North America Ostomy Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.50 Billion

USD

2.19 Billion

2025

2033

USD

1.50 Billion

USD

2.19 Billion

2025

2033

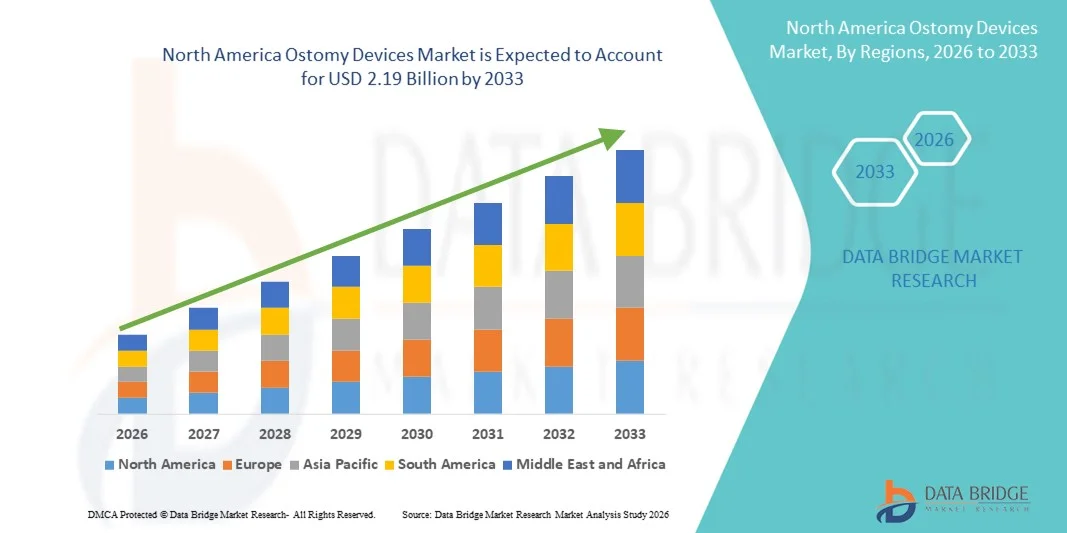

| 2026 –2033 | |

| USD 1.50 Billion | |

| USD 2.19 Billion | |

|

|

|

|

North America Ostomy Devices Market Size

- The North America ostomy devices market size was valued at USD 1.50 billion in 2025 and is expected to reach USD 2.19 billion by 2033, at a CAGR of 4.9% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic gastrointestinal conditions such as colorectal cancer and inflammatory bowel disease, increased number of ostomy procedures, and growing demand for advanced ostomy products in both homecare and clinical settings

- Furthermore, expanding healthcare infrastructure, rising patient awareness, favourable reimbursement policies, and technological innovations in ostomy supplies are establishing ostomy devices as the essential care solution of choice in North America, thereby significantly boosting the industry's growth

North America Ostomy Devices Market Analysis

- Ostomy devices, including bags and accessories, are increasingly vital components of patient care for individuals with gastrointestinal and urinary conditions, providing enhanced convenience, comfort, and improved quality of life in both homecare and clinical settings

- The escalating demand for ostomy devices is primarily fueled by the rising prevalence of chronic gastrointestinal diseases such as colorectal cancer and inflammatory bowel disease, increasing number of ostomy procedures, and growing patient preference for advanced, easy-to-use products

- The United States dominated the North America ostomy devices market with the largest revenue share of 67.1% in 2025, characterized by well-established healthcare infrastructure, high patient awareness, favourable reimbursement policies, and a strong presence of key industry players, with substantial growth in post-surgical and homecare adoption driven by innovations in one-piece and two-piece systems as well as flat and convex skin barriers

- Canada is expected to be the fastest-growing country in the North America ostomy devices market during the forecast period due to expanding healthcare access, rising awareness of ostomy care, and increasing adoption of advanced products such as ileostomy, colostomy, and urostomy drainage bags in hospitals, ambulatory surgical centers, and homecare settings

- Bags segment dominated the North America ostomy devices market with a market share of 44.7% in 2025, driven by their critical role in patient comfort, leak prevention, and ease of integration into daily care routines

Report Scope and North America Ostomy Devices Market Segmentation

|

Attributes |

North America Ostomy Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Ostomy Devices Market Trends

Enhanced Convenience Through AI and Voice Integration

- A significant and accelerating trend in the North America ostomy devices market is the development of advanced pouching systems and skin barriers that enhance patient comfort, prevent leaks, and simplify daily care routines. This innovation is significantly improving user convenience and adherence to ostomy care

- For instance, the Hollister New Image Pouching System provides patients with discreet, easy-to-use pouches and accessories, improving confidence and reducing skin irritation. Similarly, Convatec Esteem+ pouches feature improved odor control and flexible design for better mobility

- Technological innovations in ostomy devices now enable features such as integrated filters for odor management, skin-friendly adhesives, and customizable shapes that reduce irritation and improve wear time. For instance, some Nu-Hope products utilize adaptive adhesives to minimize skin complications while enhancing user comfort

- The seamless integration of ostomy products with homecare routines and digital patient support platforms facilitates improved monitoring of pouch changes, skin condition, and adherence, allowing caregivers and patients to manage care more efficiently

- This trend towards more intelligent, patient-friendly, and integrated ostomy solutions is fundamentally reshaping expectations for post-surgical care. Consequently, companies such as ConvaTec and Hollister are developing advanced systems with user-focused features such as flexible barriers, odor control, and discreet pouches

- The demand for ostomy devices offering enhanced comfort, reliability, and ease of use is growing rapidly across both hospital and homecare settings, as patients increasingly prioritize convenience, skin safety, and improved quality of life

- The rising availability of telehealth consultations and remote patient monitoring is promoting the adoption of ostomy devices that are easier to manage and maintain, with guidance from healthcare professionals without frequent hospital visits

- Increasing patient engagement and education programs by manufacturers and hospitals are enhancing awareness about proper ostomy care, driving demand for devices that combine usability, durability, and safety

North America Ostomy Devices Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Gastrointestinal Disorders

- The increasing prevalence of chronic gastrointestinal conditions such as colorectal cancer and inflammatory bowel disease, coupled with growing awareness of ostomy care, is a significant driver for the heightened demand for ostomy devices

- For instance, in March 2025, ConvaTec announced the launch of its new advanced pouching system with enhanced skin protection, aiming to improve patient outcomes and quality of life. Such strategies by key companies are expected to drive ostomy device market growth in the forecast period

- As patients and caregivers become more aware of post-surgical care requirements and complications such as leaks or skin irritation, ostomy devices offering better comfort, leak prevention, and hygiene are increasingly preferred over traditional solutions

- Furthermore, the rising adoption of homecare services and ambulatory surgical centers is making ostomy devices an integral component of patient management, offering seamless care continuity from hospital to home

- The convenience of easy-to-use pouches, flexible skin barriers, and one-piece or two-piece systems, along with education and support programs for patients, are key factors propelling the adoption of ostomy devices in hospitals, homecare, and ambulatory surgical centers

- Increased investments by manufacturers in research and development for advanced materials, improved adhesives, and innovative pouch designs are driving the availability of products that meet evolving patient needs

- Favourable reimbursement policies and insurance coverage in the U.S. and Canada are facilitating greater adoption of ostomy devices, making advanced products more accessible to patients requiring long-term care

Restraint/Challenge

Skin Irritation Issues and Regulatory Compliance Hurdle

- Concerns surrounding skin irritation, allergic reactions, and improper fitting of ostomy devices pose a significant challenge to broader market penetration. As these products directly interact with sensitive skin, complications can reduce patient adherence

- For instance, reports of skin irritation or leakage from poorly fitting pouches have made some patients hesitant to switch to new ostomy systems

- Addressing these issues through improved adhesives, hypoallergenic materials, patient education, and regulatory compliance is crucial for building trust. Companies such as Hollister and ConvaTec emphasize skin safety, clinical testing, and guidance to reassure patients and caregivers. In addition, the relatively high cost of advanced ostomy systems compared to basic pouches can be a barrier for price-sensitive consumers, particularly in homecare settings or smaller hospitals

- While prices are gradually decreasing, the perceived premium for advanced ostomy systems can still hinder widespread adoption, especially for patients without immediate access to insurance coverage or reimbursement

- Overcoming these challenges through patient support programs, regulatory adherence, innovative skin-friendly designs, and affordable options will be vital for sustained market growth. Limited awareness among caregivers and patients about proper fitting techniques and product selection can lead to lower adoption and increased dissatisfaction with ostomy devices

- Complexity in navigating regulatory approvals and compliance with health authority guidelines for new ostomy products can slow product launches and restrict market expansion, particularly for innovative designs.

North America Ostomy Devices Market Scope

The market is segmented on the basis of product type, surgery type, shape of skin barrier, system type, and end user.

- Product Type

On the basis of product type, the North America ostomy devices market is segmented into bags and accessories. The bags segment dominated the market with the largest revenue share of 44.7% in 2025, driven by its critical role in patient care. Ostomy bags serve as the primary containment solution for ileostomy, colostomy, and urostomy patients, providing leak prevention, odor control, and skin protection. Advanced bag designs now offer features such as integrated filters, flexible adhesive systems, and discreet shapes, enhancing patient comfort and confidence. Hospitals, homecare providers, and ambulatory surgical centers prefer bags that are easy to use, reliable, and compatible with both one-piece and two-piece systems. In addition, the increasing number of post-surgical procedures and rising prevalence of gastrointestinal diseases contribute to the sustained demand for ostomy bags. Manufacturers continuously innovate to improve durability, skin safety, and patient adherence, which reinforces the dominance of this segment.

The accessories segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the rising demand for complementary products such as belt supports, adhesive removers, cleaning wipes, and odor control devices. Accessories enhance the functionality of ostomy bags, improve skin health, and simplify daily maintenance, particularly for elderly or mobility-challenged patients. The growing awareness of proper ostomy care and increasing patient education programs are encouraging adoption of these products. Homecare services and ambulatory surgical centers increasingly recommend accessories to improve comfort and compliance. Furthermore, innovation in accessory design, such as hypoallergenic and reusable products, is expanding the market. The convenience, personalization, and improved quality of life offered by ostomy accessories are driving their rapid adoption.

- By Surgery Type

On the basis of surgery type, the market is segmented into ileostomy drainage bags, colostomy drainage bags, and urostomy drainage bags. The colostomy drainage bags segment dominated the market in 2025 due to the higher prevalence of colostomy procedures and chronic colorectal conditions in North America. Colostomy bags are designed to manage fecal output effectively while minimizing skin irritation and leakage. Hospitals and homecare providers prefer these bags for their reliability, long wear time, and integration with flat or convex skin barriers. Patient comfort, ease of use, and discrete designs are key factors contributing to the segment’s dominance. Manufacturers also offer variations with odor control, flexible shapes, and compatibility with both one-piece and two-piece systems, further strengthening adoption. The increasing number of post-operative care procedures and growing patient awareness about advanced colostomy solutions support the sustained market leadership of this segment.

The ileostomy drainage bags segment is expected to witness the fastest growth during the forecast period, driven by the rising prevalence of inflammatory bowel disease, Crohn’s disease, and ulcerative colitis. Ileostomy patients often require specialized pouches that offer leak prevention, skin protection, and odor control due to the high output and consistency of intestinal waste. Hospitals, ambulatory surgical centers, and homecare providers increasingly adopt advanced ileostomy solutions with adaptive adhesives and flexible barriers to improve patient compliance. Educational initiatives for caregivers and patients about proper usage also drive growth. Innovation in bag materials and adhesive systems enhances skin safety and reduces discomfort, contributing to rapid market adoption.

- By Shape of Skin Barrier

On the basis of skin barrier shape, the market is segmented into flat and convex barriers. The flat segment dominated the market in 2025 due to its wide applicability, simplicity, and comfort for patients with normal stoma protrusion. Flat skin barriers are easier to fit, reduce skin irritation risk, and are compatible with both one-piece and two-piece systems. Hospitals and homecare providers favor flat barriers for post-surgical care and long-term patient use. The availability of hypoallergenic materials and improved adhesives further reinforces the segment’s market leadership. Patient preference for easy-to-use, reliable barriers and the increasing number of colostomy and urostomy procedures also support flat barriers’ dominance. Manufacturers continue to innovate with odor control and flexible design features to maintain the segment’s appeal.

The convex segment is anticipated to witness the fastest growth during the forecast period, driven by the need to manage recessed or retracted stomas and prevent leaks. Convex barriers offer a snug fit, improved output control, and enhanced skin protection for challenging stoma types. Hospitals, ambulatory surgical centers, and homecare providers increasingly recommend convex barriers for patients with irregular stoma morphology. Rising patient awareness about stoma management and proper barrier selection contributes to higher adoption. In addition, innovations in convex barrier flexibility, adhesive technology, and integration with advanced bag systems support rapid market growth.

- By System Type

On the basis of system type, the market is segmented into one-piece systems and two-piece systems. The one-piece system segment dominated the market in 2025 due to its simplicity, lightweight design, and convenience for patients. One-piece systems combine the pouch and skin barrier, reducing the risk of leakage and making the system easy to use for homecare patients and caregivers. Hospitals and homecare providers prefer one-piece systems for post-surgical care and patients requiring quick pouch changes. The segment benefits from continuous innovation in adhesive technology, odor control, and flexible materials. Ease of portability, discreet design, and patient comfort further reinforce its market leadership. Increasing patient preference for minimal maintenance solutions contributes to sustained demand for one-piece systems.

The two-piece system segment is expected to witness the fastest growth during the forecast period, fueled by its flexibility and adaptability for frequent pouch changes and extended wear. Two-piece systems allow patients to separate the pouch from the skin barrier, providing convenience and reducing skin irritation. Hospitals, ambulatory surgical centers, and homecare providers favor two-piece systems for patients with sensitive skin or high-output stomas. Technological innovations in barrier adhesives, pouch connectors, and customizable designs are driving adoption. Patient education and support programs promoting two-piece systems for better hygiene and comfort also enhance market growth.

- By End User

On the basis of end user, the market is segmented into ambulatory surgical centers, hospitals, home care, and others. The hospitals segment dominated the market in 2025 due to the large number of post-surgical ostomy procedures performed, availability of specialized care, and preference for advanced ostomy devices in clinical settings. Hospitals drive demand for reliable bags, accessories, and skin barriers compatible with both one-piece and two-piece systems. The segment also benefits from clinical guidelines, patient education programs, and high adoption of innovative pouching systems to improve patient outcomes. In addition, hospitals contribute to early adoption of new technologies and support the transition of patients to homecare solutions, reinforcing dominance.

The homecare segment is expected to witness the fastest growth during the forecast period, driven by rising patient preference for self-managed care, growing availability of homecare services, and increasing awareness about advanced ostomy devices. Homecare adoption is fueled by convenient, user-friendly products, remote monitoring, and telehealth guidance. The segment also benefits from an aging population, chronic gastrointestinal disease prevalence, and support from insurance and reimbursement programs. Innovations in disposable bags, adhesive systems, and portable accessories enhance usability and comfort for homecare patients, accelerating market growth.

North America Ostomy Devices Market Regional Analysis

- The United States dominated the North America ostomy devices market with the largest revenue share of 67.1% in 2025, characterized by well-established healthcare infrastructure, high patient awareness, favourable reimbursement policies, and a strong presence of key industry players

- Patients and caregivers in the region highly value ostomy devices that provide comfort, leak prevention, skin safety, and ease of use, along with accessories that enhance daily care and overall quality of life

- This widespread adoption is further supported by well-established healthcare services, growing prevalence of gastrointestinal disorders, and increasing post-surgical procedures, establishing ostomy devices as essential care solutions in both hospital and homecare environments

U.S. Ostomy Devices Market Insight

The U.S. ostomy devices market captured the largest revenue share of 67.1% in 2025 within North America, fueled by the increasing prevalence of gastrointestinal disorders such as colorectal cancer, Crohn’s disease, and ulcerative colitis. Patients and caregivers are prioritizing advanced ostomy solutions that provide comfort, leak prevention, and skin protection. The growing adoption of one-piece and two-piece systems, coupled with patient education programs and homecare support, further propels the market. Moreover, the integration of innovative pouching systems, adaptive adhesives, and skin-friendly materials is significantly enhancing patient adherence and overall quality of life. Hospitals, ambulatory surgical centers, and homecare services are driving widespread adoption across post-surgical and long-term care settings.

Canada Ostomy Devices Market Insight

The Canada ostomy devices market is expected to grow at a substantial CAGR during the forecast period, primarily driven by rising awareness of ostomy care and increasing access to advanced healthcare infrastructure. The demand for high-quality bags, accessories, and skin barriers is growing across hospitals, homecare, and outpatient facilities. Patients and caregivers value solutions that simplify daily care, improve comfort, and reduce complications such as skin irritation or leakage. Government healthcare programs and insurance coverage facilitate greater adoption of advanced ostomy systems. The adoption of telehealth and remote monitoring tools further supports patient management and continuity of care.

Mexico Ostomy Devices Market Insight

The Mexico ostomy devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing gastrointestinal disease prevalence and rising awareness of ostomy care. Improved healthcare access and the expansion of hospitals and homecare services are supporting market growth. Patients are seeking reliable, easy-to-use bags and accessories that enhance comfort, skin protection, and hygiene. The growing availability of advanced one-piece and two-piece systems, along with training programs for caregivers, is encouraging adoption. Economic development, urbanization, and initiatives to expand post-surgical care infrastructure are further stimulating market growth.

North America Ostomy Devices Market Share

The North America Ostomy Devices industry is primarily led by well-established companies, including:

- Coloplast (Denmark)

- Hollister Incorporated (U.S.)

- ConvaTec Group PLC (U.K.)

- B. Braun SE (Germany)

- Nu-Hope Laboratories Inc. (U.S.)

- Torbot Group Inc. (U.S.)

- Cymed Inc. (U.S.)

- Salts Healthcare (U.K.)

- Flexicare (Group) Limited (U.K.)

- Welland Medical Limited (U.K.)

- Dansac UK (U.K.)

- ALCARE Co. Ltd. (Japan)

- Genairex Inc. (U.S.)

- Perma-Type Company Inc. (U.S.)

- Porex Corporation (U.S.)

- Vonco Products LLC (U.S.)

- Sarasota Medical Products (U.S.)

- Safe N' Simple LLC (U.S.)

- Schena Ostomy Technologies Inc. (U.S.)

What are the Recent Developments in North America Ostomy Devices Market?

- In December 2025, the Centers for Medicare & Medicaid Services (CMS) published a final rule updating the Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) Competitive Bidding Program (CBP) that includes ostomy supplies under the upcoming rounds of competitive bidding

- In March 2025, Convatec announced an exclusive collaboration with the WOCN Society to roll out complimentary educational programs for U.S. healthcare professionals, aimed at increasing ostomy care expertise and improving patient outcomes

- In April 2024, Convatec announced the U.S. launch of Esteem Body™ with Leak Defense™, a new one‑piece soft convex ostomy pouching system designed to offer secure seals and improved leak prevention across diverse body types and stoma shapes, enhancing comfort and wear‑time for ostomates

- In March 2021, Convatec extended its contract with Vizient, Inc. a major U.S. healthcare performance improvement company continuing to supply ostomy products, accessories, and its me+™ support program to Vizient members, strengthening product access and continuity of care across health systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.