Circumvent the Tariff challenges with an agile supply chain Consulting

Supply Chain Ecosystem Analysis now part of DBMR Reports

North America Tissue Towel Market, By Product Type (Rolled Towels, Folded Towels, Napkins and Luxury Towels, Boxed Towels), End-Use (Personal Care, Home Care, Healthcare, Hospitality, Commercial, Others), Distribution Channel (Direct Sales, E-Commerce, Retail Stores, Others) – Industry Trends and Forecast to 2029.

Market Analysis and Size

The worldwide tissue towel market is likely to rise significantly in the near future because of increased health and hygiene consciousness. The market for tissue towels is estimated to develop due to an increase in the number of congenital disorders, changing weather conditions, and increased urbanization. Consequently, the market growth will flourish largely over the forecasted period.

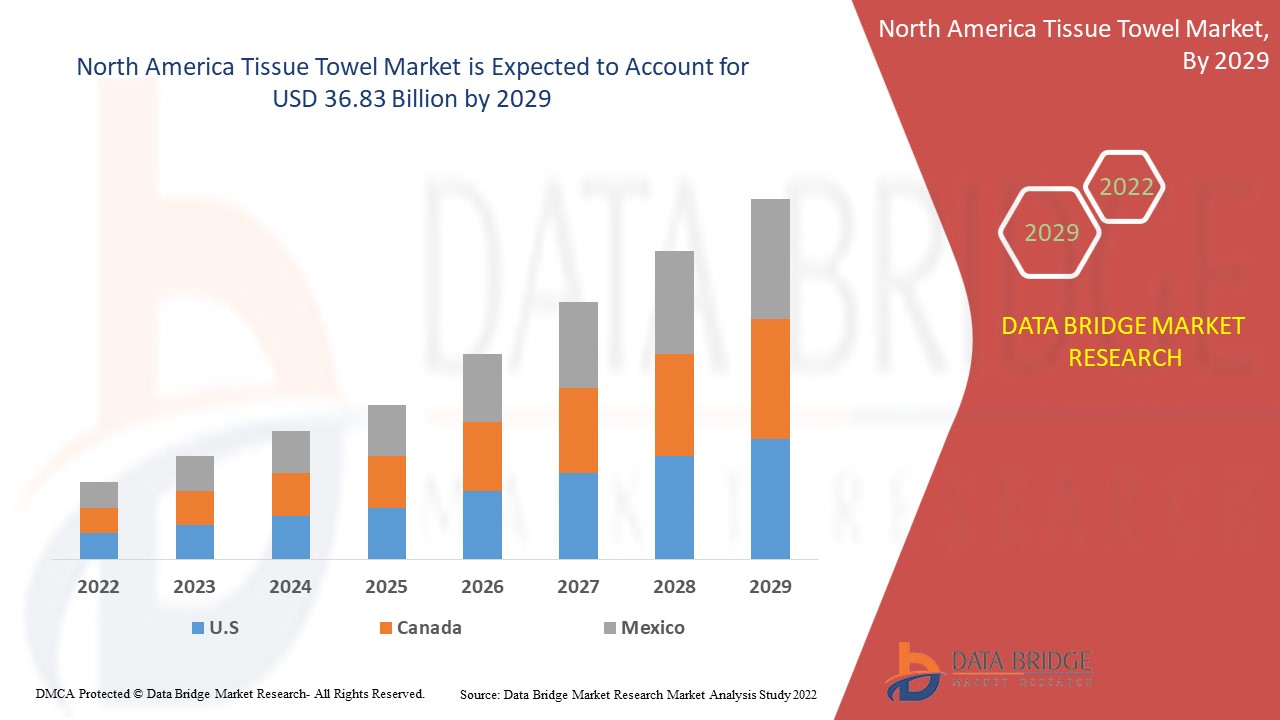

North America Tissue Towel Market was valued at USD 25 billion in 2021 and is expected to reach USD 36.83 billion by 2029, registering a CAGR of 4.40% in 2022-2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

Market Definition

Tissue towels are paper towels that are used to clean surfaces such as floors, windows, and other surfaces, as well as to dry people's hands. Because of their quick absorption technology, these items provide benefits such as prevention and cleanliness with recycling these towels. They're also known as disposable paper towels because they're only supposed to be used once and then thrown away.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada, Mexico

|

|

Market Players Covered

|

KALSINT (U.S.), Queenex (UAE), American waste & Textiles, LLC (U.S.), Riverside Paper Co. lnc. (U.S.), National Wiper Alliance lnc. (U.S.), Larsen Packaging products, lnc. (U.S.), Ovasco Industries (U.S.), Carl Hubenthal GmbH& Co. KG. (Germany), Georgia-Pacific (U.S.), METSÄ TISSUE (Finland), Procter & Gamble (U.S.), KCWW (U.S.), CARE Ratings Limited (India), HengAn (China), SHP Group (Slovakia), Grigeo (Lithuania), Essity Aktiebolag (publ) (Sweden)

|

|

Market Opportunities

|

|

Tissue Towel Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increased Demand For Tissue Towel

The tissue towel market is growing due to changing weather conditions, rising demand in other industries such as construction, and changing weather. The spike influences the tissue towel market in demand for tissue towels in emerging sectors such as outdoor activities and new regions, expansion in homes as a result of changing climatic conditions, and rising occurrences of flu and common cold increasing the demand for paper towels.

The factors such as the various benefits associated with the usage of tissue towels, including the prevention of communication of infections, the increase in the tourism and hospitality industry and the rising number of working women will further propel the growth rate of tissue towel market. Additionally, the rise in health consciousness among population, high use of these paper towels owing to its cost-effectiveness and widespread, change in consumer lifestyle combined with the rapid urbanization will also drive market value growth. The expansion of the hospitality industry and surge in disposable income of people are projected to bolster the market's growth.

Opportunities

- Eco-Friendly and Affordable Tissues

Furthermore, the development of eco-friendly biodegradable disposable tissues extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the development of affordable tablet tissues for developing countries will further expand the future growth of the tissue towel market.

Restraints/Challenges

- Concerns Regarding Environment

The growing concerns over the production of these towels, which include many pollution-causing aspects which harm environment, such as hazardous waste disposal and deforestation are projected to stymie the tissue towel market's expansion.

- Stringent Regulations

Moreover, the strengthening of regulations towards deforestation are also expected to hamper growth of the global tissue towel market.

- Raw Material Prices

Also, the fluctuation in raw material prices impacting bottom line of manufacturers is anticipated to be a demerit for the tissue towel market. Therefore, this will challenge the tissue towel market growth rate.

This tissue towel market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the tissue towel market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Tissue Towel Market

The recent outbreak of coronavirus had a positive impact on the tissue towel market as there was huge demand for the tissue towels. The rise in paper towel demand can be attributed to increased consumer awareness of the need for cleanliness and sanitization, which can be achieved using paper towels. They were primarily used for quickly wiping and drying hands and wiping areas that were potentially contaminated or regularly handled by several persons, such as door handles and cups. This product became a must-have in the consumer's list due to its ease of use, high absorption rate, and one-time use. Furthermore, several users using the same cloth towel raised the risk of virus contamination, making the paper towel a better and safer alternative.

North America Tissue Towel Market Scope

The tissue towel market is segmented on the basis of product type, end-use and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Rolled Towels

- Folded Towels

- Napkins and Luxury Towels

- Boxed Towels

End-Use

- Personal Care

- Home Care

- Healthcare

- Hospitality

- Commercial

- Others

Distribution Channel

- Direct Sales

- E-Commerce

- Retail Stores

- Others

Tissue Towel Market Regional Analysis/Insights

The tissue towel market is analyzed and market size insights and trends are provided by country, type, product type, end-use and distribution channel as referenced above.

The countries covered in the tissue towel market report are U.S., Canada and Mexico in North America.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Tissue Towel Market Share Analysis

The tissue towel market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to tissue towel market.

Some of the major players operating in the tissue towel market are

- KALSINT (U.S.)

- Queenex (UAE)

- American waste & Textiles, LLC (U.S.)

- Riverside Paper Co. lnc. (U.S.)

- National Wiper Alliance lnc. (U.S.)

- Larsen Packaging products, lnc. (U.S.)

- Ovasco Industries (U.S.)

- Carl Hubenthal GmbH& Co. KG. (Germany)

- Georgia-Pacific (U.S.)

- METSÄ TISSUE (Finland)

- Procter & Gamble (U.S.)

- KCWW (U.S.)

- CARE Ratings Limited (India)

- HengAn (China)

- SHP Group (Slovakia)

- Grigeo (Lithuania)

- Essity Aktiebolag (publ) (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TISSUE TOWEL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH LEVEL OF ABSORBENCY AS COMPARED TO OTHER ALTERNATIVES INCLUDING HOT AIR DRYERS

5.1.2 PAPER TOWEL IS MORE ENVIRONMENTALLY EFFICIENT AS COMPARED TO ELECTRIC AIR DRYERS

5.1.3 INCREASING HEALTH AWARENESS AND PREVENTION FROM CROSS-CONTAMINATION

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL DEGRADATION CAUSED DUE TO TISSUE INDUSTRIES

5.2.2 ENVIRONMENTAL CONCERNS DUE TO CUTTING DOWN OF TREES IMPACTING URBAN ECOSYSTEM

5.2.3 STRENGTHENING OF REGULATIONS TOWARDS DEFORESTATION

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF ECO-FRIENDLY BIODEGRADABLE DISPOSABLE TISSUES

5.3.2 DEVELOPMENT OF AFFORDABLE TABLET TISSUES FOR DEVELOPING COUNTRIES

5.4 CHALLENGE

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES IMPACTING BOTTOM LINE OF MANUFACTURERS

6 IMPACT OF COVID-19 PANDEMIC ON THE NORTH AMERICA TISSUE TOWEL MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA TISSUE TOWEL MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA TISSUE TOWEL MARKET

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 ROLLED TOWELS

7.2.1 STANDARD ROLLS

7.2.2 CENTER PULL ROLLS

7.3 FOLDED TOWELS

7.3.1 CENTREFOLD

7.3.2 MULTI-FOLD

7.4 BOXED TOWELS

7.5 NAPKINS AND LUXURY TOWELS

8 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE

8.1 OVERVIEW

8.2 HOME CARE

8.3 COMMERCIAL

8.3.1 OFFICE

8.3.2 RESTAURANTS

8.4 PERSONAL CARE

8.5 HEALTH CARE

8.6 HOSPITALITY

8.7 OTHERS

8.7.1 EDUCATION & RESEARCH INSTITUTES

8.7.2 PUBLIC WASHROOMS

9 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL STORES

9.2.1 HYPERMARKETS

9.2.2 SUPERMARKETS

9.2.3 WHOLESALE STORE

9.2.4 SPECIALTY STORES

9.2.5 OTHERS

9.3 E-COMMERCE

9.4 DIRECT SALES

9.5 OTHERS

10 NORTH AMERICA TISSUE TOWEL MARKET BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA TISSUE TOWEL MARKET, COMPANY LANDSCAPE

11.1 MERGERS & ACQUISITIONS

11.2 EXPANSIONS

11.3 NEW PRODUCT DEVELOPMENTS

11.4 PARTNERSHIP

12 SWOT AND DATABRIDGE MARKET RESEARCH ANALYSIS: NORTH AMERICA TISSUE TOWEL MARKET

12.1 SWOT ANALYSIS

12.1.1 STRENGTH: - STRONG GEOGRAPHICAL PRESENCE

12.1.2 WEAKNESS: - VOLATILE INPUT PRICES

12.1.3 OPPORTUNITY: - STRATEGIC ACQUISITIONS

12.1.4 THREAT: - AVAILABLITY OF SUBSTITUTES

12.2 DATABRIDGE MARKET RESEARCH ANALYSIS: NORTH AMERICA TISSUE TOWEL MARKET

13 COMPANY PROFILE

13.1 GEORGIA-PACIFIC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 PROCTER & GAMBLE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 KCWW

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 KP TISSUE INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 METSÄ TISSUE (A SUBSIDIARY OF METSÄ GROUP)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 CASCADES INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATE

13.7 IRVING CONSUMER PRODUCTS LIMITED.

13.7.1 COMPANY SNAPSHOT

13.7.2 BRAND PORTFOLIO

13.7.3 RECENT UPDATES

13.8 ASALEO CARE LIMITED

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 BRAND PORTFOLIO

13.8.4 RECENT UPDATE

13.9 BLUE RIDGE TISSUE CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 ESSITY AKTIEBOLAG (PUBL).

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 BRAND PORTFOLIO

13.10.4 RECENT UPDATES

13.11 FLOWER CITY TISSUE MILLS CO

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 GLOBAL TISSUE GROUP, INC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 GORHAM PAPER & TISSUE.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 NOVA TISSUE

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 WEPA HYGIENEPRODUKTE GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATE

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF TOILET OR FACIAL TISSUE STOCK, TOWEL OR NAPKIN STOCK AND SIMILAR PAPER FOR HOUSEHOLD OR SANITARY PURPOSES, CELLULOSE WADDING AND WEBS OF CELLULOSE FIBRES, WHETHER OR NOT CREPED, CRINKLED, EMBOSSED, PERFORATED, SURFACE-COLOURED, SURFACE-DECORATED OR PRINTED, IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE: 4803 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TOILET OR FACIAL TISSUE STOCK, TOWEL OR NAPKIN STOCK AND SIMILAR PAPER FOR HOUSEHOLD OR SANITARY PURPOSES, CELLULOSE WADDING AND WEBS OF CELLULOSE FIBRES, WHETHER OR NOT CREPED, CRINKLED, EMBOSSED, PERFORATED, SURFACE-COLOURED, SURFACE-DECORATED OR PRINTED, IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE: 4803 (USD THOUSAND)

TABLE 3 SUMMARY OF PRIMARY OR ESSENTIAL PROPERTIES OF AWAY FROM HOME (AFH) TISSUE PRODUCTS IN THE U.S. MARKET (2005)

TABLE 4 RANK ORDER 0F ENVIRONMEMNTAL IMPACT OF THE PRODUCTS

TABLE 5 NORTH AMERICA TREE GRADES CONSUMPTION, BY TISSUE TOWEL TYPE (2019)

TABLE 6 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 7 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 8 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 9 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 10 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 11 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 12 NORTH AMERICA FOLDED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 13 NORTH AMERICA FOLDED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 14 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 15 NORTH AMERICA FOLDED TOWEL IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 16 NORTH AMERICA BOXED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 17 NORTH AMERICA BOXED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 18 NORTH AMERICA NAPKINS AND LUXURY TOWELS PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 19 NORTH AMERICA NAPKINS AND LUXURY TOWELS PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 20 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 21 NORTH AMERICA HOME CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 22 NORTH AMERICA COMMERCIAL END-USE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 23 NORTH AMERICA COMMERCIAL END-USE IN TISSUE TOWEL MARKET, BY COMMERCIAL TYPE, 2019-2027 (USD MILLION)

TABLE 24 NORTH AMERICA PEESONAL CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 25 NORTH AMERICA HEALTH CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALITY IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 29 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL STORE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 31 NORTH AMERICA RETAIL STORE IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLIO N)

TABLE 32 NORTH AMERICA E-COMMERCE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 33 NORTH AMERICA DIRECT SALES IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 34 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 35 NORTH AMERICA TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 36 NORTH AMERICA TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 37 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 38 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 39 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 40 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 41 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027, 2019-2027 (THOUSAND TONS)

TABLE 42 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 43 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 44 NORTH AMERICA COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 45 NORTH AMERICA COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 46 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 47 NORTH AMERICA RETAIL STORE TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 48 U.S. TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 49 U.S. TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 50 U.S. ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 51 U.S ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 52 U.S. FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 53 U.S FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 54 U.S. TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 55 U.S. COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 56 U.S. COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 57 U.S. TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 58 U.S. RETAIL STORE IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 59 CANADA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 60 CANADA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 61 CANADA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 62 CANADA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 63 CANADA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 64 CANADA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 65 CANADA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 66 CANADA COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 67 CANADA COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 68 CANADA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 69 CANADA RETAIL STORES IN TISSUE TOWEL MARKET, BY RETAIL STORES DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 70 MEXICO TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 71 MEXICO TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 72 MEXICO ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 73 MEXICO ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 74 MEXICO FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 75 MEXICO FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 76 MEXICO TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 77 MEXICO COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 78 MEXICO COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 79 MEXICO TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 80 MEXICO RETAIL STORES IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA TISSUE TOWEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TISSUE TOWEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TISSUE TOWEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TISSUE TOWEL MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TISSUE TOWEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TISSUE TOWEL MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA TISSUE TOWEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TISSUE TOWEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TISSUE TOWEL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 10 NORTH AMERICA TISSUE TOWEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA TISSUE TOWEL MARKET: SEGMENTATION

FIGURE 12 HIGH LEVEL OF ABSORBENCY AS COMPARED TO OTHER ALTERNATIVES INCLUDING HOT AIR DRYERS IS DRIVING THE NORTH AMERICA TISSUE TOWEL MARKET IN THE FORECAST PERIOD OF 2021 TO 2027

FIGURE 13 ROLLED TOWELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TISSUE TOWEL MARKET IN 2021 & 2027

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA TISSUE TOWEL MARKET

FIGURE 15 GLOBAL PER CAPITA TOILET PAPER ROLLS CONSUMPTION, BY COUNTRY (2019)

FIGURE 16 GLOBAL FOREST COVER LOSS, SQ. KM (2000-2005)

FIGURE 17 GLOBAL PER CAPITA CONSUMPTION OF TISSUE, BY REGIONS, 2017 (KG)

FIGURE 18 NORTH AMERICA TISSUE TOWEL MARKET: BY PRODUCT TYPE, 2020

FIGURE 19 NORTH AMERICA TISSUE TOWEL MARKET: BY END-USE, 2020

FIGURE 20 NORTH AMERICA TISSUE TOWEL MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 21 NORTH AMERICA TISSUE TOWEL MARKET: SNAPSHOT (2020)

FIGURE 22 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2020)

FIGURE 23 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2021 & 2027)

FIGURE 24 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA TISSUE TOWEL MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 26 NORTH AMERICA TISSUE TOWEL MARKET: COMPANY SHARE 2019 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.