North America Infection Control Market

Market Size in USD Million

CAGR :

%

USD

13,989.57 Million

USD

38,799.94 Million

2022

2030

USD

13,989.57 Million

USD

38,799.94 Million

2022

2030

| 2023 –2030 | |

| USD 13,989.57 Million | |

| USD 38,799.94 Million | |

|

|

|

North America Infection Control Market Analysis and Size

As per research that was published in NCBI, the majority of hospital-acquired UTIs are linked to catheterization, according to statistics from the National Nosocomial Infection Surveillance (NNIS) system report, and CA-bacteriuria is the most common HAI worldwide, accounting for up to 40% of HAIs in the United States each year. The market is primarily driven by an increase in surgical procedures that necessitate high-intensity infection prevention. The high preference is due to positive clinical outcomes associated with infection control use. The infections may be transmitted directly or indirectly from one person to another via contaminated or unsterilized surgical or medical equipment used to treat a patient or from a contaminated environment in a healthcare facility.

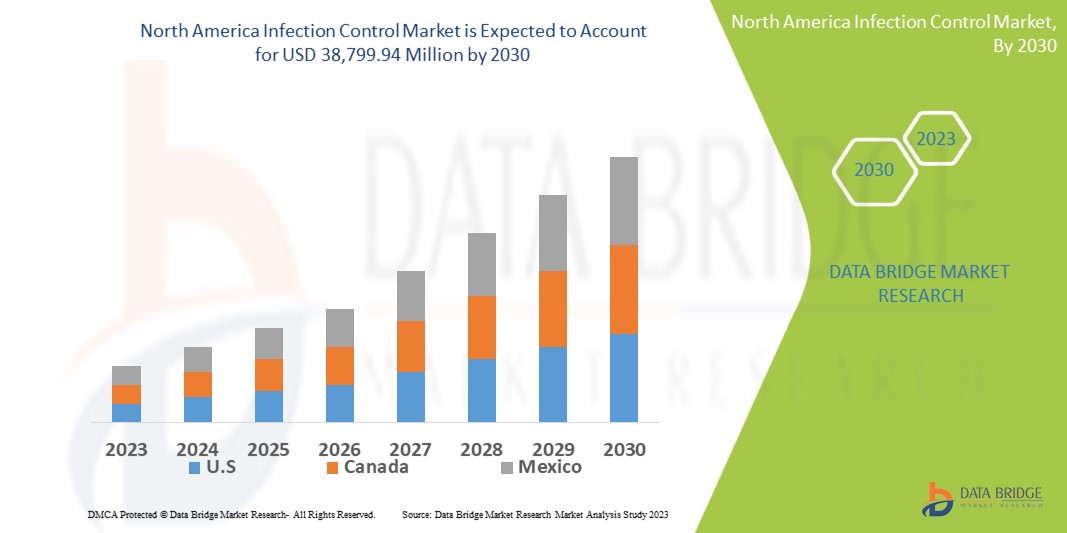

Data Bridge Market Research analyses that the infection control market which is USD 13,989.57 million in 2022, is expected to reach USD 38,799.94 million by 2030, at a CAGR of 13.6% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Infection Control Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Sterilization Products, Cleaning and Disinfection Products, Personal Protective Barriers, Endoscope Reprocessing Products, Anti-Microbial Surfaces, Other Infection Control Products), Application (Surgical Instruments, Endoscopes, Ultrasound Probes, Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributors), End User (Hospitals, Clinics, Medical Device Companies, Pharmaceutical and Biotechnology Companies, Laboratories, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

STERIS plc (U.S.), Sotera Health Company (U.S.), Getinge AB (Sweden), Advanced Sterilization Products (ASP) (U.S.), Ecolab Inc. (U.S.), 3M (U.S.), MATACHANA GROUP (Spain), MMM Group (Germany), Belimed AG (Switzerland), Reckitt Benckiser (U.K.), Metrex Research LLC (U.K.), Miele Group (Germany), Pal International (U.K.), MELAG Medizintechnik GmbH & Co. KG (Germany), Contec, Inc. (U.S.), MEDALKAN (Greece), Systec GmbH (Germany), C.B.M. S.r.l. Medical Equipment (Italy), Continental Equipment Company (U.S.), and BGS Beta-Gamma-Service GmbH & Co. KG (Germany) |

|

Market Opportunities |

|

Market Definition

The process of infection control is used in the healthcare sector to stop or prevent the spread of infections. The activity of infection control involves getting rid of bacteria from various surfaces and things. This procedure makes it possible for people to avoid disease transmission . A scientific strategy called infection control is intended to stop the harm infections can do to patients and healthcare professionals. In all healthcare settings, infection control is necessary to stop the spread of infectious diseases. It can be described as a set of generally accepted suggestions used to decrease the danger of infectious agents being transmitted by environmental or bodily fluids.

North America Infection Control Market Dynamics

Drivers

- Increasing need to prevent hospital-acquired infections

The sterilization products and services industry under the product and services area is predicted to have profitable expansion because of the growing need to prevent hospital-acquired infections and the extensive usage of sterilization equipment in healthcare settings. The World Health Organization (WHO) reports that at least 30 new diseases have appeared in the previous 20 years and that infectious diseases claim the lives of 17 million people each year. Additionally, it is predicted that the market would rise throughout the forecast period due to an increase in surgeries, an increase in the incidence of infectious diseases and growth in the healthcare sector.

- Awareness about the infection control

The CDC estimates that up to 1.7 million hospitalized patients in the US regularly get clinical care linked to pollution (HCAIs) while receiving treatment for other medical conditions and that more than 98,000 of these patients (or one out of every 17) pass away as a result of HCAIs. Urinary tract infections account for 32% of all HAIs in the nation; cautious site infections account for 22%; lung (pneumonia) diseases account for 15%; and circulatory system illnesses account for 14%. This ought to maintain consumer interest in sanitizer and disinfectant products. The likelihood of HAIs depends heavily on the patient's safety, infection control procedures and the frequency of various compelling experts in the clinical benefits office. Longer clinical centre stays result from several factors, including immunosuppression, increased age and stays in specialized care units. Around 20% of such illnesses occur in ICUs. The critical microorganisms causing HAIs to integrate C. difficile, Staphylococcus aureus, Klebsiella and Escherichia coli.

Opportunities

- Rising adoption of single-use medical nonwovens and devices

The number of surgical procedures performed each year has increased significantly due to an ageing population and an increase in the prevalence of obesity and diabetes. As a result, there is a greater demand for disposable medical products or single-use products that can be discarded after use, reducing the risk of infection transmission. The increasing importance of maintaining hygiene and sterility as well as rising per capita healthcare spending, are expected to drive demand for single-use medical nonwoven products. The emergence of pandemics such as H1N1, SARS and COVID-19 as well as viral diseases such as Zika virus, yellow fever, Ebola, and dengue fever, has increased demand for single-use medical nonwoven products.

Restraints/Challenges

- Presence of harmful and toxic chemical-based sanitizers available in the local markets

The bulk of synthetic sanitizers that are now on the market has negative characteristics. For instance, sodium hypochlorite is an effective therapy for blood-borne pathogens, but it is also highly destructive, aggravates respiratory conditions in building occupants, and is deadly when released into the environment. The improper use of these sanitizers can endanger the environment and be harmful to any patients that may be exposed to them.

This infection control market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the infection control market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2020, Ecolab received EPA approval for its AdvaCare Disinfectant laundry disinfectant and oxidizer, emerging viral pathogen claim against SARS-CoV-21, the virus that causes COVID-19. This EPA approval expanded the company's market in the future.

- In 2019, Ecolab received U.S. EPA approval for its OxyCide daily disinfectant cleaner for efficacy against Candida auris (C. auris), a fungal pathogen that causes major health issues worldwide. The company's EPA approval increased market demand for its product, resulting in increased sales in the future.

North America Infection Control Market Scope

The infection control market is segmented on the basis of product, application, distribution channel and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Sterilization

- Cleaning and Disinfection

- Personal Protective Barriers

- Endoscope Reprocessing

- Anti-Microbial Surfaces

- Other Infection Control

Application

- Surgical Instruments

- Surgical Endoscopes

- Ultrasound Probes

- Others

Distribution Channel

- Direct Tender

- Retail Sales

- Third Party Distributors

End User

- Hospitals

- Clinics

- Medical Device Companies

- Pharmaceutical and Biotechnology Companies

- Laboratories

- Others

Infection Control Market Regional Analysis/Insights

The infection control market is analyzed and market size insights and trends are provided by country, product, application, distribution channel and end user as referenced above.

The countries covered in the infection control market report are U.S., Canada and Mexico in North America.

U.S. is dominating the infection control market as the top market players expand their product offerings and virus transmission capabilities, the partnerships that occupy the most populous region in the United States will be strengthened.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The infection control market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for infection control market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the infection control market. The data is available for historic period 2011-2021.

Competitive Landscape and Infection Control Market Share Analysis

The infection control market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to infection control market.

Some of the major players operating in the infection control market are:

- STERIS plc (U.S.)

- Sotera Health Company (U.S.)

- Getinge AB (Sweden)

- Advanced Sterilization Products (ASP) (U.S.)

- Ecolab Inc. (U.S.)

- 3M (U.S.)

- MATACHANA GROUP (Spain)

- MMM Group (Germany)

- Belimed AG (Switzerland)

- Reckitt Benckiser (U.K.)

- Metrex Research LLC (U.K.)

- Miele Group (Germany)

- Pal International (U.K.)

- MELAG Medizintechnik GmbH & Co. KG (Germany)

- Contec, Inc. (U.S.)

- MEDALKAN (Greece)

- Systec GmbH (Germany)

- C.B.M. S.r.l. Medical Equipment (Italy)

- Continental Equipment Company (U.S.)

- BGS Beta-Gamma-Service GmbH & Co. KG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.