Market Analysis and Insights: North America q-PCR Reagents Market

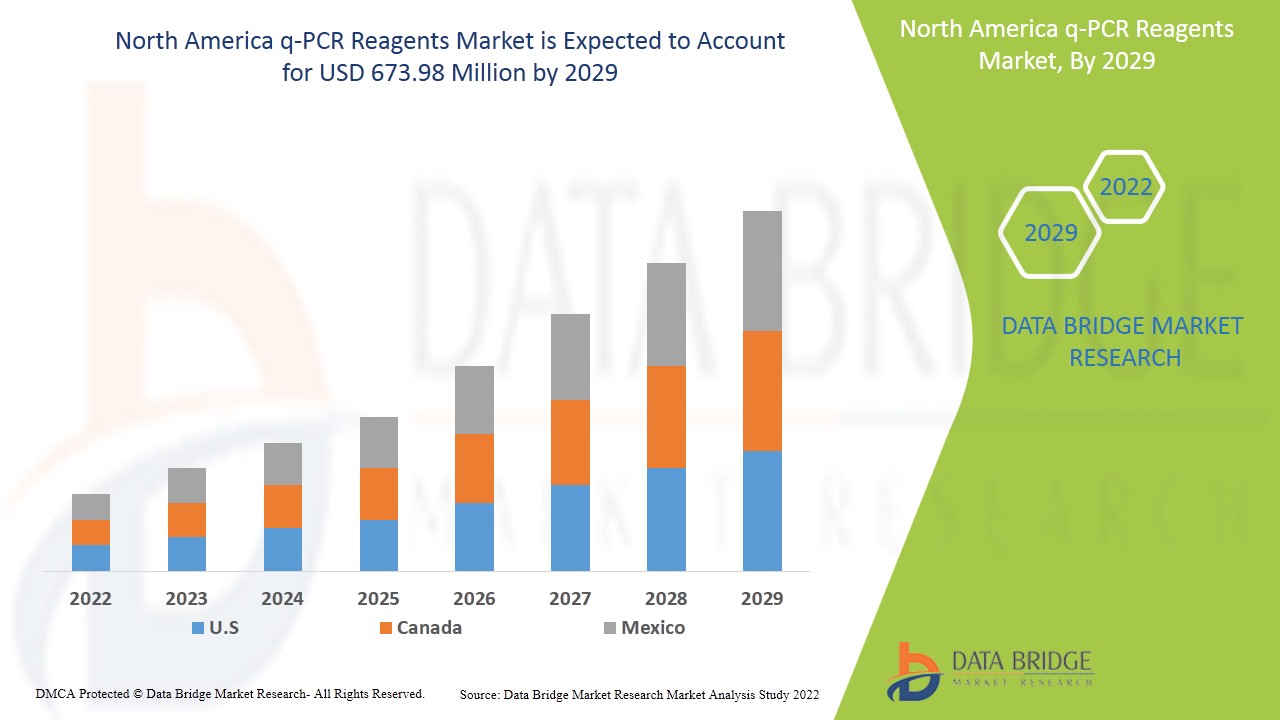

North America q-PCR reagents market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.2% in the forecast period of 2022 to 2029 and is expected to reach USD 673.98 million by 2029. Growth of R&D in the healthcare industry and increase in healthcare expenditure are the major drivers which propelled the demand of the market in the forecast period. Whereas the product recall are restraining the market.

The q-PCR reagents help in the determination of absolute or relative amounts of a known sequence in a sample and are used in different applications such as forensic, research, and diagnostics.

The demand for q-PCR reagents has been increased in both developed well as in developing countries and the reason behind this is the increasing geriatric population and product launch. The q-PCR reagents market is growing due to the introduction of innovative products, increase in technological products, and rising disposable income. The market will grow in the forecasted period due to exploration of emerging markets, strategic initiatives by market players, increasing healthcare expenditure.

Presence of various major market players are providing an opportunity for the market to grow, whereas lack of skilled professionals is challenging for the marker to grow. The q-PCR reagents helps in the determination of absolute or relative amounts of a known sequence in a sample and used in different application such as forensic, research and diagnostics.

The q-PCR reagents market report provides details of market share, new developments, impact of domestic and localized market players analysis of opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America q-PCR Reagents Market Scope and Market Size

Q-PCR reagents market is segmented on the based on the basis of the detection type, assay type, plexity, packaging type, application, technology, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of detection type, North America q-PCR reagents market is segmented into dye -based reagents and probe -based reagents. In 2022, probe-based reagents segment is expected to dominate the North America q-PCR reagent market due to its benefits over the dye based such as results that are more exact in lesser time than dye based.

- On the basis of assay type, North America q-PCR reagents market is segmented into qPCR singleplex test/assay and qPCR multiplex test/assay. In 2022, qPCR singleplex test/assay segment is expected to dominate the North America q-PCR reagent market due to the increase in technology for diagnostics tests.

- On the basis of plexity, North America q-PCR reagents market is segmented into dye -based reagents and probe -based reagents. In 2022, dye-based reagents segment is expected to dominate the North America q-PCR reagent market due to increase in healthcare expenditure.

- On the basis of packaging type, North America q-PCR reagents market is segmented into kits and master mixes. In 2022, kits are boosting market growth due to the increasing government spending and disposable income.

- On the basis of technology, North America q-PCR reagents market is segmented into gene expression, gene typing, MIRNA analysis, pre-amplification and virus detection. In 2022, the gene expression segment is expected to dominate the market owing to its credible precision and high-throughput competence.

- On the basis of application, North America q-PCR reagents market is segmented into diagnostics, research and forensic. In 2022, the forensic application is expected to grow at the fastest rate in the market due to increasing R&D activities around U.S.

- On the basis of end user, North America q-PCR reagents market is segmented into hospital & diagnostic centers, forensic laboratories, research & academic institute, clinical research organization, pharmaceutical and biopharmaceutical companies and others. In 2022, the hospital & diagnostic centers segment is expected to dominate the market due to the immense amount of diagnosis and testing required to support a disease discovery and development.

- On the basis of distribution channel, North America q-PCR reagents market is segmented into direct tender third party distributors and others. In 2022, direct tender is expected to dominate the North America q-PCR reagents market as direct tender provides all the products without any secondary medium.

Q-PCR Reagents Market Country Level Analysis

The q-PCR reagents market is analyzed and market size information is provided on the basis of country, detection type, assay type, plexity, packaging type, application, technology, end user and distribution channel.

The countries covered in the q-PCR reagents market report are the U.S., Canada, and Mexico.

Q-PCR reagents segment.in North America region is expected to grow with the highest growth rate in the forecast period of 2022 to 2029 because of increasing research development for enhancing the product quality. U.S is leading the growth of the North America q-PCR reagents market and direct tender segment is dominating in this country due to rising incidence of disease in the country.

The country section of the report also provides individual market affecting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increase in Advancement and Technology for New Product Development are Boosting the Market Growth of q-PCR Reagents

q-PCR reagents market also provides you with detailed market analysis for every country growth in q-PCR reagents industry with q-PCR reagents drugs sales, impact of advancement in the q-PCR reagents technology and changes in regulatory scenarios with their support for the q-PCR reagents market. The data is available for historic period 2010 to 2018.

Competitive Landscape and q-PCR Reagents Market Share Analysis

q-PCR reagents market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to q-PCR reagents market.

The major companies which are dealing in the North America q-PCR reagents market are Bio-Rad Laboratories, Inc., Agilent Technologies, Inc, Biotium, MiRXES Pte Ltd, GeneDireX, Inc, F. Hoffmann-La Roche Ltd, Norgen Biotek Corp, Takara Holdings Inc., Enzo Biochem Inc, Qiagen, PCR Biosystems, Tonbo Biosciences, Quantabio, Merck KgaA, Kaneka Eurogentec S.A, Promega Corporation, Solis BioDyne, and Seegene Inc among others.

Many product launch and agreement are also initiated by the companies’ worldwide which are also accelerating the q-PCR reagents market.

For instance,

- In November 2021, Biotium announces the release of EvaRuby Dye for qPCR and HRM®. This spectrally unique red fluorescent intercalating dye can be incorporated into probe-based qPCR assays, expanding multiplexing options for probe-based qPCR. This have expanded company’s product portfolio

- In November 2021, Takara Holding Inc., announced the implementation of a manufacturing facility of the Center for Gene and Cell Processing (CGCP) which aims to develop a domestic supply chain for important reagents, including PCR testing reagents. This have increased company’s production and sales

Collaboration, product launch, business expansion, award and recognition, joint ventures and other strategies by the market player is enhancing the company market in the q-PCR reagents market which also provides the benefit for organization to improve their offering for q-PCR reagents.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA Q-PCR REAGENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DETECTION TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 INDUSTRIAL INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

6 NORTH AMERICA Q-PCR REAGENTS MARKET: REGULATIONS

6.1 REGULATION IN U.S

6.2 REGULATION IN EUROPE

6.3 REGULATION IN SINGAPORE

6.4 REGULATION IN AUSTRALIA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN CHRONIC DISEASES AND COMMUNICABLE DISEASES

7.1.2 INCREASE IN GERIATRIC POPULATION

7.1.3 INCREASE IN EARLY DIAGNOSIS RATE

7.1.4 INCREASE IN ADVANCED TECHNOLOGY

7.2 RESTRAINTS

7.2.1 STRINGENT RULES & REGULATIONS

7.2.2 HIGH COST OF PRODUCT

7.2.3 NON-AVAILABILITY OF RELEVANT AND APPROPRIATE KITS

7.2.4 ADVANCEMENT IN FIELD OF GENOMICS

7.3 OPPORTUNITIES

7.3.1 RISE IN GOVERNMENT FUNDING FOR HEALTHCARE

7.3.2 RISE IN HEALTHCARE EXPENDITURE

7.4 CHALLENGES

7.4.1 LACK OF SKILLED WORKFORCE

7.4.2 OPERATIONAL BARRIERS FACED IN CONDUCTING DIAGNOSTIC TESTS

8 IMPACT OF COVID-19 ON THE NORTH AMERICA Q-PCR REAGENTS MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC DECISIONS BY MANUFACTURERS

8.5 CONCLUSION

9 NORTH AMERICA Q-PCR REAGENTS MARKET, BY DETECTION TYPE

9.1 OVERVIEW

9.2 DYE-BASED REAGENTS

9.2.1 MASTER MIX

9.2.2 PRIMERS

9.2.3 DNA TEMPLATE

9.3 PROBE-BASED REAGENTS

9.3.1 MASTER MIX

9.3.2 PRIMERS

9.3.3 DNA TEMPLATE

10 NORTH AMERICA Q-PCR REAGENTS MARKET, BY ASSAY TYPE

10.1 OVERVIEW

10.2 QPCR SINGLEPLEX TEST/ASSAY

10.3 QPCR MULTIPLEX TEST/ASSAY

11 NORTH AMERICA Q-PCR REAGENTS MARKET, BY PLEXITY

11.1 OVERVIEW

11.2 DYE-BASED REAGENTS

11.2.1 SINGLEPLEX

11.2.2 MULTIPLEX

11.3 PROBE-BASED REAGENTS

11.3.1 SINGLEPLEX

11.3.2 MULTIPLEX

12 NORTH AMERICA Q-PCR REAGENTS MARKET, BY PACKAGING TYPE

12.1 OVERVIEW

12.2 KITS

12.3 MASTER MIXERS

13 NORTH AMERICA Q-PCR REAGENTS MARKET, BY TECHNOLOGY

13.1 OVERVIEW

13.2 GENE EXPRESSION

13.3 GENE TYPING

13.4 MIRNA ANALYSIS

13.5 PRE-AMPLIFICATION

13.6 VIRUS DETECTION

14 NORTH AMERICA Q-PCR REAGENTS MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 RESEARCH

14.3 DIAGNOSTICS

14.4 FORENSIC

15 NORTH AMERICA Q-PCR REAGENTS MARKET, BY END USER

15.1 OVERVIEW

15.2 RESEARCH & ACADEMIC INSTITUTE

15.3 HOSPITAL AND DIAGNOSTIC CENTERS

15.4 CLINICAL RESEARCH ORGANIZATION

15.5 FORENSIC LABORATORIES

15.6 OTHERS

16 NORTH AMERICA Q-PCR REAGENTS MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 THIRD PARTY DISTRIBUTORS

16.4 OTHERS

17 NORTH AMERICA Q-PCR REAGENTS MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA Q-PCR REAGENTS MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 NORTH AMERICA Q-PCR REAGENTS MARKET: SWOT ANALYSIS

20 COMPANY PROFILE

20.1 F. HOFFMANN-LA ROCHE LTD

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 MERCK KGAA

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.2.4.1 PARTNERSHIP

20.2.4.2 NEW LABORATORY FACILITY

20.2.4.3 NEW DISTRIBUTION CENTER

20.3 THERMO FISHER SCIENTIFIC INC

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENTS

20.3.4.1 ACQUISITION

20.3.4.2 PRODUCT LAUNCH

20.4 AGILENT TECHNOLOGIES, INC

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.4.4.1 DISTRIBUTION AGREEMENT

20.4.4.2 PRODUCT LAUNCH

20.5 SEEGENE INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 RECENT DEVELOPMENT

20.6 BIONEER CORPORATION

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 BIO-RAD LABORATORIES, INC.

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENTS

20.7.4.1 PARTNERSHIP

20.7.4.2 AWARD

20.8 BIOTIUM

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENTS

20.9 EMPIRICAL BIOSCIENCE, INC.

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENTS

20.9.3.1 EUA AUTHORISATION

20.9.3.2 ISO CERTIFICATION

20.9.3.3 PRODUCT LAUNCH

20.1 ENZO BIOCHEM INC

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 GENEDIREX, INC

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 KANEKA EUROGENTEC S.A

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENT

20.13 MIRXES PTE LTD

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 NORGEN BIOTEK CORP

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 NEW ENGLAND BIOLABS

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENTS

20.15.3.1 AQUISITION

20.15.3.2 PRODUCT LAUNCH

20.15.3.3 SUBSIDIARY

20.16 PCR BIOSYSTEMS

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENT

20.17 PROMEGA CORPORATION

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 QIAGEN

20.18.1 COMPANY SNAPSHOT

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT DEVELOPMENTS

20.18.4.1 NEW FACILITY

20.18.4.2 ACQUISITION

20.19 QUANTABIO

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.19.3.1 CONFERENCE

20.19.3.2 PRODUCT LAUNCH

20.2 SINO BIOLOGICAL INC.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 SOLIS BIODYNE

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENT

20.22 TAKARA HOLDINGS INC

20.22.1 COMPANY SNAPSHOT

20.22.2 REVENUE ANALYSIS

20.22.3 PRODUCT PORTFOLIO

20.22.4 RECENT DEVELOPMENTS

20.22.4.1 MANUFACTURING UNIT

20.22.4.2 ISO CERTIFICATION

20.23 TONBO BIOSCIENCES

20.23.1 COMPANY SNAPSHOT

20.23.2 PRODUCT PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 TRANSGENE BIOTEK LIMITED

20.24.1 COMPANY SNAPSHOT

20.24.2 REVENUE ANALYSIS

20.24.3 PRODUCT PORTFOLIO

20.24.4 RECENT DEVELOPMENT

20.25 YOUSEQ LTD

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 HEALTHCARE EXPENDITURE IN ASIA-PACIFIC

TABLE 2 NORTH AMERICA Q-PCR REAGENTS MARKET, BY DETECTION TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY DETECTION TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY DETECTION TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA Q-PCR REAGENTS MARKET, BY ASSAY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA QPCR SINGLEPLEX TEST/ASSAY IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA QPCR MULTIPLEX TEST/ASSAY IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA Q-PCR REAGENTS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA KITS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA MASTER MIXERS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA Q-PCR REAGENTS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA GENE EXPRESSION IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA GENE TYPING IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA MIRNA ANALYSIS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PRE-AMPLIFICATION IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA VIRUS DETECTION IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA Q-PCR REAGENTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA GENE EXPRESSION IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIAGNOSTICS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA FORENSIC IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA Q-PCR REAGENTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA RESEARCH & ACADEMIC INSTITUTE IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITAL AND DIAGNOSTIC CENTERS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA CLINICAL RESEARCH ORGANIZATION IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA FORENSIC LABORATORIES IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA Q-PCR REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA DIRECT TENDER IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN Q-PCR REAGENTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA Q-PCR REAGENTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA Q-PCR REAGENTS MARKET, BY DETECTION TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA Q-PCR REAGENTS MARKET, BY ASSAY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA Q-PCR REAGENTS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA Q-PCR REAGENTS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA Q-PCR REAGENTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA Q-PCR REAGENTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA Q-PCR REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 51 U.S. Q-PCR REAGENTS MARKET, BY DETECTION TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 U.S. PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 54 U.S. Q-PCR REAGENTS MARKET, BY ASSAY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 56 U.S. DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 57 U.S. PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 58 U.S. Q-PCR REAGENTS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. Q-PCR REAGENTS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 U.S. Q-PCR REAGENTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 U.S.Q-PCR REAGENTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 U.S. Q-PCR REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 CANADA Q-PCR REAGENTS MARKET, BY DETECTION TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 CANADA PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 CANADA Q-PCR REAGENTS MARKET, BY ASSAY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 68 CANADA DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 69 CANADA PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 70 CANADA Q-PCR REAGENTS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA Q-PCR REAGENTS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 CANADA Q-PCR REAGENTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 CANADA Q-PCR REAGENTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 CANADA Q-PCR REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 MEXICO Q-PCR REAGENTS MARKET, BY DETECTION TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 MEXICO PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 MEXICO Q-PCR REAGENTS MARKET, BY ASSAY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MEXICO Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 80 MEXICO DYE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 81 MEXICO PROBE-BASED REAGENTS IN Q-PCR REAGENTS MARKET, BY PLEXITY, 2020-2029 (USD MILLION)

TABLE 82 MEXICO Q-PCR REAGENTS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO Q-PCR REAGENTS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 MEXICO Q-PCR REAGENTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO Q-PCR REAGENTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 MEXICO Q-PCR REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA Q-PCR REAGENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA Q-PCR REAGENTS MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA Q-PCR REAGENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA Q-PCR REAGENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA Q-PCR REAGENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA Q-PCR REAGENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA Q-PCR REAGENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA Q-PCR REAGENTS MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA Q-PCR REAGENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA Q-PCR REAGENTS MARKET: SEGMENTATION

FIGURE 11 INCREASE IN DEMAND FOR Q-PCR REAGENTS IS EXPECTED TO DRIVE THE NORTH AMERICA Q-PCR REAGENTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 MODERATE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA Q-PCR REAGENTS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF Q-PCRREAGENTS MARKET

FIGURE 14 PREVALENCE OF HUMAN IMMUNODEFICIENCY VIRUS (HIV) IN WORLD HEALTH ORGANISATION (WHO) REGIONS IN 2020

FIGURE 15 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DETECTION TYPE, 2021

FIGURE 16 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DETECTION TYPE, 2020-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DETECTION TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DETECTION TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA Q-PCR REAGENTS MARKET: BY ASSAY TYPE, 2021

FIGURE 20 NORTH AMERICA Q-PCR REAGENTS MARKET: BY ASSAY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA Q-PCR REAGENTS MARKET: BY ASSAY TYPE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA Q-PCR REAGENTS MARKET: BY ASSAY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA Q-PCR REAGENTS MARKET: BY PLEXITY, 2021

FIGURE 24 NORTH AMERICA Q-PCR REAGENTS MARKET: BY PLEXITY, 2020-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA Q-PCR REAGENTS MARKET: BY PLEXITY, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA Q-PCR REAGENTS MARKET: BY PLEXITY, LIFELINE CURVE

FIGURE 27 NORTH AMERICA Q-PCR REAGENTS MARKET: BY PACKAGING TYPE, 2021

FIGURE 28 NORTH AMERICA Q-PCR REAGENTS MARKET: BY PACKAGING TYPE, 2020-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA Q-PCR REAGENTS MARKET: BY PACKAGING TYPE, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA Q-PCR REAGENTS MARKET: BY PACKAGING TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA Q-PCR REAGENTS MARKET: BY TECHNOLOGY, 2021

FIGURE 32 NORTH AMERICA Q-PCR REAGENTS MARKET: BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA Q-PCR REAGENTS MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA Q-PCR REAGENTS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 35 NORTH AMERICA Q-PCR REAGENTS MARKET: BY APPLICATION, 2021

FIGURE 36 NORTH AMERICA Q-PCR REAGENTS MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA Q-PCR REAGENTS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA Q-PCR REAGENTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 39 NORTH AMERICA Q-PCR REAGENTS MARKET: BY END USER, 2021

FIGURE 40 NORTH AMERICA Q-PCR REAGENTS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 41 NORTH AMERICA Q-PCR REAGENTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 42 NORTH AMERICA Q-PCR REAGENTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 43 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 44 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 45 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 46 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 47 NORTH AMERICA Q-PCR REAGENTS MARKET: SNAPSHOT (2021)

FIGURE 48 NORTH AMERICA Q-PCR REAGENTS MARKET: BY COUNTRY (2021)

FIGURE 49 NORTH AMERICA Q-PCR REAGENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 50 NORTH AMERICA Q-PCR REAGENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 51 NORTH AMERICA Q-PCR REAGENTS MARKET: BY DETECTION TYPE (2022-2029)

FIGURE 52 NORTH AMERICA Q-PCR REAGENTS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.