industry players

- Patients and healthcare providers in the region highly value the accuracy, real-time monitoring capabilities, and integration of devices with digital health platforms and telemedicine solutions

- This widespread adoption is further supported by advanced healthcare infrastructure, strong research and development in neurological devices, and high healthcare expenditure, establishing epilepsy monitoring devices as essential tools in both hospital and homecare settings

U.S. Epilepsy Monitoring Devices Market Insight

The U.S. epilepsy monitoring devices market captured the largest revenue share in 2024 within North America, fueled by the increasing prevalence of epilepsy and growing adoption of advanced neurological monitoring solutions. Patients and healthcare providers are prioritizing accurate, real-time monitoring and remote management of seizures through smart and wearable devices. The rising trend of home-based monitoring, combined with robust demand for AI-assisted detection and telehealth integration, further propels the market. Moreover, the increasing integration of epilepsy monitoring devices with digital health platforms and mobile applications is significantly contributing to the market’s expansion.

Canada Epilepsy Monitoring Devices Market Insight

The Canada epilepsy monitoring devices market is expected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing awareness of neurological disorders and rising investment in healthcare infrastructure. Increasing demand for homecare monitoring solutions and wearable devices is fostering adoption, particularly among pediatric and geriatric patients. Canadian consumers and healthcare providers are drawn to the convenience, accuracy, and real-time data access offered by advanced monitoring systems. The region is witnessing significant growth across hospitals, neurology centers, and homecare settings, with devices being integrated into both new and existing care programs.

Mexico Epilepsy Monitoring Devices Market Insight

The Mexico epilepsy monitoring devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing epilepsy prevalence and rising healthcare expenditure. Growing concerns regarding patient safety and the need for reliable seizure monitoring are encouraging hospitals, clinics, and caregivers to adopt smart and wearable devices. Mexico’s expanding digital health infrastructure, coupled with government initiatives to improve access to neurological care, is expected to continue stimulating market growth. In addition, the integration of monitoring devices with mobile applications and telehealth services is enhancing accessibility and patient compliance.

North America Epilepsy Monitoring Devices Market Share

The North America Epilepsy Monitoring Devices industry is primarily led by well-established companies, including:

- NeuroPace, Inc. (U.S.)

- Empatica Inc. (U.S.)

- Medtronic (Ireland)

- Masimo (U.S.)

- Cadwell Laboratories, Inc. (U.S.)

- Natus Medical Incorporated (U.S.)

- Compumedics Limited (Australia)

- Brain Sentinel, Inc. (U.S.)

- EMOTIV (U.S.)

- Neuroelectrics (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- GE Healthcare (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- LivaNova PLC (U.K.)

- BioSerenity (France)

- Zeto, Inc. (U.S.)

- Ceribell, Inc. (U.S.)

- Seer Medical (Australia)

- SleepMed, Inc. (U.S.)

- Advanced Brain Monitoring, Inc. (U.S.)

What are the Recent Developments in North America Epilepsy Monitoring Devices Market?

- In April 2025, EpiWatch's Apple Watch-based app received FDA clearance, offering features such as medication reminders, seizure logging, and mental health tracking. Developed in collaboration with Johns Hopkins Medicine and powered by Apple's ResearchKit, this platform enhances remote monitoring for individuals with epilepsy

- In April 2025, The FDA granted De Novo authorization to Epiminder's Minder, an implantable continuous EEG monitoring system. This device is the first of its kind approved in the U.S. for epilepsy patients and is expected to launch in late 2025 at leading epilepsy centers

- In April 2025, Seer Medical, an Australian med-tech company specializing in at-home epilepsy monitoring, secured a USD 40 million rescue deal from Breakthrough Victoria. This funding aims to support the company's operations and facilitate its expansion into the U.S. market, despite challenges such as a product recall and financial difficulties

- In February 2025, Medtronic received FDA approval for its BrainSense Adaptive deep brain stimulation (aDBS) system. While primarily for Parkinson's disease, the FDA approval and Medtronic's related announcements mention that the company's dedication to advancing DBS research also transforms therapeutic options for individuals with epilepsy

- In February 2024, Empatica announced the launch of EpiMonitor, its next-generation FDA-cleared epilepsy monitoring system. EpiMonitor is a significant advancement in wearable technology for epilepsy, offering up to a week of battery life, enhanced seizure detection capabilities, and a user-friendly mobile app that provides comprehensive health insights, including sleep and activity tracking

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.