North America Sports Analytics Market

Market Size in USD Million

CAGR :

%

USD

912.85 Million

USD

18,437.08 Million

2024

2032

USD

912.85 Million

USD

18,437.08 Million

2024

2032

| 2025 –2032 | |

| USD 912.85 Million | |

| USD 18,437.08 Million | |

|

|

|

|

Sports Analytics Market Size

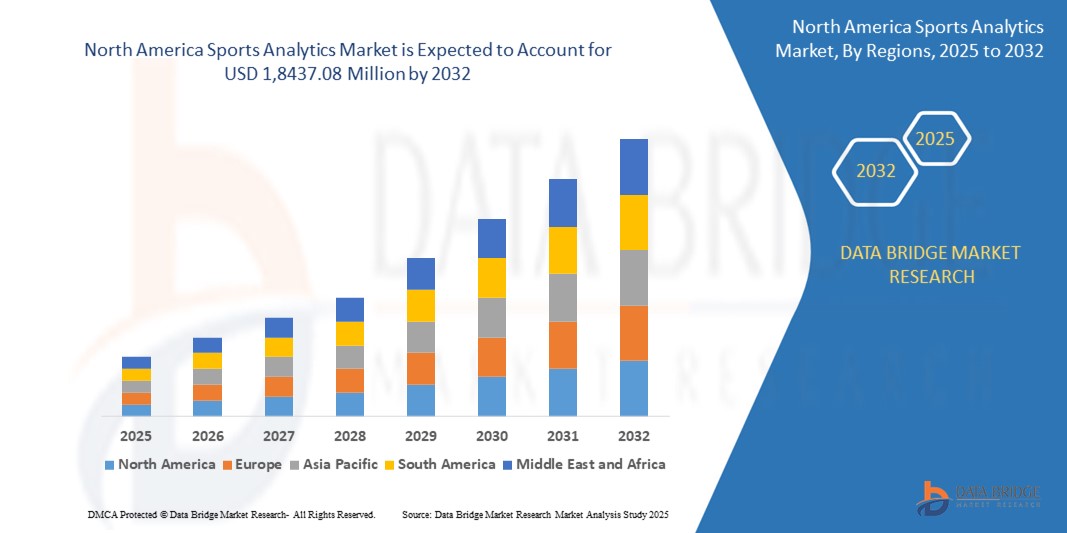

- The North America sports analytics market size was valued at USD 912.85 million in 2024 and is expected to reach USD 1,8437.08 million by 2032, at a CAGR of 45.6% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced data analytics in sports, fueled by technological advancements in AI, machine learning, and big data, leading to enhanced decision-making in team management and fan engagement

- In addition, the rising demand for real-time performance insights, player health monitoring, and personalized fan experiences is positioning sports analytics as a critical tool for sports organizations, driving significant industry growth

Sports Analytics Market Analysis

- Sports analytics solutions, encompassing software and services for data-driven insights, are becoming integral to modern sports management, offering enhanced performance tracking, strategic planning, and fan engagement capabilities across both team and individual sports

- The surge in demand for sports analytics is driven by growing investments in sports technology, increasing emphasis on player performance optimization, and the need for data-driven fan engagement strategies

- The U.S. dominated the North America sports analytics market with the largest revenue share of 65.4% in 2024, attributed to early adoption of sports technology, high investments in sports infrastructure, and the presence of major industry players. The U.S. market is experiencing robust growth, particularly in professional leagues and collegiate sports, driven by innovations in AI-powered analytics and real-time data solutions

- Canada is expected to be the fastest-growing country in the North America sports analytics market during the forecast period, propelled by increasing investments in sports technology and growing adoption of analytics in hockey and other sports

- The software segment dominated the largest market revenue share of 61.3% in 2024, driven by the widespread adoption of cloud-based analytics platforms that enable real-time data processing and advanced visualization for sports organizations

Report Scope and Sports Analytics Market Segmentation

|

Attributes |

Sports Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Sports Analytics Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The North America sports analytics market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into player performance, team strategies, and fan engagement metrics

- AI-powered analytics solutions allow for proactive decision-making, identifying performance trends and potential injury risks before they impact gameplay or athlete health

- For instance, companies are developing AI-driven platforms that analyze player movements to optimize game strategies or enhance fan experiences through personalized content based on real-time engagement data

- This trend is enhancing the value proposition of sports analytics systems, making them more appealing to sports organizations, broadcasters, and fans

- AI algorithms can analyze a wide range of player behaviors, including speed, positioning, fatigue levels, and tactical decisions, to provide actionable insights for coaches and management

Sports Analytics Market Dynamics

Driver

“Rising Demand for Data-Driven Performance and Fan Engagement”

- Increasing demand for data-driven insights in sports, such as real-time performance analytics, player tracking, and fan engagement tools, is a major driver for the North America sports analytics market

- Analytics systems enhance team performance by providing features such as real-time player and team valuation, health assessments, and strategic game planning

- Regulatory support and investments in sports technology, particularly in the U.S., are contributing to the widespread adoption of analytics solutions

- The proliferation of IoT and advancements in 5G technology are enabling faster data transmission and lower latency, supporting sophisticated applications such as video analysis and broadcast management

- Major sports leagues, such as the NFL, NBA, MLB, and NHL, are increasingly integrating analytics as standard tools to meet performance expectations and enhance fan experiences

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The significant initial investment required for analytics software, hardware, and integration can be a barrier to adoption for smaller sports organizations and teams, particularly in emerging segments such as e-sports

- Integrating analytics systems into existing sports infrastructure can be complex and costly, especially for teams with limited budgets

- Data security and privacy concerns are a major challenge, as analytics systems collect and transmit vast amounts of sensitive player and fan data, raising risks of breaches and misuse

- The varied regulatory landscape across North America, particularly regarding data protection in the U.S. and Canada, complicates compliance for organizations operating across borders

- These factors can deter adoption, especially in regions with high awareness of data privacy or where cost sensitivity is a significant concern

Sports Analytics market Scope

The market is segmented on the basis of component, sports type, application, deployment, organization mode, and analysis type.

- By Component

On the basis of component, the North America sports analytics market is segmented into software and services. The software segment dominated the largest market revenue share of 61.3% in 2024, driven by the widespread adoption of cloud-based analytics platforms that enable real-time data processing and advanced visualization for sports organizations. These solutions support performance tracking, predictive modeling, and fan engagement, making them critical for teams and leagues.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, with a projected CAGR of 22.8%. This growth is fueled by the rising demand for managed services, including data analysis, consulting, and integration, as sports organizations seek expert support to maximize the value of their analytics investments.

- By Sports Type

On the basis of sports type, the North America sports analytics market is segmented into team sports and individual sports. The team sports segment dominated with a market revenue share of 68.7% in 2024, primarily due to high adoption rates in major leagues such as the NFL, NBA, MLB, and NHL. These leagues leverage analytics for player selection, game strategy, and team performance optimization, particularly in sports such as football, baseball, and basketball.

The individual sports segment is anticipated to grow at a robust CAGR of 20.4% from 2025 to 2032, driven by increasing use of analytics in sports such as tennis, golf, and athletics. Wearable technology and personalized performance tracking are enhancing data-driven coaching and athlete development in these sports.

- By Application

On the basis of application, the North America sports analytics market is segmented into player and team valuation, performance analytics, health assessment, fan engagement, broadcast management, video analysis, and others. The performance analytics segment held the largest market revenue share of 28.5% in 2024, attributed to its critical role in optimizing in-game strategies, player performance, and coaching decisions through real-time data and predictive modeling.

The fan engagement segment is expected to experience the fastest growth rate of 24.3% from 2025 to 2032. This is driven by increasing demand for personalized fan experiences, such as tailored content, interactive platforms, and real-time analytics, which enhance viewer interaction and loyalty across digital and broadcast channels.

- By Deployment

On the basis of deployment, the North America sports analytics market is segmented into cloud and on-premise deployment models. The cloud segment dominated with a market revenue share of 62.4% in 2024, owing to its scalability, cost-effectiveness, and ability to handle large volumes of sports data. Cloud-based platforms enable seamless integration with AI, machine learning, and IoT technologies, supporting comprehensive analytics solutions.

The on-premise segment is projected to grow at a significant CAGR of 19.7% from 2025 to 2032, driven by large sports organizations’ need for enhanced data security, customization, and control over sensitive player and team data, particularly for real-time analytics during critical game-day operations.

- By Organization Mode

On the basis of organization mode, the North America sports analytics market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprise segment held the largest market revenue share of 70.2% in 2024, fueled by major sports leagues and franchises investing heavily in advanced analytics for competitive advantages in performance optimization, fan engagement, and revenue growth.

The SMEs segment is expected to witness the fastest growth rate of 23.1% from 2025 to 2032, as cloud-based analytics platforms become more accessible and cost-effective, enabling smaller teams and organizations to adopt data-driven strategies for performance and fan engagement.

- By Analysis Type

On the basis of analysis type, the North America sports analytics market is segmented into on-field and off-field analysis. The on-field segment dominated with a market revenue share of 64.8% in 2024, driven by the increasing use of wearable devices, GPS trackers, and video analysis tools for real-time player tracking, injury prevention, and game strategy optimization.

The off-field segment is anticipated to grow at a robust CAGR of 21.9% from 2025 to 2032, propelled by growing adoption of analytics for fan engagement, ticketing strategies, and sponsorship valuation. Off-field analytics leverage consumer behavior data and social media insights to enhance business operations and revenue streams.

Sports Analytics Market Regional Analysis

- The U.S. dominated the North America sports analytics market with the largest revenue share of 65.4% in 2024, attributed to early adoption of sports technology, high investments in sports infrastructure, and the presence of major industry players. The U.S. market is experiencing robust growth, particularly in professional leagues and collegiate sports, driven by innovations in AI-powered analytics and real-time data solutions

- Consumers and sports organizations prioritize analytics for enhancing player performance, optimizing team strategies, and improving fan experiences, particularly in regions with diverse and competitive sports cultures.

- Growth is supported by advancements in analytics technology, including AI, machine learning, and wearable devices, alongside rising adoption in both professional leagues and collegiate sports

U.S. Sports Analytics Market Insight

The U.S. dominates the North America sports analytics market with the highest revenue share in 2024, fueled by strong demand from major sports leagues such as the NFL, NBA, MLB, and NHL, and growing awareness of performance optimization and fan engagement benefits. The trend towards data-driven decision-making and increasing regulations promoting player safety and health further boost market expansion. Sports organizations’ growing incorporation of analytics in team management and broadcasting complements the robust aftermarket for analytics solutions, creating a diverse ecosystem.

Canada Sports Analytics Market Insight

Canada is expected to witness the fastest growth rate in the North America sports analytics market, driven by increasing adoption in hockey, basketball, and other sports, alongside a focus on enhancing fan engagement and player performance in urban and suburban settings. Rising interest in advanced analytics for injury prevention and strategic planning encourages adoption. Evolving sports regulations and a growing emphasis on fan experience through personalized content further influence market growth.

Sports Analytics Market Share

The sports analytics industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Sportradar AG (Switzerland)

- St. Gallen, Switzerland (Switzerland)

- Synergy Sports (U.S.)

- DataArt (U.S.)

- SAP SE (Germany)

- TABLEAU SOFTWARE, LLC (U.S.)

- Oracle (U.S.)

- SAS Institute Inc. (U.S.)

- HCL Technologies Limited (India)

- GlobalStep, LLC (U.S.)

- TruMedia Networks, Inc. (U.S.)

- ICEBERG Sports Analytics (Australia)

- Stats Perform (U.S.)

- Experfy, Inc. (U.S.)

- Catapult Group International Ltd (Australia)

- Orreco (Ireland)

- Zebra Technologies Corp. (U.S.)

- Exasol (Germany)

- Qualitas Global (India)

What are the Recent Developments in North America Sports Analytics Market?

- In April 2025, Warner Bros. Discovery (WBD) Sports Europe, in collaboration with Amazon Web Services (AWS), unveiled the Cycling Central Intelligence (CCI) platform—an advanced generative AI-powered system designed to transform live sports broadcasting. Debuting at the WHOOP UCI Mountain Bike World Series in Araxá, Brazil, CCI integrates technologies such as Amazon Bedrock, Claude 3.5, and Amazon Textract to deliver real-time insights on riders, race histories, and venues. This innovation empowers commentators with instant access to rich data, enabling more engaging and informed storytelling that enhances the viewer experience

- In March 2025, STATSports introduced its next-generation Apex wearable device, revolutionizing athlete performance monitoring with advanced AI and machine learning capabilities. Featuring a 20Hz double sampling rate, six times faster processing, and four times more memory, the Apex delivers unmatched positional accuracy in both indoor and outdoor environments. It supports up to 70 real-time metrics, enabling on-board AI analysis for movement patterns, injury risk detection, and training optimization. With BLE connectivity, USB-C fast downloads, and UWB technology, the device sets a new standard in sports science and athlete tracking

- In April 2024, Gemini Sports Analytics raised an additional USD 3.1 million in a funding round led by Will Ventures, with continued support from Eberg Capital and Social Leverage. This investment aims to strengthen Gemini’s AI-driven sports analytics platform, which delivers predictive insights for roster management, player development, and on-field strategy. The funding will support hiring technical leadership, expanding customer support, and growing partnerships across the data and AI ecosystem. Gemini’s innovative approach is helping professional teams transition from traditional analytics to automated, real-time decision-making tools

- In December 2024, Stats Perform expanded its long-term agreement with Football DataCo (FDC), solidifying its role as the exclusive certified sports analytics provider for all FDC competitions. Under this enhanced partnership, Stats Perform’s Opta brand will continue to deliver official statistical data and now serve as the authorized insights vendor, offering AI-powered analytics for leagues including the Premier League, EFL, SPFL, and Scottish Women’s Premier League. Starting with the 2025/26 season, OptaAI tools will generate advanced insights to enrich broadcasts, deepen fan engagement, and elevate storytelling across media platforms

- In February 2024, Infinite Athlete and Gemini Sports Analytics formed a strategic partnership to develop a cutting-edge AI-powered sports platform aimed at transforming decision-making across professional sports. By integrating Infinite Athlete’s FusionFeed™ technology with Gemini’s AI-driven analytics, the platform enables teams to streamline data ingestion, enhance recruitment strategies, and optimize performance. Designed for use across multiple sports, the collaboration empowers coaching staffs and front offices with faster, more accurate insights—supporting smarter roster management, player development, and tactical planning. This alliance reflects the growing demand for automated, data-rich solutions in modern sports operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.