North America Sarcopenia Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

2.00 Billion

2024

2032

USD

1.35 Billion

USD

2.00 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 2.00 Billion | |

|

|

|

|

North America Sarcopenia Treatment Market Size

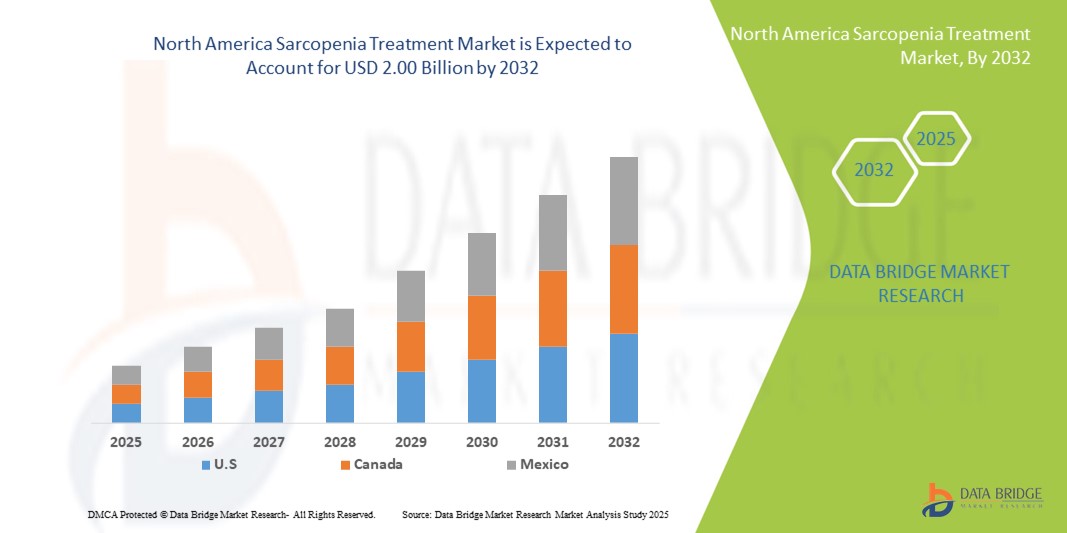

- The North America sarcopenia treatment market size was valued at USD 1.35 billion in 2024 and is expected to reach USD 2.00 billion by 2032, at a CAGR of 5.0% during the forecast period

- The market growth is primarily driven by the rising prevalence of age-related muscle loss, increasing awareness about sarcopenia among healthcare providers and patients, and advancements in pharmacological and non-pharmacological treatment options

- In addition, the growing geriatric population seeking improved mobility, muscle strength, and quality of life is propelling demand for effective sarcopenia therapies. These combined factors are accelerating the adoption of innovative treatment solutions, thereby significantly boosting the market’s growth

North America Sarcopenia Treatment Market Analysis

- Sarcopenia treatments, encompassing medications, vitamin/dietary supplements, and other therapeutic interventions, are becoming increasingly essential for managing age-related muscle loss and improving mobility, strength, and overall quality of life among older adults in both clinical and home care settings

- The rising demand for sarcopenia treatments is primarily driven by growing awareness of age-related muscle degeneration, increasing prevalence of elderly populations, and emphasis on preventive healthcare and healthy aging

- U.S. dominated the North America sarcopenia treatment market with the largest revenue share of 77.5% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading pharmaceutical and biotech companies. The U.S. accounted for substantial growth in sarcopenia therapy adoption, driven by ongoing clinical trials, novel drug developments, and combination approaches involving nutrition and exercise programs

- Canada is expected to witness rapid growth in the North America sarcopenia treatment market during the forecast period due to its aging population, increasing healthcare awareness, and expanding access to treatment options

- The Medications segment dominated the North America sarcopenia treatment market with a market share of 47.3% in 2024, fueled by approval of novel drugs targeting muscle mass and strength, alongside growing physician recommendations for early intervention in at-risk populations

Report Scope and North America Sarcopenia Treatment Market Segmentation

|

Attributes |

North America Sarcopenia Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Sarcopenia Treatment Market Trends

Rising Focus on Preventive and Personalized Therapies

- A significant trend in the North America sarcopenia treatment market is the growing emphasis on preventive and personalized healthcare solutions tailored to aging populations. This includes targeted medications, nutritional supplementation, and exercise programs designed to maintain or improve muscle mass and function before severe sarcopenia develops

- Companies are increasingly developing personalized treatment plans based on patient age, gender, nutritional status, and comorbidities. For instance, some therapies integrate resistance training regimens with pharmacological interventions to maximize outcomes in older adults

- The rise of digital health platforms and remote monitoring solutions enables healthcare providers to track patient progress in real time, optimize dosing, and adjust nutrition or exercise recommendations accordingly

- Innovative nutraceuticals and vitamin-based supplements are gaining popularity as adjuncts to pharmacological treatments, allowing patients to proactively manage muscle health. Some supplements now include combinations of protein, amino acids, and vitamin D specifically formulated for sarcopenia

- These personalized and preventive approaches are increasing patient adherence and engagement, as treatments are tailored to individual lifestyles and risk profiles. Consequently, providers are able to improve outcomes while reducing hospitalization and long-term care costs

- The trend toward early intervention and personalized sarcopenia care is reshaping the market, prompting pharmaceutical, nutraceutical, and healthcare technology companies to invest heavily in research, digital integration, and patient-centric solutions

North America Sarcopenia Treatment Market Dynamics

Driver

Growing Geriatric Population and Rising Disease Awareness

- The increasing proportion of elderly individuals in the United States and Canada is a key driver of market growth. Aging is the primary risk factor for sarcopenia, and as life expectancy rises, the demand for effective interventions to maintain mobility, independence, and quality of life is intensifying

- Greater awareness among healthcare professionals and patients about the risks of sarcopenia is accelerating adoption of treatment options. Early diagnosis and intervention are now emphasized through routine geriatric assessments and community health programs

- The U.S. leads the market supported by advanced healthcare infrastructure, widespread clinical research, and strong pharmaceutical presence. Programs integrating clinical evaluation with nutraceutical and pharmacological interventions are becoming standard practice in geriatric care

- Increasing public and private healthcare initiatives, including insurance coverage for certain treatments and rehabilitation programs, are further encouraging uptake

- Early-stage therapies are seeing particular adoption in outpatient clinics, specialty centers, and home healthcare settings, providing patients with accessible and effective treatment pathways

- These factors collectively enhance the market’s growth trajectory by creating sustained demand for sarcopenia-specific medications, dietary supplements, and supportive therapies

Restraint/Challenge

Limited Awareness, High Costs, and Regulatory Hurdles

- Despite growing interest, limited awareness of sarcopenia among some segments of the population can hinder market penetration. Many individuals and caregivers are still unfamiliar with the condition or available treatment options

- The high cost of advanced pharmacological therapies and personalized treatment programs presents a challenge, particularly for price-sensitive patients or those without comprehensive insurance coverage

- Regulatory hurdles and the rigorous approval process for new drugs and supplements can slow the introduction of innovative therapies. Companies must demonstrate efficacy, safety, and long-term benefits, which can delay market entry

- Healthcare providers may face difficulties integrating multidisciplinary approaches involving medications, supplements, and physical therapy into standard care pathways due to logistical or reimbursement constraints

- These challenges are further compounded by variability in patient adherence, especially for multi-component regimens requiring lifestyle modifications

- Overcoming these barriers requires patient education campaigns, cost-effective treatment solutions, and streamlined regulatory pathways to ensure wider accessibility and adoption across both clinical and home-care settings

North America Sarcopenia Treatment Market Scope

The market is segmented on the basis of treatment type, sarcopenia type, stages, route of administration, gender, end user, and distribution channel.

- By Treatment Type

On the basis of treatment type, the North America sarcopenia treatment market is segmented into medications, vitamin/dietary supplements, and others. The Medications segment dominated the market with the largest market revenue share of 47.3% in 2024, driven by the availability of approved pharmacological therapies targeting muscle mass, strength, and function. Patients and healthcare providers increasingly prefer medications for their clinically proven efficacy, especially in severe sarcopenia cases. Pharmaceutical companies continue to invest in novel drug development and clinical trials, expanding the range of treatment options. The dominance of medications is also supported by physician recommendations and integration into standard geriatric care pathways. Growing awareness among patients regarding early intervention with prescription therapies further strengthens this segment. In addition, combination therapies that integrate medications with exercise and nutritional support contribute to sustained market leadership.

The Vitamin/Dietary Supplements segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising consumer preference for preventive and non-pharmacological interventions. Supplements such as protein powders, amino acids, and vitamin D are increasingly used in pre-sarcopenia and mild sarcopenia stages to maintain muscle health. The segment benefits from strong adoption in home healthcare settings and wellness programs. Increasing online availability and direct-to-consumer sales enhance accessibility for older adults. Healthcare providers are increasingly recommending these supplements as adjuncts to medications and lifestyle interventions. Rising awareness through digital campaigns, social media, and community health initiatives further propels growth.

- By Type

On the basis of sarcopenia type, the sarcopenia treatment market is segmented into primary sarcopenia and secondary sarcopenia. The Primary Sarcopenia segment dominated in 2024 with the largest revenue share, driven by its strong prevalence among aging populations in the U.S. and Canada. Primary sarcopenia is directly age-related, making it a key target for early interventions involving medications, supplements, and exercise programs. Healthcare providers and geriatric specialists focus on routine screening and preventive care for this type. The dominance is also supported by research funding and clinical studies emphasizing aging-related muscle degeneration. Patients’ proactive engagement with preventive therapies contributes to sustained demand. Public awareness campaigns highlighting age-related muscle loss further reinforce the segment’s market leadership.

The Secondary Sarcopenia segment is expected to grow at the fastest CAGR during forecast period due to increasing cases associated with chronic diseases, malnutrition, and prolonged hospitalization. Patients with secondary sarcopenia often require specialized treatment plans combining medications, supplements, and rehabilitation. Growing recognition of the condition among healthcare providers and inclusion in hospital and specialty clinic protocols accelerates adoption. Personalized interventions and integration into home healthcare solutions contribute to rapid uptake. The increasing prevalence of lifestyle-related comorbidities such as diabetes and cardiovascular diseases further supports market expansion.

- By Stages

On the basis of stages, the sarcopenia treatment market is segmented into pre-sarcopenia, sarcopenia, and severe sarcopenia. The Sarcopenia stage segment dominated the market in 2024 with the largest revenue share, as it represents the stage where muscle loss is clinically evident and treatment is most often prescribed. Patients at this stage commonly receive medications, nutritional supplements, and structured exercise interventions. Healthcare providers emphasize early intervention to prevent progression to severe sarcopenia, driving consistent demand. Clinics and hospitals frequently adopt standardized protocols for sarcopenia stage patients. Insurance coverage for treatments at this stage further supports market dominance. The combination of clinical necessity, patient adherence, and physician guidance underpins the segment’s leadership.

The Pre-Sarcopenia segment is expected to witness the fastest growth rate during forecast period, driven by increasing awareness and preventive healthcare initiatives. Early intervention using supplements, lifestyle modification, and low-risk pharmacological approaches is gaining traction. Public health campaigns and digital health monitoring platforms help detect early muscle decline, supporting preventive adoption. Home healthcare and wellness programs targeting pre-sarcopenia populations further accelerate growth. The trend of personalized preventive care encourages patient engagement and proactive treatment. Expanding educational efforts among geriatric populations about maintaining muscle health also contribute to rapid uptake

- By Route of Administration

On the basis of route of administration, the sarcopenia treatment market is segmented into oral, injectable, and others. The Oral segment dominated the market with the largest revenue share in 2024, driven by its convenience, ease of self-administration, and suitability for long-term treatment plans. Most medications and vitamin/dietary supplements are formulated for oral consumption, making it the preferred choice for both patients and healthcare providers. The segment benefits from high patient adherence, especially in home healthcare settings. Oral administration also supports preventive therapy in pre-sarcopenia and mild sarcopenia stages. Pharmaceutical companies continue to innovate in oral formulations to enhance bioavailability and effectiveness. In addition, the convenience of oral dosing allows integration with daily routines, contributing to sustained market dominance.

The Injectable segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the development of novel therapies requiring parenteral administration for enhanced efficacy in severe sarcopenia cases. Injectable therapies are increasingly adopted in hospital and specialty clinic settings for targeted, rapid intervention. Clinical studies supporting injectable treatment efficacy are encouraging adoption among healthcare professionals. The segment also benefits from technological advancements in delivery systems that improve patient comfort and compliance. Growing awareness of injectable options as part of combination therapies with oral medications or supplements fuels market expansion. Rising demand for advanced treatments in the U.S. and Canada positions injectables for rapid growth.

- By Gender

On the basis of gender, the sarcopenia treatment market is segmented into male and female. The Male segment dominated the market in 2024 with the largest revenue share, primarily due to a higher prevalence of sarcopenia among older men and greater physician-prescribed medication usage in this demographic. Men are also more such likely to receive early interventions in clinical settings, including structured exercise programs and pharmacological treatments. Public health initiatives targeting elderly male populations support awareness and treatment adoption. Male-focused clinical trials and research contribute to robust data supporting treatment efficacy, reinforcing market leadership. Combined pharmacological, nutritional, and exercise interventions are widely recommended for male patients, further strengthening this segment.

The Female segment is expected to witness the fastest growth rate during forecast period, fueled by increasing awareness of sarcopenia in post-menopausal women and the rising adoption of preventive and lifestyle interventions. Healthcare providers are emphasizing early screening and supplementation for women to maintain muscle mass and bone health. Nutrition and exercise programs tailored for elderly women are expanding rapidly, particularly through home healthcare and community wellness initiatives. Rising female participation in preventive health programs and digital health monitoring also contributes to market growth. In addition, educational campaigns highlighting gender-specific risks for muscle loss drive the uptake of both supplements and medications.

- By End User

On the basis of end user, the sarcopenia treatment market is segmented into hospitals, specialty clinics, home healthcare, and others. The Hospitals segment dominated the market with the largest revenue share in 2024, driven by the availability of specialized diagnostic tools, comprehensive treatment programs, and physician-led intervention. Hospitals serve as primary points for severe sarcopenia treatment, clinical trials, and early detection through routine geriatric assessments. High patient footfall and advanced infrastructure enable the delivery of medications, injectable therapies, and supervised exercise programs. Hospitals also support combination therapy approaches integrating supplements, medications, and physiotherapy. The trusted clinical environment encourages patient adherence and comprehensive treatment adoption.

The Home Healthcare segment is expected to witness the fastest growth rate during forecast period, driven by the increasing preference for in-home preventive care and rehabilitation. Home healthcare allows patients, especially those with mobility constraints, to access medications, nutritional supplements, and guided exercise programs conveniently. The rise of remote monitoring platforms and telehealth services enhances patient engagement and treatment adherence in the home setting. Growing awareness among caregivers about the benefits of early-stage intervention accelerates adoption. Companies providing home-delivered supplements and patient support programs further propel growth. The segment also benefits from government initiatives and insurance coverage expanding access to in-home care for elderly populations.

- By Distribution Channel

On the basis of distribution channel, the sarcopenia treatment market is segmented into direct tender, retail sales, and others. The Retail Sales segment dominated the market in 2024, driven by the widespread availability of medications, supplements, and other treatments through pharmacies, online stores, and wellness outlets. Easy access, brand visibility, and consumer trust in retail channels make it the preferred choice for patients and caregivers. Retail distribution also allows rapid adoption of newly launched products. Online pharmacy growth and e-commerce platforms expand reach, particularly for vitamin/dietary supplements. Marketing campaigns and patient education programs often focus on retail channels to encourage preventive adoption. The convenience and accessibility of retail outlets further reinforce the segment’s leadership.

The Direct Tender segment is expected to witness the fastest growth rate during forecast period, driven by hospitals, specialty clinics, and government procurement initiatives for bulk supply of medications and therapeutic products. Direct tenders ensure cost-effective procurement, timely delivery, and access to specialized treatments. Institutional adoption of novel therapies, injectable medications, and combination programs fuels demand through this channel. Growing investments in public health and aging care programs enhance the importance of direct tender distribution. Partnerships between pharmaceutical companies and healthcare institutions support rapid penetration of advanced therapies. The segment benefits from streamlined logistics and preferential pricing models, contributing to accelerated growth.

North America Sarcopenia Treatment Market Regional Analysis

- U.S. dominated the sarcopenia treatment market with the largest revenue share of 77.5% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading pharmaceutical and biotech companies

- Patients and healthcare providers in the region increasingly prioritize early diagnosis and intervention, including medications, nutritional supplements, and structured exercise programs, to maintain muscle mass, strength, and mobility

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading pharmaceutical, nutraceutical, and biotech companies

U.S. North America Sarcopenia Treatment Market Insight

The U.S. sarcopenia treatment market captured the largest revenue share in 2024 within North America, fueled by the rapidly growing geriatric population and increasing prevalence of age-related muscle loss. Patients and healthcare providers are prioritizing early diagnosis and intervention through medications, vitamin/dietary supplements, and exercise programs. The rising adoption of home healthcare and telehealth platforms allows older adults to access treatments conveniently. Strong clinical research activity, ongoing trials for novel pharmacological therapies, and integration of personalized treatment plans further propel the market. In addition, physician awareness and patient education campaigns on the benefits of early intervention are significantly contributing to market expansion.

Canada Sarcopenia Treatment Market Insight

The Canada sarcopenia treatment market is expected to expand at a substantial CAGR during the forecast period, driven by a growing elderly population and increased public awareness of sarcopenia. Government initiatives promoting preventive healthcare and healthy aging are encouraging the adoption of pharmacological therapies and nutritional supplements. The availability of advanced healthcare infrastructure and support for home-based interventions enhances accessibility. Canadian patients and caregivers are increasingly adopting combination therapies integrating medications with lifestyle modifications. The focus on early-stage intervention to improve mobility and quality of life further supports market growth. Retail and online distribution channels are also expanding, increasing reach and convenience for patients.

Mexico Sarcopenia Treatment Market Insight

The Mexico sarcopenia treatment market is poised to grow at a notable CAGR during the forecast period, driven by increasing healthcare awareness and rising prevalence of age-related muscle decline. Expansion of geriatric healthcare services and specialized clinics is facilitating better diagnosis and treatment access. The adoption of dietary supplements and preventive care interventions is growing steadily. Rising investments in healthcare infrastructure and availability of home healthcare solutions support market penetration. Public health campaigns emphasizing the importance of maintaining muscle health among older adults are further propelling demand. Mexico’s growing focus on affordable and accessible treatment options is expected to stimulate market growth in both urban and semi-urban regions.

North America Sarcopenia Treatment Market Share

The North America Sarcopenia Treatment industry is primarily led by well-established companies, including:

- TNF Pharmaceuticals (U.S.)

- Biophytis (France)

- Lipocine (U.S.)

- Anodyne Nanotech (U.S.)

- AbbVie Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Lilly USA, LLC (U.S.)

- Novartis AG (U.S.)

- Sanofi (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Amgen Inc. (U.S.)

- Abbott (U.S.)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

What are the Recent Developments in North America Sarcopenia Treatment Market?

- In August 2025, Lipocine Inc. announced positive results from a Phase II clinical trial of LPCN 1148, an oral prodrug of bioidentical testosterone. The study, conducted in patients with decompensated cirrhosis, showed improvements in sarcopenia and related clinical outcomes. This positions LPCN 1148 as a potential first-in-class therapy for cirrhosis management, with a Phase III trial now in preparation

- In June 2025, Anodyne Nanotech reported preclinical data demonstrating that ANN-102, administered via its proprietary HeroPatch microneedle system, significantly improved muscle strength in models of sarcopenia. These results suggest that ANN-102 could offer a non-invasive, muscle-preserving therapy for aging populations, potentially reducing the need for daily injections

- In April 2025, Biophytis confirmed the launch of the Phase 2 OBA clinical study to evaluate BIO101's efficacy in reducing muscle strength loss caused by GLP-1 agonists in patients with obesity. This trial aims to address sarcopenia associated with obesity treatments

- In January 2025, Barunbio introduced the WE-STIM.MED MuscleGuard, a knee brace designed for sarcopenia prevention and management. Utilizing their proprietary WE-STIM technology, the device delivers micro-electric stimulation through body movements, promoting muscle health without external power sources. The product was showcased at CES 2025, highlighting its integration of wearable technology in healthcare

- In December 2024, TNF Pharmaceuticals presented statistically significant Phase 2a trial results for its novel sarcopenia/frailty treatment. Building on this success, the company initiated a Phase 2b study in early 2025, focusing on muscle preservation in frail patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.