North America Liquid Biopsy Market Analysis and Insights

The increasing awareness of advanced diagnostic technology North America has enhanced the demand for the market. The rising healthcare expenditure for better health services also contributes to the market's growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increase in improved advancement of processes and techniques also contributes to the rising demand for liquid biopsy.

The North America liquid biopsy market is expected to grow in the forecast year due to the rise in market players and the availability of advanced services. Along with this, manufacturers are engaged in the developmental activity for launching novel services in the market. The increasing development in the field of advanced healthcare techniques is further boosting market growth.

However, difficulties such as the lack of standardized protocols and the lack of skilled professionals might hamper the growth of the North America liquid biopsy market in the forecast period.

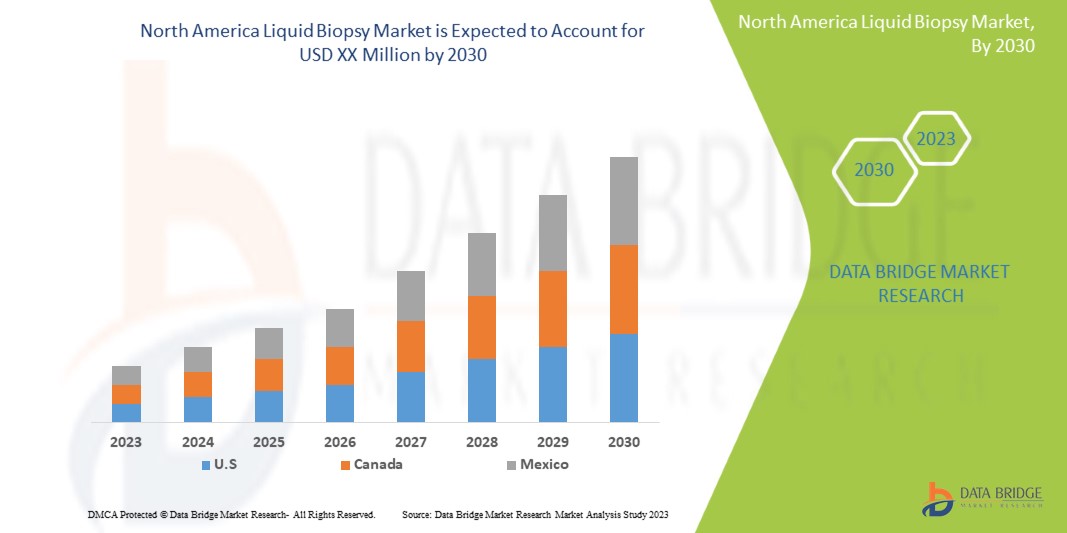

Data Bridge Market Research analyzes that the North America liquid biopsy market is expected to grow at a CAGR of 15.9% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015- 2020) |

|

Quantitative Units |

Revenue in Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Instruments, Consumables & Accessories, Services & Software), Biomaker Type (Circulating Tumor Cells (CTCS), Circulating Cell-Free DNA (CFDNA), Cell-free RNA, Extracellular Vesicles, Exosomes, and Others), Sample Type (Blood Sample-Based, Urine Sample-Based, Saliva & Other Tissue Fluid Sample-Based, and Others), Analytical Type (Molecular, Proteomics, and Histology/Imaging), Application Type (Cancer Applications and Non-Cancer Applications), Clinical Application (Routine Screening, Patient Work-Up, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, and Others), Technology (Multi-Gene Parallel Analysis, and Single-Gene Analysis), End User (Hospitals, Reference Laboratories, Diagnostic Centers, Research Centers & Academic Institutes, and Others), Distribution Channel (Direct Tender, Third Party Distributor, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

F. Hoffmann-La Roche Ltd, Guardant Health, Thermo Fisher Scientific Inc., Exact Sciences Corporation(Genomic health), QIAGEN, Labcorp, Johnson & Johnson Services, Inc., Illumina Inc, mdxhealth, NeoGenomics Laboratories, Bio-Rad Laboratories, Inc., Natera, Inc., CARDIFF ONCOLOGY, INC., PathAI, STRECK, BIOCEPT, INC., Sysmex Inostics Inc., Fluxion Biosciences Inc, Epic Sciences, and Predicine, ANGLE plc, Oncocyte Corporation among others |

Market Definition

A liquid biopsy is a medical test that involves the analysis of various biomolecules, such as DNA, RNA, proteins, and other substances in a patient's blood or other bodily fluids, to diagnose and monitor various medical conditions, including cancer. Unlike traditional biopsies that involve the removal of tissue samples from the body, a liquid biopsy is non-invasive and can provide important diagnostic information without the need for surgery or other invasive procedures. Liquid biopsies are still in the early stages of development but hold promise for improving the detection and management of cancer and other diseases.

North America Liquid Biopsy Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below

Drivers

- Growing demand for non-invasive liquid biopsy technique

Liquid biopsies consist of isolating tumor-derived entities such as circulating tumor cells, circulating tumor DNA, and tumor extracellular vesicles among others, present in the body fluids of patients with cancer, followed by an analysis of genomic and proteomic data contained within them. Methods for isolation and analysis of liquid biopsies have rapidly evolved over the past few years, as described in the review, thus providing greater details about tumor characteristics such as mutations, tumor staging, tumor progression, heterogeneity, and gene and clonal evolution, among others. Liquid biopsies from cancer patients have opened up newer avenues in detection and continuous monitoring, treatment based on precision medicine, and screening of markers for therapeutic resistance. Non-invasive cancer diagnostics offer a safer and more patient-friendly approach, resulting in a growing demand for these methods.

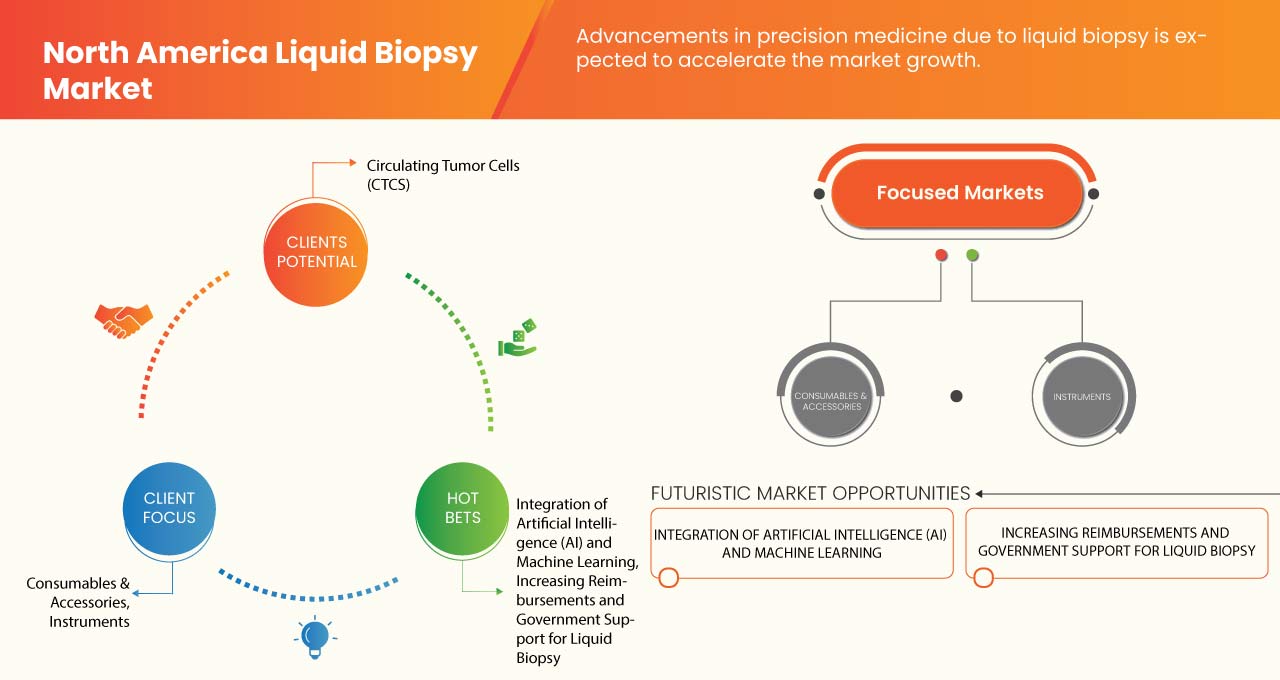

- Advancements in precision medicine due to liquid biopsy

Precision medical oncology in the clinical management of cancer may be achieved through the diagnostic platform called "liquid biopsy" (LB). The LB was recognized as a powerful real-time approach for the molecular monitoring of this dynamic cancer disease. This method utilizes the detection of Biomakers in blood for prognostic and predictive purposes by non-invasive means, which in the near future will represent a change in the paradigm of molecular biology understanding and the heterogeneity of tumors. Advancements in precision medicine, fueled by the use of liquid biopsy techniques, have contributed significantly to the growing demand for non-invasive cancer diagnostics. Liquid biopsy techniques, such as the analysis of circulating tumor DNA (ctDNA), Circulating Tumor Cells (CTCs), or exosomes in blood or other body fluids, provide valuable information about the genetic makeup of tumors, enabling precision medicine approaches in cancer care.

Opportunity

- Integration of Artificial Intelligence (AI) and machine learning

Liquid biopsy-based approaches offer many new opportunities to measure molecular Biomakers for diagnosing, prognosis, and monitoring disease. Artificial Intelligence (AI), such as machine learning, and its ability to identify signatures of specific disease states in multiplexed data will be key to taking advantage of the new molecular information that microchip-based diagnostics can extract.

Thus, the integration of AI and machine learning is expected to act as an opportunity for the growth of the market.

- Increasing reimbursements and government support for liquid biopsy

The adoption of liquid biopsy has been significantly influenced by government backing. Governments throughout the world have put legislation in place to encourage the adoption of liquid biopsy because they understand how it may enhance patient care, lower healthcare costs, and advance precision medicine. Incorporating liquid biopsy into national cancer screening programs or treatment recommendations is only one example of how this might be done. Other examples include financing for research and development of liquid biopsy technologies and backing clinical trials and studies to produce evidence on their therapeutic efficacy. Such government assistance has aided in boosting liquid biopsy test knowledge, adoption, and reimbursement coverage.

Thus, increasing reimbursements and government support for liquid biopsy is expected to act as an opportunity for the market's growth.

Restraint/Challenge

- High cost of liquid biopsy tests

The liquid biopsy is severely constrained by the high cost. While liquid biopsy tests show promise for non-invasive illness detection and monitoring, including cancer, there are cost-related obstacles that may prevent their widespread use.

The necessity for specialized tools and technologies is one of the biggest economic obstacles. Costly tools, including digital PCR machines, NGS platforms, and automated sample processing systems, are frequently needed for liquid biopsy studies. Smaller healthcare facilities with tighter budgets may find it difficult to afford the initial investment and ongoing maintenance costs connected with these technologies, which limits their capacity to provide liquid biopsy tests to patients.

Thus, the high cost of liquid biopsy tests is expected to restrain the market's growth.

- Lack of skilled professionals performing liquid biopsy

The demand for liquid biopsy tests is increasing due to their potential clinical utility in cancer detection, monitoring, and personalized treatment decision-making. However, there may be limited resources, including personnel, equipment, and funding, to support the implementation of liquid biopsy programs in healthcare institutions. This can result in a shortage of skilled professionals who can perform liquid biopsy tests, especially in regions or healthcare settings with limited resources.

Thus, the lack of skilled professionals performing liquid biopsies is expected to challenge the market growth.

Recent Development

- In January 2022, Exact Sciences Corporation announced the acquisition of Prevention Genetics, a genetic testing laboratory, to complement its advanced cancer diagnostics portfolio and support its entrance into hereditary cancer testing (HCT).

North America Liquid Biopsy Market Scope

The North America liquid biopsy market is categorized into nine notable segments which are product, Biomaker type, sample type, analytical type, application type, clinical application, technology, end user, and distribution channel. The growth amongst these segments will help you analyze market growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Instruments

- Consumables & Accessories

- Services & Software

On the basis of product, the market is segmented into instruments, consumables & accessories, services & software.

Biomaker Type

- Circulating Tumor Cells (CTCS)

- Circulating Cell-Free DNA (CFDNA)

- Cell-Free RNA

- Exosomes

- Extracellular vesicles

- Others

On the basis of biomaker type, the market is segmented into circulating tumor cells (CTCS), circulating cell-free DNA (CFDNA), cell-free RNA, extracellular vesicles, exosomes, and others.

Sample Type

- Blood Sample-Based

- Urine Sample-Based

- Saliva & Other Tissue Fluids Sample-Based

- Others

On the basis of sample type, the market is segmented into blood sample-based, urine sample-based, saliva & other tissue fluid sample-based, and others.

Analytical Type

- Molecular

- Proteomic

- Histology/Imaging

On the basis of analytical type, the market is segmented into molecular, proteomics, and histology/imaging.

Application Type

- Cancer Applications

- Non-Cancer Applications

On the basis of application type, the market is segmented into cancer applications and non-cancer applications.

Clinical Application

- Routine Screening

- Therapy Selection

- Treatment Monitoring

- Recurrence Monitoring

- Patient Work-Up

- Others

On the basis of clinical application, the market is segmented into routine screening, patient work-up, therapy selection, treatment monitoring, recurrence monitoring, and others.

Technology

- Multi-Gene-Parallel Analysis

- Single Gene Analysis

On the basis of technology, the market is segmented into multi-gene parallel analysis and single-gene analysis.

End User

- Hospitals

- Reference Laboratories

- Diagnostics Centers

- Research Centres and Academic Institutes

- Others

On the basis of end user, the market is segmented into hospitals, reference laboratories, diagnostic centers, research centers & academic institutes, and others.

Distribution Channels

- Direct Tender

- Third Party Distributor

- Others

On the basis of distribution channel, the market is segmented into direct tender, third party distributor, and others.

North America Liquid Biopsy Market Regional Analysis/Insights

The North America liquid biopsy market is analyzed, and market size insights and trends are provided based on product, biomaker type, sample type, analytical type, application type, clinical application, technology, end user, and distribution channel.

The countries covered in this market report are U.S., Canada, and Mexico.

In 2023, U.S. is expected to dominate the North America liquid biopsy market due to the growing demand for non-invasive cancer diagnostics.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Liquid Biopsy Market Share Analysis

The North America liquid biopsy market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the North America liquid biopsy market.

Some of the major players in the North America liquid biopsy market are F. Hoffmann-La Roche Ltd, Guardant Health, Thermo Fisher Scientific Inc., Exact Sciences Corporation(Genomic health), QIAGEN, Labcorp, Johnson & Johnson Services, Inc., Illumina Inc, mdxhealth, NeoGenomics Laboratories, Bio-Rad Laboratories, Inc., Natera, Inc., CARDIFF ONCOLOGY, INC., PathAI, STRECK, BIOCEPT, INC., Sysmex Inostics Inc., Fluxion Biosciences Inc, Epic Sciences, and Predicine, ANGLE plc, Oncocyte Corporation among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LIQUID BIOPSY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 INDUSTRY INSIGHTS:

6 NORTH AMERICA LIQUID BIOPSY MARKET, REGULATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR NON-INVASIVE LIQUID BIOPSY TECHNIQUE

7.1.2 ADVANCEMENTS IN PRECISION MEDICINE DUE TO LIQUID BIOPSY

7.1.3 INCREASING CANCER PREVALENCE AND AWARENESS

7.1.4 TECHNOLOGICAL ADVANCEMENTS IN LIQUID BIOPSY PLATFORMS

7.2 RESTRAINTS

7.2.1 HIGH COST OF LIQUID BIOPSY TESTS

7.2.2 LACK OF STANDARDIZED GUIDELINES

7.3 OPPORTUNITIES

7.3.1 INTEGRATION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING

7.3.2 INCREASING REIMBURSEMENTS AND GOVERNMENT SUPPORT FOR LIQUID BIOPSY

7.3.3 INCREASING R&D ACTIVITIES BY INSTITUTES

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS PERFORMING LIQUID BIOPSY

7.4.2 INCREASED DEPENDENCY ON OTHER BIOPSIES

8 NORTH AMERICA LIQUID BIOPSY MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 CONSUMABLES & ACCESSORIES

8.2.1 TEST KITS

8.2.1.1 TOTAL NUCLEIC ACID ISOLATION KIT

8.2.1.2 DNA ISOLATION KIT

8.2.1.3 OTHERS

8.2.2 COLLECTION TUBES

8.2.2.1 50 PIECES

8.2.2.2 100 PIECES

8.2.3 ASSAYS

8.2.3.1 FLEXIBLE REAGENTS

8.2.3.2 SCALABLE REAGENTS

8.2.3.3 OTHERS

8.2.4 CONTROL KIT

8.2.5 OTHERS

8.3 INSTRUMENTS

8.3.1 ANALYZERS

8.3.2 SYSTEMS

8.3.3 OTHERS

8.4 SERVICES & SOFTWARE

8.4.1 NGS ANALYSIS AND REPORTING SOFTWARE

8.4.2 DPCR ANALYSIS SOFTWARE

8.4.3 CASTPCR ANALYSIS SOFTWARE

8.4.4 OTHERS

9 NORTH AMERICA LIQUID BIOPSY MARKET, BY BIOMAKER TYPE

9.1 OVERVIEW

9.2 CIRCULATING TUMOR CELLS (CTCS)

9.3 CIRCULATING CELL-FREE DNA (CFDNA)

9.4 CELL-FREE RNA

9.5 EXOSOMES

9.6 EXTRACELLULAR VESICLES

9.7 OTHERS

10 NORTH AMERICA LIQUID BIOPSY MARKET, BY SAMPLE TYPE

10.1 OVERVIEW

10.2 BLOOD SAMPLE-BASED

10.3 URINE SAMPLE-BASED

10.4 SALIVA & OTHER TISSUE FLUIDS SAMPLE-BASED

10.5 OTHERS

11 NORTH AMERICA LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE

11.1 OVERVIEW

11.2 MOLECULAR

11.2.1 NGS

11.2.2 PCR

11.2.3 MICROARRAY

11.2.4 PROTEOMICS

11.2.5 OTHERS

11.3 PROTEOMIC

11.3.1 NGS

11.3.2 PCR

11.3.3 MICROARRAY

11.3.4 PROTEOMICS

11.3.5 OTHERS

11.4 HISTOLOGY/IMAGING

12 NORTH AMERICA LIQUID BIOPSY MARKET, BY APPLICATION TYPE

12.1 OVERVIEW

12.2 CANCER APPLICATIONS

12.2.1 LUNG

12.2.2 BREAST

12.2.2.1 EARLY BREAST CANCER

12.2.2.2 ADVANCED BREAST CANCER

12.2.3 COLORECTAL

12.2.4 PROSTRATE

12.2.5 LIVER

12.2.6 OTHERS

12.3 NON-CANCER APPLICATIONS

12.3.1 PRENATAL DIAGNOSIS

12.3.2 PERSONALIZED IMMUNOTHERAPY

12.3.3 OTHERS

13 NORTH AMERICA LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION

13.1 OVERVIEW

13.2 ROUTINE SCREENING

13.3 THERAPY SELECTION

13.4 TREATMENT MONITORING

13.4.1 EARLY-STAGE DISEASE

13.4.2 LATE-STAGE/METASTATIC DISEASE

13.5 RECURRENCE MONITORING

13.6 PATIENT WORK-UP

13.7 OTHERS

14 NORTH AMERICA LIQUID BIOPSY MARKET, BY TECHNOLOGY

14.1 OVERVIEW

14.2 MULTI-GENE-PARALLEL ANALYSIS

14.3 SINGLE GENE ANALYSIS

15 NORTH AMERICA LIQUID BIOPSY MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.3 REFERENCE LABORATORIES

15.4 DIAGNOSTIC CENTERS

15.5 RESEARCH CENTERS AND ACADEMIC INSTITUTES

15.6 OTHERS

16 NORTH AMERICA LIQUID BIOPSY MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 THIRD PARTY DISTRIBUTOR

16.4 OTHERS

17 NORTH AMERICA LIQUID BIOPSY MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA LIQUID BIOPSY MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 COMPANY PROFILE

19.1 F. HOFFMANN-LA ROCHE LTD.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 GUARDANT HEALTH

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 THERMO FISHER SCIENTIFIC INC.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 SWOT ANALYSIS

19.3.5 PRODUCT PORTFOLIO

19.3.6 RECENT DEVELOPMENTS

19.4 EXACT SCIENCE CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 QIAGEN

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 ANGLE PLC (2022)

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 BIOCEPT, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 BIO-RAD LABORATORIES, INC. (2022)

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

19.9 EPIC SCIENCES

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 FLUXION BIOSCIENCES INC

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 ILLUMINA, INC.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 SWOT ANALYSIS

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENT

19.12 JOHNSON & JOHNSON PRIVATE LIMITED

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 SWOT ANALYSIS

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENTS

19.13 LABORATORY CORPORATION OF AMERICA HOLDINGS

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 SWOT ANALYSIS

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENT

19.14 MDXHEALTH

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENTS

19.15 MENARINI SILICON BIOSYSTEMS

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 NATERA, INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 NEOGENOMICS LABORATORIES

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 ONCOCYTE CORPORATION

19.18.1 COMPANY PROFILE

19.18.2 SERVICE PORTFOLIO

19.18.3 RECENT DEVELOPMENTS

19.19 PATHAI

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 PREDICINE

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 STRECK

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENTS

19.22 SYSMEX INOSTICS INC.

19.22.1 COMPANY SNAPSHOT

19.22.2 REVENUE ANALYSIS

19.22.3 PRODUCT PORTFOLIO

19.22.4 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 WAYS IN WHICH LIQUID BIOPSY HAS ADVANCED PRECISION MEDICINE

TABLE 2 NORTH AMERICA LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA CONSUMABLES & ACCESSORIES IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA CONSUMABLES & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ASSAYS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA INSTRUMENTS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA SERVICES & SOFTWARE IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA SERVICES & SOFTWARE IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA LIQUID BIOPSY MARKET, BY BIOMAKER TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA CIRCULATING TUMOR CELLS (CTCS) IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA CIRCULATING CELL-FREE DNA (CFDNA) IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA CELL-FREE RNA IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA EXOSOMES IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA EXTRACELLULAR VESICLES IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA BLOOD SAMPLE-BASED IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA URINE SAMPLE-BASED IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA SALIVA & OTHER TISSUE FLUIDS SAMPLE-BASED IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA MOLECULAR IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MOLECULAR IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA PROTEOMIC IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PROTEOMIC IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA HISTOLOGY/IMAGING IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA BREAST IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA NON-CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA NON-CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA ROUTINE SCREENING IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA THERAPY SELECTION IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA TREATMENT MONITORING IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA TREATMENT MONITORING IN LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA RECURRENCE MONITORING IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA PATIENT WORK-UP IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA MULTI-GENE-PARALLEL ANALYSIS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA SINGLE GENE ANALYSIS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA LIQUID BIOPSY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA HOSPITALS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA REFERENCE LABORATORIES IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA DIAGNOSTICS CENTERS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA RESEARCH CENTRES AND ACADEMIC INSTITUTES IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA LIQUID BIOPSY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA DIRECT TENDER IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA THIRD PARTY DISTRIBUTOR IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN LIQUID BIOPSY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA LIQUID BIOPSY MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA CONSUMABLES & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA CONSUMABLES & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 61 NORTH AMERICA TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 63 NORTH AMERICA COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 65 NORTH AMERICA ASSAYS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 68 NORTH AMERICA SERVICES & SOFTWARE IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA LIQUID BIOPSY MARKET, BY BIOMAKER TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA MOLECULAR IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA PROTEOMIC IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA BREAST IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA NON-CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA TREATMENT MONITORING IN LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA LIQUID BIOPSY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA LIQUID BIOPSY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 83 U.S. LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 84 U.S. CONSUMABLES & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 85 U.S. CONSUMABLE & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 86 U.S. LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 87 U.S. TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 88 U.S. TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 89 U.S. TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCTS, 2021-2030 (ASP)

TABLE 90 U.S. COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 91 U.S. COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 92 U.S. COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 93 U.S. ASSAYS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 94 U.S. INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 95 U.S. INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 96 U.S. INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCTS, 2021-2030 (ASP)

TABLE 97 U.S. SERVICES & SOFTWARE IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 98 U.S. LIQUID BIOPSY MARKET, BY BIOMAKER TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.S. LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 101 U.S. MOLECULAR IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.S. PROTEOMIC IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 103 U.S. LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.S. CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 105 U.S. BREAST IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.S. NON-CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.S. LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 108 U.S. TREATMENT MONITORING IN LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 109 U.S. LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 110 U.S. LIQUID BIOPSY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 111 U.S. LIQUID BIOPSY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 CANADA LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 CANADA CONSUMABLES & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 114 CANADA CONSUMABLE & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 115 CANADA LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 116 CANADA TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 117 CANADA TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 118 CANADA TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCTS, 2021-2030 (ASP)

TABLE 119 CANADA COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 120 CANADA COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 121 CANADA COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 122 CANADA ASSAYS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 123 CANADA INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 124 CANADA INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 125 CANADA INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCTS, 2021-2030 (ASP)

TABLE 126 CANADA SERVICES & SOFTWARE IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 127 CANADA LIQUID BIOPSY MARKET, BY BIOMAKER TYPE, 2021-2030 (USD MILLION)

TABLE 128 CANADA LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 129 CANADA LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 130 CANADA MOLECULAR IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 131 CANADA PROTEOMIC IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 132 CANADA LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 133 CANADA CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 134 CANADA BREAST IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 135 CANADA NON-CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 136 CANADA LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 137 CANADA TREATMENT MONITORING IN LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 138 CANADA LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 139 CANADA LIQUID BIOPSY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 140 CANADA LIQUID BIOPSY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 141 MEXICO LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 142 MEXICO CONSUMABLES & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 143 MEXICO CONSUMABLE & ACCESSORIES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 144 MEXICO LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 145 MEXICO TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 146 MEXICO TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 147 MEXICO TEST KITS IN LIQUID BIOPSY MARKET, BY PRODUCTS, 2021-2030 (ASP)

TABLE 148 MEXICO COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 149 MEXICO COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 150 MEXICO COLLECTION TUBES IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 151 MEXICO ASSAYS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 152 MEXICO INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 153 MEXICO INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 154 MEXICO INSTRUMENTS IN LIQUID BIOPSY MARKET, BY PRODUCTS, 2021-2030 (ASP)

TABLE 155 MEXICO SERVICES & SOFTWARE IN LIQUID BIOPSY MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 156 MEXICO LIQUID BIOPSY MARKET, BY BIOMAKER TYPE, 2021-2030 (USD MILLION)

TABLE 157 MEXICO LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 158 MEXICO LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 159 MEXICO MOLECULAR IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 160 MEXICO PROTEOMIC IN LIQUID BIOPSY MARKET, BY ANALYTICAL TYPE, 2021-2030 (USD MILLION)

TABLE 161 MEXICO LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 162 MEXICO CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 163 MEXICO BREAST IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 164 MEXICO NON-CANCER APPLICATIONS IN LIQUID BIOPSY MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 165 MEXICO LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 166 MEXICO TREATMENT MONITORING IN LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2021-2030 (USD MILLION)

TABLE 167 MEXICO LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 168 MEXICO LIQUID BIOPSY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 169 MEXICO LIQUID BIOPSY MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA LIQUID BIOPSY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIQUID BIOPSY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIQUID BIOPSY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIQUID BIOPSY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIQUID BIOPSY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIQUID BIOPSY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIQUID BIOPSY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LIQUID BIOPSY MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 NORTH AMERICA LIQUID BIOPSY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIQUID BIOPSY MARKET: SEGMENTATION

FIGURE 11 THE GROWING DEMAND FOR NON-INVASIVE CANCER DIAGNOSTICS IS EXPECTED TO DRIVE THE NORTH AMERICA LIQUID BIOPSY MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 12 CONSUMABLES & ACCESSORIES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIQUID BIOPSY MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LIQUID BIOPSY MARKET

FIGURE 14 ADVANTAGES OF LIQUID BIOPSY OVER TRADITIONAL BIOPSY

FIGURE 15 NORTH AMERICA LIQUID BIOPSY MARKET: BY PRODUCT, 2022

FIGURE 16 NORTH AMERICA LIQUID BIOPSY MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 17 NORTH AMERICA LIQUID BIOPSY MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 18 NORTH AMERICA LIQUID BIOPSY MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 NORTH AMERICA LIQUID BIOPSY MARKET: BY BIOMAKER TYPE, 2022

FIGURE 20 NORTH AMERICA LIQUID BIOPSY MARKET: BY BIOMAKER TYPE, 2023-2030 (USD MILLION)

FIGURE 21 NORTH AMERICA LIQUID BIOPSY MARKET: BY BIOMAKER TYPE, CAGR (2023-2030)

FIGURE 22 NORTH AMERICA LIQUID BIOPSY MARKET: BY BIOMAKER TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA LIQUID BIOPSY MARKET: BY SAMPLE TYPE, 2022

FIGURE 24 NORTH AMERICA LIQUID BIOPSY MARKET: BY SAMPLE TYPE, 2023-2030 (USD MILLION)

FIGURE 25 NORTH AMERICA LIQUID BIOPSY MARKET: BY SAMPLE TYPE, CAGR (2023-2030)

FIGURE 26 NORTH AMERICA LIQUID BIOPSY MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA LIQUID BIOPSY MARKET: BY ANALYTICAL TYPE, 2022

FIGURE 28 NORTH AMERICA LIQUID BIOPSY MARKET: BY ANALYTICAL TYPE, 2023-2030 (USD MILLION)

FIGURE 29 NORTH AMERICA LIQUID BIOPSY MARKET: BY ANALYTICAL TYPE, CAGR (2023-2030)

FIGURE 30 NORTH AMERICA LIQUID BIOPSY MARKET: BY ANALYTICAL TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA LIQUID BIOPSY MARKET: BY APPLICATION TYPE, 2022

FIGURE 32 NORTH AMERICA LIQUID BIOPSY MARKET: BY APPLICATION TYPE, 2023-2030 (USD MILLION)

FIGURE 33 NORTH AMERICA LIQUID BIOPSY MARKET: BY APPLICATION TYPE, CAGR (2023-2030)

FIGURE 34 NORTH AMERICA LIQUID BIOPSY MARKET: BY APPLICATION TYPE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA LIQUID BIOPSY MARKET: BY CLINICAL APPLICATION, 2022

FIGURE 36 NORTH AMERICA LIQUID BIOPSY MARKET: BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

FIGURE 37 NORTH AMERICA LIQUID BIOPSY MARKET: BY CLINICAL APPLICATION, CAGR (2023-2030)

FIGURE 38 NORTH AMERICA LIQUID BIOPSY MARKET: BY CLINICAL APPLICATION, LIFELINE CURVE

FIGURE 39 NORTH AMERICA LIQUID BIOPSY MARKET: BY TECHNOLOGY, 2022

FIGURE 40 NORTH AMERICA LIQUID BIOPSY MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 41 NORTH AMERICA LIQUID BIOPSY MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 42 NORTH AMERICA LIQUID BIOPSY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 43 NORTH AMERICA LIQUID BIOPSY MARKET: BY END USER, 2022

FIGURE 44 NORTH AMERICA LIQUID BIOPSY MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 45 NORTH AMERICA LIQUID BIOPSY MARKET: BY END USER, CAGR (2023-2030)

FIGURE 46 NORTH AMERICA LIQUID BIOPSY MARKET: BY END USER, LIFELINE CURVE

FIGURE 47 NORTH AMERICA LIQUID BIOPSY MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 48 NORTH AMERICA LIQUID BIOPSY MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 49 NORTH AMERICA LIQUID BIOPSY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 50 NORTH AMERICA LIQUID BIOPSY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 51 NORTH AMERICA LIQUID BIOPSY MARKET: SNAPSHOT (2022)

FIGURE 52 NORTH AMERICA LIQUID BIOPSY MARKET: BY COUNTRY (2022)

FIGURE 53 NORTH AMERICA LIQUID BIOPSY MARKET: BY COUNTRY (2023 & 2030)

FIGURE 54 NORTH AMERICA LIQUID BIOPSY MARKET: BY COUNTRY (2022 & 2030)

FIGURE 55 NORTH AMERICA LIQUID BIOPSY MARKET: BY PRODUCT (2023-2030)

FIGURE 56 NORTH AMERICA LIQUID BIOPSY MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.