North America Medical Device Warehouse And Logistics Market

Market Size in USD Billion

CAGR :

%

USD

20.55 Billion

USD

29.90 Billion

2024

2032

USD

20.55 Billion

USD

29.90 Billion

2024

2032

| 2025 –2032 | |

| USD 20.55 Billion | |

| USD 29.90 Billion | |

|

|

|

|

North America Medical Device Warehouse and Logistics Market Size

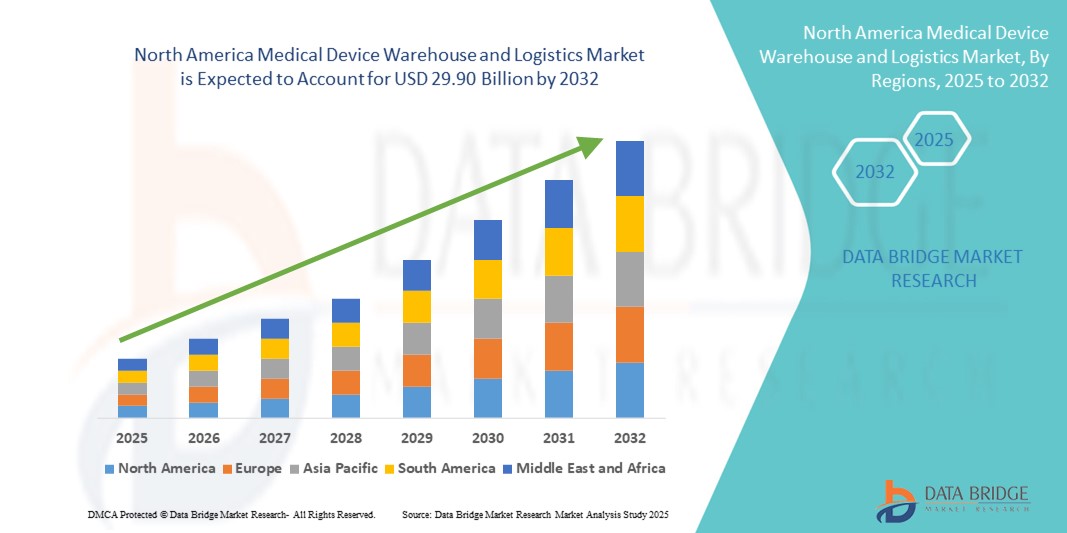

- The North America medical device warehouse and logistics market size was valued at USD 20.55 billion in 2024 and is expected to reach USD 29.90 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by the expanding healthcare infrastructure and increased demand for efficient medical supply chain systems across the North America, driven by rising chronic disease prevalence, healthcare digitization, and the growing need for timely distribution of critical medical devices

- Furthermore, rising consumer and institutional demand for secure, temperature-controlled, and technologically integrated warehousing solutions is establishing specialized medical device logistics as a cornerstone of healthcare delivery in the region. These converging factors are accelerating the uptake of advanced medical device warehouse and logistics services, thereby significantly boosting the industry's growth across both public and private healthcare sectors in the North America

North America Medical Device Warehouse and Logistics Market Analysis

- Medical device warehouse and logistics systems are increasingly critical in ensuring the timely, secure, and compliant delivery of healthcare products across the North America. These systems support temperature-sensitive storage, real-time tracking, and efficient distribution, which are essential for life-saving medical devices and equipment

- The growing demand is driven by rising healthcare infrastructure development, increasing import and export of medical technologies, and stringent regulatory requirements for supply chain traceability and cold chain management

- U.S. dominated the North America medical device warehouse and logistics market with the largest revenue share of 81.2% in 2024, driven by a robust healthcare ecosystem, high medical device consumption, and widespread adoption of advanced warehouse automation and IoT-enabled logistics. Strategic investments in cold chain and distribution hubs by major logistics providers are further propelling growth in the country

- Canada is projected to be the fastest-growing country in the North America medical device warehouse and logistics market, expected to record a CAGR of 9.8% during 2025–2032. Growth is fueled by increasing reliance on imported medical devices, growing biopharmaceutical activity, and expanding regional healthcare access in remote areas

- The overland logistics segment dominated the North America medical device warehouse and logistics market with a market share of 51.4% in 2024, reflecting its widespread use in short- to mid-range medical device deliveries across MEA, supported by an extensive road transportation network that enables timely and cost-effective distribution

Report Scope and North America Medical Device Warehouse and Logistics Market Segmentation

|

Attributes |

North America Medical Device Warehouse and Logistics Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Medical Device Warehouse and Logistics Market Trends

“Rising Integration of Smart Logistics and Compliance Technologies in the North America Medical Device Warehouse and Logistics Market”

- A significant trend shaping the North America medical device warehouse and logistics Market is the surge in automation and smart logistics technologies designed to streamline storage, handling, and distribution of high-value medical devices. These innovations are improving accuracy, traceability, and regulatory compliance in a sector where precision and safety are paramount

- Cloud-based inventory management systems and IoT-enabled sensors are increasingly deployed to monitor real-time storage conditions such as temperature, humidity, and shock exposure—especially critical for sensitive diagnostic or implantable devices. These technologies support end-to-end visibility and timely alerts, helping reduce spoilage and loss

- Major players in the U.S. and Canada are integrating robotics and automated guided vehicles (AGVs) into warehousing operations to improve efficiency and reduce human error in order-picking and dispatching. These systems are particularly beneficial for high-volume distribution centers that handle a diverse and complex range of devices

- Cold chain optimization is also a key focus area. Companies are investing in smart cold storage infrastructure with remote monitoring and backup power systems to safeguard temperature-sensitive products like surgical implants, stents, and cardiovascular devices

- Collaborations between logistics providers and medical device manufacturers are enabling greater customization of supply chains, with third-party logistics (3PL) services offering tailored compliance, packaging, and reverse logistics solutions

- Regulatory compliance remains a driver for digital transformation. The U.S. FDA’s Unique Device Identification (UDI) requirements and Health Canada’s medical device regulations have encouraged the adoption of serialization, real-time tracking, and automated reporting tools to enhance accountability across the supply chain

- This growing convergence of logistics innovation, compliance automation, and real-time tracking systems is reshaping the medical device warehousing and distribution landscape across North America, positioning the market for sustained growth through 2032

North America Medical Device Warehouse and Logistics Market Dynamics

Driver

“Growing Demand Due to Expanding Healthcare Infrastructure and Cold Chain Needs”

- The North America medical device warehouse and logistics market is experiencing substantial growth due to increasing investments in healthcare infrastructure, rising demand for advanced medical devices, and growing focus on temperature-sensitive pharmaceutical and device logistics

- For instance, in April 2024, CEVA Logistics expanded its healthcare logistics footprint in the Middle East by launching a new Good Distribution Practice (GDP)-certified facility in Dubai, aimed at providing specialized services for medical devices and pharmaceuticals

- With the rapid growth of diagnostic and surgical procedures in the region, logistics providers are increasingly focusing on tailored storage and transportation solutions that ensure device integrity, safety, and compliance

- Government initiatives to improve healthcare access, particularly in GCC countries and South Africa, are supporting the expansion of centralized warehousing systems and distribution hubs for medical equipment and consumables

- The rise of chronic diseases and increasing importation of high-end medical devices have led to a greater need for temperature-controlled logistics services, particularly in ambient, refrigerated, and frozen categories, which are becoming essential in ensuring product efficacy and safety

- Moreover, the growing adoption of digital healthcare technologies and smart tracking systems, such as RFID and IoT-based sensors, is enhancing supply chain transparency and operational efficiency, further driving market growth across both private and public healthcare sectors

Restraint/Challenge

“High Cost and Infrastructure Gaps in Low-Income Regions”

- Despite strong demand, the market faces key challenges such as limited logistics infrastructure in several Sub-Saharan African countries, inconsistent regulatory environments, and high operational costs associated with cold chain and secure storage facilities

- For instance, while South Africa and the UAE have developed advanced warehousing hubs, countries with less mature infrastructure continue to face issues such as inconsistent electricity supply, limited access to specialized freight solutions, and fragmented transport networks

- High costs associated with setting up GDP-compliant cold storage facilities and securing end-to-end device tracking are barriers for small and mid-sized logistics players

- Additionally, strict customs and import regulations across various countries in the region often lead to delays and inefficiencies, affecting timely device delivery and patient outcomes

- To overcome these restraints, public-private partnerships, government-backed logistics incentives, and international collaborations are essential to standardize processes and expand access to reliable medical device logistics in remote and underdeveloped areas of the region

North America Medical Device Warehouse and Logistics Market Scope

The market is segmented on the basis of offerings, temperature, mode of transportation, application, end use, and distribution channel.

- By Offerings

On the basis of offerings, the North America medical device warehouse and logistics market is segmented into services, hardware, and software. The hardware segment dominated the market with the largest market revenue share of 42.8% in 2024, driven by the rising need for advanced storage solutions, cold chain infrastructure, and RFID tracking systems. Hardware components form the backbone of efficient warehouse operations, supporting the storage and movement of medical devices under regulated conditions.

The software segment is projected to witness the fastest CAGR of 12.9% from 2025 to 2032, fueled by increasing digitization in logistics operations, growing demand for cloud-based warehouse management systems (WMS), and the need for real-time visibility and compliance tracking.

- By Temperature

On the basis of temperature, the North America medical device warehouse and logistics market is segmented into ambient, chilled/refrigerated, frozen, and others. The ambient segment dominated the market with a revenue share of 47.3% in 2024, owing to the high volume of non-temperature-sensitive medical devices such as surgical tools and diagnostic equipment.

The chilled/refrigerated segment is expected to witness the fastest growth, projected at a CAGR of 10.2% from 2025 to 2032, due to increasing demand for temperature-controlled storage of vaccines, diagnostic reagents, and implantable devices.

- By Mode of Transportation

On the basis of mode of transportation, the North America medical device warehouse and logistics market is segmented into overland logistics, air freight logistics, and sea freight logistics. The overland logistics segment held the largest market share of 51.4% in 2024, driven by the widespread use of road transportation networks across MEA for short- to mid-range medical device deliveries.

The air freight logistics segment is anticipated to grow at the fastest CAGR of 11.7% from 2025 to 2032, as it is increasingly used for urgent and temperature-sensitive device shipments, particularly in remote or underserved regions.

- By Application

On the basis of application, the North America medical device warehouse and logistics market is segmented into diagnostic devices, therapeutic devices, monitoring devices, surgical devices, and other devices. The diagnostic devices segment accounted for the largest revenue share of 33.6% in 2024, driven by increased testing volumes, especially post-COVID-19, and the need for secure storage of sensitive diagnostic tools.

The monitoring devices segment is anticipated to grow at the fastest CAGR of 10.5% from 2025 to 2032, supported by the surge in demand for wearable and remote health monitoring technologies.

- By End Use

On the basis of end use, the North America medical device warehouse and logistics market is segmented into hospitals & clinics, medical device companies, academic & research institutes, reference & diagnostics laboratories, emergency medical services companies, and others. The hospitals & clinics segment held the highest market share of 38.9% in 2024, due to large-scale procurement needs and the constant demand for medical devices in clinical environments.

The medical device companies segment is projected to witness the fastest CAGR of 11.2% during 2025 to 2032, as more manufacturers outsource logistics operations to third-party providers for scalability and cost-efficiency.

- By Distribution Channel

On the basis of distribution channel, the North America medical device warehouse and logistics market is segmented into conventional logistics and third-party logistics (3PL). The third-party logistics (3PL) segment dominated with a market share of 62.4% in 2024, driven by the growing trend of outsourcing logistics operations, especially for temperature-sensitive and regulatory-compliant medical devices.

The conventional logistics segment to witness the fastest CAGR from 2025 to 2032, largely utilized by hospitals and government-run health institutions with internal logistics capabilities.

North America Medical Device Warehouse and Logistics Market Regional Analysis

- North America accounted for 18.4% of the global medical device warehouse and logistics market revenue in 2024, fueled by strong private-sector healthcare growth, digital health adoption, and the need for reliable high-performance logistics systems across both the U.S. and Canada

- Medical device warehouse and logistics systems are playing an increasingly vital role in ensuring the secure, timely, and regulatory-compliant delivery of critical healthcare equipment across North America. These systems enable cold chain storage, real-time tracking, and optimized distribution operations, which are essential for maintaining the integrity of sensitive medical devices and diagnostics

- The demand in North America is being driven by the rapid expansion of healthcare infrastructure, rising import and export of sophisticated medical technologies, and the implementation of stringent regulations for product traceability and cold chain compliance

U.S. Medical Device Warehouse and Logistics Market Insight

The U.S. dominated the North America medical device warehouse and logistics market with the largest revenue share of 81.2% in 2024, driven by a robust healthcare ecosystem, high medical device consumption, and widespread adoption of advanced warehouse automation and IoT-enabled logistics. Strategic investments in cold chain and distribution hubs by major logistics providers are further propelling growth in the country.

Canada Medical Device Warehouse and Logistics Market Insight

The Canada medical device warehouse and logistics market is projected to be the fastest-growing country in the region, expected to record a CAGR of 9.8% during 2025–2032. Growth is fueled by increasing reliance on imported medical devices, growing biopharmaceutical activity, and expanding regional healthcare access in remote areas. Additionally, the Canadian market is seeing increased investment in smart warehousing technologies and sustainable logistics practices.

Mexico Medical Device Warehouse and Logistics Market Insight

The Mexico medical device warehouse and logistics market is an emerging player in the North America medical device warehouse and logistics market, benefiting from its proximity to the U.S., expanding medical device manufacturing sector, and improving healthcare infrastructure. The country is a major hub for contract manufacturing and exports of medical devices, especially along the U.S.–Mexico border. Growth is further supported by government initiatives to modernize cold chain logistics and increase regulatory alignment with international standards. Mexico is expected to witness a steady CAGR of 7.1% from 2025 to 2032, driven by increased medical tourism, public-private partnerships in healthcare, and rising demand for temperature-controlled logistics solutions.

North America Medical Device Warehouse and Logistics Market Share

The medical device warehouse and logistics market industry is primarily led by well-established companies, including:

- Deutsche Post AG (Germany)

- FedEx (U.S.)

- Kuehne+Nagel (U.K.)

- AWL India Private Limited (India)

- C.H. Robinson Worldwide, Inc. (U.S.)

- CEVA (France)

- Dimerco (Taiwan)

- DSV (Denmark)

- Hansa International (China)

- Hellmann Worldwide Logistics SE & Co. KG (Germany)

- Imperial (South Africa)

- Mercury Business Services (U.S.)

- OIA Global (U.S.)

- Omni Logistics, LLC (U.S.)

- Rhenus Group (Germany)

- SEKO (U.S.)

- TIBA (Spain)

- Toll Holdings Limited (Australia)

Latest Developments in North America Medical Device Warehouse and Logistics Market

- In November 2023, DHL Express officially opened its expanded Central Asia Hub in Hong Kong, investing EUR 562 million to enhance its capabilities amid growing global trade. The hub, crucial for connecting Asia with the world, increased its peak shipment handling capacity by nearly 70% and can now manage six times the volume since its inception in 2004. This expansion underscores DHL's commitment to supporting customers’ growth and solidifying Hong Kong's status as a key international aviation hub

- In December 2022, DHL Supply Chain announced a USD 10.93 million investment to expand its warehousing capabilities in Northern Taiwan, particularly focusing on the semiconductor and life sciences and healthcare sectors. The newly opened Taoyuan Distribution Center-Jian Guo adds 10,000 square meters to DHL's total warehousing space in Taoyuan, increasing it to 37,000 square meters. This facility enhances connectivity for efficient logistics operations and supports the company's goal of reaching 200,000 square meters of total footprint in Taiwan by 2027

- In September 2024, FedEx launched the fdx platform, a data-driven commerce solution now available to U.S. businesses. The platform leverages FedEx's network to enhance customer experiences by improving demand growth, conversion rates, and fulfillment optimization. Notable features include predictive delivery estimates, sustainability insights, branded order tracking, and simplified return processes. Raj Subramaniam, FedEx CEO, highlighted the platform's role in smarter supply chains during the Dreamforce 2024 event

- In March 2024, UPS Healthcare introduced UPS Supply Chain Symphony R, a cloud-based platform designed to integrate and manage healthcare supply chain data from various operational systems. This tool provides healthcare customers with full visibility of their logistics, empowering them to make informed decisions, improve planning, and accurately forecast. By enhancing control, efficiency, and transparency, this platform supports the critical need for streamlined supply chains in healthcare. Kate Gutmann emphasized its transformative potential in optimizing global operations and patient care

- In September 2024, Kuehne+Nagel, a leading logistics provider, has opened a new temperature-controlled fulfillment center for Medtronic in Milton, Ontario, just 50 km from Toronto. Spanning 25,000 sqm, the facility will distribute medical devices to hospitals and houses Medtronic's service, repair, and preventative maintenance centers for its equipment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.