North America Metabolic Testing Market

Market Size in USD Million

CAGR :

%

USD

166.17 Million

USD

298.58 Million

2024

2032

USD

166.17 Million

USD

298.58 Million

2024

2032

| 2025 –2032 | |

| USD 166.17 Million | |

| USD 298.58 Million | |

|

|

|

|

North America Metabolic Testing Market Size

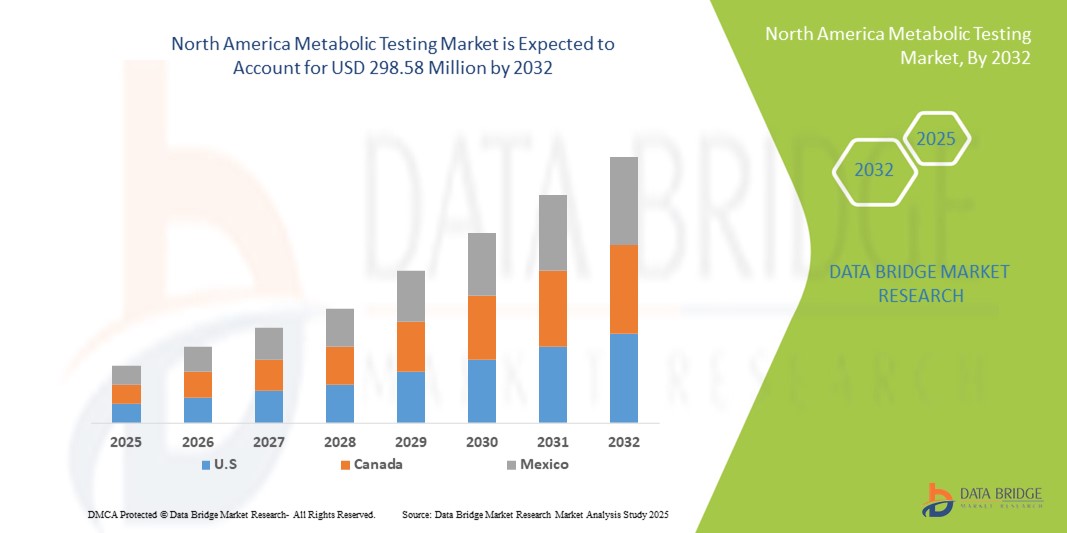

- The North America metabolic testing market size was valued at USD 166.17 million in 2024 and is expected to reach USD 298.58 million by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by the rising prevalence of metabolic disorders, increasing focus on preventive healthcare, and growing adoption of advanced diagnostic and monitoring technologies in clinical and research settings

- Furthermore, expanding consumer awareness regarding personalized nutrition, fitness tracking, and early detection of metabolic conditions is driving demand for comprehensive metabolic testing solutions. These converging factors are accelerating the uptake of metabolic testing services, thereby significantly boosting the industry's growth

North America Metabolic Testing Market Analysis

- Metabolic testing, encompassing assessments of metabolism, nutrient utilization, and biochemical markers, is becoming an essential component of preventive healthcare, personalized nutrition, and clinical diagnostics in both medical and wellness settings due to its ability to provide actionable health insights and optimize patient outcomes

- The escalating demand for metabolic testing is primarily fueled by the rising prevalence of metabolic disorders such as diabetes and obesity, growing focus on personalized medicine, and increasing consumer awareness of health and wellness monitoring

- U.S. dominated the North America metabolic testing market with the largest revenue share of 83.2% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of key industry players, with significant growth in adoption across hospitals, clinics, and wellness centers, driven by innovations in non-invasive devices, AI-based analytics, and personalized health solutions

- Canada is expected to be the fastest-growing country in the North America metabolic testing market during the forecast period due to rising healthcare awareness, increasing prevalence of metabolic disorders, and expanding access to diagnostic facilities

- Metabolic carts segment dominated the North America metabolic testing market with a market share of 39.2% in 2024, driven by their accuracy, versatility, and widespread use in both clinical and research applications

Report Scope and North America Metabolic Testing Market Segmentation

|

Attributes |

North America Metabolic Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Metabolic Testing Market Trends

Increased Accuracy and Personalization Through AI and Wearable Integration

- A significant and accelerating trend in the North America metabolic testing market is the integration of artificial intelligence (AI) and wearable health devices, enhancing the precision of metabolic measurements and personalized health recommendations

- For instance, wearable metabolic analyzers combined with AI algorithms can track real-time energy expenditure and nutrient utilization, providing actionable insights for both clinical and wellness applications

- AI integration in metabolic testing enables predictive analytics for lifestyle interventions, suggesting optimized nutrition and exercise plans based on individual metabolic profiles

- The integration of metabolic testing with health monitoring platforms allows centralized tracking of metabolic health alongside cardiovascular, activity, and sleep data, creating a comprehensive wellness management system

- This trend towards more intelligent, personalized, and interconnected metabolic monitoring is reshaping expectations for preventive healthcare. Consequently, companies such as Cosmed are developing AI-enabled metabolic carts and wearable solutions with real-time data analysis and app-based reporting

- The demand for metabolic testing solutions with seamless AI and wearable integration is growing rapidly across hospitals, clinics, and fitness centers, as consumers and healthcare providers prioritize personalized, data-driven health interventions

North America Metabolic Testing Market Dynamics

Driver

Rising Prevalence of Metabolic Disorders and Health Awareness

- The increasing incidence of obesity, diabetes, and other metabolic disorders, combined with growing awareness of preventive healthcare, is a major driver for the adoption of metabolic testing solutions

- For instance, in March 2024, a U.S.-based hospital implemented AI-enabled metabolic carts to improve patient management and monitor lifestyle disease progression

- As patients and consumers become more proactive about health, metabolic testing provides actionable insights for diet, exercise, and disease prevention, enhancing clinical decision-making

- The rising adoption of personalized medicine and wellness programs is making metabolic testing an integral component of preventive and performance-focused healthcare

- Government initiatives and insurance incentives supporting preventive diagnostics are further boosting demand for metabolic testing solutions

- Increased collaboration between healthcare providers and technology companies is facilitating the development of advanced, user-friendly metabolic testing solutions for a broader population

- The ability to monitor metabolic health in real time, track lifestyle interventions, and integrate results with electronic health records is driving adoption across hospitals, clinics, and fitness centers

Restraint/Challenge

High Equipment Costs and Data Privacy Concerns

- The high cost of advanced metabolic testing devices, including metabolic carts and wearable analyzers, remains a key challenge for broader market adoption in price-sensitive segments

- For instance, some premium metabolic testing systems offering VO2 Max and RMR analysis can cost several thousand dollars, limiting accessibility for smaller clinics or individual consumers

- Data privacy and cybersecurity concerns regarding personal metabolic and health information pose additional challenges, as these devices often transmit sensitive data to cloud platforms for analysis

- Addressing these concerns requires secure data encryption, compliance with health information regulations, and clear consumer education on data safety, which are critical for building trust

- Limited availability of trained personnel to operate complex metabolic testing systems can hinder adoption in smaller clinics and wellness centers

- Technical challenges such as calibration accuracy, device maintenance, and integration with existing healthcare IT systems can restrict seamless implementation and routine use

- While costs are gradually decreasing with technological advancements, affordability and privacy assurances will be essential for accelerating adoption across a wider range of healthcare and wellness settings

North America Metabolic Testing Market Scope

The market is segmented on the basis of product, technology, application, and end user.

- By Product

On the basis of product, the North America metabolic testing market is segmented into CPET Systems, Metabolic Carts, Body Composition Analysers, ECGs & EKGs Systems, and Software. The Metabolic Carts segment dominated the market with the largest revenue share of 39.2% in 2024, driven by their versatility, accuracy, and wide application in both clinical and research settings. Healthcare providers and wellness centers prefer metabolic carts for their ability to measure energy expenditure, VO2 Max, and substrate utilization accurately. These systems are often integrated with software for detailed data analysis, supporting preventive healthcare and personalized fitness programs. The demand for metabolic carts is also bolstered by technological advancements such as AI-powered data interpretation and cloud-based dashboards, enabling long-term tracking and actionable insights. Their adaptability to different patient populations, from athletes to individuals with metabolic disorders, further solidifies their market dominance.

The CPET Systems segment is anticipated to witness the fastest growth during the forecast period, owing to increasing adoption in hospitals and sports performance centers. CPET (Cardiopulmonary Exercise Testing) systems are essential for evaluating cardiopulmonary and metabolic health, particularly in critical care and lifestyle disease management. Growing awareness of preventive healthcare and demand for early diagnosis of metabolic and cardiovascular disorders are driving the uptake of CPET systems. The increasing trend of integrating these systems with digital monitoring platforms and AI analytics enhances their appeal. Moreover, their application in personalized exercise and rehabilitation programs further accelerates adoption in both clinical and fitness-focused environments.

- By Technology

On the basis of technology, the metabolic testing market is segmented into VO2 Max Analysis, RMR Analysis, and Body Composition Analysis. The VO2 Max Analysis segment dominated the market in 2024 due to its critical role in assessing cardiovascular fitness, energy expenditure, and metabolic efficiency. VO2 Max testing is widely used in clinical diagnostics, sports performance evaluation, and personalized nutrition planning. Its ability to provide real-time insights into an individual’s metabolic and aerobic capacity makes it highly valuable for both patients and healthcare practitioners. The segment benefits from technological advancements such as wearable integration and AI-assisted predictive analytics. VO2 Max devices are also increasingly adopted in preventive healthcare programs and wellness centers, driving consistent demand. Furthermore, its applications in monitoring treatment outcomes and guiding lifestyle interventions reinforce its dominance.

The RMR Analysis segment is expected to witness the fastest growth over the forecast period due to increasing consumer awareness of personalized diet and weight management. RMR (Resting Metabolic Rate) analysis provides critical insights into calorie requirements, helping individuals optimize nutrition plans and manage obesity or metabolic disorders. The growth is further fueled by the rising prevalence of lifestyle diseases and the expanding fitness and wellness industry. Integration with mobile apps and cloud platforms allows users to track metabolic changes over time, enhancing engagement and adoption. In addition, the demand from sports training centers, gyms, and clinics for precise metabolic profiling supports rapid segment expansion.

- By Application

On the basis of application, the metabolic testing market is segmented into Lifestyle Diseases, Critical Care, Human Performance Testing, Dysmetabolic Syndrome X, Metabolic Disorders, and Others. The Lifestyle Diseases segment dominated the market in 2024, driven by the rising prevalence of obesity, diabetes, and cardiovascular disorders in North America. Metabolic testing provides essential insights into energy expenditure, nutrient utilization, and metabolic imbalances, enabling preventive care and personalized treatment plans. Hospitals and clinics increasingly rely on metabolic testing to manage lifestyle-related conditions and monitor therapeutic interventions. Consumer demand for proactive health monitoring and personalized wellness programs also supports this segment. The growing adoption of corporate wellness initiatives and preventive healthcare policies further accelerates market growth.

The Human Performance Testing segment is expected to witness the fastest growth, fueled by increasing interest in sports performance optimization and fitness tracking. Athletes and fitness enthusiasts rely on metabolic testing to improve endurance, recovery, and overall physical performance. The integration of advanced devices with AI, wearable sensors, and software platforms allows for detailed monitoring of VO2 Max, RMR, and other metabolic parameters. Rising investments in professional sports, recreational fitness, and wellness programs contribute to segment expansion. In addition, growing awareness of personalized training regimens and nutrition strategies supports rapid adoption in training centers and gyms.

- By End User

On the basis of end user, the metabolic testing market is segmented into hospitals, laboratories, sports training centers, gyms, and others. The Hospitals segment dominated the market with the largest share in 2024 due to advanced healthcare infrastructure, high adoption of preventive diagnostics, and growing prevalence of metabolic disorders. Hospitals utilize metabolic testing for early detection, disease management, and monitoring patient outcomes across both lifestyle and clinical conditions. Integration with electronic health records and AI-based analytics enhances the value of these solutions in hospital settings. Hospitals also benefit from training programs for staff to maximize the accuracy and utilization of metabolic testing devices. Furthermore, hospitals act as early adopters of innovative products, supporting market growth.

The Sports Training Centers segment is expected to witness the fastest growth over the forecast period, driven by rising investment in athletic performance optimization and fitness-focused programs. These centers utilize metabolic testing for VO2 Max, RMR, and body composition analysis to tailor training and nutrition plans for athletes. The growing trend of personalized fitness programs and adoption of advanced metabolic devices supports rapid expansion. Integration with mobile and cloud-based platforms enables real-time monitoring and data-driven decision-making for trainers and athletes. In addition, increasing interest in preventive healthcare among fitness enthusiasts contributes to adoption.

North America Metabolic Testing Market Regional Analysis

- U.S. dominated the North America metabolic testing market with the largest revenue share of 83.2% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of key industry players

- Consumers and healthcare providers in the region highly value accurate, non-invasive metabolic assessments, personalized health insights, and seamless integration with digital health platforms and wearable devices

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare spending, and strong presence of key industry players, establishing metabolic testing as a preferred solution for hospitals, clinics, wellness centers, and sports performance facilities

U.S. Metabolic Testing Market Insight

The U.S. metabolic testing market captured the largest revenue share in 2024 within North America, fueled by the rising prevalence of metabolic disorders such as obesity, diabetes, and cardiovascular diseases. Consumers and healthcare providers are increasingly prioritizing preventive healthcare and personalized wellness programs, driving demand for accurate and non-invasive metabolic assessments. The growing adoption of wearable devices, AI-driven analytics, and digital health platforms further propels the metabolic testing industry. Moreover, integration of metabolic testing into hospitals, clinics, and sports performance centers is significantly contributing to market expansion, enabling real-time monitoring and data-driven interventions.

Canada Metabolic Testing Market Insight

The Canada metabolic testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of lifestyle-related diseases and the adoption of preventive healthcare measures. Rising consumer interest in personalized nutrition and fitness tracking is fostering the uptake of metabolic testing solutions. Canadian healthcare providers are incorporating these technologies into clinical practice, wellness programs, and research applications, enhancing patient outcomes. The country is also witnessing significant growth in diagnostic service offerings, supported by government initiatives promoting health monitoring and preventive care.

Mexico Metabolic Testing Market Insight

The Mexico metabolic testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing urbanization and the rising incidence of lifestyle diseases. Healthcare providers and wellness centers are emphasizing early diagnosis and metabolic health monitoring to manage obesity, diabetes, and other chronic conditions. Growing consumer awareness about personalized wellness and preventive diagnostics is encouraging the adoption of metabolic testing devices. In addition, Mexico’s expanding healthcare infrastructure and the presence of regional distributors and service providers are expected to stimulate market growth.

North America Metabolic Testing Market Share

The North America metabolic testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- KORR Medical Technologies, Inc. (U.S.)

- Blueprint Genetics Oy. (U.S.)

- Susquehanna Micro, Inc. (U.S.)

- BioAgilytix Labs (U.S.)

- Labcorp. (U.S.)

- DynaLife (Canada)

- Mérieux NutriSciences (U.S.)

- Live Lean Rx (U.S.)

- Nutrition HealthWorks (U.S.)

- NeoGenomics Laboratories (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Bruker (U.S.)

- Danaher Corporation (U.S.)

- Waters (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

What are the Recent Developments in North America Metabolic Testing Market?

- In August 2025, Dexcom announced that its continuous glucose monitor (CGM), Stelo, received FDA approval for over-the-counter use. This marks a significant step in making metabolic health monitoring more accessible to the general public, including individuals without diabetes

- In July 2025, INSCYD, a global leader in metabolic testing, partnered with Velocity, a premier coach-led virtual training platform, to introduce the first fully automated metabolic testing integration. This collaboration enables cycling and triathlon coaches to deliver lab-accurate performance assessments at scale, without manual involvement, revolutionizing athlete monitoring and training efficiency

- In November 2024, Trudell Medical Limited completed the acquisition of Vyaire Medical's RDx business unit, rebranding it as Jaeger Medical. This acquisition ensures the continuation of service to RDx customers and maintains operations in Germany and California, expanding Trudell Medical's portfolio in respiratory diagnostics

- In August 2024, Trudell Medical Limited reached an agreement to purchase the RDx business unit of Vyaire Medical. RDx manufactures respiratory diagnostic products that are used in hospitals and private clinics worldwide, expanding Trudell Medical's portfolio in respiratory diagnostics

- In August 2022, BD a leading global medical technology company, and Accelerate Diagnostics, Inc. an innovator of rapid in-vitro diagnostics in microbiology, announced a worldwide commercial collaboration agreement where BD will offer Accelerate's rapid testing solution for antibiotic resistance and susceptibility offering results in hours, versus one to two days with some traditional laboratory methods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.