North America Rubber Peptizers Market Analysis and Insights

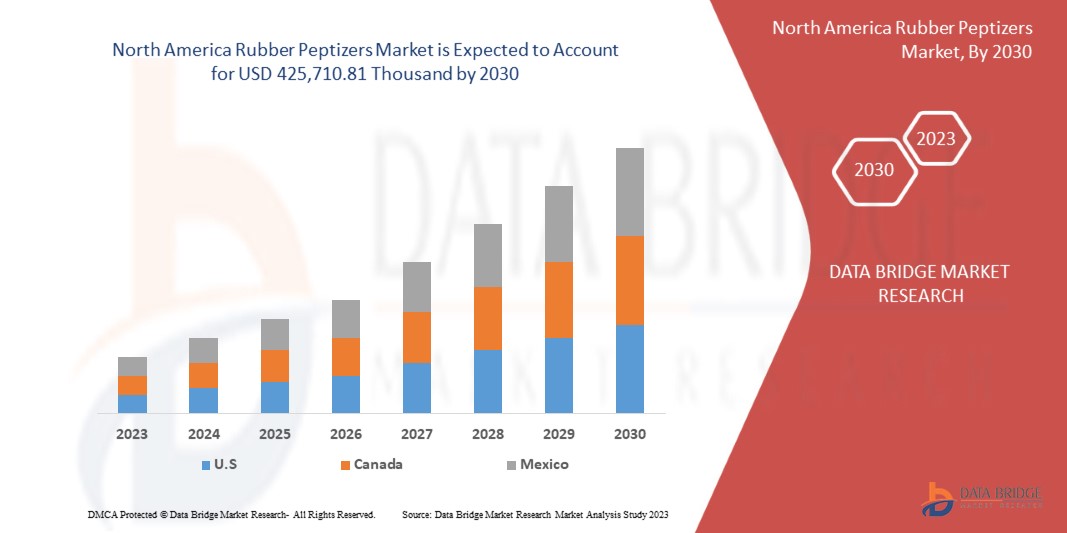

The North America rubber peptizers market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.8% in the forecast period of 2023 to 2030 and is expected to reach USD 425,710.81 thousand by 2030. The major factor driving the growth of the North America rubber peptizers market is the higher demand in the manufacturing of rubber products industry.

The North America rubber peptizers market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief, and our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Product (Dibenzamido Diphenyl Disulfide (DBD), Pentachlorothiophenol, Zinc Pentachlorothiophenate, Aryl Mercaptans, Mercaptobenzothiazole, and Others), Application (Natural Rubber, and Synthetic Rubber), End-Use (Tire, and Non-Tire) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Struktol Company of America, LLC, LANXESS, Thomas Swan & Co. Ltd., Shandong Stair Chemical & Technology Co., Ltd., Zhengzhou Double Vigour Chemical Product Co., ltd., Taizhou Huangyan Donghai Chemical Co., Ltd., Acmechem, Akrochem Corporation, HENAN CONNECT RUBBER CHEMICAL LIMITED, Kettlitz-Chemie GmbH & Co. KG, King Industries, Inc., and CHEMSPEC, LTD. |

Market Definition

Peptizers serve as either oxidation catalysts or radical acceptors, which essentially remove free radicals formed during the initial mixing of the elastomer. This prevents polymer recombination, allowing a consequent drop in polymer molecular weight and, thus, reducing compound viscosity. This polymer softening then enables the incorporation of the range of compounding materials included in the formulation. Examples of peptizers are pentachlorothiophenol, phenylhydrazine, certain diphenylsulfides, and xylyl mercaptan. Each peptizer has an optimum loading in a compound for the most efficiency. Peptizers are used in the mastication of natural rubber to optimize its processing. They reduce the molecular weight of the polymers by breaking down the molecule chains. Increased use of rubber peptizers in various applications, such as natural rubber and synthetic rubber, for the tire industry and other rubber industries, is expected to increase demand worldwide.

North America Rubber Peptizers Market Dynamics

Drivers

- INCREASING THE USE OF RUBBER PEPTIZERS IN THE MANUFACTURING OF RUBBER PRODUCTS

The growing use of natural rubber by automotive, chemical, medical, and other industries is expected to promote the scope of peptizes on a North America level. As compared to natural rubber, synthetic rubber offers more abrasion resistance. Due to this advantage, synthetic rubber is increasingly used in rubber gaskets and seals. Rubber peptizers are used in the mastication of natural rubber to optimize its processing. This rubber additive ensures quality in the manufacture of Rubber Goods where there is little or no rejection. It requires specialty chemicals to achieve a good dispersion of fillers and perfect plasticity. Natural rubber without treatment is extremely tough. In this case, peptizers are used in the mastication of natural rubber to optimize processing. The use of peptizers, which is a rubber additive, accelerates the mastication over a broad temperature range.

- ADOPTED BY THE VARIOUS INDUSTRIES BECAUSE OF SIGNIFICANT VISCOSITY

Peptizers serve as either oxidation catalysts or radical acceptors, which essentially remove free radicals formed during the initial mixing of the elastomer. This prevents polymer recombination, allowing a consequent drop in polymer molecular weight and, thus, the reduction in compound viscosity. Peptizers are used in the mastication of natural rubber to optimize its processing. They reduce the molecular weight of the polymers by breaking down the molecule chains. In contrast to the mechanical mastication of rubber, chemical peptizers shorten the mastication time and lower the energy consumption, with the result that productivity in compounding improves.

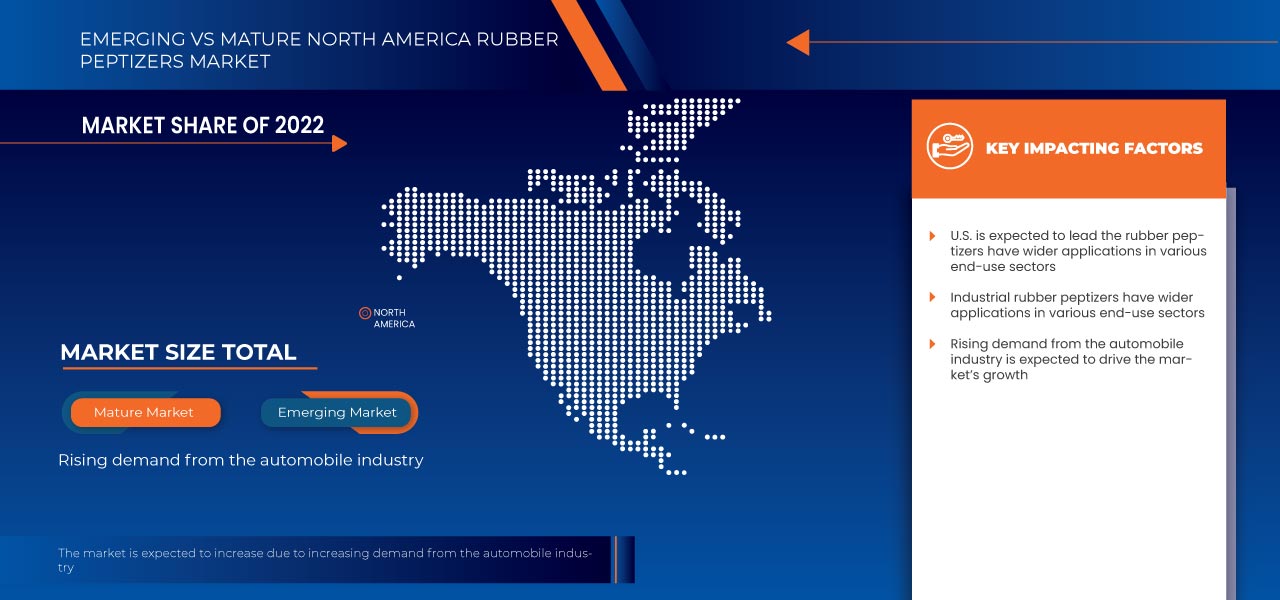

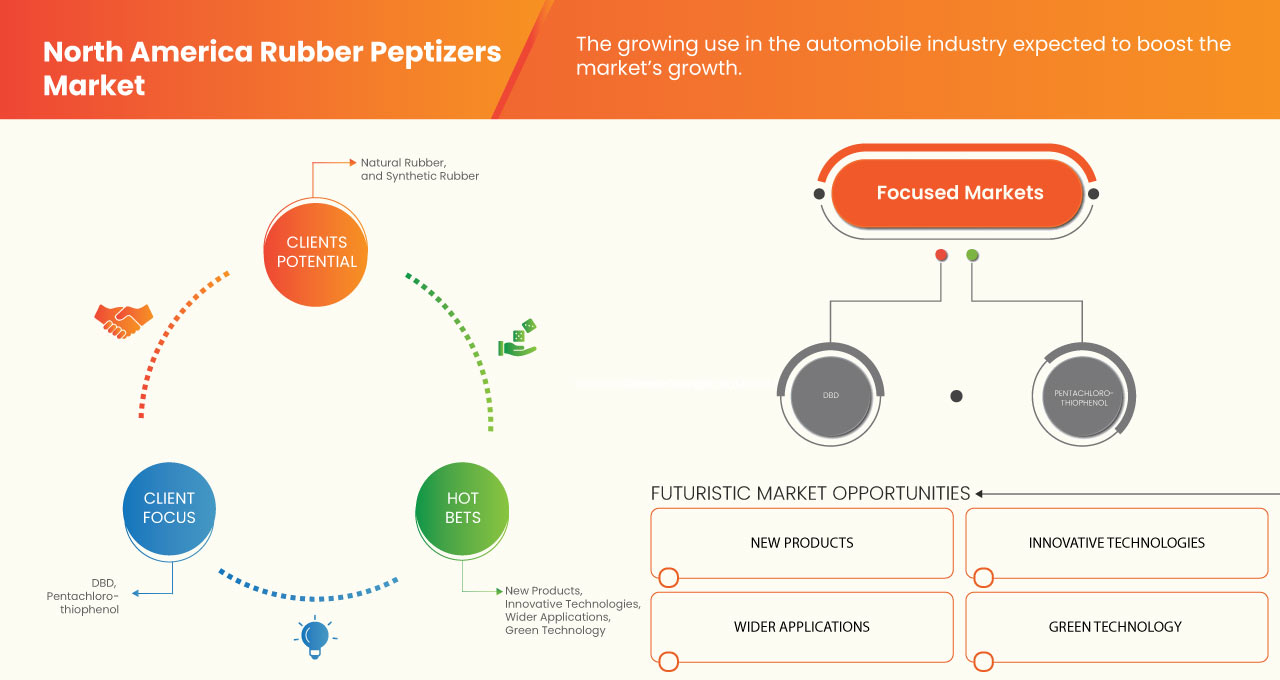

- INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY

The rapid growth of the automotive business has created a rise in demand for rubber additives within the production of tires as different rubber products improve resistance to sunlight, ozone, heat, and mechanical stress tires. Rubber additives are used for the improvement of rubber strength and performance of rubber. The demand for rubber additives for non-tire applications boosts market growth.

Opportunities

- ADOPTION OF GREEN TECHNOLOGY IN RUBBER MANUFACTURING

The adoption of green technology in rubber manufacturing has opened many ways for rubber peptizers, also as for the processing of natural rubber peptizers is one of the main compounds. The reduction of molecular weight and properties of natural rubber, such as viscosity, tensile strength, and compression strength, also decreased. Mastication is done for natural rubber only. Mastication can be done chemically (using peptizers). Chemical mastication of natural rubber results in chain session, lower molecular weight, border molecular weight distribution, and an increased number of free chain ends. Peptizers are chemicals that use for chemical mastication. There are two types of peptizers. Those are physical and chemical peptizers. Physical peptizers are lubricants that reduce internal viscosity and do not reduce molecular weight. Chemical peptizers are oxidation catalysts or radical acceptors.

- INCREASING USE OF RUBBER PEPTIZERS IN THE CONSTRUCTION SECTOR

The construction sector is one of the important markets for rubber chemical additives. A wide variety of rubber chemical additives is used in producing multiple components and ingredients for the construction sector, such as rubber tiles, gaskets, seals, and pipes, among others. The construction sector displays outstanding growth globally with increasing investments and construction activities. Compounding is the materials science of modifying a rubber or elastomer, or a blend of polymers and other materials to optimize properties to meet a given service application or set of performance parameters. Compounding is a complex multidisciplinary science necessitating knowledge of materials physics, organic and polymer chemistry, inorganic chemistry, and chemical reaction kinetics.

Restraints/Challenges

- EMISSION OF HAZARDOUS GASSES AND POLLUTANTS

Hazards caused by the industries on our environment come primarily in the form of air, water and noise pollution. There are a number of industries producing different synthetic and non-synthetic products, among which rubber industries play the role of giant backbone. The rubber manufacturing industry not only produces rubber goods as the prime product but indeed produces a massive amount of air, noise and water pollution as their by-products. A lot of volatile organic matter and other particulates are present in the air in the unit place and the facility. Also, different chemicals are used during manufacturing processes that are discharged as effluent into the environment. So the study was carried out to assess the air and noise quality of the workplace and Wastewater characteristics so that necessary measures can be taken to protect workers from occupational exposure.

- IMPOSITION OF STRINGENT GOVERNMENT REGULATIONS

Rubber chemical additives are associated with adverse impacts on human health, which has been a challenge in the market. This might hamper the market's growth during the forecast period. Various governing bodies such as Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) and the Environmental Protection Agency (EPA) strictly monitor the use of chemical additives in the preparation of rubber. The strict regulations on the use of rubber chemicals are likely to hamper the demand for rubber chemicals in the market. Since most of them are dumped into water bodies, the processing chemicals used for rubber are harmful to the atmosphere and marine life.

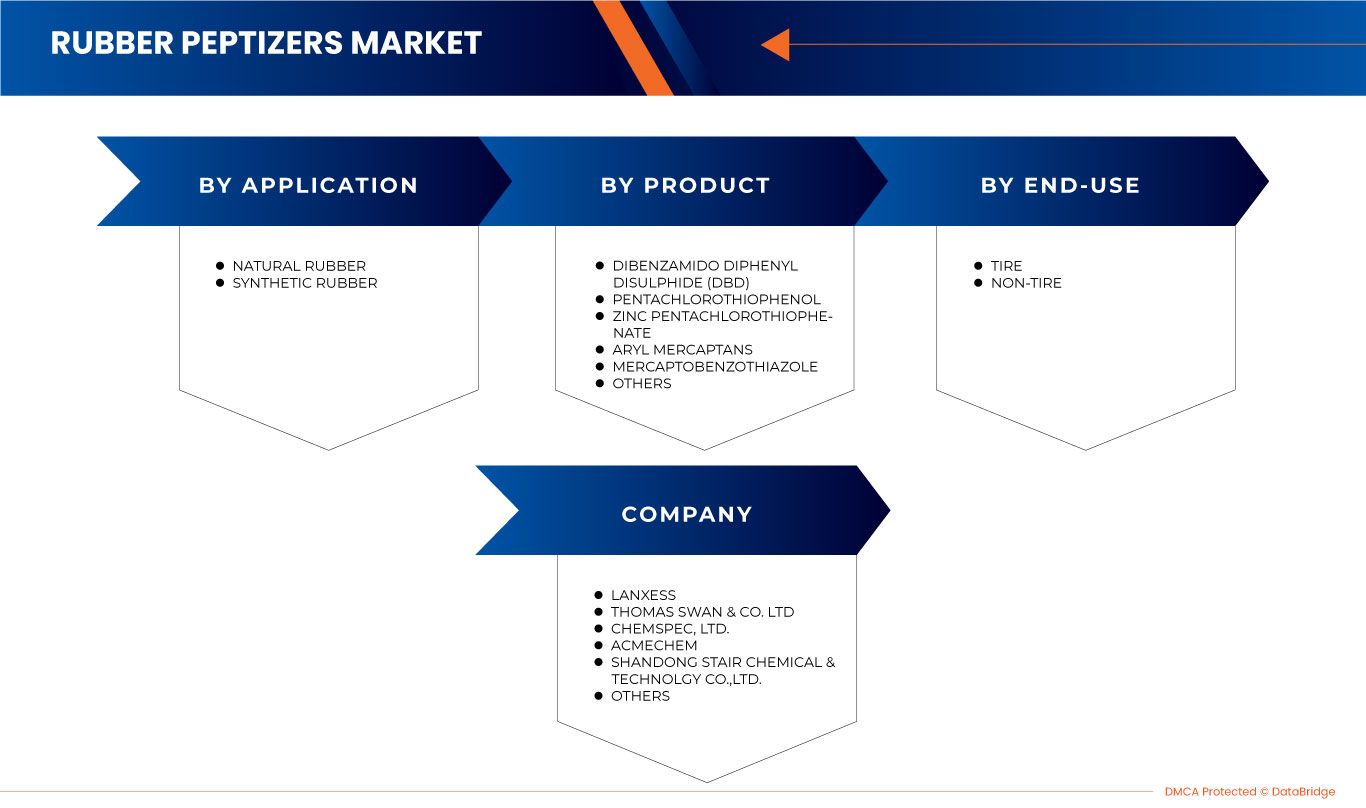

North America Rubber Peptizers Market Scope

The North America rubber peptizers market is categorized based on product, application and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Dibenzamido Diphenyl Disulphide (DBD)

- Pentachlorothiophenol

- Zinc Pentachlorothiophenate

- Aryl Mercaptans

- Mercaptobenzothiazole

- Others

Based on product, the North America rubber peptizers market is classified into dibenzamido diphenyl disulphide (DBD), pentachlorothiophenol, zinc pentachlorothiophenate, aryl mercaptans, mercaptobenzothiazole, others.

Application

- Natural Rubber

- Synthetic Rubber

Based on application, the North America rubber peptizers market is classified into natural rubber and synthetic rubber.

End-Use

- Tire

- Non-Tire

Based on the end-use, the North America rubber peptizers market is classified into tire and non-tire.

North America Rubber Peptizers Market Regional Analysis/Insights

The North America rubber peptizers market is segmented on the basis of product, application and end-use.

The countries in the North America rubber peptizers market are U.S., Canada and Mexico.

U.S. is dominating the North America rubber peptizers market in terms of market share and market revenue due to increasing demand for rubber peptizers from various industries.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Rubber Peptizers Market Share Analysis

North America rubber peptizers market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the North America rubber peptizers market.

Some of the prominent participants operating in the North America rubber peptizers market are Struktol Company of America, LLC, LANXESS, Thomas Swan & Co. Ltd., Shandong Stair Chemical & Technology Co., Ltd., Zhengzhou Double Vigour Chemical Product Co., ltd., Taizhou Huangyan Donghai Chemical Co., Ltd., Acmechem, Akrochem Corporation, HENAN CONNECT RUBBER CHEMICAL LIMITED, Kettlitz-Chemie GmbH & Co. KG, King Industries, Inc., and CHEMSPEC, LTD.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA RUBBER PEPTIZERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING AND PACKING

4.4.3 MARKETING AND DISTRIBUTION

4.4.4 END USERS

4.5 PRICE INDEX

4.6 PRODUCTION AND CONSUMPTION ANALYSIS

4.7 PRODUCTION CAPACITY OVERVIEW

4.8 RAW MATERIAL PRODUCTION COVERAGE

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING THE USE OF RUBBER PEPTIZERS IN THE MANUFACTURING OF RUBBER PRODUCTS

5.1.2 ADOPTED BY THE VARIOUS INDUSTRIES BECAUSE OF SIGNIFICANT VISCOSITY

5.1.3 INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY

5.2 RESTRAINTS

5.2.1 EMISSION OF HAZARDOUS GASSES AND POLLUTANTS

5.2.2 IMPOSITION OF STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 ADOPTION OF GREEN TECHNOLOGY IN RUBBER MANUFACTURING

5.3.2 INCREASING USE OF RUBBER PEPTIZERS IN THE CONSTRUCTION SECTOR

5.4 CHALLENGES

5.4.1 DISRUPTIONS IN THE SUPPLY CHAIN

5.4.2 FLUCTUATING PRICE OF RAW MATERIALS.

6 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DIBENZAMIDO DIPHENYL DISULPHIDE (DBD)

6.3 PENTACHLOROTHIOPHENOL

6.4 MERCAPTOBENZOTHIAZOLE

6.5 ARYL MERCAPTANS

6.6 ZINC PENTACHLOROTHIOPHENATE

6.7 OTHERS

7 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 NATURAL RUBBER

7.3 SYNTHETIC RUBBER

7.3.1 SYNTHETIC RUBBER, BY CATEGORY

7.3.1.1 STYRENE-BUTADIENE RUBBER (SBR)

7.3.1.2 ACRYLONITRILE-BUTADIENE RUBBER (NBR)

7.3.1.3 POLYBUTADIENE RUBBER (BR)

7.3.1.4 BUTYL RUBBER (IIR)

7.3.1.5 OTHERS

8 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY END-USE

8.1 OVERVIEW

8.2 NON-TIRE

8.3 TIRE

9 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA RUBBER PEPTIZERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.2 CERTIFICATION

10.3 ACHIEVEMENT

10.4 LAUNCH

10.5 EVENT

10.6 INVESTMENT

10.7 COMMITMENT

10.8 ACQUISITION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LANXESS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 THOMAS SWAN & CO. LTD

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 CHEMSPEC LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 ACMECHEM

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 SHANDONG STAIR CHEMICAL & TECHNOLOGY CO., LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 AKROCHEM CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 DONGEUN CO., LTD

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 HENAN CONNECT RUBBER CHEMICAL LIMITED

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 KETTLITZ-CHEMIE GMBH & CO. KG

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 KING INDUSTRIES, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 STRUKTOL COMPANY OF AMERICA, LLC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 TAIZHOU HUANGYAN DONGHAI CHEMICAL CO., LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 ZHENGZHOU DOUBLE VIGOUR CHEMICAL PRODUCT CO., LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (PRICE/KG)

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 5 NORTH AMERICA DIBENZAMIDO DIPHENYL DISULPHIDE (DBD) IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PENTACHLOROTHIOPHENOL IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA MERCAPTOBENZOTHIAZOLE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA ARYL MERCAPTANS IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA ZINC PENTACHLOROTHIOPHENATE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA OTHERS IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA NATURAL RUBBER IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA NON-TIRE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA TIRE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 20 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 22 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 27 U.S. RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 30 CANADA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 CANADA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 32 CANADA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 35 MEXICO RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 MEXICO RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 37 MEXICO RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 38 MEXICO SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 39 MEXICO RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA RUBBER PEPTIZERS MARKET

FIGURE 2 NORTH AMERICA RUBBER PEPTIZERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RUBBER PEPTIZERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RUBBER PEPTIZERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RUBBER PEPTIZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RUBBER PEPTIZERS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA RUBBER PEPTIZERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA RUBBER PEPTIZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA RUBBER PEPTIZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA RUBBER PEPTIZERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA RUBBER PEPTIZERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA RUBBER PEPTIZERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA RUBBER PEPTIZERS MARKET: SEGMENTATION

FIGURE 14 INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY ARE EXPECTED TO DRIVE THE NORTH AMERICA RUBBER PEPTIZERS MARKET IN THE FORECAST PERIOD

FIGURE 15 DIBENZAMIDO DIPHENYL DISULPHIDE (DBD) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA RUBBER PEPTIZERS MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN ANALYSIS – NORTH AMERICA RUBBER PEPTIZERS MARKET

FIGURE 17 NORTH AMERICA RUBBER PEPTIZERS MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (TONS)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA RUBBER PEPTIZERS MARKET

FIGURE 19 NORTH AMERICA RUBBER PEPTIZERS MARKET: BY PRODUCT, 2022

FIGURE 20 NORTH AMERICA RUBBER PEPTIZERS MARKET: BY APPLICATION, 2022

FIGURE 21 NORTH AMERICA RUBBER PEPTIZERS MARKET: BY END-USE, 2022

FIGURE 22 NORTH AMERICA RUBBER PEPTIZERS MARKET: SNAPSHOT (2022)

FIGURE 23 NORTH AMERICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2022)

FIGURE 24 NORTH AMERICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 NORTH AMERICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 NORTH AMERICA RUBBER PEPTIZERS MARKET: BY PRODUCT (2023-2030)

FIGURE 27 NORTH AMERICA RUBBER PEPTIZERS MARKET: COMPANY SHARE 2022 (%)

North America Rubber Peptizers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Rubber Peptizers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Rubber Peptizers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.