North America Wi Fi Chipset Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

3.50 Billion

2024

2032

USD

1.20 Billion

USD

3.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 3.50 Billion | |

|

|

|

|

Wi-Fi Chipset Market Size

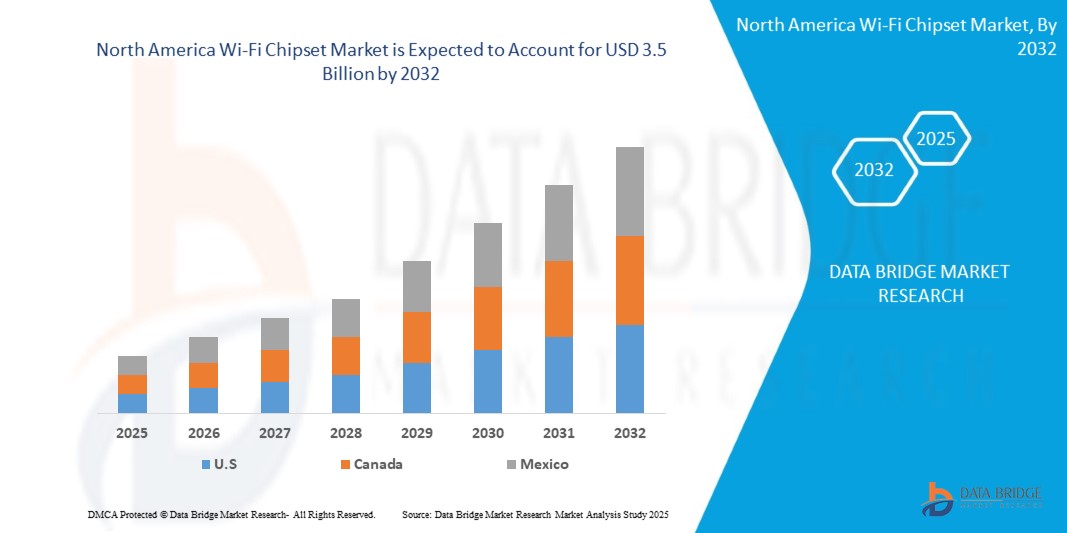

- The North America Wi-Fi Chipset Market Size was valued at USD 1.2 Billion in 2024 and is expected to reach USD 3.5 Billion by 2032, at a CAGR of 16.5% during the forecast period

- The growth of the North America Wi-Fi Chipset Market is fueled by Rising Demand for High-Speed Connectivity, Advancements in Wi-Fi Standards and Technological Innovations by Key Players

Wi-Fi Chipset Market Analysis

The North America Wi-Fi Chipset Market is experiencing robust growth, fueled by rising demand for high-speed wireless connectivity, the proliferation of smart devices, and rapid adoption of advanced Wi-Fi standards such as Wi-Fi 6, Wi-Fi 6E, and the emerging Wi-Fi 7. In 2024, the market is valued at approximately USD 1.2 to 1.5 billion and is projected to reach around USD 3.5 to 4 billion by 2032, growing at a CAGR of about 12–14%. This growth is primarily driven by increased digitalization across residential, commercial, and industrial sectors, as well as the widespread implementation of IoT technologies in applications like smart homes, healthcare, and industrial automation.

The United States dominates the regional market due to its strong digital infrastructure, high penetration of connected devices, and early adoption of next-generation wireless technologies. Canada also demonstrates significant growth, particularly in public Wi-Fi deployment, smart healthcare, and educational sectors. Mexico, though growing at a slower pace, is seeing increased adoption driven by expanding urban infrastructure and commercial connectivity initiatives.

Key industry players such as Qualcomm, Broadcom, Intel, MediaTek, and Texas Instruments are actively investing in R&D to launch innovative chipsets with enhanced performance, energy efficiency, and multi-band support. These companies are also collaborating with OEMs and telecom providers to integrate advanced chipset solutions into a wide range of consumer and enterprise devices. However, the market faces certain challenges, including regulatory limitations around spectrum allocation (especially in the 6 GHz band), high chipset integration costs for manufacturers, and growing cybersecurity concerns surrounding connected environments.

Looking ahead, the market is poised for further expansion with the anticipated rollout of Wi-Fi 7 from 2025 onward, greater integration with AI and edge computing applications, and increased usage in sectors like autonomous vehicles, robotics, and smart cities. The emphasis on sustainable and energy-efficient chipsets is also expected to shape the future trajectory of the North American Wi-Fi chipset market.

Report Scope and Wi-Fi Chipset Market Segmentation

|

Attributes |

Wi-Fi Chipset Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wi-Fi Chipset Market Trends

“Innovation and Integration: Transforming Wireless Connectivity Across Devices and Industries”

- A significant and accelerating trend in the North America Wi-Fi chipset market is the integration of next-generation wireless technologies, such as Wi-Fi 6, Wi-Fi 6E, and the emerging Wi-Fi 7, into a wide array of consumer electronics, industrial systems, and IoT devices. These advanced standards offer higher data rates, lower latency, and improved capacity, making them ideal for high-density environments like smart homes, offices, and public infrastructure.

- Leading chipset manufacturers such as Qualcomm, Broadcom, and Intel are introducing high-performance solutions that support MU-MIMO, OFDMA, and tri-band connectivity, enabling seamless data transmission for applications like 4K/8K streaming, gaming, AR/VR, and edge computing. Furthermore, the rise of connected devices in automotive, healthcare, and smart manufacturing is expanding the scope of Wi-Fi chipset applications beyond traditional consumer electronics.

- In addition, the convergence of AI, edge computing, and cloud-based services with Wi-Fi chipsets is enabling predictive analytics, autonomous operations, and smarter user experiences. Innovations such as low-power chipsets for IoT, Wi-Fi mesh systems, and secure connectivity protocols are also fueling adoption in enterprise and industrial sectors. These trends are collectively shaping a highly dynamic and innovation-driven Wi-Fi chipset market in North America.

Wi-Fi Chipset Market Dynamics

Driver

“Growing Demand Driven by Connected Devices, Wi-Fi Upgrades, and 5G Synergy”

- The surging demand for high-speed, reliable wireless connectivity is a primary driver of growth in the North America Wi-Fi chipset market. With the proliferation of smart homes, wearable devices, industrial IoT, and bandwidth-intensive applications like streaming and gaming, consumers and enterprises alike are upgrading to advanced Wi-Fi technologies. This transition is especially strong in North America, where digital infrastructure is well-established and consumer expectations are high.

- For example, in 2024, chipset makers such as Qualcomm and MediaTek launched new SoCs optimized for Wi-Fi 6E and Wi-Fi 7, offering enhanced performance for mobile devices, laptops, routers, and access points. Enterprises are also rapidly upgrading their networks to support hybrid work environments, demanding more robust and scalable Wi-Fi solutions.

- Additionally, the convergence of Wi-Fi with 5G and edge computing is creating synergistic opportunities for real-time data processing and ultra-low-latency applications. Public and private investments in smart city projects, autonomous vehicles, and remote healthcare further expand the addressable market for Wi-Fi chipsets. These drivers are not only boosting chipset demand but also encouraging innovation in energy efficiency, multi-device handling, and seamless roaming capabilities.

Restraint/Challenge

“Barriers to Market Expansion Due to Spectrum Limitations, Cost Pressures, and Interoperability Issues”

- Despite strong growth potential, the North America Wi-Fi chipset market faces several constraints that could hinder broader adoption and innovation. One key challenge is the limited availability and regulatory complexity of spectrum—especially in the 6 GHz band—needed to fully leverage the capabilities of Wi-Fi 6E and Wi-Fi 7. Variations in spectrum allocation across countries and potential interference with incumbent services can delay rollouts and restrict performance.

- Cost remains another critical barrier, particularly for high-performance chipsets used in enterprise-grade and IoT applications. Smaller OEMs and device manufacturers may struggle with the higher integration and production costs associated with the latest Wi-Fi technologies, affecting adoption in price-sensitive segments.

- Moreover, the fragmentation of standards and device compatibility issues can impede smooth integration, especially in the aftermarket and across legacy systems. Developers often face challenges ensuring chipset interoperability with various operating systems, platforms, and hardware configurations.

- Technical challenges such as signal attenuation in dense environments, power consumption in portable devices, and cybersecurity vulnerabilities also limit performance and user trust. Additionally, ongoing competition from cellular technologies (like 5G) in certain use cases may constrain the growth potential of Wi-Fi chipsets in mobile broadband and connected vehicle applications.

Wi-Fi Chipset Market Scope

The market is segmented on the basis of Chipset Type, Wi-Fi Standard, Application and End-User Industry.

|

Segmentation |

Sub-Segmentation |

|

By Chipset Type |

|

|

By Wi-Fi Standard |

|

|

By Application |

|

|

By End-User Industry |

|

- By Chipset Type

By chipset type, the market includes single-band, dual-band, and tri-band chipsets. Single-band chipsets operate on the 2.4 GHz frequency and are used in basic consumer devices due to their affordability, though they offer limited speed and coverage. Dual-band chipsets, supporting both 2.4 GHz and 5 GHz, are widely adopted in smartphones, home routers, and laptops, offering better performance and reduced interference. Tri-band chipsets, which include support for the 6 GHz band (especially in Wi-Fi 6E and Wi-Fi 7), are gaining momentum in high-performance applications like enterprise networks, gaming, and smart homes, thanks to their capacity to handle high traffic with minimal latency.

- By Wi-Fi Standard

By Wi-Fi standard, the market is categorized into Wi-Fi 4 (802.11n), Wi-Fi 5 (802.11ac), Wi-Fi 6 (802.11ax), and Wi-Fi 6E. Wi-Fi 4, though largely outdated, still supports some legacy devices and budget applications. Wi-Fi 5 remains popular in mid-range devices, offering significant speed improvements and more stable performance. Wi-Fi 6 has become a widely adopted standard due to its ability to manage higher data loads and device density, making it ideal for smart homes and workplaces. Wi-Fi 6E builds on this by utilizing the newly available 6 GHz band, offering ultra-low latency and faster speeds, which are critical for advanced use cases like augmented reality (AR), virtual reality (VR), and industrial IoT.

- By Application

In terms of application, Wi-Fi chipsets are deployed across consumer electronics, enterprise and commercial setups, automotive systems, and healthcare devices. Consumer electronics form the largest segment, with chipsets powering smartphones, tablets, smart TVs, and gaming consoles. Enterprise and commercial applications rely on high-capacity Wi-Fi for seamless connectivity in office infrastructure, point-of-sale systems, and conferencing tools. In the automotive sector, chipsets enable vehicle infotainment systems, diagnostics, and telematics, playing a crucial role in connected car technologies. Healthcare applications include Wi-Fi-enabled medical monitoring devices, wearable health trackers, and remote diagnostics tools, driven by the need for real-time data sharing and patient care efficiency.

- By End-User Industry

By end-user industry, the market serves telecom and IT, industrial and manufacturing, and government and public sector domains. Telecom and IT companies utilize Wi-Fi chipsets in broadband CPE, routers, and network infrastructure, supporting the region’s high digital connectivity standards. In industrial and manufacturing environments, chipsets support smart factory automation, logistics tracking, and real-time sensor networks, aligning with Industry 4.0 goals. The government and public sector deploy Wi-Fi chipsets in smart city projects, public internet infrastructure, emergency services, and surveillance systems, enhancing digital governance and public safety initiatives. This comprehensive segmentation underscores the widespread and evolving applications of Wi-Fi chipsets across North America’s dynamic technological landscape.

Wi-Fi Chipset Market Regional Analysis

The North America Wi-Fi chipset market is driven by the region’s advanced digital infrastructure, widespread internet access, and strong presence of leading technology companies. The United States holds the dominant share, owing to its early adoption of advanced Wi-Fi standards such as Wi-Fi 6 and Wi-Fi 6E, high concentration of smart home devices, and robust enterprise networking demand. Major chipset manufacturers like Qualcomm, Broadcom, and Intel are headquartered in the U.S., fueling continuous innovation and early commercialization of next-generation Wi-Fi technologies, including Wi-Fi 7.

Canada, though smaller in market size, is witnessing steady growth due to the expansion of broadband connectivity, smart city initiatives, and the increasing penetration of connected devices across residential and commercial sectors. The rise in remote work and e-learning across North America has also boosted demand for dual- and tri-band Wi-Fi chipsets in both home and enterprise networks. Additionally, government support for 5G and digital transformation projects is encouraging parallel investments in Wi-Fi infrastructure. Overall, North America remains a technology-forward region with strong ecosystem support, making it a critical market for Wi-Fi chipset manufacturers and solution providers.

Wi-Fi Chipset Market Share

The Wi-Fi Chipset industry is primarily led by well-established companies, including:

- Qualcomm Technologies, Inc.

- Intel Corporation

- Broadcom Inc.

- MediaTek Inc.

- Texas Instruments Inc.

- Cypress Semiconductor (Infineon Technologies)

- Marvell Technology, Inc.

- NXP Semiconductors

Latest Developments in North America Wi-Fi Chipset Market

- In 2025, Qualcomm launched its latest FastConnect 7900 platform in the U.S., integrating Wi-Fi 7 and Bluetooth 5.4 technologies. The chipset is optimized for next-gen smartphones and XR devices, offering ultra-low latency and reduced power consumption.

- In 2025, Broadcom introduced tri-band Wi-Fi 7 solutions for home gateways and mesh systems, targeting ISPs in North America to improve in-home connectivity performance for high-bandwidth applications like 8K streaming and cloud gaming.

- In 2024, Intel began mass production of BE200 Wi-Fi 7 chipsets, incorporated into high-end laptops and desktops by major OEMs like Dell and HP across North America.

- In 2024, MediaTek partnered with TP-Link and Netgear to integrate its Wi-Fi 6E chipset platform into North American consumer routers, enabling better connectivity in multi-device households.

- In 2023, Marvell Technology expanded its Wi-Fi 6E chipset portfolio to serve enterprise networking and automotive infotainment systems, responding to growing demand in commercial and industrial applications in the U.S.

- In 2022, Qualcomm collaborated with Meta (formerly Facebook) to enhance AR/VR wireless performance using advanced Wi-Fi 6E chipsets in Oculus headsets, marking a strategic push toward immersive wireless experiences.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Wi Fi Chipset Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Wi Fi Chipset Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Wi Fi Chipset Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.