North America Transplant Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

3.21 Billion

USD

5.47 Billion

2025

2033

USD

3.21 Billion

USD

5.47 Billion

2025

2033

| 2026 –2033 | |

| USD 3.21 Billion | |

| USD 5.47 Billion | |

|

|

|

|

North America Transplant Diagnostics Market Size

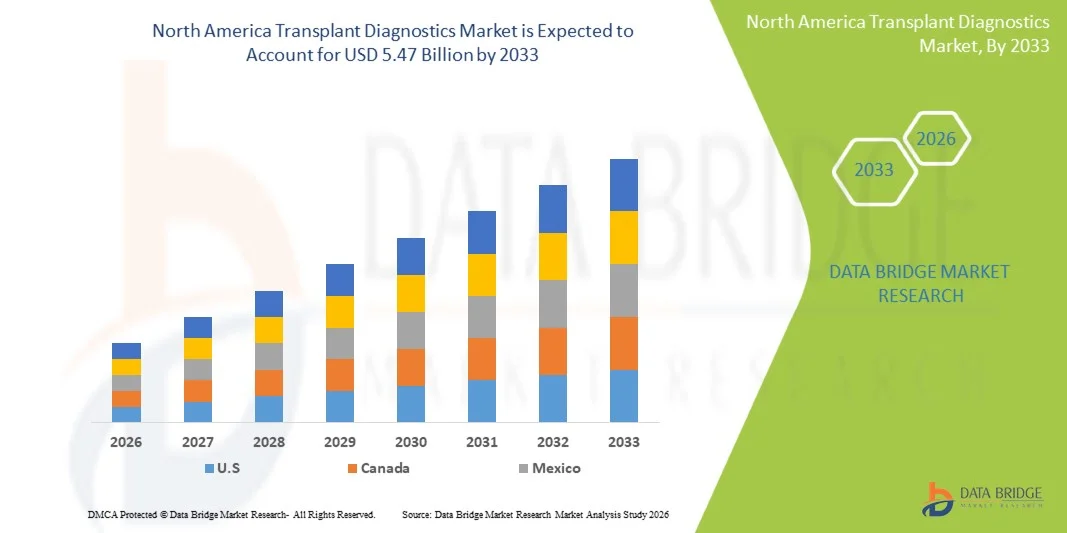

- The North America transplant diagnostics market size was valued at USD 3.21 billion in 2025 and is expected to reach USD 5.47 billion by 2033, at a CAGR of 6.9% during the forecast period

- The market growth is largely driven by the increasing number of organ transplant procedures, strong healthcare infrastructure, and the rapid adoption of advanced molecular and genetic diagnostic technologies, which are improving precision and speed in donor‑recipient matching and rejection monitoring

- Furthermore, rising demand for accurate, early post‑transplant monitoring, coupled with supportive reimbursement frameworks and growing investments in transplant research, is establishing transplant diagnostics as an essential component of modern transplant care. These converging factors are accelerating uptake of advanced diagnostic solutions across hospitals and reference laboratories, significantly boosting the industry’s growth in North America

North America Transplant Diagnostics Market Analysis

- Transplant diagnostics, offering molecular, genetic, and immunological testing for organ and tissue transplants, are increasingly vital components of modern transplant care in both hospital and laboratory settings due to their role in accurate donor‑recipient matching, early detection of transplant rejection, and post-transplant monitoring

- The escalating demand for transplant diagnostics is primarily fueled by the rising number of organ and stem cell transplants, growing adoption of advanced diagnostic technologies, and increasing awareness among clinicians and patients about the importance of precise and timely monitoring for transplant success

- The United States dominated the North America transplant diagnostics market with the largest revenue share of 88.7% in 2025, characterized by advanced healthcare infrastructure, widespread adoption of PCR-based and sequencing-based molecular assays, and a strong presence of leading industry players

- Canada is expected to witness significant growth during the forecast period due to increasing organ transplant procedures, supportive healthcare policies, and rising investments in diagnostic research and laboratory infrastructure

- Transplant diagnostic instruments segment dominated the North America market with a market share of 44.9% in 2025, driven by their critical role in enabling high-precision testing, compatibility with advanced molecular assays, and growing demand across hospitals, academic institutes, and commercial service providers

Report Scope and North America Transplant Diagnostics Market Segmentation

|

Attributes |

North America Transplant Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Transplant Diagnostics Market Trends

“Advancements in AI-Driven Predictive and Molecular Diagnostics”

- A significant and accelerating trend in the North America transplant diagnostics market is the integration of artificial intelligence (AI) and machine learning with molecular and genetic testing, enabling more accurate prediction of transplant rejection and better donor-recipient matching

- For instance, specialized AI-enabled platforms analyze PCR-based and sequencing assay data to forecast the likelihood of organ rejection, improving post-transplant patient outcomes and enabling early intervention

- AI integration in transplant diagnostics allows pattern recognition across large datasets to suggest optimized immunosuppressive therapies, and provides predictive alerts for potential complications. For instance, platforms such as AlloSure and Immucor TruGraf use AI to improve accuracy of non-invasive rejection monitoring

- The seamless integration of AI with transplant diagnostic software and instruments allows clinicians to centralize patient monitoring, manage lab results, and adjust treatment protocols through a single interface, improving workflow efficiency

- This trend toward predictive, data-driven, and interconnected transplant diagnostic solutions is fundamentally reshaping clinical expectations, with companies such as CareDx and Hologic developing AI-enhanced diagnostic platforms for real-time monitoring of transplant patients

- The demand for AI-enabled and data-integrated transplant diagnostics is growing rapidly across hospitals, research laboratories, and commercial service providers, as clinicians increasingly prioritize precision, early detection, and personalized patient management

- Collaborations between diagnostic companies and cloud-based health IT providers are increasing, facilitating secure, real-time sharing of transplant patient data across multiple care centers for improved decision-making

North America Transplant Diagnostics Market Dynamics

Driver

“Rising Number of Transplants and Technological Adoption”

- The increasing prevalence of organ and stem cell transplants, coupled with the adoption of advanced molecular and sequencing-based diagnostics, is a significant driver for heightened demand in the North America market

- For instance, in March 2025, CareDx launched an advanced AlloSure assay platform for non-invasive kidney transplant monitoring, highlighting how innovation is fueling market growth

- As clinicians seek improved post-transplant patient outcomes, transplant diagnostics provide high-precision solutions for donor-recipient compatibility, early rejection detection, and infection risk monitoring, offering a compelling advantage over conventional testing methods

- Furthermore, increasing awareness of the importance of accurate transplant diagnostics and supportive healthcare policies are driving adoption across hospitals, transplant centers, and research laboratories

- The convenience of integrated diagnostic instruments, software, and reagents for real-time monitoring, combined with the growing trend of centralized laboratory testing, is propelling the adoption of transplant diagnostics in both clinical and research settings

- Rapid advancements in sequencing-based assays and PCR technologies are expanding the scope of transplant diagnostics to rare and complex transplant types, increasing demand for specialized tests

- Government and private funding for transplant research and precision medicine initiatives is further enabling widespread adoption and innovation in diagnostic solutions

Restraint/Challenge

“High Costs and Regulatory Complexity”

- The high cost of advanced transplant diagnostic instruments, reagents, and AI-enabled platforms, along with stringent regulatory requirements, poses a significant barrier to market expansion in North America

- For instance, regulatory compliance for FDA-approved molecular assays can be time-consuming and expensive, delaying product launches and limiting adoption by smaller hospitals or labs

- Addressing these challenges requires careful navigation of complex regulatory frameworks, cost optimization, and demonstrating clinical efficacy to build trust among clinicians and laboratory administrators

- In addition, limited reimbursement coverage for certain novel diagnostic tests can restrict access, especially for outpatient monitoring or research-focused applications

- While ongoing technological advancements and decreasing costs of some diagnostic solutions may reduce barriers, the perceived premium for sophisticated transplant diagnostics continues to challenge widespread adoption across budget-conscious healthcare providers

- Interoperability challenges between different diagnostic platforms and hospital IT systems can complicate workflow integration and slow adoption of new solutions

- Shortage of skilled personnel trained to operate advanced molecular and sequencing-based diagnostic instruments further limits the scalability of these technologies in some clinical settings

North America Transplant Diagnostics Market Scope

The market is segmented on the basis of product type, technology, transplant type, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the North America transplant diagnostics market is segmented into transplant diagnostic instruments, transplant diagnostic software, and transplant diagnostic reagents. The transplant diagnostic instruments segment dominated the market in 2025 with the largest revenue share of 44.9%, driven by the critical role of instruments in performing high-precision molecular and sequencing-based assays. Hospitals and transplant centers prioritize these instruments for reliable donor-recipient matching, early rejection detection, and routine monitoring of transplant patients. The segment benefits from ongoing technological upgrades in PCR and sequencing platforms that enhance accuracy and reduce turnaround times. Instruments compatible with AI-enabled predictive software further strengthen their dominance. In addition, the increasing number of solid organ and stem cell transplants across the U.S. contributes to sustained demand for diagnostic instruments. Their adoption in research laboratories and commercial service providers for advanced assay development also supports market growth.

The transplant diagnostic software segment is expected to witness the fastest growth from 2026 to 2033, driven by integration with AI analytics and cloud-based patient monitoring platforms. Software solutions enable clinicians to track patient test results in real time, predict complications, and optimize immunosuppressive therapy. Hospitals and research laboratories are increasingly adopting software that integrates seamlessly with instruments and reagents for workflow efficiency. Rising demand for centralized transplant data management and predictive diagnostics is fueling adoption. The expansion of telemedicine and remote monitoring solutions further accelerates software usage. In addition, collaborations between diagnostic companies and IT providers are boosting the development and deployment of innovative software platforms.

- By Technology

On the basis of technology, the market is segmented into PCR-based molecular assays and sequencing-based molecular assays. The PCR-based molecular assays segment dominated the market in 2025 due to its established reliability, quick turnaround time, and high sensitivity for detecting transplant-related genetic markers. PCR assays are widely used in both hospital laboratories and research centers for donor-recipient compatibility testing and monitoring early signs of organ rejection. Their cost-effectiveness compared to sequencing assays further strengthens adoption. Hospitals prefer PCR-based assays for routine post-transplant monitoring because of their robustness and validated clinical performance. In addition, strong clinician familiarity and established regulatory approvals make PCR assays the preferred choice across North America.

The sequencing-based molecular assays segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by advancements in next-generation sequencing (NGS) technologies. Sequencing assays enable comprehensive genetic profiling, allowing precise detection of rare variants and complex transplant-related complications. Research laboratories and commercial service providers are increasingly using sequencing assays for personalized immunosuppressive therapy planning. Rising investments in precision medicine and genomics research in the U.S. are also driving adoption. Sequencing-based assays’ ability to integrate with AI predictive platforms enhances clinical decision-making. Furthermore, ongoing development of cost-efficient, high-throughput sequencing platforms is expected to expand accessibility and adoption.

- By Transplant Type

On the basis of transplant type, the market is segmented into solid organ transplantation, stem cell transplantation, soft tissue transplantation, bone marrow transplantation, and other transplants. The solid organ transplantation segment dominated the market in 2025, holding the largest share due to the high volume of kidney, liver, and heart transplants in the U.S. Hospitals and transplant centers prioritize accurate diagnostic testing for organ recipients to reduce post-transplant complications. Growing patient awareness of early rejection monitoring and increasing procedural volumes contribute to strong instrument and assay demand. Solid organ diagnostics also benefit from well-established reimbursement coverage and clinical guidelines. The widespread adoption of PCR and sequencing-based assays in organ transplant monitoring further supports market dominance. Commercial diagnostic service providers leverage this segment for routine testing and longitudinal patient follow-up.

The stem cell transplantation segment is expected to witness the fastest growth during the forecast period due to increasing stem cell therapy applications and allogeneic transplant procedures. Diagnostics for stem cell transplants require precise HLA matching and post-transplant monitoring to prevent graft-versus-host disease. Rising investment in regenerative medicine and research laboratories adopting advanced molecular assays fuel market expansion. AI-enabled predictive analytics for stem cell outcomes are driving adoption of specialized instruments and software. Furthermore, increasing collaboration between academic institutes and commercial providers for clinical trials is accelerating segment growth. The development of non-invasive monitoring assays for stem cell transplantation is also expected to further drive adoption.

- By Application

On the basis of application, the market is segmented into diagnostic applications and research applications. The diagnostic applications segment dominated the market in 2025, reflecting its primary use in clinical settings for donor-recipient compatibility testing and post-transplant monitoring. Hospitals and transplant centers rely on these applications to ensure successful transplantation and prevent organ rejection. The segment benefits from a strong focus on improving patient outcomes, integration with AI-based predictive platforms, and validated PCR and sequencing-based assays. High demand from hospital laboratories and transplant centers ensures steady revenue growth. Diagnostic applications also see frequent use in commercial service labs performing specialized transplant testing. Regulatory approvals and reimbursement coverage further reinforce dominance.

The research applications segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing investments in regenerative medicine, genomics, and immunology research. Academic institutes and commercial laboratories are expanding molecular and sequencing-based studies to improve transplant outcomes. Research applications often integrate AI and predictive analytics, driving adoption of advanced diagnostic software and instruments. Collaboration between biotech companies and universities is accelerating innovation. Rising government and private funding for transplant research contributes to strong growth. Non-invasive biomarker discovery and novel assay development further boost the research segment.

- By End User

On the basis of end user, the market is segmented into research laboratories and academic institutes, hospital and transplant centers, commercial service providers, and others. The hospital and transplant centers segment dominated the market in 2025, driven by the high volume of transplant procedures and the need for routine, precise post-transplant monitoring. Hospitals prioritize diagnostic instruments, software, and reagents to improve patient outcomes and streamline workflows. Established relationships with commercial service providers for specialized assays further strengthen market share. Clinical adoption of PCR and sequencing assays and AI-enabled platforms enhances segment dominance. Regulatory compliance and reimbursement coverage in the U.S. support wide adoption. The segment also benefits from increasing organ and stem cell transplant volumes.

The research laboratories and academic institutes segment is expected to witness the fastest growth from 2026 to 2033 due to rising interest in transplant biology, regenerative medicine, and immunogenomics studies. Institutes are adopting advanced sequencing platforms, PCR instruments, and AI-driven software for research applications. Strong funding for precision medicine and collaborative projects with biotech companies fuel growth. Increasing publication and clinical trial activity for transplant diagnostics further supports expansion. Research end users leverage predictive analytics for biomarker discovery and outcome optimization. The segment also benefits from government and private grants facilitating adoption of cutting-edge diagnostic technologies.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market in 2025, driven by hospitals and transplant centers procuring instruments, software, and reagents directly from manufacturers or authorized distributors. Direct tender ensures compliance with quality standards, bulk supply for high-volume procedures, and integration with hospital IT systems. High-value instruments and reagents are often purchased through this channel to maintain regulatory adherence. Hospitals also prefer direct vendor support for installation, calibration, and software updates. The segment benefits from strong manufacturer relationships and long-term service contracts.

The retail sales segment is expected to witness the fastest growth from 2026 to 2033, fueled by online procurement of diagnostic reagents, kits, and smaller instruments for research labs and commercial service providers. E-commerce platforms and distributor networks facilitate easier access to specialized products. Growing adoption of DIY research kits, and demand for cost-efficient assay solutions in academic and commercial labs, further supports retail sales growth. The segment also benefits from rapid product launches and innovative reagent kits entering the market. Retail availability of pre-validated kits reduces procurement delays and increases adoption among smaller institutions.

North America Transplant Diagnostics Market Regional Analysis

- The United States dominated the North America transplant diagnostics market with the largest revenue share of 88.7% in 2025, characterized by advanced healthcare infrastructure, widespread adoption of PCR-based and sequencing-based molecular assays, and a strong presence of leading industry players

- Clinicians and hospitals in the region highly value the precision, early detection capabilities, and predictive insights provided by transplant diagnostics, enabling improved donor-recipient matching and post-transplant monitoring

- This strong market presence is further supported by a technologically advanced healthcare ecosystem, substantial research and clinical investments, and supportive reimbursement frameworks, establishing transplant diagnostics as an essential component of modern transplant care across hospitals, research laboratories, and commercial service providers

The U.S. Transplant Diagnostics Market Insight

The U.S. transplant diagnostics market captured the largest revenue share of 88.7% in 2025 within North America, fueled by the high volume of organ and stem cell transplants and advanced healthcare infrastructure. Hospitals and transplant centers are increasingly prioritizing molecular and sequencing-based diagnostic solutions for accurate donor-recipient matching and early detection of transplant rejection. The growing adoption of AI-enabled predictive platforms and integration with laboratory information systems further propels the market. Moreover, robust research funding, supportive reimbursement frameworks, and the presence of key diagnostic companies in the U.S. contribute significantly to market expansion. The demand for high-precision instruments, reagents, and software across hospitals, research laboratories, and commercial service providers continues to strengthen the market’s growth trajectory.

Canada Transplant Diagnostics Market Insight

The Canada transplant diagnostics market is projected to expand at a substantial CAGR during the forecast period, driven by increasing organ and stem cell transplant procedures and rising awareness of precision diagnostics. Hospitals and transplant centers are focusing on implementing advanced molecular and sequencing assays to improve patient outcomes and minimize post-transplant complications. Supportive healthcare policies, growing research initiatives, and investments in laboratory infrastructure are fostering adoption. In addition, the integration of AI-driven diagnostic platforms and predictive analytics is enhancing clinical decision-making. Canadian transplant diagnostics adoption is also increasing in research laboratories and academic institutes, supporting long-term market growth. The demand for reliable, high-accuracy diagnostics for both clinical and research applications is expected to continue driving expansion.

Mexico Transplant Diagnostics Market Insight

The Mexico transplant diagnostics market is experiencing steady growth, driven by increasing organ and stem cell transplant procedures, improving healthcare infrastructure, and growing awareness of advanced diagnostic solutions. Hospitals and transplant centers are gradually adopting PCR-based and sequencing-based assays for accurate donor-recipient matching and post-transplant monitoring. Government initiatives aimed at improving transplant care and funding for clinical laboratories are supporting market development. Research laboratories and academic institutes are increasingly leveraging molecular diagnostics and AI-enabled predictive software for transplant research and clinical studies. Rising investments in healthcare digitalization and precision medicine are further propelling market adoption. Mexico’s growing private healthcare sector and partnerships with international diagnostic companies are enhancing access to advanced diagnostic technologies.

North America Transplant Diagnostics Market Share

The North America Transplant Diagnostics industry is primarily led by well-established companies, including:

- CareDx, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- BD (U.S.)

- QIAGEN (Netherlands)

- Immucor, Inc. (U.S.)

- Hologic, Inc. (U.S.)

- Omixon Ltd. (Hungary)

- Eurofins Scientific (Luxembourg)

- Natera, Inc. (U.S.)

- Luminex Corporation (U.S.)

- BioGenuix Medsystems (U.S.)

- GenDx (Netherlands)

- Linkage Biosciences, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- Biofortuna Limited (U.K.)

- Eurofins Transplant Genomics (Luxembourg)

- Quest Diagnostics (U.S.)

What are the Recent Developments in North America Transplant Diagnostics Market?

- In November 2025, CareDx announced the launch of the HistoMap Kidney assay that uses gene expression profiling to objectively characterize kidney transplant rejection types and enhance biopsy interpretation

- In October 2025, Thermo Fisher Scientific launched the MMDx Lung system, a molecular gene expression profiling test using machine learning to improve precision in detecting lung transplant rejection and tissue injury, expanding its transplant diagnostics portfolio in the U.S. clinical market

- In September 2025, Insight Molecular Diagnostics (iMDx) initiated a multi‑center registry enrolling 5,000 kidney transplant patients over three years to collect data on its dd‑cfDNA transplant rejection assay, supporting real‑world performance and algorithm validation

- In July 2025, CareDx showcased landmark data from over 40 abstracts and 16 oral presentations at the 2025 World Transplant Congress, and announced the launch of AlloSure® Plus, an AI‑driven diagnostic platform that integrates donor‑derived cell‑free DNA analysis for personalized organ rejection risk prediction

- In June 2025, iMDx announced positive head‑to‑head data showing its digital PCR‑based dd‑cfDNA test produced equivalent results to NGS platforms in kidney transplant rejection assessment, reinforcing its strategy toward commercialization and regulatory submission

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.