North America Rett Syndrome Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

4.04 Billion

2024

2032

USD

2.00 Billion

USD

4.04 Billion

2024

2032

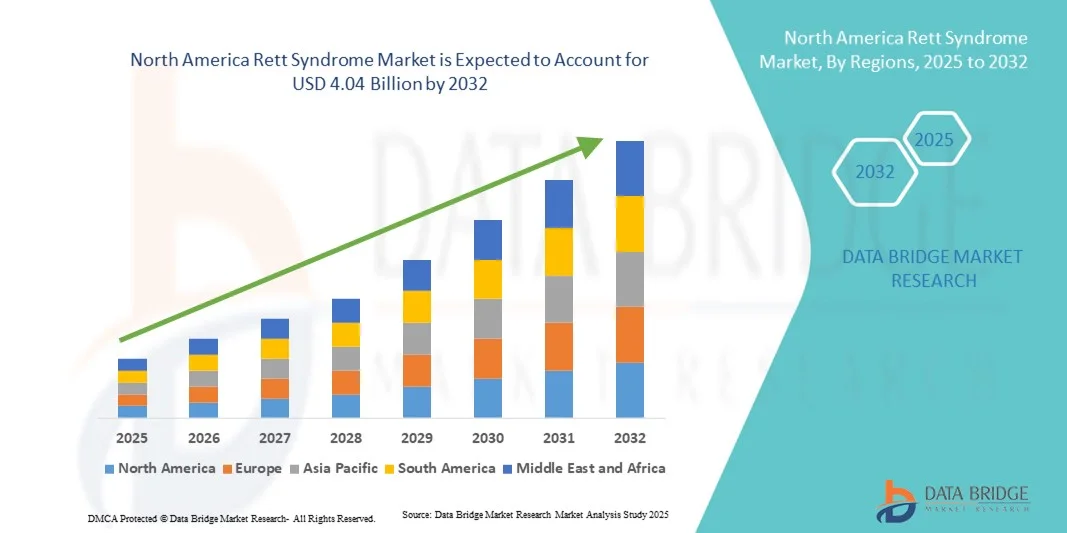

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 4.04 Billion | |

|

|

|

|

North America Rett Syndrome Market Size

- The North America Rett Syndrome market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 4.04 billion by 2032, at a CAGR of 9.2% during the forecast period

- The market growth is primarily driven by the increasing prevalence of Rett syndrome across the U.S. and Canada, coupled with rising awareness and improved diagnostic capabilities for rare neurological disorders

- Furthermore, ongoing advancements in genetic research, coupled with expanding clinical trials for targeted therapies and gene-based treatments, are accelerating innovation in the region. These factors are fostering stronger investment in Rett syndrome therapeutics and patient care infrastructure, thereby propelling the market’s overall expansion

North America Rett Syndrome Market Analysis

- Rett syndrome, a rare neurodevelopmental disorder caused by mutations in the MECP2 gene, is gaining increased medical and research attention across North America, driven by advancements in genetic diagnostics, early intervention programs, and expanding patient registries supporting targeted therapeutic development

- The market growth is primarily driven by the rising incidence of Rett syndrome diagnoses, the growing emphasis on personalized medicine, and ongoing collaborations among biotechnology companies, academic institutions, and healthcare organizations for innovative treatment development

- The United States dominated the North America Rett syndrome market with the largest revenue share of 68.9% in 2024, supported by robust R&D infrastructure, favorable reimbursement policies, and the presence of key biopharmaceutical players focusing on gene and neuro-regenerative therapies

- Canada is projected to record the fastest growth during the forecast period, propelled by improved healthcare access, increased awareness among clinicians, and active participation in multinational Rett syndrome research consortia

- The Classic Rett Syndrome segment dominated the market with the largest market share of 61.7% in 2024, attributed to its higher prevalence rate compared to atypical variants and the growing number of targeted clinical trials focused on this type

Report Scope and North America Rett Syndrome Market Segmentation

|

Attributes |

North America Rett Syndrome Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Rett Syndrome Market Trends

Advancement in Gene Therapy and Personalized Treatment Approaches

- A significant and accelerating trend in the North America Rett syndrome market is the growing focus on gene therapy and precision medicine approaches aimed at targeting the root cause of MECP2 gene mutations. This paradigm shift is enhancing the potential for long-term disease modification rather than symptomatic management

- For instance, in March 2024, Taysha Gene Therapies announced encouraging data from its ongoing TSHA-102 gene therapy trials in Rett syndrome patients, marking a critical step toward developing one-time transformative treatments. Similarly, Neurogene Inc. is advancing its NGN-401 program, designed to restore MECP2 function using an AAV9 vector system

- The integration of advanced genomic tools enables researchers to better understand patient-specific genetic variations, supporting the development of more tailored therapeutic interventions. For instance, gene editing and mRNA-based technologies are being investigated to fine-tune MECP2 expression, minimizing potential side effects. Furthermore, patient-derived stem cell models are increasingly being utilized to predict treatment response and accelerate drug discovery

- The collaboration between academic institutions, biotechnology firms, and non-profit organizations is strengthening the translational research pipeline, fostering the transition from laboratory discoveries to clinical application. Through these alliances, North America continues to lead in rare disease innovation and regulatory approvals for gene-targeted therapies

- This growing shift toward personalized and gene-targeted therapy is redefining the treatment landscape for Rett syndrome. Consequently, companies such as Taysha Gene Therapies and Neurogene are spearheading advancements in one-time gene replacement and expression regulation technologies to achieve durable therapeutic outcomes

- The demand for disease-modifying therapies and individualized treatment plans is rising rapidly across the U.S. and Canada, as patients and caregivers increasingly seek solutions that offer improved neurological outcomes and quality of life

North America Rett Syndrome Market Dynamics

Driver

Rising Research Funding and Advancements in Genetic Diagnosis

- The increasing investment in rare disease research, coupled with technological advances in genetic diagnostics, is a major driver of the North America Rett syndrome market’s expansion

- For instance, in February 2024, the U.S. National Institutes of Health (NIH) expanded its funding under the Rare Diseases Clinical Research Network to include multiple Rett-focused studies aimed at improving early diagnosis and treatment development

- As awareness of Rett syndrome continues to grow, genetic testing adoption is accelerating, allowing earlier and more accurate diagnosis, which facilitates timely therapeutic intervention and enrollment in clinical trials

- Furthermore, the introduction of next-generation sequencing (NGS) and newborn screening programs across leading U.S. states is improving detection rates, while initiatives promoting rare disease registries are enriching clinical data and aiding in therapy optimization. The increased collaboration between research institutions, healthcare providers, and pharmaceutical companies is enhancing innovation and expediting the regulatory approval process for Rett syndrome therapies across North America

- The growing number of clinical trials exploring disease-modifying therapies, including gene reactivation and neuroprotective agents, is creating strong momentum for novel treatment options

- Expanding partnerships between biotech firms and academic centers are facilitating the translation of preclinical findings into human studies, accelerating time-to-market for next-generation Rett syndrome drugs

Restraint/Challenge

High Treatment Costs and Limited Commercial Availability

- The high cost associated with advanced gene therapy and specialized neurological care poses a major challenge to broader access in the North America Rett syndrome market

- For instance, emerging gene therapies such as TSHA-102 are expected to carry multimillion-dollar price tags upon approval, raising affordability and reimbursement concerns for both patients and healthcare systems

- Limited commercial availability of Rett-specific drugs and the small patient population make it difficult for pharmaceutical companies to sustain large-scale production and distribution models

- Furthermore, the lengthy and complex regulatory pathways for rare genetic therapies often delay commercialization timelines and increase overall development costs for manufacturers

- To overcome these challenges, expanding insurance coverage, implementing rare disease funding initiatives, and fostering public-private partnerships will be essential for improving treatment accessibility and long-term market sustainability

- The shortage of specialized neurologists and limited awareness among primary care providers contribute to delayed diagnosis and underreporting of Rett syndrome cases across North America

- Ethical concerns surrounding gene editing and long-term safety monitoring requirements for gene-based therapies may slow clinical adoption and regulatory acceptance despite strong research progress

North America Rett Syndrome Market Scope

The market is segmented on the basis of type, stage, treatment type, drug type, route of administration, end user, and distribution channel.

- By Type

On the basis of type, the North America Rett syndrome market is segmented into Classic Rett Syndrome and Atypical Rett Syndrome. The Classic Rett Syndrome segment dominated the market with the largest revenue share of 61.7% in 2024, primarily due to its higher prevalence and distinct diagnostic criteria. This form of Rett syndrome is the most widely recognized, accounting for the majority of diagnosed cases across North America. Increasing awareness among clinicians, patient advocacy initiatives, and ongoing gene therapy trials targeting MECP2 mutations have significantly supported segment growth. Pharmaceutical companies are prioritizing therapies aimed at mitigating motor regression, seizures, and cognitive decline prevalent in classic Rett cases. Moreover, higher diagnosis rates and inclusion in most clinical studies further strengthen its dominance in the overall market landscape.

The Atypical Rett Syndrome segment is projected to witness the fastest growth during the forecast period, driven by advancements in next-generation sequencing (NGS) and molecular diagnostics that improve identification of variant forms. Enhanced understanding of subtypes such as the preserved speech variant and early seizure variant is enabling more accurate differentiation from other neurological disorders. Growing clinical attention and the development of targeted, personalized therapies are expanding the treatment pipeline for atypical presentations. Furthermore, research efforts supported by rare disease organizations are increasing awareness, early detection, and access to specialized care for atypical cases.

- By Stages

On the basis of stages, the market is segmented into Stage I (Early Onset), Stage II (Rapid Destruction), Stage III (Plateau), and Stage IV (Late Motor Deterioration). The Stage II (Rapid Destruction) segment dominated the market in 2024, as most diagnoses occur during this critical progression phase characterized by the loss of acquired hand function, communication skills, and mobility. This stage attracts the majority of medical interventions, including pharmacologic treatment and behavioral therapy, aimed at slowing neurological regression. The segment’s strength also stems from the concentration of clinical trials seeking to arrest or reverse rapid deterioration using novel therapeutic agents. Growing awareness among pediatric neurologists and parents about early symptom recognition further enhances diagnosis and treatment rates at this stage. Hospitals and specialty centers are emphasizing early therapeutic interventions to mitigate long-term complications, further supporting segment growth.

The Stage III (Plateau) segment is expected to record the fastest growth from 2025 to 2032, owing to advancements in supportive care and therapeutic management extending patients’ survival and improving functional outcomes. This phase is often associated with stabilization of symptoms, making patients more responsive to rehabilitation and assistive therapies. Growing availability of adaptive communication tools and physical therapy programs contributes to sustained market demand. In addition, research into maintaining neural function and preventing late-stage deterioration is increasing in this stage. Enhanced caregiver training programs and multi-disciplinary support initiatives are also driving growth within this segment.

- By Treatment Type

On the basis of treatment type, the market is categorized into drug class, therapy type, and others. The Drug Class segment dominated the market in 2024 with a significant revenue share, supported by the growing adoption of medications that manage symptoms such as seizures, anxiety, and sleep disturbances. The approval of targeted drugs such as DAYBUE™ (trofinetide) in the U.S. has accelerated the market’s momentum by offering the first disease-specific treatment for Rett syndrome. Increased R&D investments by biotechnology firms focusing on MECP2-modulating drugs and neuroprotective agents also bolster the segment’s dominance. Furthermore, orphan drug incentives and funding from rare disease programs continue to attract innovation in this area. The expansion of clinical trials exploring combination drug approaches further supports long-term growth potential for this segment.

The Therapy Type segment is anticipated to witness the fastest growth rate during the forecast period due to rising awareness of the importance of non-pharmacological interventions. Physical, occupational, and speech therapies are increasingly recognized for their role in improving mobility, communication, and social interaction. Rehabilitation centers and specialized clinics are expanding their service offerings to include multidisciplinary therapy programs tailored to Rett patients. Moreover, integration of AI-based digital rehabilitation tools and teletherapy platforms is transforming therapy accessibility across North America. Growing parental education programs emphasizing early intervention are further accelerating segment demand.

- By Drug Type

On the basis of drug type, the market is segmented into branded and generics. The Branded segment dominated the North America Rett syndrome market in 2024, driven by strong sales of recently approved treatments and ongoing gene therapy innovations. Branded drugs benefit from clinical validation, superior efficacy, and robust marketing support from major biopharmaceutical companies. The exclusivity rights and premium pricing associated with orphan drugs further enhance segment profitability. Growing patient preference for approved, clinically tested medications contributes to the continued dominance of branded products in hospital and specialty clinic settings. Moreover, collaborations between pharmaceutical companies and research institutions are reinforcing the branded segment’s market presence.

The Generics segment is forecasted to grow at the fastest pace during the period from 2025 to 2032, fueled by the expiration of key drug patents and initiatives promoting affordable access to rare disease medications. The increasing role of generics in managing symptoms such as seizures and motor dysfunction is broadening treatment accessibility for patients in lower-income demographics. Government-backed reimbursement frameworks supporting cost-effective drug options are further boosting segment growth. Moreover, as more Rett-focused drugs reach the end of exclusivity, generic manufacturing and distribution are expected to expand across North America.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, parenteral, and others. The Oral segment dominated the market with the largest revenue share in 2024 due to its convenience, ease of administration, and suitability for long-term therapeutic management. Oral medications, including trofinetide and supportive drugs for anxiety and epilepsy, are widely prescribed for home-based treatment. The segment benefits from patient compliance and reduced healthcare costs compared to parenteral routes. Increased R&D investment in developing orally bioavailable neuroprotective compounds is further strengthening its dominance. In addition, advancements in oral drug delivery systems aimed at enhancing blood-brain barrier penetration are improving treatment efficacy.

The Parenteral segment is projected to exhibit the fastest growth from 2025 to 2032, supported by the rise of injectable gene and cell-based therapies requiring specialized administration. Intravenous and subcutaneous delivery methods are increasingly used in clinical trials involving biologics and viral vector treatments. Hospitals and specialty clinics are equipping themselves with advanced infrastructure to support such therapies. Moreover, the growing emphasis on rapid systemic drug delivery and precision dosing contributes to this segment’s expansion. Partnerships between hospitals and biopharma firms for administering novel parenteral therapeutics are further propelling growth.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, research organization, and others. The Hospitals segment held the dominant market share in 2024, as they serve as primary centers for diagnosis, genetic testing, and treatment of Rett syndrome. The presence of advanced neurogenetic testing facilities and multidisciplinary care units ensures comprehensive patient management. Hospitals are also central to administering parenteral therapies, gene treatments, and ongoing clinical trials. Strong insurance integration and government funding for rare disease management further enhance the segment’s strength. In addition, the adoption of telemedicine services in hospital networks is improving accessibility for rural patients.

The Research Organisations segment is expected to witness the fastest growth during the forecast period, fueled by the rising number of academic and private collaborations in the field of gene therapy and neurodevelopmental research. Increased public and private funding for rare disease studies across the U.S. and Canada is encouraging the establishment of new research programs. Advanced lab infrastructure and access to patient registries enable organizations to accelerate translational studies. Moreover, partnerships between universities, biotech firms, and patient foundations are facilitating knowledge exchange and technology transfer.

- By Distribution Channel

On the basis of distribution channel, the market is categorized into hospital pharmacy, online pharmacy, retail pharmacy, and others. The Hospital Pharmacy segment dominated the North America Rett syndrome market in 2024, accounting for the largest revenue share due to centralized control over distribution of specialty and gene-based therapies. Hospitals ensure safe handling and administration of sensitive drugs requiring cold-chain logistics and clinical supervision. The presence of dedicated rare disease pharmacy units further reinforces this dominance. In addition, increased integration of e-prescription systems is improving efficiency in drug dispensation and record management. Rising demand for hospital-based follow-up and medication adherence programs also supports segment growth.

The Online Pharmacy segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by the increasing adoption of e-commerce platforms for chronic disease management. Online pharmacies offer convenience for patients requiring recurring medication refills and doorstep delivery. The growth of telehealth services and digital consultations in North America complements this trend, enhancing accessibility for caregivers. Furthermore, favorable regulations for licensed e-pharmacies and discounts on long-term prescriptions are attracting more consumers. The segment is also benefiting from partnerships with healthcare providers ensuring authenticity and reliability of online dispensed drugs.

North America Rett Syndrome Market Regional Analysis

- The United States dominated the North America Rett syndrome market with the largest revenue share of 68.9% in 2024, supported by robust R&D infrastructure, favorable reimbursement policies, and the presence of key biopharmaceutical players focusing on gene and neuro-regenerative therapies

- The country’s high diagnostic awareness and presence of specialized neurology and pediatric centers enable timely detection and effective management of Rett syndrome cases

- Leading U.S.-based pharmaceutical and biotech companies are actively engaged in developing novel therapies targeting MECP2 mutations, supported by substantial funding from organizations such as the National Institutes of Health (NIH)

U.S. Rett Syndrome Market Insight

The U.S. Rett syndrome market captured the largest revenue share of 68.9% in 2024 within North America, driven by advanced clinical research and the strong presence of leading biotechnology and pharmaceutical companies specializing in rare neurological conditions. The country benefits from extensive NIH funding, robust collaboration between research institutes and advocacy groups, and favorable FDA policies that promote orphan drug development and fast-track approvals. For instance, multiple U.S.-based firms are advancing MECP2-targeted gene therapies through clinical trials, reflecting the nation’s leadership in innovation. High healthcare expenditure and a well-established network of specialty clinics further enhance treatment accessibility. Collectively, these factors reinforce the U.S. as the dominant force in the North American Rett syndrome market.

Canada Rett Syndrome Market Insight

The Canada Rett syndrome market is projected to grow at a substantial CAGR during the forecast period, supported by rising awareness, expanding research collaborations, and the government’s growing focus on rare disease management. The country’s universal healthcare system and advanced genetic testing infrastructure enable earlier detection and better patient outcomes. For instance, Canadian research institutions are partnering with international biotech companies to explore gene therapy and RNA-based treatments. Support from organizations such as the Canadian Rett Syndrome Association (CRSA) plays a pivotal role in funding research and enhancing public education. Increased federal initiatives to expand rare disease registries and funding for specialized care are further accelerating market growth across the nation.

Mexico Rett Syndrome Market Insight

The Mexico Rett syndrome market is anticipated to experience steady growth over the forecast period, driven by increasing diagnostic awareness and gradual improvements in the country’s healthcare infrastructure. While diagnosis and treatment rates remain relatively lower than in the U.S. and Canada, ongoing government efforts to integrate genetic screening programs are improving early identification. For instance, collaborations with global non-profits and pharmaceutical firms are expanding access to neurodevelopmental disorder research and clinical care. In addition, growing private healthcare investments and the expansion of pediatric neurology services are enhancing patient management capabilities. As awareness and medical resources continue to rise, Mexico is emerging as a key developing market within North America for Rett syndrome diagnosis and therapeutic advancements.

North America Rett Syndrome Market Share

The North America Rett Syndrome industry is primarily led by well-established companies, including:

- Acadia Pharmaceuticals Inc. (U.S.)

- Neuren Pharmaceuticals (Australia)

- Taysha GTx (U.S.)

- Neurogene Inc. (U.S.)

- ProQR Therapeutics (Netherlands)

- Beam Therapeutics (U.S.)

- Alcyone Therapeutics (U.S.)

- ShapeTX (U.S.)

- Vico Therapeutics (Netherlands)

- Unravel Biosciences, Inc. (U.S.)

- Anavex Life Sciences Corp. (U.S.)

- Palena Therapeutics, Inc. (U.S.)

- Prilenia Therapeutics B.V. (Netherlands)

- Axonis Therapeutics (U.S.)

- Wave Life Sciences (U.S.)

What are the Recent Developments in North America Rett Syndrome Market?

- In October 2025, the FDA granted Breakthrough Therapy designation to TSHA-102, a cutting-edge gene-transfer therapy developed by Taysha Gene Therapies, following positive Part A results from its REVEAL Phase 1/2 trial. The therapy demonstrated significant improvements in motor and communication functions among adult Rett syndrome patients treated with a single dose

- In November 2024, Neurogene Inc. reported the death of a patient enrolled in its Phase 1/2 gene therapy trial (NGN-401) for Rett syndrome following a serious adverse event. The trial, designed to test the safety and efficacy of the one-time gene therapy in pediatric patients, was being closely monitored by the FDA and independent safety boards

- In July 2024, researchers from the Wyss Institute for Biologically Inspired Engineering at Harvard University identified vorinostat as a promising therapeutic candidate for Rett syndrome through an AI-driven drug discovery platform. The study successfully demonstrated that vorinostat could restore neurological function in preclinical models by targeting disrupted cellular pathways associated with MECP2 mutations

- In January 2024, Vanderbilt University Medical Center (VUMC) secured a US $13 million grant from the U.S. Department of Defense to lead a multi-site clinical trial investigating potential treatments for Rett syndrome using repurposed FDA-approved drugs such as ketamine, vorinostat, and donepezil. The goal is to evaluate their effectiveness in improving neurological function and behavioral outcomes in affected patients

- In March 2023, the U.S. Food and Drug Administration (FDA) approved trofinetide (DAYBUE) as the first-ever approved treatment for Rett syndrome in both adults and children aged 2 years and older. Developed by Acadia Pharmaceuticals, this approval marked a historic milestone for the Rett community, offering a clinically proven therapy to help improve daily function and reduce Rett-related symptoms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.