North America Exosome Therapeutic Market

Market Size in USD Million

CAGR :

%

USD

117.55 Million

USD

418.45 Million

2025

2033

USD

117.55 Million

USD

418.45 Million

2025

2033

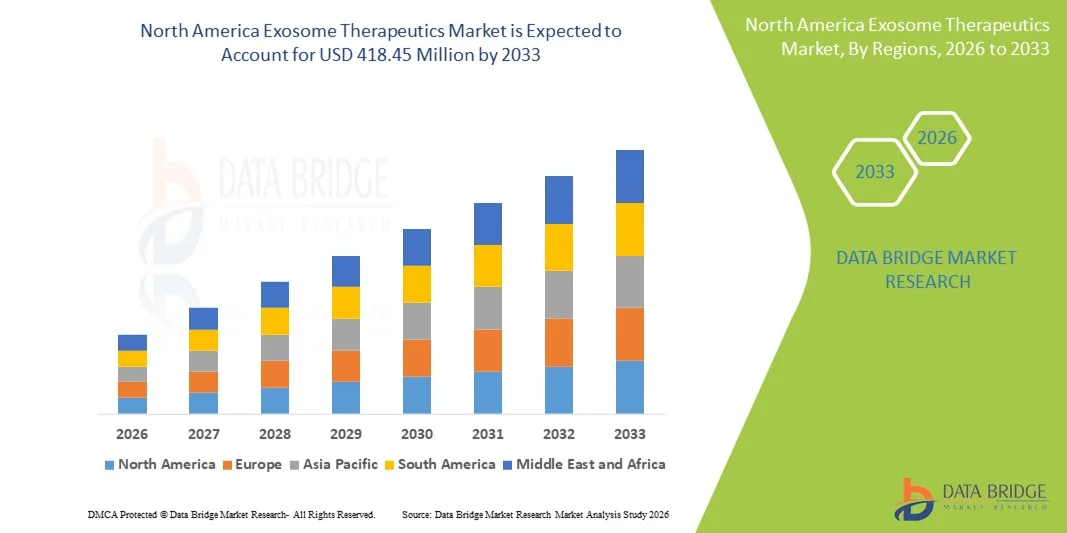

| 2026 –2033 | |

| USD 117.55 Million | |

| USD 418.45 Million | |

|

|

|

|

North America Exosome Therapeutics Market Size

- The North America exosome therapeutics market size was valued at USD 117.55 million in 2025 and is expected to reach USD 418.45 million by 2033, at a CAGR of 17.20 % during the forecast period

- This regional growth is primarily driven by rising research and development investments, increasing prevalence of chronic inflammatory and autoimmune diseases, and technological progress in exosome‑based therapeutic solutions that improve targeted delivery and regenerative treatment approaches

- Furthermore, robust consumer demand for innovative, minimally invasive therapies and the strong presence of leading biotechnology firms and research institutions in the U.S. and Canada are solidifying exosome therapeutics as a key emerging segment in modern biopharmaceuticals, accelerating adoption and market expansion across North America

North America Exosome Therapeutics Market Analysis

- Exosome therapeutics encompass advanced biological treatments that use extracellular vesicles to deliver therapeutic molecules for disease treatment and regenerative medicine, increasingly recognized for their targeted delivery capabilities, low immunogenicity, and potential in oncology, neurology, and immune‑modulation applications across clinical and research settings

- The escalating demand for exosome therapeutics in the U.S. is primarily driven by substantial investments in biotechnology R&D, a high prevalence of chronic and complex diseases such as cancer and neurodegenerative disorders, and the growing adoption of precision and personalized medicine approaches that leverage exosome‑based drug delivery and therapeutic platforms

- The U.S. dominated the North American exosome therapeutics market with the largest revenue share of 80% in 2025, characterized by a robust healthcare infrastructure, strong federal research funding, and a concentration of key industry players and academic collaborations, which together accelerate clinical trials, product innovation, and commercial adoption of exosome‑based therapies

- Canada is expected to be the next largest country market in North America during the forecast period due to growing biotechnology research initiatives, supportive healthcare policies, and increasing clinical adoption of advanced therapeutics

- Oncology segment dominated the market with a market share of 40.5% driven by extensive clinical trials and rising investment in cancer‑focused exosome therapies that enable targeted drug delivery and improved treatment outcomes

Report Scope and North America Exosome Therapeutics Market Segmentation

|

Attributes |

North America Exosome Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Exosome Therapeutics Market Trends

Advancements in Targeted Drug Delivery and Precision Medicine

- A significant and accelerating trend in the U.S. exosome therapeutics market is the increasing use of exosomes as targeted drug delivery vehicles and precision medicine platforms, enabling therapies tailored to individual patient biology and disease profiles rather than one‑size‑fits‑all treatments

- For instance, clinical research is expanding exosome use in oncology and regenerative medicine due to their ability to penetrate tumor microenvironments efficiently and carry therapeutic payloads with high specificity

- These advances are supported by improvements in exosome engineering, microfluidic isolation technologies, and next‑generation sequencing tools that enhance consistency and therapeutic targeting of exosome formulations

- Exosome therapeutics are increasingly being integrated into personalized treatment regimens for chronic diseases such as cancer and neurodegenerative disorders, offering lower side effects and improved outcomes compared with traditional biologics

- The trend towards precision therapy and disease‑specific exosome products is reshaping market expectations, with biotech firms prioritizing development pipelines that address the most challenging clinical needs

- The demand for exosome therapies that combine high specificity with customizable delivery mechanisms is growing rapidly across both research and clinical trial landscapes as healthcare systems pursue more effective, patient‑centric treatment models

- Increasing collaboration between biotech startups and academic institutions to develop novel exosome-based therapeutics is further accelerating innovation in the sector

- Expansion of digital platforms for exosome characterization and clinical data analytics is helping streamline research and accelerate regulatory approvals

North America Exosome Therapeutics Market Dynamics

Driver

Rising Incidence of Chronic Diseases and Personalized Medicine Adoption

- The increasing prevalence of chronic and complex diseases such as cancer, neurological disorders, and autoimmune conditions is a major driver of the exosome therapeutics market, as conventional therapies often fall short in efficacy and safety

- For instance, the growing burden of cancer and demand for minimally invasive, targeted treatment options are encouraging clinical adoption of exosome‑based therapeutic strategies with improved delivery efficiency

- The rising integration of precision medicine practices in healthcare, prioritizing treatments optimized for individual patients, is significantly expanding investor and clinical interest in exosome platforms

- In addition, strong federal and private investment in biotechnology R&D in the U.S. supports innovation in exosome isolation, engineering, and clinical trial advancement

- These factors collectively boost the development pipeline across oncology, regenerative medicine, and immunomodulation, reinforcing exosomes’ role as next‑generation therapeutics in clinical care

- Increasing patient awareness and acceptance of exosome-based therapies as safer and more effective alternatives to conventional biologics is supporting market growth

- Expansion of public-private partnerships and government grants targeting advanced therapeutics research is enabling faster clinical translation of exosome-based innovations

- The growing presence of contract development and manufacturing organizations (CDMOs) specializing in exosome therapeutics is facilitating faster commercialization

Restraint/Challenge

Regulatory and Manufacturing Complexities

- A significant challenge for the exosome therapeutics market is the stringent regulatory landscape and complex manufacturing requirements that complicate product approval and large‑scale commercialization

- For instance, achieving consistent quality, purity, and safety in clinical‑grade exosome products requires adherence to Good Manufacturing Practices (GMP) and complex downstream purification protocols, which can delay regulatory reviews

- The need for standardized isolation, characterization, and quality control methods across labs and production facilities adds to regulatory uncertainty and slows broader clinical adoption

- These compliance and manufacturing challenges increase development costs and can limit the pace at which new exosome therapeutics enter the market, particularly for smaller biotech firms without extensive production infrastructure

- Overcoming these barriers will require coordinated efforts among industry stakeholders, regulatory bodies, and technological innovators to establish clear guidelines and scalable production solutions

- Limited clinical data and long-term safety evidence for exosome therapies can make regulators and clinicians cautious, slowing adoption

- High production costs and complex scalability issues for commercial-grade exosomes continue to restrain widespread market penetration

- Variability in donor sources and raw material quality can affect therapeutic consistency, creating additional hurdles for standardization and regulatory compliance

North America Exosome Therapeutics Market Scope

The market is segmented on the basis of type, source, therapy, transporting capacity, application, route of administration, and end user.

- By Type

On the basis of type, the exosome therapeutics market is segmented into natural exosomes and hybrid exosomes. Natural exosomes dominated the market with the largest market revenue share in 2025, driven by their established safety profile and extensive clinical validation. Researchers and developers prefer natural exosomes because they carry endogenous therapeutic cargo, maintain high biocompatibility, and show predictable biological activity. Academic institutions and biotech firms have historically focused on natural exosomes for oncology and regenerative medicine applications. Regulatory familiarity and standardized isolation protocols further support their widespread adoption. Their dominance is reinforced by strong funding for translational research and clinical trials. The market also sees high demand for natural exosomes due to their immediate applicability in preclinical and early-stage clinical studies.

Hybrid exosomes are anticipated to witness the fastest growth rate during the forecast period due to their engineered features that allow higher payload capacity and targeted delivery. These exosomes combine natural vesicles with synthetic materials or ligands to enhance stability and specificity. Advances in bioengineering and nanotechnology accelerate hybrid exosome development. Investors and biotech startups are actively funding hybrid platforms for next-generation therapies. Their rapid adoption is fueled by promising preclinical results showing improved pharmacokinetics. The ability to tailor hybrid exosomes to specific tissue targets contributes to their accelerating market growth.

- By Source

On the basis of source, the market is segmented into mesenchymal stem cell (MSC), blood, body fluids, urine, dendritic cells, saliva, milk, and others. MSC-derived exosomes dominated the market in 2025 due to their regenerative and immunomodulatory properties. They are widely studied for applications in oncology, orthopedics, and autoimmune therapies. MSC exosomes can replicate the therapeutic benefits of their parent cells without the risks associated with stem cell transplantation. Standardized isolation protocols and pre-established clinical data make MSC exosomes the preferred choice for research and development. The high versatility of MSC exosomes across disease indications reinforces their leading market share. Their dominance reflects strong confidence from both academic and commercial stakeholders.

Exosomes derived from blood are projected to witness the fastest growth during the forecast period due to their minimally invasive collection and potential for personalized therapies. Blood-derived exosomes are suitable for systemic delivery and carry disease-specific biomarkers. Advances in isolation and purification technology enhance therapeutic efficacy and scalability. The rapid expansion of precision medicine and biomarker-driven applications supports blood exosome adoption. Increasing interest in liquid biopsy and non-invasive diagnostics further accelerates growth. Collaboration between clinical centers and biotech firms fosters research into blood-derived exosome therapeutics.

- By Therapy

On the basis of therapy, the market is segmented into immunotherapy, gene therapy, and chemotherapy. Immunotherapy dominated the market with the largest revenue share in 2025, owing to the ability of exosomes to modulate immune responses and present antigens efficiently. They are extensively explored in oncology to stimulate anti-tumor activity. Immunotherapeutic exosomes are safer alternatives to traditional cellular therapies and reduce systemic toxicity. Strong clinical and research focus on immune modulation ensures sustained demand. Investment from biotech and pharmaceutical companies reinforces their dominance. The segment benefits from regulatory familiarity and ongoing clinical validation.

Exosome-mediated gene therapy is expected to witness the fastest growth during the forecast period due to their ability to deliver nucleic acids such as siRNA, mRNA, and CRISPR components safely. Exosomes reduce immunogenicity compared to viral vectors, allowing repeated dosing. Improved loading technologies and targeting ligands increase therapeutic efficacy. Growing interest in RNA-based treatments and gene editing accelerates adoption. Preclinical successes and strategic partnerships drive market expansion. The segment offers substantial opportunities for next-generation genetic therapies.

- By Transporting Capacity

On the basis of transporting capacity, the market is segmented into bio macromolecules and small molecules. Bio macromolecules dominated the market in 2025, as most exosome therapies focus on delivering proteins, peptides, and nucleic acids. Exosomes protect fragile macromolecules during systemic delivery, ensuring therapeutic efficacy. Established protocols and analytical methods support large-scale macromolecule delivery. The majority of clinical trials currently use exosomes for macromolecule transport. Demand is driven by oncology, neurology, and regenerative medicine applications. Their dominance is reinforced by familiarity with regulatory requirements for biologics.

The small molecules segment is expected to witness the fastest growth during the forecast period due to enhanced bioavailability and targeted delivery capabilities offered by exosomes. Small molecule drugs benefit from reduced off-target effects and improved solubility. Advances in encapsulation and exosome engineering accelerate adoption. Interest from both pharmaceutical companies and academic institutions supports rapid market growth. The scalability of small molecule-loaded exosomes further boosts the segment. Growing research into repurposing approved drugs via exosome delivery drives this trend.

- By Application

On the basis of application, the market is segmented into metabolic disorders, oncology, cardiac disorders, neurology, inflammatory disorders, organ transplantation, gynecology disorders, blood disorders, and others. Oncology dominated the market in 2025 with a market share of 40.5% due to high prevalence of cancer and the urgent need for targeted therapies. Exosomes improve delivery of chemotherapeutic and immunotherapeutic agents directly to tumors, minimizing systemic toxicity. Strong clinical pipeline and research investments support sustained adoption. Personalized treatment approaches in oncology align with exosome-based therapy advantages. The segment benefits from high government and private sector funding. Demand is further driven by improved patient outcomes and reduced side effects compared with conventional therapies.

Neurology is the fastest-growing application during the forecast period as exosomes demonstrate the ability to cross the blood-brain barrier effectively. Researchers are exploring exosomes to deliver neuroprotective agents and genetic therapies for Alzheimer’s, Parkinson’s, and other CNS disorders. Early preclinical data indicates improved targeting and reduced inflammation. The increasing prevalence of neurodegenerative diseases fuels market demand. Advancements in formulation and delivery methods accelerate adoption. This segment shows high potential for both clinical trials and commercialization.

- By Route of Administration

On the basis of route of administration, the market is segmented into parenteral and oral. Parenteral administration dominated in 2025 due to reliable systemic delivery and predictable biodistribution. Most clinical studies prefer IV or IM routes to ensure therapeutic concentrations. Regulatory precedents for injectable biologics make this route favorable. Parenteral dosing ensures higher patient safety and therapeutic efficacy. Established familiarity among clinicians supports widespread adoption. The segment benefits from robust clinical trial infrastructure in the U.S.

Oral administration is the fastest-growing segment during the forecast period as innovations in encapsulation preserve exosome integrity in the digestive tract. Oral delivery improves patient convenience and compliance. This route has high potential for chronic disease management. Emerging research supports bioavailability and targeted release via oral formulations. Growing consumer preference for non-invasive therapies accelerates adoption. Advancements in oral delivery technologies support rapid market growth.

- By End User

On the basis of end user, the market is segmented into research and academic institutes, hospitals, and diagnostic centers. Research and academic institutes dominate due to their role in discovery, mechanism elucidation, and preclinical validation. They account for the majority of early-stage development and clinical trial preparation. Funding and collaborations with biotech companies enhance market dominance. These institutes generate intellectual property and train skilled scientists. They drive innovation pipelines across multiple disease areas. The segment remains largest due to extensive foundational research activity.

Hospitals and diagnostic centers are the fastest-growing segment during the forecast period as exosome therapies enter clinical use. They provide administration, monitoring, and patient management in trials and early commercial programs. Demand is fueled by adoption of personalized medicine protocols. Expansion of clinical infrastructure supports rapid growth. Increased integration with diagnostic platforms accelerates utilization. Rising patient acceptance of exosome-based therapies further boosts market penetration.

North America Exosome Therapeutics Market Regional Analysis

- The U.S. dominated the North American exosome therapeutics market with the largest revenue share of 80% in 2025, characterized by a robust healthcare infrastructure, strong federal research funding, and a concentration of key industry players and academic collaborations, which together accelerate clinical trials, product innovation, and commercial adoption of exosome‑based therapies

- Patients and healthcare providers in the region increasingly value exosome therapeutics for their targeted delivery capabilities, low immunogenicity, and potential in oncology, regenerative medicine, and immune modulation, making them a preferred choice for next-generation treatments

- This widespread adoption is further supported by strong federal and private funding for biotech innovation, a concentration of key industry players, advanced healthcare infrastructure, and active clinical trial programs, establishing exosome therapeutics as a leading segment in precision medicine across both research and clinical applications

U.S. Exosome Therapeutics Market Insight

The U.S. exosome therapeutics market captured the largest revenue share of 80% in 2025 within North America, fueled by a robust biotechnology ecosystem and growing clinical adoption of next-generation therapeutics. Research institutions, hospitals, and biotech companies are increasingly prioritizing exosome-based solutions for targeted drug delivery, regenerative medicine, and immunotherapy. The rising prevalence of chronic diseases such as cancer and neurodegenerative disorders is driving demand for safer, more effective therapies. In addition, strong federal and private investment in biotech R&D, along with an active clinical trial pipeline, is accelerating commercialization. Growing awareness of personalized medicine and advanced therapy approaches further contributes to market expansion. Moreover, collaborations between academia and industry are fostering innovation, positioning the U.S. as the dominant hub for exosome therapeutic development.

Canada Exosome Therapeutics Market Insight

The Canada exosome therapeutics market is projected to grow at a substantial CAGR throughout the forecast period, driven by increasing investment in biotechnology research and supportive government initiatives promoting advanced therapeutics. Canadian healthcare providers and research institutions are adopting exosome-based therapies in oncology and regenerative medicine, reflecting rising clinical awareness. Urbanization, growing healthcare infrastructure, and a focus on personalized medicine are fostering adoption in hospitals and academic centers. The availability of skilled talent and collaboration between local biotech firms and academic institutions further propels growth. Canada’s regulatory support for advanced therapies facilitates clinical translation, creating a favorable environment for new product introductions.

Mexico Exosome Therapeutics Market Insight

The Mexico exosome therapeutics market is expected to expand at a noteworthy CAGR during the forecast period, driven by rising investments in clinical research and biotechnology infrastructure. Growing awareness of chronic disease management and advanced treatment modalities is encouraging adoption of exosome-based therapeutics. Hospitals and diagnostic centers are increasingly participating in clinical trials for oncology and immunotherapy applications. Supportive government policies, coupled with emerging biotech startups, are contributing to market growth. Mexico’s focus on expanding healthcare access and research capabilities enhances adoption in both urban and semi-urban regions. Collaborations with international biotech companies also accelerate market development and knowledge transfer.

North America Exosome Therapeutics Market Share

The North America Exosome Therapeutics industry is primarily led by well-established companies, including:

- Direct Biologics LLC (U.S.)

- AEGLE Therapeutics (U.S.)

- NurExone Biologic Inc. (Canada)

- Kimera Labs (U.S.)

- Xsome Biotech (U.S.)

- Capricor Therapeutics, Inc. (U.S.)

- Organicell (U.S.)

- Aruna Bio (U.S.)

- RION (U.S.)

- Creative Biolabs (U.S.)

- CD Bioparticles (U.S.)

- Elevai Labs Inc. (U.S.)

- Biological Dynamics (U.S.)

- ExoCoBio (U.S.)

- Vescell (U.S.)

- PureTech Health (U.S.)

- Bio-Techne Corporation (U.S.)

- System Biosciences LLC (U.S.)

- Merck KGaA (U.S.)

- NanoSomiX, Inc. (U.S.)

What are the Recent Developments in North America Exosome Therapeutics Market?

- In September 2025, the 7th Exosome‑Based Therapeutics Development Summit was announced to take place in Boston, bringing together industry leaders, researchers, and biopharma innovators to discuss clinical translation, scalable manufacturing, and therapeutic delivery advances—themes critical for commercializing exosome therapeutics

- In February 2025, NurExone Biologic Inc. established Exo‑Top Inc., a U.S.‑based subsidiary focused on GMP‑compliant exosome production and manufacturing, strengthening North America’s infrastructure for scalable exosome therapeutic supply and accelerating clinical pipeline readiness

- In November 2024, Capricor Therapeutics showcased new pre‑clinical data for its StealthX exosome therapy platform at the 2024 American Association of Extracellular Vesicles (AAEV) Annual Meeting, highlighting the therapeutic potential of exosome‑based delivery across multiple disease models including immune and degenerative disorders

- In January 2024, Aruna Bio’s neural exosome therapeutic AB126 received clearance from the U.S. Food and Drug Administration (FDA) to begin a Phase 1b/2a clinical trial for the treatment of acute ischemic stroke, marking the first time an exosome‑based therapy entered human clinical trials for a neurological indication and showcasing progress in clinical translation of exosome therapeutics

- In May 2023, Direct Biologics reported compelling clinical results from an expanded‑access program using their ExoFlo™ exosome product in hospitalized adult COVID‑19 patients with moderate‑to‑severe ARDS, showing favorable safety and potential survival benefits. This milestone underscored real‑world therapeutic application of exosome technology within North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.