North America Single Use Medical Devices Reprocessing Market

Market Size in USD Billion

CAGR :

%

USD

1.47 Billion

USD

4.75 Billion

2025

2033

USD

1.47 Billion

USD

4.75 Billion

2025

2033

| 2026 –2033 | |

| USD 1.47 Billion | |

| USD 4.75 Billion | |

|

|

|

|

North America Single Use Medical Devices Reprocessing Market Size

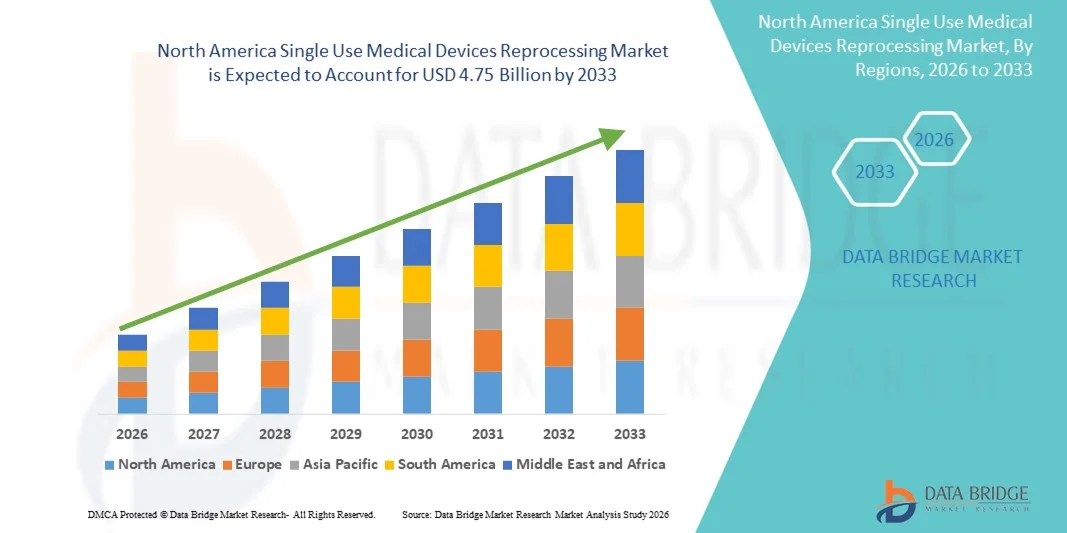

- The North America single use medical devices reprocessing market size was valued at USD 1.47 billion in 2025 and is expected to reach USD 4.75 billion by 2033, at a CAGR of 15.8% during the forecast period

- The market growth is largely driven by increasing emphasis on cost containment and sustainability in healthcare, as hospitals and surgical centers adopt reprocessing practices to reduce procurement costs and medical waste, supported by favorable reimbursement policies and regulatory frameworks

- Furthermore, technological advancements in sterilization, validation, and traceability, alongside growing demand for efficient and safe reprocessed devices across clinical settings, are expanding adoption. These converging factors are accelerating uptake of single‑use device reprocessing solutions, boosting the overall market expansion across North America

North America Single Use Medical Devices Reprocessing Market Analysis

- Single use medical device reprocessing, involving the cleaning, sterilization, and validation of disposable medical devices for safe reuse, is becoming an increasingly critical practice in healthcare facilities across North America, driven by cost savings, sustainability goals, and regulatory compliance

- The rising adoption of reprocessed single use devices is primarily fueled by growing cost pressures on hospitals, increasing medical waste concerns, and stringent regulations encouraging safe reprocessing practices

- The United States dominated the single use medical device reprocessing market with the largest revenue share of 88.4% in 2025, supported by well-established healthcare infrastructure, favorable reimbursement policies, and the presence of key market players

- Canada is expected to be the fastest growing country in the single use medical device reprocessing market during the forecast period due to increasing healthcare expenditures, rising awareness of sustainable medical practices, and expansion of modern hospitals and surgical facilities

- Class II devices dominated the market with a share of 55.2% in 2025, driven by their higher reuse potential, stringent infection control requirements, and increasing adoption across applications such as general surgery, cardiology, and gastroenterology

Report Scope and North America Single Use Medical Devices Reprocessing Market Segmentation

|

Attributes |

North America Single Use Medical Devices Reprocessing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Single Use Medical Devices Reprocessing Market Trends

Enhanced Efficiency Through Advanced Sterilization and Traceability

- A significant and accelerating trend in the North America single use medical device reprocessing market is the integration of advanced sterilization methods and digital traceability systems. This combination is significantly enhancing safety, compliance, and operational efficiency

- For instance, hospitals are increasingly adopting RFID-enabled reprocessing systems to track instruments throughout cleaning, sterilization, and redistribution, reducing human errors and ensuring regulatory compliance

- Automation and digital tracking allow healthcare facilities to monitor reprocessed device life cycles, identify usage patterns, and optimize inventory management. For instance, some major U.S. hospitals use automated sterilization logs that generate alerts for overdue reprocessing cycles

- The seamless integration of sterilization protocols with electronic health record (EHR) systems and centralized device management platforms facilitates improved monitoring and reporting, ensuring compliance with FDA and CDC guidelines

- This trend towards more automated, traceable, and efficient reprocessing practices is fundamentally reshaping hospital expectations for device safety. Consequently, companies such as Stryker and Medline are developing integrated reprocessing solutions with real-time monitoring, automated sterilization, and audit-ready reporting

- The demand for single use medical device reprocessing solutions with advanced traceability and automated sterilization is growing rapidly across hospitals and ambulatory surgical centers, as healthcare providers increasingly prioritize patient safety, cost reduction, and operational efficiency

- Emerging IoT-enabled sterilization equipment is enabling remote monitoring and predictive maintenance, further improving efficiency and reducing device downtime in busy healthcare settings

North America Single Use Medical Devices Reprocessing Market Dynamics

Driver

Growing Need Due to Rising Cost Pressures and Regulatory Compliance

- The increasing emphasis on cost containment in healthcare, combined with stringent infection control regulations, is a significant driver for the heightened adoption of device reprocessing

- For instance, in March 2025, a U.S. hospital network implemented an FDA-compliant automated endoscope reprocessing program to reduce procurement costs and minimize device-related infections

- As healthcare providers face rising expenditure pressures, reprocessed single use devices offer a cost-effective alternative while maintaining safety standards, providing a compelling upgrade over single-use disposal practices

- Furthermore, regulatory frameworks from the FDA and CDC are encouraging hospitals to adopt validated reprocessing methods, making reprocessing a key component of operational strategy

- The combination of cost savings, compliance adherence, and the convenience of in-house or outsourced reprocessing services is propelling adoption across both hospitals and ambulatory surgical centers

- For instance, partnerships between hospitals and certified third-party reprocessors are expanding, allowing smaller facilities to benefit from cost-efficient and compliant reprocessing solutions

- Increasing environmental awareness is also driving adoption, as reprocessing reduces medical waste and aligns with hospital sustainability initiatives

Restraint/Challenge

Sterilization Risks and Regulatory Hurdles

- Concerns surrounding potential sterilization failures and device integrity risks pose a significant challenge to broader market penetration. As reprocessed devices are subject to rigorous validation requirements, hospitals remain cautious about patient safety

- For instance, reported cases of improperly sterilized endoscopes in healthcare facilities have made some administrators hesitant to expand reprocessing programs

- Addressing these safety concerns through validated sterilization protocols, robust quality management systems, and staff training is crucial for building trust. Companies such as Stryker and Medline emphasize automated sterilization tracking and validation reporting to reassure healthcare providers

- In addition, the high upfront cost of advanced reprocessing equipment and compliance monitoring can be a barrier for smaller facilities or budget-constrained centers. While outsourcing offers cost relief, premium automated solutions remain expensive for some users

- Overcoming these challenges through improved device safety protocols, regulatory adherence, and cost-efficient reprocessing solutions will be vital for sustained market growth

- For instance, hospitals must ensure all reprocessed devices comply with FDA and ISO standards, requiring continuous monitoring and documentation, which can be resource-intensive

- Supply chain limitations and occasional shortages of reprocessing consumables, such as sterilization wraps and chemical agents, can disrupt operations, posing another hurdle for widespread adoption

North America Single Use Medical Devices Reprocessing Market Scope

The market is segmented on the basis of product type, price range, application, type, end user, and distribution channel.

- By Product Type

On the basis of product type, the market is segmented into Class I devices and Class II devices. The Class II devices segment dominated the market with the largest revenue share of 55.2% in 2025, driven by the higher complexity and stricter regulatory requirements of these devices, which make reprocessing a cost-saving and compliance-enhancing practice for hospitals. Hospitals often prioritize Class II devices such as endoscopes and cardiac catheters for reprocessing because of their higher procurement cost and critical clinical applications. The strong adoption is also supported by advanced sterilization and validation technologies, which ensure these devices maintain their safety and performance standards after reprocessing. Moreover, Class II devices typically have a higher reuse potential and are subject to stringent infection control measures, further enhancing the segment's dominance. The segment also benefits from hospital policies and government guidelines that encourage safe reprocessing to reduce medical waste and overall operational costs.

The Class I devices segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing awareness among smaller healthcare facilities and ambulatory surgical centers about the cost-effectiveness of reprocessing low-risk devices such as surgical gloves, syringes, and basic instrumentation. Class I devices are easier to sterilize and validate, making them attractive for facilities that may lack advanced in-house reprocessing infrastructure. The rising trend of in-house reprocessing programs and partnerships with third-party reprocessors further accelerates growth. In addition, innovations in sterilization techniques and quality assurance solutions are enabling safer and more efficient reprocessing of Class I devices, boosting confidence among healthcare providers. As more hospitals and outpatient centers adopt sustainability measures, the demand for Class I device reprocessing is expected to rise rapidly.

- By Price Range

On the basis of price range, the market is segmented into High Range and Low/Economy Range devices. The High Range segment dominated the market with the largest share in 2025, driven by the focus on reprocessing expensive and technologically advanced devices such as robotic surgical instruments, cardiovascular catheters, and endoscopes. Hospitals often prioritize high-cost devices for reprocessing to maximize return on investment and ensure cost-efficiency while maintaining compliance with regulatory standards. Advanced sterilization, validation, and traceability solutions are widely used for high-range devices to minimize the risk of device failure and enhance safety. The dominance of this segment is further supported by rising healthcare expenditure and the prevalence of complex surgical procedures in North America. Hospitals are increasingly leveraging high-range device reprocessing to reduce procurement costs and medical waste without compromising patient safety.

The Low/Economy Range segment is expected to witness the fastest growth during the forecast period due to increasing adoption of reprocessing for basic instruments and consumables in smaller clinics and ambulatory surgical centers. The growth is fueled by rising awareness of cost savings and sustainability benefits. Low/economy devices are easier to reprocess and require less sophisticated equipment, making them ideal for outpatient settings. In addition, partnerships with third-party reprocessors provide smaller facilities access to safe and cost-effective solutions. Government incentives and hospital sustainability initiatives further contribute to the rapid adoption of low-cost device reprocessing.

- By Application

On the basis of application, the market is segmented into general surgery, anesthesia, arthroscopy and orthopaedic surgery, cardiology, gastroenterology, urology, gynaecology, and others. The General Surgery segment dominated the market with the largest revenue share in 2025, owing to the high volume of surgical procedures and extensive use of reusable surgical instruments. Hospitals prioritize reprocessing in general surgery to reduce procurement costs, ensure timely availability of instruments, and minimize medical waste. The dominance is reinforced by stringent infection control protocols and the critical need for sterilized instruments in surgical outcomes. Advanced reprocessing technologies, including automated sterilizers and traceable tracking systems, are widely adopted in general surgery settings. The segment also benefits from the high reuse potential of instruments, further driving market adoption.

The Gastroenterology segment is expected to witness the fastest growth from 2026 to 2033 due to the increasing use of endoscopes, which are expensive, high-risk Class II devices requiring validated reprocessing. Rising prevalence of gastrointestinal disorders and an expanding number of endoscopic procedures are driving demand for safe and efficient reprocessing solutions. Innovations in automated endoscope reprocessors, remote monitoring, and AI-enabled tracking systems are accelerating adoption. The growth is further supported by hospitals seeking to reduce costs while complying with FDA and CDC reprocessing guidelines. As outpatient gastroenterology centers expand, the demand for reliable reprocessing solutions is projected to grow rapidly.

- By Type

On the basis of type, the market is segmented into In-House and Outsource reprocessing. The In-House segment dominated the market with the largest revenue share in 2025, supported by large hospitals and medical centers that have advanced sterilization facilities and trained staff to reprocess high-risk devices. In-house reprocessing provides better control over quality, compliance, and turnaround times, ensuring patient safety. Hospitals also prefer in-house programs for critical instruments used in surgeries and specialized procedures. Integration with hospital IT systems for tracking, monitoring, and validation enhances operational efficiency. The dominance is reinforced by policies encouraging hospitals to maintain direct control over high-value devices and reduce dependency on external vendors.

The Outsource segment is expected to witness the fastest growth from 2026 to 2033, driven by small and medium-sized hospitals, ambulatory surgical centers, and clinics that lack sophisticated sterilization infrastructure. Outsourcing to certified third-party reprocessors ensures compliance with FDA and ISO standards while reducing capital expenditure. The growth is also supported by partnerships with specialized service providers offering end-to-end reprocessing solutions. Outsourced reprocessing reduces operational burden on hospital staff, improves safety, and allows facilities to focus on core healthcare services. Increasing awareness of cost-efficiency and sustainability benefits further accelerates adoption.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, and others. The Hospitals segment dominated the market with the largest revenue share in 2025, driven by the high volume of surgical procedures, extensive use of high-cost and Class II devices, and well-established reprocessing facilities. Hospitals prioritize in-house or outsourced reprocessing to maintain compliance, reduce costs, and ensure timely instrument availability. Advanced sterilization technologies, digital traceability systems, and validated cleaning protocols are widely adopted in hospitals to minimize infection risk. The dominance is reinforced by strict regulatory requirements and hospital policies encouraging the reuse of devices where safe. Hospitals also benefit from economies of scale, which make reprocessing more cost-effective compared to smaller facilities.

The Ambulatory Surgical Centers segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing number of outpatient procedures and rising adoption of cost-effective reprocessing practices. Smaller centers often partner with third-party reprocessors or invest in compact in-house reprocessing systems for low-risk and Class I devices. The growth is supported by the increasing number of outpatient surgeries, cost-containment strategies, and sustainability initiatives. Ambulatory surgical centers benefit from reduced device procurement costs, minimized waste, and improved operational efficiency. Rising awareness of patient safety and regulatory compliance further accelerates market adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into B2B and B2C. The B2B segment dominated the market with the largest revenue share in 2025, driven by hospitals, surgical centers, and clinics procuring reprocessed devices and services through direct contracts with certified reprocessing companies. B2B distribution allows healthcare providers to ensure quality, compliance, and timely delivery of devices. Large-scale hospitals and networks prefer B2B arrangements for both in-house and outsourced reprocessing solutions. The dominance is also reinforced by long-term service agreements, integration with hospital IT systems, and bulk procurement advantages.

The B2C segment is expected to witness the fastest growth from 2026 to 2033, fueled by small outpatient centers, clinics, and individual practitioners increasingly seeking reprocessed medical devices directly from certified vendors. The growth is supported by the rising availability of online ordering platforms and partnerships with specialized service providers offering end-to-end solutions. B2C distribution provides flexibility, cost-efficiency, and access to devices without requiring in-house infrastructure. The expansion of digital platforms and awareness campaigns further accelerates adoption among smaller end users

North America Single Use Medical Devices Reprocessing Market Regional Analysis

- The United States dominated the single use medical device reprocessing market with the largest revenue share of 88.4% in 2025, supported by well-established healthcare infrastructure, favorable reimbursement policies, and the presence of key market players

- Healthcare providers in the U.S. place high importance on reducing device procurement costs and medical waste while maintaining strict compliance with FDA guidelines, making reprocessing an integral part of hospital operational strategies

- This dominance is further supported by favorable reimbursement policies, a high volume of surgical procedures, and the strong presence of certified third-party reprocessors and leading medical device companies, establishing the U.S. as the primary growth engine for the North America market

U.S. Single Use Medical Devices Reprocessing Market Insight

The U.S. single use medical devices reprocessing market captured the largest revenue share within North America in 2025, driven by a well-established regulatory framework, high surgical volumes, and strong adoption of cost-containment strategies across healthcare facilities. Hospitals and ambulatory surgical centers increasingly prioritize reprocessing to reduce device procurement costs while maintaining compliance with FDA standards. The widespread presence of certified third-party reprocessors and advanced in-house sterilization infrastructure further strengthens market leadership. Moreover, rising emphasis on sustainability and medical waste reduction is accelerating the integration of reprocessing programs across healthcare systems.

Canada Single Use Medical Devices Reprocessing Market Insight

The Canada single use medical devices reprocessing market is projected to expand at a steady CAGR during the forecast period, primarily driven by growing healthcare expenditures and increasing awareness of sustainable medical practices. Canadian healthcare providers are gradually adopting reprocessing solutions to manage costs and address environmental concerns associated with single-use medical waste. Supportive government initiatives, coupled with modernization of hospital infrastructure, are fostering wider acceptance of validated reprocessing practices. The market is also benefiting from partnerships with certified reprocessing service providers serving public healthcare institutions.

Mexico Single Use Medical Devices Reprocessing Market Insight

The Mexico single use medical devices reprocessing market is anticipated to grow at a notable CAGR during the forecast period, supported by expanding healthcare infrastructure and increasing demand for cost-effective medical solutions. Hospitals in Mexico are increasingly exploring outsourced reprocessing services to reduce capital investment while ensuring compliance with international sterilization standards. The growth in surgical procedures and gradual alignment with North American healthcare practices are further encouraging market expansion. In addition, rising private healthcare investments are contributing to the adoption of reprocessing solutions.

North America Single Use Medical Devices Reprocessing Market Share

The North America Single Use Medical Devices Reprocessing industry is primarily led by well-established companies, including:

- INNOVATIVE HEALTH (U.S.)

- NEScientific, Inc. (U.S.)

- Stryker (U.S.)

- Medline Industries, Inc. (U.S.)

- SureTek Medical (U.S.)

- SteriPro Canada (Canada)

- SterilMed, Inc. (U.S.)

- Sustainable Technologies (U.S.)

- Device Science (U.S.)

- Mediq (U.S.)

- MedSalv (U.S.)

- MD Reprocess (U.S.)

- Cardinal Health (U.S.)

- Ascent Healthcare Solutions (U.S.)

- Vanguard AG (U.S.)

- Northeast Scientific, Inc. (U.S.)

- Healthmark Industries (U.S.)

- Advanced Sterilization Products (U.S.)

- Getinge AB (U.S.)

- STERIS plc (U.S.)

What are the Recent Developments in North America Single Use Medical Devices Reprocessing Market?

- In May 2025, a federal jury in California ruled that Johnson & Johnson’s Medtech unit violated U.S. antitrust laws by withholding clinical support from hospitals using Innovative Health’s FDA-approved reprocessed catheters, awarding a plaintiff $147 million in damages. This verdict highlights growing legal and competitive dynamics in the reprocessing industry and could influence broader hospital adoption of reprocessed devices to reduce costs and waste

- In July 2024, Innovative Health, Inc. announced a strategic collaboration with MC Healthcare, Inc. to collect single-use devices from hospitals in Japan that cannot be reprocessed locally, enabling Innovative Health to reprocess them for use by U.S. hospitals boosting device availability, cost savings, and environmental impact

- In May 2023, the National Academies of Medicine’s Climate Collaborative recommended that hospitals use more FDA-regulated reprocessed single-use medical devices to reduce greenhouse gas emissions from U.S. health systems, positioning reprocessing as a strategy to combat climate change in healthcare

- In April 2023, Sustainable Technologies™, a Cardinal Health business, expanded its medical device reprocessing operations in Florida to increase capacity for reprocessing single-use medical devices, aiming to reduce healthcare’s carbon footprint and drive cost savings. The expanded facility, which serves more than 2,000 U.S. hospitals and ambulatory service centers, enables processing of larger volumes of single-use devices and testing of new reprocessing methods to broaden device portfolio and sustainability impact

- In February 2023, the Association of Medical Device Reprocessors (AMDR) launched a new website offering comprehensive resources to help hospitals, policy leaders, and purchasers reduce costs and greenhouse gas emissions through increased use of reprocessed single-use medical devices. The platform consolidates actionable information to support decision-making and broader adoption of reprocessing practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.