North America Image Guided Surgery Equipment And Robot Assisted Surgical Equipment Market

Market Size in USD Billion

CAGR :

%

USD

9.52 Billion

USD

20.42 Billion

2024

2032

USD

9.52 Billion

USD

20.42 Billion

2024

2032

| 2025 –2032 | |

| USD 9.52 Billion | |

| USD 20.42 Billion | |

|

|

|

|

North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Size

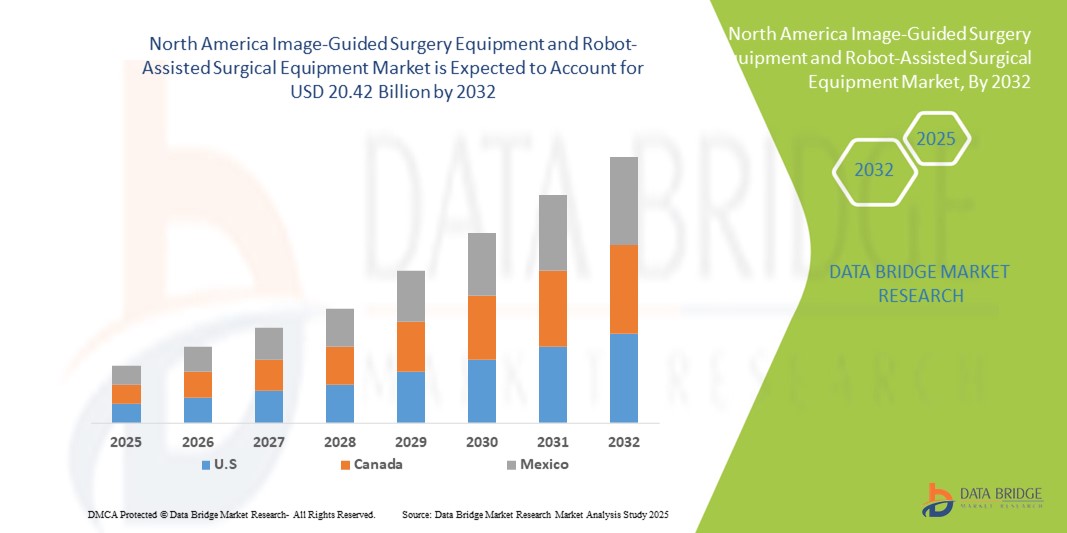

- The North America image-guided surgery equipment and robot-assisted surgical equipment market size was valued at USD 9.52 billion in 2024 and is expected to reach USD 20.42 billion by 2032, at a CAGR of 10.00% during the forecast period

- The market growth is largely fueled by technological advancements, including AI integration, robotics, and real-time imaging, which enhance surgical precision and outcomes, coupled with the rising adoption of minimally invasive procedures that reduce recovery times and complications

- Furthermore, expansion of healthcare infrastructure, increasing demand for efficient surgical solutions, and rising preference for modern robotic-assisted surgical platforms in hospitals are establishing image-guided and robot-assisted systems as the preferred choice for advanced surgeries. These converging factors are accelerating the uptake of such surgical equipment, thereby significantly boosting the industry's growth

North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Analysis

- Image-guided surgery and robot-assisted surgical equipment, providing advanced visualization, precision, and minimally invasive capabilities, are increasingly critical components of modern surgical procedures in both hospitals and specialty clinics due to their enhanced accuracy, real-time guidance, and seamless integration with robotic surgical systems

- The escalating demand for these surgical systems is primarily fueled by the growing adoption of minimally invasive procedures, increasing prevalence of chronic diseases requiring complex surgeries, and rising focus on improving surgical outcomes and reducing patient recovery times

- U.S. dominated the North America image-guided surgery equipment and robot-assisted surgical equipment market with the largest revenue share of 79.1% in 2024, characterized by early adoption of advanced surgical technologies, well-established healthcare infrastructure, and a strong presence of key industry players, with substantial growth in robotic-assisted and image-guided surgeries, particularly in specialty and academic hospitals, driven by innovations from both established medtech companies and startups focusing on AI-assisted imaging and robotic precision

- Canada is expected to be the fastest-growing country in the North America image-guided surgery equipment and robot-assisted surgical equipment market during the forecast period due to increasing healthcare investments, rising awareness of minimally invasive surgical benefits, and expansion of advanced surgical facilities

- Orthopedic trauma surgery segment dominated the North America image-guided surgery equipment and robot-assisted surgical equipment market with a share of 42.2% in 2024, driven by its high adoption for complex joint replacements, spine surgeries, and trauma procedures where precision and reduced invasiveness are critical

Report Scope and North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Segmentation

|

Attributes |

North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Trends

Advanced Integration of AI and Real-Time Imaging

- A significant and accelerating trend in the North American market is the deepening integration of artificial intelligence (AI) and advanced real-time imaging with robotic-assisted surgical systems. This fusion of technologies is enhancing surgical precision, intraoperative decision-making, and procedural efficiency

- For instance, The latest da Vinci Xi Surgical System integrates AI-assisted imaging for real-time tissue recognition, enabling surgeons to perform complex procedures with improved accuracy and reduced operative time. Similarly, Medtronic’s Stealth Autoguide system leverages AI-driven navigation for minimally invasive spine surgery, offering enhanced guidance and safety

- AI integration in these systems enables predictive analytics for surgical planning, optimizes robotic movements, and provides real-time alerts for anatomical or procedural deviations. For instance, some Mazor X systems utilize AI to improve alignment accuracy over time and can alert the surgical team of potential deviations. Furthermore, real-time imaging allows surgeons to make informed adjustments during operations, enhancing patient outcomes

- The seamless integration of robotic systems with imaging platforms and hospital IT networks facilitates centralized control over surgical planning, monitoring, and navigation. Through a single interface, surgeons can manage preoperative imaging, intraoperative guidance, and postoperative assessments, creating a unified and automated surgical workflow

- This trend towards more intelligent, intuitive, and interconnected surgical systems is fundamentally reshaping hospital expectations for surgical care. Consequently, companies such as Stryker and Johnson & Johnson are developing AI-enabled robotic systems with features such as automatic trajectory optimization and real-time imaging guidance

- The demand for image-guided and robot-assisted systems with integrated AI and real-time imaging is growing rapidly across hospitals and specialty clinics, as healthcare providers increasingly prioritize precision, efficiency, and improved surgical outcomes

North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Dynamics

Driver

Increasing Demand Due to Rising Surgical Complexity and Minimally Invasive Procedures

- The growing prevalence of complex surgical procedures, coupled with the accelerating adoption of minimally invasive techniques, is a significant driver for the heightened demand for image-guided and robotic-assisted systems

- For instance, In March 2025, Intuitive Surgical announced the expansion of its da Vinci robotic platforms in multiple U.S. hospitals, aiming to improve access to minimally invasive procedures and enhance surgical outcomes. Such initiatives by key companies are expected to drive market growth in the forecast period

- As healthcare providers aim to reduce operative risks and improve patient recovery times, robotic-assisted systems offer advanced features such as enhanced precision, real-time imaging guidance, and motion scaling, providing a compelling upgrade over traditional surgical methods

- Furthermore, the rising adoption of minimally invasive surgeries and the increasing focus on patient-centric care are making these systems integral to hospital surgical programs, offering seamless integration with imaging and monitoring platforms

- The ability to perform complex procedures with smaller incisions, reduced blood loss, and faster patient recovery, along with growing investments in hospital surgical infrastructure, are key factors propelling the adoption of these systems in North America

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high initial cost of robotic-assisted and image-guided surgical systems, combined with regulatory compliance requirements, poses a significant challenge to broader market adoption. These systems require substantial capital investment, training, and maintenance, which can limit penetration in smaller hospitals and clinics

- For instance, Reports of budget constraints in community hospitals have delayed the acquisition of advanced robotic platforms despite clinical interest. Addressing these financial and regulatory challenges is crucial for expanding adoption

- In addition, the complexity of obtaining FDA approvals and meeting stringent safety and quality standards can slow product launches and market entry. For instance, Medtronic and Stryker emphasize compliance with regulatory protocols to reassure hospitals of system safety and efficacy

- While prices are gradually decreasing and financing options are available, the perceived premium for advanced surgical technology can still hinder widespread adoption, especially in smaller or budget-conscious healthcare facilities

- Overcoming these challenges through cost-effective system designs, streamlined regulatory pathways, and robust training programs will be vital for sustained market growth

North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Scope

The market is segmented on the basis of type, application, procedure type, end user, and distribution channel.

- By Type

On the basis of type, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into robotic systems, instruments and accessories, interventional imaging systems, and services. The robotic systems segment dominated the market with the largest revenue share in 2024, driven by increasing adoption in complex surgical procedures such as urology, orthopedic, and abdominal surgeries. Hospitals prioritize robotic systems for their precision, enhanced dexterity, and ability to reduce surgical complications and recovery times. The established presence of key players such as Intuitive Surgical and Stryker, offering comprehensive robotic platforms, further strengthens this segment. Strong demand is also driven by the integration of AI-assisted navigation and real-time imaging, which improves surgical accuracy and patient outcomes. Furthermore, robotic systems are increasingly used across specialty hospitals and academic centers due to their versatility across multiple procedures. Their ability to support minimally invasive surgeries with smaller incisions also enhances patient satisfaction and hospital efficiency.

The instruments and accessories segment is anticipated to witness the fastest growth rate from 2025 to 2030, fueled by continuous innovations in surgical tools, reusable robotic instruments, and procedure-specific accessories. These tools enhance the functionality of existing robotic systems without requiring major capital expenditure. Hospitals and clinics prefer instruments and accessories for upgrading capabilities of installed robotic platforms. The growth is also supported by demand for disposable and sterile instruments in high-volume surgical procedures. Moreover, emerging players are introducing cost-effective, compatible instruments, increasing adoption among ambulatory surgical centers and smaller clinics.

- By Application

On the basis of application, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into abdominal surgery, urology, otorhinolaryngology, orthopedic trauma surgery, oncology, gynecology, neurology, spine surgery, cardiology, respiratory, thoracic surgery, and others. The orthopedic trauma surgery segment dominated the market with the highest revenue share of 42.2% in 2024, due to the high incidence of fractures and joint replacement surgeries that require precision and minimally invasive interventions. Robotic-assisted and image-guided systems offer improved alignment, reduced surgical errors, and faster post-operative recovery, making them the preferred choice for orthopedic surgeons. Hospitals increasingly adopt these systems to enhance surgical outcomes and reduce complications in trauma cases. In addition, orthopedic procedures often involve complex bone structures, which benefit from high-resolution imaging and robotic precision. The segment is further strengthened by growing geriatric populations requiring joint replacement and trauma repair procedures.

The urology segment is expected to witness the fastest growth rate during forecast period, driven by the rising prevalence of prostate cancer and other urological disorders requiring minimally invasive robotic interventions. Robotic-assisted prostatectomies and kidney surgeries are becoming the standard of care due to reduced blood loss and shorter hospital stays. Increasing awareness among patients and healthcare providers regarding robotic advantages in urological procedures contributes to adoption. Furthermore, innovations in robotic imaging and AI-assisted navigation are enhancing outcomes and expanding applicability across hospitals and specialty centers.

- By Procedure Type

On the basis of procedure type, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into open surgery and minimally invasive surgery (MIS). The minimally invasive surgery segment dominated the market in 2024, driven by the rising preference for procedures that reduce incision size, blood loss, and recovery times. Hospitals and ambulatory surgical centers prioritize MIS to improve patient outcomes, reduce hospital stays, and enhance surgical efficiency. MIS procedures also benefit from robotic-assisted platforms that provide enhanced visualization and instrument control. Furthermore, government initiatives and reimbursement policies favoring MIS are encouraging hospitals to invest in such technologies. Patients increasingly prefer MIS due to quicker return to normal activities and reduced post-operative complications.

The open surgery segment is expected to witness faster growth during forecast period in smaller hospitals and emerging facilities that are gradually adopting robotic instruments and image-guided tools to improve traditional open procedures. Innovations that allow hybrid approaches combining open and minimally invasive techniques are also driving growth. This enables surgeons to gradually transition to robotic-assisted procedures while managing complex surgical cases. The adoption of high-precision instruments for open surgeries also improves patient outcomes and surgical efficiency.

- By End User

On the basis of end user, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into hospitals, ambulatory surgical centers (ASCs), clinics, and others. The hospitals segment dominated the market with the largest share in 2024, owing to high surgical volumes, availability of capital investment, and demand for advanced surgical capabilities. Hospitals invest in comprehensive robotic platforms and imaging systems to improve surgical precision, reduce complications, and enhance patient satisfaction. Academic and specialty hospitals are major adopters, leveraging systems for multi-specialty applications and research purposes. The presence of trained surgical teams and high patient inflow ensures maximum utilization of robotic systems, further strengthening revenue.

The ambulatory surgical centers segment is expected to witness the fastest growth during forecast period due to increasing outpatient procedures and demand for cost-effective robotic and imaging solutions. ASCs are adopting compact, modular systems for urology, orthopedic, and minor abdominal procedures to reduce operative time and improve patient throughput. Rising investments in ASCs and expansion of minimally invasive outpatient procedures are key growth drivers. In addition, ASCs prefer instruments and accessories compatible with existing robotic platforms to optimize investment.

- By Distribution Channel

On the basis of distribution channel, the image-guided surgery equipment and robot-assisted surgical equipment market is segmented into direct tender and retail sales. The direct tender segment dominated the market in 2024, driven by hospitals and large healthcare institutions procuring robotic and imaging systems directly from manufacturers. This ensures comprehensive after-sales service, maintenance, and training support, which are critical for complex surgical equipment. Major players such as Intuitive Surgical, Medtronic, and Stryker often offer customized procurement agreements to large hospital chains. Direct tender contracts also provide better pricing, bulk procurement advantages, and long-term service agreements, which are preferred by healthcare providers.

The retail sales segment is expected to witness the fastest growth during forecast period, due to the increasing demand from smaller clinics and ambulatory centers seeking standalone instruments, accessories, and compact imaging solutions. Retail channels allow faster availability, flexible purchase options, and easier access to emerging technologies for smaller healthcare facilities. Growth is also fueled by online and regional distributors offering cost-effective instruments and procedural kits compatible with existing robotic systems.

North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Regional Analysis

- U.S. dominated the image-guided surgery equipment and robot-assisted surgical equipment market with the largest revenue share of 79.1% in 2024, characterized by early adoption of advanced surgical technologies, well-established healthcare infrastructure, and a strong presence of key industry players, with substantial growth in robotic-assisted and image-guided surgeries

- Hospitals and specialty clinics in the region highly value the precision, enhanced visualization, and improved patient outcomes offered by robotic-assisted and image-guided systems across multiple surgical applications such as urology, orthopedic, and abdominal surgeries

- This widespread adoption is further supported by a well-established healthcare infrastructure, high investments in medical technology, and a strong presence of key industry players, establishing robotic and image-guided surgical equipment as the preferred solution for both complex and routine surgical procedures

U.S. Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Insight

The U.S. image-guided surgery equipment and robot-assisted surgical equipment market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of minimally invasive procedures and the expansion of advanced surgical technologies. Hospitals and specialty clinics are increasingly prioritizing robotic-assisted and image-guided systems to enhance surgical precision, reduce complications, and improve patient outcomes. The growing preference for AI-assisted navigation, real-time imaging, and multi-specialty robotic platforms further propels market growth. Moreover, strong investments in healthcare infrastructure, supportive reimbursement policies, and the presence of key industry players are significantly contributing to the market’s expansion.

Canada Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Insight

The Canadian image-guided surgery equipment and robot-assisted surgical equipment market is expected to expand at a notable CAGR during the forecast period, driven by the increasing adoption of minimally invasive surgeries and investments in advanced surgical facilities. Healthcare providers in Canada are focusing on improving surgical efficiency, precision, and patient recovery times through robotic-assisted and image-guided systems. Growing awareness of the benefits of robotic surgery among both patients and surgeons, along with technological advancements in imaging and AI-assisted navigation, is fostering market growth. In addition, government initiatives promoting healthcare modernization and digital integration in hospitals further support adoption.

Mexico Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Insight

The Mexican image-guided surgery equipment and robot-assisted surgical equipment market is anticipated to grow steadily, driven by rising healthcare expenditure and the expansion of private hospital networks offering advanced surgical solutions. Increasing awareness of minimally invasive procedures and patient demand for high-quality surgical outcomes are encouraging the adoption of image-guided and robotic-assisted systems. Technological partnerships between international medtech companies and local healthcare providers are facilitating access to these systems in key urban centers. Furthermore, training programs and surgical workshops are enhancing the proficiency of surgeons in using robotic-assisted technologies, supporting broader market penetration.

North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market Share

The North America image-guided surgery equipment and robot-assisted surgical equipment industry is primarily led by well-established companies, including:

- Intuitive Surgical, Inc. (U.S.)

- Medtronic (Ireland)

- Stryker (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Zimmer Biomet. (U.S.)

- Smith + Nephew (U.K.)

- Medrobotics Corporation (U.S.)

- Titan Medical Inc. (Canada)

- Corindus Vascular Robotics, Inc. (U.S.)

- TransEnterix, Inc. (U.S.)

- Asensus Surgical, Inc. (U.S.)

- Medivators Inc. (U.S.)

- EndoControl (France)

- CMR Surgical Ltd (U.K.)

- Vicarious Surgical (U.S.)

- Microbot Medical Inc. (U.S.)

- Brainlab SE (Germany)

- OrthAlign (U.S.)

What are the Recent Developments in North America Image-Guided Surgery Equipment and Robot-Assisted Surgical Equipment Market?

- In July 2025, Intuitive Surgical announced that its da Vinci 5 surgical system received the CE Mark, allowing its commercial availability in Europe. This system features over 150 design innovations and aims to provide greater surgeon autonomy, more streamlined operating room workflows, and advanced data analytics

- In April 2025, LEM Surgical announced that its Dynamis Robotic Surgical System received FDA clearance, marking a significant advancement in spine surgery technology. This integrated navigation-based platform combines real-time imaging, dynamic guidance, and adaptable instrumentation compatibility, enhancing precision and control during spine procedures. The system's versatility aims to improve surgical outcomes and streamline operating room workflows

- In November 2024, Johnson & Johnson MedTech announced that the U.S. FDA approved the OTTAVA™ robotic surgical system investigational device exemption (IDE), allowing clinical trials to begin at U.S. sites. The system is designed as a multi-specialty soft-tissue surgery robot, supporting a broad range of procedures across patient anatomy and surgical specialties

- In September 2024, Medtronic expanded its AiBLE spine surgery ecosystem by introducing new technologies and forming a partnership with Siemens Healthineers. This expansion aims to enhance the integration of navigation, robotics, data, AI, imaging, software, and implants to enable more predictable outcomes in spine and cranial procedures

- In July 2024, Stryker announced that it received FDA clearance for new software for its Q Guidance System for spine surgeries. The technology provides auditory and sensory alerts when a surgeon approaches planned anatomical boundaries during a procedure and includes a feature called Copilot, which stops automatically when it reaches a planned depth during a surgery, to help with screw placement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.