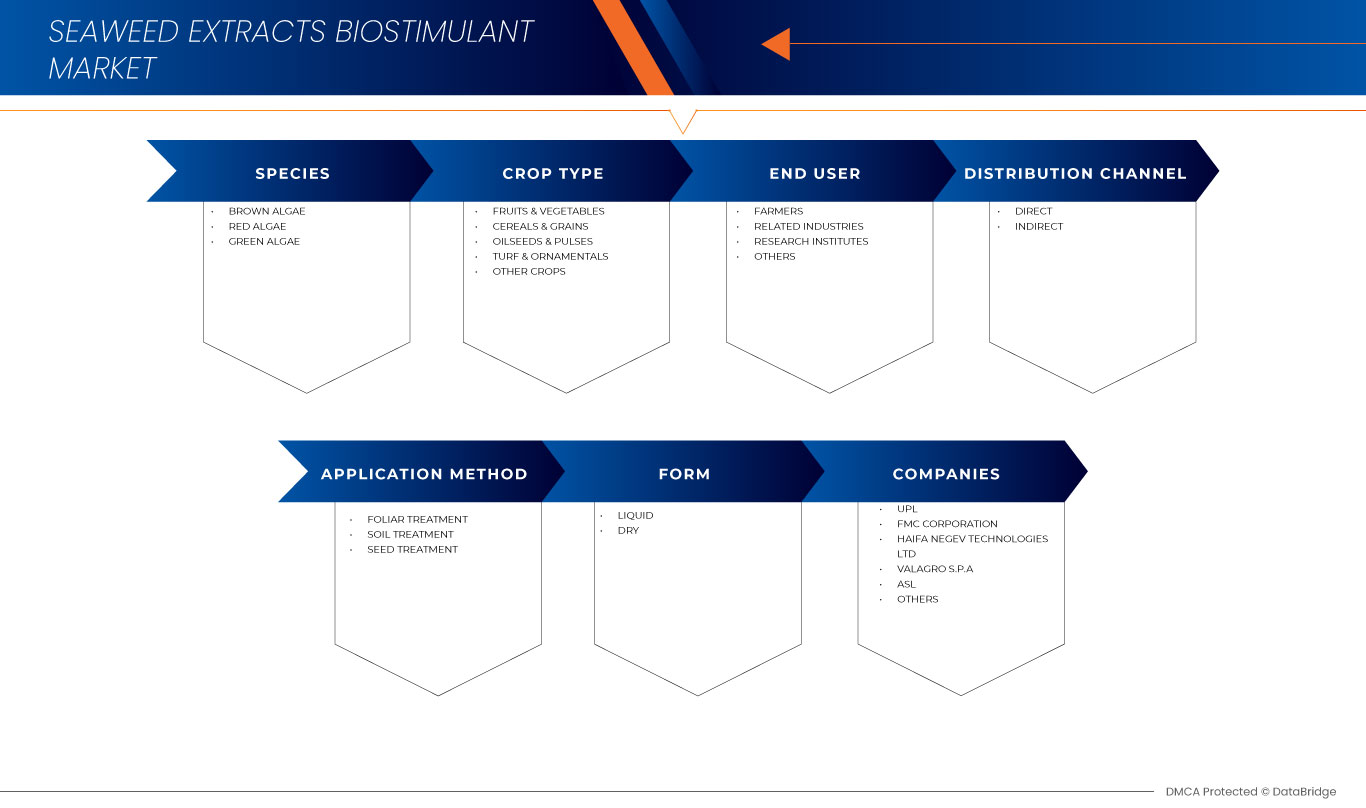

TABLE 1 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA TURF & ORNAMENTALS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OTHER CROPS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA FOLIAR TREATMENT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SOIL TREATMENT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SEED TREATMENT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA LIQUID IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA DRY IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA FARMERS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA RELATED INDUSTRIES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA RESEARCH INSTITUTES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA DIRECT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA INDIRECT IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY REGION, 2021-2030 (USD MILLION)

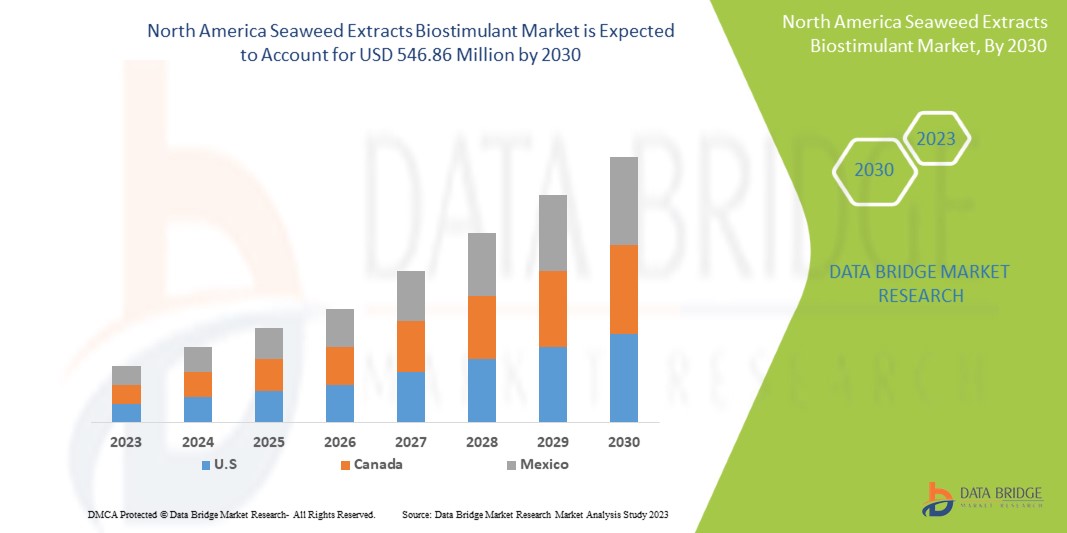

TABLE 31 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 44 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 45 U.S. BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 46 U.S. RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 47 U.S. GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 48 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 49 U.S. FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 53 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 54 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 55 U.S. SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 57 CANADA BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 58 CANADA RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 59 CANADA GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 60 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 61 CANADA FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 62 CANADA CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 63 CANADA OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 64 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 65 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 66 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 67 CANADA SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 68 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 69 MEXICO BROWN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 70 MEXICO RED ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 71 MEXICO GREEN ALGAE IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 72 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 73 MEXICO FRUITS & VEGETABLES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 74 MEXICO CEREALS & GRAINS IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 75 MEXICO OILSEEDS & PULSES IN SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 76 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY APPLICATION METHOD, 2021-2030 (USD MILLION)

TABLE 77 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 78 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 MEXICO SEAWEED EXTRACTS BIOSTIMULANT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)