North America Industrial Hoses Market Analysis and Size

Industrial hoses are widely used in various industry verticals for their wide offerings. These hoses operate in adverse surroundings causing damages such as abrasion, rupture, and premature failure. Working in these conditions makes it important to select the type of hose needed for the application correctly. For high-pressure transfer, hydraulic hoses are most suitable and operate on millions of Psi pressure. The oil and gas sector uses hoses to transfer fuels and gases and requires high-quality build hoses to meet the standard specifications and safety. The usage of hose caters to a wide range of applications, thus becoming an essential element to various industry verticals.

For this, various market players are introducing new products and forming a partnership to expand their business in the North America industrial hoses market.

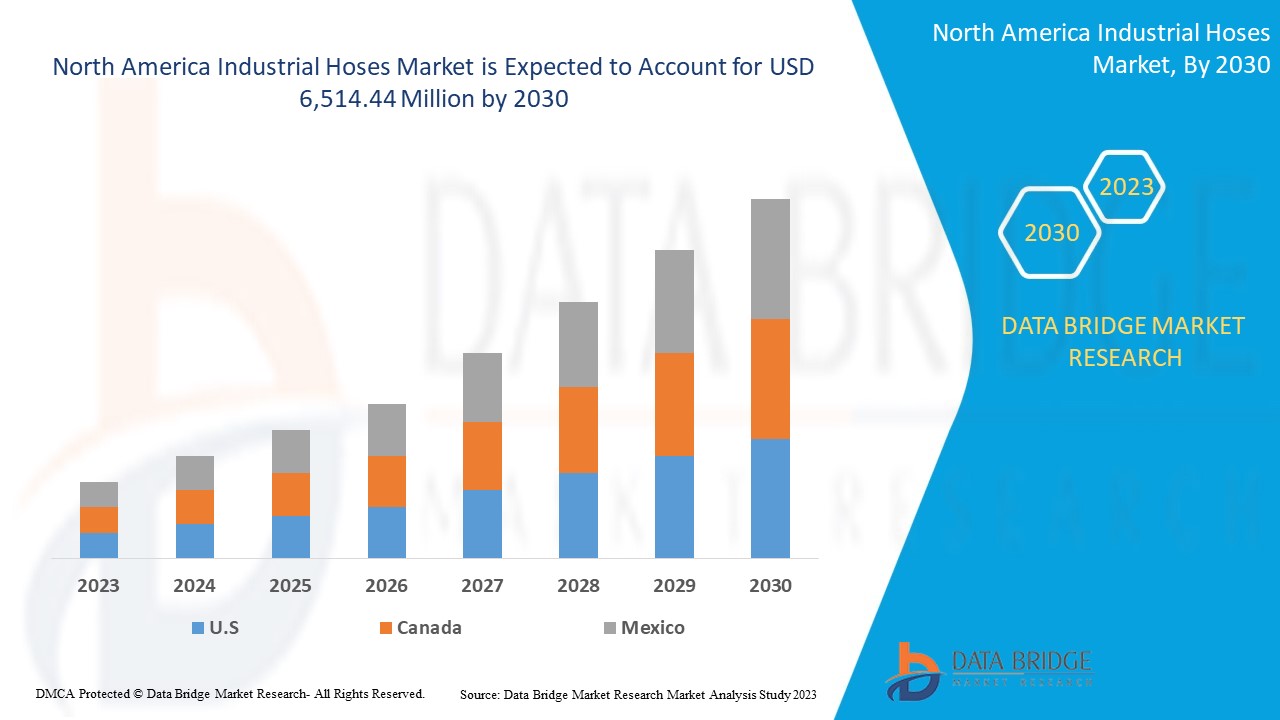

Data Bridge Market Research analyzes that the North America industrial hoses market is expected to reach a value of USD 6,514.44 million by 2030, at a CAGR of 6.4% during the forecast period. This market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Million Meter, Pricing in USD |

|

Segments Covered |

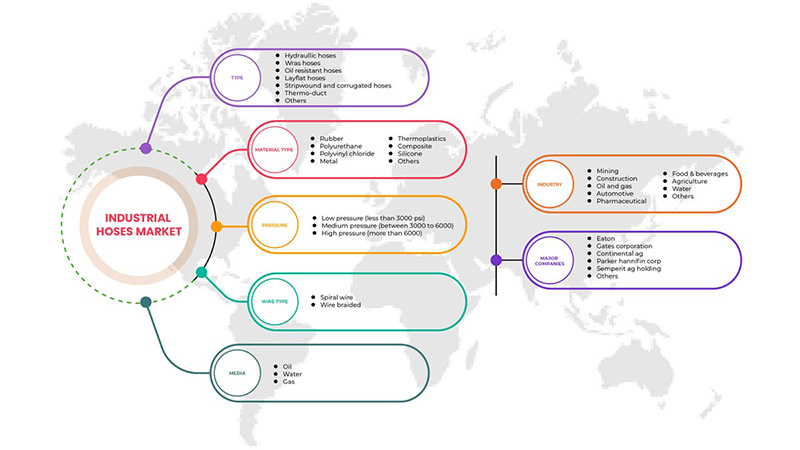

By Type (Hydraulic Hoses, Layflat Hoses, WRAS Hoses, Oil Resistant Hoses, Stripwound Hoses, Corrugated Hoses, Thermo-Duct and Others), Material Type (Silicone, Polyurethane, Polyvinyl Chloride, Nitrile Rubber, Elastomers, Metal, Thermoplastics, Composite and Others), Media (Oil, Water and Gas), Wire Type (Wire Braided and Spiral Wire), Pressure (Low Pressure (Less Than 3000 Psi), Medium Pressure (Between 3000 To 6000) and High Pressure (More Than 6000)), Industry (Oil and Gas, Water, Agriculture, Food and Beverages, Pharmaceuticals, Automotive, Mining, Construction and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Eaton, PARKER HANNIFIN CORP, RYCO Hydraulics, Kurt Manufacturing, NORRES Schlauchtechnik GmbH, Transfer Oil S.p.A, ContiTech AG (A Subsidiary of Continental AG), Kanaflex Corporation Co.,ltd., Pacific Echo, Colex International Limited, UK, Gates Corporation, Semperit AG Holding, Dixon Valve & Coupling Company, LLC and Titan Fittings |

Market Definition

Industrial hoses are flexible reinforced tubes used for transferring the different states of materials, such as liquids and gases. The industrial hose operates in a wide range of pressure, thus being suitable for a different set of applications. Industrial hoses are available in different materials such as polyurethane, thermoplastics and polyvinyl chloride among others. Each material offers a different set of operations and is used to transport various materials. Industrial hoses are available in rigid and flexible forms according to the need of industrial applications.

North America Industrial Hoses Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail below:

Drivers

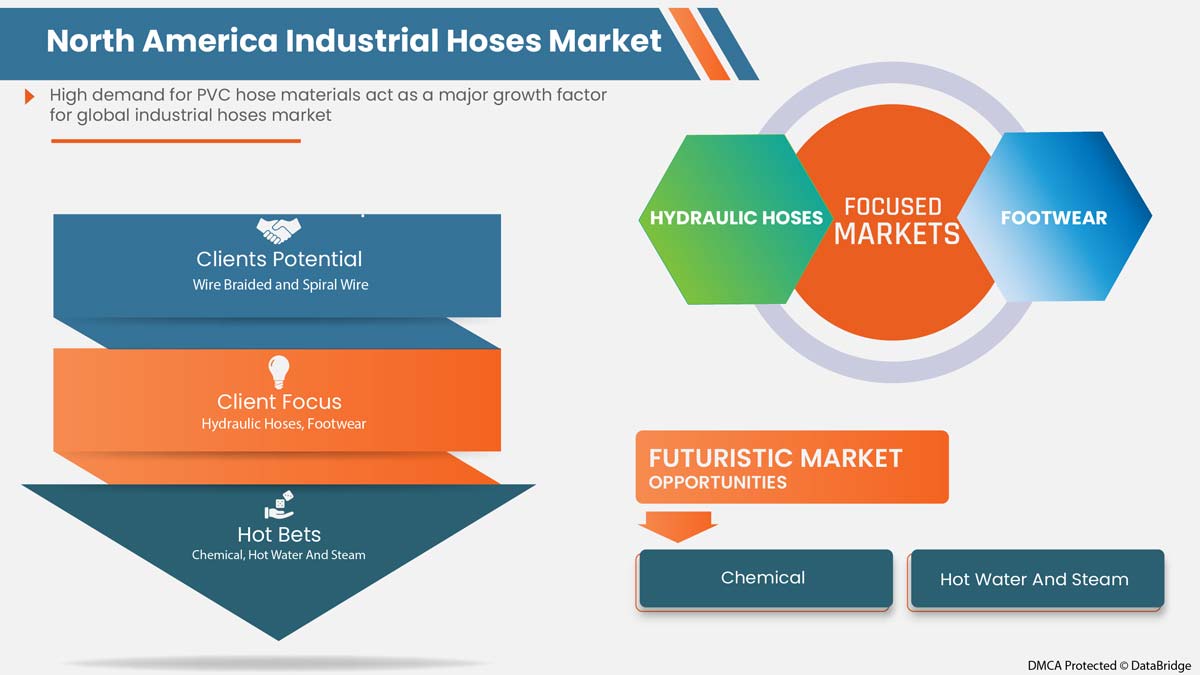

- High Demand for PVC Hose Materials

In recent days, industrial hoses of PVC material are becoming prominent in automotive, pharmaceuticals, infrastructure, oil and gas, food and beverages, mining, water, agriculture and other industries for manufacturing and using tubes and pipes for the transportation of air, water, chemicals, fluids from one end to another.

The demand is getting increased day by day owing to their wide range of applications, such as air, abrasive products, mineral oils, water, technical and domestic gases, steam, fuels and others. Technological development is helping industrial hoses product supplement the market growth.

- Increasing Need for Durable Industrial Hoses in Critical Applications

The application of industrial hoses includes moving fluids, chemicals, air, water, oil and other materials from one place to another. There is a significant demand for robust industrial hoses in the market in crucial applications like high temperature, high pressure, chemical reaction and vacuum.

Before choosing the hoses, the customers must consider a number of important criteria, including catastrophic failure, permeability, chemical compatibility, temperature, external environment, vacuum and others. The major players in the market are releasing cutting-edge products for mission-critical uses, which is fueling the demand for durable hoses in the industry.

Opportunity

- Growing Adoption of Hoses in Automobiles Sectors

Automobiles consist of complex internal structures and systems with various components intact. The integration of these systems and components allows the automobile to operate as an efficient machine. In automobiles, hoses play an important role as it is used as an engine cooling system, in a brake oil carrier, as a fuel carrier, in air conditioning and in other parts of the vehicle. In the design of an engine cooling system, hoses of various types are used for coolant circulation. These hoses are of different material properties as some are designed to withstand the heat of coolant, whereas others can take just cold coolant. This increases the importance of hoses in automobiles and the market growth is directly affected by the growth of the automobile industry. As the automobile sector in the EV industry is showing enormous growth over the years owing to rising demand for vehicles and electric vehicles, this is expected to provide lucrative opportunities for market growth.

Restraint/Challenge

- Limitations of Industrial Hoses in Various Applications

An industrial hose is extensively used across various industries for optimum operating efficiency and transfer of fuel, chemicals, bulk materials and air among others. Although the industrial applications of industrial hoses continue to expand, the end users are increasingly focusing on the efficiency levels of industrial hoses. However, industrial hoses pose various challenges in various system environments such as temperature range and this results in hampering the overall performance and efficiency of the system. The characteristic limitation of industrial hoses is expected to hamper the market growth. Many end users and businesses tend towards alternatives to hoses due to their limitations.

Post-COVID-19 Impact on North America Industrial Hoses Market

The industrial hoses industry noted a gradual decrease in demand due to lockdown and COVID-19 governmental laws, as manufacturing facilities and services were closed. Moreover, the industry was also affected by the halt of the supply chain especially of raw materials used in the manufacturing process of industrial hoses. As industrial hose production slowed down owing to the restrictions by governments across the globe, the production was not meeting the demand in the first three quarters of 2020. Moreover, high demand/requirement for industrial hose products in the chemical, pharmaceutical and agriculture sector and hydraulics applications has been witnessed. The resuming production of the oil and gas industry and automotive further fueled the rising demand for industrial hoses across the globe. Thus, this not only led to a hike in the demand but also increased the cost of the product.

Recent Developments

- In July 2021, NORRES Schlauchtechnik GmbH, a manufacturer, developer and distributor of flexible hose system solutions, acquired Baggerman Group ("Baggerman"), a manufacturer and distributor of industrial hoses, couplings and accessories. This acquisition would help the company to increase its North America presence and also help expand the market.

- In September 2020, KURIYAMA OF AMERICA company developed a new product called Tigerflex Tiger Aquaâ" Suction and Discharge Hose. This new addition of a product would not only improve the product portfolio of the company but also help in boosting overall sales.

North America Industrial Hoses Market Scope

The North America industrial hoses market is segmented into six notable segments based on type, material type, media, wire type, pressure and industry. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

BY TYPE

- Hydraulic Hoses

- WRAS Hoses

- Oil Resistant Hoses

- Layflat Hoses

- Stripwound and Corrugated Hoses

- Thermo-Duct

- Others

Based on type, the market is segmented into hydraullic hoses, WRAS hoses, oil resistant hoses, layflat hoses, stripwound and corrugated hoses, thermo-duct and others.

BY MATERIAL TYPE

- Silicone

- Polyvinyl Chloride

- Polyurethane

- Nitrile Rubber

- Elastomers

- Thermoplastics

- Metal

- Composite

- Others

Based on material type, the market is segmented into silicone, polyurethane, polyvinyl chloride, nitrile rubber, elastomers, metal, thermoplastics, composite and others.

BY MEDIA

- Oil

- Water

- Gas

Based on media, the market is segmented into oil, water and gas.

BY WIRE TYPE

- Spiral Wire

- Wire Braided

Based on wire type, the market is segmented into spiral wire and wire braided.

BY PRESSURE

- Low Pressure (Less Than 3000 Psi)

- Medium Pressure (Between 3000 To 6000)

- High Pressure (More Than 6000)

Based on pressure, the market is segmented into low pressure (less than 3000 psi), medium pressure (between 3000 to 6000) and high pressure (more than 6000).

BY INDUSTRY

- Automotive

- Pharmaceuticals

- Oil And Gas

- Food And Beverages

- Water

- Mining

- Agriculture

- Others

Based on industry, the market is segmented into oil and gas, water, agriculture, food and beverages, pharmaceutical, automotive, mining and others.

North America Industrial Hoses Market Regional Analysis/Insights

North America industrial hoses market is analyzed and market size insights and trends are provided by country, type, material type, media, wire type, pressure and industry as referenced above.

The countries covered in this market report are the U.S., Canada, and Mexico. The U.S. dominates in the North America region due to the high demand for industrial hoses. Additionally, the high demand for PVC hose materials is expected to act as a driving factor for market growth.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Industrial Hoses Market Share Analysis

North America industrial hoses market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the North America industrial hoses market are Eaton, PARKER HANNIFIN CORP, RYCO Hydraulics, Kurt Manufacturing, NORRES Schlauchtechnik GmbH, Transfer Oil S.p.A, ContiTech AG (A Subsidiary of Continental AG), Kanaflex Corporation Co.,ltd., Pacific Echo, Colex International Limited, UK, Gates Corporation, Semperit AG Holding, Dixon Valve & Coupling Company, LLC and Titan Fittings among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPACT OF UKRAINE WAR ON NORTH AMERICA INDUSTRIAL HOSES MARKET

4.1.1 ANALYSIS OF THE IMPACT OF THE UKRAINE WAR ON THE INDUSTRIAL HOSES MARKET

4.1.2 STRATEGIC DECISIONS FROM COUNTRIES AND THEIR EFFECT ON MARKET

4.1.3 IMPACT ON PRICE AND SUPPLY CHAIN

4.1.4 CONCLUSION

4.2 IMPACT OF COVID-19 ON THE NORTH AMERICA INDUSTRIAL HOSES MARKET

4.2.1 ANALYSIS ON THE IMPACT OF COVID-19 ON THE INDUSTRIAL HOSES MARKET

4.2.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

4.2.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

4.2.4 IMPACT ON PRICE

4.2.5 IMPACT ON DEMAND AND SUPPLY CHAIN

4.2.6 CONCLUSION

4.3 PRICING LIST

4.4 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR PVC HOSE MATERIALS

5.1.2 INCREASING NEED FOR DURABLE INDUSTRIAL HOSES IN CRITICAL APPLICATIONS

5.1.3 GROWING CONCERN ABOUT WORKPLACE SAFETY AND TESTING PROCEDURES

5.1.4 HIGH ADOPTION OF NON-METAL HOSES

5.2 RESTRAINTS

5.2.1 LIMITATIONS OF INDUSTRIAL HOSES IN VARIOUS APPLICATIONS

5.2.2 ENVIRONMENTAL CONCERNS REGARDING HOSES

5.3 OPPORTUNITIES

5.3.1 GROWING ADOPTION OF HOSES IN AUTOMOBILES SECTORS

5.3.2 GROWING USAGE AND DEMAND OF HOSES IN THE CHEMICAL INDUSTRY

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

5.3.4 RAPID PRODUCT DEVELOPMENT AND LAUNCHES OF INDUSTRIAL HOSES

5.4 CHALLENGE

5.4.1 LOW AWARENESS AMONG END USERS REGARDING HOSES

5.4.2 LACK OF SKILLED PROFESSIONALS FOR FITTING HOSES IN INDUSTRIES

6 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE

6.1 OVERVIEW

6.2 HYDRAULIC HOSES

6.3 LAYFLAT HOSE

6.4 WRAS HOSE

6.5 OIL RESISTANT HOSE

6.6 CORRUGATED HOSE

6.7 STRIPWOUND HOSE

6.8 THERMO-DUCT

6.9 OTHERS

7 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 RUBBER

7.2.1 BY INDUSTRY

7.2.1.1 MINING

7.2.1.2 CONSTRUCTION

7.2.1.3 OIL AND GAS

7.2.1.4 AUTOMOTIVE

7.2.1.5 PHARMACEUTICAL

7.2.1.6 FOOD & BEVERAGES

7.2.1.7 AGRICULTURE

7.2.1.8 WATER

7.2.1.9 OTHERS

7.3 POLYURETHANE

7.3.1 BY WIRE TYPE

7.3.1.1 WIRE BRAIDED

7.3.1.2 SPIRAL WIRE

7.3.2 BY INDUSTRY

7.3.2.1 MINING

7.3.2.2 OIL AND GAS

7.3.2.3 CONSTRUCTION

7.3.2.4 AGRICULTURE

7.3.2.5 PHARMACEUTICAL

7.3.2.6 FOOD & BEVERAGES

7.3.2.7 WATER

7.3.2.8 AUTOMOTIVE

7.3.2.9 OTHERS

7.4 POLYVINYL CHLORIDE

7.4.1 BY WIRE TYPE

7.4.1.1 WIRE BRAIDED

7.4.1.2 SPIRAL WIRE

7.4.2 BY INDUSTRY

7.4.2.1 CONSTRUCTION

7.4.2.2 FOOD & BEVERAGES

7.4.2.3 AGRICULTURE

7.4.2.4 MINING

7.4.2.5 OIL AND GAS

7.4.2.6 PHARMACEUTICAL

7.4.2.7 AUTOMOTIVE

7.4.2.8 WATER

7.4.2.9 OTHERS

7.5 METAL

7.5.1 BY INDUSTRY

7.5.1.1 MINING

7.5.1.2 OIL AND GAS

7.5.1.3 PHARMACEUTICAL

7.5.1.4 CONSTRUCTION

7.5.1.5 FOOD & BEVERAGES

7.5.1.6 WATER

7.5.1.7 AUTOMOTIVE

7.5.1.8 AGRICULTURE

7.5.1.9 OTHERS

7.6 THERMOPLASTICS

7.6.1 BY INDUSTRY

7.6.1.1 OIL AND GAS

7.6.1.2 PHARMACEUTICAL

7.6.1.3 FOOD & BEVERAGES

7.6.1.4 AUTOMOTIVE

7.6.1.5 MINING

7.6.1.6 CONSTRUCTION

7.6.1.7 WATER

7.6.1.8 AGRICULTURE

7.6.1.9 OTHERS

7.7 COMPOSITE

7.7.1 BY INDUSTRY

7.7.1.1 OIL AND GAS

7.7.1.2 WATER

7.7.1.3 PHARMACEUTICAL

7.7.1.4 CONSTRUCTION

7.7.1.5 MINING

7.7.1.6 FOOD & BEVERAGES

7.7.1.7 AGRICULTURE

7.7.1.8 AUTOMOTIVE

7.7.1.9 OTHERS

7.8 SILICONE

7.8.1 BY INDUSTRY

7.8.1.1 AUTOMOTIVE

7.8.1.2 OIL AND GAS

7.8.1.3 MINING

7.8.1.4 CONSTRUCTION

7.8.1.5 FOOD & BEVERAGES

7.8.1.6 PHARMACEUTICAL

7.8.1.7 AGRICULTURE

7.8.1.8 WATER

7.8.1.9 OTHERS

7.9 OTHERS

8 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA

8.1 OVERVIEW

8.2 OIL

8.3 WATER

8.4 GAS

9 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE

9.1 OVERVIEW

9.2 WIRE BRAIDED

9.3 SPIRAL WIRE

10 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE

10.1 OVERVIEW

10.2 LOW PRESSURE (LESS THAN 3000 PSI)

10.3 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

10.4 HIGH PRESSURE (MORE THAN 6000)

11 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 MINING

11.2.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.2.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.2.3 HIGH PRESSURE (MORE THAN 6000)

11.3 CONSTRUCTION

11.3.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.3.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.3.3 HIGH PRESSURE (MORE THAN 6000)

11.4 OIL AND GAS

11.4.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.4.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.4.3 HIGH PRESSURE (MORE THAN 6000)

11.5 AUTOMOTIVE

11.5.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.5.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.5.3 HIGH PRESSURE (MORE THAN 6000)

11.6 PHARMACEUTICAL

11.6.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.6.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.6.3 HIGH PRESSURE (MORE THAN 6000)

11.7 FOOD & BEVERAGES

11.7.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.7.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.7.3 HIGH PRESSURE (MORE THAN 6000)

11.8 AGRICULTURE

11.8.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.8.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.8.3 HIGH PRESSURE (MORE THAN 6000)

11.9 WATER

11.9.1 LOW PRESSURE (LESS THAN 3000 PSI)

11.9.2 MEDIUM PRESSURE (BETWEEN 3000 TO 6000)

11.9.3 HIGH PRESSURE (MORE THAN 6000)

11.1 OTHERS

12 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 EATON

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GATES CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CONTITECH AG (A SUBSIDIARY OF CONTINENTAL AG)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PARKER HANNIFIN CORP

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SEMPERIT AG HOLDING

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 COLEX INTERNATIONAL LIMITED, UK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DIXON VALVE & COUPLING COMPANY, LLC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 FLEXAUST INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 KANAFLEX CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 KURIYAMA OF AMERICA, INC. (A SUBSIDIARY OF KURIYAMA HOLDINGS CORPORATION)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 KURT MANUFACTURING

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 NORRES SCHLAUCHTECHNIK GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 PACIFIC ECHO

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 PIRTEK

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 RYCO HYDRAULICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SALEM-REPUBLIC RUBBER COMPANY

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 TITAN FITTINGS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TITEFLEX (A SUBSIDIARY OF SMITHS GROUP PLC)

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TRANSFER OIL S.P.A.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TRELLEBORG GROUP (A SUBSIDIARY OF TRELLEBORG AB)

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 3 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 4 NORTH AMERICA HYDRAULIC HOSES IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA LAYFLAT HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA WRAS HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OIL RESISTANT IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CORRUGATED HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA STRIPWOUND HOSE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA THERMO-DUCT IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA THERMOPLASTICS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA THERMOPLASTICS IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OIL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA GAS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA WIRE BRAIDED IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA SPIRAL WIRE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA LOW PRESSURE (LESS THAN 3000 PSI) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA MEDIUM PRESSURE (BETWEEN 3000 TO 6000) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA HIGH PRESSURE (MORE THAN 6000) IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OIL & GAS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA OIL & GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN INDUSTRIAL HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 62 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 63 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 85 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 87 U.S. INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 88 U.S. INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.S. POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 91 U.S. RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 92 U.S. POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 93 U.S. POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 94 U.S. METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 95 U.S. THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 96 U.S. COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 97 U.S. SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 98 U.S. INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 99 U.S. INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 101 U.S. INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 102 U.S. MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 103 U.S. CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 104 U.S. OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 105 U.S. AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 106 U.S. PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 107 U.S. FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 108 U.S. AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 109 U.S. WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 110 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 112 CANADA INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 113 CANADA INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 114 CANADA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 115 CANADA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 116 CANADA RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 117 CANADA POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 118 CANADA POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 119 CANADA METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 120 CANADA THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 121 CANADA COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 122 CANADA SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 123 CANADA INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 124 CANADA INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 125 CANADA INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 126 CANADA INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 127 CANADA MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 128 CANADA CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 129 CANADA OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 130 CANADA AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 131 CANADA PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 132 CANADA FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 133 CANADA AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 134 CANADA WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 135 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (ASP USD)

TABLE 137 MEXICO INDUSTRIAL HOSES MARKET, BY TYPE, 2021-2030 (MILLION METER)

TABLE 138 MEXICO INDUSTRIAL HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 139 MEXICO POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 140 MEXICO POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 141 MEXICO RUBBER IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 142 MEXICO POLYURETHANE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 143 MEXICO POLYVINYL CHLORIDE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 144 MEXICO METAL IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 145 MEXICO THERMOPLASTIC IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 146 MEXICO COMPOSITE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 147 MEXICO SILICONE IN INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 148 MEXICO INDUSTRIAL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 149 MEXICO INDUSTRIAL HOSES MARKET, BY WIRE TYPE, 2021-2030 (USD MILLION)

TABLE 150 MEXICO INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 151 MEXICO INDUSTRIAL HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 152 MEXICO MINING IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 153 MEXICO CONSTRUCTION IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 154 MEXICO OIL AND GAS IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 155 MEXICO AUTOMOTIVE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 156 MEXICO PHARMACEUTICAL IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 157 MEXICO FOOD & BEVERAGES IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 158 MEXICO AGRICULTURE IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

TABLE 159 MEXICO WATER IN INDUSTRIAL HOSES MARKET, BY PRESSURE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA INDUSTRIAL HOSES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL HOSES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL HOSES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL HOSES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL HOSES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL HOSES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL HOSES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL HOSES MARKET: SEGMENTATION

FIGURE 10 INCREASED DEMAND IN FOR ROBUST INDUSTRIAL PROCESSES IN CRITICAL APPLICATIONS IS EXPECTED TO DRIVE THE NORTH AMERICA INDUSTRIAL HOSES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 HYDRAULIC HOSES ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INDUSTRIAL HOSES MARKET

FIGURE 13 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY TYPE, 2022

FIGURE 14 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY MATERIAL TYPE, 2022

FIGURE 15 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY MEDIA, 2022

FIGURE 16 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY WIRE TYPE, 2022

FIGURE 17 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY PRESSURE, 2022

FIGURE 18 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY INDUSTRY, 2022

FIGURE 19 NORTH AMERICA INDUSTRIAL HOSES MARKET: SNAPSHOT (2022)

FIGURE 20 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2022)

FIGURE 21 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 NORTH AMERICA INDUSTRIAL HOSES MARKET: BY TYPE (2023-2030)

FIGURE 24 NORTH AMERICA INDUSTRIAL HOSES MARKET: COMPANY SHARE 2021 (%)

North America Industrial Hose Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Industrial Hose Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Industrial Hose Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.