North America Obsessive Compulsive Disorder Ocd Drugs Market

Market Size in USD Million

CAGR :

%

USD

688.41 Million

USD

321.14 Million

2025

2033

USD

688.41 Million

USD

321.14 Million

2025

2033

| 2026 –2033 | |

| USD 688.41 Million | |

| USD 321.14 Million | |

|

|

|

|

North America Obsessive-Compulsive Disorder (OCD) Drugs Market Size

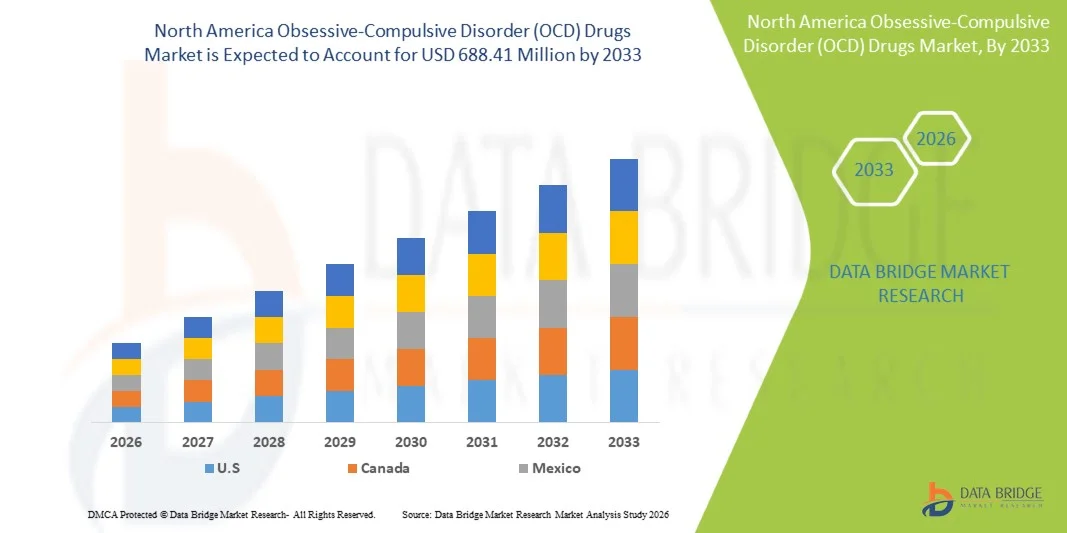

- The North America Obsessive-Compulsive Disorder (OCD) drugs market size was valued at USD 321.14 million in 2025 and is expected to reach USD 688.41 million by 2033, at a CAGR of 10.0% during the forecast period

- The market growth is largely fueled by the increasing prevalence of OCD in both adult and adolescent populations, coupled with advancements in pharmacological therapies and personalized treatment approaches

- Furthermore, rising awareness about mental health, growing healthcare expenditure, and patient preference for effective, well-tolerated, and accessible drug therapies are driving the adoption of OCD medications across the region. These factors are accelerating market uptake, thereby significantly boosting the industry's growth

North America Obsessive-Compulsive Disorder (OCD) Drugs Market Analysis

- OCD drugs, comprising antidepressants, antipsychotics, NMDA blockers, and other emerging pharmacological therapies, are increasingly vital for managing obsessive-compulsive disorder in both adult and pediatric populations due to their efficacy in symptom reduction and improving quality of life

- The escalating demand for OCD drugs is primarily fueled by the rising prevalence of OCD, growing awareness about mental health, and increasing preference for clinically validated pharmacological treatments over non-medical interventions

- The United States dominated the OCD drugs market with the largest revenue share of 55.8% in 2025, characterized by well-established healthcare infrastructure, high healthcare expenditure, and a strong presence of key pharmaceutical players, with substantial growth in prescriptions, particularly in hospitals and specialty clinics, driven by innovations in drug formulations and targeted therapies

- Canada is expected to be the fastest-growing country in the OCD drugs market during the forecast period due to increasing awareness programs, expanding mental health initiatives, and improving access to psychiatric care

- Antidepressants segment dominated the OCD drugs market with a market share of 52.9% in 2025, driven by their proven efficacy, wide adoption as the first-line therapy, and established safety profile across both adult and pediatric populations

Report Scope and North America Obsessive-Compulsive Disorder (OCD) Drugs Market Segmentation

|

Attributes |

North America Obsessive-Compulsive Disorder (OCD) Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Obsessive-Compulsive Disorder (OCD) Drugs Market Trends

“Personalized and Digital-Enabled Treatment Approaches”

- A significant and accelerating trend in the North America OCD drugs market is the integration of digital health tools and personalized treatment approaches, enabling better monitoring of patient symptoms, adherence, and response to therapy

- For instance, mobile apps and telehealth platforms now allow patients to track OCD symptom severity, medication intake, and therapy progress, which can be shared directly with psychiatrists for tailored treatment adjustments

- Advances in pharmacogenomics and AI-driven treatment recommendations are enabling clinicians to optimize drug selection for individual patients, minimizing adverse effects while maximizing therapeutic outcomes

- Telepsychiatry consultations combined with remote prescription management are expanding access to OCD drugs, particularly in underserved or rural areas

- Digital adherence tools, reminders, and remote patient monitoring improve compliance, reduce relapse risk, and support continuity of care in both adult and pediatric populations

- This trend towards digital and personalized OCD management is reshaping patient expectations for therapy, with companies such as Biohaven and Axsome Therapeutics exploring integrated patient support programs combined with pharmacological treatment

- The adoption of digital-enabled, patient-centered OCD treatment solutions is growing rapidly across outpatient clinics, specialty hospitals, and home healthcare settings, as patients and caregivers increasingly prioritize convenience, safety, and continuous care

North America Obsessive-Compulsive Disorder (OCD) Drugs Market Dynamics

Driver

“Increasing Prevalence and Awareness Driving Adoption”

- The rising prevalence of OCD among adults and pediatric populations, coupled with growing mental health awareness, is a significant driver for the heightened demand for OCD drugs

- For instance, national health surveys indicate increasing diagnosis rates, prompting healthcare providers to actively prescribe SSRIs, antipsychotics, and NMDA blockers for effective management of OCD symptoms

- As patients and caregivers become more informed about treatment options, the demand for clinically validated, evidence-based pharmacological therapies has strengthened adoption across outpatient and specialty care settings

- Furthermore, increasing insurance coverage and reimbursement for mental health treatments are facilitating access to medications, making evidence-based drug therapy a preferred choice over non-pharmacological interventions alone

- The convenience of oral administration, availability of multiple drug classes, and patient support programs are key factors propelling OCD drug uptake in hospitals, specialty clinics, and home healthcare

- The trend towards early intervention, comprehensive treatment plans, and integrated care pathways is further driving adoption of OCD drugs in both adult and pediatric populations

- Rising partnerships between pharmaceutical companies and digital health providers are creating patient-centric programs that encourage adherence and optimize treatment outcomes. Public awareness campaigns and mental health initiatives are helping reduce stigma associated with OCD, resulting in increased diagnosis and treatment uptake

Restraint/Challenge

“Skin Irritation Issues and Regulatory Compliance Hurdle”

- Concerns surrounding side effects, potential drug interactions, and long-term adherence pose a significant challenge to broader market penetration of OCD drugs

- For instance, common adverse effects such as gastrointestinal disturbances, sleep issues, or weight changes can lead to therapy discontinuation and reduce patient compliance

- Strict regulatory approvals, clinical trial requirements, and post-marketing surveillance add complexity for pharmaceutical companies seeking to launch new OCD drugs in North America

- High out-of-pocket costs for some branded therapies and limited availability of advanced drug formulations in certain regions can further restrict patient access and market growth

- While generics and patient assistance programs are improving affordability, perceived treatment burden and side effect concerns can hinder widespread adoption among price-sensitive or hesitant patients

- Concerns over drug-drug interactions, particularly in patients with comorbid psychiatric or medical conditions, can limit prescriber confidence and usage

- Variability in insurance coverage policies and prior authorization requirements can delay treatment initiation and reduce patient adherence. Addressing these challenges through patient education, adherence support programs, safer drug formulations, and robust regulatory compliance will be vital for sustained market growth

North America Obsessive-Compulsive Disorder (OCD) Drugs Market Scope

The market is segmented on the basis of severity, sub-type, drugs, route of administration, population type, end user, and distribution channel.

- By Severity

On the basis of severity, the OCD drugs market is segmented into mild to moderate and moderate to severe. The moderate to severe segment dominated the market in 2025 with the largest revenue share, driven by the higher clinical necessity of pharmacological intervention in severe cases. Patients often require higher doses or combination therapy with SSRIs and antipsychotics, increasing overall drug consumption and market revenue. Hospitals and specialty clinics actively manage moderate to severe cases, providing structured follow-ups and long-term therapy. Digital patient monitoring tools enhance adherence and treatment outcomes. Awareness programs emphasizing the risks of untreated severe OCD further encourage treatment initiation. Early diagnosis and hospital-based management also support continuous therapy, reinforcing market dominance.

The mild to moderate segment is expected to witness the fastest growth during the forecast period due to increasing focus on early diagnosis and intervention programs. Telepsychiatry and home healthcare services are improving access for patients with mild to moderate symptoms. Rising awareness among parents, schools, and adult populations is leading to earlier pharmacological treatment. Digital symptom-tracking tools enhance therapy adherence and monitoring. Generic and affordable drug options are making therapy accessible to a wider population. The integration of behavioral therapy with pharmacological treatment also supports adoption in this segment.

- By Sub-Type

On the basis of sub-type, the market is segmented into contamination obsessions with washing/cleaning compulsion, harm obsessions with checking compulsions, obsessions without visible compulsions, symmetry obsessions with ordering/arranging/counting compulsions, hoarding, and others. The contamination obsessions with washing/cleaning compulsion segment dominated the market due to its high prevalence and predictable response to SSRIs. Patients in this sub-type often require long-term therapy to manage relapses, boosting drug consumption. Hospitals and specialty clinics frequently prioritize treatment for this sub-type. Digital monitoring tools and mobile apps enhance adherence and symptom management. Insurance coverage and reimbursement facilitate therapy adoption. Awareness campaigns targeting hygiene-related compulsions increase early detection and treatment initiation.

The symmetry obsessions with ordering, arranging, and counting compulsions segment is expected to witness the fastest growth due to increased recognition in both pediatric and adult populations. Early diagnosis and targeted treatment approaches are driving demand. Integration of pharmacological therapy with behavioral interventions improves outcomes. Telepsychiatry platforms enable easier access to specialty care. Digital tools for symptom tracking improve adherence and monitoring. Growing research and clinical trials focused on this sub-type further support market adoption. The use of combination therapies also increases prescription rates in this segment.

- By Drugs

On the basis of drugs, the market is segmented into antidepressants, antipsychotics, NMDA blockers, and others. The antidepressants segment dominated the market in 2025, with a market share of 52.9% due to SSRIs being the first-line therapy for OCD. They are widely prescribed across adult and pediatric populations due to proven efficacy and safety. Hospitals, specialty clinics, and home healthcare rely heavily on oral antidepressants for long-term therapy. Patient assistance programs and insurance coverage enhance adoption. The segment benefits from strong brand recognition and extensive clinical evidence. Combination therapy options with antipsychotics or NMDA blockers further strengthen dominance.

The NMDA blockers segment is expected to witness the fastest growth during the forecast period due to emerging evidence of efficacy in treatment-resistant OCD. Hospitals and specialty clinics increasingly adopt NMDA blockers when first-line therapy fails. Clinical trials and regulatory approvals are supporting adoption. Digital adherence tools and telepsychiatry monitoring improve patient compliance. Combination therapies with SSRIs are becoming more common. Growing awareness among clinicians of NMDA blockers’ benefits drives prescription rates. Patient support programs and home healthcare integration further accelerate growth.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral and parenteral. The oral segment dominated the market due to convenience, ease of use, and broad availability. Patients and caregivers prefer oral administration for both adult and pediatric therapy. Hospitals and specialty clinics recommend oral drugs for long-term management. Insurance coverage supports affordability and widespread access. Digital adherence programs and home healthcare monitoring enhance compliance. Oral formulations are also preferred for combination therapy, further driving market revenue.

The parenteral segment is expected to witness the fastest growth due to use in acute or treatment-resistant OCD cases. Injectable formulations provide rapid symptom relief in severe episodes. Hospitals and specialty clinics increasingly adopt these formulations for critical patients. Telepsychiatry monitoring and digital adherence tools support therapy compliance. Improved safety profiles and monitoring technologies encourage clinician adoption. Combination therapy with oral drugs boosts market demand. Awareness of injectable options among clinicians and caregivers drives further adoption.

- By Population Type

On the basis of population type, the market is segmented into pediatrics and adults. The adult segment dominated the market in 2025 due to higher prevalence, longer treatment durations, and consistent diagnosis. Adults require higher dosages and more intensive therapy, driving revenue. Hospitals, specialty clinics, and outpatient psychiatric centers account for the majority of adult prescriptions. Insurance coverage and workplace mental health programs support therapy uptake. Patient adherence programs ensure long-term treatment compliance. Awareness campaigns promote early intervention and reinforce market dominance.

The pediatrics segment is expected to witness the fastest growth due to rising awareness of early intervention and diagnosis. Telepsychiatry and home healthcare services improve access for children. Pediatric psychiatry programs integrate behavioral therapy with pharmacological treatment. Digital symptom tracking enhances adherence and therapy monitoring. School-based programs and parental awareness campaigns increase early detection. Specialized drug formulations for children further boost adoption. Combination therapy options are gaining acceptance, accelerating growth in this segment.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, home healthcare, and others. The hospitals segment dominated the market due to high patient volumes and integrated care for both adults and pediatric populations. Hospitals provide comprehensive treatment including drug therapy, follow-up, and monitoring. Specialist psychiatrists concentrated in hospitals support high prescription volumes. Insurance coverage ensures affordability for patients. Patient support programs and combination therapy options reinforce adherence. Hospitals also drive long-term therapy management, sustaining revenue dominance.

The home healthcare segment is expected to witness the fastest growth due to adoption of telepsychiatry, remote monitoring, and convenience trends. Patients can access treatment without frequent hospital visits. Digital adherence and mobile tracking apps improve long-term therapy compliance. Parents and caregivers prefer home-based therapy for pediatric patients. Subscription-based drug delivery services support continuity of care. Behavioral therapy integration with pharmacological treatment enhances adoption. Telehealth platforms expand access to remote regions, further fueling growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment dominated the market due to widespread availability, easy access, and insurance-supported purchases. Adult and pediatric populations can conveniently obtain therapy. Hospitals and specialty clinics often coordinate with retail pharmacies for fulfillment. Patient loyalty programs and repeat prescriptions ensure sustained revenue. Strong brand recognition drives repeated purchases. Convenience and local presence reinforce market dominance.

The online pharmacy segment is expected to witness the fastest growth due to increasing digital adoption and e-commerce penetration. Patients can order drugs remotely with home delivery. Telemedicine prescriptions integrated with online fulfillment accelerate adoption. Subscription-based delivery and reminder systems enhance adherence. Privacy and discreet purchase options increase patient preference. Digital platforms allow monitoring of therapy and adherence. Awareness campaigns and growing online pharmacy trust boost adoption further.

North America Obsessive-Compulsive Disorder (OCD) Drugs Market Regional Analysis

- The United States dominated the OCD drugs market with the largest revenue share of 55.8% in 2025, characterized by well-established healthcare infrastructure, high healthcare expenditure, and a strong presence of key pharmaceutical players, with substantial growth in prescriptions, particularly in hospitals and specialty clinics, driven by innovations in drug formulations and targeted therapies

- Patients and caregivers in the region increasingly value clinically validated pharmacological treatments, including SSRIs, antipsychotics, and NMDA blockers, for effective management of OCD symptoms

- This widespread adoption is further supported by advanced healthcare facilities, telepsychiatry services, insurance coverage, and patient support programs, establishing pharmacological therapy as the preferred solution for both adult and pediatric populations

U.S. North America Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The U.S. OCD drugs market captured the largest revenue share of 55.8% in 2025 within North America, fueled by the high prevalence of OCD and well-established healthcare infrastructure. Patients and caregivers are increasingly prioritizing effective pharmacological treatment using SSRIs, antipsychotics, and NMDA blockers for symptom management. The growing adoption of telepsychiatry services, mobile health monitoring, and digital adherence tools is further propelling the market. In addition, insurance coverage and patient support programs are improving access to medications. Awareness campaigns and early diagnosis initiatives are significantly contributing to market expansion. The increasing focus on pediatric and adult mental health care is sustaining strong demand for OCD drugs across hospitals, specialty clinics, and home healthcare.

Canada North America Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The Canada OCD drugs market is anticipated to grow at a steady CAGR during the forecast period, driven by rising awareness about mental health and increasing OCD diagnosis rates. Canadian patients are showing a growing preference for integrated therapy approaches combining pharmacological treatment with behavioral therapy. The country’s robust healthcare system and government initiatives supporting mental health services foster greater access to OCD medications. Telepsychiatry and home healthcare services are enhancing treatment availability in remote areas. Furthermore, strong insurance coverage and reimbursement programs are encouraging higher adoption of prescribed OCD drugs. Public health campaigns highlighting OCD symptoms and early intervention are supporting consistent market growth.

Mexico North America Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The Mexico OCD drugs market is expected to expand at a notable CAGR during the forecast period, fueled by increasing awareness of mental health disorders and improving healthcare infrastructure. Patients in Mexico are becoming more receptive to evidence-based pharmacological therapies, including antidepressants, antipsychotics, and NMDA blockers. The integration of telemedicine platforms is making OCD treatment more accessible, particularly in rural regions. Growing government initiatives to promote mental health awareness are supporting market adoption. The rising number of specialty clinics and mental health professionals is further facilitating treatment availability. In addition, increasing insurance penetration and patient assistance programs are enhancing access to medications and supporting market growth.

North America Obsessive-Compulsive Disorder (OCD) Drugs Market Share

The North America Obsessive-Compulsive Disorder (OCD) Drugs industry is primarily led by well-established companies, including:

- Eli Lilly and Company (U.S.)

- Axsome Therapeutics, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- GSK plc (U.K.)

- Lundbeck A/S (Denmark)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- AbbVie (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Amneal Pharmaceuticals LLC (U.S.)

- Zydus Group (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Aurobindo Pharma Limited (U.S.)

- Mallinckrodt (U.S.)

- Lannett. (U.S.)

- Par Health, Inc. (U.S.)

- Alvogen (U.S.)

- Apotex Inc. (Canada)

What are the Recent Developments in North America Obsessive-Compulsive Disorder (OCD) Drugs Market?

- In September 2025, a clinical trial reported that the FDA‑approved anti‑emetic drug Ondansetron, when used as an add‑on therapy to serotonin reuptake inhibitor (SRI) medications, significantly decreased severity of Obsessive‑Compulsive Disorder symptoms. The trial results highlight ondansetron’s potential role as an augmentation strategy in OCD, particularly for patients with residual symptoms despite first‑line therapy

- In April 2025, media coverage highlighted that “electroceutical” therapies including deep brain stimulation (DBS), transcranial magnetic stimulation (TMS), vagus nerve stimulation (VNS) and focused ultrasound are becoming increasingly recognised for treatment‑resistant OCD in the U.S. Specifically, up to ~60% of Americans with OCD are considered treatment‑resistant, making these non‑drug options more relevant

- In March 2025, a research summary published by the American Psychiatric Association noted the publication of a randomised controlled trial of high‑dose ondansetron for both OCD and tic disorders. The trial examined not only clinical symptom changes but also neural connectivity changes via fMRI. This marks a meaningful shift toward mechanistic and biomarker‑driven pharmacotherapy in OCD management, pointing to how future drugs might be evaluated with brain imaging endpoints

- In August 2024, the U.S. regulatory and research landscape for psychedelic compounds took a notable turn, with an article outlining that despite promising early results, the MDMA‑assisted therapy for PTSD was not approved by the U.S. Food & Drug Administration (FDA), raising questions about how psychedelics will advance in broader mental health applications including OCD

- In June 2023, it was reported that the state of Washington authorised a major medical trial of Psilocybin at the University of Washington School of Medicine to study its therapeutic potential including for anxiety, depression, and by extension possibly OCD. This signals growing legislative and clinical momentum around alternative therapies that could influence OCD pharmacotherapy down the line, even if not yet drug‑approval specific for OCD

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.