North America Medical Device Sterilization Market

Market Size in USD Billion

CAGR :

%

USD

2.05 Billion

USD

3.91 Billion

2024

2032

USD

2.05 Billion

USD

3.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.05 Billion | |

| USD 3.91 Billion | |

|

|

|

|

North America Medical Device Sterilization Market Size

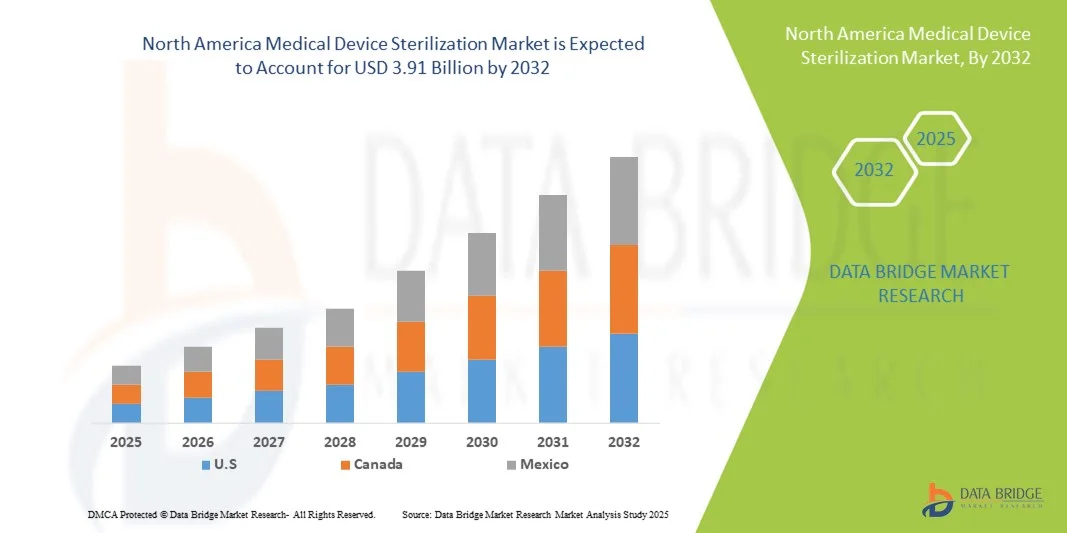

- The North America medical device sterilization market size was valued at USD 2.05 billion in 2024 and is expected to reach USD 3.91 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by the rising prevalence of hospital-acquired infections (HAIs), increasing number of surgical procedures, and advancements in sterilization technologies, leading to a higher demand for sterile medical devices in both hospitals and other healthcare settings

- Furthermore, growing regulatory requirements for infection control, coupled with the rising need for safe and efficient sterilization processes, are establishing medical device sterilization as a critical component in modern healthcare infrastructure. These converging factors are accelerating the adoption of sterilization solutions, thereby significantly boosting the industry's growth

North America Medical Device Sterilization Market Analysis

- Medical device sterilization, encompassing methods such as steam, gas, and radiation sterilization for surgical instruments and medical equipment, is increasingly critical in healthcare settings due to rising infection control requirements, patient safety concerns, and stringent regulatory standards across hospitals, clinics, and laboratories

- The escalating demand for sterilization solutions is primarily fueled by the increasing prevalence of hospital-acquired infections (HAIs), the growing number of surgical procedures, and technological advancements in sterilization equipment that enhance efficiency and safety

- The U.S. dominated the North America medical device sterilization market with the largest revenue share of 67.8% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players

- Canada is expected to be the fastest-growing country in the North America medical device sterilization market during the forecast period due to increasing investments in healthcare infrastructure and rising awareness about infection control protocols

- Thermal sterilization segment dominated the North America medical device sterilization market by technology with a market share of 39% in 2024, driven by its proven reliability, cost-effectiveness, and widespread application across medical instruments, reagents, and other healthcare products

Report Scope and North America Medical Device Sterilization Market Segmentation

|

Attributes |

North America Medical Device Sterilization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Medical Device Sterilization Market Trends

Advancements in Low-Temperature and IoT-Enabled Sterilization

- A significant and accelerating trend in the North America medical device sterilization market is the adoption of low-temperature sterilization technologies such as hydrogen peroxide plasma and ozone, reducing damage to heat-sensitive instruments while maintaining sterility

- For instance, STERRAD NX systems utilize low-temperature hydrogen peroxide plasma sterilization for delicate surgical instruments, enhancing operational efficiency and device lifespan

- Integration of IoT-enabled sterilizers allows real-time monitoring, predictive maintenance, and automated reporting, providing enhanced operational control and compliance tracking. For instance, Getinge’s SteriLog platform integrates sterilizers with hospital IT systems, enabling centralized management of sterilization cycles, usage logs, and maintenance schedules

- The trend of combining sterilization with data analytics and predictive maintenance helps healthcare providers reduce downtime and optimize resource allocation

- This trend toward smarter, automated, and low-temperature sterilization is reshaping expectations for safety and efficiency in hospitals and pharmaceutical facilities

- The demand for advanced sterilization systems combining low-temperature processes with IoT connectivity is growing rapidly across hospitals, clinics, and pharmaceutical manufacturing units, as healthcare providers prioritize both patient safety and operational efficiency

North America Medical Device Sterilization Market Dynamics

Driver

Increasing Demand Due to Rising Surgical Procedures and Infection Control

- The increasing number of surgical procedures and rising incidence of hospital-acquired infections (HAIs) is a significant driver for the heightened demand for advanced sterilization solutions

- For instance, in March 2024, STERIS announced an expansion of its automated sterilization systems in U.S. hospitals to address growing surgical workloads and infection control requirements

- As healthcare facilities emphasize patient safety and regulatory compliance, medical device sterilization offers reliable, validated processes to prevent cross-contamination and ensure sterility

- Furthermore, the adoption of advanced sterilizers that integrate with hospital IT systems enables seamless documentation, tracking, and reporting, which is essential for regulatory adherence

- Enhanced operational efficiency, reduced instrument downtime, and standardized sterilization procedures are key factors propelling the adoption of modern sterilization systems across hospitals, clinics, and pharmaceutical manufacturing units

- Increasing demand for sterile medical instruments in pharmaceutical production and research labs is creating additional growth opportunities for sterilization technologies. For instance, Midmark Corporation has expanded its sterilization offerings for biotech labs producing injectable drugs, meeting both sterility and compliance requirements

- Supportive government initiatives promoting patient safety and infection control standards in the U.S. are further boosting market growth

Restraint/Challenge

High Equipment Cost and Regulatory Compliance Hurdles

- The relatively high initial cost of advanced sterilization equipment, coupled with ongoing maintenance expenses, poses a significant challenge to broader market penetration

- For instance, sophisticated low-temperature sterilizers or automated systems from STERIS or Getinge require substantial capital investment, which can be a barrier for smaller healthcare facilities

- Compliance with stringent U.S. FDA and CDC sterilization standards increases operational complexity and requires ongoing staff training, further adding to the cost and adoption challenge. For instance, hospitals must maintain detailed sterilization logs and adhere to validated protocols to meet regulatory audits, which can strain resources in smaller or underfunded facilities

- Limited awareness and technical expertise among smaller healthcare providers in operating advanced sterilization systems can slow adoption rates. For instance, clinics may require external training or service support to properly utilize Tuttnauer or Midmark sterilizers, adding operational complexity

- Potential downtime and disruption during installation or maintenance of high-end sterilization equipment can also hinder rapid adoption

North America Medical Device Sterilization Market Scope

The market is segmented on the basis of product, technology, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into instruments, reagents, and services. The instruments segment dominated the market with the largest revenue share in 2024, driven by the high demand for sterilized surgical instruments and diagnostic tools across hospitals, clinics, and laboratories. Hospitals and surgical centers prioritize the sterilization of instruments to ensure patient safety and compliance with stringent regulatory standards. The widespread use of reusable instruments and the increasing number of surgical procedures further contribute to the segment’s growth. Advanced sterilization equipment designed for instruments, such as automated autoclaves and low-temperature sterilizers, also enhances operational efficiency. Moreover, the segment benefits from continuous innovation in sterilization technologies tailored for sensitive instruments. Overall, instruments remain critical due to their direct role in patient care and infection prevention.

The services segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by outsourcing trends among healthcare facilities and pharmaceutical companies. Service providers offer sterilization-as-a-service, reducing the need for hospitals and labs to invest heavily in in-house equipment. This segment also benefits from strict regulatory compliance requirements, which make third-party sterilization services an attractive option for smaller facilities or specialized applications. The rise of biotech and pharmaceutical manufacturing, where sterile processes are critical, further drives demand for professional sterilization services. In addition, service providers often offer integrated solutions, including monitoring, documentation, and validation, enhancing operational efficiency. Convenience, cost-effectiveness, and access to advanced technologies contribute to the rapid adoption of sterilization services.

- By Technology

On the basis of technology, the market is segmented into thermal sterilization, ionizing radiation sterilization, filtration sterilization, and gas & chemical sterilization. The thermal sterilization segment dominated the market with the largest revenue share of 39% in 2024, driven by its proven reliability, cost-effectiveness, and widespread application across healthcare facilities. Steam autoclaves and other thermal sterilizers are preferred due to their ability to sterilize a wide range of instruments efficiently. The method is well-established, validated, and widely supported by regulatory guidelines, making it a preferred choice for hospitals and labs. The high adoption rate is also supported by continuous technological improvements in autoclave design, energy efficiency, and cycle monitoring. Healthcare providers rely on thermal sterilization for its simplicity, reproducibility, and long-standing effectiveness in preventing infections.

The ionizing radiation sterilization segment is expected to witness the fastest growth from 2025 to 2032, driven by its suitability for heat-sensitive medical devices and pharmaceutical products. Gamma rays, electron beams, and X-rays can sterilize products without causing thermal damage, which is critical for modern medical instruments and implants. The pharmaceutical sector increasingly relies on radiation sterilization for single-use devices, injectable drugs, and packaging materials. Its ability to provide large-scale, uniform sterilization supports rapid industrial adoption. Growing regulatory approval and awareness of radiation sterilization benefits further accelerate its adoption. This method’s precision, speed, and compatibility with sensitive materials make it a key growth area in the North American market.

- By End User

On the basis of end user, the market is segmented into pharmaceutical companies, hospitals, clinics, laboratories, academic & research institutes, medical device manufacturers, and others. The hospitals segment dominated the market with the largest revenue share in 2024, driven by the high volume of surgical procedures, critical need for sterile instruments, and adherence to stringent infection control protocols. Hospitals require reliable sterilization solutions to maintain patient safety, regulatory compliance, and operational efficiency. The growing number of inpatient procedures and minimally invasive surgeries contributes to sustained demand. Integration of advanced sterilizers with hospital IT systems for monitoring and documentation also enhances adoption. Hospitals remain the largest end user due to their extensive usage of medical devices and instruments requiring frequent sterilization.

The pharmaceutical companies segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing production of sterile drugs, biologics, and injectable therapies. Pharmaceutical manufacturers require high-volume sterilization solutions for reagents, instruments, and production lines. Strict FDA and USP guidelines for sterility, combined with rising outsourcing of sterilization services, drive market adoption. Advanced technologies such as low-temperature and radiation sterilization are particularly relevant for sensitive products. Increasing R&D activities in biologics and sterile injectable medications also support segment growth. The need for compliance, safety, and high throughput makes pharmaceutical companies a rapidly growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, retail sales, and third-party distributors. The direct tenders segment dominated the market with the largest revenue share in 2024, driven by hospitals, clinics, and large pharmaceutical companies procuring sterilization equipment directly from manufacturers. Direct purchasing ensures compliance with contractual obligations, warranty, service, and maintenance agreements. Bulk procurement through tenders reduces operational costs and allows facilities to access the latest sterilization technologies. Direct tender agreements also support integration with existing hospital or laboratory IT and workflow systems. The preference for direct tenders is reinforced by long-term service contracts and high-value investments.

The third-party distributor segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing demand from smaller healthcare facilities, laboratories, and clinics that cannot invest heavily in direct procurement. Distributors provide flexible access to advanced sterilization equipment and consumables without significant upfront capital expenditure. They often offer maintenance, installation, and training support, making adoption easier for end users. The growth of remote and smaller healthcare facilities across North America further supports distributor-led sales. Availability of diverse brands and technologies through distributors also increases market penetration. Cost-effectiveness and operational convenience make third-party distributors a rapidly growing channel.

North America Medical Device Sterilization Market Regional Analysis

- The U.S. dominated the North America medical device sterilization market with the largest revenue share of 67.8% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players

- Healthcare providers and pharmaceutical companies in the region prioritize patient safety, infection control, and compliance, making sterilization solutions critical across hospitals, clinics, laboratories, and manufacturing facilities

- This widespread adoption is further supported by a strong presence of key industry players, high healthcare expenditure, and continuous investments in advanced sterilization technologies, establishing the U.S. as the leading market for medical device sterilization in North America

U.S. Medical Device Sterilization Market Insight

The U.S. medical device sterilization market captured the largest revenue share of 67.8% in 2024 within North America, fueled by the high prevalence of hospital-acquired infections, increasing surgical procedures, and advanced healthcare infrastructure. Healthcare providers are prioritizing patient safety and regulatory compliance, making sterilization solutions critical across hospitals, clinics, and laboratories. The growing demand for automated, low-temperature, and IoT-enabled sterilization systems further propels the market. Moreover, the presence of key industry players such as STERIS, Getinge, and Tuttnauer, combined with continuous technological advancements, is significantly contributing to market expansion.

Canada Medical Device Sterilization Market Insight

The Canada medical device sterilization market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing investments in healthcare infrastructure and rising awareness about infection control. Hospitals, clinics, and pharmaceutical companies are increasingly adopting advanced sterilization systems to meet regulatory standards and ensure patient safety. The government’s emphasis on healthcare quality and stringent compliance requirements fosters market growth. In addition, automation and IoT integration in sterilizers are gaining traction, enabling efficient monitoring, documentation, and predictive maintenance across healthcare facilities.

Mexico Medical Device Sterilization Market Insight

The Mexico medical device sterilization market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising number of healthcare facilities and growing surgical procedures. Increasing awareness about infection control and patient safety is encouraging hospitals and clinics to invest in reliable sterilization equipment. The market growth is also supported by collaborations between local distributors and global sterilization equipment manufacturers. Moreover, the adoption of low-temperature and radiation sterilization technologies is expanding, particularly in private hospitals and specialty clinics, to meet both efficiency and compliance requirements.

North America Medical Device Sterilization Market Share

The North America Medical Device Sterilization industry is primarily led by well-established companies, including:

- STERIS (U.S.)

- Sterigenics U.S., LLC (U.S.)

- Sotera Health (U.S.)

- Getinge AB (Sweden)

- Cardinal Health (U.S.)

- 3M (U.S.)

- Midmark Corporation (U.S.)

- Merck KGaA, (Germany)

- Dentsply Sirona (U.S.)

- MATACHANA (Spain)

- SciCan Ltd. (Canada)

- MELAG Medizintechnik GmbH & Co. KG (Germany)

- MMM Group (Germany)

- ASP (U.S.)

- Tuttnauer USA Co. Ltd. (U.S.)

- Steelco S.p.A. (Italy)

- Belimed AG (Switzerland)

- Systec GmbH (Germany)

- BMT USA, LLC (U.S.)

- Continental Equipment Company (U.S.)

What are the Recent Developments in North America Medical Device Sterilization Market?

- In November 2024, the U.S. Food and Drug Administration (FDA) released guidance on the transitional enforcement policy for changes in ethylene oxide sterilization facilities for Class III devices. This policy outlines the FDA's approach to ensuring continued patient safety and device availability during the implementation of new sterilization methods or facility modifications. The guidance reflects the agency's commitment to balancing regulatory compliance with the need for effective sterilization processes

- In November 2024, Cosmed Group Inc., a sterilization company, filed for Chapter 11 bankruptcy protection following numerous lawsuits alleging injuries, including cancer, due to ethylene oxide exposure. The company faced at least 300 lawsuits and had previously settled a USD 1.5 million probe with the EPA over EtO emissions at multiple facilities. This development underscores the increasing legal and financial risks associated with traditional sterilization methods

- In July 2024, Noxilizer, Inc. announced a USD 30 million investment to expand its nitrogen dioxide (NO₂) sterilization platform. This technology offers a safer, non-carcinogenic alternative to EtO, addressing growing regulatory pressures. The funding will support the scaling of NO₂ sterilization systems, aiming to provide a viable solution for medical device sterilization without the health risks associated with EtO

- In April 2024, the Sterilization Services of Tennessee plant in Memphis, which used ethylene oxide for sterilizing medical equipment, announced its closure due to lease extension issues. The plant's shutdown is seen as a victory by environmental groups, as the facility had been a source of health concerns related to EtO exposure in nearby communities. This closure highlights the ongoing challenges and scrutiny faced by facilities relying on EtO for sterilization

- In March 2024, the U.S. Environmental Protection Agency (EPA) finalized a rule to reduce ethylene oxide (EtO) emissions from commercial sterilization facilities by approximately 90%. This decision was prompted by increased cancer risks associated with prolonged exposure to EtO. The new regulations require nearly 90 facilities to implement enhanced pollution controls and air quality testing. While this move aims to protect public health, it has raised concerns about potential disruptions in the medical device supply chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.