North America Food Storage Container Market

Market Size in USD Million

CAGR :

%

USD

34.00 Million

USD

46.54 Million

2024

2032

USD

34.00 Million

USD

46.54 Million

2024

2032

| 2025 –2032 | |

| USD 34.00 Million | |

| USD 46.54 Million | |

|

|

|

|

Food Storage Container Market Size

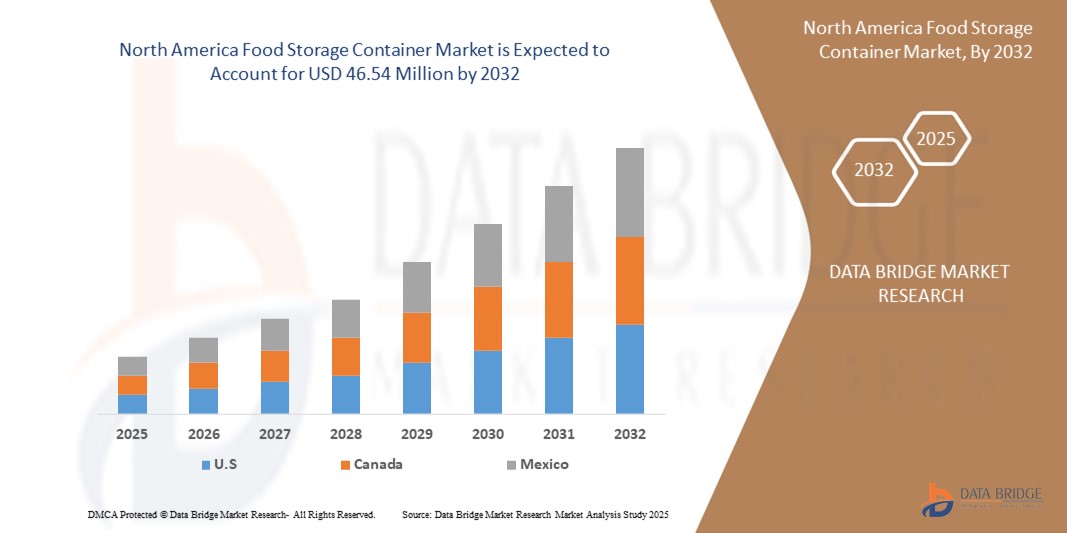

- The North America food storage container market size was valued at USD 34.00 million in 2024 and is expected to reach USD 46.54 million by 2032, at a CAGR of 4.0% during the forecast period

- The market growth is largely fueled by increasing consumer preference for convenience, portability, and extended shelf-life of food products, driving demand for durable and versatile food storage solutions across both residential and commercial sectors

- Furthermore, rising awareness of food waste reduction, sustainability concerns, and the growing popularity of meal prepping and on-the-go lifestyles are accelerating the adoption of reusable, recyclable, and eco-friendly containers, thereby significantly boosting the industry's growth

Food Storage Container Market Analysis

- A food storage container stores food products in the freezer or refrigerator at room temperature. Various options are available for storing food products, such as bottles and jars, cans, bags, cups and tubs, and boxes. Before choosing the right type of container, numerous factors must be taken into consideration. Considering the kind of storage, such as storage at room temperature, refrigerated, or frozen, the length of storage, the type of food, and the amount of storage space

- The escalating demand for food storage containers is primarily fueled by changing consumer lifestyles, the surge in packaged and convenience food consumption, and increasing emphasis on sustainable, reusable, and waste-reducing packaging solutions

- U.S. dominated the food storage container market with a share of over 50% in 2024, due to high household consumption, widespread use of meal-prep practices, and robust demand from the packaged food industry

- Mexico is expected to be the fastest growing region in the food storage container market during the forecast period due to rising urbanization, growing middle-class expenditure on kitchenware, and increased awareness around food hygiene and preservation

- Plastics segment dominated the market with a market share of 47.3% in 2024, due to its lightweight nature, cost-effectiveness, and adaptability across both household and industrial applications. Plastic containers are preferred for their durability, resistance to breakage, and compatibility with varied food types. Moreover, advancements in BPA-free and recyclable plastic technologies have strengthened consumer confidence in plastic-based food storage

Report Scope and Food Storage Container Market Segmentation

|

Attributes |

Food Storage Container Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Storage Container Market Trends

“Increasing Demand for Convenience Foods”

- A significant and accelerating trend in the food storage container market is the rising demand for convenience foods, driven by busy lifestyles, urbanization, and growing preference for ready-to-eat meals and meal prepping solutions. Consumers are increasingly seeking packaging that supports easy storage, transport, and reheating, propelling the adoption of multi-functional food containers

- For instance, companies such as Tupperware and Freshware offer microwave-safe and compartmentalized containers that allow for easy portioning and reheating, aligning with on-the-go consumption habits. Similarly, OXO and EMSA provide products with leak-proof technology and stackable designs, supporting efficient fridge and pantry organization

- The trend toward healthier eating and sustainability is influencing product innovation, with brands offering BPA-free, recyclable, and reusable options to meet eco-conscious consumer preferences. For instance, LocknLock has introduced eco-containers made from recycled materials, reflecting the shift towards greener consumption

- Food storage containers are also evolving in design, incorporating smart features such as freshness indicators or QR codes for inventory tracking, further appealing to tech-savvy consumers seeking improved food management

- This growing inclination toward convenient, safe, and sustainable storage solutions is reshaping the expectations of consumers and encouraging manufacturers to continuously upgrade materials, functionalities, and designs

- The demand for versatile, durable, and consumer-friendly food containers is growing rapidly across residential and commercial sectors, as consumers prioritize freshness, sustainability, and ease of use in food storage solutions

Food Storage Container Market Dynamics

Driver

“Increasing Usage of the Bag for Food Storage”

- The increasing use of bags, especially flexible pouches and resealable storage bags, is a significant driver in the food storage container market, owing to their lightweight structure, low cost, and convenience for short-term storage

- For instance, companies such as Ziploc and Vtopmart are seeing rising demand for their resealable storage bags, particularly among consumers seeking portability, portion control, and ease of freezing or refrigerating leftovers

- These storage bags are particularly popular in foodservice operations and household kitchens due to their ability to store a variety of food types while occupying minimal space

- Furthermore, advancements in material technology, such as improved barrier properties for moisture and odor resistance, are expanding the applicability of bags for both dry and perishable foods

- The growing trend of bulk buying and meal portioning also supports the use of such storage solutions, encouraging further product innovation and increasing their contribution to overall market growth

Restraint/Challenge

“Increasing Chances of Food Contamination”

- Concerns regarding the risk of food contamination due to the use of substandard or non-food-grade materials in storage containers pose a significant restraint to the market

- For instance, low-quality plastic containers may leach harmful chemicals into food, especially when used for reheating, leading to health risks and growing consumer distrust in certain product categories

- To mitigate this challenge, manufacturers are increasingly investing in certified food-grade materials and BPA-free solutions, while also enhancing consumer education on proper use and storage practices

- Despite these efforts, the presence of counterfeit and poorly regulated products in emerging markets continues to threaten consumer confidence and poses a hurdle to the growth of legitimate brands in the segment

- Ensuring stringent regulatory oversight and clearer labeling, along with innovations in safer material composition, will be crucial to overcoming this barrier and maintaining consumer trust in food storage solutions

Food Storage Container Market Scope

The market is segmented on the basis of material, purpose, shape, capacity, technology, size, appearance, function, and end-user.

• By Material

On the basis of material, the food storage container market is segmented into metal, plastics, glass, acrylic, ceramic, silicone, paper, and others. The plastics segment dominated the largest market revenue share of 47.3% in 2024 due to its lightweight nature, cost-effectiveness, and adaptability across both household and industrial applications. Plastic containers are preferred for their durability, resistance to breakage, and compatibility with varied food types. Moreover, advancements in BPA-free and recyclable plastic technologies have strengthened consumer confidence in plastic-based food storage.

The glass segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer awareness about chemical leaching from plastics and growing demand for sustainable and reusable alternatives. Glass containers are favored for their non-porous nature, transparency, and premium appearance, making them ideal for households and gourmet food storage in retail applications.

• By Purpose

On the basis of purpose, the market is categorized into microwave compatible, airtight containers, and others. Airtight containers accounted for the largest market share in 2024, primarily because of their superior ability to preserve freshness and prevent contamination. Consumers in North America increasingly seek airtight packaging for extending shelf life, especially in urban areas where bulk buying and meal prepping are common.

The microwave compatible segment is projected to grow at the highest CAGR during the forecast period due to the rising adoption of convenience-based lifestyles and demand for heat-and-eat food storage solutions. Consumers are favoring containers that allow for direct microwave usage without the need for transferring contents, thereby enhancing practicality and reducing clean-up time.

• By Shape

On the basis of shape, the market is segmented into round, square, and others. Round containers held the largest share in 2024, owing to their traditional dominance in food storage and better space utilization within circular vessels or bowls. Their uniform surface area ensures even heating and ease of handling, making them popular in both domestic and commercial kitchens.

The square segment is expected to register the fastest growth through 2032 as it offers efficient stackability and better utilization of refrigerator and shelf space. Square containers are gaining preference, particularly in foodservice environments and retail displays where maximized storage with clear visibility is a priority.

• By Capacity

On the basis of capacity, the market is segmented into less than 100 ml, 100–500 ml, 500–1000 ml, 1000–1500 ml, 1500–2000 ml, and more than 2000 ml. The 500–1000 ml segment commanded the largest market share in 2024 due to its suitability for single-serving and mid-sized meal storage, commonly used in households and takeaway packaging.

Containers with a capacity of more than 2000 ml are projected to grow at the fastest pace, particularly driven by growing usage in food processing units and bulk storage in restaurant kitchens. This category is also expanding in the B2B segment for items such as grains, vegetables, and meat storage.

• By Technology

On the basis of technology, the market is segmented into injection molding, extrusion, stretch blow molding, thermoforming, and others. Injection molding held the largest revenue share in 2024 as it allows for precise and scalable production of complex container designs with consistent quality. Its cost efficiency in large-scale production and compatibility with varied materials make it widely used among North American manufacturers.

Thermoforming is expected to grow at the fastest rate, supported by increasing demand for lightweight and single-use containers in the food delivery and retail sectors. It is particularly suited for clear, shallow trays and lids, offering visual appeal and cost savings.

• By Size

On the basis of size, the market is segmented into small, medium, and large. The medium-sized containers dominated in 2024 due to their versatility in serving both individual and family food storage requirements. They are widely used across households and food outlets for items such as leftovers, pre-cut fruits, or deli products.

The small segment is projected to witness the fastest growth during the forecast period, especially for on-the-go snacking, condiment storage, and baby food applications. Compact size and portability are increasingly valued in urban and working-class populations.

• By Appearance

On the basis of appearance, the market is categorized into transparent and colored containers. Transparent containers held the largest share in 2024 owing to their practical utility in allowing visual identification of contents without opening, reducing food waste and simplifying kitchen organization.

Colored containers are anticipated to grow at the highest rate, supported by aesthetic preferences, brand differentiation in retail environments, and usage in segmentation (e.g., meat vs. produce) to avoid cross-contamination.

• By Function

On the basis of function, the market is segmented into storage, conveying and transport, picking, handling, interlinked workstations, and others. Storage accounted for the largest market share in 2024, driven by the core role of containers in preserving food across household and industrial settings. Demand for reliable and reusable food storage solutions remains consistent across sectors.

The conveying and transport segment is expected to grow most rapidly due to the boom in food delivery services and cross-border food trade within North America. Specialized containers designed for stability, insulation, and tamper resistance are gaining prominence in logistics.

• By End-User

On the basis of end-user, the market is segmented into household, bakery and confectionery, chocolates, convenience food, fruits and vegetables, meat, fish and poultry, condiments and spices, dairy products, and others. The household segment led the market in 2024, driven by increasing consumer focus on food preservation, meal prepping, and reducing food waste. Rising single-person and nuclear households across North America are contributing to consistent demand.

The convenience food segment is expected to register the fastest growth during the forecast period, supported by the surge in demand for ready-to-eat meals, especially among the working population. This drives need for durable, reheatable, and visually appealing packaging formats.

Food Storage Container Market Regional Analysis

- U.S. dominated the food storage container market with the largest revenue share of over 50% in 2024, driven by high household consumption, widespread use of meal-prep practices, and robust demand from the packaged food industry

- Consumers prioritize durable, BPA-free, and microwave-safe containers, especially amid growing health awareness and sustainability concerns

- Strong retail penetration, increasing demand for reusable storage solutions in urban kitchens, and rapid growth in e-commerce grocery delivery are key factors supporting market expansion

Mexico Food Storage Container Market Insight

Mexico is witnessing notable growth in the food storage container market during forecast period of 2025-2032, due to rising urbanization, growing middle-class expenditure on kitchenware, and increased awareness around food hygiene and preservation. The market is being driven by a shift from disposable packaging to reusable plastic and glass containers, particularly in urban areas such as Mexico City and Guadalajara. Local food vendors and small-scale meal-prep services are also contributing to the rising demand for affordable, stackable, and portable storage options.

Canada Food Storage Container Market Insight

Canada’s food storage container market is experiencing steady growth, driven by sustainability-oriented consumer behavior and a high preference for glass and stainless-steel containers. The increasing popularity of zero-waste lifestyles and government initiatives against single-use plastics are fostering demand for long-lasting and recyclable storage products. Furthermore, the expansion of organic and health food sectors and rising popularity of meal planning in cities such as Toronto and Vancouver are boosting adoption of eco-friendly, space-saving food storage systems.

Food Storage Container Market Share

The food storage container industry is primarily led by well-established companies, including:

- The Clorox Company (U.S.)

- Tupperware (U.S.)

- Newell Brands (U.S.)

- Amcor plc (Switzerland)

- LocknLock Co. (South Korea)

- Molded Fiber Glass Company (U.S.)

- Prepara (U.S.)

- Thermos L.L.C. (U.S.)

- Freshware (U.S.)

- Oneida (U.S.)

- Glasslock (U.S.)

- Vremi (U.S.)

- Vtopmart (U.S.)

- EMSA GmbH (Germany)

- Silgan Containers (U.S.)

- Lindar Corp. (U.S.)

- Detmold Group (Australia)

- Pactiv L.L.C. (U.S.)

- OXO (U.S.)

Latest Developments in North America Food Storage Container Market

- In March 2024, Amcor, in collaboration with Stonyfield Organic and Cheer Pack North America, introduced an all-polyethylene (PE) spouted pouch for Stonyfield's YoBaby yogurt line, aiming to reduce the environmental impact of traditional packaging. This innovation enhances recyclability and aligns with increasing consumer and regulatory expectations for sustainable packaging, positioning Amcor to capture a larger share of the eco-friendly segment in the food storage container market

- In December 2023, Novolex unveiled a new line of recyclable food packaging containers made with a minimum of 10% post-consumer recycled (PCR) content, reinforcing its commitment to sustainability in the food storage container market. By offering a variety of products including dessert cups, tamper-evident containers, and cake containers, this initiative is expected to strengthen Novolex’s market presence and attract environmentally conscious consumers, thereby boosting demand for recycled-content packaging

- In 2021, Plastipak announced its recycling investment at its Toledo, Spain plant, aiming to convert P.E.T. flakes into food-grade recycled pellets. These pellets are considered for direct use in new food containers. This plant would manufacture nearly 20,000 tons of food-grade pellets yearly and produce them from the summer of 2022

- In 2021, Berry Superfos, a business unit of Berry Global, revealed a new sustainable CombiLight packaging pot for food producers. This modern and advanced resource-efficient food packaging solution would help remove plastic content by 60 percent compared to similar solutions

- In February 2020, The Molded Fibre Glass Tray Company launched ULTRA-LITE Totes and Containers, combining lightweight design with high durability to target new consumer segments. This product line expansion is likely to open up revenue opportunities by appealing to industries and consumers seeking strong yet manageable food storage solutions, further diversifying the company’s market reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Food Storage Container Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Food Storage Container Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Food Storage Container Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.