North America Laryngoscopes Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

2.44 Billion

2024

2032

USD

1.07 Billion

USD

2.44 Billion

2024

2032

| 2025 –2032 | |

| USD 1.07 Billion | |

| USD 2.44 Billion | |

|

|

|

|

North America Laryngoscopes Market Size

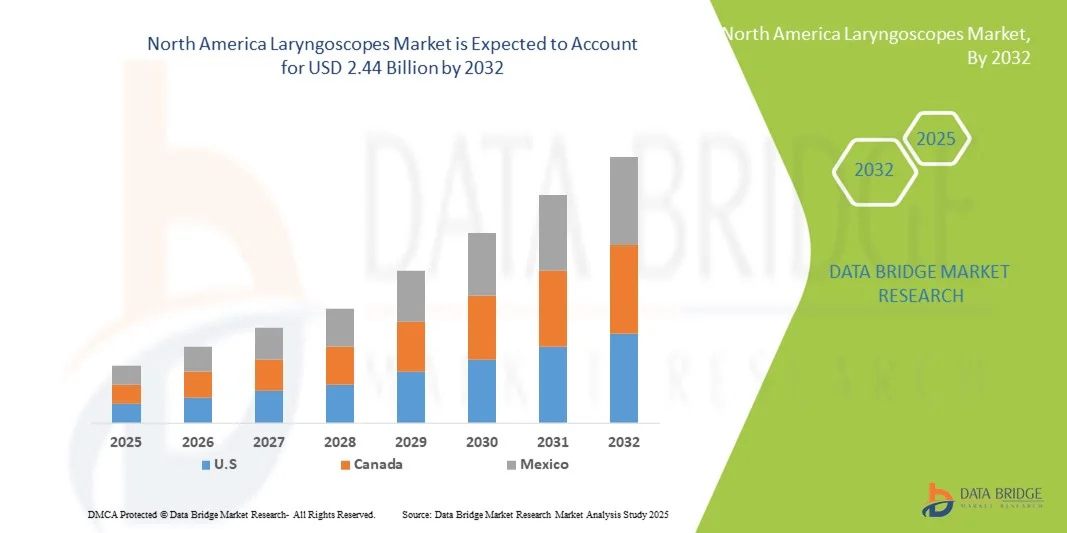

- The North America laryngoscopes market size was valued at USD 1.07 billion in 2024 and is expected to reach USD 2.44 billion by 2032, at a CAGR of 10.9% during the forecast period

- The market growth is largely fueled by the increasing prevalence of respiratory diseases, rising demand for emergency medical services, and technological advancements in medical devices, leading to greater adoption of laryngoscopes in hospitals, clinics, and emergency care settings

- Furthermore, rising demand for user-friendly, accurate, and efficient airway management solutions is positioning laryngoscopes as a critical tool for healthcare professionals, accelerating the uptake of advanced devices and significantly boosting the industry's growth

North America Laryngoscopes Market Analysis

- Laryngoscopes, essential devices for airway management and intubation in medical procedures, are increasingly critical in hospitals, ambulatory surgical centers, and emergency care settings, driven by the rising prevalence of respiratory and surgical interventions

- The growing demand for advanced laryngoscopy devices is fueled by the rising incidence of respiratory disorders, increasing surgical procedures, and the adoption of video laryngoscopes that offer improved visualization and patient safety

- The United States dominated the laryngoscopes market with the largest revenue share of 34.8% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and strong adoption of innovative medical devices, with major growth in video laryngoscope installations in operating rooms and emergency departments, driven by technological advancements from both established medical device manufacturers and innovative startups

- Canada is expected to be the fastest growing country in the North America laryngoscopes market during the forecast period due to rising healthcare expenditure, expanding hospital networks, and increasing awareness of advanced airway management solutions

- Video laryngoscope segment dominated the market with a market share of 46.5% in 2024, driven by superior visualization, enhanced patient safety, and growing preference among anesthesiologists and emergency care professionals for minimally invasive intubation techniques

Report Scope and North America Laryngoscopes Market Segmentation

|

Attributes |

North America Laryngoscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Laryngoscopes Market Trends

Increasing Adoption of Video and AI-Assisted Laryngoscopy

- A significant and accelerating trend in the North America laryngoscopes market is the rising adoption of video laryngoscopes and AI-assisted intubation systems, enhancing visualization and procedural accuracy for clinicians

- For instance, the GlideScope video laryngoscope allows anesthesiologists to obtain a clear airway view on a digital screen, improving success rates in difficult intubations. Similarly, McGRATH MAC provides real-time imaging and ergonomic design for easier handling

- AI integration in laryngoscopes enables features such as automated glottis detection, guidance for optimal blade placement, and predictive intubation analytics, improving patient safety. For instance, some King Vision models leverage AI to assist in visual recognition and suggest positioning adjustments during critical procedures

- Integration with hospital digital platforms allows centralized monitoring and record-keeping of intubation procedures, supporting training, compliance, and quality control across multiple departments. Clinicians can review procedure data alongside patient vitals for improved workflow efficiency

- This trend towards more intelligent, connected, and user-friendly airway management tools is shaping clinician expectations and procedural standards. Consequently, companies such as Verathon are developing AI-enabled laryngoscopes with features such as automatic glottis detection and video recording for training purposes

- The demand for video and AI-assisted laryngoscopes is growing rapidly across hospitals, ambulatory surgical centers, and emergency departments, as healthcare providers increasingly prioritize patient safety and procedural efficiency

North America Laryngoscopes Market Dynamics

Driver

Rising Surgical Procedures and Advanced Healthcare Infrastructure

- The increasing volume of surgical procedures, emergency care interventions, and ICU admissions is a significant driver for the heightened demand for advanced laryngoscopes

- For instance, in March 2024, Medtronic announced the launch of enhanced video laryngoscope systems for U.S. hospitals, aiming to improve procedural outcomes and workflow efficiency in operating rooms and emergency departments. Such initiatives by key companies are expected to drive laryngoscope market growth in the forecast period

- Growing awareness of patient safety and the need for reliable airway management in complex procedures is encouraging adoption of video and AI-assisted laryngoscopes. For instance, clinicians increasingly prefer King Vision devices for high-risk intubations due to improved visualization and accuracy

- Expansion of hospital networks, adoption of technologically advanced medical devices, and government initiatives to upgrade healthcare infrastructure are further supporting market growth. Hospitals are integrating modern laryngoscopes as part of broader investment in digital operating room technologies

- The convenience of enhanced visualization, reduced intubation attempts, and improved procedural training for healthcare professionals are key factors propelling the adoption of advanced laryngoscopes in the U.S. and Canada. The growing preference for minimally invasive and safer airway management solutions further contributes to market expansion

Restraint/Challenge

High Device Cost and Training Requirements

- The relatively high cost of advanced video and AI-assisted laryngoscopes poses a challenge to widespread adoption, particularly in smaller clinics and budget-constrained hospitals. As these devices integrate advanced imaging, AI, and digital monitoring, purchase and maintenance costs remain higher than traditional direct laryngoscopes

- For instance, some U.S. hospitals report slower adoption rates of premium GlideScope or McGRATH MAC devices due to upfront investment concerns, despite clinical advantages

- In addition, specialized training is required for clinicians to efficiently operate video and AI-assisted laryngoscopes, which may slow implementation in emergency and high-turnover healthcare environments. For instance, hospitals conduct structured workshops for King Vision users to ensure procedural competence and safety

- The need for regular software updates, device calibration, and integration with hospital IT systems adds to operational challenges and may hinder adoption among facilities with limited technical support

- Overcoming these challenges through cost reduction strategies, enhanced clinician training programs, and simplified user interfaces will be crucial for sustained growth and broader acceptance of advanced laryngoscopes in North America

North America Laryngoscopes Market Scope

The market is segmented on the basis of type, visualization system, accessories, application, and end user.

- By Type

On the basis of type, the North America laryngoscopes market is segmented into flexible and rigid laryngoscopes. The rigid laryngoscope segment dominated the market with the largest revenue share of 55.3% in 2024, driven by its widespread use in surgical procedures and emergency airway management. Rigid laryngoscopes are preferred for their durability, reliability, and ease of handling in operating rooms. The segment also benefits from strong clinician familiarity, extensive availability of compatible blades, and integration with video systems for improved visualization. Hospitals and surgical centers increasingly invest in rigid laryngoscopes due to their versatility across diagnostic and surgical applications. Ongoing innovations in ergonomics, material quality, and digital integration further strengthen the dominance of rigid laryngoscopes in North America.

The flexible laryngoscope segment is expected to witness the fastest growth rate of 20.8% from 2025 to 2032, fueled by rising demand in specialty clinics and ambulatory centers for minimally invasive procedures. Flexible laryngoscopes provide superior maneuverability and access to difficult airway structures, making them ideal for complex diagnostic and ENT procedures. Increasing awareness of patient comfort, reduced trauma during intubation, and advancements in fiber-optic technology are driving adoption. The segment is also gaining traction due to integration with video imaging and AI-assisted guidance, improving procedural accuracy. Rising use in outpatient procedures and growing clinician training programs contribute to the rapid growth of flexible laryngoscopes.

- By Visualization System

On the basis of visualization system, the market is segmented into video laryngoscopes, standard laryngoscopes, and fiber laryngoscopes. The video laryngoscope segment dominated the North America market with a 46.5% revenue share in 2024, driven by superior airway visualization, enhanced patient safety, and reduced intubation complications. Video laryngoscopes are widely adopted in hospitals, surgical centers, and emergency departments for difficult airway management. The segment benefits from increasing investments in advanced medical devices, integration with digital operating room platforms, and growing clinician preference for real-time visual guidance. Ongoing innovations such as AI-assisted glottis detection, high-definition imaging, and ergonomic designs further reinforce the dominance of video laryngoscopes. Hospitals and emergency units increasingly rely on video laryngoscopes for standardized airway management protocols.

The fiber laryngoscope segment is anticipated to witness the fastest growth rate of 22.1% during 2025–2032, due to its specialized applications in ENT diagnostics, minimally invasive procedures, and airway examinations. Fiber laryngoscopes offer high flexibility, portability, and patient comfort, making them increasingly preferred in outpatient and specialty settings. Integration with video recording, telemedicine platforms, and AI guidance is expanding the utility of fiber laryngoscopes. Rising awareness of non-invasive airway evaluation techniques and enhanced clinician training programs also support rapid growth. The segment’s adoption is further accelerated by technological improvements in illumination and image clarity.

- By Accessories

On the basis of accessories, the North America laryngoscopes market is segmented into handles, blades, fibre bundles, shell and caps, sets and kits, cytology brushes, bulbs, battery holders, bags, and others. The blades segment dominated the market with a largest share of 38.7% in 2024, owing to its critical role in performing precise intubations and airway visualizations. High demand from hospitals and surgical centers, coupled with frequent replacement requirements, drives blade sales. The segment also benefits from innovations in materials, such as stainless steel and disposable options, improving hygiene and safety. Compatibility with multiple laryngoscope handles and integration with video systems further enhances adoption. Hospitals and emergency care units prioritize high-quality blades to minimize patient trauma and improve procedural outcomes.

The sets and kits segment is expected to witness the fastest growth rate of 21.5% during 2025–2032, driven by the increasing need for ready-to-use, comprehensive airway management solutions in hospitals and emergency care units. Sets and kits typically combine handles, blades, and accessories, enabling clinicians to perform procedures efficiently with minimal preparation. The growing trend of standardizing airway management tools in surgical and emergency protocols is fueling the segment. Advances in portable and modular sets, especially for ambulatory and specialty centers, further support rapid adoption. Training and workflow efficiency improvements also drive the demand for sets and kits.

- By Application

On the basis of application, the market is segmented into diagnostic and surgical applications. The surgical application segment dominated the North America market with a revenue share of 59.2% in 2024, due to the critical role of laryngoscopes in anesthesia, airway management, and ENT procedures. Hospitals and surgical centers rely heavily on advanced laryngoscopes for precise, safe, and minimally invasive surgeries. The segment benefits from rising surgical volumes, adoption of video and AI-assisted laryngoscopes, and stringent clinical safety protocols. Surgeons increasingly prefer video-guided intubations for complex cases, reinforcing the dominance of the surgical segment. Ongoing R&D in visualization, ergonomics, and AI-assisted guidance strengthens the segment’s position.

The diagnostic application segment is expected to witness the fastest growth rate of 19.9% from 2025 to 2032, driven by expanding use in ENT clinics, outpatient facilities, and respiratory disorder evaluations. Flexible and fiber-optic laryngoscopes are increasingly used for non-invasive airway inspections, early disease detection, and routine diagnostics. Rising awareness of patient comfort, adoption of minimally invasive techniques, and technological integration with imaging platforms further boost growth. Training programs and increasing outpatient procedure volumes are accelerating adoption. The segment is further supported by growing demand for portable and compact laryngoscopy devices.

- By End User

On the basis of end user, the North America laryngoscopes market is segmented into hospitals, specialty clinics, ambulatory centers, surgical centers, and others. The hospitals segment dominated the market with a 61.3% revenue share in 2024, supported by high patient volumes, diverse procedural requirements, and investment in advanced airway management equipment. Hospitals benefit from centralized purchasing, availability of skilled clinicians, and integration of laryngoscopes with digital operating room systems. The segment is also reinforced by the adoption of AI and video-assisted laryngoscopes to enhance patient safety and operational efficiency. High surgical volumes, emergency care needs, and regulatory compliance further strengthen hospital dominance.

The specialty clinics segment is anticipated to witness the fastest growth rate of 20.4% during 2025–2032, fueled by rising demand for ENT, respiratory, and outpatient airway procedures. Specialty clinics increasingly adopt flexible, fiber-optic, and portable laryngoscopes for patient convenience and minimally invasive diagnostics. Growing awareness of non-surgical airway evaluations, increasing patient footfall, and adoption of advanced visualization technologies contribute to rapid growth in this segment. Technological improvements in portability, imaging, and ergonomics accelerate adoption. Training programs and specialized procedural applications also support segment expansion.

North America Laryngoscopes Market Regional Analysis

- The U.S. dominated the laryngoscopes market with the largest revenue share of 34.8% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and strong adoption of innovative medical devices, with major growth in video laryngoscope installations in operating rooms and emergency departments, driven by technological advancements from both established medical device manufacturers and innovative startups

- Hospitals, surgical centers, and emergency care units in the U.S. prioritize patient safety and procedural efficiency, contributing to strong demand for video and AI-assisted laryngoscopes

- This dominance is further supported by increasing surgical volumes, rising prevalence of respiratory and airway-related disorders, and strong adoption of minimally invasive procedures requiring advanced laryngoscopy devices

Canada Laryngoscopes Market Insight

The Canada laryngoscopes market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing healthcare spending and the expansion of hospital networks. Growing awareness of advanced airway management techniques and patient safety is encouraging the adoption of video laryngoscopes and flexible devices. Canada’s healthcare system emphasizes standardization and quality of care, fostering investment in modern laryngoscopy equipment. The market is witnessing growth across diagnostic, surgical, and emergency care applications, with both new installations and replacements of older devices. Clinician training programs and government funding initiatives further stimulate market demand. Integration of laryngoscopes with digital patient monitoring and electronic health record systems enhances procedural efficiency and compliance.

Mexico Laryngoscopes Market Insight

The Mexico laryngoscopes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing investments in healthcare infrastructure and modernization of hospitals. Rising awareness of airway management procedures, coupled with expanding surgical volumes, supports the adoption of advanced laryngoscopy systems. Mexico’s growing private healthcare sector and emerging specialty clinics are contributing to market expansion. Video and AI-assisted laryngoscopes are becoming increasingly preferred due to improved visualization and patient safety. Training programs for clinicians and rising outpatient procedures further enhance adoption. In addition, collaborations between local distributors and international medical device manufacturers strengthen market accessibility and availability.

North America Laryngoscopes Market Share

The North America Laryngoscopes industry is primarily led by well-established companies, including:

- KARL STORZ SE & Co. KG (Germany)

- Olympus Corporation (Japan)

- Medtronic (Ireland)

- Teleflex Incorporated (U.S.)

- Ambu A/S (Denmark)

- Verathon Inc. (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Stryker (U.S.)

- Smiths Medical (U.S.)

- Hill-Rom Holdings, Inc. (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Baxter (U.S.)

- Heine Optotechnik GmbH & Co. KG (Germany)

- Penlon Ltd. (U.K.)

- Flexicare Medical Ltd. (U.K.)

- Rudolf Riester GmbH (Germany)

- Clarus Medical LLC (U.S.)

- Intersurgical Ltd. (U.K.)

- Vivid Medical, Inc. (U.S.)

- UE Medical Devices, Inc. (U.S.)

What are the Recent Developments in North America Laryngoscopes Market?

- In July 2025, Verathon introduced the GlideScope ClearFit, a cover-based video laryngoscope designed for cost-effective airway management. It combines a reusable video baton with single-use covers in various styles, including Mac, Miller, and Hyperangle, to cater to diverse patient needs and clinical settings

- In April 2025, Karl Storz introduced the Slimline C-MAC S single-use video laryngoscope, featuring a slimmer profile for enhanced maneuverability and clear imaging. Designed for challenging intubations, it combines a reusable imager with a single-use blade to reduce electronic waste and material usage. This launch underscores Karl Storz's commitment to advancing airway management solutions

- In October 2024, Verathon launched its first single-use video laryngoscope made with bio-based plastics, aiming to reduce environmental impact while maintaining the trusted performance of GlideScope. This innovation reflects Verathon's commitment to sustainability in medical device manufacturing

- In June 2024, AirLife announced a partnership with HEINE to distribute the visionPRO video laryngoscope in North America. This collaboration enhances AirLife's portfolio, providing healthcare providers with advanced airway management solutions

- In June 2023, Teleflex entered into an exclusive distribution agreement with Shenzhen Insighters Medical Technology Co., Ltd. for the Insighters Video Laryngoscope system in the U.S. This partnership aims to expand Teleflex's airway management offerings with innovative video laryngoscopy solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.