North America Textured Soy Protein Market

Market Size in USD Billion

CAGR :

%

USD

100.41 Billion

USD

178.81 Billion

2024

2032

USD

100.41 Billion

USD

178.81 Billion

2024

2032

| 2025 –2032 | |

| USD 100.41 Billion | |

| USD 178.81 Billion | |

|

|

|

|

Textured Soy Protein Market Size

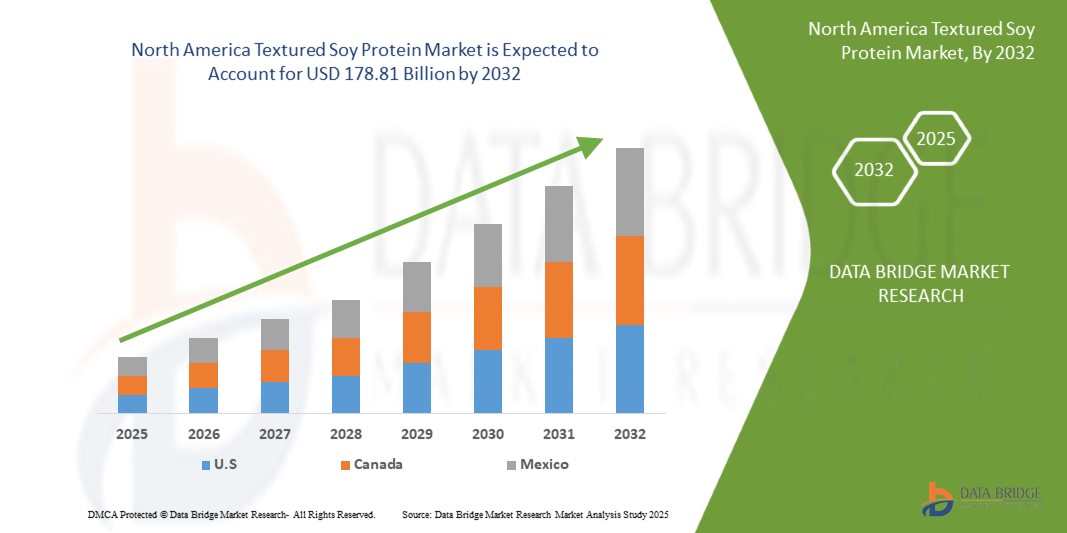

- The North America textured soy protein market was valued at USD 100.41 billion in 2024 and is expected to reach USD 178.81 billion by 2032, at a CAGR of 7.5% during the forecast period

- The market growth is largely fueled by the increased focus on sustainability-driven formulation and innovation. This growth is driven by factors such as increasing demand for meat substitutes in processed food products

Textured Soy Protein Market Analysis

- Textured soy protein (TSP) is witnessing robust regional demand, fuelled by the rising shift toward plant-based diets and the increasing need for sustainable and affordable protein sources. Its growing adoption across food and beverage applications—especially in meat analogs, ready meals, and processed foods—is accelerating market expansion. Health-conscious consumers, flexitarians, and expanding vegan product lines are key factors supporting this growth

- TSP is utilized across various industries, primarily in food and beverage applications as a meat substitute due to its fibrous texture and high protein content. It also finds applications in dietary supplements, animal feed, and personal care products owing to its functional properties such as water absorption, emulsification, and protein fortification. Its low cost, long shelf life, and versatility make it an ideal ingredient in cost-sensitive and nutrition-focused markets

- U.S. dominated the North America textured soy protein market. This dominance is attributed to its vast soy processing capacity, strong domestic consumption of plant-based protein products, and widespread integration of TSP in both traditional and modern food applications.

- U.S. is expected to witness the highest CAGR in the textured soy protein market during the forecast period. The country's large population, rising health awareness, and increasing adoption of meat substitutes have fueled steady demand growth

- Textured soy protein isolates (More Than 70%) segment dominated the market due to its high protein content, superior functional properties, and increasing demand for clean-label, plant-based protein ingredients in food and beverage applications

Report Scope and Textured Soy Protein Market Segmentation

|

Attributes |

Textured Soy Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Textured Soy Protein Market Trends

“Rising Adoption of Plant-Based Diets”

- A growing trend in the North America textured soy protein (TSP) market is the increased focus on sustainability-driven formulation and innovation. As industries and consumers alike place greater emphasis on environmental responsibility, manufacturers are reformulating products to align with eco-friendly practices without compromising nutritional value or performance. TSP, being a plant-based protein, already holds an advantage due to its significantly lower environmental impact compared to animal-based proteins—requiring less water, land, and generating fewer greenhouse gas emissions

- Leading companies are incorporating sustainable sourcing and processing practices to strengthen their market position. For instance, there is a rise in the use of non-GMO soybeans and organic farming methods to meet the growing demand for clean-label and responsibly produced foods. In addition, the use of byproducts from soy oil extraction in TSP production reflects a move toward circular processing and waste minimization

- Energy-efficient manufacturing technologies are also gaining traction, with producers optimizing drying, extrusion, and packaging processes to reduce energy consumption and emissions. These developments are particularly important for food and beverage companies seeking to improve their sustainability metrics while offering high-protein meat alternatives

- For instance In July 2024, Nestlé launched Maggi Rindecarne in Chile—a soy-based meat extender blending soy and spices for affordable hybrid meals

- The demand for environmentally certified ingredients—compliant with global standards such as USDA Organic, EU Organic, and other sustainability certifications—is driving innovation in TSP formulations. As brands across retail, foodservice, and manufacturing sectors seek to enhance their sustainability credentials, textured soy protein is becoming a key ingredient due to its balance of performance, affordability, and eco-friendlines

- This trend is especially prominent in North America and Europe, where regulatory and consumer pressure is prompting reformulation and sourcing shifts across the protein supply chain. As a result, sustainable TSP offerings are emerging as both a competitive advantage and a market necessity, shaping product development strategies for years to come

Textured Soy Protein Market Dynamics

Driver

“Increasing Demand for Meat Substitutes in Processed Food Products”

- A key driver in the North America textured soy protein (TSP) market is the increasing demand for meat substitutes in processed food products. As consumers continue to prioritize health, sustainability, and ethical food choices, manufacturers are integrating plant-based proteins such as TSP into a wide variety of ready-to-eat and convenience foods. TSP stands out as a cost-effective, versatile, and high-functionality alternative that mimics the texture and sensory attributes of real meat

- Its fibrous structure allows TSP to closely replicate the chew and mouthfeel of meat, making it ideal for products such as sausages, patties, nuggets, canned meals, and frozen entrées. In addition, its excellent moisture retention and flavor absorption qualities enhance the eating experience, making it a preferred ingredient in plant-based meat analogs

- The growing flexitarian demographic—consumers who reduce but do not eliminate meat intake—is also fueling this trend. This group is increasingly looking for convenient, protein-rich processed foods that support their dietary goals. TSP provides manufacturers with a reliable and affordable solution to deliver meat substitutes that meet consumer expectations on taste, nutrition, and texture without increasing production costs.

- In February 2024, Quorn partnered with the University of Teesside to explore more sustainable and nutritious plant-based meat technologies, including those incorporating TSP. In October 2024, Nasoya launched Plantspired Plant-Based Chick’n, offering pre-seasoned bites made from soy and textured vegetable proteins with 22 grams of protein per serving.

- The increasing use of TSP in processed foods reflects a broader shift in consumer behavior and food innovation. With its affordability, adaptability, and similarity to meat, TSP is becoming a foundational ingredient in the growing market for plant-based meat alternatives.

Restraint/Challenge

“Allergenicity Of Soy Limiting Consumer Acceptance”

- A notable restraint in the North America textured soy protein (TSP) market is the allergenic nature of soy, which continues to limit consumer acceptance despite TSP's nutritional and functional benefits. Soy ranks among the top eight food allergens globally, and even minimal exposure can lead to allergic reactions, ranging from mild symptoms to severe anaphylaxis, particularly in infants and young children. This risk discourages many consumers and complicates product development for manufacturers aiming for mass-market appeal

- To mitigate these challenges, food producers are increasingly exploring alternative plant-based proteins such as pea, rice, and chickpea, which are generally considered less allergenic. These alternatives are often positioned as “allergen-free” or “clean-label,” appealing to health-conscious and sensitive consumers while allowing brands to tap into a broader, more inclusive market segment

- Strict regulatory frameworks requiring clear allergen labeling, particularly concerning soy, further influence consumer decisions. Although such transparency enhances food safety, it can also dissuade potential buyers from choosing soy-based products such as TSP due to heightened awareness of allergen risks. This regulatory landscape places soy-derived ingredients at a relative disadvantage compared to more allergen-neutral options

- Despite its affordability, protein content, and sustainability profile, TSP faces a significant hurdle in gaining widespread market penetration due to concerns surrounding soy allergies. Until scientific advancements succeed in reducing the allergenic properties of soy, this limitation is expected to persist and influence product strategy across the industry

- For instance, in November 2024, an article published by Elsevier Inc. highlighted a case of food-dependent exercise-induced anaphylaxis caused by hidden soy ingredients in processed foods, illustrating the difficulties consumers face in detecting allergens. Similarly, in December 2022, the Asthma and Allergy Foundation of America, via Kids with Food Allergies, emphasized the need for complete avoidance of soy in children with allergies, reinforcing the need for alternative ingredients in pediatric nutrition

- Overall, allergen concerns surrounding soy present a considerable restraint to the textured soy protein market, prompting a shift among manufacturers toward hypoallergenic alternatives and driving innovation in allergen-free product development

Textured Soy Protein Market Scope

The market is segmented on the basis of type, form, nature, function, and application.

- By Type

On the basis of type, the textured soy protein market is segmented into Textured Soy Protein Isolates (more than 70% protein content), Textured Soy Protein Concentrates (65–70% protein content), and Textured Soy Protein Flour (50–65% protein content). The Textured Soy Protein Isolates (more than 70% protein content) segment accounted for the largest revenue share in 2024 due to its optimal balance of protein content, cost-efficiency, and suitability in various processed food products such as meat substitutes, ready-to-eat meals, and snacks. Its ability to absorb flavors and mimic meat-like textures makes it a go-to choice for manufacturers targeting flexitarian and vegetarian consumers.

The Textured Soy Protein Isolates (more than 70% protein content) segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand for high-protein food formulations in dietary supplements, sports nutrition, and functional foods. Isolates offer superior purity and digestibility, making them ideal for protein-fortified products in health-conscious and athletic demographics.

- By Form

On the basis of form, the textured soy protein market is segmented into dry and liquid. The dry form dominated in 2024, owing to its long shelf life, easy storage, and convenience in bulk transportation. It is widely preferred by food manufacturers for large-scale formulations of burgers, sausages, and meal extenders.

The liquid form segment is expected to witness the fastest CAGR through 2032, supported by innovations in ready-to-cook and instant food applications. Liquid forms offer quicker preparation, better dispersion in food matrices, and are gaining traction in foodservice and catering sectors.

- By Nature

On the basis of nature, the textured soy protein market is segmented into conventional and organic. The conventional segment held the largest market share in 2024 due to its wide availability, lower production costs, and extensive use in mainstream food processing. Its competitive pricing makes it suitable for both emerging and developed markets.

The organic segment is anticipated to expand at the fastest CAGR from 2025 to 2032, driven by growing consumer preference for clean-label, non-GMO, and sustainably sourced products. Regulatory support and premium positioning in the health food sector

- By Function

On the basis of function, the textured soy protein market is segmented into water & fat absorption, texturizing agent, emulsifier, binding agent, protein fortification, gelling agent, flavoring agent, and others. The texturizing agent segment accounted for the highest revenue in 2024, attributed to the essential role of TSP in replicating the fibrous and chewy texture of meat in plant-based alternatives. Its performance in texture retention and flavor binding supports its use in a wide range of processed foods.

The protein fortification segment is projected to grow at the fastest CAGR during the forecast period, fueled by increasing demand for protein-enriched snacks, beverages, and nutritional bars. The ability of TSP to enhance the nutritional profile of food without altering taste or structure makes it highly valuable in the functional food space.

- By Application

On the basis of application, the textured soy protein market is segmented into food & beverages, personal care & cosmetics, dietary supplements, animal feed, pharmaceuticals, and others. The food & beverages segment captured the largest share in 2024, due to the rising demand for plant-based meat analogs, convenience foods, and high-protein meal options. TSP is widely used in burgers, nuggets, sauces, and meal kits due to its affordability and versatility.

The dietary supplements segment is expected to record the fastest CAGR from 2025 to 2032, as consumers increasingly seek plant-based protein alternatives for muscle building, weight management, and wellness. TSP’s high protein concentration and amino acid profile make it a natural fit for protein powders, bars, and functional snacks.

Textured Soy Protein Market Regional Analysis

- North America dominated the North America textured soy protein market with a revenue share of 48.68% in 2024, fueled by the growing consumer shift toward plant-based diets, increased health awareness, and strong demand for meat alternatives across the U.S. and Canada

- The region benefits from a well-established food processing industry, widespread availability of soy-based ingredients, and rising vegan and flexitarian populations, all contributing to the expanding adoption of textured soy protein in processed foods, snacks, and dietary supplements

- Furthermore, leading food manufacturers and brands are investing in clean-label, high-protein, and sustainable product innovations, incorporating TSP into a variety of applications such as ready-to-eat meals, frozen foods, and protein-fortified products. Regulatory support for plant-based claims and consumer preference for high-nutrition, allergen-conscious alternatives continue to drive market momentum.

U.S. Textured Soy Protein Market Insight

The U.S. textured soy protein market accounted for the largest revenue share of 63.56% in North America in 2024, driven by strong demand for plant-based meat alternatives, growing health consciousness, and the mainstream adoption of flexitarian and vegan diets. The country’s well-developed food processing industry and innovation in meat substitutes have positioned TSP as a go-to ingredient for high-protein, affordable, and clean-label products. The presence of major players focused on soy-based formulations and increasing retail availability of TSP-enhanced foods are supporting robust market growth.

- Canada Textured Soy Protein Market Insight

The Canada textured soy protein market remains a significant player due to increasing consumer preference for clean-label, high-protein, and sustainable food products. The country’s vibrant plant-based food ecosystem and aggressive innovation in alternative proteins have created a fertile environment for TSP-based applications across ready meals, snacks, and meat substitutes. In addition, consumer awareness around ethical sourcing and carbon reduction is further bolstering the appeal of soy-based proteins.

The Major Market Leaders Operating in the Market Are:

- Sun Nutrafoods (India)

- Shandong Yuxin Biotechnology Co., Ltd (China)

- Linyi Shansong Biological Products Co., Ltd. (China)

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- Fooding Group Limited (China)

- Tianwei Biotechnology Co., Ltd. (China)

- BIOWAY INDUSTRIAL GROUP LTD (China)

- Xi'an Demeter Biotech Co., Ltd. (China)

- Taj Agro International (Taj Pharma Group) (India)

- Shandong Wonderful Biotech Co., Ltd (China)

- Foodchem International Corporation (China)

- International Flavors & Fragrances Inc. (U.S.)

- Bunge (U.S.)

- Dalian JustLong Imp. & Exp. Co., Ltd (China)

- BRF (Brazil)

- Crown Soya Protein Group Company (China)

- Sonic Biochem (India)

- FUJI OIL HOLDINGS INC. (Japan)

- Prinova Group LLC. (U.S.)

- Kriti Nutrients (India)

Latest Developments in North America Textured Soy Protein Market

- In September 2022, ADM inaugurated a new extrusion facility in Serbia to bolster the production of non-GMO textured soy proteins. This strategic move aims to meet the escalating demand for meat alternatives in Europe and the Middle East. The facility sources 90% of its soybeans locally, within a 100 km radius, ensuring a sustainable supply chain. Advanced extrusion and texturizing equipment at the plant enable rapid development of plant-based protein products with desirable texture and taste

- In July 2024, Bunge has launched Beleaf PlantBetter in North America, a new plant-based protein line designed to meet growing consumer demand for sustainable and nutritious options. This strategic move enhances Bunge’s product portfolio, strengthens its market position, and aligns with its commitment to innovation and sustainability in the food industry.

- In July 2024, Bunge has launched Beleaf PlantBetter in North America, a new plant-based protein line designed to meet growing consumer demand for sustainable and nutritious options. This strategic move enhances Bunge’s product portfolio, strengthens its market position, and aligns with its commitment to innovation and sustainability in the food industry.

- In May 2024, Foodchem International Corporation participated in the China (Beijing)-Saudi Arabia Agricultural Industry and Sustainable Development Forum, strengthening its role as a key strategic partner in Saudi Arabia’s food and animal nutrition sectors. The company engaged in high-level dialogues with Saudi and Chinese officials to promote sustainable agricultural development and signed cooperation agreements contributing to the forum’s USD 4 billion total. Foodchem emphasized its commitment to supporting Saudi Vision 2030 through advanced nutrition solutions and climate-resilient food technologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 BARGAINING POWER OF SUPPLIERS

4.1.2 BARGAINING POWER OF BUYERS

4.1.3 THREAT OF NEW ENTRANTS

4.1.4 THREAT OF SUBSTITUTE

4.1.5 INTENSITY OF COMPETITIVE RIVALRY

4.2 PRICING ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL COLLECTION

4.3.2 PRE-PROCESSING AND TRANSPORTATION

4.3.3 PROCESSING AND FORMULATION

4.3.4 PACKAGING AND LABELING

4.3.5 MARKETING AND DISTRIBUTION

4.4 BRAND OUTLOOK

4.4.1 BRAND COMPARITIVE ANALYSIS OF NORTH AMERICA TEXTURED SOY PROTEIN MARKET

4.4.2 PRODUCT VS BRAND OVERVIEW

4.4.2.1 PRODUCT OVERVIEW

4.4.2.2 BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.6 COST ASSOCIATED WITH IMPORTS/EXPORTS

4.6.1 LOGISTICS & FREIGHT

4.6.2 MANUFACTURING/PROCESSING COST

4.6.3 EXPORT COST DRIVERS

4.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.7.1 HEALTH AND NUTRITION AWARENESS

4.7.2 PRICE SENSITIVITY

4.7.3 PRODUCT QUALITY AND TASTE

4.7.4 CLEAN LABEL AND INGREDIENTS TRANSPARENCY

4.7.5 FUNCTIONAL APPLICATIONS

4.7.6 BRAND REPUTATION AND TRUST

4.7.7 AVAILABILITY AND DISTRIBUTION

4.7.8 CULTURAL AND REGIONAL PREFERENCES

4.7.9 MARKETING AND PRODUCT EDUCATION

4.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.9 IMPACT OF ECONOMIC SLOWDOWN ON THE NORTH AMERICA TEXTURED SOY PROTEIN MARKET

4.9.1 IMPACT OF PRICE

4.9.2 IMPACT ON SUPPLY CHAIN

4.9.3 IMPACT ON SHIPMENT

4.9.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.1 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.11 INNOVATIONS

4.11.1 SMALL-SCALE MANUFACTURING UNITS

4.11.2 MEDIUM-SCALE MANUFACTURING UNITS

4.11.3 LARGE INDUSTRIAL UNITS

4.11.4 CONCLUSION

4.12 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.14 RAW MATERIAL SOURCING ANALYSIS

4.15 SUPPLY CHAIN ANALYSIS

5 TARIFFS AND THEIR IMPACT ON MARKET

5.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.2.1 VENDOR SELECTION CRITERIA DYNAMICS

5.3 IMPACT ON SUPPLY CHAIN

5.3.1 RAW MATERIAL PROCUREMENT

5.3.2 MANUFACTURING AND PRODUCTION

5.3.3 LOGISTICS AND DISTRIBUTION

5.3.4 PRICE PITCHING AND POSITION OF MARKET

5.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.4.1 SUPPLY CHAIN OPTIMIZATION

5.4.2 JOINT VENTURE ESTABLISHMENTS

5.5 IMPACT ON PRICES

5.6 REGULATORY INCLINATION

5.6.1 GEOPOLITICAL SITUATION

5.6.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.6.2.1 FREE TRADE AGREEMENTS

5.6.2.2 ALLIANCE ESTABLISHMENTS

5.6.3 STATUS ACCREDITATION (INCLUDING MFN)

5.6.4 DOMESTIC COURSE OF CORRECTION

5.6.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.6.5 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING ADOPTION OF PLANT-BASED DIETS

7.1.2 INCREASING DEMAND FOR MEAT SUBSTITUTES IN PROCESSED FOOD PRODUCTS

7.1.3 ADVANCEMENTS IN FOOD PROCESSING TECHNOLOGY IMPROVING TSP TEXTURE AND FLAVOR

7.1.4 GROWTH OF VEGAN AND FLEXITARIAN POPULATIONS GLOBALLY

7.2 RESTRAINTS

7.2.1 ALLERGENICITY OF SOY LIMITING CONSUMER ACCEPTANCE

7.2.2 NEGATIVE CONSUMER PERCEPTION REGARDING GENETICALLY MODIFIED (GMO) SOYBEANS

7.3 OPPORTUNITIES

7.3.1 GROWING DEMAND FOR CLEAN-LABEL, SUSTAINABLE, AND PLANT-BASED PROTEIN INGREDIENTS

7.3.2 PRODUCT INNOVATION IN FLAVORED AND READY-TO-EAT TSP-BASED MEALS

7.3.3 COLLABORATIONS WITH FAST FOOD CHAINS AND FOOD SERVICE PROVIDERS TO DEVELOP PLANT-BASED MENUS

7.4 CHALLENGES

7.4.1 INTENSE COMPETITION FROM ALTERNATIVE PLANT PROTEINS

7.4.2 COMPLEX INTERNATIONAL REGULATIONS REGARDING GMO CONTENT, LABELING, AND HEALTH CLAIMS

8 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY TYPE

8.1 OVERVIEW

8.2 TEXTURED SOY PROTEIN ISOLATES (MORE THAN 70%)

8.3 TEXTURED SOY PROTEIN CONCENTRATES (65-70%)

8.4 TEXTURED SOY PROTEIN FLOUR (50 - 65%)

9 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY FUNCTION

11.1 OVERVIEW

11.2 WATER & FAT ABSORPTION

11.3 TEXTURIZING AGENT

11.4 EMULSIFIER

11.5 BINDING AGENT

11.6 PROTEIN FORTIFICATION

11.7 GELLING AGENT

11.8 FLAVORING AGENT

11.9 OTHERS

12 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.3 PERSONAL CARE & COSMETICS

12.4 DIETARY SUPPLEMENTS

12.5 ANIMAL FEED

12.6 PHARMACEUTICALS

12.7 OTHERS

13 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 CARGIL, INCORPORATED

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 BUNGE.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 INTERNATIONAL FLAVORS & FRAGRANCES INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 WILMAR INTERNATIONAL LTD

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 BIOWAY INDUSTRIAL GROUP LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BRF

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CROWN SOYA PROTEIN GROUP COMPANY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DALIAN JUSTLONG IMP.& EXP. CO., LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 ERIC INDIA AGRO AND FOOD PVT LTD

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 FOODRICH SOYA CO.,LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FUJI OIL HOLDINGS INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FOODCHEM INTERNATIONAL CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 FOODING GROUP LIMITED

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 GALPRO SRL

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 KRITI NUTRIENTS

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT/ PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 LINYI SHANSONG BIOLOGICAL PRODUCTS CO., LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NEWSEED CHEMICAL CO., LIMITED

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PRINOVA GROUP LLC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHANDONG WONDERFUL BIOTECH CO.,LTD

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SHANDONG YUXIN BIOTECHNOLOGY CO., LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SHREENIDHI OILS FOOD INGREDIENTS PVT. LTD.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SOLBAR NINGBO PROTEIN TECHNOLOGY CO.,LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 SONIC BIOCHEM

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 SOYPROTEINCN

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SUN NUTRAFOODS

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 TAJ AGRO INTERNATIONAL (TAJ PHARMA GROUP)

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 TIANWEI BIOTECHNOLOGY CO., LTD.

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 TITAN BIOTECH

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT/BRAND PORTFOLIO

16.29.4 RECENT DEVELOPMENT

16.3 XI'AN DEMETER BIOTECH CO., LTD.

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 3 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 4 NORTH AMERICA TEXTURED SOY PROTEIN ISOLATES (MORE THAN 70%) IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 5 NORTH AMERICA TEXTURED SOY PROTEIN ISOLATES (MORE THAN 70%) IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 ( KILO TONS)

TABLE 6 NORTH AMERICA TEXTURED SOY PROTEIN CONCENTRATES (65-70%) IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 7 NORTH AMERICA TEXTURED SOY PROTEIN CONCENTRATES (65-70%) IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 8 NORTH AMERICA TEXTURED SOY PROTEIN CONCENTRATES (65-70%) IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 9 NORTH AMERICA TEXTURED SOY PROTEIN CONCENTRATES (65-70%) IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 10 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 11 NORTH AMERICA DRY IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 12 NORTH AMERICA DRY IN TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 13 NORTH AMERICA LIQUID IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 14 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY NATURE, 2018-2032 (USD)

TABLE 15 NORTH AMERICA CONVENTIONAL IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 16 NORTH AMERICA ORGANIC IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 17 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 18 NORTH AMERICA WATER & FAT ABSORPTION IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 19 NORTH AMERICA TEXTURIZING AGENT IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 20 NORTH AMERICA EMULSIFIER IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 21 NORTH AMERICA BINDING AGENT IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 22 NORTH AMERICA PROTEIN FORTIFICATION IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 23 NORTH AMERICA GELLING AGENT IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 24 NORTH AMERICA FLAVORING AGENT IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 25 NORTH AMERICA OTHERS IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 26 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 27 NORTH AMERICA FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 28 NORTH AMERICA FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 29 NORTH AMERICA FOOD IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 30 NORTH AMERICA BAKERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 31 NORTH AMERICA CONFECTIONERY FOOD IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 32 NORTH AMERICA CONVENIENCE FOOD IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 33 NORTH AMERICA DAIRY PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 34 NORTH AMERICA SPORTS NUTRITION IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 35 NORTH AMERICA INFANT FORMULA IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 36 NORTH AMERICA BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 37 NORTH AMERICA FLAVORED DRINKS IN TEXTURED SOY PROTEIN MARKET, BY FLAVOR, 2018-2032 (USD)

TABLE 38 NORTH AMERICA RTD DRINKS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 39 NORTH AMERICA FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 40 NORTH AMERICA PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 41 NORTH AMERICA PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 42 NORTH AMERICA FACIAL CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 43 NORTH AMERICA HAIR CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 44 NORTH AMERICA PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 45 NORTH AMERICA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 46 NORTH AMERICA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 47 NORTH AMERICA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 48 NORTH AMERICA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 49 NORTH AMERICA ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 50 NORTH AMERICA ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 51 NORTH AMERICA POULTRY IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 52 NORTH AMERICA SWINE IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 53 NORTH AMERICA RUMINANTS IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 54 NORTH AMERICA PET IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 55 NORTH AMERICA AQUATIC ANIMAL IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 56 NORTH AMERICA FISH IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 57 NORTH AMERICA MOLLUSKS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 58 NORTH AMERICA CRUSTACEANS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 59 NORTH AMERICA ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 60 NORTH AMERICA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 61 NORTH AMERICA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 62 NORTH AMERICA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 63 NORTH AMERICA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 64 NORTH AMERICA OTHERS IN TEXTURED SOY PROTEIN MARKET, BY REGION, 2018-2032 (USD)

TABLE 65 NORTH AMERICA OTHERS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 66 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY COUNTRY, 2018-2032 (USD)

TABLE 67 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 68 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 69 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 70 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 71 NORTH AMERICA DRY IN TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 72 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY NATURE, 2018-2032 (USD)

TABLE 73 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 74 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 75 NORTH AMERICA FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 76 NORTH AMERICA FOOD IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 77 NORTH AMERICA BAKERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 78 NORTH AMERICA CONFECTIONERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 79 NORTH AMERICA CONVENIENCE FOOD IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 80 NORTH AMERICA DAIRY PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 81 NORTH AMERICA SPORTS NUTRITION IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 82 NORTH AMERICA INFANT FORMULA IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 83 NORTH AMERICA BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 84 NORTH AMERICA FLAVORED DRINKS IN TEXTURED SOY PROTEIN MARKET, BY FLAVOR, 2018-2032 (USD)

TABLE 85 NORTH AMERICA RTD DRINKS IN TEXTURED SOY PROTEIN MARKET TYPE, 2018-2032 (USD)

TABLE 86 NORTH AMERICA FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 87 NORTH AMERICA PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 88 NORTH AMERICA FACIAL CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 89 NORTH AMERICA HAIR CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 90 NORTH AMERICA PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 91 NORTH AMERICA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 92 NORTH AMERICA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 93 NORTH AMERICA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 94 NORTH AMERICA ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 95 NORTH AMERICA POULTRY IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 96 NORTH AMERICA SWINE IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 97 NORTH AMERICA RUMINANTS IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 98 NORTH AMERICA PET IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 99 NORTH AMERICA AQUATIC ANIMAL IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 100 NORTH AMERICA FISH IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 101 NORTH AMERICA MOLLUSKS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 102 NORTH AMERICA CRUSTACEANS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 103 NORTH AMERICA ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 104 NORTH AMERICA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 105 NORTH AMERICA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 106 NORTH AMERICA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 107 NORTH AMERICA OTHERS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 108 U.S. TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 109 U.S. TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 110 U.S. TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 111 U.S. DRY IN TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 112 U.S. TEXTURED SOY PROTEIN MARKET, BY NATURE, 2018-2032 (USD)

TABLE 113 U.S. TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 114 U.S. TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 115 U.S. FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 116 U.S. FOOD IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 117 U.S. BAKERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 118 U.S. CONFECTIONERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 119 U.S. CONVENIENCE FOOD IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 120 U.S. DAIRY PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 121 U.S. SPORTS NUTRITION IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 122 U.S. INFANT FORMULA IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 123 U.S. BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 124 U.S. FLAVORED DRINKS IN TEXTURED SOY PROTEIN MARKET, BY FLAVOR, 2018-2032 (USD)

TABLE 125 U.S. RTD DRINKS IN TEXTURED SOY PROTEIN MARKET TYPE, 2018-2032 (USD)

TABLE 126 U.S. FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 127 U.S. PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 128 U.S. FACIAL CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 129 U.S. HAIR CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 130 U.S. PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 131 U.S. DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 132 U.S. DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 133 U.S. DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 134 U.S. ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 135 U.S. POULTRY IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 136 U.S. SWINE IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 137 U.S. RUMINANTS IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 138 U.S. PET IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 139 U.S. AQUATIC ANIMAL IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 140 U.S. FISH IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 141 U.S. MOLLUSKS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 142 U.S. CRUSTACEANS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 143 U.S. ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 144 U.S. PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 145 U.S. PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 146 U.S. PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 147 U.S. OTHERS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 148 CANADA TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 149 CANADA TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 150 CANADA TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 151 CANADA DRY IN TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 152 CANADA TEXTURED SOY PROTEIN MARKET, BY NATURE, 2018-2032 (USD)

TABLE 153 CANADA TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 154 CANADA TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 155 CANADA FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 156 CANADA FOOD IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 157 CANADA BAKERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 158 CANADA CONFECTIONERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 159 CANADA CONVENIENCE FOOD IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 160 CANADA DAIRY PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 161 CANADA SPORTS NUTRITION IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 162 CANADA INFANT FORMULA IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 163 CANADA BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 164 CANADA FLAVORED DRINKS IN TEXTURED SOY PROTEIN MARKET, BY FLAVOR, 2018-2032 (USD)

TABLE 165 CANADA RTD DRINKS IN TEXTURED SOY PROTEIN MARKET TYPE, 2018-2032 (USD)

TABLE 166 CANADA FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 167 CANADA PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 168 CANADA FACIAL CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 169 CANADA HAIR CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 170 CANADA PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 171 CANADA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 172 CANADA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 173 CANADA DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 174 CANADA ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 175 CANADA POULTRY IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 176 CANADA SWINE IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 177 CANADA RUMINANTS IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 178 CANADA PET IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 179 CANADA AQUATIC ANIMAL IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 180 CANADA FISH IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 181 CANADA MOLLUSKS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 182 CANADA CRUSTACEANS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 183 CANADA ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 184 CANADA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 185 CANADA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 186 CANADA PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 187 CANADA OTHERS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 188 MEXICO TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 189 MEXICO TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 190 MEXICO TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 191 MEXICO DRY IN TEXTURED SOY PROTEIN MARKET, BY FORM, 2018-2032 (USD)

TABLE 192 MEXICO TEXTURED SOY PROTEIN MARKET, BY NATURE, 2018-2032 (USD)

TABLE 193 MEXICO TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 194 MEXICO TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 195 MEXICO FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 196 MEXICO FOOD IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 197 MEXICO BAKERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 198 MEXICO CONFECTIONERY IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 199 MEXICO CONVENIENCE FOOD IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 200 MEXICO DAIRY PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 201 MEXICO SPORTS NUTRITION IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 202 MEXICO INFANT FORMULA IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 203 MEXICO BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 204 MEXICO FLAVORED DRINKS IN TEXTURED SOY PROTEIN MARKET, BY FLAVOR, 2018-2032 (USD)

TABLE 205 MEXICO RTD DRINKS IN TEXTURED SOY PROTEIN MARKET TYPE, 2018-2032 (USD)

TABLE 206 MEXICO FOOD & BEVERAGES IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 207 MEXICO PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 208 MEXICO FACIAL CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 209 MEXICO HAIR CARE PRODUCTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 210 MEXICO PERSONAL CARE & COSMETICS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 211 MEXICO DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 212 MEXICO DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 213 MEXICO DIETARY SUPPLEMENTS IN TEXTURED SOY PROTEIN MARKET, BY FUNCTION, 2018-2032 (USD)

TABLE 214 MEXICO ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 215 MEXICO POULTRY IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 216 MEXICO SWINE IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 217 MEXICO RUMINANTS IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 218 MEXICO PET IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 219 MEXICO AQUATIC ANIMAL IN TEXTURED SOY PROTEIN MARKET, BY ANIMAL, 2018-2032 (USD)

TABLE 220 MEXICO FISH IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 221 MEXICO MOLLUSKS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 222 MEXICO CRUSTACEANS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 223 MEXICO ANIMAL FEED IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 224 MEXICO PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 225 MEXICO PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY PRODUCT FORM, 2018-2032 (USD)

TABLE 226 MEXICO PHARMACEUTICALS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

TABLE 227 MEXICO OTHERS IN TEXTURED SOY PROTEIN MARKET, BY TYPE, 2018-2032 (USD)

List of Figure

FIGURE 1 NORTH AMERICA TEXTURED SOY PROTEIN MARKET

FIGURE 2 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 THREE SEGMENTS COMPRISE THE NORTH AMERICA TEXTURED SOY PROTEIN MARKET, BY TYPE (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING ADOPTION OF PLANT-BASED DIETS IS EXPECTED TO DRIVE THE NORTH AMERICA TEXTURED SOY PROTEIN MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE TEXTURED SOY PROTEIN ISOLATES (MORE THAN 70%) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TEXTURED SOY PROTEIN MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 NORTH AMERICA TEXTURED SOY PROTEIN MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/TONS)

FIGURE 18 VALUE CHAIN OF NORTH AMERICA TEXTURED SOY PROTEIN MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA TEXTURED SOY PROTEIN MARKET

FIGURE 20 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: BY TYPE, 2024

FIGURE 21 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: BY FORM, 2024

FIGURE 22 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: BY NATURE, 2024

FIGURE 23 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: BY FUNCTION, 2024

FIGURE 24 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: BY APPLICATION, 2024

FIGURE 25 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: SNAPSHOT (2024)

FIGURE 26 NORTH AMERICA TEXTURED SOY PROTEIN MARKET: COMPANY SHARE 2024 (%)

North America Textured Soy Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Textured Soy Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Textured Soy Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.