North America Laboratory Information Systems Lis Market

Market Size in USD Million

CAGR :

%

USD

660.41 Million

USD

1,335.36 Million

2024

2032

USD

660.41 Million

USD

1,335.36 Million

2024

2032

| 2025 –2032 | |

| USD 660.41 Million | |

| USD 1,335.36 Million | |

|

|

|

|

North America Laboratory Information Systems (LIS) Market Size

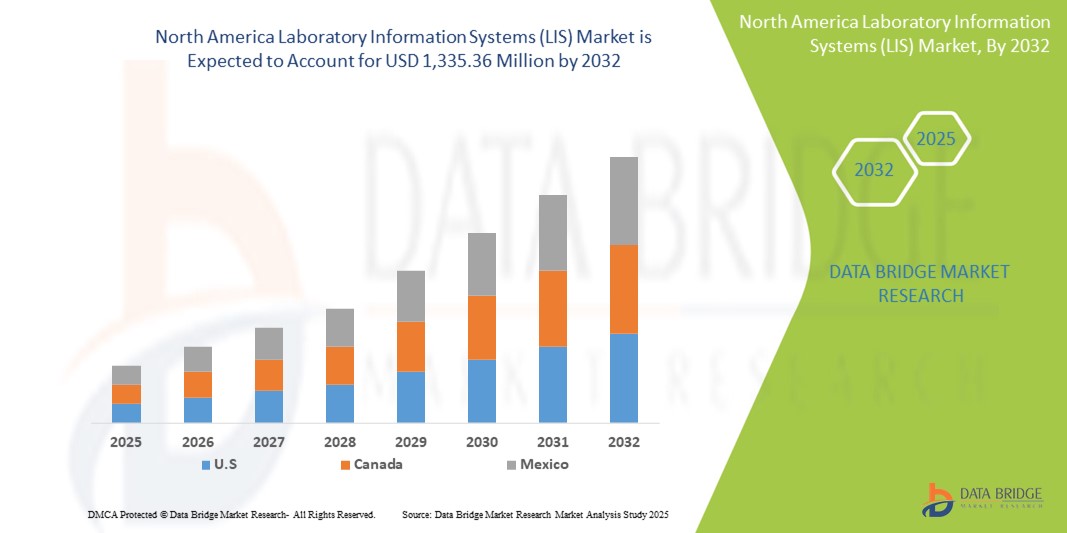

- The North America laboratory information systems (LIS) market size was valued at USD 660.41 million in 2024 and is expected to reach USD 1,335.36 million by 2032, at a CAGR of 9.20% during the forecast period

- The market growth is primarily driven by increasing demand for advanced diagnostic solutions, coupled with the growing volume of laboratory tests, which necessitate efficient data management and automation within clinical settings

- Moreover, rising adoption of cloud-based LIS platforms, regulatory pressure for accurate diagnostics, and integration with electronic health records (EHR) are encouraging healthcare providers to invest in robust laboratory informatics

North America Laboratory Information Systems (LIS) Market Analysis

- The North America laboratory information systems (LIS) market, offering digital platforms for managing laboratory data and optimizing diagnostic workflows, is becoming increasingly vital in healthcare settings across the United States, Canada, and Mexico, due to its ability to improve accuracy, streamline operations, and support regulatory compliance

- The growing demand for LIS is primarily fueled by the rising number of diagnostic tests, the push for healthcare digitalization, and the need for integrated systems that connect seamlessly with electronic health records (EHRs) and other clinical IT platforms

- U.S. dominated the North America laboratory information systems (LIS) market, with the largest revenue share of 42.7% in 2024, driven by early adoption of health IT solutions, strong government support, high test volumes, and a concentration of major LIS providers. The country continues to lead in LIS deployments, especially in large hospitals and diagnostic networks adopting automation and AI-powered analytics

- Canada is expected to be the fastest growing region in the North America laboratory information systems (LIS) market, supported by national digital health initiatives and increasing investments in laboratory infrastructure. Mexico is gradually advancing through modernization efforts in its public healthcare system, boosting LIS penetration in government labs and hospitals.

- The cloud-based LIS segment led the North America laboratory information systems (LIS) market with a share of 46.8% in 2024, owing to its scalability, cost efficiency, and suitability for small- to mid-sized laboratories

Report Scope and North America Laboratory Information Systems (LIS) Market Segmentation

|

Attributes |

North America Laboratory Information Systems (LIS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Laboratory Information Systems (LIS) Market Trends

“AI-Driven Automation and Cloud Integration Enhancing Lab Efficiency”

- A significant and accelerating trend in the North America LIS market is the growing integration of artificial intelligence (AI) and cloud-based infrastructure to modernize diagnostic workflows and improve laboratory efficiency across the United States, Canada, and Mexico. This technological advancement is transforming lab operations by offering enhanced accuracy, scalability, and real-time data access

- For instance, LabWare and Orchard Software have introduced AI-enhanced modules within their LIS platforms that support predictive diagnostics, automate repetitive tasks, and detect workflow anomalies. These capabilities help laboratories reduce turnaround times and ensure compliance with clinical standards

- AI-enabled LIS solutions also analyze historical test data to improve decision-making and can issue proactive alerts regarding quality control issues or potential diagnostic errors. Meanwhile, cloud deployment models allow for centralized data access, multi-location connectivity, and streamlined software updates—especially vital in large healthcare systems across the U.S.

- The growing need for interoperability and remote diagnostics has made cloud-based LIS increasingly essential. In Canada, digital health strategies support cross-institutional data sharing, further driving cloud adoption

- The integration of AI and cloud capabilities into LIS platforms is redefining expectations for laboratory systems, offering labs a unified, intelligent environment that enables automation, real-time reporting, and centralized oversight

- As healthcare systems across the region continue to prioritize digital transformation, the demand for advanced LIS platforms with AI-powered automation and scalable cloud functionality is expected to grow rapidly in both public and private sectors

North America Laboratory Information Systems (LIS) Market Dynamics

Driver

“Increased Diagnostic Volume and Push for Digital Healthcare Transformation”

- The increasing diagnostic workload across healthcare systems, combined with regional efforts toward digital healthcare modernization, is a major driver for LIS market growth in North America. Laboratories require robust data management solutions to handle high volumes of patient samples while maintaining speed and accuracy

- For instance, in March 2024, the U.S. Department of Health and Human Services introduced updated interoperability guidelines aimed at improving electronic data exchange, encouraging greater adoption of integrated LIS platforms across hospitals and diagnostic centers

- LIS solutions support automated sample tracking, result validation, and compliance monitoring, which are essential for labs operating under pressure. In Canada, national initiatives to enhance lab connectivity and reporting efficiency are also advancing LIS adoption

- As personalized medicine, molecular diagnostics, and genomics testing become more widespread, laboratories need intelligent systems capable of processing complex datasets. LIS platforms offering AI-powered tools and integration with EHR systems are increasingly favored in research centers and specialized labs across the region

- The widespread push for digital transformation, data-driven clinical decision-making, and quality assurance is expected to fuel the expansion of LIS adoption throughout North America in the coming years

Restraint/Challenge

“Data Security Concerns and Interoperability Barriers”

- Concerns over data privacy and cybersecurity vulnerabilities continue to challenge the broader deployment of LIS solutions in North America. Since LIS platforms handle highly sensitive patient and diagnostic data, they are frequently targeted by cyber threats and ransomware attacks

- For instance, several healthcare data breaches reported in the U.S. in 2023 raised alarm over the security of cloud-based systems and third-party software integrations. Ensuring compliance with HIPAA and other data protection laws is crucial to gaining user trust and mitigating risk

- Another persistent challenge is interoperability, particularly when LIS platforms must integrate with outdated EHR systems or laboratory instruments lacking standardized protocols. This can result in delayed implementations and increased IT complexity.

- In addition, the high initial cost of LIS implementation, ongoing maintenance, and customization requirements can be a financial barrier, especially for small and mid-sized labs. In Mexico, slower digital infrastructure development and limited budgets in public institutions further constrain market penetration

- To overcome these challenges, LIS providers must prioritize secure system architecture, promote adoption of common data standards, and offer more affordable, scalable solutions tailored to diverse laboratory needs across the region

North America Laboratory Information Systems (LIS) Market Scope

The market is segmented on the basis of component, product, delivery mode, and end user.

- By Component

On the basis of component, the North America laboratory information systems (LIS) market is segmented into software and services. The software segment dominated the market with the largest revenue share in 2024, attributed to the rising need for automation in laboratory operations and the integration of LIS platforms with electronic health records (EHRs). Software solutions are critical in enabling data-driven workflows, automated result validation, and compliance tracking, making them indispensable for modern clinical and diagnostic laboratories.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for LIS customization, software upgrades, training, and technical support. As laboratories seek to optimize and maintain their LIS environments, service providers are playing a growing role in ensuring system uptime and long-term performance.

- By Product

On the basis of product, the North America laboratory information systems (LIS) market is segmented into integrated LIS and standalone LIS. The integrated LIS segment held the largest revenue share in 2024 due to its seamless compatibility with broader healthcare IT systems, including EHRs, billing software, and clinical decision support tools. Integrated LIS platforms are increasingly adopted in hospital laboratories and large diagnostic centers for their centralized control and multi-department coordination capabilities.

The standalone LIS segment is expected to witness the fastest CAGR from 2025 to 2032, particularly in small to mid-sized labs that require dedicated laboratory information management without the complexity of full hospital integration. These systems are valued for their cost-effectiveness and ease of deployment in niche testing environments and specialized research labs.

- By Delivery Mode

On the basis of delivery mode, the North America laboratory information systems (LIS) market is segmented into cloud-based, remotely-hosted, and on-premise models. The cloud-based segment led the market with the highest revenue share of 46.8% in 2024, driven by its scalability, reduced infrastructure costs, and ability to support remote access across multi-site laboratory networks. Cloud-based LIS platforms are increasingly favored in the U.S. and Canada due to regulatory compliance, real-time data availability, and streamlined updates.

The remotely-hosted segment is expected to witness significant growth during the forecast period as it offers a middle ground between on-premise control and cloud flexibility. It appeals to labs that seek external hosting without full cloud dependency, particularly those with moderate IT capacity.

- By End User

On the basis of end user, the North America laboratory information systems (LIS) market is segmented into hospital laboratories, independent laboratories, physician office laboratories, and others. The hospital laboratories segment held the largest market share in 2024, supported by high patient volumes, regulatory mandates, and the need for integrated diagnostics and centralized data management in clinical settings.

The independent laboratories segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for outsourced diagnostic services, growing test complexity, and investments in automation. These labs often prioritize flexible LIS systems that support high-throughput operations and diverse testing menus.

North America Laboratory Information Systems (LIS) Market Regional Analysis

- The U.S. dominated the North America laboratory information systems (LIS) market, with the largest revenue share of 42.7% in 2024, driven by early adoption of health IT solutions, strong government support, high test volumes, and a concentration of major LIS providers. The country continues to lead in LIS deployments, especially in large hospitals and diagnostic networks adopting automation and AI-powered analytics

- U.S. laboratories prioritize integrated, AI-enabled LIS platforms that enhance efficiency, ensure compliance with HIPAA regulations, and enable seamless data exchange with EHR systems—making LIS a core component of clinical operations

- The region's collective growth is underpinned by increasing awareness of data-driven diagnostics, a need for laboratory workflow automation, and rising emphasis on quality control and reporting accuracy across clinical and research setting

U.S. North America Laboratory Information Systems (LIS) Market Insight

The U.S. laboratory information systems (LIS) market captured the largest revenue share of 78% in 2024 within North America, driven by the country’s highly digitized healthcare infrastructure and the rising volume of diagnostic testing. Hospitals, clinics, and research laboratories are increasingly deploying advanced LIS platforms to streamline operations, meet regulatory requirements, and enhance diagnostic accuracy. The push for interoperability, integration with electronic health records (EHR), and adoption of AI-powered analytics tools are further fueling demand. In addition, government initiatives such as interoperability mandates and funding for health IT modernization are supporting widespread LIS implementation across public and private healthcare sectors.

Canada North America Laboratory Information Systems (LIS) Market Insight

The Canada laboratory information systems (LIS) market is projected to grow at a robust CAGR throughout the forecast period, fueled by national digital health strategies and investments aimed at modernizing laboratory systems. Public and private healthcare providers are increasingly adopting cloud-based LIS solutions to improve data accessibility and reporting efficiency across provinces. The focus on interoperability, data standardization, and quality control is driving the adoption of integrated LIS platforms. Canada’s emphasis on decentralized and community-based healthcare delivery is also promoting LIS expansion in outpatient and remote care settings.

Mexico North America Laboratory Information Systems (LIS) Market Insight

The Mexico laboratory information systems (LIS) market is anticipated to witness steady growth during the forecast period, supported by efforts to upgrade healthcare IT infrastructure and digitize public laboratories. While challenges such as budget constraints and limited interoperability persist, the demand for scalable and affordable LIS solutions is increasing, particularly in government-run hospitals and diagnostic centers. Cloud-based LIS platforms are gaining traction due to their cost-effectiveness and low IT maintenance requirements. Mexico’s growing awareness of diagnostic accuracy, coupled with an expanding healthcare network, is expected to continue driving LIS adoption.

North America Laboratory Information Systems (LIS) Market Share

The North America laboratory information systems (LIS) industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina Inc. (U.S.)

- PerkinElmer (U.S.)

- Roper Technologies (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Autoscribe Informatics (U.K.)

- Benchling (U.S.)

- Eusoft Ltd (Portugal)

- Infor AG (U.S.)

- Kritisoft (India)

- Labvantage Solutions Inc. (U.S.)

- Labware (U.S.)

- McKesson Corporation (U.S.)

- Orchard Software Corporation (U.S.)

- Novatek International (Canada)

- Lqms (U.S.)

- Starlims Corporation (U.S.)

What are the Recent Developments in North America Laboratory Information Systems (LIS) Market?

- In April 2024, LabWare launched LabWare 8, the latest iteration of its enterprise LIMS/LIS platform, with enhanced machine learning and AI analytics modules that enable predictive diagnostics and anomaly detection—emphasizing its commitment to next-gen lab informatics

- In March 2024, Orchard Software Corporation formed a strategic partnership with a major U.S. health system to deploy its cloud-based LIS platform across multiple facilities. The implementation enhances EHR integration and centralized access—highlighting the growing shift toward scalable, cloud-enabled LIS infrastructure

- In June 2024, CompuGroup Medical USA released CGM LABDAQ v24.4, which introduces strengthened audit-report search, microbiology and billing rules engines, and auto-verification—underscoring advancements in AI and rule-based lab workflows.Shortly after, CGM LABDAQ was named Best Laboratory Information System 2024 by Lighthouse Lab Services, validating its intuitive interface and reporting excellence

- In January 2024, Sunquest Information Systems (under Clinisys) integrated its LIS with genomic data platforms at a major U.S. academic medical center, enabling seamless management of high-complexity genetic testing workflows and reinforcing the trend toward precision medicine

- In December 2023, Cerner Corporation (Oracle Health) initiated a LIS modernization program across select U.S. hospital networks, focusing on interoperability enhancements, improved UX, and adherence to regulatory standards—demonstrating sustained investment in next-gen lab informatics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: REGULATIONS

5.1 REGULATORY GUIDELINES AND STANDARDS IN UNITED STATES: U.S. FOOD AND DRUG ADMINISTRATION (FDA)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE REQUIREMENT OF QUICK-DECISION MAKING PROCESS IN BIOTECHNOLOGY

6.1.2 RISING DEMAND FOR ADVANCED COMPUTATIONAL TOOLS IN RESEARCH LABORATORY

6.1.3 RISING USE OF LIMS FOR COMPLIANCE WITHOUT SACRIFICING FLEXIBILITY

6.1.4 INTEGRATION OF ADVANCED TECHNOLOGIES SUCH AS AI, MACHINE LEARNING

6.2 RESTRAINTS

6.2.1 HIGHER COST OF DATA MANAGEMENT & SOFTWARE

6.2.2 LACK OF WELL-DEFINED STANDARD FORMAT FOR DATA INTEGRATION

6.2.3 STRINGENT REGULATION BY GOVERNMENT ENTITLES IN INFORMATICS DOMAIN

6.3 OPPORTUNITIES

6.3.1 INCREASING STRATEGIC DECISIONS

6.3.2 ADVANCEMENTS IN R&D LABS SPECIALLY IN PHARMACEUTICAL SECTOR

6.3.3 INCREASE IN VARIOUS INITIATIVES FROM GOVERNMENT AS WELL AS PRIVATE SECTORS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED & TRAINED PROFESSIONALS TO USE THE COMPUTATIONAL TOOLS

6.4.2 DATA COMPLEXITY & LACK OF USER FRIENDLY TOOLS

7 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 INTEGRATED LIS

7.3 STANDALONE LIS

8 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 SERVICE

8.3 SOFTWARE

8.3.1 SAMPLE MANAGEMENT SOFTWARE

8.3.2 REPORTING SOFTWARE

8.3.3 WORKFLOW MANAGEMENT SOFTWARE

8.3.4 EMR/EHR SOFTWARE

8.3.5 OTHERS SOFTWARE

9 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY

9.1 OVERVIEW

9.2 CLOUD-BASED

9.3 REMOTELY-HOSTED

9.4 ON-PREMISE

10 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL LABORATORIES

10.3 INDEPENDENT LABORATORIES

10.4 PHYSICIAN OFFICE LABORATORIES

10.5 OTHERS

11 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ROPER TECHNOLOGIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMAPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 PERKINELMER INC

14.3.1 COMPANY SNAPSHOT

14.3.2 COMAPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ILLUMINA INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMAPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 AGILENT TECHNOLOGIES, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMAPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AGARAM TECHNOLOGIES PVT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AUTOSCRIBE INFORMATICS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BENCHLING

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COMPUGROUP MEDICAL

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.9.5 CLINISYS

14.9.6 COMPANY SNAPSHOT

1.1.4 PRODUCT PORTFOLIO 120

14.9.7 RECENT DEVELOPMENT

14.1 EPIC SYSTEMS CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 EUSOFT

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INFORS AG

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KRITILIMS.IN

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 LABSOLS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LQMS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 MCKESSON CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 NOVATEK INTERNATIONAL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SHIMADZU CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 SIEMENS AG

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 STARLIMS CORPORATION

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 2 NORTH AMERICA INTEGRATED LIS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 3 NORTH AMERICA STANDALONE LIS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 4 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 8 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA CLOUD-BASED IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 NORTH AMERICA REMOTELY-HOSTED IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA ON-PREMISE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA HOSPITAL LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 NORTH AMERICA INDEPENDENT LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 NORTH AMERICA PHYSICIAN OFFICE LABORATORIES IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 19 NORTH AMERICA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 20 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 21 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 22 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 23 U.S. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 24 U.S. SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 25 U.S. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 26 U.S. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 27 U.S. LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 28 CANADA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 29 CANADA SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 30 CANADA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 31 CANADA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 32 CANADA LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 33 MEXICO LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 34 MEXICO SOFTWARE IN LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 35 MEXICO LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 36 MEXICO LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY DELIVERY, 2022-2031 (USD MILLION)

TABLE 37 MEXICO LABORATORY INFORMATION SYSTEMS (LIS) MARKET, BY END USER, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET , BY COMPONENT

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISION

FIGURE 14 INCREASE IN THE REQUIREMENT OF QUICK-DECISION MAKING PROCESS IN BIOTECHNOLOGY IS DRIVING THE GROWTH OF THE NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET FROM 2024 TO 2031

FIGURE 15 THE SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET IN 2024 AND 2031

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR NORTH AMERICA LABORATORY INFORMATION MANAGEMENT SYSTEMS MARKET

FIGURE 17 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, 2023

FIGURE 18 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, 2024-2031 (USD MILLION)

FIGURE 19 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 20 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, 2023

FIGURE 22 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, 2024-2031 (USD MILLION)

FIGURE 23 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, CAGR (2024-2031)

FIGURE 24 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, 2023

FIGURE 26 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, 2024-2031 (USD MILLION)

FIGURE 27 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, CAGR (2024-2031)

FIGURE 28 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY DELIVERY, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, 2023

FIGURE 30 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 31 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 32 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: SNAPSHOT (2023)

FIGURE 34 NORTH AMERICA LABORATORY INFORMATION SYSTEMS (LIS) MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.