North America Infection Surveillance Solution Systems Market

Market Size in USD Million

CAGR :

%

USD

699.30 Million

USD

2,037.19 Million

2025

2033

USD

699.30 Million

USD

2,037.19 Million

2025

2033

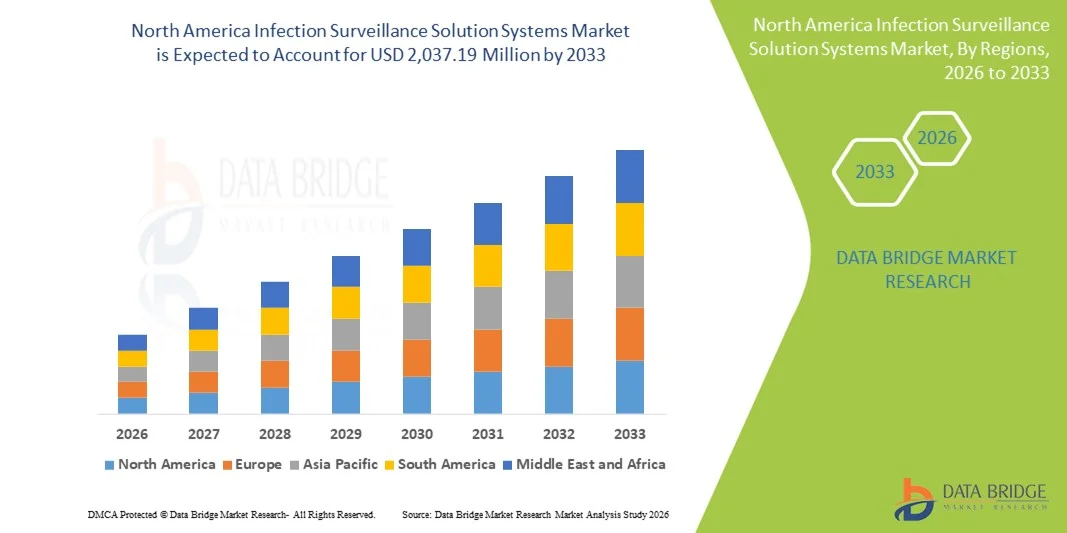

| 2026 –2033 | |

| USD 699.30 Million | |

| USD 2,037.19 Million | |

|

|

|

|

North America Infection Surveillance Solution Systems Market Size

- The North America infection surveillance solution systems market size was valued at USD 699.30 million in 2025 and is expected to reach USD 2,037.19 million by 2033, at a CAGR of 14.30% during the forecast period

- The market growth is largely fueled by increasing adoption of digital infection‑monitoring solutions and advanced healthcare IT infrastructure in hospitals and long‑term care facilities, leading to improved patient safety and timely detection of hospital-acquired infections

- Furthermore, rising regulatory focus and growing demand for real-time, user-friendly, and integrated infection prevention and control solutions are establishing infection surveillance systems as the modern standard for healthcare facilities. These converging factors are accelerating the uptake of these solutions, thereby significantly boosting the industry's growth

North America Infection Surveillance Solution Systems Market Analysis

- Infection surveillance solution systems, offering real-time monitoring and analytics for healthcare-associated infections (HAIs), are increasingly vital components of modern hospital and long-term care facility management due to their enhanced accuracy, automation capabilities, and seamless integration with electronic health records (EHRs) and hospital IT systems

- The escalating demand for infection surveillance solutions is primarily fueled by rising incidences of HAIs, growing regulatory and institutional focus on patient safety, and a preference for automated, user-friendly systems that enable timely detection and prevention of infections

- The United States dominated the infection surveillance solution systems market with the largest revenue share of 61.5% in 2025, characterized by advanced healthcare IT infrastructure, early adoption of digital health solutions, and a strong presence of key industry players, experiencing substantial growth in hospital and long-term care facility deployments, driven by innovations from both established medical technology companies and emerging health-tech startups focusing on AI-driven analytics and real-time reporting

- Canada is expected to be the fastest-growing country in the infection surveillance solution systems market during the forecast period due to increasing government initiatives for infection control and expanding healthcare IT investments

- Software segment dominated the infection surveillance solution systems market with a market share of 56.8% in 2025, driven by its ability to provide comprehensive data analytics, customizable reporting, and integration with existing hospital IT infrastructure

Report Scope and North America Infection Surveillance Solution Systems Market Segmentation

|

Attributes |

North America Infection Surveillance Solution Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Infection Surveillance Solution Systems Market Trends

Enhanced Capabilities Through AI and Real-Time Analytics

- A significant and accelerating trend in the North America infection surveillance market is the integration of artificial intelligence (AI) and real-time data analytics into hospital and long-term care monitoring systems. This fusion of technologies is significantly improving infection detection speed, accuracy, and overall patient safety

- For instance, the BioSense Infection Monitoring Platform leverages AI algorithms to identify potential outbreaks in real time, allowing healthcare staff to intervene immediately and prevent further spread of infections. Similarly, iScrub+ can analyze multiple infection data points across wards to predict high-risk areas

- AI-enabled infection surveillance systems can detect unusual patterns, generate intelligent alerts, and support predictive risk assessments. For instance, some Cerner systems utilize AI to flag abnormal infection trends and notify infection control teams proactively. Furthermore, real-time dashboards allow healthcare administrators to track infection metrics remotely

- The seamless integration of these systems with hospital electronic health records (EHRs) and IT infrastructure enables centralized monitoring of multiple wards and facilities. Through a single interface, infection control teams can oversee patient data, compliance reports, and intervention measures, creating a unified infection prevention ecosystem

- This trend towards more intelligent, automated, and interconnected infection surveillance systems is fundamentally reshaping hospital expectations for patient safety. Consequently, companies such as Baxter are developing AI-driven surveillance solutions with features such as predictive alerts and integration with hospital IT systems

- The demand for infection surveillance systems offering AI capabilities and real-time monitoring is growing rapidly across U.S. hospitals and long-term care facilities, as healthcare providers increasingly prioritize proactive infection prevention and operational efficiency

North America Infection Surveillance Solution Systems Market Dynamics

Driver

Rising Demand Due to Growing Infection Concerns and Hospital Safety Initiatives

- The increasing prevalence of hospital-acquired infections (HAIs) and the growing focus on patient safety initiatives is a significant driver for the heightened demand for infection surveillance solutions

- For instance, in March 2025, Cerner Corporation launched an AI-enabled infection surveillance module aimed at early detection of bloodstream infections, anticipating enhanced adoption across U.S. hospitals. Such advancements by key companies are expected to drive the market growth in the forecast period

- As hospitals and long-term care facilities become more aware of infection risks and seek proactive measures, surveillance systems offer automated reporting, real-time alerts, and compliance tracking, providing a compelling alternative to manual monitoring

- Furthermore, increasing government regulations and accreditation standards requiring infection monitoring are making surveillance solutions an integral part of hospital operations, facilitating integration with existing IT and EHR platforms

- The ability to centralize infection data, track compliance, and generate actionable insights across multiple wards or facilities is a key factor propelling the adoption of infection surveillance systems in both hospitals and long-term care centers

Restraint/Challenge

Data Security Concerns and High Initial Implementation Costs

- Concerns surrounding data privacy and cybersecurity vulnerabilities in connected infection surveillance systems pose a significant challenge to broader adoption. As these systems rely on network connectivity and cloud-based analytics, they are susceptible to breaches and unauthorized access, raising concerns among hospital administrators

- For instance, reported vulnerabilities in hospital IT systems have made some institutions hesitant to deploy connected infection surveillance solutions without robust security measures

- Addressing these concerns through encrypted data transmission, secure authentication protocols, and regular software updates is critical for gaining trust. Companies such as Baxter and Cerner emphasize advanced encryption and secure cloud platforms in their solutions to reassure clients. In addition, the relatively high initial investment required for advanced infection surveillance systems compared to manual tracking methods can be a barrier for smaller healthcare facilities

- While prices are gradually becoming more competitive, the perceived premium of AI-enabled and real-time surveillance technology can hinder adoption, especially for hospitals with limited budgets or low infection incidence

- Overcoming these challenges through enhanced cybersecurity measures, staff training, and cost-effective deployment options will be vital for sustained growth of the North America infection surveillance solution systems market

North America Infection Surveillance Solution Systems Market Scope

The market is segmented on the basis of products, infection type, and end user.

- By Products

On the basis of products, the market is segmented into software and services. The software segment dominated the market with the largest revenue share of 56.8% in 2025, driven by its ability to provide real-time monitoring, predictive analytics, and integration with hospital electronic health records (EHRs). Hospitals often prioritize software solutions for their centralized dashboard capabilities, automated reporting, and compliance tracking, which significantly reduce manual intervention. The demand for software solutions is also supported by their scalability and flexibility, allowing healthcare facilities to customize alerts and analytics based on infection type, ward, or patient risk. Furthermore, software platforms offer advanced AI-driven analytics that help identify trends and potential outbreaks before they escalate, thereby improving patient outcomes and operational efficiency.

The services segment is anticipated to witness the fastest growth rate of 8.2% from 2025 to 2032, fueled by increasing adoption of managed infection surveillance programs and outsourced infection prevention support in hospitals and long-term care facilities. Services include implementation, training, maintenance, and continuous monitoring support, which are particularly appealing to smaller healthcare facilities lacking internal IT or infection control teams. The growth of telehealth and remote monitoring initiatives also contributes to the rising demand for service-based solutions, as these offerings ensure real-time guidance and compliance without extensive onsite resources.

- By Infection Type

On the basis of infection type, the market is segmented into surgical site infections (SSI), bloodstream infections (BSI), urinary tract infections (UTI), central line-associated bloodstream infections (CLABSI), catheter-associated urinary tract infections (CAUTI), and others. The CLABSI segment dominated the market with the largest revenue share of 22% in 2025, driven by its high prevalence in intensive care units and critical care settings. Hospitals often prioritize CLABSI monitoring due to strict regulatory requirements, reimbursement penalties, and the severe health risks associated with central line infections. Advanced surveillance systems can automatically track central line usage, monitor adherence to hygiene protocols, and trigger alerts for early intervention, making them indispensable in critical care units.

The SSI segment is expected to witness the fastest CAGR of 7.5% from 2025 to 2032, fueled by increasing elective surgical procedures, heightened awareness of postoperative complications, and hospital initiatives to reduce surgical infection rates. AI-enabled SSI monitoring tools allow real-time detection of infection indicators, automated reporting to surgeons, and integration with patient follow-up systems. The growing focus on patient safety, combined with rising demand for compliance with global surgical standards, supports rapid adoption of SSI-focused surveillance solutions.

- By End User

On the basis of end user, the market is segmented into hospitals, long-term care facilities, clinics, ambulatory surgical centers, academic institutes, and others. The hospital segment dominated the market with the largest revenue share of 55% in 2025, driven by the high prevalence of hospital-acquired infections (HAIs) and substantial investments in infection prevention infrastructure. Hospitals often prioritize surveillance solutions for critical care units, surgical wards, and emergency departments to ensure patient safety and meet stringent regulatory standards. The integration of surveillance systems with hospital EHRs enables real-time alerts, centralized dashboards, and data-driven decision-making, which are crucial for managing high patient volumes efficiently.

The long-term care facilities segment is anticipated to witness the fastest growth rate of 9% from 2025 to 2032, fueled by the increasing elderly population and rising demand for infection prevention in nursing homes and rehabilitation centers. Surveillance systems help long-term care facilities monitor HAIs such as UTIs and respiratory infections, track compliance with hygiene protocols, and provide actionable insights to reduce outbreak risks. The growth of telehealth, remote monitoring, and specialized care programs further supports adoption in this segment, enabling smaller facilities to benefit from advanced infection surveillance without extensive in-house IT resources

North America Infection Surveillance Solution Systems Market Regional Analysis

- The United States dominated the infection surveillance solution systems market with the largest revenue share of 61.5% in 2025, characterized by advanced healthcare IT infrastructure, early adoption of digital health solutions, and a strong presence of key industry players, experiencing substantial growth in hospital and long-term care facility deployments

- Healthcare providers in the U.S. highly value the real-time monitoring, AI-enabled analytics, and seamless integration offered by infection surveillance systems with electronic health records (EHRs) and hospital IT platforms

- This widespread adoption is further supported by strict regulatory standards, rising awareness of infection control, and substantial investments in patient safety programs, establishing infection surveillance systems as a preferred solution for both hospitals and long-term care facilities.

U.S. Infection Surveillance Solution Systems Market Insight

The U.S. infection surveillance solution systems market captured the largest revenue share of 61.5% in 2025 within North America, fueled by the widespread adoption of digital health technologies and stringent hospital infection control standards. Healthcare providers are increasingly prioritizing real-time monitoring, AI-enabled analytics, and predictive surveillance to reduce hospital-acquired infections (HAIs). The growing demand for automated reporting, integration with electronic health records (EHRs), and compliance tracking further propels market expansion. Moreover, rising investments in patient safety programs, combined with the integration of advanced IT infrastructure across hospitals and long-term care facilities, is significantly contributing to the market's growth.

Canada Infection Surveillance Solution Systems Market Insight

The Canada infection surveillance solution systems market is expected to grow at a substantial CAGR during the forecast period, primarily driven by increasing government initiatives for infection prevention, expanding healthcare IT adoption, and rising awareness of hospital-acquired infections. Healthcare facilities are focusing on real-time infection monitoring, centralized dashboards, and AI-driven predictive analytics to ensure patient safety. The growing trend of digitization in hospitals, coupled with proactive infection control programs, is fostering the adoption of infection surveillance solutions. Canadian providers are increasingly integrating software and services to enhance compliance, reporting, and operational efficiency across hospitals and long-term care facilities.

Mexico Infection Surveillance Solution Systems Market Insight

The Mexico infection surveillance solution systems market is poised to grow at a notable CAGR during the forecast period, driven by increasing investments in healthcare infrastructure and rising awareness of hospital-acquired infections (HAIs) in both urban and semi-urban areas. Healthcare providers are prioritizing digital surveillance solutions to improve infection monitoring, reporting, and compliance with emerging regulatory guidelines. The growing adoption of electronic health records (EHRs) and the integration of AI-driven analytics into hospital IT systems are facilitating real-time detection of infections and preventive interventions. In addition, initiatives to modernize public and private hospitals, coupled with a rising middle-class population demanding safer healthcare services, are further supporting the adoption of infection surveillance solutions across hospitals and long-term care facilities in Mexico.

North America Infection Surveillance Solution Systems Market Share

The North America Infection Surveillance Solution Systems industry is primarily led by well-established companies, including:

- BD (U.S.)

- Premier Inc., (U.S.)

- Wolters Kluwer N.V. (Netherlands)

- Baxter (U.S.)

- Cerner Corporation (U.S.)

- GOJO Industries, Inc., (U.S.)

- RLDatix (U.K.)

- Vecna Technologies, Inc., (U.S.)

- VigiLanz Corporation, (U.S.)

- BIOMÉRIEUX (France)

- Clinisys Group Ltd (U.K.)

- Deb Group Ltd (U.K.)

- Merative, (U.S.)

- PeraHealth Inc. (U.S.)

- CenTrak, Inc. (U.S.)

- Ecolab Inc. (U.S.)

- Medexter Healthcare GmbH (Austria)

- STANLEY Healthcare Solutions (U.S.)

- Vitalacy Inc. (U.S.)

- VIZZIA Technologies LLC (U.S.)

What are the Recent Developments in North America Infection Surveillance Solution Systems Market?

- In September 2025, Cleveland Clinic announced the expanded rollout of Bayesian Health AI Platform across its U.S. hospitals for early detection of sepsis. The AI‑enabled platform analyzes real-time lab results, vital signs and clinical notes, enabling clinicians to identify sepsis earlier, reduce false alerts, and accelerate antibiotic treatment

- In April 2025, A platform described as a “sepsis‑detection platform” was reported to have prevented thousands of deaths through early sepsis identification highlighting the real-world life‑saving potential of infection surveillance systems when AI and clinical workflows are combined

- In April 2025, EDS‑HAT (Enhanced Detection System for Healthcare‑Associated Transmission), developed by University of Pittsburgh scientists in collaboration with hospital infection‑prevention teams, was shown to stop outbreaks, save lives and cut costs during a two‑year trial at a U.S. hospital. Over the trial period, EDS‑HAT reportedly prevented 62 infections and five deaths, and delivered nearly a 3.2‑fold return on investment

- In March 2024, A proof-of-concept study published in American Journal of Infection Control demonstrated that AI tools can accurately identify healthcare‑associated infections (HAIs) such as CLABSI and CAUTI even in complex clinical scenarios. The researchers tested AI agents on fictional patient case descriptions; both agents correctly identified infection cases when provided clear, detailed data

- In September 2023, A hospital‑based surveillance system (also EDS‑HAT) deployed at a hospital flagged a drug‑resistant infection tied to contaminated eye‑drops months before the outbreak was publicly declared by national health authorities. This demonstrated that automated, genome‑based surveillance systems can detect and signal emerging multi‑state or multi‑hospital outbreaks significantly earlier than traditional reporting channels

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.