North America Protective Films Market

Market Size in USD million

CAGR :

%

USD

644.13 million

USD

791.93 million

2022

2030

USD

644.13 million

USD

791.93 million

2022

2030

| 2023 –2030 | |

| USD 644.13 million | |

| USD 791.93 million | |

|

|

|

North America Protective Films Market Analysis and Size

Protective films are used to protect high-quality surfaces such as fluorescent screens, metals, wood, glass, and others from scratches, marks, dust particles, moisture, and other substances must be protected. Protective films are widely used in construction, automobiles, electronics, packaging, and other industries.

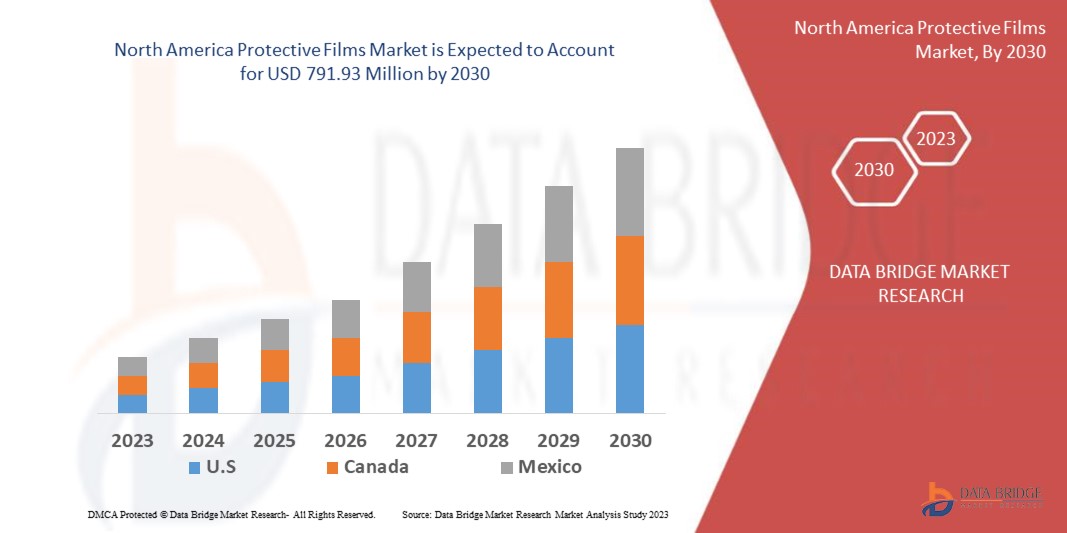

Data Bridge Market Research analyses that the North America Protective Films Market which was USD 644.13 million in 2022, is expected to reach USD 791.93 million by 2030, and is expected to undergo a CAGR of 5.3% during the forecast period of 2023 to 2030.

Several advantages are associated with protective films, and that is the increasing demand for protective films in automobile industries to protect the surface of vehicles from scratches, marks, dust, and other particles, and this is the driving factor for the market growth. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

North America Protective Films Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Tons |

|

Segments Covered |

Class (Adhesive-Coated, Self-Adhesive), Material (Polyethylene, Polypropylene, Polyethylene Terephthalate, Polyvinyl Chloride, Polyurethane, Polyamide, Polyester, Paper, Others), Thickness (0 - 2 mm, 2 - 4 mm, 4 - 6 mm, 6 - 8 mm, 8 - 10 mm, Others), Surface (Metals, Glass, Textiles, Wood, Marbles, Molded Plastics, Others), Texture (Opaque, Transparent, Glossy, Matte, Others), End-User (Building & Construction, Automotive, Electronics, Life Science, Aerospace, Packaging, Industrial, Marine, Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Lamin-x (U.S.), Tee Group Films (U.S.), Mactac (a subsidiary of LINTEC Corporation) (U.S.), DuPont (U.S.), Arkema (France), Hitachi Chemical Co., Ltd., (Japan), Saint-Gobain (France) and 3M (U.S.) |

|

Market Opportunities |

|

Market Definition

Protective films are used to protect high-quality surfaces such as fluorescent screens, metals, wood, glass, and others from scratches, marks, dust particles, moisture, and other substances must be protected. Protective films are widely used in construction, automobiles, electronics, packaging, and other industries.

These films are made from high quality plastics based raw materials such as polyethylene (HDPE), low-density polyethylene (LDPE), linear low density polyethylene (LLPE), polypropylene, Polyethylene Terephthalate, polyvinyl chloride, polyurethane, polyamide, polyester, paper, and others.

North America Protective Films Market Dynamics

Drivers

- High Adoption Of Packaging Film In E-Commerce Industries

In today’s time, the packaging is a coordinated system of preparing various products or goods for safe transport from one place to another. Packaging widely plays a crucial part in the entire supply chain management. Packaging protects the products from damage, jerks, cracks, scratches, and other. In fact, various manufacturers are adopting new and innovative packaging technology for the creation of an effective brand identity.

According to a survey by the National Retail Federation in 2020, when it comes to consumer behavior for shopping, the most preferable parameters are quality (32%), and price (30%), and only 13% say convenience is important. This does not, however, reflect overall shopping habits since 97 per 100 consumers say that they did not buy because of disadvantages.

- Low Cost of Protective Films Compared To Its Peers

Protective films are films that are made from plastic as raw materials. Production of the protective film is quite complex as the top layer of the film must be tough while the coating substance used in the film must have a thin layer of coatings of rubber or acrylic with low thickness, and the layer must be removed easily without causing any traces or any other marks on the surface of the products. An easy measure of a product, highly monitoring the thickness, reflection, and adhesive layer of formation, acrylic, and silicone layers can result in the overall quality of the films by reducing the waste of the products.

Protective films are available in various colors, sizes, and shapes, such as in transparent color, opaque, matte, and others. The prices of protective films are less than paints and protective clear coats. The installation process of these films is quite complex and requires trained labor for this to get the optimum results. A small or slight mistake at the time of installation may cause a variation in the final results.

- High Demand For Protective Films In Construction And Transportation Industries

The construction industry is well known for the movement of materials and heavy machinery within a confined area, leading to a high level of safety hazards. Protection of everything is required, such as carpeting, countertops, appliances, windows, and doors, from any external abrasions, that is, scratches. Adhesive coated films adhere to and protect the surface to prevent the repairing of expensive goods. The protective film is used to protect the surface from damage and other atmospheric activities.

Customized protective films have great demand in construction industries depending upon the kind of work being done, such as for a variety of construction projects, from painting to remodeling, decorating, or painting projects. Protective films are made from plastics as raw materials such as polyethylene and propylene are commonly used raw material in the manufacturing of protective films. These plastics sheets are widely used in the construction industry due to their high heat resistance properties. Other plastics used are TPU, Polyvinyl Chloride, and polyethylene terephthalate. TPU films are widely used in the in building and construction sectors due to their higher heat resistant properties which these films are widely used in window glasses and panels.

Opportunities

- High Adaptability of Protective Films in Electronics Sectors

The electronic industry has promised to form the next generation of electronic devices, and most electronic devices are widely used all over the world in various applications used in the wide range of applications. Electronic devices such as T.V., A.C., fridges, and phones are becoming the part of the everyday need of the consumer on a wider range.

Surface protection tape or protective films are widely used in the electronics industries to protect florescent screens, T.V screens and other electronic equipment from scratches, marks, dusts and other impurities.

The electronic market also includes resisters, insulators, florescent screens, motors, capacitors, photoresists, flexible printed circuits, flat panel displays (FPDs), solar screens, solar cells, and others. Many electronics products are widely used in BOPET film to protect their surfaces. In solar cells and solar appliances, polyester film is used in the back glasses.

-

Advancement in Technology to Offer Sustainable Product with Minimal Environmental Impact

Protective films are the films which is made from the plastic as a raw materials. Production of protective film are quite complex as the top layer of the film must be tough while the coating substance used in the film must have a thin layer of coatings of rubber or acrylic with low thickness and the layer must be removed easily without causing any traces or any other marks on the surface of the products.

An easy measure of a product, highly monitoring the thickness, reflection, and adhesive layer of formation, acrylic and silicone layers can result in the overall quality of the films by reducing the waste of the products.

The fabrication of protective packaging film technology has widely gained significant momentum. The wider consumer preference for protective films to increase the shelf-life of goods and facilitate ease of handling and transportation increase the demand for protective films.

Restraints/Challenges

Fluctuation in Raw Material Prices

Protective films are used wherever high-quality surfaces should be protected from outside damages such as pollution, dust, scratches, and other properties that reduce the overall appearance of the surfaces.

Protected films are widely manufactured from plastic raw materials such as materials such polyethylene (HDPE), low-density polyethylene (LDPE), linear low density polyethylene (LLPE), polypropylene, polyethylene terephthalate, polyvinyl chloride, Polyurethane, polyamide, polyester, paper. The processing of protective films is quite complex as most consumer demand thin protective sheets for optimum results.

The price of raw materials are highly volatile as the price of plastics is heavily depends on the prices of oil and other market fluctuations. Crude oil is a mixture of hydrocarbons where at different temperature, different products get separated, such as petrol, kerosene, and naphtha diesel, among others.

As per the report published by Business Standard in July 2018, the prices of various plastic raw materials have surged approximately 13% due to rising fluctuation prices of crude oil prices due to pandemic situations all around the world and robust consumption from export-centric plastic manufacturers. Polymer prices have increased due to a sharp increase in crude oil prices.

Stringent Environmental and Government Regulations

There is a strong connection between packaging and consumer protection. A package is a vehicle for safety and aims to provide consumers with safe, healthful, and nutritious food. Packaging rules and legislation have been adopted by the State to safeguard the needs of the customer and community as a whole. The government of most countries is imposed a banned on the U.S.ge of various plastic products as these plastic products contaminate the environment in a wider range.

For instance,

- In June 2018, the Indian Prime Minister announced that India would eliminate the U.S.ge of single-use plastics till 2022. On the other hand, Canada and the European Union would eliminate the U.S.ge of single use plastic till 2021.

Recent Developments

- In May 2022, Saint-Gobain S.A. made an investment in a new blowing glass wool production line in its ISOVER plant in France to meet the rising demand of the French market for roof space thermal insulation solutions

- In December 2021, Saint-Gobain S.A. has entered into an agreement with Alghamin Group for the acquisition of its 100% subsidiary, Rockwool India Pvt Ltd, a major manufacturer of stone wool in India with a range of insulation products for thermal, acoustic, and fire safety applications.

North America Protective Films Market Scope

The North America Protective Films Market is segmented on the basis of product type, material type, temperature, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Class

- Adhesive-Coated

- Acrylic

- Rubber

- Self-Adhesive

Material

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyvinyl Chloride

- Polyurethane

- Polyamide

- Polyester

- Paper

- Others

Thickness

- 0- 2 MM

- 2 - 4 MM

- 4 - 6 MM

- 6 - 8 MM

- 8 - 10 MM

- Others

Surface

- Metals

- Stainless Steel

- Aluminum

- Others

- Glass

- Textilefhydrocarbon

- Wood

- Marbles

- Molded Plastics

- Others

Texture

- Opaque

- Transparent

- Glossy

- Matte

- Others

End-User

- Building & Construction

- Automotive

- Electronics

- Life Science

- Aerospace

- Packaging

- Industrial

- Marine

- Others

North America Protective Films Market Regional Analysis/Insights

The North America Protective Films Market is analysed, and market size insights and trends are by class, material, thickness, surface, texture, and end-user, as referenced above.

The countries covered in the North America Protective Films Market report are U.S., Canada, and Mexico.

U.S. is expected to dominate the North America Protective Films Market because of the large customer base in the region for the e-commerce packaging market in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Protective Films Market Share Analysis

The North America Protective Films Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the company’s focus related to North America Protective Films Market.

Some of the major players operating in the North America Protective Films Market are:

- Lamin-x (U.S.)

- Tee Group Films (U.S.)

- Mactac (a subsidiary of LINTEC Corporation) (U.S.)

- DuPont (U.S.)

- Arkema (France)

- Hitachi Chemical Co., Ltd., (Japan)

- Saint-Gobain (France

- 3M (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Protective Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Protective Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Protective Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.