North America Indoor Air Purification Market Analysis and Size

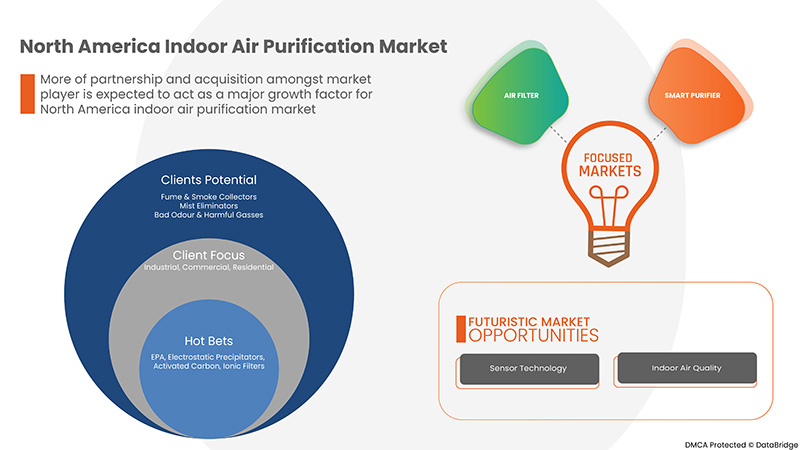

The increasing use of air purifier to contain airborne contaminants and advent of smart air purifier are driving the North America indoor air purification market. Additionally, growth in e-commerce sector has allowed higher penetration of air purifier across the globe and improvement in sensor technology has miniaturized the air purifier. However, high cost associated with air purifier and various concerns regarding air purifier is estimated to act as restraint for the market. Moreover, continuous fluctuations in the prices of raw materials and high Electricity consumption leading to high electricity cost because of air purifier are challenging the market growth. Additionally, low rate of upgradation in air filter technology has slowed down the market. However, rise in demand for air filter due to health awareness among consumers and increasing initiatives by governments for air filter adoption are estimated to provide opportunities for the growth of North America indoor air purification market.

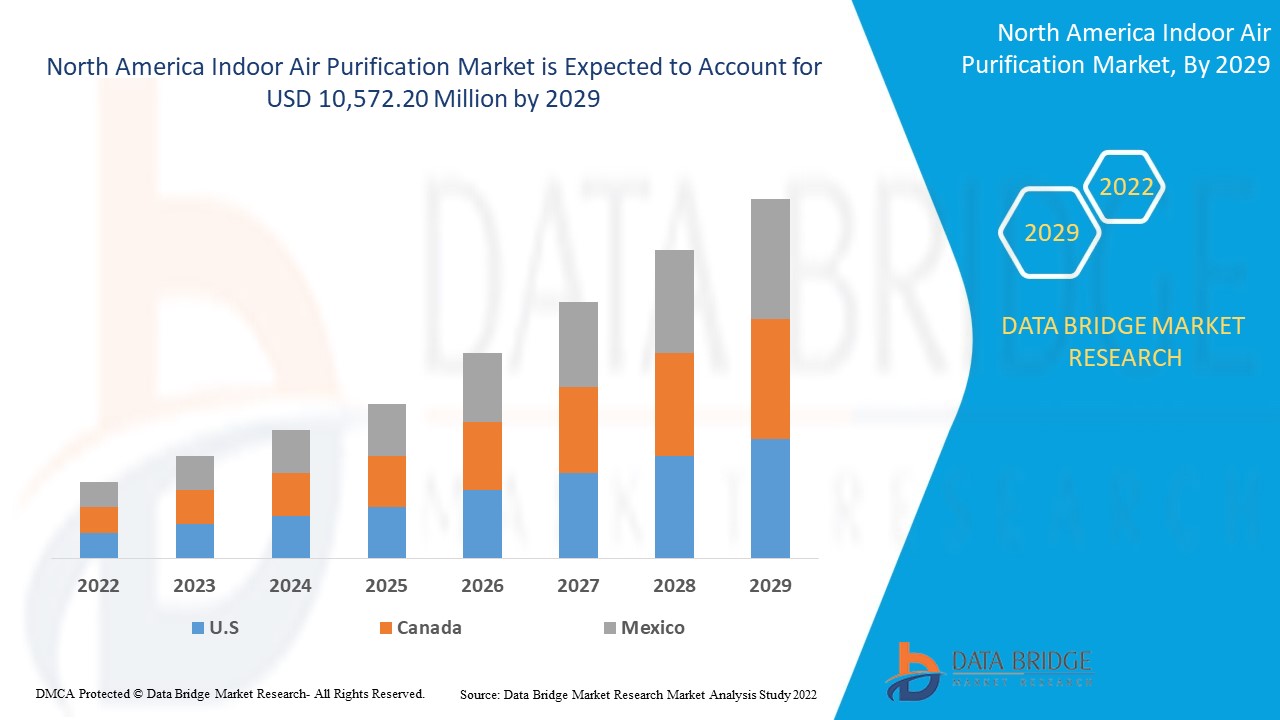

Data Bridge Market Research analyses that the indoor air purification market is expected to reach a value of USD 10,572.20 million by 2029, at a CAGR of 8.5% during the forecast period. The solution segment accounts for the largest offering segment in the air purification market. The indoor air purification market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product (Dust Collectors & Vacuums, Fume & Smoke Collectors, Mist Eliminators, Bad Odor & Harmful Gasses, Fire & Emergency Exhaust And Viruses & Fungus) Category (Small Room, Medium Room, Large Room) Technology (HEPA, Electrostatic Precipitators, Activated Carbon, Ionic Filters And Others) Function (Manual, Sensor And Others) Outer Material (Plastic And Metal) Price Range (Low, Mid, Premium) Distribution Channel (Direct Selling, E-Commerce, Supermarkets/Hypermarkets, Specialty Stores And Others) Application (Industrial, Commercial And Residential), Industry Trends and Forecast to 2029. |

|

Countries Covered |

U.S., Canada, and Mexico in North America. |

|

Market Players Covered |

Koninklijke Philips N.V.; LG Electronics, Panasonic Corporation, DAIKIN INDUSTRIES ltd., Aerus LLC, Legend Brands, xpower, Abatement Technologies, Omnitech Design, B-AIR, Pulllman-Ermator; Envirco, AEROSPACE AMERICA, INC.; Camfil; Carrier, Hamilton Beach Brands, Inc.; Whirlpool, Lifa Air Ltd., NIKRO INDUSTRIES, INC. and COWAY CO. LTD. among others. |

Market Definition

Indoor purification is done by the products such as humidifiers, air purifiers, and dehumidifiers in industrial, commercial and residential sectors. These products are developed and produced with motive to change the quality of indoor air, in an individual room or within an area. These products are normally small so they can be efficiently moved, and do not require installations in case of residential application. Air quality items are getting huge traction and demand from Eastern-influences complementary and alternative medicine (CAM). CAM is a spectrum of therapies, treatments, and health systems; both ancient and new; can be normally identified as health and wellness practices falling outside of the spectrum of normal Western medicine and Western consumer habits. With the growth in consumer knowledge of, an interest in, better air quality, there is a great opportunity for manufacturers and companies to position air quality items as must-have products for home, office and in commercial spaces.

Indoor Air Purification Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Increasing usage of air purifier to contain airborne contaminants

An airborne disease is caused by a microorganism that is transmitted through the air. These organisms may be spread through sneezing, coughing, spraying of liquids, the spread of dust, or any activity that results in the generation of aerosolized particles. There are many airborne diseases that are of clinical importance and include bacteria, viruses, and fungi. The microorganisms may be spread through sneezing, coughing, spraying of liquids, the spread of dust, or any activity that results in the generation of aerosolized particles. The microorganisms transmitted airborne can be spread via a fine mist, dust, aerosols, or liquids. Additionally, the aerosolized particles may be generated from a source of infection, such as body secretions of an infected patient or even an animal. The infected aerosolized particles often remain suspended in the air currents and may travel considerable distances, although many particles will drop off within the vicinity. As the distance travelled of the aerosol particle increases, the risk of infection increases. Airborne precautions necessitate the prevention of infections and the use of available interventions in healthcare facilities to prevent the transmission of airborne particles such as air filters. When used properly, air cleaners and HVAC filters can help reduce airborne contaminants including viruses in a building or small space. This use of air purifier to contain airborne contaminants and infections is the reason of increasing demand of air purifier, globally; acting as a driver for North America indoor air purification market.

- Advent of smart air purifier

Air purifier are been used form 20th century, initially for the industrial purposes but with the rise of pollution levels across the globe and advent of technological solutions; its use has increased. The growing air pollution level in urban regions are prime concerns for health for large section of society. In parallel, the use of technology in order to increase the efficiency and ease the use of air filter has resulted in development of smart air purifier. Smart air purifier allows a user to monitor and control the indoor air quality through a dedicated application in smartphone. The product also helps track indoor air quality over a period of time which enables consumers to observe the time of the day with the best and worst air quality. This increase its impact on the user, as a result the demand of smart air purifier is increasing across the nations which is driving the market

- Growth in e- commerce sector

Ecommerce (or electronic commerce) is the buying and selling of goods or services over the Internet. It encompasses a wide variety of data, systems and tools for online buyers and sellers, including mobile shopping and online payment encryption. In current times, most businesses with an online presence use an online store and/or platform to conduct ecommerce marketing and sales activities and to oversee logistics and fulfilment which is resulting in the rapid growth of e-commerce sectors. As the e-commerce sector is growing the ability of buy products as per requirement by the customer are becoming easier and businesses can also list the goods with competitive price on multiple e-commerce platform to expand the market reachability. The increasing demand of air purifier in urban region due to its advantages; function has boosted its sales on e-commerce site such as amazon, shopify, flipkart. The growth of e-commerce sector is acting positively for the North America indoor air purification market as customer can see all the available air purifier for a pin code, compare it and can order the best suited for their requirement and budget. Thus, the growth of e-commerce sector is acting positively for the growth of North America indoor air purification market.

Opportunities

-

Rise in demand for air filter due to health awareness among consumers

When compared to outdoor air, interior air pollution levels can be up to five times higher. Whether in the convenience of their home or place of employment, people spend more than 90% of their time indoors. Indoor Air Quality (IAQ), health and well-being are closely related. Breathing air which is free of pollutants not only improves the quality of life but also reduces the risk of respiratory infections, and minimizes the risk of developing a variety of chronic diseases. Organizations namely American Air Filter (AAF) have a number of options to connect with the target audience and inform them about IAQ & its significance. The increase in consumer awareness towards the health impact such as irritation of the eyes, nose, and throat, headaches, dizziness, and fatigue, respiratory diseases, heart disease, and cancer creates a prospect for the growth of the global air purifier market. Air filters are one of the growing markets across the globe. With people becoming more aware of the need to breathe clean air that is free from allergens and disease-causing microorganisms, the demand for air purifiers has increased significantly in recent years.

Restraints/Challenges

- High costs associated with air purifiers

The importance of air purifier is increasing as the outdoor, indoor air quality is degrading due to rapid urbanization, increasing air borne infection/diseases across the globe. Air pollution is becoming more serious concern for health risk, linked to around 7 million deaths in 2012 according to a recent World Health Organisation (WHO) report. The new data further reveals a stronger link between, indoor and outdoor air pollution exposure and cardiovascular diseases, such as strokes and ischemic heart disease, as well as between air pollution and cancer. As both indoor and outdoor pollution affect health, the consumers are inclining towards air purifier in order to get good indoor air quality. This allowed the manufacturer to increase the cost associated with air purifier by increasing its technological features; in order to meet the demand globally. This high cost associated with air purifiers and smart air purifier; limits its market growth as middle class cannot afford to spend so much on an equipment. This in results act as a restraint for the growth of North America indoor air purification market.

Recent Development

- In August 2022, Carrier announced its plan to offer to abound healthy air starter package to Universities, entertainment venues, schools and commercial real estate organizations. Under this plan, the company will provide a simple, quick, and cost-effective way to monitor, visualize and react to the unseen components of indoor air quality (IAQ), helping support occupant wellness. Through this step, the company aims to increase its market dominance in the North America indoor air purification market.

- In June 2021, Hamilton Beach Brands, Inc. announced its partnership with The Clorox Company. Under the agreement, Hamilton Beach Brands plans to launch a line of premium air purifiers under the Clorox brand name that will remove 99.97% of allergens and particulates from pollen, dust, and smoke. This is estimated to allow the company to use the Clorox Company license for its offered product for the indoor air purification market.

Indoor Air Purification Market Scope

The indoor air purification market is segmented on the basis ofproduct, category, technology, function, outer material, price range, distribution channel and application... The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By product

- Dust Collectors & Vacuums

- Fume & Smoke Collectors

- Mist Eliminators

- Bad Odour & Harmful Gasses

- Fire & Emergency Exhaust

- Viruses & Fungus

On the basis of product, the indoor air purification market is segmented into dust collectors & vacuums; fume & smoke collectors; mist eliminators; bad odor & harmful gasses; fire & emergency exhaust and viruses & fungus.

By Category

- Small Room

- Medium Room

- Large Room

On the basis of category, the indoor air purification market is segmented into small room, medium room and large room

By Technology

- HEPA

- Electrostatic Precipitators

- Activated Carbon

- Ionic Filters

- Others

On the basis of technology, the indoor air purification market is segmented into HEPA; electrostatic precipitators; activated carbon; ionic filters and others.

By Function

- Manual

- Sensor

- Others

On the basis of function, the indoor air purification market is segmented into manual, sensor and others.

By Outer Material

- Plastic

- Metal

On the basis of outer material, the indoor air purification market is segmented into plastic and metal.

By Price Range

- Low

- Mid

- Premium

On the basis of price range, the indoor air purification market is segmented into low, mid and premium.

By Distribution Channel

- Direct Selling

- E-Commerce

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

On the basis of distribution channel, the indoor air purification market is segmented into direct selling; e-commerce; supermarkets/hypermarkets; specialty stores and others...

By Application

- Industrial

- Commercial

- Residential

On the basis of application, the indoor air purification market is segmented into industrial, commercial and residential.

Indoor Air Purification Market Regional Analysis/Insights

The indoor air purification market is analysed, and market size insights and trends are provided by country, product, category, technology, function, outer material, price range, distribution channel and application, as referenced above.

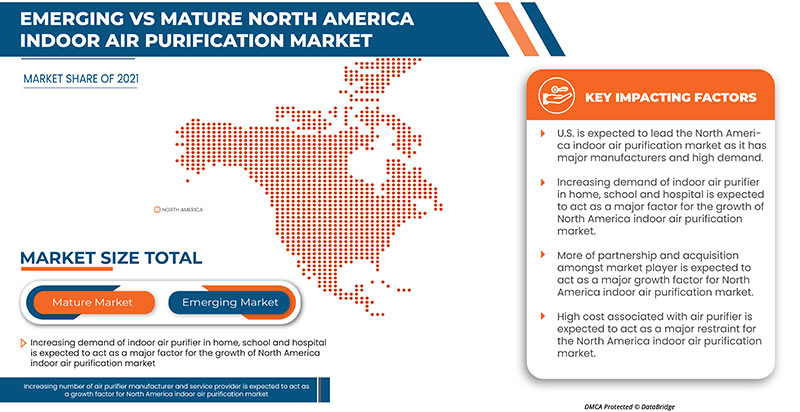

The countries covered in the indoor air purification market report are the U.S., Canada, and Mexico in North America,

The U.S is expected to dominate the market due to the rise in demand for air filter due to health awareness among consumers.

Country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Indoor Air Purification Market Share Analysis

The indoor air purification market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Indoor Air Purification Market.

Some of the major players operating in the market are Koninklijke Philips N.V.; LG Electronics, Panasonic Corporation, DAIKIN INDUSTRIES ltd., Aerus LLC, Legend Brands, xpower, Abatement Technologies, Omnitech Design, B-AIR, Pulllman-Ermator; Envirco, AEROSPACE AMERICA, INC.; Camfil; Carrier, Hamilton Beach Brands, Inc.; Whirlpool, Lifa Air Ltd., NIKRO INDUSTRIES, INC. and COWAY CO. LTD. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA INDOOR AIR PURIFICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTERS MODEL

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.3.1 PHOTOELECTROCHEMICAL OXIDATION

4.3.2 HIGH-EFFICIENCY PARTICULATE AIR PURIFIERS

4.3.3 ACTIVATED CARBON

4.3.4 ELECTROSTATIC PRECIPITATOR

4.3.5 IONIC FILTERS

4.3.6 AUTOMATED AIR PURIFICATION SYSTEM

4.4 VENDOR SELECTION CRITERIA

4.5 REGULATORY STANDARD

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USAGE OF AIR PURIFIERS TO CONTAIN AIRBORNE CONTAMINANTS

6.1.2 ADVENT OF SMART AIR PURIFIER

6.1.3 GROWTH IN E- COMMERCE SECTOR

6.1.4 IMPROVEMENT IN SENSOR TECHNOLOGY

6.2 RESTRAINTS

6.2.1 HIGH COSTS ASSOCIATED WITH AIR PURIFIERS

6.2.2 RISING CONCERNS REGARDING AIR PURIFIER

6.3 OPPORTUNITIES

6.3.1 RISE IN DEMAND FOR AIR FILTER DUE TO HEALTH AWARENESS AMONG CONSUMERS

6.3.2 MORE OF PARTNERSHIP AND ACQUISITION AMONGST MARKET PLAYERS

6.3.3 INCREASING INITIATIVES BY GOVERNMENTS FOR AIR FILTER ADOPTION

6.4 CHALLENGES

6.4.1 CONTINUOUS FLUCTUATIONS IN THE PRICES OF RAW MATERIALS

6.4.2 HIGH ELECTRICITY CONSUMPTION LEADING TO HIGH ELECTRICITY COST

6.4.3 LOW RATE OF UPGRADATION IN AIR FILTER TECHNOLOGY

7 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 DUST COLLECTORS & VACCUMS

7.3 FUME & SMOKE COLLECTORS

7.4 VIRUSES & FUNGUS

7.5 BAD ODOUR & HARMFUL GASES

7.6 MIST ELIMINATORS

7.7 FIRE & EMERGENCY EXHAUST

8 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 LARGE ROOM

8.3 MEDIUM ROOM

8.4 SMALL ROOM

9 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 SENSOR

9.3 MANUAL

9.4 OTHERS

10 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 HEPA

10.3 ACTIVATED CARBON

10.4 ELECTROSTATIC PRECIPITATORS

10.5 IONIC FILTERS

10.6 OTHERS

11 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.2.1 POLYCARBONATE (PC)

11.2.2 ABS

11.2.3 POLYVINYL CHLORIDE (PVC)

11.2.4 HIGH-DENSITY POLYETHYLENE (PE)

11.2.5 OTHERS

11.3 METAL

11.3.1 STAINLESS STEEL

11.3.2 ALUMINIUM

11.3.3 OTHERS

12 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE

12.1 OVERVIEW

12.2 MID

12.3 LOW

12.4 PREMIUM

13 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 E-COMMERCE

13.3 SPECIALTY STORES

13.4 DIRECT SELLING

13.5 SUPERMARKETS/HYPERMARKETS

13.6 OTHERS

14 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 COMMERCIAL

14.3 RESIDENTIAL

14.4 INDUSTRIAL

15 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 PANASONIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 DAIKIN INDUSTRIES, LTD.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 LG ELECTRONICS

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 HONEYWELL INTERNATIONAL

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 KONINKLIJKE PHILIPS N.V

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ABATEMENT TECHNOLOGIES

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 AEROSPACE AMERICA, INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AERUS LLC

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 B-AIR

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 CAMFIL

18.10.3 COMPANY SNAPSHOT

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 CARRIER (2021)

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 COWAY CO. LTD. (2021)

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 ENVIRCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 HAMILTON BEACH BRANDS, INC. (2021)

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 LEGEND BRANDS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LIFA AIR LTD. (2021)

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 NIKRO INDUSTRIES, INC.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 OMNITEC DESIGN

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PULLMAN-ERMATOR

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 WHIRLPOOL (2021)

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 XPOWER.COM

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 AIR PURIFIER AND COST ASSOCIATED WITH THEM IN USD

TABLE 2 COMPARISON OF THE ENERGY CONSUMPTION OF HOME APPLIANCES AND ELECTRONICS

TABLE 3 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DUST COLLECTORS & VACCUMS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA FUME & SMOKE COLLECTORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA VIRUSES & FUNGUS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BAD ODOUR & HARMFUL GASES IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MIST ELIMINATORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA FIRE & EMERGENCY EXHAUST IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LARGE ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA MEDIUM ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SMALL ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SENSOR IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MANUAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA INDOOR AIR PURIFICATION MARKET , BY TECHNOLOGY 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HEPA IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ACTIVATED CARBON IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA ELECTROSTATIC PRECIPITATORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA IONIC FILTERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA METAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA MID IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA LOW IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PREMIUM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA E-COMMERCE IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA SPECIALTY STORES IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA DIRECT SELLING IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA SUPERMARKETS/HYPERMARKETS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA COMMERCIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA RESIDENTIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INDUSTRIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 U.S. INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 56 U.S. INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 57 U.S. INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 58 U.S. INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 U.S. PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 62 U.S. INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 U.S. INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 CANADA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 66 CANADA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 67 CANADA INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 68 CANADA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 CANADA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 72 CANADA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 CANADA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 MEXICO INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 MEXICO INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 MEXICO INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 MEXICO INDOOR AIR PURIFICATION MARKET, BY FUNCTION , 2020-2029 (USD MILLION)

TABLE 78 MEXICO INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 MEXICO PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 MEXICO INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF AIR PURIFIER TO CONTAIN AIRBORNE CONTAMINANTS IS EXPECTED TO BE KEY DRIVERS FOR NORTH AMERICA INDOOR AIR PURIFICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DUST COLLECTORS & VACUUMS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA INDOOR AIR PURIFICATION MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INDOOR AIR PURIFICATION MARKET

FIGURE 14 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY PRODUCT, 2021

FIGURE 15 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY CATEGORY, 2021

FIGURE 16 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY FUNCTION, 2021

FIGURE 17 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY TECHNOLOGY, 2021

FIGURE 18 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY OUTER MATERIAL, 2021

FIGURE 19 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY PRICE RANGE, 2021

FIGURE 20 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: BY PRODUCT (2022-2029)

FIGURE 27 NORTH AMERICA INDOOR AIR PURIFICATION MARKET: COMPANY SHARE 2021 (%)

North America Indoor Air Purification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Indoor Air Purification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Indoor Air Purification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.