North America Urology Laser Market

Market Size in USD Million

CAGR :

%

USD

373.81 Million

USD

618.66 Million

2024

2032

USD

373.81 Million

USD

618.66 Million

2024

2032

| 2025 –2032 | |

| USD 373.81 Million | |

| USD 618.66 Million | |

|

|

|

|

North America Urology Laser Market Size

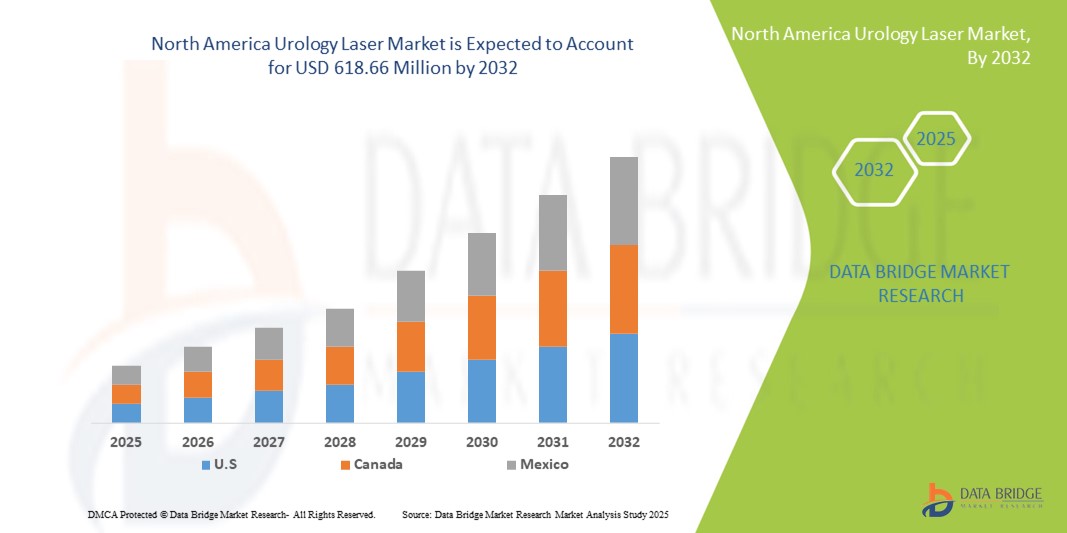

- The North America urology laser market size was valued at USD 373.81 million in 2024 and is expected to reach USD 618.66 million by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by the increasing prevalence of urological disorders, including benign prostatic hyperplasia (BPH), kidney stones, and bladder cancer, alongside the rising preference for minimally invasive procedures that offer shorter recovery times and lower complication risks

- Furthermore, technological advancements in laser systems, improving efficiency and treatment outcomes, coupled with supportive healthcare infrastructure and favorable reimbursement policies in the United States, are accelerating the adoption of urology laser solutions in both hospitals and specialized clinics. These converging factors are significantly boosting the industry's growth

North America Urology Laser Market Analysis

- Urology lasers, providing precise and minimally invasive treatment options for conditions such as benign prostatic hyperplasia (BPH), kidney stones, and bladder tumors, are becoming essential tools in modern urological procedures in both hospitals and specialized clinics due to their enhanced precision, reduced recovery times, and improved patient outcomes

- The escalating demand for urology lasers is primarily driven by the rising prevalence of urological disorders, growing patient preference for minimally invasive procedures, and increasing adoption of advanced laser technologies that improve procedural efficiency and safety

- U.S. dominated the North America urology laser market with the largest revenue share of 78.5% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players, with substantial growth in urology laser adoption in large hospitals and specialized urology centers, fueled by innovations in laser systems and treatment protocols

- Canada is expected to be the fastest-growing country in the North America urology laser market during the forecast period, due to increasing healthcare investments, rising awareness of minimally invasive treatments, and growing patient demand for advanced urological care

- Holmium Yttrium Aluminum Garnet laser segment dominated the urology laser market with a market share of 45.5% in 2024, driven by its established efficacy in treating BPH and urinary stones, as well as its versatility across a wide range of urological procedures

Report Scope and North America Urology Laser Market Segmentation

|

Attributes |

North America Urology Laser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Urology Laser Market Trends

Advancements in Laser Technology and Minimally Invasive Procedures

- A significant and accelerating trend in the North America urology laser market is the development of high-powered holmium and thulium lasers that provide precise, minimally invasive treatment for conditions such as BPH, kidney stones, and bladder tumors, improving patient outcomes and reducing recovery times

- For instance, the Lumenis MOSES Pulse 120H laser allows urologists to perform efficient lithotripsy with minimal tissue damage, while the Boston Scientific GreenLight XPS system offers effective prostate tissue ablation with reduced intraoperative bleeding

- Integration of urology lasers with imaging systems and robotic-assisted platforms enables enhanced surgical precision, better visualization, and more controlled energy delivery, improving procedural safety and efficiency

- The seamless combination of laser systems with hospital IT and patient management platforms facilitates centralized control of procedure parameters, treatment documentation, and postoperative monitoring, enhancing workflow and patient care

- This trend towards more advanced, integrated, and precise laser systems is fundamentally reshaping urological treatment standards. Consequently, companies such as Olympus and Richard Wolf are developing multi-functional laser platforms with automated energy modulation and real-time tissue feedback

- The demand for lasers that offer enhanced precision, minimally invasive operation, and integration with hospital management systems is growing rapidly across hospitals and specialized urology centers as patients and providers increasingly prioritize safety and procedural efficiency

North America Urology Laser Market Dynamics

Driver

Rising Prevalence of Urological Disorders and Preference for Minimally Invasive Treatments

- The increasing prevalence of urological disorders, including BPH, urinary stones, and bladder tumors, coupled with the growing preference for minimally invasive procedures, is a significant driver for the heightened demand for urology lasers

- For instance, in 2024, Boston Scientific reported strong adoption of GreenLight XPS lasers in U.S. hospitals for minimally invasive BPH treatment, demonstrating the effectiveness of laser-based interventions over conventional surgery

- Patients increasingly seek procedures that reduce hospitalization time, pain, and risk of complications, making laser therapies a preferred choice in modern urological care

- Furthermore, hospitals and clinics are expanding their surgical offerings with laser systems to meet rising patient demand and maintain a competitive edge, often integrating lasers with imaging and robotic systems for optimized outcomes

- The efficiency of procedures, faster recovery, and reduced postoperative complications are key factors propelling the adoption of urology lasers in both large hospitals and specialized urology centers

- The trend towards advanced minimally invasive treatments, combined with hospital investment in state-of-the-art laser systems, is further accelerating market growth

Restraint/Challenge

High Costs and Need for Specialized Training

- The high initial cost of advanced urology laser systems and disposable laser fibers poses a significant challenge to wider market adoption, particularly for smaller clinics or budget-conscious healthcare facilities

- For instance, the purchase and maintenance cost of systems such as Lumenis MOSES or Boston Scientific GreenLight XPS can exceed USD 150,000, making investment challenging for some institutions

- In addition, effective operation of laser systems requires specialized training and certified urologists, limiting rapid deployment in regions with a shortage of skilled personnel

- Hospitals must invest in staff training programs, ongoing certification, and technical support to ensure safe and effective use, which can be a barrier to entry for new facilities

- While costs are gradually managed through leasing options or bundled service agreements, the perceived financial and operational burden can hinder adoption among smaller healthcare providers

- Overcoming these challenges through cost-effective solutions, training programs, and service support will be crucial for sustained growth and wider implementation of urology lasers in North America

North America Urology Laser Market Scope

The market is segmented on the basis of laser type, modality, application, end user, and distribution channel.

- By Laser Type

On the basis of laser type, the North America urology laser market is segmented into Holmium Yttrium Aluminum Garnet (Ho:Yag), Thulium Yttrium Aluminum Garnet (Thu:Yag), Neodymium-Doped Yttrium Aluminum Garnet (Nd:Yag), Potassium Titanyl Phosphate Yttrium Aluminum Garnet (Ktp:Yag), Diode Laser, Erbium:YAG Laser, Lithium Borate, and Others. The Holmium YAG (Ho:Yag) laser segment dominated the market with the largest revenue share of 45.5% in 2024, driven by its proven efficacy in treating BPH, urinary stones, and other urological conditions. Hospitals and urological clinics prefer Ho:Yag lasers due to their ability to perform precise lithotripsy, minimal tissue damage, and compatibility with a wide range of urological procedures. This versatility, combined with a high safety profile and reliability, reinforces its dominance. Ho:Yag lasers are also widely supported by trained surgeons, making them a default choice for most hospitals. The availability of multiple energy settings and fiber sizes allows customization for each patient procedure. Its established track record and strong physician preference further support market leadership.

The Thulium YAG (Thu:Yag) laser segment is anticipated to witness the fastest growth rate of 12.8% from 2025 to 2032, fueled by its superior hemostatic properties, continuous-wave operation, and enhanced tissue ablation capabilities. Thu:Yag lasers are increasingly adopted in minimally invasive procedures for BPH and soft tissue tumor treatments. Their growing adoption in specialized urology centers and large hospitals is driven by better precision and reduced intraoperative bleeding compared to traditional Ho:Yag systems. Thu:Yag also enables simultaneous tissue vaporization and coagulation, increasing procedural efficiency. Patient recovery is faster, and complication rates are lower, making it attractive to both hospitals and clinics. Rising awareness among urologists regarding its clinical advantages is boosting demand.

- By Modality

On the basis of modality, the North America urology laser market is segmented into portable and standalone lasers. The Standalone laser segment dominated the market in 2024 with a revenue share of 60%, largely due to hospitals and large surgical centers preferring high-powered, multi-purpose laser systems. Standalone systems provide higher energy outputs, better integration with imaging and robotic-assisted platforms, and flexibility to perform a wide range of urological procedures efficiently. Hospitals rely on standalone systems for both complex and routine procedures. Their robustness and longevity also make them a cost-effective investment for high-volume centers. Advanced features such as automated energy modulation and tissue feedback further reinforce their adoption. The ability to handle multiple procedures from one system supports hospital workflow efficiency.

The Portable laser segment is expected to witness the fastest CAGR of 13.5% from 2025 to 2032, driven by growing demand in ambulatory surgical centers and smaller clinics. Portable lasers are ideal where space constraints and budget considerations favor compact solutions. They enable on-demand procedures without dedicated operating rooms, improving procedural accessibility. Lightweight and easy-to-use designs facilitate quick setup and transport between rooms. Increasing physician preference for outpatient treatments supports adoption. Rising availability of portable lasers with multiple wavelength options further accelerates growth.

- By Application

On the basis of application, the North America urology laser market is segmented into Urolithiasis, bph, partial kidney resection, removal of kidney stones, urethral strictures, tumors, and others. The BPH treatment segment dominated the market with a revenue share of 38% in 2024, attributed to the high prevalence of BPH among aging populations. Hospitals and urology centers increasingly adopt laser systems such as Ho:Yag and Thu:Yag to perform precise tissue ablation with minimal bleeding and rapid recovery times. BPH laser procedures are considered safer than traditional TURP surgery. Growing awareness among patients and physicians further supports market dominance. Increasing reimbursement coverage for minimally invasive BPH treatments is also driving adoption. The ability to combine treatment with outpatient care adds to hospital preference for lasers.

The Urolithiasis (kidney stone removal) segment is expected to witness the fastest growth rate of 11.9% from 2025 to 2032, driven by rising incidences of kidney stones. Laser lithotripsy is increasingly preferred as a minimally invasive alternative to traditional surgery. Adoption is particularly high in ambulatory surgical centers where outpatient procedures are prioritized. Portable laser systems allow flexible treatment locations, increasing efficiency. Patient preference for reduced pain and faster recovery supports adoption. Technological advancements improving stone fragmentation efficiency are further boosting market growth.

- By End User

On the basis of end user, the North America urology laser market is segmented into hospitals, urological clinics, ambulatory surgical centers, and others. The hospital segment dominated the market in 2024 with a revenue share of 65%, as hospitals are equipped with the infrastructure, trained personnel, and budget required for high-end laser systems. Hospitals prefer integrating advanced laser platforms for multi-procedure capability and improved patient outcomes. Large hospitals often invest in both Ho:Yag and Thu:Yag lasers for versatility. Centralized surgical management systems further support dominance. Hospitals also benefit from economies of scale in purchasing and maintenance. The ability to handle high patient volumes efficiently reinforces adoption.

The ambulatory surgical centers (ASCs) segment is expected to witness the fastest CAGR of 12.3% from 2025 to 2032, driven by increasing outpatient procedures and patient preference for shorter recovery times. Compact and portable laser systems are ideal for ASCs. These centers benefit from reduced space and lower operational costs. Portable systems allow quick turnover between procedures. Rising patient demand for minimally invasive treatments supports adoption. ASCs are increasingly investing in lasers to expand their service offerings and attract patients.

- By Distribution Channel

On the basis of distribution channel, the North America urology laser market is segmented into direct tender, retail sales, online sales, and others. The direct tender segment dominated the market with a revenue share of 55% in 2024, primarily due to hospitals and large clinics procuring high-value laser systems directly from manufacturers. Direct procurement ensures customized solutions, reliable after-sales support, and bulk purchasing advantages. Hospitals negotiate service agreements and warranties through direct tenders. This segment remains dominant due to trust and long-term relationships with manufacturers. Multi-year maintenance contracts and training packages are commonly bundled. The ability to procure full-featured systems tailored to hospital needs reinforces dominance.

The online sales segment is expected to witness the fastest CAGR of 14% from 2025 to 2032, fueled by growing adoption in smaller clinics and ambulatory centers. Online procurement offers convenience, flexible payment options, and quicker delivery of compact or portable systems. Small hospitals and clinics benefit from lower administrative overheads and ease of comparison. Digital platforms provide access to product reviews and technical specifications. Rising confidence in online purchasing and manufacturer-supported delivery boosts growth. Increasing availability of small-scale laser systems online accelerates adoption in outpatient facilities.

North America Urology Laser Market Regional Analysis

- U.S. dominated the North America urology laser market with the largest revenue share of 78.5% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players, with substantial growth in urology laser adoption in large hospitals and specialized urology centers, fueled by innovations in laser systems and treatment protocols

- Hospitals and urology centers in the U.S. highly value the precision, safety, and efficiency offered by advanced laser systems, which allow for faster recovery, reduced complications, and improved patient outcomes across multiple urological procedures

- This widespread adoption is further supported by advanced healthcare infrastructure, strong reimbursement policies, availability of skilled urologists, and a high level of awareness among patients and providers regarding the benefits of laser-based treatments

U.S. Urology Laser Market Insight

The U.S. urology laser market captured the largest revenue share in 2024 within North America, fueled by the growing prevalence of urological disorders such as BPH, kidney stones, and bladder tumors. Hospitals and specialized urology centers are increasingly prioritizing minimally invasive procedures that reduce patient recovery times and improve surgical outcomes. The rising adoption of advanced laser systems with integration capabilities for imaging and robotic-assisted platforms further propels the market. Moreover, supportive healthcare infrastructure, favorable reimbursement policies, and the presence of skilled urologists are significantly contributing to market expansion. Patient awareness and preference for outpatient procedures with faster recovery times are also driving adoption. The strong focus on technological innovation by key manufacturers reinforces the U.S. as the dominant market in North America.

Canada Urology Laser Market Insight

The Canada urology laser market accounted for 22% of North America’s revenue share in 2024 and is expected to grow steadily during the forecast period. The growth is driven by rising healthcare investments, increasing prevalence of urological conditions, and the adoption of minimally invasive laser procedures in hospitals and specialized clinics. Canadian healthcare providers are focusing on improving patient outcomes and procedural efficiency, which supports the deployment of advanced laser systems. Increasing awareness of laser treatments among patients, coupled with government support for healthcare modernization, is encouraging adoption. The market also benefits from a strong presence of international laser manufacturers and growing interest in outpatient and ambulatory procedures. Technological integration with hospital IT systems enhances workflow efficiency and procedural accuracy, further supporting market growth.

Mexico Urology Laser Market Insight

The Mexico urology laser market is emerging as a growth market within North America, contributing 10% of the regional market in 2024. The growth is driven by increasing investments in private hospitals and specialty clinics offering advanced urological treatments. Rising awareness among patients about minimally invasive procedures for BPH, kidney stones, and bladder tumors is accelerating adoption. Mexico is witnessing the introduction of modern laser systems through partnerships with international manufacturers, enabling access to both Ho:Yag and Thu:Yag lasers. Healthcare infrastructure improvements and government initiatives to enhance surgical care quality further support market growth. The preference for outpatient procedures and growing medical tourism also contribute to the adoption of urology lasers.

North America Urology Laser Market Share

The North America urology laser industry is primarily led by well-established companies, including:

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- Olympus Corporation (Japan)

- HealthTronics, LLC. (U.S.)

- United Medical Systems, Inc. (U.S.)

- Lumenis Be Ltd. (Israel)

- Dornier MedTech (Germany)

- Potent Medical (U.S.)

- Visotek Inc. (U.S.)

- Coloplast A/S (Denmark)

- IPG Photonics Corporation (U.S.)

- Urology Partners (U.S.)

- American Medical Systems (U.S.)

- Biolitec AG (Germany)

- Quanta System S.p.A. (Italy)

- Ellex Medical Lasers Ltd. (Australia)

- Medtronic (Ireland)

- SonaCare Medical (U.S.)

What are the Recent Developments in North America Urology Laser Market?

- In July 2025, Biolitec announced the FDA approval of its LEONARDO® Duster Super Pulsed Thulium Fiber Laser (TFL), marking a significant advancement in urology laser technology. This innovative laser enhances precision and efficiency in urological procedures, aligning with the growing demand for minimally invasive treatments

- In January 2025, Delta Health launched the Lumenis Pulse 120H Holmium Laser System with MOSES 2.0 Technology, aiming to provide minimally invasive urological procedures for prostate and kidney stone treatments. This addition underscores Delta Health's commitment to advancing patient care through innovative laser technology

- In June 2025, Shree Krishna Hospital in Karamsad, Gujarat, India, installed a state-of-the-art 65-watt laser system to enhance urological care. This system facilitates precise stone fragmentation and treatment of soft tissue conditions, significantly reducing recovery time and patient discomfort

- In December 2024, Dornier MedTech introduced the Nautilus, its new flagship urology table, after receiving FDA clearance and CE mark approval. This advanced table is designed to enhance procedural efficiency and patient positioning during urological surgeries, including those utilizing laser technologies. The Nautilus aims to improve workflow in the operating room, facilitating better outcomes in procedures such as lithotripsy and prostate treatments

- In December 2024, Rhein Laser Technologies Co., Ltd. announced that its UroFiber® 60Q SuperPulsed Thulium Fiber Laser System received FDA 510(k) clearance. This system is recognized as the most powerful thulium superpulsed fiber laser for urology, offering enhanced capabilities for stone fragmentation and soft tissue procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.