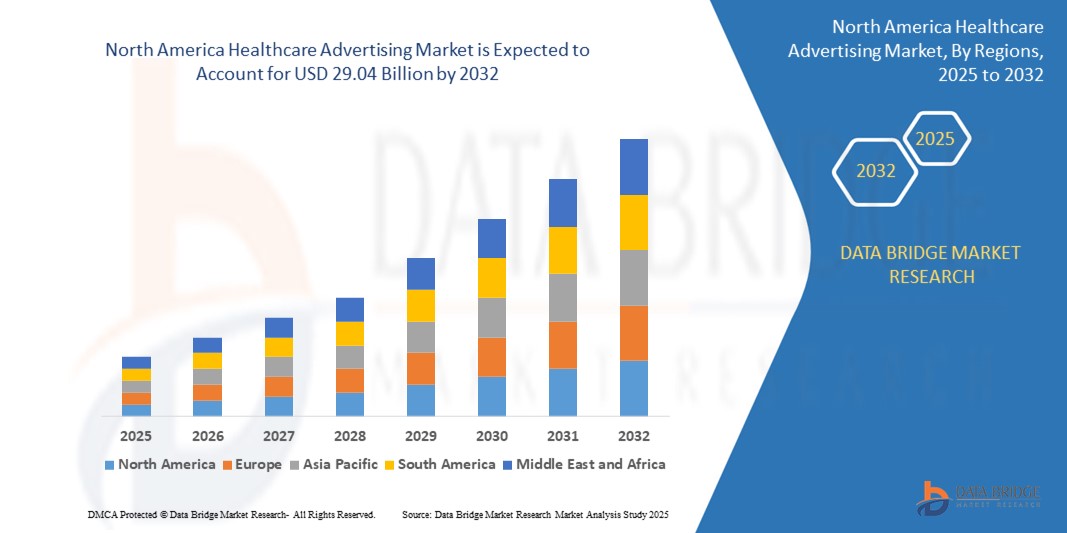

North America Healthcare Advertising Market

Market Size in USD Billion

CAGR :

%

USD

19.21 Billion

USD

29.04 Billion

2024

2032

USD

19.21 Billion

USD

29.04 Billion

2024

2032

| 2025 –2032 | |

| USD 19.21 Billion | |

| USD 29.04 Billion | |

|

|

|

|

North America Healthcare Advertising Market Size

- North America dominates the North America healthcare advertising market with the largest revenue share of % in 2024,

- The market growth is largely fuelled by the increasing demand for personalized healthcare services, expansion of digital advertising platforms, and rising investments by pharmaceutical and biotech companies in direct-to-consumer (DTC) advertising

- A strong presence of leading pharmaceutical companies, advanced media infrastructure, and high consumer engagement with digital health platforms further contribute to the region's dominant position in the market

North America Healthcare Advertising Market Analysis

- The region’s high internet penetration and smartphone usage are accelerating the adoption of digital advertising formats, including search, video, and display ads across platforms such as Google, YouTube, and health-focused apps

- Rising demand for preventative care and wellness products is encouraging advertisers to focus on education-based marketing strategies that emphasize lifestyle management, early diagnosis, and virtual care services

- U.S. healthcare advertising market captured the largest revenue share of 84% in 2024 within North America, supported by a robust pharmaceutical industry and the highest per capita healthcare spending globally

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America healthcare advertising market due to increasing digital transformation across the healthcare sector, rising investments in public health campaigns, and growing demand for personalized, bilingual advertising content

- The online segment accounted for the largest market revenue share in 2024, driven by the rise of digital platforms, increased mobile device usage, and growing preference for search engine and social media outreach. Healthcare providers and pharmaceutical brands are increasingly investing in online advertising to expand patient reach, improve engagement, and gain real-time performance insights

Report Scope and North America Healthcare Advertising Market Segmentation

|

Attributes |

North America Healthcare Advertising Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Healthcare Advertising Market Trends

“Growing Consumer Awareness and Demand for Preventive Healthcare”

- Healthcare brands are increasingly adopting data-driven advertising strategies to deliver personalized messages to segmented audiences based on age, health conditions, behavior, and location, leading to more targeted and efficient campaigns

- Digital platforms such as Google, Facebook, and health-related mobile apps are becoming primary advertising channels, as they allow brands to reach consumers where they search, scroll, and engage with health content daily

- AI and machine learning tools are enabling dynamic ad optimization, helping companies tailor content in real-time to improve relevance, engagement, and conversion rates across web and mobile platforms

- Younger, tech-savvy demographics are driving demand for interactive and engaging content, leading brands to invest in video ads, influencer marketing, and gamified health promotions on platforms such as Instagram, TikTok, and YouTube

- For instance, Teladoc Health expanded its digital-first strategy by launching personalized Google and YouTube ad campaigns promoting virtual doctor visits, leading to a measurable increase in user signups and online appointment bookings

North America Healthcare Advertising Market Dynamics

Driver

“Stringent Regulatory Compliance and Advertising”

- Rising health consciousness among the population has led to increased attention on wellness, early detection, and lifestyle modification, creating more opportunities for healthcare brands to advertise preventive solutions

- Surge in chronic illnesses such as diabetes, hypertension, and obesity is motivating consumers to seek proactive management solutions, prompting advertisers to highlight products and services that aid in long-term disease prevention

- Technological advancements in wearable health tech and mobile apps allow advertisers to market personalized preventive tools, from heart-rate monitors to diet-tracking platforms, that encourage consistent health monitoring

- Public and private healthcare entities are aligning efforts to educate citizens on preventive care through collaborative advertising campaigns, amplifying reach and credibility of such initiatives

- For instance, CVS Health launched a national campaign encouraging Americans to get flu shots and biometric screenings at their MinuteClinic locations, using both traditional and digital media to spread preventive awareness across demographics

Restraint/Challenge

“Stringent Regulatory Compliance and Advertising Restrictions”

- Healthcare advertising in North America is heavily regulated by authorities such as the U.S. FDA and FTC, which enforce stringent rules on ad claims, risk disclosures, and promotional messaging, especially in pharmaceuticals and medical devices

- Approval timelines for direct-to-consumer (DTC) advertising can be lengthy, requiring exhaustive legal and medical review to ensure compliance, which delays marketing execution and reduces agility in fast-paced digital campaigns

- Creative content is often constrained, as companies must include lengthy disclaimers and detailed side-effect information in their messaging, which may reduce viewer engagement or weaken emotional impact

- Emerging digital platforms such as Meta and Google are implementing their own healthcare ad policies, adding another layer of compliance complexity and often requiring certifications before ads can run

- For instance, Merck was required to revise its DTC ad for a diabetes medication after the FDA flagged it for omitting certain side effects, leading to temporary ad withdrawal, public scrutiny, and regulatory warnings

North America Healthcare Advertising Market Scope

The North America healthcare advertising market is segmented on the basis of type, form of engagement, technology, format, approach, and application.

• By Type

On the basis of type, the North America healthcare advertising market is segmented into online, traditional, physician referrals, internal marketing, public relations, employer marketing, unique branding and awareness, and others. The online segment accounted for the largest market revenue share in 2024, driven by the rise of digital platforms, increased mobile device usage, and growing preference for search engine and social media outreach. Healthcare providers and pharmaceutical brands are increasingly investing in online advertising to expand patient reach, improve engagement, and gain real-time performance insights.

The employer marketing segment is expected to witness a fastest growth rate between 2025 and 2032, supported by rising workplace wellness initiatives and partnerships between healthcare providers and employers. Customized healthcare programs, mental health offerings, and preventive care advertising through employee channels are becoming instrumental in reaching specific workforce demographics.

• By Form of Engagement

On the basis of form of engagement, the market is segmented into healthcare facility, in home/in person, digital, and others. The digital segment dominated the market in 2024, driven by the convenience and scalability of digital interactions such as emails, patient portals, mobile apps, and virtual consultations. Brands are capitalizing on these platforms to deliver personalized, data-driven advertising while maintaining user privacy.

The in home/in person segment is expected to witness a fastest growth rate between 2025 and 2032, supported by home healthcare services and outreach campaigns that directly engage patients in their living environments. This includes advertising linked to home diagnostics, remote patient monitoring, and community-based awareness drives.

• By Technology

On the basis of technology, the market is segmented into telemedicine, artificial intelligence, personal data tracking, and others. The telemedicine segment captured the largest revenue share in 2024 due to its integration into advertising campaigns promoting virtual healthcare services and 24/7 access to professionals. These solutions became prominent during the pandemic and have since remained a major focus for digital advertising.

The artificial intelligence segment is expected to witness a fastest growth rate between 2025 and 2032, fueled by AI-driven ad targeting, patient behavior analytics, and conversational bots. Advertisers are leveraging AI to deliver personalized experiences and optimize content delivery across various channels.

• By Approach

Based on approach, the market is segmented into detailing and direct-to-consumer advertising. The direct-to-consumer advertising segment led the market in 2024, owing to its extensive use by pharmaceutical companies to educate and influence patients through mass media and digital platforms. This strategy enhances brand recognition and drives patient inquiries.

The detailing segment is expected to witness a fastest growth rate between 2025 and 2032, supported by virtual detailing, webinars, and AI-assisted sales tools that streamline information delivery and compliance tracking.

• By Format

On the basis of format, the market is divided into display, search, and video. The display segment held the largest market share in 2024, supported by banner ads, native content, and programmatic placements across health-related websites and news portals. These formats allow healthcare advertisers to maintain strong visibility with minimal intrusiveness.

The video segment is expected to witness a fastest growth rate between 2025 and 2032, driven by increased consumption of short and long-form videos across YouTube, Instagram, and OTT platforms. Video content is being used effectively to explain treatments, patient journeys, and testimonials in engaging formats.

• By Application

By application, the market is segmented into pharmaceuticals advertising, biopharmaceuticals, vaccines, over-the-counter drugs, prescription medicines, medical devices and equipment, biotech companies, medical insurance, fitness and diet products and services, hygiene products, corrective lenses and glasses, and others. The pharmaceuticals advertising segment accounted for the largest revenue share in 2024, driven by high advertising budgets from major drug makers and growing competition in treatment options.

The fitness and diet products and services segment is expected to witness a fastest growth rate between 2025 and 2032, supported by increased consumer interest in wellness, weight management, and preventive healthcare. Advertisers are promoting personalized diet plans, supplements, and fitness programs through targeted digital campaigns.

North America Healthcare Advertising Market Regional Analysis

- The U.S. healthcare advertising market captured the largest revenue share of 84% in 2024 within North America, supported by a robust pharmaceutical industry and the highest per capita healthcare spending globally

- Brands are heavily investing in multi-channel campaigns to engage patients and providers through platforms such as television, social media, and search engines

- The expansion of telemedicine, growing demand for personalized treatment options, and the widespread use of data analytics have significantly enhanced targeting capabilities

- Moreover, the U.S. remains the leading adopter of direct-to-consumer pharmaceutical advertising, bolstering market momentum

Canada Healthcare Advertising Market Insight

The Canada healthcare advertising market is expected to witness a fastest growth rate between 2025 and 2032, driven by rising demand for patient-centered communication, the expansion of digital healthcare services, and increasing government efforts to promote public health initiatives. Canadian healthcare providers and pharmaceutical companies are adopting multichannel advertising approaches, blending traditional media with digital platforms such as YouTube, Google, and healthcare-specific mobile apps.

North America Healthcare Advertising Market Share

The North America Healthcare Advertising industry is primarily led by well-established companies, including:

- FCB (U.S.)

- Havas Health and You (U.S.)

- Publicis Health (U.S.)

- CDM New York (U.S.)

- Xandr Inc. (U.S)

- Verizon (U.S)

- NextRoll, Inc. (U.S)

- Google (U.S)

- Adobe (U.S)

- Magnite, Inc (U.S)

- MediaMath (U.S)

- IPONWEB Limited (U.S)

- The Trade Desk (U.S)

- Connexity (U.S)

- Centro, Incorporated (U.S)

- RhythmOne, LLC (U.S)

- Syneos Health (U.S.)

Latest Developments in North America Healthcare Advertising Market

- In 2020, PUBLICIS GROUPE Heartbeat was honored with the MANNYAwards for Med Ad News, reinforcing its ongoing dedication to Diversity and Inclusion. This accolade is poised to elevate the company's brand value, subsequently driving increased revenue generation

- In 2020, Havas Health & You partnered with the Programmatic Health Council Media group, leveraging expertise in programmatic advertising within the healthcare sector. This collaboration seeks to fortify the company's market position, amplifying consumer engagement through data-driven strategies to enhance brand reputation and revenue streams

- In 2020, Care Health Insurance unveiled plans for a new TV campaign post-rebranding, emphasizing exceptional customer service, value-driven offerings, and product innovation. This initiative underscores the company's commitment to delivering unparalleled service, fostering customer loyalty, and stimulating revenue growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.