North America Medical Transport Boxes Market Analysis and Size

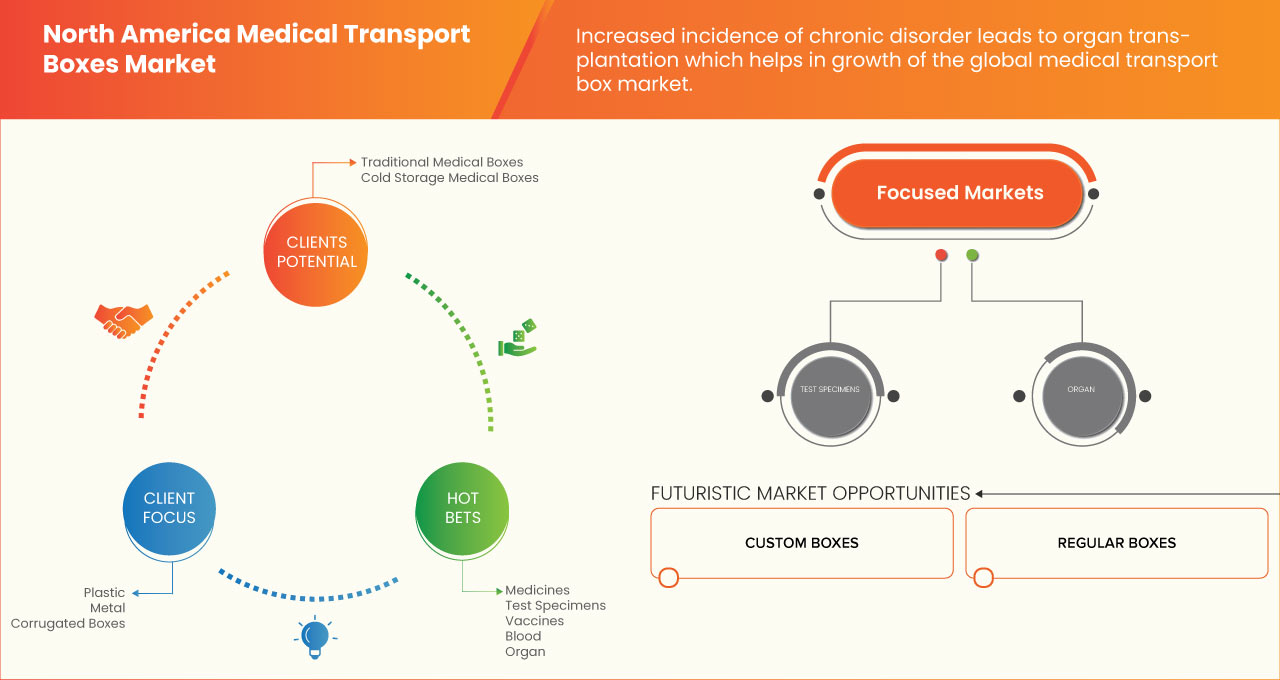

One of the primary factors driving the growth of the North America medical transport boxes market is the increased incidence of chronic disorders leading to organ transplantation. The continuing clinical trial research being conducted by several companies for better results leads to market expansion. The market is also influenced by the rise in healthcare expenditure and disposable income and easy transportation of fragile and expensive items. However, the poor reimbursement scenario acts as a restraining factor for the North America medical transport boxes market in the forecast period.

On the other hand, the increased incidence of the chronic disorder leading to organ transplantation is driving the market. However, high competition among the market players is restraining the growth of the North America medical transport boxes market in the forecast period.

The demand for medical transport boxes will increase North America due to a rise in product development and awareness regarding its benefits.

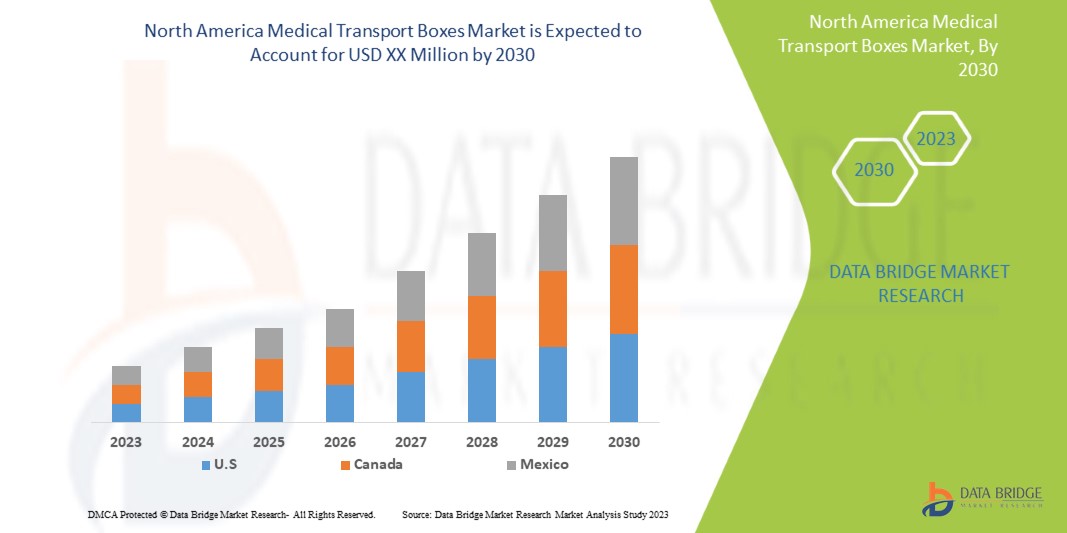

North America medical transport boxes market is supportive and aims to reduce the progression of the disease. Data Bridge Market Research analyses that North America medical transport boxes market will grow at a CAGR of 7.0% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

By Product Type (Traditional Medical Boxes and Cold Storage Medical Boxes), By Material (Plastic, Metal, and Corrugated Boxes), By Application (Medicines, Test Specimen, Vaccines, Blood, Organ, Medical Devices, Medical Waste, and Others), By Design (Regular Boxes and Custom Boxes), By End User (Diagnostic Laboratories, Blood Banks, Hospitals and Clinics, Ambulatory Surgical Centers, Academic and Research Institutes, and Others), By Distribution Channel (Direct Tender, Retail Sales, and Others). |

|

Countries Covered |

(U.S., Canada, and Mexico) |

|

Market Players Covered |

The Yebo Group, Shuttlepac Ltd , Summit Medical LLC, B medical systems, BWAY Corporation, Avantor, Inc., Sonoco Products Company, Orlando Products Inc., TRANSPAK, INC., Star Industrial, Thermo Fisher Scientific, and SARSTEDT AG & Co. KG, among others. |

MARKET DEFINITION

Medical transport boxes are defined as the boxes that are used for the transport of specimens. They are an essential component in managing product custody through the last mile of the medical cold chain. They are used for the storage of vaccines and dilutens at a prescribed temperature. It offers a temperature-controlled and protected environment for transportation. It provides various transport solutions regarding storage volume and temperature requirements and is specially designed for transportation, and follows the highest safety standards for the end user and patients.

Medical Transport Boxes Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increased Incidence of Chronic Disorder Leads to Organ Transplantation

The increased prevalence of chronic diseases due to the rapidly increasing population and infections can be seen. Individual risk factors, environmental factors, lack of physical activities, and human lifestyles are the major factors that are propelling rising incidences of diseases. The evaluation and replacement of organs will further lead to high demand for clinical studies through different routes of administration in the human body. The number of organ transplant surgeries has increased in recent years for a variety of reasons, including an increase in the number of cases of organ damage from car accidents, such as liver and kidney disease. Along with it, there is an increased occurrence of chronic conditions, including cardiovascular disease and renal failure, which require heart or kidney transplants to improve the health of the human organ system.

These organ needs to be stored in well-maintained and specialized custom medical boxes so that they will be properly stored and can be used for further process.

- Rise in Healthcare Expenditure and Disposable Income

Healthcare expenditure and its growth rate over time are inclined by a wide variety of economic and social factors, including the financing arrangements and structure of the organization of the health system.

Healthcare expenditure has increased across the world as people's disposable income in various countries is increasing. Moreover, to accomplish the population requirements, government bodies and healthcare organizations are taking initiatives by virtue of accelerating healthcare expenditure, and rising use of medical transport box solutions in outpatient care facilities.

Restraint

- Poor Reimbursement Scenario

Reimbursement for all healthcare products has been under downward pressure for several years. These devices also face a major roadblock in their growth due to the lack of reimbursement for these products. The reimbursement of products can significantly affect the ability of a provider to access a particular technology, as well as the willingness of a manufacturer to deliver it. If coverage is uncertain, the manufacturer has difficulty predicting whether an investment in new technology will yield enough returns. This lack of predictability is an apparent barrier to obtaining funding for the company. It further compromises innovation and restricts patient access to advanced technology and solutions.

Medical transport boxes have become an important part of healthcare in terms of the safe transportation of specimens. The increasing application of medical boxes in conditions like cardiovascular disease and renal failure, among more, makes it crucial for the healthcare facility. However, the high cost of such products and the lack of a proper reimbursement policy hampers the adoption rate of these products.

Thus, the poor reimbursement scenarios act as a restraint to the growth of the North America medical transport boxes market.

Opportunity

- Rise In Technological Advancement For Product Development

Growing healthcare infrastructure and the rise in technology help provide better critical care, leading to faster recovery and rehabilitation into normal life. Also, as an investment in healthcare increases, more people are getting aware and desire advanced critical care equipment and diagnosing their health for precaution and cure. This process needs faster transportation of medical equipment, medicines and other consumables.

The increasing rise in technology in product development needs advancement in transportation also helps patients to take hassle-free advanced treatment for better diagnosis, and fast recovery is acting as an opportunity for growing the demand of the market.

An increase in healthcare expenditure leads to the implementation of advanced technologies, equipment & products and better treatment for critical care patients, leading to faster recovery through the transport of medical boxes needed to deliver. For this reason, faster recovery and rehabilitation into a normal life are expected to act as an opportunity for growing the demand for the North America medical transport boxes market.

Challenge

- Stringent Regulations For Product Approval

The concerns regarding the efficacy and safety of products have caused most governments to develop regulatory agencies and policies to look after the development and transportation of new devices and critical care consumables. The use of medical boxes can be done after passing stringent regulatory standards, which ensure the medical boxes are safe, well-studied, and has no adverse reactions.

The recent guidelines and the amendment have adequate guidance for manufacturers. International regulations such as food, drugs, and administration play a major role in the new launch of the medical boxes transportation into the market. Thus, it is expected to be a major market challenge.

Some special controls also include implementing post-marketing surveillance measures, guidance documents, adherence to performance standards, and special labeling.

Thus, stringent government regulations on medical box transportation approval are expected to impact the growth of the North America medical transport boxes market.

Post COVID-19 Impact on North America Medical Transport Boxes Market

Previously, routine care, as well as emergency care, crisis care, and other types of care, making use of remote care and telemedical transport boxes services. Their use in a more widespread capacity has picked up speed as the COVID-19 pandemic has progressed. Telemedical transport boxes services are now being used in the large-scale screening of patients prior to their visit and triage assessment, in the routine monitoring of patients at home, for remote clinical encounters, or for supervising patient care by off-site experts. Telemedical transport box services are also being used in the United Kingdom to screen patients at home. It is likely that a significant portion of such services will continue to be based on telemedical transport boxes after COVID-19, for example, the remote monitoring and management of a greater number of patients. This is because telemedical transport boxes offer greater convenience and better patient-centered care, which helps to partially address the challenges of the flow rate and capacity within the healthcare system.

This phenomenon has also been observed in the field of mental healthcare, where the pandemic acted as a catalyst for the implementation of online therapy and e-health tools in routine practice. This came after more than two decades of many brilliant but mostly unsuccessful attempts to improve mental healthcare. The imperatives that have dominated the field, such as the belief that "the clinician/patient therapeutic alliance can only be established face-to-face," despite research showing the opposite, are being resolved. One example of this is the belief that "the clinician/patient therapeutic alliance can only be established face-to-face." It is possible that once mental healthcare institutions have developed the capabilities post-COVID-19 of serving their patients via various digital technologies, there will be little reason for them to give all of these up in light of the benefits they have experienced over an extended period of crisis response. This is because of the fact that COVID-19 was passed after mental healthcare institutions had already developed these capabilities. It is likely that in the not-too-distant future, a "blended approach" will emerge, in which e-mental-health solutions will take up a greater proportion of routine services. In addition, the knowledge and skills that are currently being developed can be put to use in the development of a more comprehensive public e-mental health approach. This would involve the utilization of interventions that are not only guided but also fully self-guided, such as self-help apps or online therapeutic modules. As a positive post-COVID-19 long-term outcome, the latter could also be tested and eventually applied in settings and countries with scarce mental health resources where such a need has been previously identified.

Recent Development

- In October 2021, the Innova Medical Group inaugurated its first rapid antigen test production line in France, in Pithiviers, Loiret. The company believes this will help in its business expansion and in the economic development of the Centre-Val de Loire region.

- In December 2022, Focus Technology Co., Ltd. launched Aucma China's big-capacity low-temperature equipment blood bank refrigerator for cryopreservation purposes.

North America Medical Transport Boxes Market Scope

The North America medical transport boxes market is categorized into six notable segments based on product type, material, application, design, end user, and distribution channel.

By Product Type

- Traditional Medical Boxes

- Cold-Storage Medical Boxes

On the basis of product type, the North America medical transport boxes market is further segmented into traditional medical boxes and cold storage medical boxes.

By Material

- Plastic

- Corrugated Boxes

- Metal

On the basis of material, the North America medical transport boxes market is segmented into plastic, corrugated boxes, and metal.

Application

- Medicines

- Test Specimen

- Vaccines

- Blood

- Organ

- Medical Devices

- Medical Waste

- Others

On the basis of application, the North America medical transport boxes market is segmented into medicines, test specimens, vaccines, blood, organ, medical devices, medical waste, and others.

By Design

- Regular Boxes

- Custom Boxes

On the basis of design, the North America medical transport boxes market is segmented into regular boxes and custom boxes.

End User

- Diagnostic Laboratories

- Blood Banks

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Academic and Research Institutes

- Others

On the basis of end user, the North America medical transport boxes market is segmented into diagnostic laboratories, blood banks, hospitals, clinics, ambulatory surgical centers, academic, research institutes, and others.

Distribution Channel

- Direct Tender

- Retail Sales

- Others

On the basis of distribution channel, the North America medical transport boxes market is segmented into direct tender, retail sales, and others.

Medical Transport Boxes Market Regional Analysis/Insights

The North America medical transport boxes market is analyzed, and market size insights and trends are provided by product type, material, application, design, end user, and distribution channel as referenced above.

The countries covered in the medical transport boxes report U.S., Canada, and Mexico.

North America are growing in the North America wireless microphone market. The broad base of the medical transport boxes industry in the country, with significant spending in healthcare, is set to drive the market growth for various devices and equipment used to deliver to different end users of the medical transport boxes market. The U.S. dominates the North America region due to the exponential use of remote monitoring, and transport boxes.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Medical Transport Boxes Market Share Analysis

North America medical transport boxes market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the medical transport boxes market.

Some of the key players operating in the North America medical transport boxes market are The Yebo Group, Shuttlepac Ltd, Summit Medical LLC, B medical systems, BWAY Corporation, Avantor, Inc., Sonoco Products Company, Orlando Products Inc., TRANSPAK, INC., Star Industrial, Thermo Fisher Scientific, and SARSTEDT AG & Co. KG, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE SEGMENT LIFELINE CURVE

2.8 MARKET APPLICATION COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PATENT ANALYSIS

4.4 TECHNOLOGICAL ADVANCEMENT IN THE TRANSPORTATION PROCESS

4.5 SHORTER TURNAROUND TIME FOR VACCINES

4.6 APPROVED DATALOGGER/TEMPERATURE MONITORING DEVICE

4.6.1 TEMPERATURE MONITORING DEVICES

4.6.2 DATALOGGER

5 INDUSTRY INSIGHT

6 REGULATORY FRAMEWORK

6.1 ISO 15378 – 2017 QMS STANDARD FOR THE PRIMARY PACKAGING MATERIALS FOR MEDICINAL PRODUCTS

6.2 REGULATIONS IN THE U.S.

6.3 REGULATIONS IN CANADA

6.4 REGULATIONS IN EUROPE

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 INCREASED INCIDENCE OF CHRONIC DISORDER LEADS TO ORGAN TRANSPLANTATION

7.1.2 RISE IN HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME

7.1.3 EASY TRANSPORTATION OF FRAGILE AND EXPENSIVE ITEMS

7.2 RESTRAINT

7.2.1 POOR REIMBURSEMENT SCENARIO

7.2.2 HIGH COMPETITION AMONG MARKET PLAYERS

7.3 OPPORTUNITIES

7.3.1 RISE IN TECHNOLOGICAL ADVANCEMENT FOR PRODUCT DEVELOPMENT

7.3.2 RISING AWARENESS REGARDING MEDICAL TRANSPORTATION BY KEY PLAYERS

7.4 CHALLENGES

7.4.1 STRINGENT REGULATION FOR PRODUCT APPROVAL

7.4.2 LACK OF KNOWLEDGE AND SKILLED PROFESSIONAL REGARDING THE USAGE AND HANDLING OF MEDICAL BOXES

8 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TRADITIONAL MEDICAL BOXES

8.2.1 LESS THAN 10L

8.2.2 10L-40L

8.2.3 40L-80L

8.2.4 MORE THAN 80L

8.3 COLD STORAGE MEDICAL BOXES

8.3.1 LESS THAN 10L

8.3.2 10L-40L

8.3.3 40L-80L

8.3.4 MORE THAN 80L

9 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 PLASTIC

9.2.1 POLYETHYLENE

9.2.2 HIGH DENSITY POLYETHYLENE

9.2.3 POLYSTYRENE

9.2.4 OTHERS

9.3 CORRUGATED BOXES

9.4 METAL

10 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 MEDICINES

10.3 VACCINES

10.4 TEST SPECIMEN

10.5 BLOOD

10.6 MEDICAL DEVICES

10.7 ORGAN

10.8 MEDICAL WASTE

10.9 OTHERS

11 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY DESIGN

11.1 OVERVIEW

11.2 REGULAR BOXES

11.3 CUSTOM BOXES

12 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY END USER

12.1 OVERVIEW

12.2 DIAGNOSTIC LABORATORIES

12.3 HOSPITALS AND CLINICS

12.4 BLOOD BANKS

12.5 AMBULATORY SURGICAL CENTERS

12.6 ACADEMIC AND RESEARCH INSTITUTES

12.7 OTHERS

13 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.4 OTHERS

14 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 THERMO FISHER SCIENTIFIC INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 SARSTEDT AG & CO. KG

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 GREINER BIO-ONE INTERNATIONAL GMBH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 TRANSPAK, INC

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 B MEDICAL SYSTEMS

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AOV INTERNATIONAL LLP

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 APEX INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 AVANTOR, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 BADU (XIAMEN) TECHNOLOGY CO.LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 BLOWKINGS INDIA

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 BWAY CORPORATION

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 COLD CHAIN TECHNOLOGIES

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GIMA S.P.A. VIA MARCONI

17.13.1 COMPANY PROFILE

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 HEATHROW SCIENTIFIC

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 INSPIRED TECHNOLOGY

17.15.1 COMPANY PROFILE

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LABCOLD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 LEFF INTERNATIONAL TRADING CO. LTD

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 MEDICUS HEALTH.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ORLANDO PRODUCTS

17.19.1 COMPANY PROFILE

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 POLAR THERMAL

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 SHUTTLEPAC LTD

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 SONOCO PRODUCTS COMPANY

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENT

17.23 STAR INDUSTRIAL

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 SUMMIT MEDICAL LLC

17.24.1 COMPANY PROFILE

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 THE YEBO GROUP

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, PATENT ANALYSIS

TABLE 2 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, TEMPERATURE MONITORING DEVICE

TABLE 3 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, PREQUALIFY PRODUCTS OF TEMPERATURE MONITORING DEVICE

TABLE 4 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, DATA LOGGER

TABLE 5 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TRADITIONAL MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TRADITIONAL MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA COLD STORAGE MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA COLD STORAGE MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PLASTIC IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PLASTIC IN MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA CORRUGATED BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA METAL IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA MEDICINES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA VACCINES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TEST SPECIMEN IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA BLOOD IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA MEDICAL DEVICES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ORGAN IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA MEDICAL WASTE IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA REGULAR BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA CUSTOM BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA DIAGNOSTIC LABORATORIES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA HOSPITALS AND CLINICS IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA BLOOD BANKS IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA DIRECT TENDER IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA RETAIL SALES IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN MEDICAL TRANSPORT BOXES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA TRADITIONAL MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA COLD STORAGE MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA PLASTIC IN MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 48 U.S. MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 U.S. TRADITIONAL MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. COLD STORAGE MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 52 U.S. PLASTIC IN MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 53 U.S. MEDICAL TRANSPORT BOXES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 U.S. MEDICAL TRANSPORT BOXES MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 55 U.S. MEDICAL TRANSPORT BOXES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 56 U.S. MEDICAL TRANSPORT BOXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 57 CANADA MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA TRADITIONAL MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA COLD STORAGE MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 61 CANADA PLASTIC IN MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 62 CANADA MEDICAL TRANSPORT BOXES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 CANADA MEDICAL TRANSPORT BOXES MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 64 CANADA MEDICAL TRANSPORT BOXES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 65 CANADA MEDICAL TRANSPORT BOXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 66 MEXICO MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO TRADITIONAL MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO COLD STORAGE MEDICAL BOXES IN MEDICAL TRANSPORT BOXES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 70 MEXICO PLASTIC IN MEDICAL TRANSPORT BOXES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 71 MEXICO MEDICAL TRANSPORT BOXES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 MEXICO MEDICAL TRANSPORT BOXES MARKET, BY DESIGN, 2021-2030 (USD MILLION)

TABLE 73 MEXICO MEDICAL TRANSPORT BOXES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 74 MEXICO MEDICAL TRANSPORT BOXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: SEGMENTATION

FIGURE 11 INCREASED INCIDENCE OF CHRONIC DISORDER LEADS TO ORGAN TRANSPLANTATION, AND RISE IN HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET FROM 2023 TO 2030

FIGURE 12 TRADITIONAL MEDICAL BOXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET

FIGURE 14 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY MATERIAL, 2022

FIGURE 19 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY MATERIAL, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY MATERIAL, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 22 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY DESIGN, 2022

FIGURE 27 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY DESIGN 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY DESIGN, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 30 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: SNAPSHOT (2022)

FIGURE 39 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY COUNTRY (2022)

FIGURE 40 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 43 NORTH AMERICA MEDICAL TRANSPORT BOXES MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.