North America Laboratory Filtration Market

Market Size in USD Billion

CAGR :

%

USD

1.05 Billion

USD

1.79 Billion

2025

2033

USD

1.05 Billion

USD

1.79 Billion

2025

2033

| 2026 –2033 | |

| USD 1.05 Billion | |

| USD 1.79 Billion | |

|

|

|

|

North America Laboratory Filtration Market Size

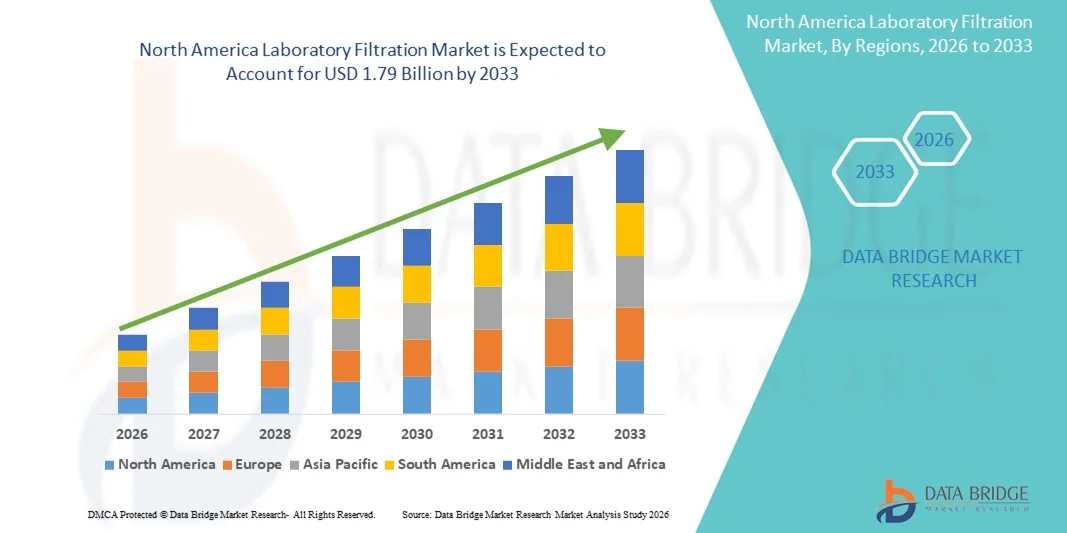

- The North America laboratory filtration market size was valued at USD 1.05 billion in 2025 and is expected to reach USD 1.79 billion by 2033, at a CAGR of 6.9% during the forecast period

- The market growth is largely fueled by increased demand for membrane-based filtration technologies, driven by expansion in biopharmaceuticals, stringent purity and quality requirements, and rising focus on biologics and downstream processing

- Furthermore, the region's strong pharmaceutical, biotechnology, and research infrastructure, including high regulatory standards and widespread adoption of advanced filtration methods for sterilization, purification, and analytical workflows, is supporting the rising adoption of laboratory filtration solutions

North America Laboratory Filtration Market Analysis

- Laboratory filtration, encompassing membrane- and media-based filtration systems for laboratories, is increasingly vital in modern research, pharmaceutical, and biotechnological workflows due to its role in ensuring sample purity, sterility, and reproducibility across analytical, diagnostic, and manufacturing applications

- The escalating demand for laboratory filtration is primarily fueled by growth in biopharmaceutical research, rising regulatory requirements for sample quality, and an increasing preference for high-throughput, reliable filtration solutions in laboratories

- The United States dominated the North America laboratory filtration market with the largest revenue share of 81.2% in 2025, characterized by advanced pharmaceutical and biotechnology infrastructure, high R&D investment, and a strong presence of key industry players, with substantial adoption across biotechnology companies, pharmaceutical companies, contract research organizations, and academic research institutes

- Canada is experiencing steady growth in laboratory filtration adoption due to increasing investments in diagnostic centers, food and beverage testing labs, and research institutes, supported by government initiatives and rising demand for high-quality lab consumables

- Filtration media dominated the North America laboratory filtration market in 2025 with a market share of 45%, driven by its essential role in microfiltration, ultrafiltration, and vacuum filtration applications, along with widespread use in disposable and reusable lab workflows across diverse end users

Report Scope and North America Laboratory Filtration Market Segmentation

|

Attributes |

North America Laboratory Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Laboratory Filtration Market Trends

Adoption of Advanced Membrane and Filtration Technologies

- A significant and accelerating trend in the North America laboratory filtration market is the increasing adoption of advanced filtration technologies such as microfiltration, ultrafiltration, and nano-filtration, which enhance efficiency, throughput, and reliability in laboratory workflows

- For instance, ultrafiltration systems are being widely implemented in biotechnology labs to concentrate proteins and remove impurities with high precision, improving downstream processing and analytical outcomes

- Integration with automated laboratory systems enables features such as reduced manual handling, consistent filtration performance, and improved sample reproducibility. For instance, some automated vacuum filtration units can filter multiple samples simultaneously while minimizing contamination risks

- The seamless adoption of membrane filtration technologies across biotechnology, pharmaceutical, and diagnostic laboratories facilitates standardized workflows, enabling consistent quality control and compliance with regulatory requirements

- This trend towards more automated, high-throughput, and precise filtration systems is reshaping laboratory operational expectations. Consequently, companies such as Merck and Sartorius are developing next-generation filtration assemblies with improved throughput, reliability, and compatibility with diverse laboratory instruments

- The demand for laboratory filtration systems that offer high precision, integration with automated workflows, and versatility across end users is growing rapidly across biotechnology companies, pharmaceutical firms, and research institutes

- Increasing focus on sustainability and reusable filtration products is driving innovation in eco-friendly filtration assemblies, reducing laboratory waste and operational costs. For instance, some new filtration assemblies are designed for repeated sterilization and use without compromising filtration efficiency

- The convergence of IoT-enabled laboratory instruments with filtration systems is emerging as a key trend, enabling real-time monitoring of filtration efficiency, predictive maintenance, and automated alerts for contamination or membrane replacement

North America Laboratory Filtration Market Dynamics

Driver

Rising Demand from Biotechnology and Pharmaceutical Research

- The increasing focus on biopharmaceutical development, clinical research, and quality control in laboratories is a significant driver for the heightened demand for advanced filtration solutions

- For instance, in March 2025, Merck introduced new sterile filtration membranes aimed at improving biologics manufacturing efficiency, helping pharmaceutical companies enhance product purity and compliance

- As research and production workflows expand, laboratory filtration systems offer high-throughput sample processing, reliable sterilization, and reproducible results, providing a compelling upgrade over conventional manual filtration techniques

- Furthermore, growing investments in laboratory infrastructure and the rising number of biotechnology startups are making high-performance filtration systems an integral component of research and development activities, offering seamless integration with automated lab workflows

- The demand for disposable and reusable filtration assemblies, along with advanced filtration accessories, is propelling adoption across biotechnology companies, pharmaceutical firms, and contract research organizations. The trend towards automation and integration with laboratory instruments further contributes to market growth

- Expansion of diagnostic centers and food & beverage testing labs in North America is fueling demand for reliable filtration technologies to meet stringent safety and quality standards. For instance, filtration solutions are increasingly used in clinical sample preparation and microbial testing

- Government and private funding for research initiatives is supporting adoption of high-end filtration technologies, enabling laboratories to implement more advanced filtration protocols for biopharmaceuticals and environmental monitoring

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- Concerns surrounding the high initial costs of advanced filtration systems and the need to comply with stringent regulatory standards pose significant challenges to market penetration. Advanced membrane technologies and automated filtration units are often expensive relative to basic filtration methods

- For instance, high costs associated with sterile filtration membranes and ultrafiltration devices may limit adoption in smaller laboratories or budget-conscious research facilities

- Addressing regulatory compliance, including FDA and ISO standards for laboratory filtration products, is crucial for market growth. Companies such as Sartorius and Pall emphasize certifications and compliance features to reassure end users

- While costs are gradually decreasing due to technological advancements and competition, the perceived premium for high-performance filtration solutions can hinder adoption, particularly in academic or emerging laboratory setups

- Overcoming these challenges through affordable product offerings, simplified compliance documentation, and increased awareness of the benefits of advanced filtration systems will be vital for sustained market growth

- Limited technical expertise in handling advanced filtration technologies can restrict adoption in smaller labs. For instance, training personnel to operate ultrafiltration and nano-filtration units safely and efficiently remains a critical challenge

- Variability in regulatory frameworks across North American countries adds complexity for manufacturers and end users, requiring localized compliance strategies. For instance, differences in FDA and Health Canada standards for lab consumables necessitate additional testing and certification

North America Laboratory Filtration Market Scope

The market is segmented on the basis of product, technology, utility, and end user.

- By Products

On the basis of products, the laboratory filtration market is segmented into filtration media, filtration assembly, and filtration accessories. The filtration media segment dominated the market with the largest revenue share of 45% in 2025, driven by its essential role in various filtration applications such as microfiltration, ultrafiltration, and vacuum filtration. Filtration media provides the primary barrier for contaminants and particles, ensuring sample purity and reproducibility. Laboratories prioritize high-quality membranes and filter papers to maintain consistency in research outcomes, regulatory compliance, and critical biopharmaceutical production processes. The widespread adoption across biotechnology companies, pharmaceutical firms, and diagnostic centers further solidifies its dominant position. Moreover, continuous innovation in membrane materials and pore-size customization has enhanced the efficiency and reliability of filtration media in analytical, clinical, and industrial laboratories.

The filtration assembly segment is expected to witness the fastest growth rate of 9% from 2026 to 2033, fueled by increasing automation and integration with laboratory instruments. Filtration assemblies, including preassembled cartridges and housings, offer convenience, reduce handling errors, and improve throughput in labs. Their growing use in contract research organizations (CROs) and academic institutes reflects the rising preference for ready-to-use solutions that save time and minimize contamination risks. Furthermore, innovations in modular and scalable assemblies allow labs to tailor filtration setups for specific applications, supporting the trend toward flexible, high-performance laboratory workflows.

- By Technology

On the basis of technology, the laboratory filtration market is segmented into microfiltration, ultrafiltration, vacuum filtration, nano filtration, and reverse osmosis. The microfiltration segment dominated the market in 2025 due to its widespread application in sterilization, clarification, and particle removal for research and clinical laboratories. Microfiltration membranes are highly reliable for removing bacteria, debris, and other contaminants while maintaining sample integrity. The segment’s dominance is further supported by its adoption in biotechnology companies and pharmaceutical manufacturing processes where reproducibility and compliance with regulatory standards are critical. In addition, the cost-effectiveness and versatility of microfiltration across both disposable and reusable utilities enhance its market leadership.

The ultrafiltration segment is expected to witness the fastest growth rate of 9–10% from 2026 to 2033, driven by rising demand in protein concentration, desalting, and biomolecule purification applications. Ultrafiltration is increasingly used in pharmaceutical and biotechnology R&D for its precision, efficiency, and ability to handle large volumes. The integration of ultrafiltration systems with automated lab instruments, including robotic liquid handling and high-throughput workflows, is contributing to its rapid adoption. The segment’s ability to support biopharmaceutical production, diagnostics, and academic research workflows is further accelerating its growth trajectory.

- By Utility

On the basis of utility, the laboratory filtration market is segmented into disposable and reusable filtration products. The disposable segment dominated the market with a 57% share in 2025 due to its convenience, reduced contamination risk, and compliance with stringent regulatory requirements. Disposable filtration products, including sterile filter units and single-use cartridges, are preferred in pharmaceutical manufacturing, diagnostic centers, and clinical laboratories where avoiding cross-contamination is critical. Their adoption is further driven by increasing automation in lab workflows, where single-use products simplify setup and reduce labor costs. In addition, the growing preference for disposable products in contract research organizations and biotech labs ensures consistent performance without the need for complex cleaning and sterilization procedures.

The reusable segment is expected to witness the fastest growth rate of 8% from 2026 to 2033, fueled by increasing focus on sustainability, cost efficiency, and eco-friendly laboratory practices. Reusable filtration units, including autoclaveable assemblies and membrane housings, allow multiple sterilization cycles while maintaining high filtration efficiency. The segment is gaining traction in academic research institutes and pharmaceutical process development labs that require scalable and environmentally conscious solutions. Continuous innovation in durable materials and compatibility with multiple filtration technologies supports its growing adoption across North America.

- By End User

On the basis of end users, the laboratory filtration market is segmented into biotechnology companies, pharmaceutical companies, food and beverage companies, contract research organizations, academic and research institutes, and diagnostic centers. The pharmaceutical companies segment dominated the market in 2025 due to high adoption of filtration systems in biologics manufacturing, sterile product preparation, and quality control processes. Filtration solutions are essential to maintain regulatory compliance, ensure product purity, and support high-throughput workflows in drug development and production. The dominance is reinforced by the large number of pharmaceutical manufacturing facilities and strong R&D investments in the United States and Canada. In addition, pharmaceutical companies often prefer integrated filtration assemblies and advanced membranes for consistency, reproducibility, and efficiency in production-scale operations.

The biotechnology companies segment is expected to witness the fastest growth rate of 11% from 2026 to 2033, driven by the rapid expansion of biotech startups and research activities in North America. Biotechnology firms require precise and high-throughput filtration solutions for protein purification, cell culture, and analytical testing. Increasing investments in R&D, focus on biologics, and adoption of automated workflows have accelerated the need for advanced filtration technologies. Furthermore, biotechnology companies prioritize flexible filtration setups that are compatible with multiple technologies, including microfiltration, ultrafiltration, and vacuum filtration, to support diverse research and production applications.

North America Laboratory Filtration Market Regional Analysis

- The United States dominated the North America laboratory filtration market with the largest revenue share of 81.2% in 2025, characterized by advanced pharmaceutical and biotechnology infrastructure, high R&D investment, and a strong presence of key industry players, with substantial adoption across biotechnology companies, pharmaceutical companies, contract research organizations, and academic research institutes

- Laboratories in the region highly value the precision, reliability, and reproducibility offered by advanced filtration technologies, including microfiltration, ultrafiltration, and vacuum filtration, which are critical for research, quality control, and biologics production

- This widespread adoption is further supported by substantial R&D investments, advanced laboratory infrastructure, and a strong presence of key industry players, establishing laboratory filtration systems as essential tools for both academic research institutes and commercial laboratories across the United States and Canada

U.S. Laboratory Filtration Market Insight

The U.S. laboratory filtration market captured the largest revenue share of 81.2% in 2025 within North America, fueled by the rapid expansion of pharmaceutical, biotechnology, and diagnostic research activities. Laboratories are increasingly prioritizing high-performance filtration solutions to ensure sample purity, sterility, and reproducibility in biologics development, quality control, and clinical testing. The growing adoption of automated laboratory systems, combined with robust demand for microfiltration, ultrafiltration, and vacuum filtration technologies, further propels the market. Moreover, stringent regulatory requirements from the FDA and other authorities are driving laboratories to upgrade to advanced filtration assemblies and media. The integration of filtration solutions with high-throughput analytical instruments and lab automation workflows is significantly contributing to market expansion.

Canada Laboratory Filtration Market Insight

The Canada laboratory filtration market is witnessing steady growth due to increasing investments in healthcare research, diagnostic laboratories, and food and beverage testing facilities. The country’s focus on maintaining high laboratory standards, coupled with adoption of disposable and reusable filtration systems, is fostering market expansion. Canadian laboratories are placing high importance on precision, efficiency, and contamination-free processes, particularly in biotechnology and pharmaceutical research. Government support for R&D and strong presence of research institutions further supports adoption. In addition, the integration of filtration assemblies with automated workflows and analytical instruments is enhancing laboratory productivity and accuracy. The growing emphasis on sustainable and eco-friendly filtration solutions is also driving the Canadian market.

Mexico Laboratory Filtration Market Insight

The Mexico laboratory filtration market is expected to grow at the fastest rate in North America during the forecast period, driven by the expansion of pharmaceutical manufacturing and clinical research activities. Increasing laboratory infrastructure across biotechnology, pharmaceutical, and academic sectors is boosting demand for high-quality filtration systems. Laboratories in Mexico are adopting advanced microfiltration, ultrafiltration, and nano-filtration technologies to improve sample quality and throughput. Rising regulatory awareness and government initiatives to enhance research capabilities are contributing to market growth. In addition, the trend toward integrating filtration assemblies with automated laboratory workflows is facilitating efficient operations. The availability of cost-effective filtration solutions tailored for emerging laboratories is further accelerating adoption across the country.

North America Laboratory Filtration Market Share

The North America Laboratory Filtration industry is primarily led by well-established companies, including:

- Pall Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cytiva (U.S.)

- 3M (U.S.)

- Sterlitech Corporation (U.S.)

- Graver Technologies LLC (U.S.)

- Repligen Corporation (U.S.)

- Cole-Parmer Instrument Company, LLC (U.S.)

- Agilent Technologies (U.S.)

- GE Healthcare (U.S.)

- Parker Hannifin Corporation (U.S.)

- Meissner Filtration Products (U.S.)

- Porvair Filtration Group (U.K.)

- GVS SpA (Italy)

- Advantec MFS, Inc. (U.S.)

- Donaldson Company, Inc. (U.S.)

- Koch Separation Solutions (U.S.)

- Foxx Life Sciences (U.S.)

- Phenomenex, Inc. (U.S.)

- Membrane Solutions (U.S.)

What are the Recent Developments in North America Laboratory Filtration Market?

- In February 2025, Thermo Fisher Scientific announced it will acquire Solventum’s Purification & Filtration business for USD 4.1 billion, bringing a broad filtration and membrane portfolio into its Life Sciences Solutions segment and significantly strengthening its bioprocessing‑filtration capabilities across biopharma, healthcare, and industrial filtration

- In September 2024, Sartorius AG introduced its new Vivaflow Tangential Flow Filtration Cassettes targeted at laboratory‑scale TFF operations. The launch aims to streamline tangential flow filtration workflows including clarification, concentration, and buffer exchange of proteins, viruses, and nanoparticles thereby enhancing efficiency for labs involved in R&D, biopharma, and diagnostics

- In September 2024, Repligen opened a new “Training & Innovation Center (RTIC)” at its Waltham, Massachusetts headquarters a dedicated 7,500 sq ft facility showcasing the company’s full suite of bioprocessing and filtration technologies. The center is intended to give biopharma and CDMO customers hands-on access, technical training, and demonstration of integrated filtration and downstream processing workflows

- In December 2023, according to a summary of market developments, there was a noted wave of new filtration‑related product introductions globally (which also supply the North American market), reflecting increased R&D and demand for lab-grade filtration underlining growing adoption of advanced filtration media, assemblies and technologies

- In November 2023, Repligen Corporation launched its first‑to‑market holder‑free, self‑contained tangential flow filtration (TFF) device TangenX SC designed for ultrafiltration/diafiltration (UF/DF) in biologics manufacturing. The “plug‑and‑play” device simplifies downstream filtration workflows, reduces setup time by ~80%, minimizes risk of product loss, and supports scalable production from pilot to process scale

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.