North America Orthopedic Surgical Energy Devices Market

Market Size in USD Million

CAGR :

%

USD

507.67 Million

USD

912.19 Million

2024

2032

USD

507.67 Million

USD

912.19 Million

2024

2032

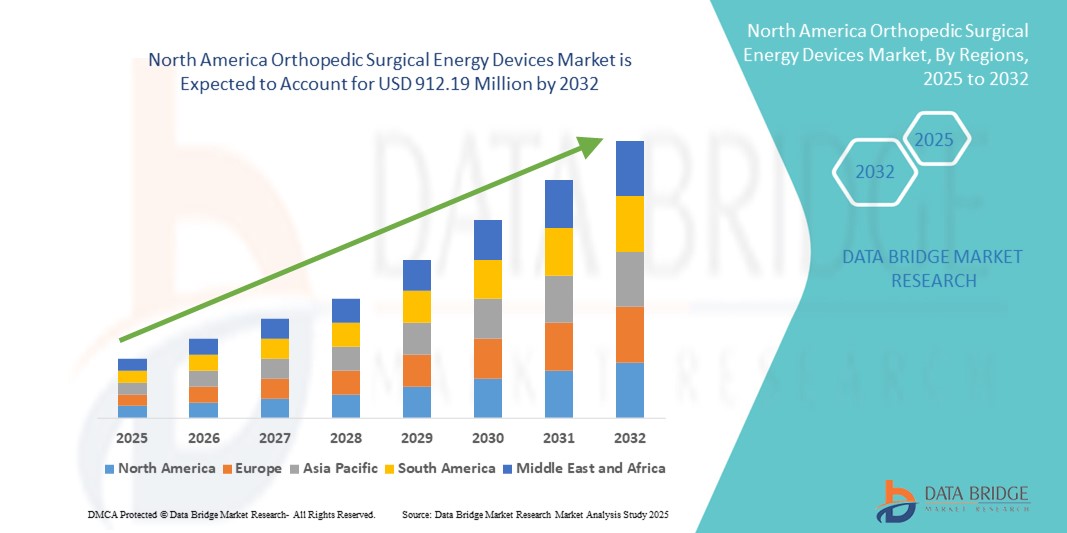

| 2025 –2032 | |

| USD 507.67 Million | |

| USD 912.19 Million | |

|

|

|

|

North America Orthopedic Surgical Energy Devices Market Size

- The North America orthopedic surgical energy devices market size was valued at USD 507.67 million in 2024 and is expected to reach USD 912.19 million by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is primarily driven by the rising volume of orthopedic procedures, increasing elderly population prone to musculoskeletal disorders, and the growing adoption of minimally invasive surgical techniques that require precision-based energy devices

- In addition, technological advancements in surgical tools, along with the heightened demand for efficient, safe, and time-saving orthopedic interventions, are bolstering the use of energy-based systems in surgical settings. These factors collectively contribute to the rapid expansion of the market across the region

North America Orthopedic Surgical Energy Devices Market Analysis

- Orthopedic surgical energy devices, which include tools powered by radiofrequency, ultrasound, microwave, and other technologies, are becoming essential in modern orthopedic surgeries due to their ability to improve precision, reduce intraoperative bleeding, and support minimally invasive procedures across both hospital and outpatient settings

- The escalating demand for these devices is primarily fueled by the rising prevalence of musculoskeletal conditions, increasing geriatric population, and the growing number of hip and knee replacement procedures throughout the region

- U.S. dominated the orthopedic surgical energy devices market with the largest revenue share of 41.8% in 2024, driven by high surgical volumes, advanced healthcare infrastructure, and the strong presence of leading medical device manufacturers. The country is experiencing significant adoption of these technologies, supported by favorable reimbursement structures and rapid integration of robotic and AI-assisted surgical platforms

- Canada is expected to be the fastest growing country in the orthopedic surgical energy devices market during the forecast period due to rapidly aging population, increasing incidence of orthopedic disorders, and rising investments in advanced surgical technologies across hospitals and ambulatory surgical centers

- Hand pieces segment dominated the orthopedic surgical energy devices market with a market share of 61.8% in 2024, owing to their critical role in delivering energy during surgical procedures and their high replacement frequency, making them a core component of most orthopedic surgical systems

Report Scope and North America Orthopedic Surgical Energy Devices Market Segmentation

|

Attributes |

North America Orthopedic Surgical Energy Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Orthopedic Surgical Energy Devices Market Trends

“Rising Adoption of Minimally Invasive and Robotic-Assisted Orthopedic Surgeries”

- A significant and accelerating trend in the North America orthopedic surgical energy devices market is the growing integration of energy-based tools with minimally invasive and robotic-assisted orthopedic procedures, enhancing surgical precision, reducing patient trauma, and enabling faster recovery

- For instance, Stryker’s advanced surgical systems incorporate radiofrequency and ultrasonic energy devices for enhanced control during joint replacement procedures. Similarly, Medtronic's integration of energy tools with its Mazor robotic spine platform supports real-time surgical guidance

- Energy device innovations now feature intelligent sensors and ergonomic designs that improve surgeon control, reduce thermal damage, and allow tailored energy delivery. For instance, CONMED’s ultrasonic handpieces offer precise dissection with minimal heat spread, aligning with minimally invasive approaches

- These devices also enable seamless integration with intraoperative navigation and imaging systems, supporting accuracy in complex orthopedic surgeries. As robotic-assisted orthopedic surgery becomes more prevalent across U.S. and Canadian hospitals, demand for compatible, smart energy devices is expected to surge

- The trend toward smarter, less invasive orthopedic solutions is reshaping surgeon expectations and patient outcomes. Manufacturers such as Smith+Nephew and Zimmer Biomet are investing in AI-powered platforms and multi-functional energy systems that enhance operative efficiency and safety

- The growing preference for high-precision, interoperable energy tools in orthopedic surgery is driving innovation and accelerating the modernization of surgical suites across North America’s leading hospitals and ASCs

North America Orthopedic Surgical Energy Devices Market Dynamics

Driver

“Increasing Orthopedic Procedures and Technological Advancements”

- The growing volume of orthopedic procedures in North America, driven by an aging population and the rising prevalence of joint diseases and sports injuries, is significantly contributing to the demand for advanced surgical energy devices

- For instance, the American Joint Replacement Registry reported over 2 million hip and knee procedures in 2023, highlighting the expanding need for safe, efficient surgical solutions

- Advanced energy devices such as bipolar electrosurgery and ultrasonic systems are increasingly preferred for their ability to reduce operative time, blood loss, and postoperative complications, making them essential in modern orthopedic surgeries

- Companies such as Arthrex and Olympus are launching innovative energy tools with better control, modular components, and compatibility with robotic systems, enabling precision-based orthopedic procedures across high-volume surgical centers

- The integration of AI, haptics, and smart energy feedback mechanisms is further advancing the performance and reliability of these devices, creating new growth opportunities in the region

Restraint/Challenge

“High Costs and Regulatory Compliance Barriers”

- Despite their clinical benefits, the high cost of orthopedic surgical energy devices remains a key challenge, particularly for small to mid-sized healthcare facilities and ASCs with limited capital budgets

- For instance, robotic-compatible energy systems often involve significant upfront investment, along with ongoing maintenance and training expenses, which may restrict broader adoption across rural and community hospitals

- In addition, compliance with stringent FDA and Health Canada regulations requires extensive testing, documentation, and product validation, often leading to delayed product approvals and increased development costs

- Concerns around thermal injury, equipment sterilization, and staff training further complicate implementation in resource-limited settings. Moreover, lack of awareness or reluctance to adopt new technologies among some surgeons also poses a challenge

- Overcoming these barriers through cost-effective innovation, robust clinical validation, improved training programs, and enhanced post-market support will be critical for expanding the adoption of energy-based surgical tools in the North American orthopedic sector

North America Orthopedic Surgical Energy Devices Market Scope

The market is segmented on the basis of product, technology, application, end user, and distribution channel.

- By Product

On the basis of product, the North America orthopedic surgical energy devices market is segmented into hand pieces and accessories. The hand pieces segment dominated the market with the largest market revenue share of 61.8% in 2024, driven by their essential role in energy transmission during orthopedic procedures and their frequent usage across a wide range of surgeries. Hospitals and ASCs consistently rely on hand pieces due to their precision, compatibility with multiple energy sources, and necessity for replacement after repeated use. Their widespread application in minimally invasive surgeries further contributes to their dominance.

The accessories segment is anticipated to witness steady growth from 2025 to 2032, supported by rising surgical volumes and demand for efficient supplementary components such as cables, electrodes, and connectors. The need for disposable and single-use items in sterile environments is also fueling demand for accessories in orthopedic operating rooms.

- By Technology

On the basis of technology, the orthopedic surgical energy devices market is segmented into radiofrequency, ultrasound, microwave, radiation, and others. The radiofrequency segment held the largest market revenue share in 2024, driven by its effectiveness in tissue coagulation and controlled cutting during orthopedic interventions. Surgeons prefer radiofrequency-based devices for their thermal efficiency, safety profile, and wide applicability in procedures such as arthroscopy and spinal surgeries.

The ultrasound segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in minimally invasive surgeries. Ultrasonic energy devices offer reduced collateral damage, precision tissue dissection, and better outcomes in orthopedic trauma and joint surgeries, making them an attractive option for evolving surgical practices.

- By Application

On the basis of application, the North America orthopedic surgical energy devices market is segmented into hip and knee procedures. The knee segment dominated the market with the largest market revenue share in 2024, driven by the growing prevalence of osteoarthritis and rising number of total knee replacements in the U.S. The demand for energy-based devices that reduce blood loss and improve procedural efficiency is accelerating adoption in high-volume knee surgeries.

The hip segment is projected to grow steadily from 2025 to 2032, supported by an aging population and increasing focus on minimally invasive hip arthroplasty. Technological advancements in energy devices that improve precision and reduce recovery times are further boosting the segment.

- By End User

On the basis of end user, the orthopedic surgical energy devices market is segmented into hospitals and clinics, ambulatory surgical centres (ASCs), and others. The hospitals and clinics segment dominated the market with the largest revenue share in 2024, driven by the availability of advanced infrastructure, skilled personnel, and integration of robotic and navigation-assisted orthopedic procedures. Hospitals remain the preferred setting for complex surgeries requiring energy-based systems.

The ambulatory surgical centres (ASCs) segment is anticipated to witness the fastest growth rate from 2025 to 2032, due to the growing trend toward outpatient orthopedic procedures. ASCs are increasingly adopting compact and cost-efficient energy devices to improve throughput, reduce patient hospital stays, and lower procedural costs.

- By Distribution Channel

On the basis of distribution channel, the North America orthopedic surgical energy devices market is segmented into direct tender and third-party distributors. The direct tender segment held the largest market revenue share in 2024, as hospitals and large healthcare systems prefer to procure energy surgical systems in bulk through long-term contracts with manufacturers, ensuring cost savings and consistent supply.

The third-party distributors segment is expected to grow steadily from 2025 to 2032, especially among smaller clinics and ASCs seeking diverse product options and flexible procurement solutions. Distributors offering value-added services and technical support are playing an increasing role in expanding market reach across urban and regional healthcare facilities.

North America Orthopedic Surgical Energy Devices Market Regional Analysis

- U.S. dominated the orthopedic surgical energy devices market with the largest revenue share of 41.8% in 2024, driven by high surgical volumes, advanced healthcare infrastructure, and the strong presence of leading medical device manufacturers

- U.S. hospitals and surgical centers are increasingly utilizing radiofrequency, ultrasound, and other energy-based devices to improve surgical precision, reduce complications, and enhance patient recovery outcomes in hip and knee procedures

- This market leadership is further reinforced by the presence of leading medical device manufacturers, strong healthcare infrastructure, favorable reimbursement systems, and continued investments in robotic and AI-assisted orthopedic surgery platforms, making the U.S. a key hub for innovation and utilization of energy-based surgical tools

U.S. Orthopedic Surgical Energy Devices Market Insight

The U.S. orthopedic surgical energy devices market held the largest revenue share of 81% in 2024 within North America, driven by the country’s advanced healthcare infrastructure and high demand for minimally invasive orthopedic procedures. The widespread adoption of technologies such as radiofrequency, ultrasound, and microwave energy devices in joint replacements and trauma surgeries significantly boosts the market. In addition, a high prevalence of orthopedic conditions such as osteoarthritis and sports-related injuries, along with robust R&D investments and favorable reimbursement frameworks, continue to propel market expansion in the U.S.

Canada Orthopedic Surgical Energy Devices Market Insight

The Canada orthopedic surgical energy devices market is projected to grow at a notable CAGR during the forecast period, supported by increasing orthopedic surgery volumes and rising awareness of energy-based surgical technologies. Canada’s aging population and growing demand for hip and knee replacements are contributing to the uptake of advanced surgical tools. The presence of supportive healthcare policies, public healthcare funding, and government emphasis on reducing surgical wait times also foster the adoption of high-precision, energy-powered surgical devices across hospitals and ambulatory surgical centers.

Mexico Orthopedic Surgical Energy Devices Market Insight

The Mexico orthopedic surgical energy devices market is expected to witness steady growth during the forecast period, driven by expanding access to healthcare services and rising surgical procedure volumes. Increasing government investments in public health infrastructure, coupled with the modernization of surgical departments in both public and private hospitals, are enhancing the adoption of orthopedic energy devices. Moreover, the rising incidence of road traffic injuries and degenerative bone diseases, along with growing awareness of minimally invasive techniques, is accelerating market development across the country.

North America Orthopedic Surgical Energy Devices Market Share

The North America orthopedic surgical energy devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Stryker (U.S.)

- CONMED Corporation (U.S.)

- KARL STORZ SE & Co. KG (Germany)

- Smith & Nephew (U.K.)

- Auxein (India)

- MatOrtho Limited (U.K.)

- Zimmer Biomet (U.S.)

- B. Braun SE (Germany)

- Boston Scientific Corporation (U.S.)

- Söring GmbH (Germany)

- Apothecaries Sundries Mfg. Private Limited. (India)

- NOUVAG AG (Switzerland)

- De Soutter Medical (U.K.)

- Bioventus (U.S.)

- Olympus Corporation (Japan)

- Johnson & Johnson Private Limited (U.S.)

- Portescap (U.S.)

What are the Recent Developments in North America Orthopedic Surgical Energy Devices Market?

- In May 2023, Medtronic plc expanded its orthopedic surgical portfolio by introducing a new radiofrequency ablation system tailored for orthopedic soft tissue procedures across North American hospitals. The system is designed to minimize thermal spread, enhance surgical precision, and improve recovery times. This advancement reflects Medtronic’s commitment to developing cutting-edge, minimally invasive energy-based solutions that meet the evolving needs of orthopedic surgeons and patients

- In April 2023, Stryker Corporation announced the launch of a next-generation ultrasonic energy device specifically engineered for orthopedic applications, including knee and hip arthroplasties. The device offers superior bone and soft tissue dissection capabilities, contributing to reduced operative time and enhanced surgical outcomes. Stryker’s innovation is part of its broader strategy to lead the orthopedic space through high-performance surgical energy technologies

- In March 2023, Smith+Nephew unveiled its advanced radiofrequency-based surgical tool at the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting in Las Vegas. The tool integrates real-time energy modulation and adaptive thermal feedback, offering increased control during joint reconstruction procedures. This development highlights Smith+Nephew’s focus on precision energy delivery and improved safety in orthopedic surgeries

- In February 2023, Zimmer Biomet Holdings, Inc. entered a collaboration with a leading U.S.-based surgical robotics startup to integrate microwave energy devices into their orthopedic robotic-assisted platforms. The integration aims to provide surgeons with enhanced soft tissue management during joint replacement procedures. The partnership signifies Zimmer Biomet’s strategic direction toward technology-driven, energy-efficient surgical interventions

- In January 2023, Arthrex, Inc. introduced its updated Synergy RF Ablation System in select orthopedic clinics across the U.S. The system enables surgeons to perform more efficient arthroscopic procedures with minimal collateral tissue damage. With user-friendly interface upgrades and enhanced energy modulation features, Arthrex reaffirms its dedication to advancing orthopedic surgical energy technology across North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.