Market Analysis and Size

Aquaculture farming fish or water species in ponds, recirculating tanks, and similar environments. Aquaculture has a long history dating back to the ancient era and there have been many recent developments in the aquaculture industry. Warm water aquaculture practises began in 1990 when the construction of concrete tanks for fish farming began and the production expanded to meet market demand. Warm water aquaculture feeds are being introduced into the market to provide the necessary nutritional feeds.

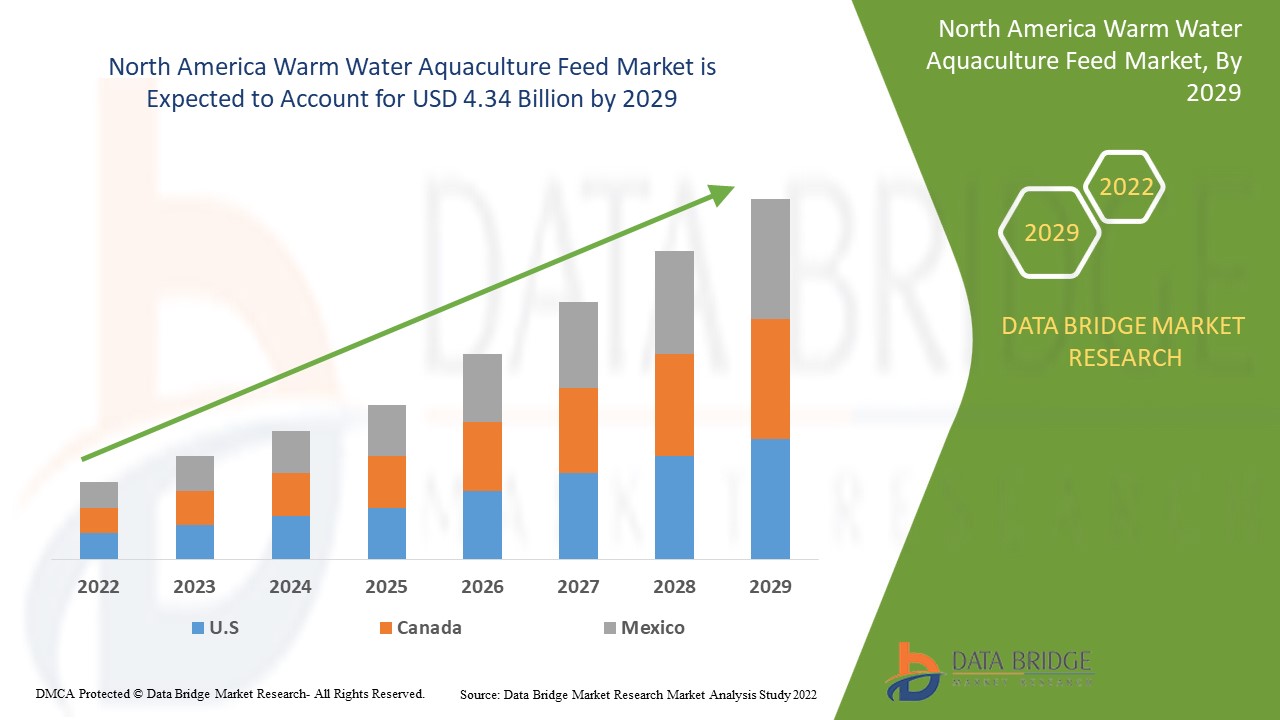

Data Bridge Market Research analyses that the warm water aquaculture feed market which was growing at a value of 3.15 billion in 2021 and is expected to reach the value of USD 4.34 billion by 2029, at a CAGR of 4.1% during the forecast period of 2022 to 2029.

Market Definition

Warm water aquaculture feed is made up of compounded meals made from raw materials such as sunflower, corn, soybean, fish meal, and fish oil. The name implies that the feed is intended for consumption by aquatic species such as fish, shrimp, and crustaceans. These have high nutritional content and a variety of growth-promoting properties.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Water Type (Freshwater and Saltwater), Species (Carps, Catfish, Barramundi, Pike Perch, Tilapia, Sturgeon, Yellow Tail Kingfish, Eel, Sea Bass, Sea Bream, Grouper, Meagre, Rockfish, Sole, Turbot, Milk Fish and Others), Feed Type (Starters, Grower Feed, Fry Feed, Functional Feed, Brood stock Feed, Organic Feed and Others), Nature (Conventional and Organic) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Alltech (US), Purina Mills (US), Nutreco N.V. (Netherlands), Ridley Corporation Limited (Australia), Adisseo (China), Aller Aqua Group (Denmark), BIOMIN (EMEA), INVE Aquaculture (Belgium), Charoen Pokphand Group Company, Ltd. (Thailand), hanpel (South Korea), Coppens International B.V. (Netherlands), BioMar Group (Denmark), LifeCircle Nutrition AG (Switzerland), Kent Nutrition Group (US), Sonac (US), Growel Feeds Pvt Ltd (India), Japfa Ltd (Singapore), Marvesa Oils & Fats B.V. (Netherlands), Marubeni Nisshin Feed Co.,Ltd. (Japan), Novus International (US) |

|

Opportunities |

|

Warm Water Aquaculture Feed Market Dynamics

Drivers

- Rising fish farming activities in the region

Rising fish farming activities worldwide and increased spending on research and development activities are driving the growth of the warm water aquaculture feed market. The rising need and demand for compounded meals to maintain aquatic species' health and growing awareness about warm water aquaculture feed are other market growth determinants.

- Aquaculture as a form of livelihood

Global fish and aquaculture production has increased due to population growth, rising incomes in developing countries, and urbanization. The increasing consumption of seafood at the expense of staple foods is positively related to revenue and consumption of animal protein. Due to rising incomes and urbanization, global fish consumption increases faster than the growing global population. Fisheries and aquaculture are increasingly becoming a primary source of protein, foreign exchange, livelihoods, and population well-being worldwide.

Opportunity

Manufacturers' increased emphasis on innovative product offerings and increased restrictions on animal-based food products will create even more lucrative growth opportunities for the warm water aquaculture feed market.

Restraints

However, fluctuations in raw material prices will be a significant impediment to the growth of the warm water aquaculture feed market. The government's stringent regulations on product approvals will further slow the growth rate of the warm water aquaculture feed market.

This warm water aquaculture feed market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the warm water aquaculture feed market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Warm Water Aquaculture Feed Market

The COVID-19 pandemic has slowed operations, resulting in staff shortages and new sanitary guidelines for fisheries and processing. Many countries consider the marine ingredients industry to be an essential part of the food supply chain, which explains why fishing and reduction operations have continued almost everywhere. Feed companies have ensured that farmers have the supplies they need to protect the health and welfare of their animals while also maintaining farm production levels. Growing fish demand has increased export-oriented aquaculture and the adoption of 'Scientific Aquaculture Management Practices' (SAMP).

Recent Development

- Skretting, a Nutreco company, will launch a new starter and grower feed for rainbow trout in December 2021, dubbed Nutra Sprint and Celero, respectively, to assist farms in reaching their full potential. Validation trials for the launched product revealed growth increases of up to 8% and an 8% decrease in the Feed Conversion Ratio.

- Cargill announced a multi-year agreement with The Conservation Fund's Freshwater Institute in September 2021 to develop, evaluate, and improve feeds for the land-based aquaculture industry. Cargill nutritionists and researchers with experience in recirculating aquaculture systems are available through the Institute. The collaboration will enhance land-based aquaculture's environmental and economic performance by developing and testing feeds specifically for recirculating aquaculture systems.

North America Warm Water Aquaculture Feed Market Scope

The warm water aquaculture feed market is segmented on the basis of water type, species, feed type and nature. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Water Type

- Fresh water

- Salt water

On the basis of water type, the market is segmented into fresh water and salt water.

Species

- Carps

- Catfish

- Tilapia

- Grouper

- Barramundi

- Milkfish

- Sturgeon

- Eel

- Sea bass

- Sea bream

- Yellowtail Kingfish

- Meagre

- Sole

- Turbot

- Pike perch

- Rockfish

- Others

On the basis of species, the market is segmented into carps, catfish, tilapia, grouper, barramundi, milkfish, sturgeon, Eel, sea bass, sea bream, yellowtail kingfish, meagre, sole, turbot, pike perch, rockfish and others

Feed type

- Grower feed

- Starters

- Functional feed

- Fry feed

- Broodstock feed

- Organic feed

- Others

On the basis of feed type, the market is segmented into grower feed, starters, functional feed, fry feed, broodstock feed, organic feed and others

Nature

- Conventional

- Organic

On the basis of nature, the market is segmented into conventional and organic

Warm Water Aquaculture Feed Market Regional Analysis/Insights

The warm water aquaculture feed market is analyzed and market size insights and trends are provided by country, water type, species, feed type and nature as referenced above.

The countries covered in the warm water aquaculture feed market report are U.S., Canada and Mexico.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Warm Water Aquaculture Feed Market Share Analysis

The warm water aquaculture feed market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to warm water aquaculture feed market.

Some of the major players operating in the warm water aquaculture feed market are:

- Alltech (US)

- Purina Mills (US)

- Nutreco N.V. (Netherlands)

- Ridley Corporation Limited (Australia)

- Adisseo (China)

- Aller Aqua Group (Denmark)

- BIOMIN (EMEA)

- INVE Aquaculture (Belgium)

- Charoen Pokphand Group Company, Ltd. (Thailand)

- hanpel (South Korea)

- Coppens International B.V. (Netherlands)

- BioMar Group (Denmark)

- LifeCircle Nutrition AG (Switzerland)

- Kent Nutrition Group (US)

- Sonac (US)

- Growel Feeds Pvt Ltd (India)

- Japfa Ltd (Singapore)

- Marvesa Oils & Fats B.V. (Netherlands)

- Marubeni Nisshin Feed Co.,Ltd. (Japan)

- Novus International (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 DBMR MARKET POSITION GRID

2.6 DBMR VENDOR SHARE ANALYSIS

2.7 SECONDARY SOURCES

2.8 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 RISING CONSUMPTION OF FISH FOOD

3.1.2 DEVELOPMENT OF NEW FORMULATED AQUACULTURE FEED

3.1.3 GROWING AQUACULTURE INDUSTRY

3.2 RESTRAINTS

3.2.1 FLUCTUATION OF RAW MATERIAL PRICES

3.2.2 STRONG MARKET PRESENCE OF COLD WATER AQUACULTURE

3.3 OPPORTUNITIES

3.3.1 HIGH USAGE OF ORGANIC AQUACULTURE

3.3.2 GROWING DEMAND OF HIGH VALUE, OMEGA 3 FATTY ACIDS OWING TO HEALTH BENEFITS

3.3.3 RISING GOVERNMENT FUNDING AND PROMOTIONAL ACTIVITIES IN AQUA SECTOR

3.4 CHALLENGES

3.4.1 TEMPERATURE MAINTENANCE IN AQUACULTURE

3.4.2 DEPENDENCY ON MARINE INGREDIENT FOR AQUACULTURE

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY WATER TYPE

6.1 OVERVIEW

6.2 FRESH WATER

6.3 SALT WATER

7 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY SPECIES

7.1 OVERVIEW

7.2 CARPS

7.3 CATFISH

7.4 TILAPIA

7.5 GROUPER

7.6 BARRAMUNDI

7.7 MILKFISH

7.8 STURGEON

7.9 EEL

7.1 SEA BASS

7.11 SEA BREAM

7.12 YELLOWTAIL KINGFISH

7.13 MEAGRE

7.14 SOLE

7.15 TURBOT

7.16 PIKE PERCH

7.17 ROCKFISH

7.18 OTHERS

8 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY FEED TYPE

8.1 OVERVIEW

8.2 GROWER FEED

8.3 STARTERS

8.4 FUNCTIONAL FEED

8.5 FRY FEED

8.6 BROODSTOCK FEED

8.7 ORGANIC FEED

8.8 OTHERS

9 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY NATURE

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET,

COMPANY LANDSCAPE 87

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET,

BY COMPANY PROFILE 88

12.1 CARGILL, INCORPORATED.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 BIOMAR GROUP

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 NUTRECO N.V.

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 CHAROEN POKPHAND FOODS PCL

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ARCHER DANIELS MIDLAND COMPANY

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 ADISSEO

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 ALLER AQUA GROUP

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 ALLTECH

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 AVANTI FEEDS LTD.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 BIOMIN HOLDING GMBH

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 BIO-OREGON.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 BRF

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 CALYSTA, INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 EVONIK INDUSTRIES AG

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENTS

12.15 KEMIN INDUSTRIES, INC.

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 PURINA ANIMAL NUTRITION LLC.

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 RANGEN INC

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 SOLVAY

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 SOLUTIONPORTFOLIO

12.18.4 RECENT DEVELOPMENT

12.19 SPECTRUM BRANDS, INC.

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 TECHNA SA

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

12.21 THAN VUONG COMPANY LTD

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 ORGANIC SPECIES PRODUCED, 2015

TABLE 2 VOLUME OF ORGANIC FISH PROCESSED IN ESTONIA

TABLE 3 ORGANIC AQUACULTURE: PRODUCTION VOLUME BY COUNTRY 2017

TABLE 4 ORGANICALLY-CERTIFIED AQUACULTURE COMPANIES IN GERMANY IN 2015 BY SPECIES

TABLE 5 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 6 NORTH AMERICA FRESH WATER IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 7 NORTH AMERICA SALT WATER IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 8 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY SPECIES, 2019–2026 (USD MILLION)

TABLE 9 NORTH AMERICA CARPS IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 10 NORTH AMERICA CATFISH IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 11 NORTH AMERICA TILAPIA IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 12 NORTH AMERICA GROUPER IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 13 NORTH AMERICA BARRAMUNDI IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 14 NORTH AMERICA MILKFISH IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 15 NORTH AMERICA STURGEON IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 16 NORTH AMERICA EEL IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 17 NORTH AMERICA SEA BASS IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 18 NORTH AMERICA SEA BREAM IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 19 NORTH AMERICA YELLOWTAIL KINGFISH IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 20 NORTH AMERICA MEAGRE IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 21 NORTH AMERICA SOLE IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 22 NORTH AMERICA TURBOT IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 23 NORTH AMERICA PIKE PERCH IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 24 NORTH AMERICA ROCKFISH IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 26 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY FEED TYPE, 2019–2026 (USD MILLION)

TABLE 27 NORTH AMERICA GROWER FEED IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 28 NORTH AMERICA STARTERS IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 29 NORTH AMERICA FUNCTIONAL FEED IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 30 NORTH AMERICA FRY FEED IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 31 NORTH AMERICA BROODSTOCK FEED IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 32 NORTH AMERICA ORGANIC FEED IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 34 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY NATURE, 2019–2026 (USD MILLION)

TABLE 35 NORTH AMERICA CONVENTIONAL IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 36 NORTH AMERICA ORGANIC IN WARM WATER AQUACULTURE FEED MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 37 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY COUNTRY, 2017-2026 (USD MILLION)

TABLE 38 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY WATER TYPE, 2017-2026 (USD MILLION)

TABLE 39 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY SPECIES, 2017-2026 (USD MILLION)

TABLE 40 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY FEED TYPE, 2017-2026 (USD MILLION)

TABLE 41 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET, BY NATURE, 2017-2026 (USD MILLION)

TABLE 42 U.S. WARM WATER AQUACULTURE FEED MARKET, BY WATER TYPE, 2017-2026 (USD MILLION)

TABLE 43 U.S. WARM WATER AQUACULTURE FEED MARKET, BY SPECIES, 2017-2026 (USD MILLION)

TABLE 44 U.S. WARM WATER AQUACULTURE FEED MARKET, BY FEED TYPE, 2017-2026 (USD MILLION)

TABLE 45 U.S. WARM WATER AQUACULTURE FEED MARKET, BY NATURE, 2017-2026 (USD MILLION)

TABLE 46 CANADA WARM WATER AQUACULTURE FEED MARKET, BY WATER TYPE, 2017-2026 (USD MILLION)

TABLE 47 CANADA WARM WATER AQUACULTURE FEED MARKET, BY SPECIES, 2017-2026 (USD MILLION)

TABLE 48 CANADA WARM WATER AQUACULTURE FEED MARKET, BY FEED TYPE, 2017-2026 (USD MILLION)

TABLE 49 CANADA WARM WATER AQUACULTURE FEED MARKET, BY NATURE, 2017-2026 (USD MILLION)

TABLE 50 MEXICO WARM WATER AQUACULTURE FEED MARKET, BY WATER TYPE, 2017-2026 (USD MILLION)

TABLE 51 MEXICO WARM WATER AQUACULTURE FEED MARKET, BY SPECIES, 2017-2026 (USD MILLION)

TABLE 52 MEXICO WARM WATER AQUACULTURE FEED MARKET, BY FEED TYPE, 2017-2026 (USD MILLION)

TABLE 53 MEXICO WARM WATER AQUACULTURE FEED MARKET, BY NATURE, 2017-2026 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: NORTH AMERICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET

FIGURE 10 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: SEGMENTATION

FIGURE 11 RISING CONSUMPTION OF SEAFOOD IS EXPECTED TO DRIVE NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET IN THE FORECAST PERIOD OF 2019 TO 2026

FIGURE 12 FRESH WATER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET IN 2019

FIGURE 13 MULTIVARIATE MODELLING

FIGURE 14 TIMELINE GRID

FIGURE 15 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: BY PRODUCT TYPE, 2018

FIGURE 16 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: BY SPECIES, 2018

FIGURE 17 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: BY FEED TYPE, 2018

FIGURE 18 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: BY NATURE, 2018

FIGURE 19 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: SNAPSHOT (2018)

FIGURE 20 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: BY COUNTRY (2018)

FIGURE 21 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: BY COUNTRY (2019 & 2026)

FIGURE 22 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: BY COUNTRY (2018 & 2026)

FIGURE 23 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: BY WATER TYPE (2019-2026)

FIGURE 24 NORTH AMERICA WARM WATER AQUACULTURE FEED MARKET: COMPANY SHARE 2018 (%)

North America Warm Water Aquaculture Feed Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Warm Water Aquaculture Feed Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Warm Water Aquaculture Feed Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.