North America Hemodialysis Peritoneal Dialysis Market

Market Size in USD Billion

CAGR :

%

USD

55.36 Billion

USD

112.76 Billion

2024

2032

USD

55.36 Billion

USD

112.76 Billion

2024

2032

| 2025 –2032 | |

| USD 55.36 Billion | |

| USD 112.76 Billion | |

|

|

|

|

North America Hemodialysis and Peritoneal Dialysis Market Size

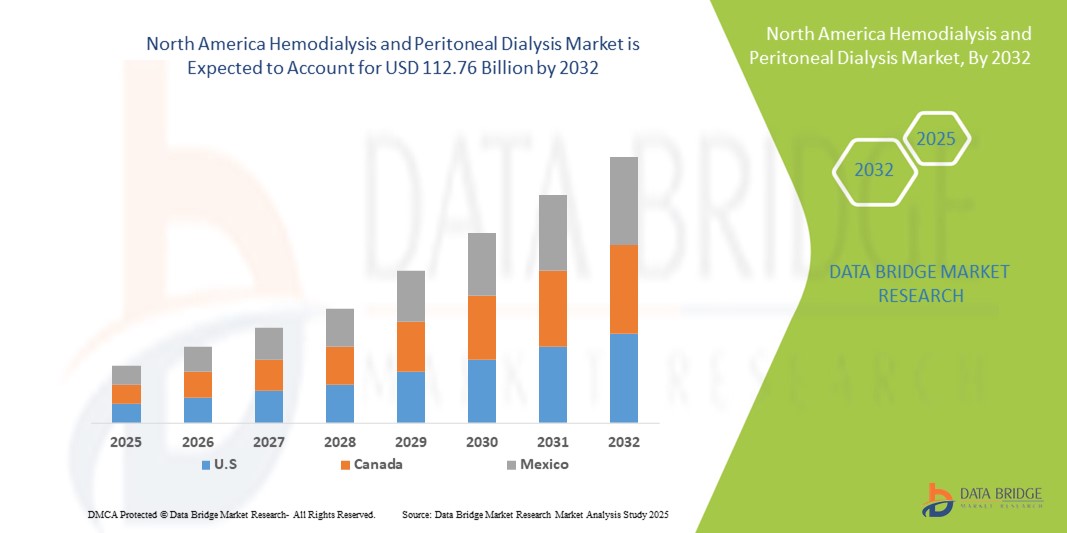

- The North America hemodialysis and peritoneal dialysis market size was valued at USD 55.36 billion in 2024 and is expected to reach USD 112.76 billion by 2032, at a CAGR of 9.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), advancements in dialysis technologies, and expanding access to treatment options in both hospital and home care settings

- Furthermore, rising patient demand for effective, convenient, and home-based dialysis solutions is establishing hemodialysis and peritoneal dialysis as the preferred renal replacement therapies. These converging factors are accelerating the adoption of dialysis solutions, thereby significantly boosting the industry's growth

North America Hemodialysis and Peritoneal Dialysis Market Analysis

- Hemodialysis and peritoneal dialysis, offering life-sustaining renal replacement therapy for patients with chronic kidney disease (CKD) and end-stage renal disease (ESRD), are increasingly vital components of modern healthcare systems in hospitals, dialysis centers, and home care settings due to their improved treatment efficacy, patient monitoring capabilities, and integration with advanced dialysis technologies

- The escalating demand for dialysis therapies is primarily fueled by the rising prevalence of CKD and ESRD, technological advancements in hemodialysis machines, dialyzers, and peritoneal dialysis products, and a growing preference for home dialysis and independent care that enhance patient convenience and quality of life

- U.S. dominated the North America hemodialysis and peritoneal dialysis market with the largest revenue share of 75.8% in 2024, characterized by advanced healthcare infrastructure, high adoption of in-center and home hemodialysis modalities, and a strong presence of key industry players providing both consumables and dialysis services

- Canada is expected to be the fastest growing country in the North America hemodialysis and peritoneal dialysis market during the forecast period due to increasing adoption of peritoneal dialysis, supportive reimbursement policies, and investments in home dialysis and independent dialysis solutions

- Center-use hemodialysis machines dominated the North America hemodialysis and peritoneal dialysis market with a share of 39.2% in 2024, driven by their widespread adoption in dialysis centers, established clinical effectiveness, and continuous innovations that improve treatment efficiency and patient safety

Report Scope and North America Hemodialysis and Peritoneal Dialysis Market Segmentation

|

Attributes |

North America Hemodialysis and Peritoneal Dialysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Hemodialysis and Peritoneal Dialysis Market Trends

Advancements in Home-Based Dialysis and Remote Monitoring

- A significant and accelerating trend in the North American dialysis market is the increasing adoption of home-based hemodialysis (HHD) and peritoneal dialysis (PD), combined with remote patient monitoring systems that enhance treatment compliance and patient safety

- For instance, home-use dialysis machines integrated with telehealth platforms allow clinicians to monitor vital parameters, adjust treatment schedules, and provide guidance without requiring patients to visit dialysis centers

- Remote monitoring enables real-time alerts for complications, adherence tracking, and early intervention, improving overall patient outcomes and reducing hospitalizations. For instance, some PD systems provide automated reporting to nephrologists, ensuring timely response to abnormal readings

- The seamless integration of dialysis devices with digital health platforms facilitates centralized patient management, allowing clinicians to track multiple patients, adjust treatment remotely, and optimize therapy from a single interface

- This trend towards more patient-centric, connected, and autonomous dialysis systems is fundamentally reshaping treatment delivery expectations. Consequently, companies are developing home-use hemodialysis machines and peritoneal dialysis systems with remote monitoring and automated alerts for patient convenience and safety

- The demand for dialysis solutions that offer home usability, telemonitoring, and improved patient autonomy is growing rapidly across both hospitals and home care settings, as patients increasingly prioritize convenience and consistent healthcare management

North America Hemodialysis and Peritoneal Dialysis Market Dynamics

Driver

Increasing Prevalence of CKD and ESRD

- The rising prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), coupled with improved diagnosis rates and awareness programs, is a significant driver for the growing demand for dialysis therapies

- For instance, in 2024, major U.S. hospitals and renal care providers expanded their home dialysis programs to accommodate increasing patient volumes, driving market growth

- As more patients require long-term renal replacement therapy, dialysis products and services provide life-sustaining treatment while improving quality of life. For instance, high-flux dialyzers and advanced peritoneal dialysis systems enhance clinical outcomes and reduce complications

- Furthermore, the increasing focus on patient-centric care and home-based treatment adoption is making dialysis services an integral component of the healthcare ecosystem, offering convenience and better resource management

- The availability of in-center, home, and independent dialysis solutions, along with supportive reimbursement policies, is propelling the adoption of dialysis products and services. For instance, telemonitoring and portable devices help patients manage therapy from home efficiently

Restraint/Challenge

High Treatment Costs and Infrastructure Limitations

- The high cost of dialysis equipment, consumables, and ongoing therapy sessions, particularly for home-based solutions, poses a significant challenge to broader market penetration. Patients may face financial burdens despite insurance coverage

- For instance, home-use hemodialysis machines and peritoneal dialysis systems with remote monitoring features are expensive, limiting adoption among price-sensitive patients

- Infrastructure requirements, including trained personnel, water treatment systems, and facility setup for in-center dialysis, further restrict market expansion. For instance, some rural or small clinics lack the necessary resources to offer advanced dialysis modalities

- While efforts are being made to reduce costs through reimbursement and insurance support, the overall financial burden for advanced devices and long-term treatment can still hinder widespread adoption

- Overcoming these challenges through cost-effective technologies, increased healthcare funding, and patient education on home-based dialysis benefits will be vital for sustained market growth

North America Hemodialysis and Peritoneal Dialysis Market Scope

The market is segmented on the basis of hemodialysis products, dialyzer material type, flux type, hemodialysis modality, water treatment systems, peritoneal dialysis products and services, peritoneal dialysis modality, disease indication, usage, and end user.

- By Hemodialysis Products

On the basis of hemodialysis products, the North America hemodialysis and peritoneal dialysis market is segmented into hemodialysis machines, center-use hemodialysis machines, home-use hemodialysis machines, and hemodialysis consumables and supplies. The center-use hemodialysis machines segment dominated the market with a revenue share of 39.2% in 2024, driven by its extensive use in hospitals and dialysis centers. These machines are preferred for their high throughput and consistent performance across multiple patients, ensuring treatment reliability. They integrate advanced monitoring systems and safety protocols, which are critical for clinical operations. The large installed base in urban healthcare facilities reinforces dominance. Continuous innovations, such as automated treatment schedules and improved user interfaces, further strengthen adoption. Hospital administrators favor center-use machines due to their efficiency, durability, and compatibility with advanced consumables.

The home-use hemodialysis machines segment is expected to witness the fastest growth rate of 12.5% from 2025 to 2032, fueled by the rising preference for home-based treatment and remote patient monitoring. Home-use machines provide flexibility and reduce the frequency of hospital visits, improving quality of life. Telehealth integration allows clinicians to monitor vital parameters, adjust treatments, and provide guidance remotely. Compact design and ease of operation make these machines suitable for a broader patient base. Supportive reimbursement policies and awareness campaigns are also accelerating adoption. The segment growth reflects a shift toward patient-centric care and convenience in dialysis therapy.

- By Dialyzer Material Type

On the basis of dialyzer material type, the North America hemodialysis and peritoneal dialysis market is segmented into synthetic dialyzers and cellulose-based dialyzers. The synthetic dialyzers segment dominated the market in 2024 due to superior biocompatibility, higher solute clearance, and reduced risk of inflammation during treatment. Hospitals and dialysis centers prefer synthetic membranes for patient safety and improved treatment outcomes. Continuous R&D has enhanced the durability and efficiency of these dialyzers, making them more cost-effective in the long term. Clinical protocols often recommend synthetic dialyzers for high-risk or long-term patients. Their integration with advanced hemodialysis machines ensures consistent performance. Adoption is further supported by favorable regulatory approvals and clinical evidence demonstrating safety and efficacy.

The cellulose-based dialyzers segment is expected to witness the fastest growth during the forecast period due to cost advantages and increasing use in emerging dialysis centers. These dialyzers offer an economical option for smaller clinics and home dialysis setups. Improvements in cellulose membrane technology have enhanced solute clearance and reduced adverse reactions. Clinics with budget constraints find them suitable for frequent dialysis sessions. Training programs and manufacturer support are driving adoption in less urbanized regions. Growing awareness of dialysis benefits among patients also supports the expansion of this segment.

- By Flux Type

On the basis of flux type, the North America hemodialysis and peritoneal dialysis market is segmented into high-flux dialyzers and low-flux dialyzers. The high-flux dialyzers segment dominated the market with a revenue share of 54.2% in 2024 due to superior removal of larger molecular toxins and improved cardiovascular outcomes. High-flux dialyzers are widely adopted in hospital-based treatments and in-center dialysis programs. Continuous technological innovations have improved biocompatibility, efficiency, and patient safety. The segment benefits from strong clinical evidence supporting high-flux usage for ESRD patients. Physicians prefer high-flux dialyzers for better long-term patient outcomes. Their adoption is further reinforced by the availability of compatible high-performance hemodialysis machines.

The low-flux dialyzers segment is expected to witness the fastest growth during the forecast period due to adoption in home dialysis setups and small-scale clinics. Low-flux dialyzers are easier to maintain, require simpler water treatment systems, and are cost-effective. They are increasingly used in portable and home-use machines. Telehealth monitoring and remote guidance improve patient safety during home dialysis. Manufacturers are introducing improved low-flux membranes for better solute clearance. The segment growth is driven by affordability, ease of use, and rising patient preference for home-based therapy.

- By Hemodialysis Modality

On the basis of hemodialysis modality, the North America hemodialysis and peritoneal dialysis market is segmented into conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis (NHD). The conventional hemodialysis segment dominated the market in 2024 due to its long-standing adoption in hospitals and dialysis centers, proven safety, and consistent clinical outcomes. Conventional hemodialysis remains the primary modality for ESRD patients, supported by established protocols and physician familiarity. Its widespread use is facilitated by the large installed base of compatible machines and consumables. Hospitals and dialysis centers favor conventional hemodialysis for efficiency in treating multiple patients daily. Continuous improvements in machine automation and monitoring enhance its reliability. Patient adherence and treatment standardization further reinforce dominance.

The short daily hemodialysis segment is expected to witness the fastest growth during the forecast period due to rising patient preference for shorter, more frequent sessions that reduce cardiovascular risks. Home adoption of short daily hemodialysis is increasing with portable machine designs and telemonitoring integration. Patients benefit from improved quality of life, fewer complications, and greater flexibility in daily routines. Healthcare providers support short daily treatments to reduce in-center congestion. Insurance coverage and reimbursement policies are increasingly accommodating home-based short daily dialysis. The segment growth reflects a trend toward patient-centric and personalized treatment schedules.

- By Hemodialysis Water Treatment Systems

On the basis of water treatment systems, the North America hemodialysis and peritoneal dialysis market is segmented into central water disinfection systems and portable water disinfection systems. The central water disinfection systems segment dominated in 2024 due to widespread use in hospital and dialysis center setups. These systems ensure consistent water quality for multiple patients, reducing risk of contamination and ensuring compliance with clinical standards. Centralized systems offer operational efficiency and integrate with high-volume dialysis operations. Their reliability and capacity make them preferred for large in-center dialysis programs. Regular maintenance and monitoring improve patient safety and treatment outcomes. Continuous technological upgrades in central systems enhance water purification and reduce operational costs.

The portable water disinfection systems segment is expected to witness the fastest growth during the forecast period due to rising home dialysis adoption. Portable systems are compact, easy to install, and enable patients to perform dialysis safely at home. Telehealth integration and remote monitoring ensure quality control even outside clinical environments. The segment is favored in independent dialysis centers with limited infrastructure. Manufacturers are offering cost-effective and user-friendly portable systems to drive adoption. The trend toward patient autonomy and home therapy supports accelerated growth in portable water treatment systems.

- By Peritoneal Dialysis Products and Services

On the basis of peritoneal dialysis products and services, the North America hemodialysis and peritoneal dialysis market is segmented into peritoneal dialysis concentrates/dialysates, machines, catheters, transfer sets, other products, and services. The peritoneal dialysis concentrates/dialysates segment dominated the market in 2024 due to high consumption per treatment session and essential role in therapy. Hospitals and home care patients rely on consistent, high-quality dialysates to ensure effective treatment. The segment benefits from strong supply chains and regulatory approvals. Continuous innovation in solutions improves biocompatibility and reduces complications. High-volume usage in both in-center and home-based therapy contributes to dominance. Clinical reliance and widespread availability further reinforce market leadership.

The peritoneal dialysis machines segment is expected to witness the fastest growth during the forecast period due to rising home adoption and automated peritoneal dialysis therapy. Portable and user-friendly machines enhance convenience and patient compliance. Integration with remote monitoring allows clinicians to track treatment adherence and intervene when necessary. Technological advancements in cyclers and automation reduce manual intervention. Supportive reimbursement policies in the U.S. and Canada accelerate adoption. The segment growth reflects a strong shift toward patient-centric, home-based therapy models.

- By Peritoneal Dialysis Modality

On the basis of peritoneal dialysis modality, the North America hemodialysis and peritoneal dialysis market is segmented into continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD). The CAPD segment dominated in 2024 due to its simplicity, cost-effectiveness, and suitability for both home and hospital settings. Patients benefit from manual, continuous treatment without needing complex machinery. CAPD is widely recommended for patients with stable residual kidney function. Hospitals and home care programs prefer CAPD for its minimal infrastructure requirements. Continuous training and patient education support its consistent adoption. The segment remains dominant due to strong physician preference and affordability.

The APD segment is expected to witness the fastest growth during the forecast period due to rising adoption of automated, overnight peritoneal dialysis therapy at home. APD cyclers reduce patient effort and provide precise fluid exchange schedules. Telemonitoring integration ensures treatment safety and adherence. Patients prefer APD for convenience and improved lifestyle compatibility. Reimbursement support and growing awareness encourage wider adoption. The segment growth highlights the increasing focus on patient autonomy and technology-driven care.

- By Disease Indication

On the basis of disease indication, the North America hemodialysis and peritoneal dialysis market is segmented into acute kidney infections, ESRD, septic shock, multi-organ failure, and others. The ESRD segment dominated in 2024 due to high prevalence and long-term dialysis requirements. ESRD patients require frequent hemodialysis or peritoneal dialysis sessions to sustain life. Hospitals and home care centers prioritize advanced dialysis modalities for these patients. Continuous improvements in machine safety, consumables, and remote monitoring enhance treatment outcomes. ESRD remains the primary driver of dialysis demand across North America. Clinical protocols and regulatory frameworks reinforce the focus on ESRD management.

The acute kidney infections segment is expected to witness the fastest growth during the forecast period due to rising hospitalizations and early-stage interventions. Dialysis therapy is increasingly used to prevent complications in acute kidney injury. Rapid diagnosis and integration with hospital care systems enhance adoption. Technological advancements in short-term dialysis modalities support growth. Hospitals are increasingly equipping centers for acute interventions. Awareness campaigns and early treatment protocols accelerate adoption.

- By Usage

On the basis of usage, the North America hemodialysis and peritoneal dialysis market is segmented into in-center dialysis, hospital dialysis, independent dialysis, home dialysis, peritoneal dialysis, and home hemodialysis (HHD). The in-center dialysis segment dominated in 2024 due to high patient volume, established infrastructure, and availability of specialized staff. In-center dialysis ensures consistent treatment and immediate clinical supervision. Hospitals and dialysis centers prefer in-center modalities for safety and operational efficiency. Continuous technological improvements in machines and water systems enhance reliability. Patients benefit from trained personnel and real-time monitoring. Widespread presence of dialysis centers across urban and semi-urban areas reinforces dominance.

The home dialysis segment is expected to witness the fastest growth during the forecast period due to rising patient preference for convenience, flexibility, and telehealth support. Home dialysis adoption reduces hospital visits and improves patient quality of life. Integration with portable machines and remote monitoring ensures treatment safety. Insurance coverage and reimbursement policies support growth. Patient education programs encourage self-management of dialysis. The segment growth reflects the shift toward patient-centric care and autonomous therapy models.

- By End User

On the basis of end user, the North America hemodialysis and peritoneal dialysis market is segmented into hospitals, dialysis centers, and home care settings. The hospitals segment dominated in 2024 due to established infrastructure, high patient volumes, and access to advanced hemodialysis and peritoneal dialysis technologies. Hospitals provide in-center dialysis with trained personnel and comprehensive monitoring. Continuous upgrades in equipment, consumables, and water treatment systems support high-quality care. Hospitals also serve as key referral points for home dialysis programs. Regulatory compliance and adherence to clinical protocols favor hospital dominance. Strong supplier networks and long-standing relationships with healthcare providers reinforce market leadership.

The home care settings segment is expected to witness the fastest growth during the forecast period due to increasing patient preference for home therapy, portable devices, and remote monitoring solutions. Patients benefit from convenience, autonomy, and reduced travel to dialysis centers. Integration with telehealth platforms ensures clinical supervision and adherence. Reimbursement policies support home care adoption. Technological advancements in user-friendly machines enhance feasibility. The segment growth highlights the trend toward patient-centric care and decentralized treatment models.

North America Hemodialysis and Peritoneal Dialysis Market Regional Analysis

- The United States dominated the North America hemodialysis and peritoneal dialysis market with the largest revenue share of 75.8% in 2024, characterized by advanced healthcare infrastructure, high adoption of in-center and home hemodialysis modalities, and a strong presence of key industry players providing both consumables and dialysis services

- Patients and healthcare providers in the region prioritize reliable treatment options, continuous patient monitoring, and access to advanced hemodialysis machines and peritoneal dialysis systems, ensuring effective management of renal conditions

- This widespread adoption is further supported by supportive reimbursement policies, technological advancements in dialysis equipment, and growing awareness of home dialysis and patient-centric care, establishing hemodialysis and peritoneal dialysis as preferred renal replacement therapies across hospitals, dialysis centers, and home care settings

U.S. Hemodialysis and Peritoneal Dialysis Market Insight

The U.S. hemodialysis and peritoneal dialysis market captured the largest revenue share in 2024 within North America, fueled by the high prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), and the well-established healthcare infrastructure. Patients increasingly prioritize access to advanced hemodialysis machines, home-use dialysis systems, and peritoneal dialysis therapies to manage their conditions effectively. The growing trend of home-based dialysis, combined with remote monitoring and telehealth integration, further propels the market. Moreover, supportive reimbursement policies and strong presence of key dialysis service providers are significantly contributing to market expansion. High patient awareness regarding treatment options and clinical outcomes also drives adoption of both in-center and home dialysis solutions.

Canada Hemodialysis and Peritoneal Dialysis Market Insight

The Canada hemodialysis and peritoneal dialysis market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing adoption of home hemodialysis and peritoneal dialysis therapies, coupled with rising CKD and ESRD cases. The demand for patient-centric care, convenience, and remote monitoring solutions is fostering market growth. Canada’s healthcare policies and supportive reimbursement frameworks encourage uptake of both in-center and home dialysis modalities. In addition, growing awareness among patients and healthcare providers regarding dialysis efficiency and safety is further accelerating adoption. The country is witnessing significant growth across hospitals, dialysis centers, and home care settings.

Mexico Hemodialysis and Peritoneal Dialysis Market Insight

The Mexican hemodialysis and peritoneal dialysis market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing prevalence of kidney disorders and rising healthcare infrastructure investments. The growing trend of home dialysis adoption and telehealth-enabled monitoring supports patient convenience and treatment adherence. Rising demand for cost-effective dialysis solutions and supportive government initiatives also encourage uptake in both urban and semi-urban regions. Mexico’s focus on expanding dialysis centers and improving access to renal care services is expected to continue stimulating market growth. Furthermore, awareness campaigns targeting early CKD diagnosis are positively influencing market expansion.

North America Hemodialysis and Peritoneal Dialysis Market Share

The North America hemodialysis and peritoneal dialysis industry is primarily led by well-established companies, including:

- Baxter (U.S.)

- Fresenius Medical Care AG (Germany)

- Medtronic (Ireland)

- Nipro Medical Corporation (U.S.)

- Asahi Kasei Medical Co., Ltd. (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- B. Braun SE (U.S.)

- NxStage Medical, Inc. (U.S.)

- Rockwell Medical, Inc. (U.S.)

- DSI (U.S.)

- U.S. Renal Care, Inc. (U.S.)

- American Renal Associates Holdings, Inc. (U.S.)

- Satellite Healthcare, Inc. (U.S.)

- Fresenius Kidney Care (U.S.)

- DaVita Inc. (U.S.)

- Medtronic Renal Care Solutions (U.S.)

- Nipro Europe Group Companies (U.S.)

- Fresenius Medical Care North America (U.S.)

What are the Recent Developments in North America Hemodialysis and Peritoneal Dialysis Market?

- In July 2025, CorMedix Inc. announced an expanded agreement for its flagship drug, DefenCath, which combines the antimicrobial taurolidine and anticoagulant heparin to prevent bloodstream infections in dialysis patients using catheters. A large dialysis organization began using DefenCath in significantly more patients than initially planned, prompting CorMedix to raise its Q2 sales guidance to USD 35-40 million

- In April 2025, DaVita, Inc., a Denver-based dialysis provider with 28 Connecticut locations and 2,605 nationwide, experienced a ransomware cyberattack. The attack encrypted parts of its network, disrupting operations across the U.S., according to a report filed with the Securities and Exchange Commission. Despite the disruption, DaVita has activated contingency plans and continues providing patient care using interim measures, though the extent and duration of the impact remain uncertain

- In March 2025, The U.S. Food and Drug Administration (FDA) announced that the shortage of hemodialysis bloodlines, essential components in dialysis devices, will such asly persist until early fall 2025 due to ongoing supply issues. These bloodlines consist of tubing that connects a patient's blood to the dialysis machine during treatment. The announcement follows a January statement from medical device manufacturer B. Braun, which identified supply and labor constraints causing production disruptions, with their inventory expected to deplete by January 20

- In October 2024, Baxter International began importing intravenous (IV) products from international facilities to the U.S. after Hurricane Helene caused severe flooding to its North Carolina plant, which produces 60% of the country's IV fluids and peritoneal dialysis solutions. The U.S. FDA granted Baxter temporary clearance to import these products from five facilities in Canada, China, Ireland, and the UK as they assess and clean the damaged plant. The shortage of IV fluids has led hospitals to limit elective procedures

- In August 2024, Healthcare company DaVita raised its 2024 profit forecast due to strong demand for its kidney dialysis services, leading to a 3% increase in its shares in aftermarket trading. Despite a sharp decline in shares last October, the company has recovered in 2024 after downplaying concerns over the potential impact of new weight-loss drugs on the dialysis market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.