North America Ultrasound Imaging Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.46 Billion

USD

5.64 Billion

2024

2032

USD

3.46 Billion

USD

5.64 Billion

2024

2032

| 2025 –2032 | |

| USD 3.46 Billion | |

| USD 5.64 Billion | |

|

|

|

|

North America Ultrasound Imaging Devices Market Size

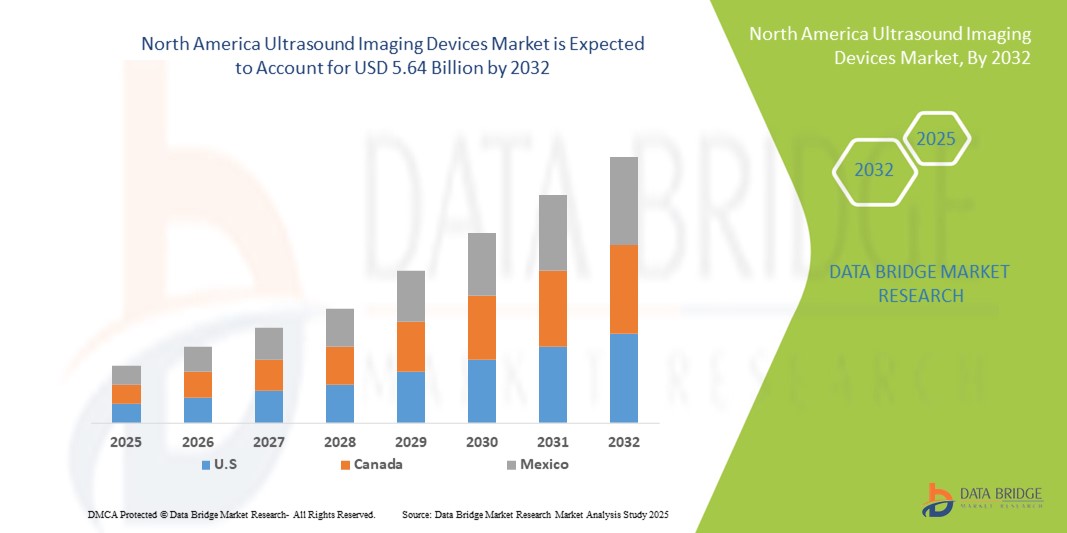

- The North America ultrasound imaging devices market size was valued at USD 3.46 billion in 2024 and is expected to reach USD 5.64 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, rising geriatric population, and growing demand for non-invasive diagnostic imaging solutions across hospitals and diagnostic centers

- Furthermore, technological advancements such as portable and wireless ultrasound devices, AI-integrated imaging systems, and enhanced 3D/4D imaging capabilities are driving adoption in clinical and point-of-care settings. These factors, combined with healthcare infrastructure expansion and rising awareness of early disease detection, are accelerating the uptake of ultrasound imaging devices, thereby significantly boosting the industry’s growth

North America Ultrasound Imaging Devices Market Analysis

- Ultrasound imaging devices, providing non-invasive diagnostic imaging for a wide range of medical conditions, are increasingly essential tools in modern healthcare settings across hospitals, diagnostic centers, and point-of-care facilities due to their real-time imaging capabilities, portability, and safety profile

- The rising demand for ultrasound imaging devices is primarily driven by the increasing prevalence of chronic diseases, growing geriatric population, and a shift toward non-invasive and early diagnostic solutions, alongside technological advancements such as AI-assisted imaging, portable systems, and enhanced 3D/4D imaging

- U.S. dominated the North America ultrasound imaging devices market with the largest revenue share of 79.5% in 2024, supported by advanced healthcare infrastructure, high adoption of innovative medical technologies, and the presence of key market players, with substantial growth in portable and point-of-care ultrasound deployments, fueled by innovations from both established medical device companies and startups focusing on AI, wireless connectivity, and miniaturized imaging systems

- Canada is expected to be the fastest-growing country in the North America ultrasound imaging devices market during the forecast period due to expanding healthcare facilities, increasing government initiatives for diagnostic imaging adoption, and rising demand for advanced imaging technologies in both urban and rural areas

- Compact/handheld ultrasound devices segment dominated the North America ultrasound imaging devices market with a share of approximately 43.8% in 2024, driven by their ease of use, mobility, and growing adoption in emergency care, outpatient clinics, and rural healthcare settings

Report Scope and North America Ultrasound Imaging Devices Market Segmentation

|

Attributes |

North America Ultrasound Imaging Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Ultrasound Imaging Devices Market Trends

Advancements Through AI and 3D/4D Imaging Integration

- A significant and accelerating trend in the North America ultrasound imaging devices market is the integration of artificial intelligence (AI) and advanced 3D/4D imaging technologies, which enhance diagnostic accuracy, image clarity, and workflow efficiency

- For instance, Butterfly iQ+ integrates AI algorithms for automated measurements and image optimization, improving diagnostic speed and reducing operator dependency. Similarly, GE Healthcare’s Voluson series offers high-resolution 3D/4D imaging for obstetric and cardiovascular applications

- AI integration in ultrasound systems enables features such as automated detection of anomalies, predictive diagnostics, and adaptive image enhancement. For instance, Philips Lumify uses AI to assist in point-of-care imaging and can provide real-time guidance to clinicians, improving clinical decision-making

- The seamless integration of ultrasound devices with hospital PACS systems and cloud-based platforms facilitates centralized image management, enabling remote consultation and telemedicine support across multiple facilities

- This trend toward more intelligent, precise, and connected imaging systems is redefining clinical expectations, driving manufacturers such as Canon Medical Systems to develop AI-enabled ultrasound devices with features such as automated workflow assistance and enhanced 3D/4D visualization

- The demand for AI-powered, advanced imaging ultrasound devices is growing rapidly across hospitals, diagnostic centers, and outpatient clinics, as clinicians increasingly prioritize efficiency, accuracy, and improved patient outcomes

North America Ultrasound Imaging Devices Market Dynamics

Driver

Rising Demand Due to Chronic Disease Prevalence and Non-Invasive Diagnostics

- The increasing prevalence of chronic diseases and growing need for non-invasive, real-time diagnostic solutions is a major driver of the North America ultrasound imaging devices market

- For instance, in March 2024, Siemens Healthineers introduced an AI-enhanced ultrasound platform for cardiovascular monitoring, aimed at improving early disease detection and clinical efficiency

- As healthcare providers seek early diagnosis and continuous monitoring options, ultrasound imaging devices offer advantages such as real-time imaging, portability, and safe, non-ionizing technology

- Furthermore, the rising adoption of point-of-care and bedside ultrasound in hospitals and outpatient clinics is making these devices integral to modern healthcare workflows, enhancing patient management and reducing diagnostic delays

- The growing demand for portable, wireless, and AI-integrated ultrasound systems, combined with increasing awareness among clinicians and patients, is significantly driving market growth

- The trend toward early diagnosis, patient-centric care, and non-invasive imaging solutions is expanding opportunities for manufacturers to innovate in both hospital-grade and point-of-care ultrasound devices

Restraint/Challenge

High Costs and Regulatory Compliance Concerns

- The high cost of advanced ultrasound imaging systems, particularly AI-enabled and 3D/4D devices, poses a significant challenge to broader adoption in healthcare facilities

- For instance, high-end ultrasound devices from brands such as GE Healthcare and Philips can cost multiple times more than basic portable units, limiting accessibility for smaller clinics or budget-conscious providers

- In addition, compliance with regulatory standards from the FDA and other health authorities can delay product launches and increase development costs, creating hurdles for new entrants and innovative technologies

- Manufacturers must ensure adherence to safety, imaging, and software validation protocols, which can be time-consuming and resource-intensive, potentially slowing market growth

- While prices for portable and point-of-care ultrasound systems are gradually decreasing, the premium for advanced AI and imaging features continues to restrict adoption in cost-sensitive healthcare segments

- Overcoming these challenges through cost optimization, regulatory support, and robust validation of AI-assisted features will be critical for sustained growth in the North America ultrasound imaging devices market

North America Ultrasound Imaging Devices Market Scope

The market is segmented on the basis of array format, device display, device portability, technology, application, end-user, and distribution channel.

- By Array Format

On the basis of array format, the North America ultrasound imaging devices market is segmented into phased array, linear array, curved linear array, and others. The phased array segment dominated the market with the largest revenue share in 2024, driven by its widespread use in cardiac and vascular imaging. Hospitals and cardiac care units often prefer phased array systems because they provide high-resolution imaging of moving structures, such as the heart. Advanced AI integration and real-time image processing improve diagnostic accuracy and clinical efficiency. The segment benefits from compatibility with multiple transducer types and workflow automation tools. Growing demand in emergency and critical care settings further reinforces its market dominance, making it the preferred choice for high-end healthcare facilities.

The linear array segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing adoption in musculoskeletal, vascular, and superficial tissue imaging. Linear array probes provide superior resolution for shallow structures, making them ideal for outpatient clinics and point-of-care applications. The growth is also driven by portable and handheld ultrasound systems, which often use linear probes due to their compact design. Rising adoption in orthopedic, vascular, and dermatology imaging supports faster expansion. Integration with AI-assisted measurement tools enhances diagnostic reliability and workflow efficiency. The versatility and ease of use of linear array devices make them attractive to smaller healthcare facilities and mobile medical units.

- By Device Display

On the basis of device display, the North America ultrasound imaging devices market is segmented into color ultrasound devices and black and white (B/W) ultrasound devices. The color ultrasound devices segment held the largest market revenue share in 2024, driven by their enhanced ability to visualize blood flow and anatomical structures accurately. Hospitals and diagnostic centers prefer color ultrasound for cardiovascular, obstetric, and vascular applications. AI-assisted flow analysis and 3D/4D imaging features further support the adoption of color ultrasound systems. Their higher diagnostic accuracy and broader clinical utility make them indispensable in modern imaging departments. The segment also benefits from integration with hospital PACS and telemedicine platforms. Continuous technological advancements in color imaging ensure sustained market dominance.

The B/W ultrasound devices segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption in outpatient clinics and budget-conscious facilities. B/W devices are cost-effective, portable, and suitable for basic imaging needs, especially in rural healthcare settings. Their simplicity and low maintenance requirements make them ideal for mobile medical units and point-of-care diagnostics. The growth is further driven by rising awareness of ultrasound’s utility in primary care and emergency scenarios. B/W devices also serve as an entry point for clinics looking to expand into imaging services without significant investment. Integration with handheld and compact ultrasound systems enhances their adoption in diverse care settings.

- By Device Portability

On the basis of device portability, the North America ultrasound imaging devices market is segmented into trolley/cart-based, compact/handheld, stationary, and point-of-care ultrasound devices. The compact/handheld ultrasound devices segment dominated the market in 2024 with a market share of 43.8% due to its increasing adoption across hospitals, emergency departments, outpatient clinics, and remote healthcare settings. These devices offer real-time imaging at the patient’s bedside, reducing dependence on centralized imaging facilities and improving diagnostic turnaround times. Advanced AI integration, wireless connectivity, and cloud-based storage further enhance their clinical utility. The portability, ease of use, and cost-effectiveness of these devices make them attractive to a wide range of healthcare providers. Continuous innovations and rising demand for point-of-care diagnostics reinforce their market dominance.

The trolley/cart-based ultrasound devices segment is expected to witness the fastest growth from 2025 to 2032, driven by high-performance imaging requirements in large hospitals and diagnostic centers. These systems are preferred for comprehensive workflows in cardiology, radiology, and obstetrics departments. Multi-transducer compatibility, large display screens, and advanced imaging features make them suitable for complex examinations. Hospitals and surgical centers continue to invest in these systems for long-term reliability and integration with PACS. The growth is further supported by AI-enabled imaging tools and automated measurements, enhancing clinical efficiency. Increasing adoption in multi-specialty departments accelerates the segment’s expansion.

- By Technology

On the basis of technology, the North America ultrasound imaging devices market is segmented into diagnostic ultrasound and therapeutic ultrasound. The diagnostic ultrasound segment dominated in 2024, driven by growing demand for non-invasive imaging across cardiology, obstetrics, radiology, and other specialties. Hospitals and imaging centers rely on diagnostic devices for routine examinations, advanced clinical applications, and early disease detection. AI-enabled imaging solutions improve accuracy, reduce operator dependency, and facilitate real-time analysis. Integration with hospital information systems and PACS further enhances clinical utility. High reliability, safety, and versatility of diagnostic ultrasound devices maintain their market leadership. Growing awareness among clinicians and patients about non-invasive imaging benefits supports continuous adoption.

The therapeutic ultrasound segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by expanding applications in physiotherapy, pain management, and targeted drug delivery. Increasing adoption in rehabilitation and outpatient care centers is driving demand. Advancements in focused ultrasound therapies enable precise treatment for musculoskeletal and soft tissue disorders. The use of portable therapeutic systems in clinics and home care settings supports faster market growth. Continuous innovations and rising clinical acceptance of ultrasound therapy contribute to segment expansion. The potential for non-invasive treatment with minimal side effects further encourages adoption.

- By Application

On the basis of application, the North America ultrasound imaging devices market is segmented into radiology/general imaging, obstetrics and gynecology, cardiovascular, gastroenterology, vascular, urological, orthopedic and musculoskeletal, pain management, emergency department, critical care, and others. The radiology/general imaging segment dominated in 2024 due to its extensive use in routine diagnostics and multi-organ assessment across hospitals and diagnostic centers. Radiologists prefer these devices for versatility, reliability, and integration with advanced imaging workflows. High patient throughput and the need for accurate diagnostics reinforce segment dominance. AI-assisted imaging and cloud-based solutions enhance workflow efficiency. Continuous technological innovations and demand for early disease detection further strengthen market leadership.

The emergency department segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing use of point-of-care and portable ultrasound systems for rapid diagnosis of trauma, cardiac events, and critical care conditions. AI-enabled imaging provides automated measurements and decision support in time-sensitive scenarios. Integration with handheld devices and mobile carts facilitates bedside diagnostics. Rising adoption in critical care units and pre-hospital settings further fuels growth. The segment benefits from government initiatives and hospital investments to improve emergency care capabilities. Portable, fast, and accurate imaging solutions drive rapid market expansion in this segment.

- By End-User

On the basis of end-user, the North America ultrasound imaging devices market is segmented into hospitals, surgical centers, research and academia, maternity centers, ambulatory care centers, diagnostic centers, and others. The hospitals segment dominated in 2024, supported by high patient inflow, advanced imaging requirements, and investment in state-of-the-art ultrasound systems. Hospitals prefer integrated, AI-assisted ultrasound devices for multi-departmental applications. Their ability to manage high-volume imaging workflows enhances market dominance. Large healthcare facilities also benefit from integration with PACS and telemedicine platforms. Continuous replacement cycles and upgrades in hospitals sustain revenue growth.

The ambulatory care centers segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the rising number of outpatient clinics and diagnostic centers focusing on rapid, cost-effective, and non-invasive imaging solutions. These centers increasingly adopt portable and compact devices to provide efficient diagnostics. The growth is further supported by telemedicine adoption and AI-enabled imaging tools. Point-of-care ultrasound solutions improve patient throughput and satisfaction. Lower investment requirements compared to hospitals make ambulatory centers attractive targets for manufacturers. The segment benefits from increasing healthcare decentralization and outpatient care demand.

- By Distribution Channel

On the basis of distribution channel, the North America ultrasound imaging devices market is segmented into direct tender, third-party distributors, and retail sales. The direct tender segment dominated the market in 2024, driven by bulk procurement by hospitals, government agencies, and large diagnostic chains to ensure cost-efficiency, service agreements, and long-term support. Large healthcare facilities often prefer direct procurement for device customization, training, and maintenance contracts. This channel ensures reliability and continuity of supply. Integration with hospital networks and PACS is also easier through direct tender agreements. High-value contracts and government initiatives further reinforce dominance.

The third-party distributors segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing partnerships between manufacturers and regional distributors to expand market reach in smaller clinics, rural healthcare facilities, and emerging medical centers. Distributors help manufacturers provide localized support, training, and maintenance services. Expansion in tier-2 and tier-3 cities drives adoption through this channel. Partnerships with distributors reduce entry barriers for new players. Increasing awareness of ultrasound utility among small clinics accelerates growth. The segment benefits from flexible procurement options and improved after-sales service.

North America Ultrasound Imaging Devices Market Regional Analysis

- U.S. dominated the North America ultrasound imaging devices market with the largest revenue share of 79.5% in 2024, supported by advanced healthcare infrastructure, high adoption of innovative medical technologies, and the presence of key market players

- Healthcare providers in the region highly value the accuracy, real-time imaging capabilities, and integration of ultrasound devices with hospital PACS, AI-assisted tools, and portable systems for point-of-care diagnostics

- This widespread adoption is further supported by advanced healthcare infrastructure, high investments in medical technology, and strong presence of key industry players, establishing ultrasound imaging devices as a preferred choice across hospitals, diagnostic centers, and outpatient care facilities

U.S. Ultrasound Imaging Devices Market Insight

The U.S. ultrasound imaging devices market captured the largest revenue share in 2024 within North America, fueled by the increasing prevalence of chronic diseases and the rising demand for non-invasive diagnostic solutions. Hospitals and diagnostic centers are prioritizing the adoption of advanced ultrasound systems, including portable, handheld, and AI-integrated devices, for improved clinical efficiency. The growing trend of point-of-care imaging, coupled with technological innovations such as 3D/4D imaging and real-time analytics, further propels market growth. Moreover, government initiatives supporting healthcare infrastructure, alongside high healthcare expenditure and awareness among clinicians, are significantly contributing to the market expansion.

Canada Ultrasound Imaging Devices Market Insight

The Canada ultrasound imaging devices market is projected to grow at a substantial CAGR during the forecast period, primarily driven by increasing investments in healthcare infrastructure and the rising demand for advanced diagnostic imaging. The country’s well-developed healthcare system, combined with government reimbursement policies, promotes the adoption of ultrasound systems across hospitals, maternity centers, and outpatient clinics. Canadian healthcare providers are increasingly integrating AI-enabled and portable ultrasound devices to enhance diagnostic accuracy and workflow efficiency. The demand is also fueled by an aging population and rising awareness about early disease detection.

Mexico Ultrasound Imaging Devices Market Insight

The Mexico ultrasound imaging devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising healthcare awareness and expansion of diagnostic facilities in urban and semi-urban areas. Increasing prevalence of chronic conditions and maternal health monitoring requirements are boosting the adoption of ultrasound imaging systems. The market growth is further supported by government initiatives to improve diagnostic services and healthcare accessibility. Integration of portable and point-of-care devices is becoming increasingly common to provide timely diagnostics. Mexico’s growing private healthcare sector also contributes significantly to the market expansion.

North America Ultrasound Imaging Devices Market Share

The North America ultrasound imaging devices industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (U.S.)

- Samsung Healthcare (South Korea)

- Terason (U.S.)

- OtoNexus Medical Technologies, Inc. (U.S.)

- Boston Imaging (U.S.)

- Medtronic (Ireland)

- Aidoc. (Israel)

- Akumin Inc. (Canada)

- AMETEK, Inc. (U.S.)

- Sofwave Medical Ltd. (Israel)

- Capsa Healthcare (U.S.)

- NAI Imaging Systems, Inc. (U.S.)

- Avante Health Solutions (U.S.)

- Hologic, Inc. (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION. (U.S.)

- Hitachi High-Tech Corporation (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Esaote SPA (U.S.)

What are the Recent Developments in North America Ultrasound Imaging Devices Market?

- In August 2025, GE HealthCare introduced the Vivid Pioneer, its most advanced cardiovascular ultrasound system, designed to support clinicians with imaging in 2D, 4D, and color flow. The system aims to streamline workflows and enhance diagnostic confidence

- In August 2025, Esaote North America and Epica International announced a strategic partnership to expand their portfolio of human and veterinary MRI and ultrasound systems, aiming to reach a broader base of U.S. hospitals and specialty practices

- In July 2025, MAUI Imaging raised USD 14 million in Series D funding to advance its ultrasound technology capable of visualizing through barriers such as bone, gas, fat, and surgical tools. The company aims to enhance diagnostic imaging, particularly in trauma scenarios

- In May 2025, Johnson & Johnson MedTech, a global leader in cardiac arrhythmia treatment, announced the U.S. launch of the SOUNDSTAR CRYSTAL Ultrasound Catheter for intracardiac echocardiography (ICE) imaging in cardiac ablation procedures

- In December 2024, Siemens Healthineers and DeepHealth, Inc., a global leader in AI-powered health informatics and a wholly-owned subsidiary of RadNet, Inc. announced a strategic collaboration aimed at transforming ultrasound operations through the implementation of SmartTechnology by embedding AI-powered health informatics within workflows and imaging hardware

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.