North America Insect Protein Market

Market Size in USD Billion

CAGR :

%

USD

59.45 Billion

USD

340.97 Billion

2024

2032

USD

59.45 Billion

USD

340.97 Billion

2024

2032

| 2025 –2032 | |

| USD 59.45 Billion | |

| USD 340.97 Billion | |

|

|

|

|

Insect Protein Market Size

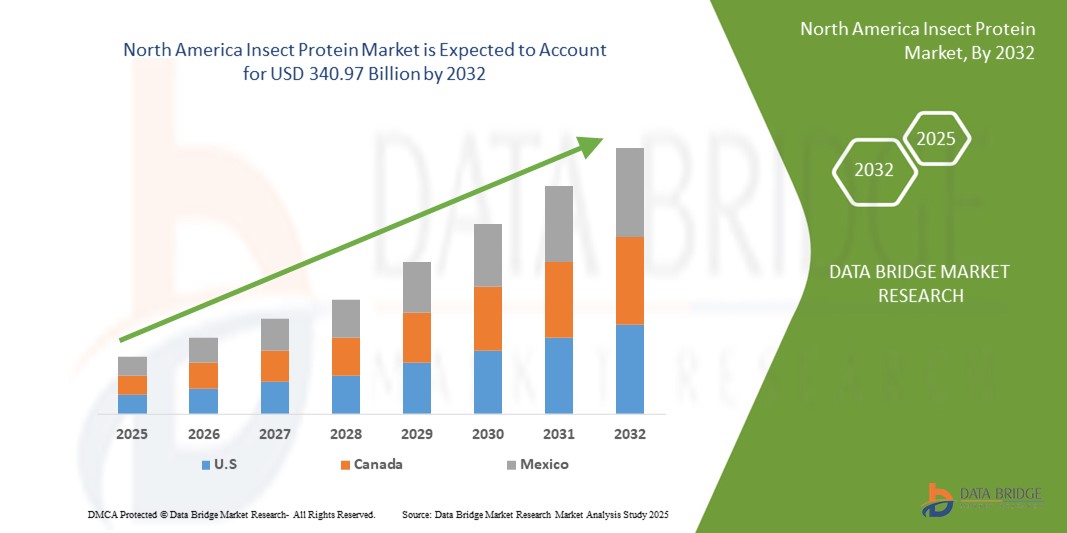

- The North America insect protein market size was valued at USD 59.45 billion in 2024 and is expected to reach USD 340.97 billion by 2032, at a CAGR of 24.40% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of sustainable protein sources, rising demand for eco-friendly food alternatives, and advancements in insect farming technologies

- Growing environmental concerns, coupled with the need for high-protein diets and the integration of insect-based ingredients in various applications, are accelerating the adoption of insect protein, significantly boosting industry growth

Insect Protein Market Analysis

- Insect protein, derived from edible insects, is emerging as a sustainable and nutrient-rich alternative to traditional protein sources, finding applications in food and beverage, animal feed, and pharmaceuticals and cosmetics due to its high protein content, low environmental footprint, and scalability

- The surge in demand for insect protein is fueled by increasing consumer acceptance of alternative proteins, supportive regulatory frameworks, and growing investments in insect-based food production

- The U.S. dominated the North America insect protein market with the largest revenue share of 37.8% in 2024, driven by a strong focus on sustainability, widespread adoption in food and feed industries, and the presence of leading market players. The U.S. market is further propelled by innovative startups and research into novel insect-based products tailored to consumer preferences

- Canada is expected to be the fastest-growing country in the insect protein market during the forecast period, attributed to rising consumer interest in sustainable diets, favourable government initiatives, and increasing urbanization

- The Coleoptera segment, encompassing beetles, dominated the largest market revenue share of 58.5% in 2024, driven by the diverse and abundant beetle species, particularly mealworms, which offer high protein content and are widely used in animal feed and food products

Report Scope and Insect Protein Market Segmentation

|

Attributes |

Insect Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insect Protein Market Trends

“Increasing Integration of Advanced Processing Technologies and Product Innovation”

- The North America insect protein market is experiencing a notable trend toward the integration of advanced processing technologies and innovative product development

- Technologies such as automated farming systems, AI-driven quality control, and optimized protein extraction methods are enhancing the efficiency and scalability of insect protein production

- These advancements enable the creation of diverse products such as insect-based protein powders, bars, snacks, and flours, appealing to health-conscious consumers and expanding market reach

- For instance, companies are leveraging AI to monitor insect growth conditions, ensuring consistent quality and nutritional content, while IoT technologies optimize farming operations for higher yields

- This trend is making insect protein more appealing by improving product consistency, taste, and texture, thus attracting both individual consumers and industries such as food and beverage, feed, and pharmaceuticals

- Advanced analytics are also used to tailor products to consumer preferences, such as developing cricket-based protein bars with enhanced flavors or mealworm powders for pet food applications

Insect Protein Market Dynamics

Driver

“Rising Demand for Sustainable Protein Sources and Eco-Friendly Food Solutions”

- Increasing consumer awareness of environmental sustainability and the demand for alternative protein sources are major drivers for the North America insect protein market

- Insect protein offers a sustainable alternative to traditional livestock, requiring significantly less land, water, and feed while producing fewer greenhouse gas emissions

- Government initiatives and consumer trends in the U.S., the dominating country, and Canada, the fastest-growing market, are promoting sustainable food systems, further boosting the adoption of insect-based products

- The proliferation of health-conscious diets, such as keto and paleo, is driving demand for nutrient-rich insect protein products, which offer high protein content (40%-70%) and essential amino acids

- Companies such as Aspire Food Group and EntomoFarms are expanding production capacities in Canada and the U.S. to meet growing demand for insect-based foods, feed, and cosmetics, supported by advancements in 5G and IoT for efficient supply chain management

Restraint/Challenge

“High Production Costs and Consumer Acceptance Barriers”

- The high initial investment required for insect farming infrastructure, processing equipment, and regulatory compliance poses a significant barrier, particularly for smaller companies in the North America insect protein market

- Scaling up production and developing cost-effective processing methods remain complex and costly, especially in emerging markets within the region

- Consumer acceptance, particularly in the U.S. and Canada, is hindered by cultural aversions to entomophagy (insect consumption) and limited awareness of its nutritional and environmental benefits

- Data from a 2018 study by PureGym indicates that while 35% of gym members are open to trying edible insects, broader consumer hesitancy persists, particularly in Western markets where entomophagy is less familiar

- Regulatory challenges, such as varying standards for insect-based products across the U.S., Canada, and Mexico, and concerns about allergen risks (chitin-related sensitivities), further complicate market growth

Insect Protein market Scope

The market is segmented on the basis of source, insect type, application, and distribution channels.

- By Source

On the basis of source, the North America insect protein market is segmented into Coleoptera and Orthoptera. The Coleoptera segment, encompassing beetles, dominated the largest market revenue share of 58.5% in 2024, driven by the diverse and abundant beetle species, particularly mealworms, which offer high protein content and are widely used in animal feed and food products. Their resilience and adaptability to large-scale cultivation further bolster their dominance.

The Orthoptera segment, including crickets, grasshoppers, and locusts, is anticipated to witness the fastest growth rate of 26.8% from 2025 to 2032. This growth is fueled by the high protein content of Orthoptera species (up to 77% in grasshoppers) and their increasing use in food products such as protein bars and snacks, appealing to health-conscious consumers. Advancements in cricket farming and processing technologies also drive this segment's rapid expansion.

- By Insect Type

On the basis of insect type, the North America insect protein market is segmented into Beetles, Caterpillars, Bees, Wasps and Ants, Grasshoppers, Locusts, Crickets, True Bugs, Black Soldier Flies, Cicadas, Leafhoppers, Plant Hoppers, Scale Insects, Termites, Dragonflies, Flies, Mealworms, and Others. The Beetles segment is expected to dominate with a market revenue share of 42.5% in 2024, owing to their high nutritional profile and widespread use in animal feed, particularly mealworms, which are cost-effective and sustainable.

The Crickets segment is projected to experience the fastest growth rate of 28.4% from 2025 to 2032, driven by their high protein content (up to 69%), ease of farming, and growing consumer acceptance in food products such as cricket flour and protein bars. Increasing demand for sustainable and nutrient-rich alternatives in the U.S. and Canada further accelerates this segment's growth.

- By Application

On the basis of application, the North America insect protein market is segmented into Food and Beverage, Feed, and Pharmaceuticals and Cosmetics. The Feed segment holds the largest market revenue share of 48.5% in 2024, driven by the rising demand for sustainable animal feed in aquaculture, poultry, and pet food industries. Insect protein, with 40–70% protein content and high digestibility, is increasingly favored for its eco-friendly profile.

The Food and Beverage segment is expected to witness the fastest growth rate of 27.5% from 2025 to 2032, propelled by growing consumer interest in sustainable and nutritious food options. Innovations in processing have led to products such as insect protein powders, bars, and snacks, gaining traction among health-conscious consumers in the U.S. and Canada.

- By Distribution Channels

On the basis of distribution channel, the North America insect protein market is segmented into Direct and Indirect channels. The Indirect segment, including retailers and distributors, is expected to hold the largest market revenue share of 62.5% in 2024, driven by its extensive reach through supermarkets, specialty stores, and online platforms, catering to both commercial and consumer markets.

The Direct segment is anticipated to grow at the fastest rate of 25.9% from 2025 to 2032, fueled by increasing partnerships between insect protein producers and end-users, such as food manufacturers and feed companies. Direct sales enable better control over branding and supply chains, particularly in Canada, where demand for sustainable proteins is surging.

Insect Protein Market Regional Analysis

- The U.S. dominated the North America insect protein market with the largest revenue share of 37.8% in 2024, driven by a strong focus on sustainability, widespread adoption in food and feed industries, and the presence of leading market players. The U.S. market is further propelled by innovative startups and research into novel insect-based products tailored to consumer preferences

- Canada is expected to be the fastest-growing country in the insect protein market during the forecast period, attributed to rising consumer interest in sustainable diets, favorable government initiatives, and increasing urbanization

U.S. Insect Protein Market Insight

The U.S. dominated the North America insect protein market with the largest revenue share of 76% in 2024, driven by strong consumer awareness of sustainability and nutritional benefits. The demand for insect-based products, such as cricket flour and mealworm-based snacks, is growing in both food and beverage and animal feed sectors. The aftermarket segment thrives due to consumer interest in eco-friendly diets and health-focused products, while OEM adoption by pet food and aquaculture industries boosts market growth. Regulatory support for insect protein in feed applications and increasing investments in production facilities, such as Innovafeed’s collaboration with ADM, further fuel expansion.

Canada Insect Protein Market Insight

Canada is the fastest-growing country in the North America insect protein market, driven by rising consumer interest in sustainable protein sources and government support for eco-friendly agricultural practices. The demand for insect protein in food and beverage applications, such as protein bars and snacks, is increasing, particularly among health-conscious and environmentally aware consumers. The feed sector, including aquaculture and poultry, is also a significant growth driver, with companies such as Enterra Feed Corporation leading innovations. Canada’s focus on reducing carbon footprints and advancements in insect farming technologies contribute to its rapid market growth.

Insect Protein Market Share

The insect protein industry is primarily led by well-established companies, including:

- AgriProtein (South Africa)

- Enterra Feed Corporation (Canada)

- Aspire Food Group (Canada)

- Beta Hatch (U.S.)

- BIOFLYTECH (Spain)

- Chapul Cricket Protein (U.S.)

- Entobel (Vietnam)

- Entocycle (U.K.)

- Entomo Farms (France)

- North America Bugs (Thailand)

- Haocheng Mealworms Inc. (China)

- Hexafly (Ireland)

- Innovafeed (France)

- JSC „INSECTUM“(Norway)

- nextProtein (France)

What are the Recent Developments in North America Insect Protein Market?

- In October 2023, Tyson Foods announced a strategic partnership with Protix, a Dutch pioneer in insect-based ingredients, to advance sustainable protein production. The collaboration includes a joint venture to build the first large-scale insect ingredient facility in the U.S., where black soldier flies will be cultivated using food manufacturing byproducts. These insects will be processed into high-quality proteins and lipids for use in pet food, aquaculture, and livestock feed, creating a circular, low-impact protein source. Tyson also acquired a minority stake in Protix, supporting its global expansion and reinforcing its commitment to innovative, eco-friendly food systems

- In March 2023, Aspire Food Group received funding from Next Generation Manufacturing Canada (NGen) to advance its cricket protein production facility in London, Ontario—the world’s first fully automated insect-protein manufacturing site. The facility integrates artificial intelligence, Industrial Internet of Things (IIoT) sensors, and automated storage and retrieval systems to optimize the breeding, processing, and packaging of crickets into sustainable protein ingredients. With a projected annual output of nine million kilograms, the initiative aims to revolutionize food-grade protein production, supporting both pet nutrition and human consumption while addressing food insecurity and environmental sustainability

- In February 2023, EntomoFarms, North America’s largest edible insect farm, partnered with Crickstart, a Canadian food manufacturer, to launch a new line of cricket protein-based bars. These bars are designed for health-conscious consumers seeking sustainable, high-protein alternatives. The collaboration leverages EntomoFarms’ expertise in cricket powder production and Crickstart’s experience in crafting nutrient-dense snacks, expanding their footprint in the North American functional food market. This move aligns with growing consumer interest in eco-friendly protein sources that support both personal wellness and environmental sustainability

- In January 2023, Ÿnsect became the first company authorized by the Association of American Feed Control Officials (AAFCO) to commercialize defatted mealworm proteins (Protein70) for dog food in the United States. This landmark approval followed a two-year evaluation and a six-month feeding trial, confirming the ingredient’s nutritional benefits, including high protein digestibility, essential amino acids, unsaturated fats, and micronutrients. The move opens the door for Ÿnsect’s pet food brand Sprÿng in the U.S. market and supports the shift toward sustainable, low-impact protein sources in pet nutrition

- In December 2022, Neo Bites, a sustainable pet food startup based in Austin, Texas, launched the first line of functional dog food toppers made with insect protein in North America. These toppers, formulated with the company’s proprietary Super-Insect Blend (featuring cricket protein), are designed to support specific canine health needs—digestive health, skin and coat care, and daily vitality. Each formula includes whole-food superfoods such as turmeric, pumpkin, flaxseed, and kale, and is hypoallergenic and nutrient-dense. The launch reflects Neo Bites’ mission to improve pet wellness while reducing the environmental impact of traditional meat-based pet foods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INSECT PROTEIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 INSECT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PATENT ANALYSIS

3.2 COUNTRY LEVEL INSIGHTS

3.3 COMPANY BASED ANALYSIS

3.4 TECHNICAL CHALLENGES

3.5 CLIENT REQUIREMENT

3.5.1 COST OF MACHINES/EQUIPMENT USED IN INSECT REARING AND PROCESSING

3.5.2 PARTNERS AROUND THE WORLD SELLING INSECT REARING AND PROCESSING EQUIPMENT/TECHNOLOGY

3.6 REGULATIONS

3.6.1 EUROPEAN LAW ON INSECTS IN FOOD AND FEED

3.6.1.1 INSECTS AS FEED

3.6.1.2 INSECTS AS FOOD

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 GROWING DEMAND FOR ALTERNATIVE PROTEIN SOURCE

4.1.2 RISING AWARENESS ABOUT THE BENEFITS OF INSECT PROTEINS

4.1.3 INCREASING INVESTMENT IN R&D

4.1.4 EASY AVAILABILITY OF EDIBLE INSECTS AND SNACKS

4.2 RESTRAINTS

4.2.1 LOWER CONSUMER ACCEPTANCE LEVEL

4.2.2 LACK OF AUTOMATED FARMING METHODS

4.2.3 STRINGENT REGULATORY FRAMEWORK

4.2.4 HIGHER COSTS OF INSECT PROTEINS

4.3 OPPORTUNITIES

4.3.1 NEW PRODUCT INNOVATION TO ATTRACT CONSUMERS

4.3.2 DEVELOPMENT OF INSECT REARING AND PROCESSING EQUIPMENT

4.4 CHALLENGES

4.4.1 GROWING TREND FOR PLANT-BASED FOOD PRODUCTS

4.4.2 MICROBIAL AND TOXICITY RISKS ASSOCIATED WITH INSECTS

5 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE

5.1 OVERVIEW

5.2 BEETLES

5.3 CATERPILLARS

5.4 BEES

5.5 WASPS & ANTS

5.6 GRASSHOPERS

5.7 LOCUSTS

5.8 CRICKETS

5.9 TRUE BUGS

5.1 BLACK SOLDIER FLIES

5.11 CICADAS

5.12 LEAFHOPPERS

5.13 PLANTHOPPERS

5.14 SCALE INSECTS

5.15 TERMITES

5.16 DRAGONFLIES

5.17 FLIES

5.18 MEALWORMS

5.19 OTHERS

6 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 FEED

6.2.1 AQUATIC ANIMALS

6.2.2 PETS

6.2.3 POULTRY

6.2.4 SWINE

6.2.5 EQUINE

6.2.6 RUMINANTS

6.2.7 OTHERS

6.3 FOOD & BEVERAGE

6.3.1 BAKERY PRODUCTS

6.3.1.1 BREADS & ROLLS

6.3.1.2 BISCUITS & COOKIES

6.3.1.3 CAKES & MUFFINS

6.3.1.4 OTHERS

6.3.2 CONVENIENCE FOOD

6.3.2.1 SAVOURY SNACKS

6.3.2.2 PASTA & NOODLES

6.3.2.3 RTE MEALS

6.3.2.4 OTHERS

6.3.3 MEAT PRODUCTS & ANALOGS

6.3.3.1 MINCED MEAT

6.3.3.2 PATTIES & SAUSAGES

6.3.3.3 PATÉS

6.3.3.4 OTHERS

6.3.4 ENERGY BARS/PROTEIN BARS

6.3.5 GRANOLA

6.3.6 DAIRY PRODUCTS

6.3.7 RTM POWDER

6.3.8 BEVERAGES

6.3.9 OTHERS

6.4 PHARMACEUTICALS AND COSMETICS

7 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL

7.1 OVERVIEW

7.2 DIRECT

7.3 INDIRECT

7.3.1 STORE BASED RETAILERS

7.3.2 NON-STORE RETAILERS

8 NORTH AMERICA INSECT PROTEIN MARKET, BY REGION

8.1 NORTH AMERICA

8.1.1 U.S.

8.1.2 CANADA

8.1.3 MEXICO

9 NORTH AMERICA INSECT PROTEIN MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 ENVIROFLIGHT

11.1.1 COMPANY SNAPSHOT

11.1.2 COMPANY SHARE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 PROTIFARM

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT DEVELOPMENT

11.3 AGRIPROTEIN

11.3.1 COMPANY SNAPSHOT

11.3.2 COMPANY SHARE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENTS

11.4 ENTERRA FEED CORPORATION

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENT

11.5 ASPIRE FOOD GROUP

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 RECENT DEVELOPMENT

11.6 BETA HATCH

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 BIOFLYTECH

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 CHAPUL CRICKET PROTEIN

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 ENTOBEL

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 ENTOCYCLE

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 ENTOMO FARMS

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENT

11.12 NORTH AMERICA BUGS

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 HAOCHENG MEALWORMS INC.

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENT

11.14 HEXAFLY

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENT

11.15 INNOVAFEED

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 INSECTUM

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENT

11.17 NEXTPROTEIN

11.17.1 COMPANY SNAPSHOT

11.17.2 PRODUCT PORTFOLIO

11.17.3 RECENT DEVELOPMENT

11.18 PROTENGA PTE LTD

11.18.1 COMPANY SNAPSHOT

11.18.2 PRODUCT PORTFOLIO

11.18.3 RECENT DEVELOPMENT

11.19 PROTIFLY

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENT

11.2 PROTIX

11.20.1 COMPANY SNAPSHOT

11.20.2 PRODUCT PORTFOLIO

11.20.3 RECENT DEVELOPMENT

11.21 SEEK FOOD

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENT

11.22 THAILAND UNIQUE

11.22.1 COMPANY SNAPSHOT

11.22.2 PRODUCT PORTFOLIO

11.22.3 RECENT DEVELOPMENT

11.23 ŸNSECT

11.23.1 COMPANY SNAPSHOT

11.23.2 PRODUCT PORTFOLIO

11.23.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 NORTH AMERICA INSECT PROTEIN MARKET: VOLUME TABLE FOR INSECT PROTEIN SOLD AROUND THE GLOBE

TABLE 2 THE PRICE RANGE OF EQUIPMENT USED IN INSECT REARING AND PROCESSING

TABLE 3 COMPANIES OFFERING INSECT REARING AND PROCESSING EQUIPMENT AND TECHNOLOGY

TABLE 4 REGULATIONS FOR INSECT BASED FOOD AND FEED PRODUCT BY EUROPEAN UNION

TABLE 5 COST COMPARISON OF DIFFERENT PROTEIN SOURCES

TABLE 6 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 7 NORTH AMERICA BEETLES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 8 NORTH AMERICA CATERPILLARS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 9 NORTH AMERICA BEES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 10 NORTH AMERICA WASPS & ANTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 11 NORTH AMERICA GRASSHOPPERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 12 NORTH AMERICA LOCUSTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 13 NORTH AMERICA CRICKETS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 14 NORTH AMERICA TRUE BUGS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 15 NORTH AMERICA BLACK SOLDIERS FLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 16 NORTH AMERICA CICADAS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 17 NORTH AMERICA LEAFHOPPERS INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 18 NORTH AMERICA PLANT HOPPERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 19 NORTH AMERICA SCALE INSECTS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 20 NORTH AMERICA TERMITES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 21 NORTH AMERICA DRAGONFLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 22 NORTH AMERICA FLIES IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 23 NORTH AMERICA MEALWORMS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 24 NORTH AMERICA OTHERS IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 25 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 26 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 27 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY APPLICATION ,2018-2027 (USD THOUSAND )

TABLE 28 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 29 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 30 NORTH AMERICA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 31 NORTH AMERICA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 32 NORTH AMERICA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION,2018-2027 (USD THOUSAND )

TABLE 33 NORTH AMERICA PHARMACEUTICALS AND COSMETICS IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 34 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL ,2018-2027 (USD THOUSAND )

TABLE 35 NORTH AMERICA DIRECT IN INSECT PROTEIN MARKET, BY REGION,2018-2027 (USD THOUSAND )

TABLE 36 NORTH AMERICA NDIRECT IN INSECT PROTEIN MARKET, BY REGION, 2018-2027 (USD THOUSAND )

TABLE 37 NORTH AMERICA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL 2018-2027 (USD THOUSAND )

TABLE 38 NORTH AMERICA INSECT PROTEIN MARKET, BY COUNTRY, 2018-2027 (USD THOUSANDS)

TABLE 39 NORTH AMERICA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 40 NORTH AMERICA INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 41 NORTH AMERICA FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 42 NORTH AMERICA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 43 NORTH AMERICA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 44 NORTH AMERICA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 45 NORTH AMERICA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 46 NORTH AMERICA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 47 NORTH AMERICA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 48 U.S. INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 49 U.S. INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 50 U.S. FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 51 U.S. FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 52 U.S. BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 53 U.S. MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 54 U.S. CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 55 U.S. INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 56 U.S. INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 57 CANADA INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 58 CANADA INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 59 CANADA FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 60 CANADA FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 61 CANADA BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 62 CANADA MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 63 CANADA CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 64 CANADA INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 65 CANADA INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 66 MEXICO INSECT PROTEIN MARKET, BY INSECT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 67 MEXICO INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 68 MEXICO FEED IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 69 MEXICO FOOD & BEVERAGE IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 70 MEXICO BAKERY PRODUCTS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 71 MEXICO MEAT PRODUCTS & ANALOGS IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 72 MEXICO CONVENIENCE FOOD IN INSECT PROTEIN MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 73 MEXICO INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

TABLE 74 MEXICO INDIRECT IN INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSANDS)

List of Figure

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INSECT PROTEIN MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INSECT PROTEIN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INSECT PROTEIN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INSECT PROTEIN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INSECT PROTEIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INSECT PROTEIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INSECT PROTEIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA INSECT PROTEIN MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INSECT PROTEIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA INSECT PROTEIN MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR ALTERNATIVE PROTEIN SOURCES TO DRIVE THE NORTH AMERICA INSECT PROTEIN MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 BEETLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INSECT PROTEIN MARKET IN 2020 & 2027

FIGURE 13 PATENT REGISTERED FOR ACEROLA, BY COUNTRY

FIGURE 14 PATENT REGISTERED BY YEAR (1999-2019)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA INSECT PROTEIN MARKET

FIGURE 16 PERCENTAGE OF EDIBLE PART OF ANIMAL

FIGURE 17 ABUNDANCE OF EDIBLE INSECTS (IN %)

FIGURE 18 SALE OF THE U.S. PLANT-BASED MEAT (IN USD MILLION)

FIGURE 19 NORTH AMERICA INSECT PROTEIN MARKET: BY INSECT TYPE, 2019

FIGURE 20 NORTH AMERICA INSECT PROTEIN MARKET: BY APPLICATION, 2019

FIGURE 21 NORTH AMERICA INSECT PROTEIN MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 22 NORTH AMERICA INSECT PROTEIN MARKET: SNAPSHOT (2019)

FIGURE 23 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2019)

FIGURE 24 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA INSECT PROTEIN MARKET: BY COUNTRY (2019 & 2027)

FIGURE 26 NORTH AMERICA INSECT PROTEIN MARKET: BY TYPE (2020-2027)

FIGURE 27 NORTH AMERICA INSECT PROTEIN MARKET: COMPANY SHARE 2019 (%)

North America Insect Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Insect Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Insect Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.