North America Horticulture Lighting Market

Market Size in USD Million

CAGR :

%

USD

2,382.15 Million

USD

9,388.04 Million

2022

2030

USD

2,382.15 Million

USD

9,388.04 Million

2022

2030

| 2023 –2030 | |

| USD 2,382.15 Million | |

| USD 9,388.04 Million | |

|

|

|

|

North America Horticulture Lighting Market Analysis and Size

The swiftly increasing importance of the farm-to-table concept and increasing number of government policies and initiatives to encourage the adoption of controlled-environment agriculture (CEA) practices are some major factors which enhance the market growth forward. The top lighting is expected to the fastest growing lighting type segment owing to growing the preference of illumination for indoor and vertical farming all over the globe special in North America regions.

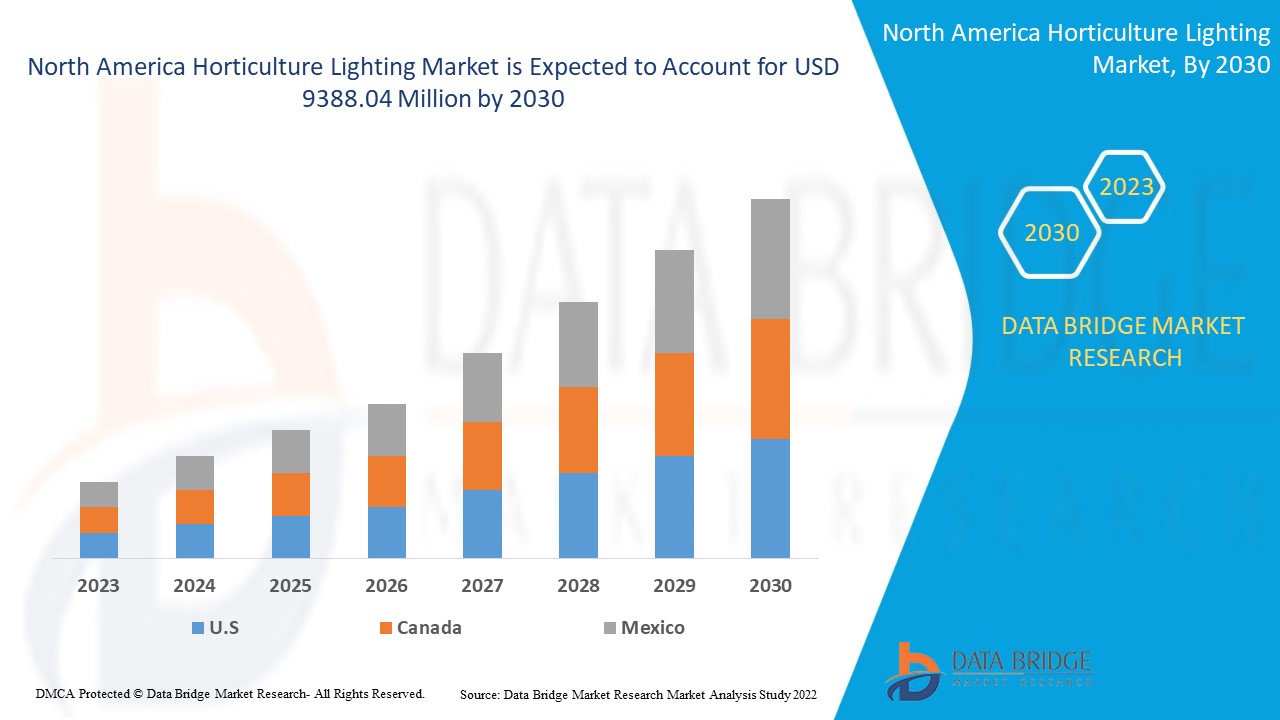

Data Bridge Market Research analyses that the horticulture lighting market was valued at USD 2382.15 million in 2022 and is expected to reach the value of USD 9388.04 million by 2030, at a CAGR of 18.70% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

North America Horticulture Lighting Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Infrared (880 nm & 935 nm), Red (660 nm), Blue (470 nm), Red + White (600 to 700 nm), Others), Offering (Hardware, Software and Services), Technology (Fluorescent, High-Intensity Discharge (HId), Light-Emitting Diode (LED), Other Technologies), Lighting Type (Top lighting, Inter lighting), Application (Greenhouses, Vertical Farming, Indoor Farming, Others), Deployment (Turnkey, Retrofit), Cultivation (Fruits and Vegetables, Floriculture) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Heliospectra AB (Sweden), excite LED Grow Lights (Switzerland), Greens Hydroponics (U.K.), UPSHINE Lighting (China), TESLUX Lighting s.r.o. (Czechia), Hortisystems UK Ltd (U.K.), ProGrowTech (U.S.), Ronfell Group (U.K.), General Electric (U.S.), Agrolux (Netherlands), SAMSUNG (South Korea), Hortilux Schréder B.V. (Netherlands), OSRAM GmbH (Germany), Signify Holding (Netherlands), BSSLED Manufacturing Ltd. (U.K.), Forge Europa (U.K.), Cropmaster LED (U.K.), TE Connectivity Ltd. (Switzerland), Cree, Inc. (U.S.), DiCon Lighting (U.S.), Valoya (Finland), EVERLIGHT (Taiwan), and Gavita (Norway) |

|

Market Opportunities |

|

Market Definition

Horticulture lighting is the technique for stimulating growth of the plant by artificial lighting fixtures when natural light is short. Horticulture lighting is not only about offering enough light for plant growth for photosynthesis, but also about aiding plants to produce better shape of leaves, more beautiful flower, and more fruit as well as extend or shorten a specific increasing period.

Horticulture Lighting Market Dynamics

Drivers

- Growing usage of light-emitting diode (LED) technology

The light-emitting diode (LED) lighting is gaining traction in the horticulture sector, generally owing to NASA, which continues to conduct experiments for the growth of the plant under light-emitting diode (LED) lighting. It witnesses huge potential as horticulture lighting fixtures because of low energy consumption, cool operation and the capability to modify the spectral output to produce the specific wavelengths usable by plants. The rising usage of light-emitting diode (LED) technology in horticulture sector is anticipated to drive the market growth.

- Increasing demand for organic food products

The growth of the horticulture lighting market has recently increased owing to the large demand for nutritious food. For instance, In the U.S. around 20,000 natural food stores are available and approx. 3 out of 4 conventional grocery stores have organic products. The entire organic sales witnessed over 4% of total the U.S. food sales. These aspects aid to upsurge the demand of the organic food in the U.S. These growing demands of organic food boost the growth of the market.

- High usage of greenhouse

A greenhouse is specifically made for the cultivation of fruits and vegetables, floriculture and other horticulture. It is made up of transparent material, specifically glass. Regular crops such as fruits and vegetables, floriculture, which do not require any advanced planning and care with stable weather conditions are grown in greenhouses. A greenhouse is important and acts as a temperature controller. As a result, the plant's growth is healthy and they do not perish.

Opportunities

- Growing adoption of advanced methods

The rapid adoption of advanced methods and technology in developing nations of North America is a potential opportunity for the industry players. Currently, the use of artificial lights for farming purposes is quite low, mainly in countries such as U.S and Mexico, but with the growing popularity of the indoor crop cultivation and horticulture concepts, this market is anticipated to pick up speedily in the coming years. Furthermore, to conserve energy, the government of numerous countries in North America are extending their support for LEDs, which could be a main development factor for market players

- Increasing demand of advanced horticulture lighting

It is projected that the horticulture lighting market will raise considerably in upcoming years, owing to an increase in the demand for sophisticated products mainly organic products and lighting technologies. The growing popularity of horticulture surge the demand for these lights that are expected to spur the market growth. Furthermore, the necessity for horticulture lighting systems in vertical farming applications is increasing, which further encourages the farmers or producers of vertical farming to create effective management, therefore supporting the growth of the market.

Restraints

- High cost and lack of standard testing practices

High installation costs and setup prices associated with horticulture lighting and high demand for different light spectra for different crops in horticulture are anticipated to obstruct market growth. Furthermore, lack of standard testing practices for accessing food product quality and complexities with the placement of controlled environment agriculture technology in large areas are expected to challenge the market's growth during the forecast period of 2023-2030.

This horticulture lighting market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the horticulture lighting market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Covid-19 Impact on Horticulture Lighting Market

The outbreak of COVID-19 has impacted the North America horticulture lighting market considerably. The horticulture lighting market had hit a stagnant stage in starting phase of pandemic. The instant impact was on the supply chain, affecting the overall market growth. There was a shortage of food products due to which costs of vegetables and fruits were rising rapidly. The horticulture sector of North America also faced a shortage in the staff because many workforces went back to their hometowns due to lockdowns. As a result, lockdowns were lifted, the horticulture lighting market saw major growth. The growing demand for these lighting market will upsurge the market's revenue growth during the forecast period.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In September 2020 - Fluence Bioengineering is an Osram business unit referred to as Fluence by Osram. This organization collaborated with Israel-based Remy 108 Ltd and announced new solid-state lighting (SSL) distribution. This partnership mainly focused on the burgeoning legalized cannabis market in Israel.

July 2020 - The European Commission has accepted the acquisition of Osram by Austrian optical sensor maker AMS. This acquisition is ruling that the combination of the two companies poses no competitive threat in the European Economic Area.

North America Horticulture Lighting Market Scope

The horticulture lighting market is segmented based on the type, offering, technology, lighting type, application, deployment and cultivation. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Infrared (880 nm & 935 nm)

- Red (660 nm)

- Blue (470 nm)

- Red + White (600 to 700 nm)

- Others

Offering

- Hardware

- Software

- Services

Technology

- Fluorescent

- High-Intensity Discharge (HId)

- Light-Emitting Diode (LED)

- Other Technologies

Lighting Type

- Top lighting

- Inter lighting

Application

- Greenhouses

- Vertical Farming

- Indoor Farming

- Others

Deployment

- Turnkey

- Retrofit

Cultivation

- Fruits and Vegetables

- Floriculture

Horticulture Lighting Market Regional Analysis/Insights

The horticulture lighting market is analyzed and market size insights and trends are provided by country, type, offering, technology, lighting type, application and deployment and cultivation as referenced above.

The countries covered in the horticulture lighting market report are report U.S., Canada and Mexico in North America.

North America is projected to be the fastest developing region during the forecast period of 2023-2030. The U.S dominates the growth of the market due to increasing demand for indoor farms and greenhouses vertical in this region. Moreover, horticulture lighting is energy proficient because the energy consumption of this lighting is less than normal lighting which will likely to boost the growth of the market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Horticulture Lighting Market Share Analysis

The horticulture lighting market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to horticulture lighting market.

Some of the major players operating in the horticulture lighting market are:

- Heliospectra AB (Sweden)

- Excite LED Grow Lights (Switzerland)

- Greens Hydroponics (U.K.)

- UPSHINE Lighting (China)

- TESLUX Lighting s.r.o. (Czechia)

- Hortisystems UK Ltd (U.K.)

- ProGrowTech (U.S.)

- Ronfell Group (U.K.)

- General Electric (U.S.)

- Agrolux (Netherlands)

- SAMSUNG (South Korea)

- Hortilux Schréder B.V. (Netherlands)

- OSRAM GmbH (Germany)

- Signify Holding (Netherlands)

- BSSLED Manufacturing Ltd. (U.K.)

- Forge Europa (U.K.)

- Cropmaster LED (U.K.)

- TE Connectivity Ltd. (Switzerland)

- Cree, Inc. (U.S.)

- DiCon Lighting (U.S.)

- Valoya (Finland)

- EVERLIGHT (Taiwan)

- Gavita (Norway)

Research Methodology: North America Horticulture Lighting Market

Data collection and base year analysis is done using data collection modules with large sample sizes. The stage includes the obtainment of market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analyzed and estimated using market statistical and coherent models. Also market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Factbook) or can assist you in creating presentations from the data sets available in the report.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Horticulture Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Horticulture Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Horticulture Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.