North America Popping Boba Juice Balls Market

Market Size in USD Billion

CAGR :

%

USD

2.03 Billion

USD

3.71 Billion

2024

2032

USD

2.03 Billion

USD

3.71 Billion

2024

2032

| 2025 –2032 | |

| USD 2.03 Billion | |

| USD 3.71 Billion | |

|

|

|

|

North America Popping Boba Juice Balls Market Size

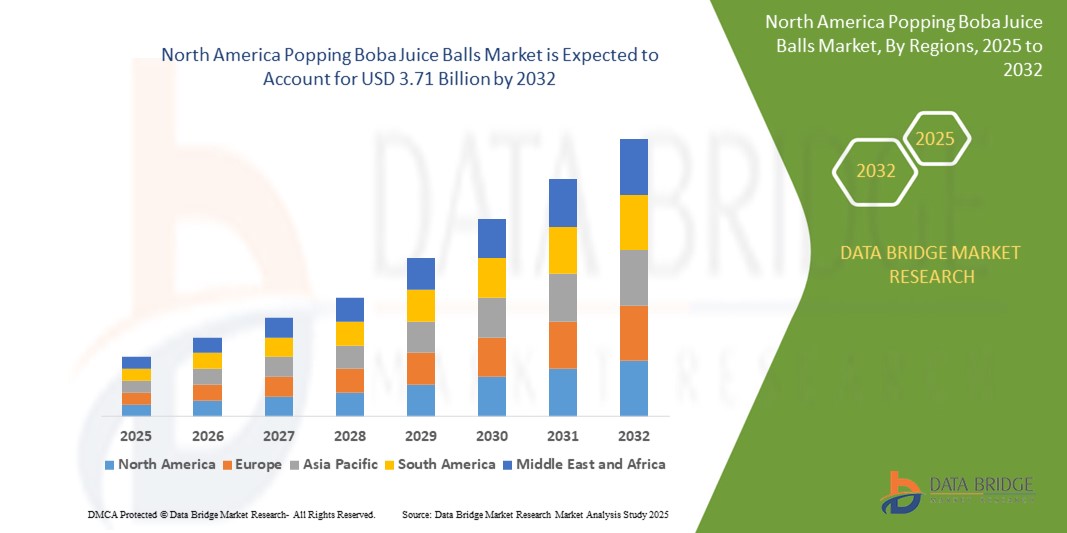

- The North America popping boba juice balls market size was valued at USD 2.03 billion in 2024 and is expected to reach USD 3.71 billion by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is largely fuelled by the rising popularity of Asian-inspired beverages, increased adoption in frozen yogurt and dessert shops, and the expanding footprint of bubble tea chains across the region

- In addition, innovations in flavors, health-conscious formulations using natural fruit juices, and enhanced shelf-life packaging are also contributing to the accelerated market demand

North America Popping Boba Juice Balls Market Analysis

- The North America market is experiencing a rapid surge in consumer preference for unique textures and flavor experiences in beverages, driving demand for popping boba as a versatile ingredient

- The increasing use of popping boba in smoothies, cocktails, and non-traditional applications such as bakery and confectionery is expanding its commercial viability

- U.S. popping boba juice balls market captured the largest revenue share of 79.6% in North America in 2024, driven by rising consumer interest in Asian-inspired beverages and the widespread penetration of bubble tea shops across urban and suburban areas

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America popping boba juice balls market due to rising multicultural influences, increasing popularity of Asian-inspired beverages, and expanding retail and online availability of boba-related products

- The fruit based segment dominated the market with the largest market revenue share in 2024, driven by the high consumer preference for natural fruity flavors in bubble tea and dessert applications. The versatility of fruit-based boba across beverages such as smoothies and juices further enhances its appeal among foodservice providers. Widespread availability in popular flavors such as mango, lychee, strawberry, and passionfruit continues to support its dominance in both retail and quick-service formats

Report Scope and North America Popping Boba Juice Balls Market Segmentation

|

Attributes |

North America Popping Boba Juice Balls Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion into Quick-Service Restaurant Chains • Growing Demand for Functional and Fruit-Based Beverages |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Popping Boba Juice Balls Market Trends

“Rising Popularity of Fusion and Customizable Beverages Across Foodservice Chains”

- Fusion beverages combining popping boba with milk teas, fruit juices, lemonades, and smoothies are rapidly gaining traction in North America, particularly among Gen Z and millennials who crave personalized flavor experiences. The multi-textured and colorful appeal of popping boba enhances the sensory quality of these beverages. Cafés and quick-service restaurants are capitalizing on this by offering seasonal and limited-edition blends to attract repeat footfall

- Customization is now a major consumer expectation, and popping boba allows brands to offer multiple fruit flavors, colors, and pairing options to enhance the beverage experience. The visual appeal of popping boba in transparent cups also contributes to social media-driven marketing and consumer sharing. This trend is especially prominent in urban and university-based retail locations where younger consumers drive beverage experimentation

- The growing influence of Asian-inspired culinary culture in U.S. and Canadian foodservice segments is boosting the popularity of boba-based products. Popping boba is viewed as a fun and innovative ingredient compared to traditional toppings, appealing to consumers looking for novelty. Its compatibility with multiple types of beverages positions it as a go-to choice for brands targeting modern, adventurous palates

- For instance, major chains such as Kung Fu Tea, Sharetea, and Jamba Juice have introduced drinks that allow customers to choose between multiple types of popping boba such as lychee, passion fruit, and mango, increasing engagement and driving impulse purchases. These flexible, build-your-own drink models have led to repeat sales and stronger brand loyalty in competitive beverage markets

- Overall, the combination of customizable drink trends, increasing influence of Asian beverage formats, and demand for visual and flavorful innovation is making popping boba a staple in North America’s fast-evolving beverage scene. As more brands adopt this ingredient into their offerings, the market is poised for sustained growth driven by experiential consumption

North America Popping Boba Juice Balls Market Dynamics

Driver

“Rising Popularity of Bubble Tea and Asian-Inspired Beverages in the U.S. and Canada”

- The rapid expansion of bubble tea franchises and specialty beverage outlets in major U.S. and Canadian cities is significantly driving demand for popping boba juice balls. These chains are introducing innovative drink formats where popping boba adds interactive texture and visual appeal. Consumers are increasingly drawn to such offerings for their novelty and Instagram-friendly aesthetics

- The trend is supported by a cultural shift toward experiential food and drink consumption, especially among younger demographics. Urban millennials and Gen Z consumers are frequenting bubble tea outlets as part of social and lifestyle habits. In turn, popping boba becomes a core ingredient not only for flavor but also for customer engagement

- Product visibility in mall kiosks, food trucks, and quick-service restaurants is rising due to increased consumer familiarity and curiosity. This accessibility fuels spontaneous purchasing behavior and broader market adoption beyond niche audiences

- For instance, popular chains such as Tiger Sugar and Gong Cha have expanded across North America, featuring drinks with flavored popping boba that attract diverse consumer segments. These chains promote the boba experience as a daily treat, boosting frequency of purchase and long-term loyalty

- Overall, the growth of organized beverage retail infrastructure, coupled with consumers’ evolving preferences toward fun, flavorful, and texturally rich drinks, is propelling the popping boba market toward sustained expansion across North America

Restraint/Challenge

“Short Shelf Life and Cold Chain Storage Constraints”

- Popping boba juice balls are delicate and perishable products that require controlled refrigeration and protection from rupture during transit. Maintaining the right temperature and packaging integrity across long distribution routes remains a key logistical challenge for manufacturers and retailers

- Smaller cafés and independent foodservice providers often lack access to consistent cold chain infrastructure, limiting their ability to store and offer popping boba-based products. This barrier restricts market penetration into rural or underdeveloped regions where demand could otherwise grow

- Inventory spoilage and waste also pose a financial burden, especially during seasonal slumps or unpredictable demand patterns. These risks reduce the profitability of carrying popping boba as a regular menu item

- For instance, several regional cafés in North America have reported product losses due to delayed deliveries or improper storage, resulting in ruptured boba pearls and compromised customer experience. This highlights the fragility of the product and the need for investment in better transportation and storage solutions

- In summary, while demand for popping boba is rising, its physical vulnerability and logistical demands present ongoing supply chain hurdles, particularly for smaller players seeking to enter or expand in the North American market

North America Popping Boba Juice Balls Market Scope

The market is segmented on the basis of product type, category, range, ingredients, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the North America popping boba juice balls market is segmented into fruit based, chocolate, yogurt, coffee, and others. The fruit based segment dominated the market with the largest market revenue share in 2024, driven by the high consumer preference for natural fruity flavors in bubble tea and dessert applications. The versatility of fruit-based boba across beverages such as smoothies and juices further enhances its appeal among foodservice providers. Widespread availability in popular flavors such as mango, lychee, strawberry, and passionfruit continues to support its dominance in both retail and quick-service formats.

The coffee-based segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for novelty beverage experiences in cafes and specialty drink shops. Coffee-flavored popping boba provides a unique twist to traditional cold brew and iced coffee drinks, offering texture and flavor in a single addition. Its popularity among young adults and college-going consumers is driving rapid adoption in urban foodservice menus.

- By Category

On the basis of category, the market is segmented into conventional and vegan. The conventional segment held the largest revenue share in 2024, largely due to its widespread availability, established consumer base, and extensive use of traditional gelling agents. Most foodservice chains continue to offer conventional options due to their affordability and proven performance in diverse temperatures and textures.

The vegan segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising plant-based dietary trends and increased demand for allergen-free dessert toppings. Formulated with seaweed extract and fruit-based gelling agents, vegan popping boba is gaining traction in health-conscious consumer segments. Restaurants and cafes are expanding their vegan-friendly offerings in response to this growing preference.

- By Range

On the basis of range, the market is segmented into standard/simple and premium. The standard/simple segment accounted for the largest revenue share in 2024, primarily due to its affordability, mass-market appeal, and dominant presence in quick-service restaurants. These products are available in bulk quantities, making them cost-effective for high-volume beverage applications.

The premium segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer willingness to spend on gourmet toppings and elevated dining experiences. Premium popping boba features unique flavor infusions, transparent casing, and customizable color or texture profiles that appeal to upscale foodservice providers and boutique dessert cafes.

- By Ingredients

On the basis of ingredients, the market is segmented into water, sugar, fruit juice, calcium lactate, seaweed extract, malic acid, potassium sorbate, colouring, fruit flavourings, and others. The water and sugar segment together held a dominant share in 2024, being essential foundational components in the boba formation process. These base ingredients form the gel membrane and internal juice solution that deliver the signature popping texture.

The seaweed extract segment is expected to witness the fastest growth rate from 2025 to 2032 due to its critical role in vegan boba production. With more manufacturers aiming for clean-label and plant-based claims, the demand for seaweed extract as a natural gelling agent is increasing across the region.

- By Application

On the basis of application, the market is segmented into bubble tea, smoothies, milkshakes, frozen yogurts, cake topping, ice cream topping, puddings, and others. The bubble tea segment dominated the market in 2024, driven by the category’s explosive growth across urban centers and college towns. Popping boba has become a signature element in bubble tea beverages, enhancing both texture and presentation.

The ice cream topping segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of popping boba in dessert bars and frozen treat chains. The contrast between cold ice cream and juice-filled spheres creates a novel sensory experience that resonates with children and young adults.

- By End User

On the basis of end user, the market is segmented into food service providers, household cooking, and others. The food service providers segment held the largest market share in 2024, with cafes, quick-service restaurants, and bubble tea shops leading the adoption of popping boba. These businesses benefit from the visual and taste appeal of popping boba as a functional and decorative ingredient.

The household cooking segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing availability of retail-ready packs and DIY dessert trends among consumers. Increased online tutorials and recipe blogs are making popping boba a popular inclusion in home-based beverages and snacks.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into store based retailers and non-store based. The store based retailers segment accounted for the majority revenue share in 2024, as supermarkets, convenience stores, and specialty food shops remain primary access points for consumers. Retailers often display popping boba in chilled or dessert aisles, ensuring high visibility and impulse purchases.

The non-store based segment is expected to witness the fastest growth rate from 2025 to 2032, owing to growing consumer preference for doorstep delivery and the ability to access a wide variety of flavors and packaging formats online. Subscription boxes and specialty food websites are driving this growth by offering curated selections and customization options.

North America Popping Boba Juice Balls Market Regional Analysis

- U.S. popping boba juice balls market captured the largest revenue share of 79.6% in North America in 2024, driven by rising consumer interest in Asian-inspired beverages and the widespread penetration of bubble tea shops across urban and suburban areas

- The growing inclination toward visually engaging and customizable beverages has positioned popping boba as a trendy and appealing option

- In addition, increasing product availability through mainstream foodservice outlets and health-forward variants, such as vegan and low-sugar options, are further accelerating market growth in the country

Canada Popping Boba Juice Balls Market Insight

The Canada popping boba juice balls market is expected to grow at a promising CAGR over the forecast period, supported by the increasing number of Asian dessert and beverage cafes and a growing demand for novelty food experiences. The country's multicultural population is playing a pivotal role in promoting the adoption of popping boba products beyond traditional applications. As consumer preferences shift toward fun, experiential eating, the integration of popping boba in frozen treats, carbonated drinks, and alcoholic beverages is becoming more mainstream in Canada.

North America Popping Boba Juice Balls Market Share

The North America Popping Boba Juice Balls industry is primarily led by well-established companies, including:

- Leadway International Inc. (U.S.)

- Yummy Bazaar (U.S.)

- Fruity Boba (U.S.)

- Bossen (U.S.)

- Qbubble (U.S.)

- Boba Tea Direct (U.S.)

- Fusion Select (U.S.)

- Tea Zone (U.S.)

- Popping Boba (U.S.)

- Lollicup USA (U.S.)

Latest Developments in North America Popping Boba Juice Balls Market

- In January 2024, Tachiz Group, a prominent popping boba manufacturer based in Taiwan, announced the development of its new product, Crystal Boba, aimed at expanding its offerings in the food and beverage sector. This product launch marks a strategic move to tap into the growing demand for innovative boba ingredients in beverages and desserts. The introduction of Crystal Boba is expected to diversify consumer choices and enhance the brand’s visibility in international markets. With plans to launch early in the year, Tachiz Group aims to strengthen its competitive position by catering to evolving flavor and texture preferences. The move is likely to influence product innovation trends across the global boba industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Popping Boba Juice Balls Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Popping Boba Juice Balls Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Popping Boba Juice Balls Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.