North America Polyvinyl Chloride (PVC) Paste Resin Market Analysis and Size

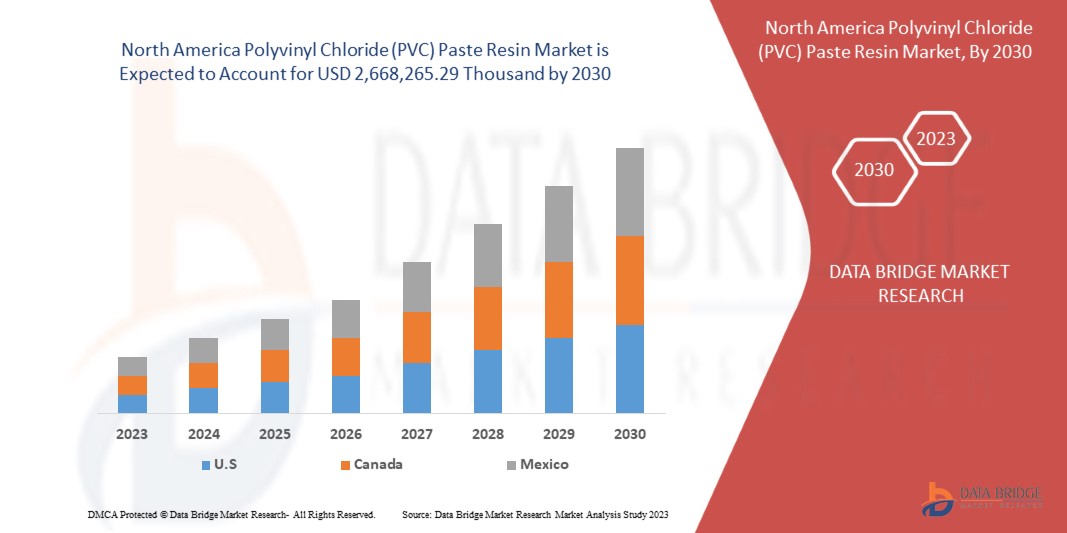

The North America polyvinyl chloride (PVC) paste resin market is expected to grow significantly from 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.1% from 2023 to 2030 and is expected to reach USD 2,668,265.29 thousand by 2030. The increase in North America PVC-based construction materials demand is the key factor fueling the expansion of the polyvinyl chloride (PVC) paste Resin market.

The construction sector is witnessing a rise in infrastructure investment by the government, construction companies, and private builders to meet the rising demand for residential and commercial properties. The demand for low-cost and low-weight alternatives for replacing conventional materials such as metal and wood is increasing, making room for PVC based such as vinyl siding, window profiles, magnetic stripe cards, pipe, and plumbing, as well as conduit fixtures. Therefore, increasing. PVC-based construction materials are gaining importance in the construction sector. Also, PVC paste resin can withstand moisture and has good tensile strength, making them a preferred choice for manufacturing industrial gloves.

The North America polyvinyl chloride (PVC) paste resin market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. Contact us for an analyst brief to understand the analysis and the market scenario. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Suspension Copolymer Grade, and Suspension Blending Grade), Manufacturing Process (Micro-Suspension Process and Emulsion Process), Application (Artificial Leather, Wall Papers, Plastisol Inks, Hand Gloves, Artificial Flowers, Transparent Balls, and Others), End-Use (Construction, Automotive, Consumer Goods, Electrical & Electronics, Packaging, Healthcare, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Formosa Plastics Corporation, U.S.A., KANEKA CORPORATION, Orbia, INEOS, Shin-Etsu Chemical Co., Ltd., PT. Standard Toyo Polymer (A subsidiary of TOSOH CORPORATION), LG Chem, Solvay, Westlake Vinnolit GmbH & Co. KG, Occidental Petroleum Corporation, Braskem, KEM ONE, SCG Chemicals Public Company Limited, CIRES, Lda, Chemplast Sanmar Ltd, Redox, CHEMDO, Gogara International, THE CHEMICAL COMPANY, and SHANGHAI KEAN TECHNOLOGY CO., LTD., among others. |

Market Definition

Polyvinyl chloride PVC paste resin is a type of resin used to produce rubber and plastic. PVC paste resin grade is made by emulsion and micro-suspending and is widely used in processing such as dipping, roto forming, coating, and foaming. This is also used as a main raw material for artificial leather, wallpaper, disposable PVC latex examination gloves, and tarp, among others.

North America Polyvinyl Chloride (PVC) Paste Resin Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Growing applications of PVC paste in construction and healthcare industry

The construction sector is witnessing a rise in infrastructure investment by the government, construction companies, and private builders to meet the rising demand for residential and commercial properties. The demand for low-cost and low-weight alternatives for replacing conventional materials such as metal and wood is increasing, making room for PVC based such as vinyl siding, window profiles, magnetic stripe cards, pipe, and plumbing, as well as conduit fixtures. Therefore, increasing. PVC-based construction materials are gaining importance in the construction sector.

Moreover, the rapid shift towards modernizing households using various flooring options is expected to drive market growth soon. In the construction industry, PVC resins are also used to manufacture consumer goods and home materials such as pipes and fittings, cable isolation, doors and springs, office furniture, and many more. PVC paste resin is used for coating, dipping, foaming, spray coating, and rotational forming.

Thus, with an increase in construction production and investment activities across the globe, demand and production for PVC resins are growing, which, in turn, is anticipated to boost the growth scope for the polyvinyl chloride (PVC) paste resin market in the forecast period.

Opportunity

- The flourishing growth of the electrical & electronics industry

Polyvinyl chloride (PVC) resin is widely used in the electrical and electronics sector for applicability in wires and cables, computers, lighting, and others, owing to superior insulation and durability. With the constant research and development in the sector, innovation paves the way to improved products and upliftment. The electrical and electronics market constantly expands as traditional products give way to smart products.

Moreover, various governments are continuously making efforts to boost the Indian electronics industry and are attracting foreign and local players to invest in the country's electronics sector.

Restraint/Challenge

- Ban on phthalates

Various countries have banned phthalates due to their toxicity, which is projected to obstruct trade growth in the North America polyvinyl chloride (PVC) paste resin market. Phthalates are mainly used as plasticizers, substances added to plastics to increase their flexibility, transparency, durability, and longevity. They are used primarily to soften polyvinyl chloride (PVC).

Phthalates were initially considered harmless because they do not have an acutely toxic effect. However, risk assessments within the EU have shown that some phthalates must be classified as toxic to reproduction. Of the most frequently used phthalates, the four phthalates DEHP, DBP, DIBP, and BBP are classified within the EU as toxic to reproduction. Consumption of these phthalates has fallen since they were classified.

Therefore, the increase in instances of harm from phthalate and its ban is expected to pose a challenge to the growth of the North America polyvinyl chloride (PVC) paste resin market

Recent Developments

- In February 2023, INEOS acquired a portion of Chesapeake Energy's oil and gas assets in the Eagle Ford shale, south Texas, U.S., for USD 1.4 billion. The addition of Chesapeake's assets and operations in south Texas is part of INEOS' strategy to build a North America integrated portfolio fit for the energy transition, offering high-quality energy solutions to its customers.

- In September 2022, Orbia was listed on the DJSI MILA Pacific Alliance Index, with a year-over-year score increase of 6%. Orbia was awarded a score of 68, marking a 6% increase from 2021 and reflecting the company's progress across economic, governance, environmental, and social dimensions.

North America Polyvinyl Chloride (PVC) Paste Resin Market Scope

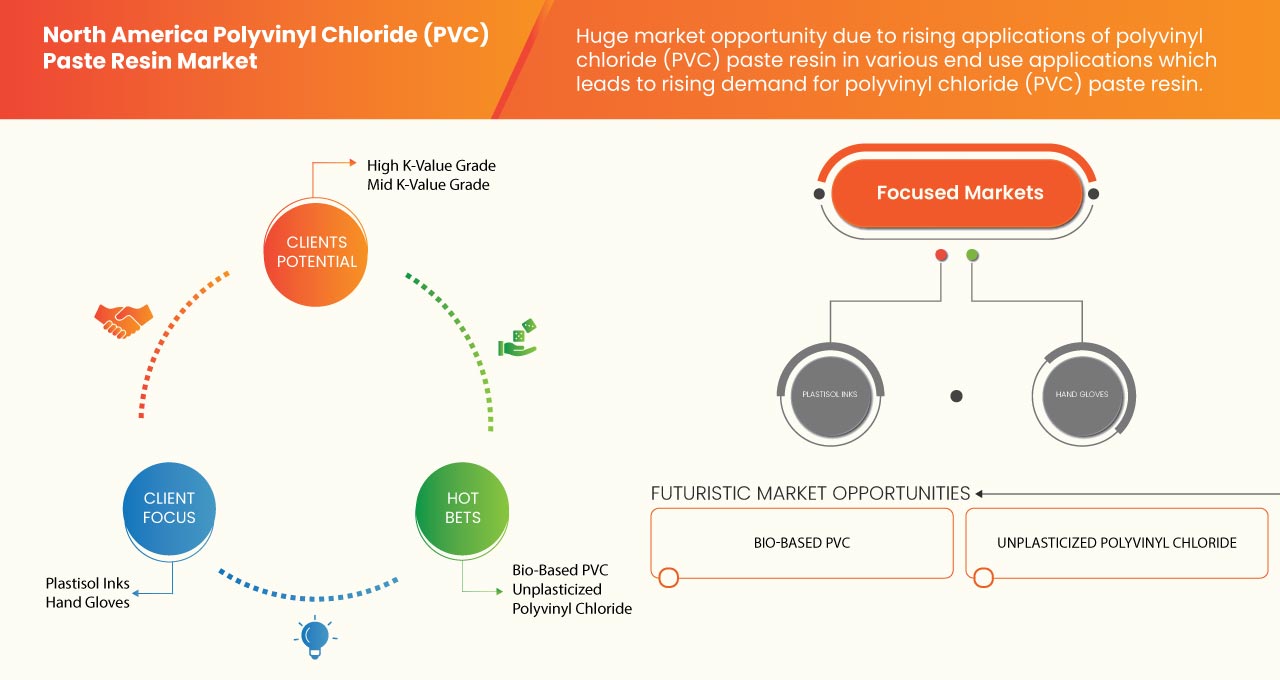

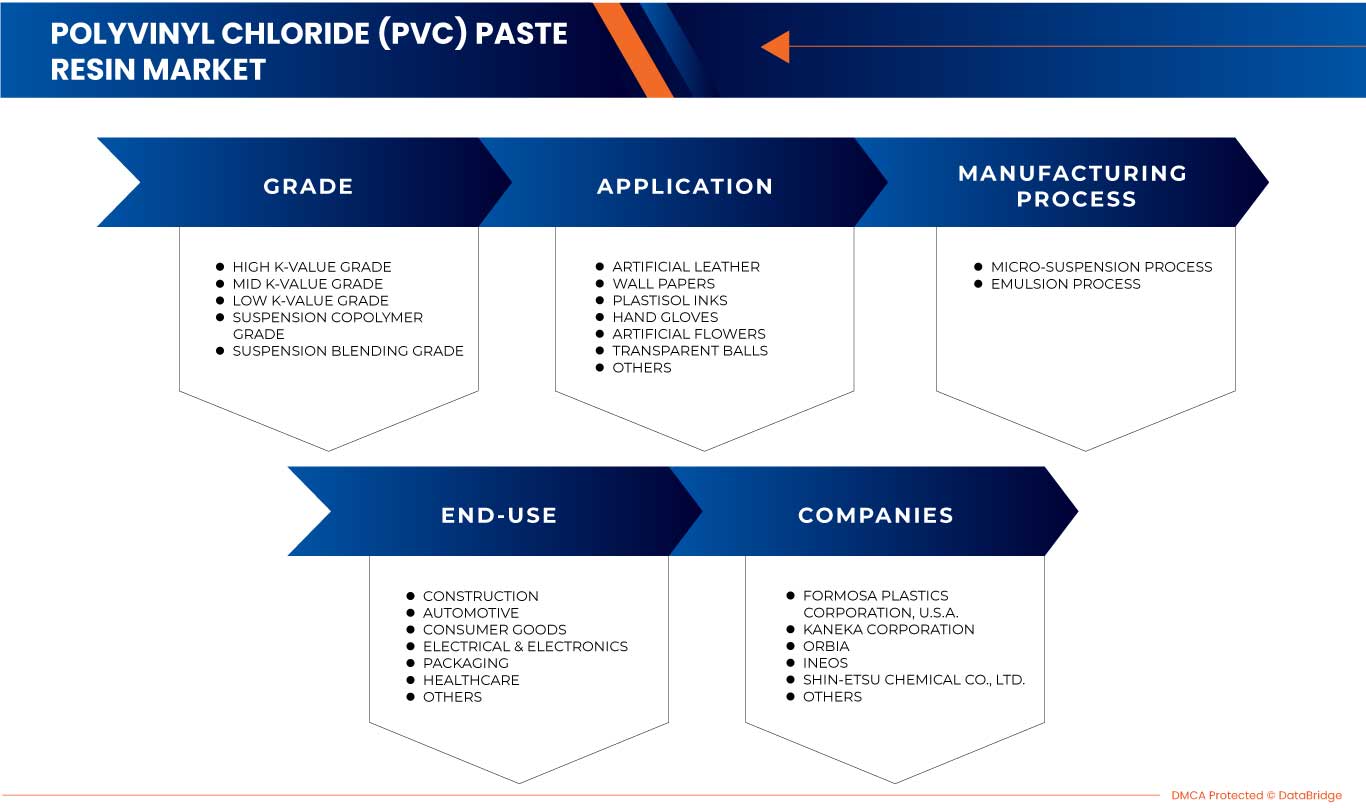

North America polyvinyl chloride (PVC) paste resin market is segmented into four notable segments: grade, manufacturing process, application, and end-use. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

By Grade

- High K-Value Grade

- Mid K-Value Grade

- Low K-Value Grade

- Suspension Copolymer Grade

- Suspension Blending Grade

On the basis of grade, the North America polyvinyl chloride (PVC) paste resin market is classified into five segments, namely high k-value grade, mid k-value grade, low k-value grade, suspension copolymer grade, and suspension blending grade.

By Manufacturing Process

- Micro-Suspension Process

- Emulsion Process

On the basis of manufacturing process, the North America polyvinyl chloride (PVC) paste resin market is classified into two segments, namely micro-suspension process and emulsion process.

By Application

- Artificial Leather

- Wall Papers

- Plastisol Inks

- Hand Gloves

- Artificial Flowers

- Transparent Balls

- Others

On the basis of application, the North America polyvinyl chloride (PVC) paste resin market is classified into seven segments, artificial leather, wall papers, plastisol inks, hand gloves, artificial flowers, transparent balls, and others.

By End-Use

- Construction

- Automotive

- Consumer Goods

- Electrical & Electronics

- Packaging

- Healthcare

- Others

On the basis of end-use, the North America polyvinyl chloride (PVC) paste resin market is classified into seven segments, construction, automotive, consumer goods, electrical & electronics, packaging, healthcare, and others.

North America Polyvinyl Chloride (PVC) Paste Resin Market Regional Analysis/Insights

North America polyvinyl chloride (PVC) paste resin market is segmented into four notable segments that are grade, manufacturing process, application, and end-use.

The countries in the North America polyvinyl chloride (PVC) paste resin market are the U.S., Canada, and Mexico.

U.S. is expected to dominate the North America polyvinyl chloride (PVC) paste resin market. The U.S. dominates in the North America region due to the increasing use of polyvinyl chloride (PVC) paste resin and growing applications of PVC paste in the construction and healthcare industry, boosting the demand for North America polyvinyl chloride (PVC) paste resin market

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Polyvinyl Chloride (PVC) Paste Resin Market Share Analysis

The North America polyvinyl chloride (PVC) paste resin market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies focusing on the North America polyvinyl chloride (PVC) paste resin market.

Some of the prominent participants operating in the North America polyvinyl chloride (PVC) paste resin market are Formosa Plastics Corporation, U.S.A., KANEKA CORPORATION, Orbia, INEOS, Shin-Etsu Chemical Co., Ltd., PT. Standard Toyo Polymer (A subsidiary of TOSOH CORPORATION), LG Chem, Solvay, Westlake Vinnolit GmbH & Co. KG, Occidental Petroleum Corporation, Braskem, KEM ONE, SCG Chemicals Public Company Limited, CIRES, Lda, Chemplast Sanmar Ltd, Redox, CHEMDO, Gogara International, THE CHEMICAL COMPANY, and SHANGHAI KEAN TECHNOLOGY CO., LTD., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING APPLICATIONS OF PVC PASTE IN THE CONSTRUCTION AND HEALTHCARE INDUSTRY

5.1.2 SHIFTING FOCUS ON THE PRODUCTION OF SYNTHETIC LEATHER AND INDUSTRIAL GLOVES

5.1.3 EXTENSIVE PROPERTIES OFFERED BY POLYVINYL CHLORIDE (PVC) PASTE RESIN

5.2 RESTRAINTS

5.2.1 LESS CONSUMER KNOWLEDGE RELATED TO PVC PASTE RESIN

5.2.2 AVAILABILITY OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 RAPID GROWTH OF THE AUTOMOTIVE INDUSTRY

5.3.2 FLOURISHING GROWTH OF THE ELECTRICAL & ELECTRONICS INDUSTRY

5.4 CHALLENGES

5.4.1 BAN ON PHTHALATES

5.4.2 HARMFUL IMPACTS OF POLYVINYL CHLORIDE (PVC) RESIN ON THE ENVIRONMENT

6 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE

6.1 OVERVIEW

6.2 HIGH K-VALUE GRADE

6.3 MID K-VALUE GRADE

6.4 LOW K-VALUE GRADE

6.5 SUSPENSION COPOLYMER GRADE

6.6 SUSPENSION BLENDING GRADE

7 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 MICRO-SUSPENSION PROCESS

7.3 EMULSION PROCESS

8 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ARTIFICIAL LEATHER

8.3 WALL PAPERS

8.4 PLASTISOL INKS

8.5 HAND GLOVES

8.6 ARTIFICIAL FLOWERS

8.7 TRANSPARENT BALLS

8.8 OTHERS

9 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE

9.1 OVERVIEW

9.2 CONSTRUCTION

9.2.1 CONSTRUCTION, BY GRADE

9.2.1.1 HIGH K-VALUE GRADE

9.2.1.2 MID K-VALUE GRADE

9.2.1.3 LOW K-VALUE GRADE

9.2.1.4 SUSPENSION COPOLYMER GRADE

9.2.1.5 SUSPENSION BLENDING GRADE

9.3 AUTOMOTIVE

9.3.1 AUTOMOTIVE, BY GRADE

9.3.1.1 HIGH K-VALUE GRADE

9.3.1.2 MID K-VALUE GRADE

9.3.1.3 LOW K-VALUE GRADE

9.3.1.4 SUSPENSION COPOLYMER GRADE

9.3.1.5 SUSPENSION BLENDING GRADE

9.4 CONSUMER GOODS

9.4.1 CONSUMER GOODS, BY GRADE

9.4.1.1 HIGH K-VALUE GRADE

9.4.1.2 MID K-VALUE GRADE

9.4.1.3 LOW K-VALUE GRADE

9.4.1.4 SUSPENSION COPOLYMER GRADE

9.4.1.5 SUSPENSION BLENDING GRADE

9.5 ELECTRICAL & ELECTRONICS

9.5.1 ELECTRICAL & ELECTRONICS, BY GRADE

9.5.1.1 HIGH K-VALUE GRADE

9.5.1.2 MID K-VALUE GRADE

9.5.1.3 LOW K-VALUE GRADE

9.5.1.4 SUSPENSION COPOLYMER GRADE

9.5.1.5 SUSPENSION BLENDING GRADE

9.6 PACKAGING

9.6.1 PACKAGING, BY GRADE

9.6.1.1 HIGH K-VALUE GRADE

9.6.1.2 MID K-VALUE GRADE

9.6.1.3 LOW K-VALUE GRADE

9.6.1.4 SUSPENSION COPOLYMER GRADE

9.6.1.5 SUSPENSION BLENDING GRADE

9.7 HEALTHCARE

9.7.1 HEALTHCARE, BY GRADE

9.7.1.1 HIGH K-VALUE GRADE

9.7.1.2 MID K-VALUE GRADE

9.7.1.3 LOW K-VALUE GRADE

9.7.1.4 SUSPENSION COPOLYMER GRADE

9.7.1.5 SUSPENSION BLENDING GRADE

9.8 OTHERS

9.8.1 OTHERS, BY GRADE

9.8.1.1 HIGH K-VALUE GRADE

9.8.1.2 MID K-VALUE GRADE

9.8.1.3 LOW K-VALUE GRADE

9.8.1.4 SUSPENSION COPOLYMER GRADE

9.8.1.5 SUSPENSION BLENDING GRADE

10 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 BUSINESS ACQUISITION & EXPANSION

11.3 RECOGNITION & PRODUCT LAUNCH

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 FORMOSA PLASTICS CORPORATION, U.S.A.

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 KANEKA CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 ORBIA

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 INEOS

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 SHIN-ETSU CHEMICALS., LTD.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 BRASKEM

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CHEMDO

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CHEMPLAST SANMAR LIMITED

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 CIRES, LDA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GOGARA INTERNATIONAL

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KEM ONE

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 LG CHEM

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 OCCIDENTAL PETROLEUM CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 PT. STANDARD TOYO POLYMER

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 REDOX

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SCG CHEMICALS PUBLIC COMPANY LIMITED

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SHANGHAI KEAN TECHNOLOGY CO., LTD

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SOLVAY

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 THE CHEMICAL COMPANY

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 WESTLAKE VINNOLIT GMBH & CO. KG

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXY ACIDS, AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS, AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 3 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 5 NORTH AMERICA HIGH K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA HIGH K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 7 NORTH AMERICA MID K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA MID K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 NORTH AMERICA LOW K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA LOW K-VALUE GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 11 NORTH AMERICA SUSPENSION COPOLYMER GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA SUSPENSION COPOLYMER GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 13 NORTH AMERICA SUSPENSION BLENDING GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA SUSPENSION BLENDING GRADE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (TONS)

TABLE 15 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA MICRO-SUSPENSION PROCESS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA EMULSION PROCESS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA ARTIFICIAL LEATHER IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA WALL PAPERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA PLASTISOL INKS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA HAND GLOVES IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA ARTIFICIAL FLOWERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA TRANSPARENT BALLS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 43 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 45 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 57 U.S. POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 58 U.S. POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 U.S. POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 63 U.S. ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 67 CANADA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 68 CANADA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 69 CANADA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 70 CANADA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 71 CANADA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 72 CANADA CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 73 CANADA AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 74 CANADA CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 75 CANADA ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 76 CANADA PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 77 CANADA HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 78 CANADA OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 79 MEXICO POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 80 MEXICO POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 81 MEXICO POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 82 MEXICO POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 83 MEXICO POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 84 MEXICO CONSTRUCTION IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 85 MEXICO AUTOMOTIVE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 86 MEXICO CONSUMER GOODS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 87 MEXICO ELECTRICAL & ELECTRONICS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 88 MEXICO PACKAGING IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 89 MEXICO HEALTHCARE IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 90 MEXICO OTHERS IN POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET

FIGURE 2 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA HANGERS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: SEGMENTATION

FIGURE 14 GROWING APPLICATIONS OF PVC PASTE IN THE CONSTRUCTION AND HEALTHCARE INDUSTRY ARE EXPECTED TO DRIVE THE NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET IN THE FORECAST PERIOD

FIGURE 15 THE HIGH K-VALUE GRADE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET

FIGURE 17 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY GRADE, 2022

FIGURE 18 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY MANUFACTURING PROCESS, 2022

FIGURE 19 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET, BY END-USE, 2022

FIGURE 21 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: BY COUNTRY (2022)

FIGURE 23 EUROPE POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: BY GRADE (2023-2030)

FIGURE 26 NORTH AMERICA POLYVINYL CHLORIDE (PVC) PASTE RESIN MARKET: COMPANY SHARE 2022 (%)

North America Pvc Paste Resin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Pvc Paste Resin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Pvc Paste Resin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.